CryptoCurrency

How Stock Exchanges Are Entering Crypto With White Label Exchange

Crypto isn’t a bubble, and the numbers silence every skeptic. With a $4 trillion cryptocurrency market and over 730 million owners worldwide, the digital asset space is now a legit parallel economy.

Stock and forex trading venues can’t stay on the sidelines much longer. In fact, if they don’t enter the cryptosphere soon, crypto exchanges software will start integrating traditional trading products by launching synthetic stocks or acquiring regulated venues to blur the lines completely. They’ve already taken the lead:

- Kraken and Robinhood already allow users to trade tokenized stocks while Coinbase is seeking approval to launch these blockchain-based versions of stocks.

- Bitget has also expanded its offerings to include perpetual futures contracts linked to major stocks, indices, and forex pairs.

- Fusion markets and ActiveTraders allow users to trade forex, stocks, and cryptocurrencies on the same platform, often using MT4/MT5 or proprietary interfaces.

Also, the lines between stock and crypto markets are blurring with stock exchanges offering BTC ETFs and crypto exchanges offering tokenized stocks. By leveraging white label cryptocurrency exchange development solutions, stock and forex exchanges can take the faster route to building unified markets. These pre-built, customizable trading infrastructures allow legacy institutions to launch secure, compliant, and liquid crypto trading venues without reinventing the core systems.

Why Should Stock and Forex Exchanges Launch Their Crypto Exchange Software?

- Increasing Institutional Demand: Bitcoin and Ether-based ETPs now see flows measured in tens of billions.

- Evolving Investor Expectations: Younger cohorts expect access to digital assets alongside traditional equities. By integrating white label crypto exchange platforms, stock and forex can grab a new user base. Even existing forex and stock traders can access crypto trading on the platform, increasing engagement and revenues for them.

- Regulatory Clarity: The regulatory frameworks governing cryptocurrencies and their trading venues have been evolving lately, giving institutions confidence to consider crypto offerings.

- Competitive Pressure: As stated above, this push may come from a stock, forex or a crypto exchange software. If a major exchange from any of these categories offers crypto trading, others may risk being left behind. This is the perfect opportunity for early birds to tap into the market.

Legacy exchanges need not rebuild the entire crypto trading arm. They can integrate a white label exchange software or a Crypto-as-a-Service offering from a reputable blockchain development company to tap new markets. This helps them stay relevant and diversify their revenue streams without incurring the full cost and time of building an in-house crypto trading empire.

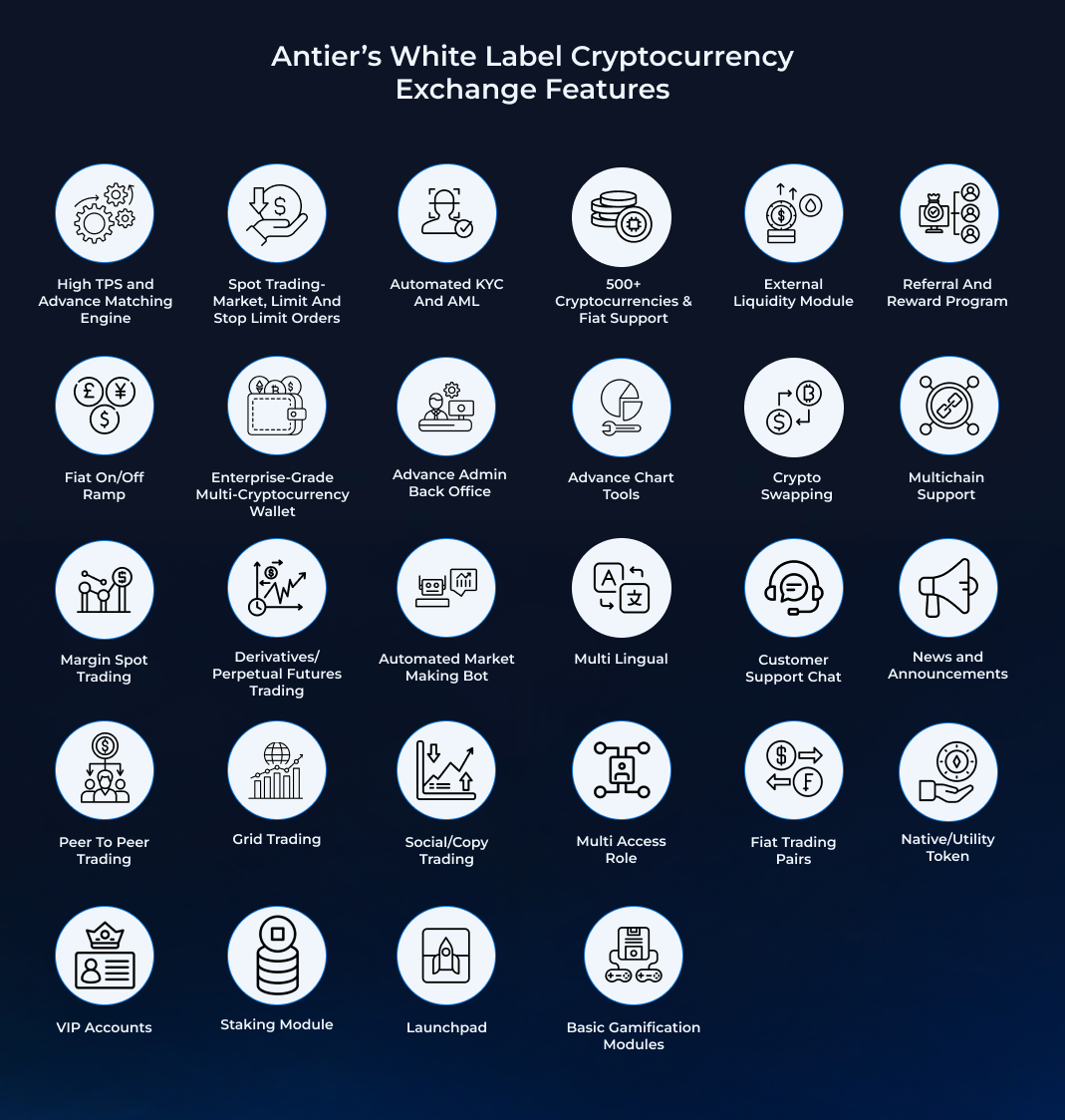

The Ultimate Feature Checklist for White Label Crypto Exchanges Serving Stock Markets

Those stock or forex exchanges seeking to launch their crypto trading platform leveraging white label exchange software must look for the following essential features:

- Multi-asset Trading Models Supporting Spot Trading, NFTs, Derivatives, Tokenized RWAs

- Advanced Order Types, Settlement Models and Risk Logic.

- Fiat-to-Crypto Rails For Easy Fiat Deposits & Payments Integration

- Order Books, Robust Matching Engine & Settlement Layer

- Wallets/Custody Integration (Self Custody, Managed Custody or Hybrid)

- Liquidity Feeds For Sourcing Liquidity From Aggregated Pools

- Risk Controls Such as Margin Monitoring, Fraud Detection, AML Mechanisms

- Compliance Modules As Per SEC, VARA, MiCA, MAS, etc.

Custom crypto exchange development is expensive and time consuming. Crypto exchange white label solutions built to enable stock exchanges expand into the crypto space have the following benefits over it.

- Speed to market: Launching via a turnkey solution can cut development time dramatically compared to building from scratch. Antier’s white label exchange platform is proven to slash development time by 3X.

- Lower upfront cost and risk: Most of the platform is already built, tested and audited when sourced from a reliable white label cryptocurrency exchange development company. Stock exchanges just need to rebrand it, customize modules, and launch. With development costs reduced by at least 50% compared to custom builds, the overall financial and technical risks drop significantly.

- Compliance readiness: Compliance costs for crypto exchange platforms for small to medium firms rose 28% and reached 620,000 in 2025. Established white label exchange platform providers include modules for KYC/AML, wallet security, audit trails, etc. Businesses must pick a geo-shield white label exchange solution with modular architecture even if it is high priced.

- Brand extension: White label crypto exchange platforms come with a completely customizable frontend. This way, the stock exchange retains its brand identity and client trust while offering new asset classes.

What are Essential Considerations For Stock and Forex Exchanges Entering Crypto Markets?

- Regulatory risk: Tokenised assets, crypto trading, custody all raise regulatory flags. Stock exchanges must ensure clarity on licensing and scope even if they’re launching in crypto-friendly jurisdictions. A white label cryptocurrency exchange development company with legal expertise can assist exchanges launch lawfully with appropriate licenses and compliance modules.

- Integration complexity: Legacy systems have their limitations. Bridging fiat, institutional clients, clearing, settlement with a crypto exchange white label platform can be very challenging. It is therefore necessary to pick a seasoned white label cryptocurrency exchange development company.

- Liquidity and risk-management: Crypto markets differ from traditional equities. In order for stock and forex exchanges to accommodate volatility, 24/7 trading, cross-chain settlement, robust risk controls, etc, you need to discuss possibilities with your crypto exchange developers.

- Custody and infrastructure security: Well-known vulnerabilities exist in digital-asset custody and trading. Stock and forex businesses must implement advanced security mechanisms to ensure uncompromised safety of users’ funds and information.

- Branding and Client Experience: Existing clients should find the crypto trading offering integrated and familiar. It should not feel like a disparate system to traders as well as the platform operators.

- Revenue model: Crypto trading fees, institutional and retail-based modules, tokenized asset listings, market making, ancillary services such as custody, staking, etc., all significantly boost the bottom line. They must be considered while integrating a crypto exchange white label platform to a stock or forex exchange.

Future Outlook

If you’re jumping into the crypto arena, your exchange must support perpetuals, NFTs, tokenized RWAs along with the traditional trading products. Bringing equities, funds, real estate, etc. to blockchain rails, enables 24/7 trading, instant settlement and lower costs. Most white label crypto exchanges might not have Fiat RWA Ramps as their feature. You can get this module integrated for future-proofing your trading platform. You can also create hybrid markets where traditional equities and tokenised versions exist side-by-side on the same platform.

Institutional clients are increasingly demanding seamless access to both fiat-tradable and crypto-native assets via one account. Stock exchanges can leverage their credibility and infrastructure to become “digital-asset exchanges” under the hood, powered by white label cryptocurrency exchange development solutions but branded and managed by themselves.

Final Word

Stock exchanges have to step into the crypto trading world not just because it’s trendy but because economics, client demand and technology are now perfectly aligned. White label cryptocurrency exchange development solutions offer a low-risk, fast-to-market path, enabling them to become players in the digital asset trading space without bearing the full burden of building from zero.

From NASDAQ-backed brokers to regional stock exchanges across Europe and Asia, traditional players are using white label architectures to tap into blockchain’s liquidity, tokenization, and 24/7 trading model. You could be the next.

If you already have the brand, compliance infrastructure and client base, adopting a proven crypto exchange white label platform gives you a strategic edge. Don’t wait for the market to shift. Build your crypto trading arm before the market shifts and outruns you.

Antier empowers traditional trading venues to enter the digital asset era with confidence. Our white label cryptocurrency exchange development solutions combine regulatory precision, institutional-grade performance and rapid deployment. Our infrastructure engineering and multi-jurisdictional legal expertise ensures that every launch is compliant and liquid from day one.

Frequently Asked Questions

01. Why is the cryptocurrency market considered a legitimate parallel economy?

The cryptocurrency market has reached a valuation of $4 trillion and boasts over 730 million owners worldwide, demonstrating its significance and legitimacy as an alternative economic system.

02. How are traditional stock and forex exchanges responding to the rise of cryptocurrencies?

Traditional exchanges are integrating crypto trading by offering tokenized stocks and perpetual futures contracts, as well as utilizing white label cryptocurrency exchange solutions to create unified trading platforms.

03. What factors are driving stock and forex exchanges to adopt crypto exchange software?

Key factors include increasing institutional demand for digital assets, evolving investor expectations for access to cryptocurrencies, regulatory clarity, and competitive pressure from other exchanges.