Crypto World

How to achieve a stable daily income through WPA Hash mining in 2026

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

WPA Hash cloud mining gains attention in 2026 as investors seek stable crypto income beyond price swings.

Summary

- In 2026, crypto investors are shifting from trading to WPA Hash cloud mining for stable, contract-based daily income.

- WPA Hash lets users earn daily crypto returns via computing power, avoiding hardware hassle and frequent trading.

- Cloud mining gains traction as investors seek structured, low-risk crypto income beyond market price fluctuations.

In 2026, after several rounds of volatility, the cryptocurrency market is gradually becoming more structured and rational. For many investors, simply relying on price fluctuations is no longer the only option; how to obtain a relatively stable cash flow while controlling risk has become a new focus.

It is against this backdrop that someone would begin to explore and try participating in the operation of cryptocurrency networks through WPA Hash cloud mining, hoping to explore a long-term income model that does not rely on frequent trading and is based on a computing power mechanism.

From active trading to passive computing power participation

The first thing that anyone who gets in contact with cryptocurrencies focuses on is to earn profits by buying and selling cryptocurrencies. However, as market volatility increased, they gradually realize that rather than frequently judging price direction, it is better to let assets operate continuously through computing power, forming a more stable cash flow structure.

The cloud mining model provided by WPA Hash is based on this logic: users do not need to purchase mining machines or maintain hardware; they only need to allocate computing power through the platform to participate in the mining process of mainstream cryptocurrency networks, and the income is settled daily according to the contract rules. How is the “daily fixed income” achieved?

In actual use, the overall process of WPA Hash is relatively clear:

Step 1: Register an Account

Step 2: Select a BTC Cloud Mining Contract

The platform offers Bitcoin cloud mining contracts with different hashrate levels and periods, covering various options from small-scale trials to high-hashrate participation.

Step 3: Automatic Hashrate Management

After contract activation, the platform centrally allocates hashrate resources to participate in the Bitcoin network operation; users do not need to intervene in the technical aspects.

Step 4: Daily Earnings Settlement

Earnings are settled daily in BTC or equivalent assets; relevant data can be viewed in the user’s backend.

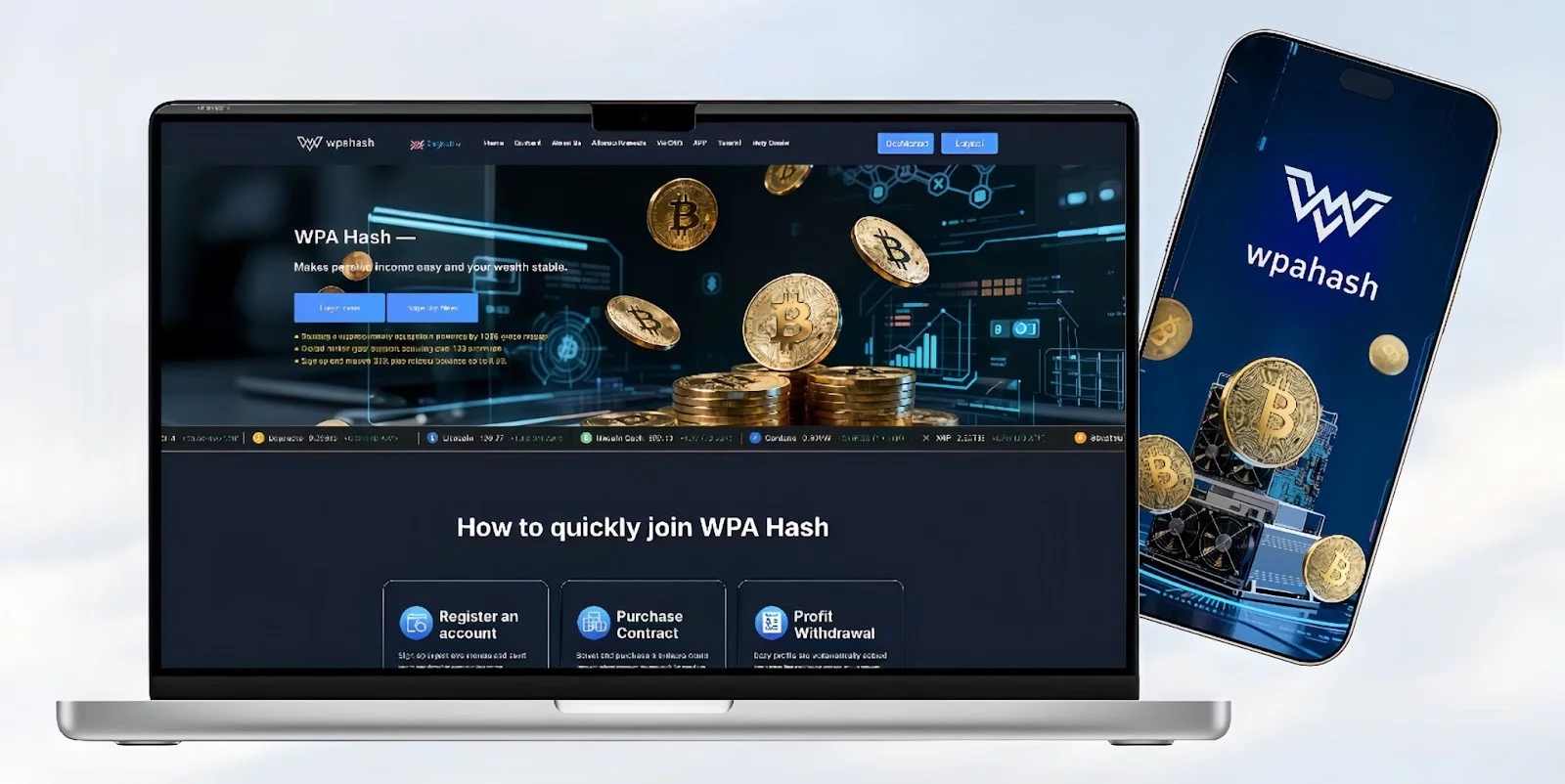

Cloud mining contract examples (platform showcase)

New User Experience Contract

Investment: $100 | Term: 2 days | Daily Yield: $3

Maturity Yield: $100 + $6

Basic Computing Power: 1659 | Investment: $500 | Term: 5 days | Daily Yield: $6

Maturity Yield: $500 + $30

Medium Computing Power: Project 2747

Investment: $3,000 | Term: 18 days

Daily Yield: $42

Maturity Yield: $3,000 + $756

Medium Computing Power: Project 2938

Investment: $5,000 | Term: 22 days

Daily Yield: $75

Maturity Yield: $5,000 + $1,650

Classic Computing Power: Project 4834

Investment: $58,000 | Term: 38 days

Daily Yield: $1,131

Maturity Yield: $58,000 + $42,978

Yields are settled automatically daily. Principal is returned upon contract maturity. Specific yields depend on real-time platform data. Click here for more contract details.

Why WPA Hash?

After comparing multiple platforms, many investors ultimately chose WPA Hash for long-term use, primarily based on the following considerations:

- No hardware or maintenance costs: Avoids mining machine depreciation, electricity, and operational issues.

- Multi-currency hashrate support: Allows for flexible adjustments to participation based on market conditions and personal preferences.

- High degree of automation: Yield settlement and data display are highly automated.

- Relatively clear transparency: Contract rules, cycles, and settlement logic are clear.

In conclusion

WPA Hash mining isn’t about “changing a financial situation overnight,” but rather using it as part of a crypto asset system to balance risk and return. Achieving a relatively stable daily income without constant monitoring or frequent trading is precisely the initial motivation for choosing cloud mining.

For users seeking to reduce operational burden and pursue long-term stable returns, participation in computing power may be a worthwhile area of research.

For more information, please visit the official platform.

Email: [email protected]

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Oil-linked futures on Hyperliquid surge 5% after U.S.-Israel strike on Iran

Perpetual futures tied to oil prices trading on decentralized exchange Hyperliquid surged Saturday after the U.S. and Israel launched coordinated missile strikes on Iran, a key oil producer, igniting explosions across Tehran and multiple other cities.

Oil-USDH perpetuals climbed more than 5% to $71.26, while another contract, USOIL-USDH, advanced above $86.00. Combined, the two saw nearly $4 million in trading volume and over $5 million in notional open interest, data from Hyperliquid showed.

Gold and silver contracts also rose, likely on haven demand as markets reacted to heightened geopolitical risk.

Price gains followed after the U.S. and Israel launched a coordinated missile strike on Iran on Saturday, triggering massive explosions across Tehran and several other cities in a dramatic escalation that threatens to push the oil-rich Middle East into prolonged uncertainty.

Iran retaliated soon after, targeting multiple U.S. airbases in the region.

Iran is not only a major oil producer but also controls much of the Strait of Hormuz, through which more than $500 billion worth of oil and gas passes annually. Its designated shipping lanes fall entirely within the territorial waters of Iran and Oman. Worries have long circulated that an all-out war could see Iran weaponize its control of the strait, potentially sparking a massive global oil surge.

Rising oil prices could feed into inflation, making it harder for central banks to cut borrowing costs, prioritize growth, and encourage risk-taking in financial markets.

Crypto World

Crypto VC Paradigm Plans $1.5B Fund Expansion Into AI and Robotics

Venture capital firm Paradigm is preparing a new $1.5 billion fund aimed at artificial intelligence, robotics and other emerging technologies, marking its clearest push yet beyond the crypto sector that built its reputation.

Key Takeaways:

- Paradigm is raising a $1.5B fund to invest in AI, robotics and other frontier technologies while continuing crypto backing.

- The firm will use its existing technical team as it expands beyond blockchain-only investments.

- Paradigm sees growing overlap between AI and crypto, including applications like autonomous payments and smart contract security.

The San Francisco-based investor will continue backing blockchain startups while expanding into adjacent industries, according to people familiar with the plan cited by the Wall Street Journal.

Paradigm intends to rely on its existing technical investment team to source deals in frontier technologies rather than building a separate unit.

Paradigm Manages $12.7B After Launching Record Crypto Funds

Regulatory filings show the firm manages about $12.7 billion in assets.

It previously launched a $2.5 billion flagship fund in November 2021, at the time the largest dedicated crypto fund, and followed it in 2024 with an $850 million vehicle focused on early-stage blockchain projects.

Managers reportedly concluded that limiting investments to crypto alone risked missing promising opportunities developing across computing and automation.

The decision reflects a broader shift among technology investors as artificial intelligence reshapes both software and financial infrastructure.

Executives have long argued that the fields are interconnected. One example is agent-driven payments, in which autonomous software systems execute transactions using blockchain rails.

The concept relies on both AI decision-making and decentralized settlement.

Paradigm’s interest in AI is not new. As early as 2023, observers noticed the firm quietly removed Web3-specific language from parts of its website, fueling speculation that it was pivoting away from digital assets.

Co-founder and managing partner Matt Huang rejected that interpretation but acknowledged the firm was studying AI’s implications.

“We’ve never been more excited about crypto,” Huang wrote at the time, adding that developments in AI were too important to ignore. He argued the technologies should not be seen as rivals, predicting overlap between the two ecosystems.

That overlap has already appeared in practice.

Earlier this month, Paradigm partnered with OpenAI to release EVMbench, a benchmark designed to test whether machine-learning models can identify and patch vulnerabilities in smart contracts, a persistent security challenge in decentralized finance.

AI Startups Drew $258.7B in VC Funding in 2025, OECD Says

The fundraising effort also comes as venture capital flows heavily into AI startups.

According to OECD data, AI companies attracted $258.7 billion in venture funding during 2025, accounting for 61% of total VC investment and roughly doubling their share since 2022.

Generative AI firms alone represented 14% of AI-focused funding, with US startups receiving the largest portion.

Last month, Andreessen Horowitz secured more than $15 billion in fresh capital, strengthening its standing as one of the most powerful venture capital firms in the US tech sector.

The funds span multiple strategies, including infrastructure, applications, healthcare, growth investments and its “American Dynamism” initiative.

In 2025 alone, the firm represented over 18% of total venture capital deployed in the United States.

Co-founder Ben Horowitz said the fundraising reflects the firm’s core philosophy that venture capital exists to give people opportunities to build companies and create value.

The post Crypto VC Paradigm Plans $1.5B Fund Expansion Into AI and Robotics appeared first on Cryptonews.

Crypto World

Blackstone (BX) Executes Triple Play: Data Centers, Automotive Assets, and Cancer Research

TLDR

- Blackstone plans to debut a publicly accessible investment vehicle dedicated to acquiring AI-focused data center infrastructure with multi-billion dollar ambitions

- Initial capital raising efforts target sovereign wealth funds and major institutional investment partners

- Both Blackstone and Brookfield submitted competing proposals valued at minimum €8 billion to acquire Volkswagen’s heavy-duty engine division, Everllence SE

- A collaborative funding arrangement between Blackstone Life Sciences and Johnson & Johnson will support development of bleximenib, an experimental AML treatment

- RBC Capital launched research coverage on February 23 with Outperform designation and $179 share price objective

The private equity heavyweight is preparing to introduce a fresh publicly traded acquisition platform dedicated exclusively to AI data center assets. The initiative aims to democratize access to AI infrastructure investments — a sector where Blackstone seeks commanding market position.

The initial phase focuses on securing commitments from sovereign wealth entities and major institutional capital providers. Following this foundation, the firm intends to attract investment capital measuring in the tens of billions from a wider investor universe.

The strategy demonstrates significant ambition. However, skepticism exists regarding market timing.

Certain market participants have questioned whether massive AI training complexes constructed in remote locations might face obsolescence risks as technological capabilities advance. Blackstone appears prepared to address these reservations directly.

This initiative represents a component of the firm’s larger objective to expand beyond its established pension fund and endowment client relationships. Individual investors now represent an increasingly important strategic focus.

Volkswagen Unit Bid

Regarding transaction activity, Blackstone and Brookfield Asset Management (NYSE: BAM) have each presented acquisition proposals exceeding €8 billion ($9.4 billion) to secure controlling ownership in Volkswagen’s Everllence SE division.

Everllence specializes in manufacturing marine propulsion systems and industrial power generation turbines. Volkswagen has pursued divestiture of this operation as component of broader corporate restructuring and margin enhancement initiatives.

Additional competing bidders include Advent International, Bain Capital, EQT AB, and CVC Capital Partners — all successfully advancing to subsequent bidding stages.

Transaction completion remains uncertain. Bloomberg sources indicated negotiations continue without final determination.

Biotech and Analyst Coverage

On February 23, Blackstone Life Sciences revealed a collaborative financing agreement with Johnson & Johnson supporting clinical progression of bleximenib, an experimental oral medication designed to treat acute myeloid leukemia.

AML represents the most prevalent acute leukemia diagnosis among adult patients and demonstrates the poorest survival outcomes across all leukemia classifications. Company leadership characterized this condition as presenting exceptional therapeutic challenges.

This marks the inaugural co-funding partnership between BXLS and Johnson & Johnson, representing a significant milestone for Blackstone’s healthcare investment division.

Simultaneously, RBC Capital established research coverage of Blackstone with an Outperform recommendation and $179 price objective.

RBC communicated to investors that Blackstone maintains a “first-mover advantage” as the pioneering alternatives manager to establish a dedicated private wealth distribution team. The investment bank positions the firm as a long-term beneficiary of expanding retail investor participation and stabilizing commercial real estate conditions.

Blackstone conducts operations through four primary business segments: Real Estate, Private Equity, Credit and Insurance, and Hedge Fund Solutions.

BX stock declined 3.88% on February 27, coinciding with public disclosure of the AI data center platform and Volkswagen competitive bid developments.

Crypto World

Wall Street Giants Morgan Stanley and Citigroup Push Deep Into Cryptocurrency Services

Key Highlights

- Morgan Stanley has submitted an application to the OCC for a national trust bank charter designed for cryptocurrency custody services

- The proposed entity, dubbed “Morgan Stanley Digital Trust,” would facilitate digital asset custody, trading activities, swaps, staking services, and transfers

- Citigroup is preparing to roll out institutional bitcoin custody services within the current year, embedding them into existing traditional asset management frameworks

- Citi’s vision includes unified account management where clients handle bitcoin together with securities and cash, featuring cross-margining functionality

- Major financial institutions are building out crypto capabilities in response to rising institutional client interest in digital asset services

Morgan Stanley has submitted a request for a de novo national trust bank charter through the Office of the Comptroller of the Currency (OCC). The submission, which arrived on February 18, bears the designation “Morgan Stanley Digital Trust, National Association.”

This charter would grant Morgan Stanley authorization to provide digital asset custody services for its client base. The planned subsidiary intends to facilitate buying, selling, swapping, transferring, and staking of cryptocurrencies.

A national trust bank charter empowers financial institutions to conduct fiduciary operations including asset protection and custody services. This represents Morgan Stanley’s inaugural trust charter designed exclusively for cryptocurrency operations.

Morgan Stanley has demonstrated aggressive expansion into digital assets recently. The firm brought aboard equity markets veteran Amy Oldenburg in January to spearhead its cryptocurrency division and submitted applications for spot Bitcoin and Solana ETFs, subsequently filing for a staked Ether ETF as well.

The financial institution, which manages approximately $8 trillion in client assets, is simultaneously deploying spot cryptocurrency trading capabilities through its E*TRADE platform. The bank is also considering lending products and yield-generating opportunities connected to digital currencies.

Current job postings reveal Morgan Stanley is recruiting for positions such as digital assets strategy director and digital assets product lead. The institution is additionally investigating wallet technology implementation throughout its wealth management platform.

Citi Plans Institutional Bitcoin Custody

Citigroup has revealed intentions to introduce institutional bitcoin custody services before year-end. Nisha Surendran, who oversees Citi’s digital asset custody development, shared these details during Thursday’s World Strategy Forum.

Surendran characterized the objective as rendering “bitcoin bankable.” Citi aims to incorporate bitcoin into identical custody, reporting, and taxation systems currently deployed for conventional assets such as stocks and bonds.

Clients would gain the ability to initiate transactions through SWIFT messaging, APIs, or graphical user interfaces. Citi would manage all clearing and settlement procedures behind the scenes.

The financial institution additionally intends to enable clients to maintain bitcoin positions alongside U.S. Treasuries, international bonds, and tokenized money market funds within a unified custody account. This framework would permit cross-margining between cryptocurrency holdings and traditional asset classes.

Citi conducted research among its institutional client base and discovered they prefer not to handle wallets and private keys directly. Instead, they seek bitcoin access through established banking infrastructure.

The Broader Push by Major Banks

Citi maintains connections to over 220 payment and settlement networks worldwide. The bank has introduced Citi Token Services for cash management, a continuously operating blockchain-based network utilized for internal global fund transfers.

JPMorgan has pursued a comparable strategy through its JPM Coin offering. The New York Stock Exchange similarly unveiled intentions for a round-the-clock blockchain-powered trading platform for tokenized equities and ETFs launching later in 2025.

The OCC granted conditional approval to five cryptocurrency-focused national trust bank applications in December, encompassing Ripple, BitGo, Fidelity Digital Assets, and Paxos. Stablecoin infrastructure provider Bridge, acquired by Stripe, along with Crypto.com have subsequently obtained conditional approvals.

Payoneer similarly submitted a national trust bank charter application this month, potentially positioning it to issue stablecoins and deliver cryptocurrency services.

Crypto World

Bitcoin Crashes to $63K as US, Israel Bomb Iran

Bitcoin (CRYPTO: BTC) faced renewed geopolitical turbulence over the weekend as reports of a joint U.S.-Israel operation targeting Iran intensified market chatter. The move came as traditional markets remained in a holding pattern, leaving crypto traders to assess the implications in a vacuum. On Saturday, BTC slid toward the lower end of a key trading band, briefly testing the $63,000 region as investors weighed the potential fallout from a campaign aimed at Iran’s nuclear infrastructure. The timing coincided with a quiet moment in traditional markets, where futures and other risk assets had not yet resumed full trading, underscoring how crypto can move on its own schedule during periods of geopolitical stress.

Key takeaways

- BTC traded around the mid-$60,000s, probing the $63,000 level as weekend escalation unfolded and U.S. and Israeli actions were reported against Iran.

- Liquidations tied to the move surpassed $250 million within a four-hour window, highlighting heightened risk-off dynamics within crypto despite a pause in broader market activity.

- Trump’s remarks—calling on Iranians to take over their government after describing the objective as targeting Iran’s nuclear infrastructure—added a political overlay to the headline-led move.

- Crypto markets moved independently of TradFi during the period, with traditional market activity disrupted or delayed, amplifying a crypto-driven narrative around safe-haven + risk-off tension.

- Historical echoes surfaced in trading chatter, referencing prior Iran-related shocks in 2025 that produced outsized volatility across crypto and risk assets, a pattern that some traders cited as context for the current reaction.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. The weekend developments contributed to a near-4% drop and a test of notable support around the $63,000 area.

Trading idea (Not Financial Advice): Hold. Price action remains within a framework of key support and the potential for a renewed test of higher levels will hinge on evolving geopolitical signals and macro cues.

Market context: The episode underscored how geopolitics can drive crypto-specific volatility even when traditional markets are quiet or paused, with liquidity dynamics shaping the immediate response and sentiment.

Why it matters

The unfolding weekend episode reinforces the role of Bitcoin as a potential nonlinear reaction to geopolitical stress. While equities and other traditional assets were not fully pricing in the latest headlines, BTC moved with a decisive tilt, testing an important round-number barrier and illustrating how market participants treat crypto as a distinct risk-on/risk-off instrument during times of international tension. The magnitude of intraday liquidations—reported to exceed $250 million in a short span—highlights the rapid, leveraged dynamics that can accompany sudden shifts in sentiment, even when broader markets remain comparatively subdued.

Beyond the immediate price action, the incident raises questions about liquidity and correlation in the current macro environment. The absence or delay of traditional market participation on the weekend left a vacuum that crypto markets often fill with their own narratives, sometimes amplifying moves beyond what fundamentals would suggest. The juxtaposition of a hawkish geopolitical headline with a crypto market that has recently faced a prolonged drawdown in prior cycles adds texture to the analysis of BTC’s resilience near blocks of support, including around the $60,000 level that traders view as a psychological and technical hinge in this cycle.

The episode also nods to a broader history of Iran-related shocks in the crypto space. A notable note from observers cited a previous Iran-focused episode in 2025 that sparked a surge in volatility across risk assets—an echo that keeps some traders attentive to the potential for follow-through moves as headlines evolve. In this sense, the latest escalation becomes part of a longer-running narrative about how geopolitical risk translates into crypto-specific dynamics, particularly as markets approach monthly or quarterly closes where liquidity and risk sentiment can tighten further.

Against this backdrop, traders remained mindful of the broader inflation and macro data cycle that can compound or cap spikes in volatility. Prior to the weekend move, hot U.S. inflation data had already given Bitcoin bulls a reason to tread carefully, underscoring that price resilience often coexists with a fragile narrative around sustained upside. The combination of a fresh geopolitical shock and sticky inflation metrics paints a complex picture for BTC, where sharp short-term moves coexist with a longer arc of price discovery that is still trying to chart a sustainable path above key support levels.

As the situation evolved, the narrative around Bitcoin’s behavior during geopolitical flare-ups continued to gain traction. Analysts emphasized the importance of monitoring $63,000 as a test point—an inflection that, if held, could set the stage for a cautious rebound or a renewed consolidation. Conversely, a break of that level would invite a fresh wave of risk-off selling and raise the possibility of retesting lower cushions established earlier in the year, particularly given the sensitive macro backdrop and ongoing concerns about liquidity if volatility persists into the February close.

On the ground, observers also noted the role of media framing and social chatter in shaping short-term expectations. A post from political commentators and market analysts alike threaded together the weekend’s headlines with the technical narrative, underscoring how crypto markets continue to operate at the confluence of macro, policy, and technology-driven factors. The result is a market environment where BTC can diverge from traditional assets for stretches, but remains tethered to the same fundamentals that govern risk appetite, funding conditions, and liquidity availability as traders size up the next significant catalyst.

What to watch next

- February monthly close: Watch for whether BTC can defend the $60,000–$63,000 range or if a break below sharpens the downside bias.

- Geopolitical updates: Any new statements or actions from the U.S. or allied governments, and Iran’s official responses, could redraw the risk landscape for crypto markets.

- Liquidity metrics: Monitor liquidity flows and liquidation data from trackers like CoinGlass as markets digest new headlines and potential policy signals.

- Regulatory signals: Any regulatory commentary or policy signals that could affect crypto markets in the wake of geopolitical events.

Sources & verification

- BTC price action near $63,000 and intraday dynamics as reported by market data aggregators (e.g., TradingView) for BTCUSD.

- Public statements from U.S. President Donald Trump regarding the weekend operation and his remarks about Iran.

- Liquidation data tracked by market observatories (CoinGlass) during the four-hour window cited.

- Analysis and context provided by commentators referencing the Kobeissi Letter and its remarks on related Iran-related episodes.

- Historical references to prior Iran-related events affecting crypto and risk assets, including related coverage from Cointelegraph.

Geopolitical shock and Bitcoin’s path

Bitcoin (CRYPTO: BTC) moved to absorb fresh geopolitical headlines as a joint U.S.-Israel operation targeted Iran’s nuclear infrastructure. In the immediate aftermath, price action suggested a cautious mood among traders: the asset hovered near the upper mid-range before dipping toward support levels, with the market registering a roughly four-percent decline in intraday trading. Data from market trackers captured a considerable liquidation footprint—more than $250 million in a four-hour window—underscoring how liquidity can ebb and flow in response to headlines even when traditional markets are less active.

The weekend narrative was further shaped by political signals. A video message from U.S. President Donald Trump contained a dual aim: to describe the operation’s objective as targeting nuclear infrastructure while urging Iranians to “take over your government.” The message added a layer of political risk to an already delicate market environment, illustrating how policy chatter can intersect with price dynamics in crypto markets that are increasingly sensitive to headline risk.

In market commentary, observers noted that crypto markets were effectively operating in isolation as TradFi trading hours were unsettled or paused. This was a period where BTC moved independently of equity futures and other traditional benchmarks, a pattern that some analysts attribute to the asset’s ongoing role as a non-sovereign store of value during times of geopolitical strain. Yet even with a certain degree of independence, BTC’s trajectory remained tethered to the broader macro narrative—specifically, how inflation data and risk sentiment evolve in the days ahead and whether the market can defend key technical fortresses near $60,000.

The historical angle remains salient. Some market watchers pointed to a prior Iran-related episode in 2025 that produced a pronounced risk-off response across crypto and traditional assets, illustrating how geopolitical shocks can imprint a multi-month pattern on price action. While this does not define a forecast, it provides context for current traders who monitor the interplay between headlines, liquidity, and the delicate balance between risk-on and risk-off dynamics at a time when the February close looms.

As the near-term narrative unfolds, the market context remains one of cautious navigation. The combination of geopolitical catalysts, inflation dynamics, and the fragility of intraday liquidity means investors are watching not just the immediate price moves but the persistence of support levels that have held in prior tests. The coming days will reveal whether BTC’s reaction to the weekend headlines translates into a broader shift in momentum or a temporary pause as traders reassess risk preferences ahead of the next macro and policy updates.

Crypto World

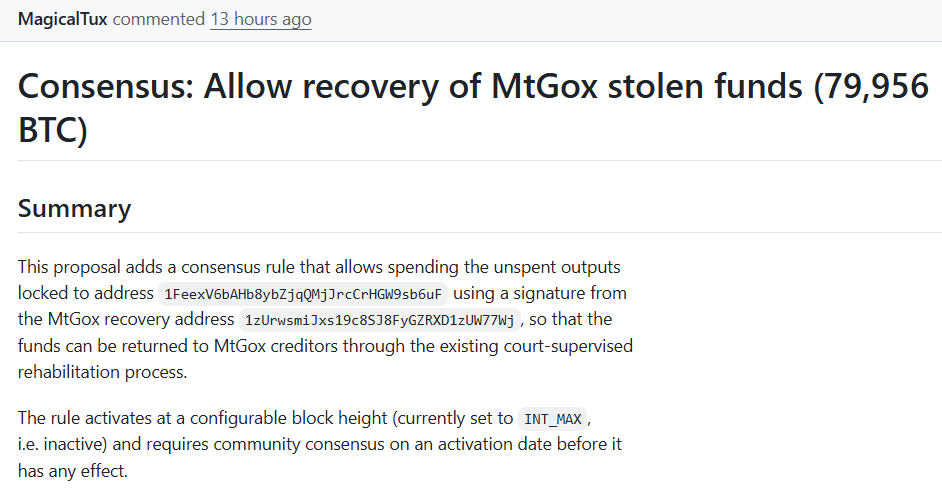

Former Mt. Gox CEO Seeks Bitcoin Hard Fork to Reclaim $5.2B in Stolen Cryptocurrency

TLDR

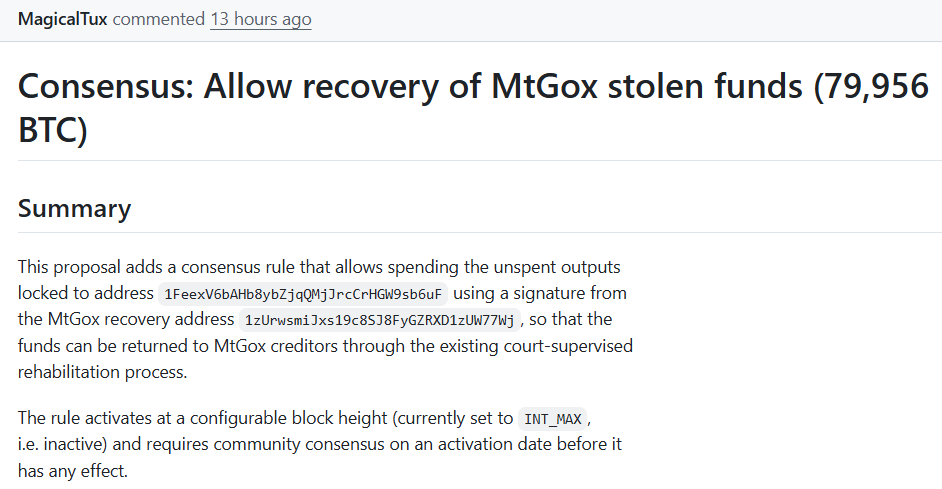

- Mark Karpelès, who previously led Mt. Gox, has floated a Bitcoin hard fork idea aimed at retrieving approximately 80,000 BTC taken during a 2011 security breach, currently valued above $5.2 billion.

- His plan would enable these funds to transfer without accessing the lost private key, through implementing a specialized consensus mechanism for one specific wallet.

- The draft was posted to GitHub as an exploratory discussion rather than an official Bitcoin Improvement Proposal.

- Detractors believe this creates a risky precedent that could undermine Bitcoin’s foundational immutability principle.

- These stolen coins exist separately from the approximately 200,000 BTC currently undergoing distribution to Mt. Gox claimants, with that process scheduled through October 2026.

Mark Karpelès, who formerly ran the defunct Mt. Gox Bitcoin exchange, has unveiled a draft plan advocating for a Bitcoin hard fork. His objective centers on retrieving approximately 79,956 BTC taken during a security breach over 15 years ago.

These digital assets remain locked in one specific wallet, representing more than $5.2 billion based on current market valuations. The funds have remained untouched since their theft in June 2011.

Bitcoin’s existing protocol requires the original private key to authorize any transaction. That critical key was never retrieved.

Karpelès uploaded his proposal to GitHub last Friday. His suggestion involves creating a novel consensus mechanism enabling fund movement to a designated recovery wallet without needing the missing key.

This rule would exclusively target that particular wallet address. Network-wide adoption would trigger activation at a predetermined future block height.

Karpelès showed transparency regarding the proposal’s nature. “I want to be upfront: this is a hard fork,” he stated.

He positioned this submission as a solution to an ongoing impasse. Nobuaki Kobayashi, serving as the Mt. Gox trustee, has refused to pursue blockchain-based recovery without guaranteed community support for such a protocol modification.

Why Critics Are Pushing Back

The suggestion has triggered substantial opposition, primarily focused on Bitcoin’s unchangeable nature. Bitcoin operates on the principle that confirmed transactions cannot be reversed or altered.

Numerous community members contend that modifying ownership protocols for a single address, regardless of theft circumstances, establishes dangerous precedent. Bitcointalk forum participants cautioned this might encourage comparable requests following future security incidents.

The proposal recognizes this concern directly. It notes: “If it can be done once, the argument goes, it can be done again.”

Governance concerns also emerge. Bitcoin lacks established procedures for determining which past thefts warrant protocol rule modifications.

Successful hard fork implementation requires widespread approval from miners, node operators, and trading platforms. Throughout Bitcoin‘s history, achieving consensus on divisive modifications has proven exceptionally challenging.

How This Fits Into Broader Mt. Gox Repayments

The 80,000 BTC held in the compromised wallet exist independently from funds presently distributed to creditors. Current repayments originate from a distinct reserve of roughly 200,000 BTC retrieved following the platform’s 2014 shutdown.

Creditor distributions commenced during mid-2024, with the completion deadline now pushed to October 2026. The stolen coins remain completely beyond trustee jurisdiction.

Mt. Gox declared bankruptcy in Tokyo on February 28, 2014, following the loss of approximately 750,000 customer bitcoins. During its operational prime, the platform processed 70% of worldwide Bitcoin transactions.

Certain creditors have expressed approval for this initiative. One individual identifying as a creditor mentioned receiving roughly 15% of their Bitcoin through bankruptcy proceedings and would endorse a legal mandate to recover the remaining stolen assets.

The proposal currently exists as a preliminary discussion draft without official endorsement or implementation schedule.

Crypto World

Ethereum $159B Stablecoin Dominance: Why Infrastructure Beats Price

Ethereum (ETH) price action is stalling near $2,000, but the on-chain reality of its stablecoin advantage tells a radically different story.

The network now commands over 53%, or $159 billion, of the $300 billion stablecoin market, cementing its status as the settlement layer for Institutional Crypto.

So, while the ETH price chart usually looks flat nowadays, the infrastructure moat is arguably deeper than ever.

Key Takeaways

- The Stat: Ethereum holds $153.41 billion in Stablecoins, controlling nearly 60% of the global supply.

- The Argument: Jeff Housenbold views ETH as vertical infrastructure for fintech, distinct from day-to-day asset pricing.

- The Tension: Price lags infrastructure utility, creating a disconnect between value settled and token valuation.

The $159B Stablecoin Moat: Why Institutions Stick with Ethereum

Jeff Housenbold is betting on infrastructure. The President and CEO of Beast Industries (the company behind the viral MrBeast brand) recently termed Ethereum the “backbone” of the stablecoin industry in an interview with CNBC.

That assessment aligns with hard data. As of today, Ethereum hosts $159 billion of the market’s total $300 billion stablecoin supply.

This dominance persists because, arguably, institutional crypto use cases value settlement finality over speed.

While Beast Industries expands its fintech footprint following the acquisition of Step, a financial literacy app with 1.45 million users, the focus remains on where the deepest liquidity lives.

Housenbold’s firm, which also oversees a $200 million investment from Bitmine, isn’t chasing pump-and-dump mechanics. They are looking at the rails moving $10.3 trillion in monthly transfer volume.

That volume matters. While price continues trading sideways, Wall Street institutions are eyeing Ethereum. The 2024 GENIUS Act provided regulatory clarity for stablecoin issuers, but it was Ethereum’s existent liquidity that captured the institutional share.

The sheer market share of USDT ($183 billion) and USDC ($75 billion) on the network creates a self-reinforcing loop. Institutions mint where the liquidity is deepest. That lock-in effect is why the supply on Ethereum’s headstart on the stablecoin sector will be a tough challenge for rivals like Ripple to navigate.

Discover: The best crypto to diversify your portfolio with

Solana and Base: The Retail Volume Shift

While Ethereum holds the collateral, retail users are transacting elsewhere. That is the clear signal from recent Stablecoins flow data.

Solana’s stablecoin supply surged 40% in late 2025, outpacing Ethereum’s percentage growth, according to BitWise research analyst Danny Nelson. Traders chasing speed and low fees have migrated, driving Solana to 2.3 million daily active users compared to Ethereum’s 709,000.

Base, Coinbase’s Ethereum Layer 2, processed $5.3 trillion in January 2026 Circle (USDC) transfers despite holding a fraction of the supply found on mainnet.

This points to a high velocity of money on Layer 2, i.e., tokens moving fast in small amounts, versus the stagnant, high-value collateral sitting on Ethereum.

Stablecoin transfer volume across EVM, Solana, and Tron reached $10.3T in Jan ’26.

While Ethereum holds the supply, velocity is moving to L2s and Solana.

— CryptoNews Analyst (@CryptoNews) February 12, 2026

Circle is a primary beneficiary of this multi-chain expansion. The issuer recently saw revenue surges as USDC proliferates across high-speed chains.

However, for Ethereum, the loss of retail transaction dominance hasn’t eroded its reserve status. It has simply specialized: Ethereum is the savings account; Solana and Base are the checking accounts.

Beyond the Stablecoin Advantage, Is $2,000 the Floor for Ethereum?

Ethereum is trading at $1,960. The price has compressed into a tight range, lagging behind the broader market rally. The $2,000 level is now the critical psychological and technical pivot that will help ETH consolidate its current ground and go up to the next leg.

Losing this support level could put Ethereum in freefall, which may not break until $1,500, effectively invalidating all gains since the post-FTX 2021/2022 crash.

Supply dynamics favored a move higher. 31% of the total ETH supply is now staked, removing over 10 million coins from circulation since 2024.

That supply shock is latent energy. Standard Chartered sees this leading to $7,500 by year-end, but the market needs a catalyst to ignite it.

For now, momentum indicators are neutral. The RSI is sitting at 41, indicating indecision. The market is waiting for institutional capital to deploy the stablecoin dry powder sitting on Ethereum’s network. Until that capital rotates from stablecoins into risk assets, ETH remains in a consolidation phase.

Discover: The best new crypto to buy now

The post Ethereum $159B Stablecoin Dominance: Why Infrastructure Beats Price appeared first on Cryptonews.

Crypto World

Nebius (NBIS) Plunges 13% After Earnings Miss and Massive Capex Spend

TLDR

- Nebius Group (NBIS) plummeted 13.1% Friday, hitting an intraday low of $88.40 and settling at $91.19

- Fourth-quarter earnings showed a loss of $0.69 per share versus the anticipated -$0.42; sales reached $227.7M against a $246M projection

- Capital spending for the quarter totaled approximately $2.06B, sparking investor worries about liquidity

- Sector-wide weakness intensified as CoreWeave’s (CRWV) lackluster results triggered a broader neocloud retreat

- Wall Street analysts continue favoring the stock with a “Moderate Buy” consensus and $143.22 mean target

Nebius Group (NBIS) experienced significant turbulence Friday, surrendering 13.1% to finish at $91.19 after touching $88.40 earlier in the trading session. The previous session had seen shares close at $104.88.

Volume metrics painted a picture of heightened investor activity. Approximately 22.8 million shares traded hands — representing a 68% surge compared to the typical daily volume of 13.6 million.

The sharp decline followed NBIS’s February 12th fourth-quarter earnings release that fell short of analyst projections across key metrics.

The neocloud provider reported a per-share loss of $0.69, substantially wider than the Street’s forecast of a $0.42 deficit — representing a $0.27 shortfall. Top-line performance also underwhelmed, with revenue reaching $227.7 million versus the $246 million consensus.

While the earnings disappointment initially triggered selling, the investment spending figures ultimately amplified concerns.

The company disclosed capital expenditures totaling roughly $2.06 billion during Q4. Management’s outlook for sustained multi-billion dollar annual investments has prompted investor scrutiny regarding financing strategies and short-term liquidity management.

Sector Pressure From CoreWeave

The NBIS decline wasn’t an isolated incident. Competing neocloud provider CoreWeave (NASDAQ: CRWV) plunged up to 21.9% the same session following its own earnings disappointment.

Both enterprises compete in an identical market segment — acquiring GPU infrastructure and leasing AI computing resources to hyperscalers and emerging artificial intelligence companies. Market sentiment tends to correlate between these players.

This dynamic has emerged as a recurring theme. These equities attract intense scrutiny, remain opaque to mainstream investors, and demonstrate acute sensitivity to adverse developments within the AI infrastructure ecosystem.

NBIS exhibits a beta coefficient of 3.90, underscoring its pronounced volatility relative to broader market movements.

Analyst Views Still Mostly Positive

Notwithstanding Friday’s retreat, Street sentiment remains constructive. Among 11 analysts tracking the name, two rate it Strong Buy, seven assign Buy ratings, one maintains Hold, and one recommends Sell.

The consensus price objective stands at $143.22 — substantially above Friday’s closing level. Morgan Stanley launched coverage in January with an Equal Weight stance and $126 target. Freedom Capital elevated its recommendation to Strong Buy this month.

Skepticism exists in certain quarters. Both Wall Street Zen and Weiss Ratings have recently downgraded shares to Sell.

CICC Research initiated coverage last November with an Outperform recommendation and $143 price objective.

Technical indicators show the 50-day moving average at $95.00, while the 200-day moving average rests at $95.95. The company’s market capitalization approximates $22.96 billion.

Street forecasts project 2026 revenue at $3.35 billion, implying year-over-year expansion of 531%.

Strategic cloud collaborations with Meta and Microsoft underpin analyst confidence in the long-term revenue trajectory.

For the ongoing fiscal period, consensus estimates anticipate a $1.10 per-share loss.

Institutional ownership accounts for 21.90% of outstanding shares, with multiple funds gradually increasing their allocations in recent reporting periods.

Crypto World

ARK Invest’s Latest Moves: CoreWeave and Kratos Purchases Highlight February 27 Trading

Quick Summary

- ARK Invest acquired approximately $19.4M in CoreWeave stock following a 19% decline after the company’s Q4 earnings report

- The fund’s most significant transaction was a $23.2M acquisition of Kratos Defense & Security Solutions shares

- Teradyne holdings were reduced by $12.9M, extending ARK’s pattern of trimming this position

- ARK decreased its Rocket Lab stake despite the company exceeding earnings forecasts, with shares declining roughly 5%

- Additional moves included divesting Roku holdings and establishing a position in Generate Biomedicines

On Friday, February 27, Cathie Wood’s ARK Invest executed multiple strategic portfolio adjustments. The trading activity encompassed fresh investments and position reductions spanning technology, defense, and biotechnology sectors.

Kratos Defense & Security Solutions emerged as the day’s most substantial acquisition. ARK accumulated 252,169 shares valued at $23.2 million. The company specializes in unmanned aerial systems and autonomous defense technologies, aligning with ARK’s investment thesis centered on robotics and automation.

The second-largest acquisition involved CoreWeave, a provider of AI-focused cloud infrastructure. ARK secured 198,980 shares totaling approximately $19.4 million, distributed between its ARKK and ARKW exchange-traded funds.

CoreWeave, Inc. Class A Common Stock, CRWV

ARK’s CoreWeave purchase occurred during a session where the stock declined 19%. The downturn followed fourth-quarter earnings that demonstrated robust revenue growth but revealed expanding losses and capital expenditures that exceeded market expectations.

By purchasing shares during the selloff, ARK appears to interpret the market reaction as temporary volatility rather than fundamental business deterioration. CoreWeave operates in the AI computing infrastructure space, which has experienced substantial demand expansion.

CoreWeave maintains a Moderate Buy rating among Wall Street analysts. With eleven Buy ratings and eight Hold ratings, the consensus price target of $114.18 suggests potential upside of approximately 43.5% from current trading levels.

ARK Scales Back Teradyne and Rocket Lab Holdings

Regarding portfolio reductions, ARK divested 38,773 Teradyne shares valued at $12.9 million across several ETFs. Teradyne manufactures semiconductor testing systems and industrial automation equipment. This transaction continues ARK’s recent pattern of decreasing its Teradyne exposure.

ARK also liquidated 46,921 shares of Rocket Lab valued at approximately $3.4 million. The space technology company had recently announced quarterly performance that surpassed both earnings and revenue projections, yet shares declined roughly 5% on Friday.

Rocket Lab disclosed robust launch operations and an expanding order backlog. Nevertheless, the inaugural launch of its larger Neutron rocket was delayed until late 2026, potentially contributing to investor disappointment.

Additional Portfolio Adjustments in Biotech and Technology

ARK disposed of 46,389 shares of Roku valued at $4.3 million from its ARKK fund. The rationale for this divestment was not publicly disclosed.

Within the biotechnology sector, ARK acquired 459,525 shares of Generate Biomedicines valued at $7.4 million via its ARKG fund. Simultaneously, the fund sold 39,423 shares of Ionis Pharmaceuticals for $3.2 million.

ARK liquidated 10,590 Deere & Co shares for $6.6 million and reduced its Guardant Health position by 27,334 shares valued at $2.7 million.

Minor transactions included a reduction of 205,211 PagerDuty shares for $1.5 million and an acquisition of 14,097 Brera Holdings shares valued at approximately $15,600.

The CoreWeave and Kratos acquisitions represented ARK’s two most significant individual transactions on February 27, with combined value exceeding $42 million.

Crypto World

Former Mt. Gox CEO Proposes Hardfork to Recover $5.2B in BTC

Mark Karpelès, the former chief executive of the defunct Mt. Gox exchange, is urging the Bitcoin community to consider a network hard fork designed to retrieve nearly 80,000 Bitcoin linked to the platform’s historic hack.

Key Takeaways:

- Mark Karpelès proposed a Bitcoin hard fork to recover 79,956 BTC worth about $5.2B from the Mt. Gox hack.

- The plan would allow the coins to move without the original private key and potentially repay creditors.

- The proposal has triggered strong opposition over fears it would weaken Bitcoin’s immutability.

In a proposal published Friday on GitHub, Karpelès outlined a change to Bitcoin’s consensus rules that would allow 79,956 BTC, currently held in a single wallet, to be transferred to a designated recovery address without access to the original private key.

At current prices, the holdings are worth more than $5.2 billion.

Dormant Mt. Gox Bitcoin Unmoved for 15 Years

“These coins have not moved in over 15 years,” Karpelès wrote, describing the funds as among the most widely monitored unspent transaction outputs in Bitcoin’s history.

He acknowledged the magnitude of the suggestion, stating plainly that the change would require a hard fork.

Such an update would make a transaction previously rejected by the network valid and would require node operators to upgrade their software before a specified activation block.

Karpelès said the idea is not an attempt to sidestep Bitcoin’s development process but rather to trigger discussion around a long-standing impasse.

According to him, bankruptcy trustee Nobuaki Kobayashi has declined to pursue on-chain recovery because there is no certainty the community would support it.

“That creates a deadlock,” Karpelès wrote. “The trustee won’t act without confidence, and the community can’t evaluate the idea without a concrete proposal.”

If the coins were recovered, the existing bankruptcy framework could distribute them to creditors already receiving repayments from the estate.

The suggestion has sparked sharp backlash across Bitcoin forums. Critics argue that altering consensus rules to reclaim stolen funds would undermine Bitcoin’s defining characteristic: irreversible transactions.

“Every time a hack happens, someone will want another special rule,” one Bitcointalk member wrote, warning it would erode trust in the system.

Another user argued Bitcoin should remain independent from legal or government determinations in any jurisdiction.

Karpelès Says Mt. Gox Recovery Case Is Unique as Creditors Back Proposal

Karpelès countered that the case is unique because both law enforcement and much of the community agree the wallet contains stolen Mt. Gox funds.

Some individuals claiming creditor status expressed support, saying any recovery could restore losses from the 2014 collapse.

Mt. Gox once processed roughly 70% of global Bitcoin trading between 2010 and 2014.

The exchange unraveled after a massive theft went undetected for years, ultimately losing about 750,000 customer Bitcoin and forcing a bankruptcy filing in Tokyo.

More than a decade later, the incident remains one of the largest failures in crypto history.

In May last year, Vivek Ramaswamy’s Strive said it plans to acquire 75,000 Bitcoin, valued slightly over $8 billion, from claims related to the defunct Mt. Gox exchange bankruptcy.

Strive noted that the strategy is intended to purchase Bitcoin at a discount price.

The post Former Mt. Gox CEO Proposes Hardfork to Recover $5.2B in BTC appeared first on Cryptonews.

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports5 days ago

Sports5 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion15 hours ago

Fashion15 hours agoWeekend Open Thread: Iris Top

-

Politics5 days ago

Politics5 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business4 days ago

Business4 days agoTrue Citrus debuts functional drink mix collection

-

Politics1 day ago

Politics1 day agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Sports5 hours ago

The Vikings Need a Duck

-

Business6 days ago

Business6 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech4 days ago

Tech4 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

Business6 days ago

Business6 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat2 days ago

NewsBeat2 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech6 days ago

Tech6 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat6 days ago

NewsBeat6 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics6 days ago

Politics6 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business2 days ago

Business2 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat3 days ago

NewsBeat3 days agoPolice latest as search for missing woman enters day nine

-

Business2 days ago

Business2 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality