CryptoCurrency

How To Build an Institution-Ready Exchange With White Label Exchange

Top crypto exchanges and neo banks are launching their institutional offerings in several crypto-friendly regions. With liquidity migrating on-chain, ETFs normalizing crypto exposure, and global regulators tightening frameworks, enterprises are now demanding fast, robust, scalable, and compliant trading infrastructures. But not everyone wants to burn their $20M on R&D. That’s exactly when white label cryptocurrency exchange development flips the script.

Instead of stitching together dozens of modules, reinventing the onboarding, order matching, and settlement processes from scratch, businesses can simply deploy an enterprise-grade foundation and focus on growth. This guide sheds light on why white label tech is suitable for institutional-grade crypto exchange software development and provides a comprehensive blueprint for launch.

What Do Institutional Investors Expect From an Exchange?

Institutional crypto investments hit $21.6 billion in Q1 2025. Additionally, as of mid-2025, 71% of institutional investors had deployed their capital in digital assets. This clearly demonstrates skyrocketing institutional interest in cryptocurrencies. Emerging cryptocurrency exchange software development projects must address this skyrocketing institutional demand.

Let’s now discuss the essential components of institution-ready crypto exchanges:

- Performance Architecture

Institutions won’t tolerate slow blocks, unreliable order execution, or downtime during liquidations. They need:

- Low-latency matching

- High throughput

- Realtime monitoring

- Multi-account risk controls

- FIX/WebSocket API reliability that can handle HFT activity

White label crypto exchange software solutions built on optimized matching kernels or modern L2 execution layers now provide this out of the box.

- Liquidity & Market Depth

You can’t onboard institutions if order books look like a desert. White label cryptocurrency exchanges from reliable tech providers now come with:

- Liquidity integrations (MMs, OTC desks, aggregators)

- Configurable spreads

- Automated market-making modules

- Optional synthetic depth for early-stage operations

Liquidity isn’t for looking big. But it is a staple to be stable enough for institutional volume.

- Compliance & Governance Readiness

The compliance burden sits on the exchange operators. Institutions simply demand crypto exchange software that is airtight. Your institution-ready exchange must therefore support:

- KYC/KYB automation

- AML screening

- Transaction monitoring

- Reporting dashboards (MiCA, SFC, MAS, FinCEN)

- Cold–hot wallet governance frameworks

White label exchange software platforms significantly reduce the cost and effort by embedding these modules from the outset.

- Multi-Product Expansion

Institutions don’t want a “spot-only” venue. They want a scalable revenue engine with the option to add:

- Derivatives

- Perpetuals

- Staking modules

- Tokenized RWAs

- Launchpad or payment rails

The architecture must allow for switching on new modules without requiring the rewriting of core logic.

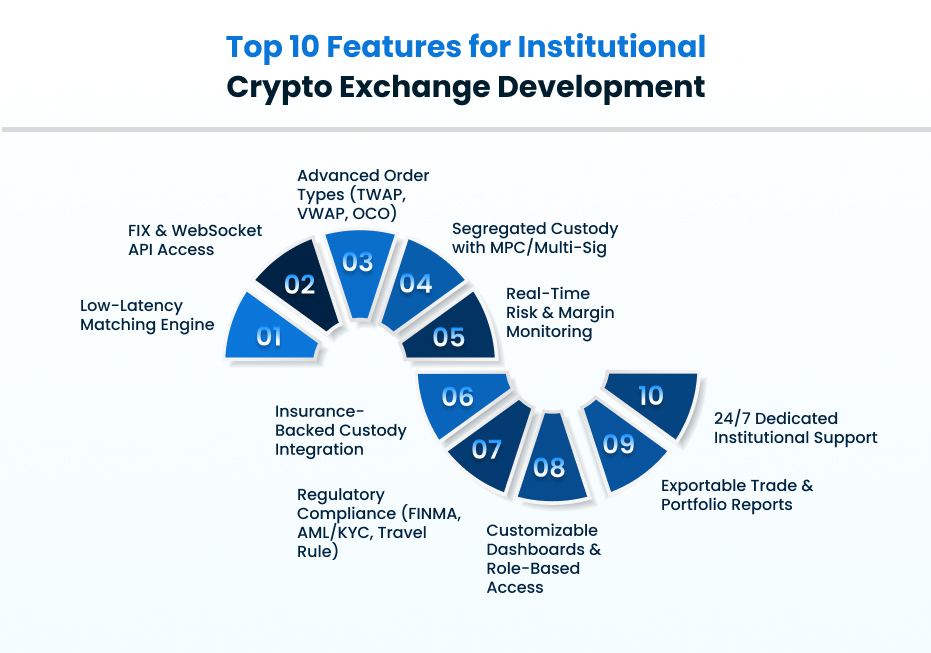

The graphic below displays the top features required for institution-ready crypto exchange development.

Whether you’re going for a custom exchange development or leveraging an institutional-level white label exchange software, these features are a must-have.

How White Label Crypto Exchange Development Supports Institutional-Grade Launches?

Building institutional-grade trading infrastructures from scratch takes at least 18-36 months, huge capital, and a long compliance loop. White label exchanges shrink this to 90–120 days while maintaining institutional capabilities. You basically get going with a pre-built, production-tested engine for your phase one in a week. And then you can customize everything from the matching engine to workflows, asset listings, and revenue modules.

Here are the benefits that white label crypto exchange software solutions have over custom builds for institutional-grade deployments:

- Reduced Time-to-Market As Institutions Can’t Afford Late Entry

Custom build: 18-36 months

White label: 3-4 months

- Slashed Engineering Cost So Enterprises Can Invest In Liquidity, Licensing & Customer Acquisition

Custom build: $5M-$20M

White label: 20-30% of that

- Operational Risk

Custom builds are untested systems that may have unpredictable failure points

White label cryptocurrency exchange development solutions built to serve institutions are often proven infrastructures running across multiple deployments worldwide

- Compliance Cost

Institution-ready white label exchange platforms from a reputed white label crypto exchange development company like Antier already support audit trails, segregation models, and governance workflows. It often saves months of redesign and revamps.

Top Exchanges That Have Recently Launched Their Institutional Trading Services

| Exchange/Platform | Key Offering/Initiative | Primary Location(s) / Target Markets |

|---|---|---|

| HSX Exchange | Launch of Global MarketLink Initiative, a cross-market connectivity network for institutional execution efficiency. | Network integrates infrastructure in London, Singapore, Frankfurt, and New York. |

| SGX Derivatives (Singapore Exchange) | Launch of Bitcoin and Ethereum perpetual futures, offering exchange-cleared, regulated perpetual contracts for institutional, accredited, and expert investors. | Singapore (Asia-Pacific Focus) |

| Crypto.com | Full introduction of the Crypto.com Exchange, their institutional-grade exchange services, to the market. | United States (Platform is Singapore-based, but targeting the US market) |

| FalconX | Launch of a new 24/7 trading platform, Electronic Options, to expand institutional access to around-the-clock OTC crypto options trading. | Global (with recent expansion in Latin America and general focus on U.S., Europe, and Asia-Pacific post-acquisition) |

| Wyden | Launch of Wyden Infinity, a complete end-to-end trade lifecycle platform for digital assets, targeting banks, brokers, and asset managers. | Zurich, Switzerland (EMEA) and APAC regions |

How To Launch an Institutional-Grade Trading Platform with a White Label Cryptocurrency Exchange?

- Define Your Market Strategy

This determines the compliance configuration and product stack. So, businesses may pick carefully:

- Retail, institutional, or hybrid

- Spot-first or derivatives-first

- Target jurisdictions (SFC/MiCA/MAS/ADGM)

Businesses planning to launch their institutional-level exchange may evaluate:

- Matching engine performance

- API performance under load

- Liquidity partnerships

- Deployment options (cloud, on-prem, hybrid)

- Governance and reporting modules

- Expansion pathways (perps, staking, tokenization)

- Configure Compliance & Custody

As discussed above, these are the key compliance and custody requirements for institution-ready exchange development.

- Automated onboarding workflows

- Multi-signature technology and MPC wallet systems

- Safekeeping & segregation models

- Chain analytics integration

- Reporting automation for regulators

Businesses must also collaborate with a white label crypto exchange development company to build compliance-first workflows that keep UX friction low.

- Integrate Liquidity & Market Makers

Liquidity partners fill the order books on day zero, so you can launch liquid from day 1.

Top-notch white label crypto exchange software allows:

- Plug-and-play market makers onboarding

- Synthetic liquidity as scaffolding

- Cross-exchange routing

- OTC block execution support

- Launch, Scale & Add Revenue Modules

Once live with a fully-functional spot trading institutional trading desk, businesses can typically expand into:

- Derivatives

- Structured products

- Staking

- Tokenized assets

- API-driven trading programs

The only requirement is a institution-ready white label exchange with a modular infrastructure.

Launch Your Institutional-Grade Exchange With Antier

If you’re serious about serving institutions, the exchange you launch has to hold up under real demand. A white label cryptocurrency exchange built simply gets you there faster, without compromising on what actually matters.

Antier has led enterprise-grade exchange deployments across 25+ jurisdictions with:

- Regulator-aligned frameworks (SFC, MiCA, SEC, FINRA, MAS)

- High-performance matching engine architecture

- Integrated liquidity networks

- FIX/WebSocket APIs tailored for institutional desks

- Add-on modules for derivatives, staking, payments, and tokenization

- Experience with 250+ regulated exchanges worldwide

For institutions planning a 2026 launch, Antier’s white label crypto exchange software is the most strategic, cost-efficient, compliance-ready path to market.

Frequently Asked Questions

01. What is white label cryptocurrency exchange development?

White label cryptocurrency exchange development allows businesses to deploy a ready-made, enterprise-grade trading infrastructure without the need for extensive R&D, enabling them to focus on growth.

02. What do institutional investors expect from a crypto exchange?

Institutional investors expect high performance, including low-latency matching, high throughput, reliable order execution, and robust compliance features from a crypto exchange.

03. Why is liquidity important for institutional crypto exchanges?

Liquidity is crucial for institutional crypto exchanges as it ensures stable trading environments, allowing institutions to execute large orders without significant price impact, thereby attracting institutional volume.