CryptoCurrency

How to Build & Analyze the Cost of a Closed-Loop Crypto Wallet Development Solution?

Closed-loop cryptocurrency wallet solutions are reshaping how merchants think about payments, loyalty, and customer engagement. Imagine a payment instrument that lives only inside your brand’s ecosystem, keeps revenue on your balance sheet, speeds up checkouts, and turns refunds into repeat purchases.

For merchants, this is not just a payment tool. It is a direct channel to deepen customer relationships, gather first-party data, and design bespoke incentives that actually move the needle. In this article, we shall explore what closed-loop crypto wallets are, how they work in practice, the business advantages they unlock, and the tactical steps to build one. The focus is practical: how to design a secure, compliant, and scalable digital wallet that supports everyday transactions, rewards, and merchant-level reporting so businesses can convert users into loyal customers and sustainable revenue streams.

What are Closed Loop Crypto Wallets?

A closed-loop crypto wallet is a digital wallet that operates only within a defined merchant or brand ecosystem. Funds loaded into the wallet can be spent exclusively at the issuing merchant or a curated partner network. Unlike open wallets that interact with card networks and banks, closed-loop wallets keep transaction flows internal. They can be implemented with traditional stored-value technology or enriched with blockchain primitives when merchants need immutable records, programmable rewards, tokenized credits, or multi-party reconciliation. Common uses include branded wallets, gift and reward wallets, prepaid store credit, and event or venue wallets. The merchant controls branding, settlement rules, refund logic, loyalty linking, and the customer experience.

Closed-Loop vs. Open-Loop Crypto Wallets: Which Model Empowers More

| Dimension | Closed-Loop Wallet | Open-Loop Wallet |

| Merchant control | Full control of rules | Limited, third-party rules |

| Settlement & fees | Internal settlement, lower per-use fees | Network fees, variable costs |

| Customer data | First-party ownership | Limited, often shared |

| Loyalty & rewards | Native, programmable rewards | Harder to integrate |

| Fraud & chargebacks | Fewer chargebacks, easier control | Higher chargeback risk |

| Compliance & KYC | Merchant-defined KYC limits | Network-driven compliance |

| Integration complexity | Deeper backend and POS work | Easier plug-and-play |

| Programmability | High- tokenization, logic | Mostly static payments |

| Customer experience | Branded, seamless checkout | Standardized across networks |

| Revenue recirculation | Keeps value in ecosystem | Funds leave to external rails |

| Time to market | Longer due to pilots | Faster via existing gateways |

| Scalability | Scales within merchant network | Wide acceptance, global rails |

| Treasury & liquidity | Merchant manages float | Processor/rails handle settlement |

How Does a Closed-Loop Crypto Wallet Work?

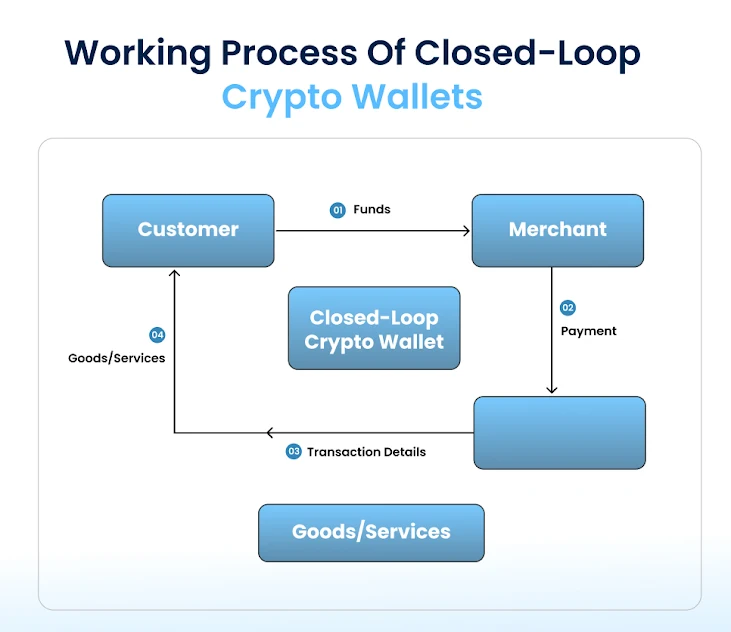

A customer loads value into the merchant crypto wallet platform using linked bank cards, crypto rails, stablecoins, or accepted fiat onramps. The wallet records the balance in the merchant ledger. At checkout the wallet authorizes payment instantly without routing through external card networks. The merchant system debits the balance, applies any loyalty logic or discounts, records the transaction, and triggers inventory and accounting updates. Settlement occurs internally or through periodic reconciliation with an external treasury partner if converting to fiat. When built on blockchain, transactions are optionally recorded on a private or permissioned ledger for auditability and token logic. Security layers include authentication, encryption of keys, KYC gating for higher limits, rate limiting, and fraud analytics. The understanding of the entire working process of a closed-loop Web3 crypto wallet development solution helps you further analyze the wide range of advantages it has to offer. Let us scroll through the blog to have a closer look at it.

Get In Touch With The Most Certified Experts For a Closed Loop Wallet!

Top-Notch Benefits of Closed-Loop Crypto Wallets for Merchants

1. Faster, more reliable checkouts that reduce cart abandonment and increase conversion.

2. Lower transaction fees by avoiding per-transaction card network costs for on-platform spending.

3. Stronger customer retention through integrated loyalty, personalized offers, and instant refunds that keep value inside the ecosystem.

4. First-party data captured at the payment layer enables smarter personalization and lifecycle marketing.

5. Programmability via tokenization for conditional rewards, subscriptions, and campaign mechanics.

6. Controlled risk and refund flows since funds never leave the merchant ecosystem until settlement.

7. Brand-centric payment experience that strengthens trust and reduces friction with repeat buyers.

How to Build a Closed-Loop Crypto Wallet in Just 7 Steps?

1. Define objectives and business rules – Decide acceptance network, partner merchants, and use cases such as loyalty, gift cards, refunds, or subscription billing. Specify rules for top-ups, refunds, expiries, and KYC thresholds.

2. Choose architecture and rails – Pick between a centralized ledger with secure APIs or a permissioned blockchain for auditability and token programmability. Decide how fiat and crypto onramps will flow into the wallet.

3. Design security and compliance – Implement authentication, key management, encryption, anti-fraud rules, transaction monitoring, and KYC/AML policies. Plan data residency and reporting to meet local regulations.

4. Build core wallet services – Develop or integrate modules for balance management, top-up, spending, refunds, transaction ledger, reconciliation, and batch settlement.

5. Integrate UX and merchant touchpoints – Embed wallet in web checkout, mobile app, POS systems, and merchant dashboards. Provide clear balance displays, quick pay buttons, and simple top-up flows.

6. Implement loyalty and programmability- Add tokenized rewards, tier rules, campaign engines, and merchant-triggered incentives. Ensure these link to the wallet ledger atomically.

7. Test, pilot, and iterate- Run closed pilots with limited users and merchants. Monitor transaction success rates, latency, fraud signals, and customer feedback. Iterate on UX and rules before full rollout.

Choosing the right technical and compliance partner turns a pilot into a scalable merchant platform. After launch, focus on monitoring performance, treasury efficiency, and iterative UX improvements to drive adoption. Keep the architecture modular for new integrations and regional compliance. Partnering with a trusted white label crypto wallet development company ensures strong security, faster market entry, and the ongoing support needed to grow.

How Much Time Does a Closed-Loop Crypto Wallet Development Take?

The closed-loop wallet app development timelines vary with scope. A minimal viable wallet focused on balance management, basic top-up, simple spend and reconciliation can be built quickly when leveraging proven modular components and third-party onramps. If you add programmable token mechanics, permissioned ledger integration, complex loyalty engines, multi-currency support, and strict compliance flows, the timeline extends due to additional design, security, and regulatory work. Pilot phases are essential and often reveal necessary changes to settlement or refund logic. Parallelize workstreams where possible: while backend ledger and security are developed, UX and integrations can proceed simultaneously to shorten calendar time to pilot. The shortest and fastest way to the Web3 market is by designing a white-label closed-loop crypto wallet. It helps you save time and cost at the same time.

How Much Does It Cost?

Blockchain wallet development costs are driven by choices rather than a single number. Key cost drivers include the architecture you choose, integrations to fiat and crypto onramps, compliance and regulatory requirements, level of security and auditing, the complexity of loyalty and tokenization features, and ongoing operational costs such as treasury and settlement. Visionary investors can save significantly by choosing modular, reusable components, using permissioned blockchain services instead of building distributed infrastructure from scratch, partnering with compliant payment facilitators for settlement, and automating reconciliation. Early pilots help limit scope creep and prevent expensive redesigns. Prioritize features that directly improve conversion or retention to maximize ROI.

Start Your Crypto Wallet Development Vision With Antier’s Experts

Closed-loop cryptocurrency wallet platforms give merchants a direct and powerful way to own payments, loyalty, and customer relationships. Built right, they reduce costs, accelerate checkouts, and become a growth channel that turns refunds and rewards into retention engines. At Antier we design and deliver impactful and successful blockchain wallet solutions that combine blockchain, AI, and neo banking expertise. Our team builds secure, compliant, and scalable wallets tailored to merchant needs, with experience in tokenization, permissioned ledgers, treasury integrations, and merchant integrations. Partnering with an experienced provider reduces risk and accelerates time to market so you can focus on growing your customer base and revenue. We hold a full spectrum of capabilities-

- Expert wallet architecture

- Secure permissioned ledger setup

- Programmable token and rewards systems

- AI-enabled fraud and risk controls

- Seamless POS and app integrations

- Compliant treasury and settlement flows

Connect with us today to share your requirements and watch them turn into reality.

Frequently Asked Questions

01. What is a closed-loop cryptocurrency wallet?

A closed-loop cryptocurrency wallet is a digital wallet that operates exclusively within a specific merchant or brand ecosystem, allowing funds to be spent only at the issuing merchant or their curated partners.

02. What are the advantages of using closed-loop crypto wallets for merchants?

Closed-loop crypto wallets provide merchants with full control over transaction rules, lower fees, ownership of customer data, native loyalty rewards, reduced chargeback risks, and customizable compliance measures.

03. How do closed-loop wallets differ from open-loop wallets?

Closed-loop wallets offer full merchant control, internal settlement with lower fees, first-party customer data ownership, and easier management of loyalty programs, while open-loop wallets involve third-party rules, network fees, and shared customer data.