CryptoCurrency

How to Ensure Success When Building a DEX in 2026?

Aster DEX, formerly APX Finance or ApolloX, is an inspiration for everyone with a DeFi dream, reminding them that they can adopt a pioneer’s playbook and still beat it at its own game. While Aster has distinct technical architectures, it adopts Hyperliquid’s CEX-like trading experience, “points-to-airdrop”, “real yield”, and tokenomics, and a mobile-first approach.

Leonard, the CEO of Aster, told the block…

“Hyperliquid opened up everyone’s mind that you can compete with centralized exchanges. Today, all major crypto players are creating their own orderbook DEX. Bybit is working on one, and Ex-FTX guys are doing another one. We’re doing one on the BNB Chain ecosystem.”

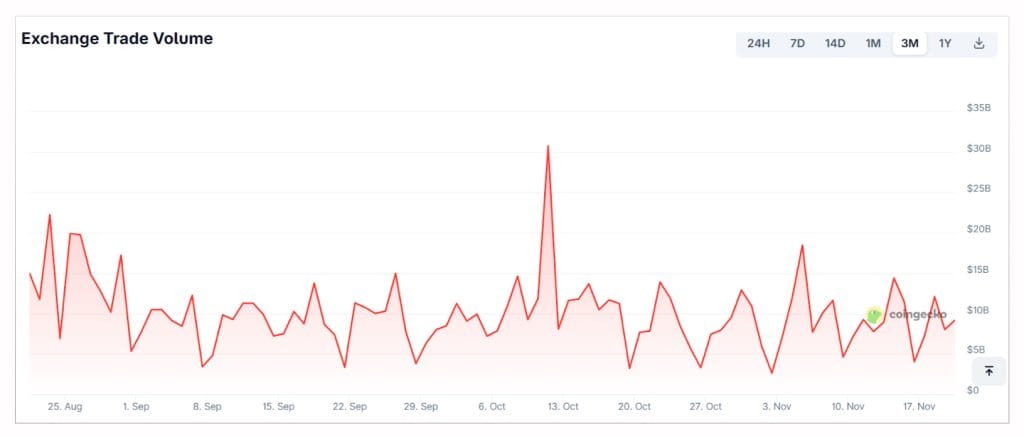

In September, Aster beat Hyperliquid in daily trading volume and fee revenue. The emerging order book perpetual DEX giant surpassed the $100B daily trading volume mark while Hyperliquid barely touched $30B. The winner of DEX wars seems very clear from the graphs below.

Hyperliquid Daily Perpetual Trading Volume

Aster Daily Perpetual Trading Volume

And not just in trading volumes, it even leads in terms of revenue generated from trading fees.

| Metric | Value | Source |

|---|---|---|

| DEX Spot Volume (Q2 2025) | $876B (+25% QoQ) | Top DEXs Report |

| Perp DEX Volume (Q3 2025) | $1.8T (ATH) | Derivatives Sector Analysis |

| Institutional DeFi Exposure | 24% → 75% | EY-Parthenon / Coinbase |

| Total DeFi TVL | $123.6B (+41% YoY) | L2 Adoption Stats |

So, Aster-style DEXs represent the new blueprint for high-performance perpetual DEX development in 2026. Before stating the process for Aster-like DeFi exchange development, let’s discuss what makes Aster perpetual DEX stand out.

What Makes Aster Perpetual DEX Work?

Aster isn’t a single-chain AMM or basic orderbook DEX. It’s a full-stack trading machine tailored to deliver CEX-grade performance on a trustless, cross-chain foundation. It stands out with the following features:

- Bridge-less Multi-chain spot and perpetual execution

- Yield-bearing collateral support (LSTs, LRTs, RWAs)

- 100×–1001× leverage

- Zk-protected, hidden but auditable intent-order flow

- MEV-resistant execution with hidden orders

At its core, Aster solves the three biggest issues that cripple most DEXs today, including fragmented liquidity, public mempool exploits, and slow settlement.

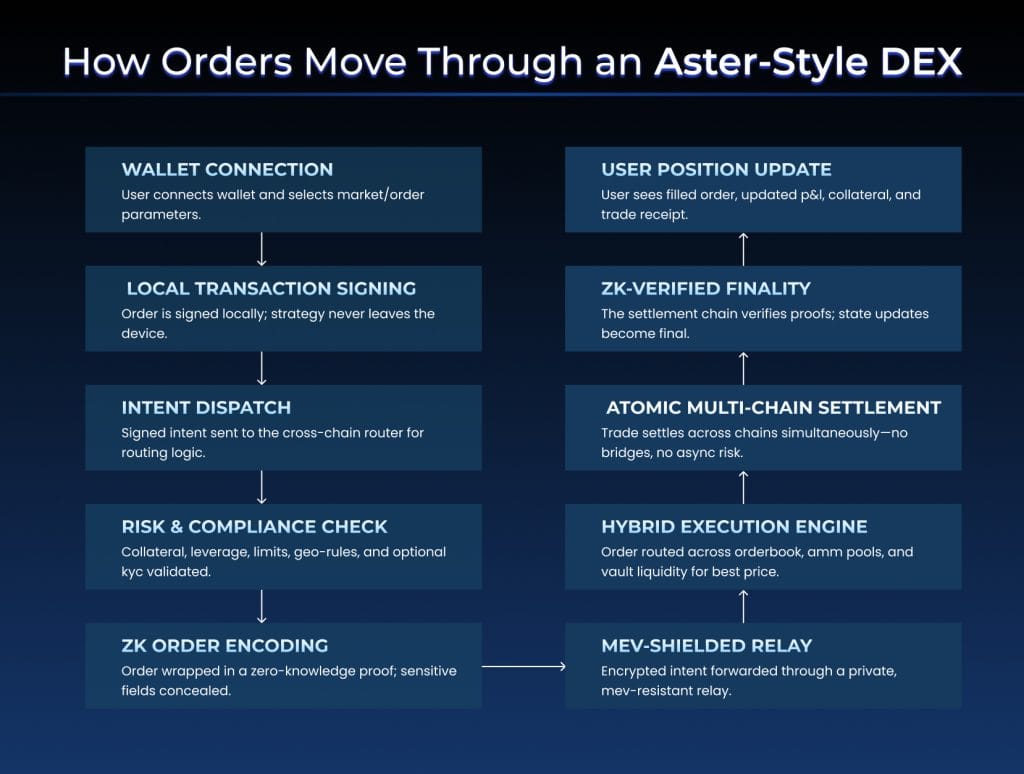

- Multi-Chain Execution Without Bridges

Aster routes trades across ecosystems like BNB, Ethereum, Arbitrum, and Solana using atomic settlement and ZK routing, letting traders tap liquidity across chains without touching risky bridges or juggling assets. Its aggregated liquidity engine gives traders deeper books, tighter spreads, and lower slippage, something that single-chain DEXs can only dream of.

- Institutional-Grade Privacy & MEV Protection

Instead of broadcasting orders publicly like a standard DEX, Aster, the leading decentralized perpetual exchange software, encodes them using:

- ZK-proofs: For validity without disclosure

- Hidden orders: For zero leakage of size, direction, or strategy

- Encrypted relays: Eliminating chances of mempool sniping

- MEV-resistant sequencing

This keeps professional strategies private while preserving full auditability for compliance teams, making it attractive for professional traders and institutions.

- Capital Efficiency That Outperforms CEXs

Aster lets traders post yield-bearing collateral including staked ETH, liquid restaked assets, RWAs, and tokenized treasuries, turning idle funds into productive trading capital. Not just this, the platform also allows 100x-1001x leverage. It is something that even offshore CEXs can’t rival.

- Predictable Performance Under Load

Aster delivers near-CEX performance on top of BNB smart chain using a parallelized matching engine, private intent routing and optimized settlement logic. This setup avoids typical public-mempool bottlenecks and sustains over 25,000+ orders/second, giving traders stable execution even under heavy volume.

However, Leonard mentioned this during a community AMA…

“Our current goal is to complete internal testing and testnet launch by the end of this year. If all goes well, we plan to officially launch the mainnet in the first quarter of next year”

This launch boosts the throughput and also enables the decentralized crypto exchange software scale seamlessly by onboarding new features.

- Enterprise Features That Actually Matter

Aster’s architecture gives builders the exact stack enterprises want:

Trade hybrid execution isn’t hostage to the completely decentralized or centralized processes.

Optional KYC/AML, geo-fencing, institution-only markets, etc. are deployable per jurisdiction.

Cross-chain routing and deep LP vaults eliminate fragmentation.

All fees flow to the treasury. Aster uses some of that money to buy its own tokens and burns a part of those tokens, so the supply reduces and the remaining tokens become more valuable. Another part goes to reward stakers, liquidity providers, traders earning profits, loyalty or airdrop programs, etc. This “real-yield” engine pushed Aster’s fee revenue past $25M daily peaks.

| Criteria | Aster-Style Hybrid DEX | Traditional AMM DEX | Centralized Exchange (CEX) |

|---|---|---|---|

| Latency | Sub-100-ms execution with parallel matching | Block-time delays slow under congestion | Fastest; microsecond-level matching |

| Privacy | ZK-protected orders, hidden intent, selective disclosure | Fully public mempool; no order privacy | High privacy but fully opaque and custodial |

| Liquidity Depth | Aggregated cross-chain liquidity + orderbook depth | Fragmented pools; LP-dependent | Deepest liquidity; centralized market-maker control |

| Control / Ownership | User-custodied assets + enterprise-controlled infra | Fully user-custodied; minimal operational control | Full platform control; user assets custodial |

| MEV Protection | Native MEV shielding + encrypted order flow | No MEV protection; prone to sandwich attacks | No MEV but opaque internal sequencing |

| Compliance Flexibility | Optional KYC/AML, geo-rules, institution-only markets | No compliance controls | Mandatory KYC/AML; full compliance stack |

| Cross-Chain Settlement | Atomic multi-chain execution; no bridges | Single-chain only; bridging needed for multi-chain | Multi-asset support but off-chain accounting |

| API Performance | High-performance feeds for HFT/quant desks | Basic RPC; low throughput consistency | Professional-grade FIX/WebSocket APIs |

Steps to Aster-Style DEX Development

Institutions are clearly signaling that Aster-style DeFi exchange development is a trillion-dollar opportunity in 2026.

Building a perpetual DEX that can compete with Aster requires more than an orderbook and liquidity pools. Businesses need a coordinated, enterprise-grade architecture spanning execution, liquidity, security, compliance, and operational scalability. Here’s the blueprint to follow when building an Aster-style DEX in 2026:

1. Architect the Core Trading Infrastructure

- Execution Engine (Hybrid AMM + Orderbook)

You’ll need a dual-engine architecture to give users the best of both worlds:

-

- Orderbook for precision, speed, and pro-trading features

- AMM fallback for 24/7 liquidity

- Parallel execution for HFT and grid strategies

- Routing logic to fetch the best prices across supported chains

This is the same model that pushed Hyperliquid past $898B+ quarterly derivatives volume. Aster simply executed it better.

An Aster-grade liquidity layer implemented during DEX development requires multiple components working together:

-

- Concentrated liquidity positions

- Single-sided deposits

- Dynamic LP incentives based on market conditions

- Automated rebalancing to stabilize pool depth

- Market-making vaults or intent-based liquidity engines

Aster’s own “Rocket Launch” vault system hit $340M TVL pre-token, proving the model works.

Your smart contract suite must be:

-

- Audited

- Modular

- Upgrade-safe

- Formally verified

Essential modules include:

-

- Swap engine

- Liquidity pools

- Perp engine (funding, liquidation, risk limits)

- Fee & rewards distribution

- Governance hooks

- Upgrade timelocks

Formal verification has historically reduced exploit risk by ~70%. It is essential for a high-leverage perp DeFi exchange development.

2. Build the Off-Chain Performance Layer

Aster-style decentralized crypto exchange software wins because their off-chain systems are optimized for speed and institutional load:

- Matching engine with <100ms latency

- Oracles (Pyth, Chainlink) for price accuracy

- Indexers to track multi-chain state

- Analytics pipelines for quant and HFT access

- Institutional APIs (FIX/WebSocket)

DEX infra handled 158B+ requests/month in 2025, so your backend must be engineered to scale horizontally.

3. Implement a Comprehensive Security Framework

Comprehensive audits ($25K–$150K) prevented ~85% of exploit classes seen in 2025.

4. Design for Scalability & Performance

To match Aster’s responsiveness, enterprises target:

- 25,000+ TPS capacity

- 70–100ms execution latency

- Modular gas model

- State minimization and caching

- Cross-chain routing that stays stable under load

Aster’s aggregated routing already proved that multi-chain performance can outperform single-chain DEXs.

5. Build a Trader-First User Experience

Technology doesn’t take the sole credit for its momentous success. It won because of UX:

- Wallet support (Trust Wallet, MetaMask, OKX, Coinbase Wallet)

- Gas abstraction for easy onboarding

- Mobile-first layouts

- Persistent sessions + biometrics

- Smart orders, copy trading, alerts

- Clean PnL/portfolio views

Aster shows professional UX is not a “nice-to-have” but it’s an essential for your trading engine.

6. Establish Governance, Compliance & Token Utility

- Token Utility That Actually Matters

Your token must have real roles:

-

- Fee share

- Staking rewards

- LP incentives

- Governance

- Buybacks & burns

- Vault boosts

As stated above, the “real-yield” model dominated 2025, with 50%+ tokens shifting toward user-centric emissions.

Adopt a DAO-lite framework:

-

- 4–7 signer multisig

- Snapshot-like voting

- Clear upgrade boundaries

- Emergency response committees

Fast governance is not bad governance in 2025. Aster proved this, and you should be taking it forward in 2026.

A progressive DEX development project must layer compliance instead of hard-coding it. These are lessons from an emerging pioneer:

-

- Geo-fencing

- Optional KYC/AML

- Institution-only markets

- Policy-based listing rules

- Jurisdiction-aware onboarding

Platforms enabling optional KYC saw 40%+ adoption uplift from institutions.

Critical partners include:

-

- Wallets

- Bridges

- On/off ramps

- Market makers

- Custodians

- Quant API partners

This partnership-first strategy helped Aster process $393B+ cumulative volume across chains.

What are the Estimated Build costs and Timelines For Aster-style DEX Development in 2026?

Aster-style decentralized exchange software built to serve spot and burning hot perpetual markets may cost anywhere from $300k to $2M. However, you can leverage Antier’s advanced white label DEX infrastructures and slash your costs and deployment time significantly.

An Estimated Timeline For Your Aster-Like DEX Development:

- 6 Months: Spot + AMM + testnet

- 9 Months: Perps + multi-chain + beta

- 12 Months: Full hybrid DEX + compliance + mainnet

Launch Your Aster-Like DEX With Antier

Aster won because it executed better than anyone else. With a reliable DEX development company, you can do it too.

Aster proved that a decentralized crypto exchange software can feel like a CEX, scale like a cloud platform, and still stay trustless at its core. No wonder every serious crypto enterprise wants to replicate that formula.

If you’re aiming to build an Aster-style perpetual DEX in 2026, the playbook is clear:

Engineer a hybrid execution layer, prioritize privacy and performance, build for institutions without sacrificing DeFi values, and back it all with real-yield economics that traders actually care about.

If you need a partner who’s already shipped high-volume DEXs, perpetual engines, LP vaults, and multi-chain architectures, Antier is ready to step in. We help enterprises build exchange infrastructure that performs at Aster’s level, or surpasses it, with compliance, scalability, and security baked in from day one.

Frequently Asked Questions

01. What is Aster DEX and how does it differ from traditional DEXs?

Aster DEX, formerly known as APX Finance or ApolloX, is a full-stack trading platform that offers CEX-like performance on a trustless, cross-chain foundation, distinguishing itself from traditional DEXs with features like bridge-less multi-chain execution and yield-bearing collateral support.

02. How has Aster DEX performed compared to Hyperliquid?

In September, Aster DEX surpassed Hyperliquid in both daily trading volume and fee revenue, achieving over $100 billion in daily trading volume while Hyperliquid reached around $30 billion.

03. What are the key features that make Aster DEX stand out in the DeFi space?

Aster DEX stands out due to its bridge-less multi-chain execution, support for yield-bearing collateral, high leverage options (100×–1001×), zk-protected order flow, and MEV-resistant execution, addressing major issues faced by most DEXs today.