Crypto World

How to Fix Cross-Border Delays at Scale

“Every hour a payment is delayed is capital that cannot be reinvested, scaled, or compounded.” Cross-border payments remain one of the most complex challenges in global finance. Despite advances in digital banking and fintech infrastructure, many international transactions still take days to settle. Multiple intermediaries, fragmented regulations, and inefficient reconciliation systems continue to slow down money movement.

For fintech founders, payment service providers, and institutional investors, these delays translate into higher costs, liquidity constraints, and lost customer trust. A TRON-enabled stablecoin payment platform offers a modern alternative. Businesses can enable near-instant, low-cost, and transparent international payments by combining blockchain settlement with fiat-pegged digital assets.

This guide explains how such platforms work, why TRON plays a critical role, and how organizations can implement scalable systems to eliminate cross-border payment delays.

Understanding the Real Problem Behind Cross-Border Payment Delays

Cross-border payment delays are not caused by a single technical limitation. They are the result of structural inefficiencies embedded in traditional banking systems. Even with digital interfaces, most international transactions still depend on fragmented infrastructure, multiple intermediaries, and manual verification processes.

For scaling fintech companies and global payment operators, these frictions directly impact liquidity management, customer satisfaction, and operational margins. Without a modern stablecoin payment platform, businesses remain dependent on slow settlement rails that limit their ability to compete in real-time financial markets.

Key Friction Points in Traditional Cross-Border Payments

| Friction Point | Key Data Point | The Real Problem |

|---|---|---|

| Speed | 80% of delays occur in the last mile | Local bank processing and legacy systems slow final settlement |

| Availability | Systems operate ~66 hours per week | Financial dead zones during weekends and holidays |

| Success Rate | Only 35% meet the 1-hour target | Fragmented AML and KYC regulations |

| Cost | 6.49% global average fee | Too many correspondent banks and intermediaries |

What does this mean for payment leaders?

- Speed Remains Unreliable

- Availability Is Limited

- Compliance Slows Execution

- Intermediaries Inflate Costs

The root issue is continued dependence on legacy rails and intermediary-heavy models. Incremental upgrades rarely solve these problems without comprehensive stablecoin payment platform development. Sustainable improvement requires rebuilding settlement workflows at the infrastructure level.

See How Modern Payment Platforms Reduce Delays

Why TRON Is a Preferred Network for Stablecoin Payment Platform Development

When evaluating blockchain networks for stablecoin payment platform development, real-world usage and performance matter most. TRON offers a blend of high throughput, low fees, and strong adoption, making it a practical choice for payment infrastructure.

TRON’s technical characteristics support reliable payment orchestration:

- High transaction speed helps reduce settlement time compared to traditional rails.

- Low network costs make stablecoin transfers more economical, improving margins.

- Mature ecosystem adoption means wider developer support and integration options.

- Stablecoin compatibility ensures seamless settlement workflows for USDT and other assets.

These traits have contributed to TRON’s growth and positioned it as a strong foundation for building a Stablecoin Payment Platform that meets enterprise performance and scalability needs.

How a TRON-Enabled Stablecoin Payment Platform Works

- Payment initiation: Customers trigger transactions through wallets or integrated apps. The system validates identity and balance before processing.

- Merchant and gateway processing: Merchant systems connect via APIs. The payment gateway applies routing rules, fees, and compliance checks.

- Transaction orchestration: The platform prepares, signs, and routes transactions while managing fallback and risk controls.

- TRON settlement layer: Stablecoin transfers are executed on the TRON network, enabling near-real-time settlement and transparent records.

- Liquidity and on/off ramps: Integrated exchanges and custodians convert between fiat and stablecoins for local payouts and treasury management.

- Security and custody management: Multi-signature wallets, cold storage, and access controls protect digital assets.

- Compliance and monitoring: Automated KYC, AML, and transaction screening ensure regulatory alignment.

- Reconciliation and reporting: On-chain data and system logs enable automated accounting and settlement reporting.

- Integration and scalability: APIs connect with banking systems, ERPs, and marketplaces, supporting long-term growth.

When these components operate together, they form a unified, secure, and high-performance Stablecoin payment system, making professional stablecoin payment platform development essential for building scalable, compliant, and future-ready global settlement systems.

Business Benefits of Adopting Stablecoin Payment Infrastructure

For fintech operators, payment platforms, and global enterprises, implementing a TRON-enabled solution delivers measurable and long-term business value. Beyond technical efficiency, it directly improves financial performance, operational resilience, and market competitiveness.

- Faster Settlement Cycles: TRON-based settlement enables funds to move within minutes instead of days. This accelerates cash flow, reduces working capital pressure, and improves treasury visibility. For high-volume platforms, faster settlements supported by a modern stablecoin payment platform translate into better liquidity planning and reduced dependency on credit lines.

- Lower Operating Costs: Traditional cross-border payments involve multiple intermediaries, each charging processing and reconciliation fees. A blockchain-based settlement layer removes many of these cost centers. Combined with automated workflows, this significantly lowers per-transaction expenses and improves margin sustainability.

- Improved Customer Experience: End users increasingly expect instant and transparent payments. Delayed settlements and unclear fee structures lead to churn and reputational risk. A reliable stablecoin payment system enables faster transfers, real-time status updates, and predictable pricing, strengthening user trust and platform retention.

- Global Market Expansion: TRON-enabled platforms allow businesses to operate in regions with limited banking infrastructure. This enables payment providers to serve underbanked populations and emerging markets without establishing local correspondent relationships.

- Better Risk Control and Compliance: On-chain transaction records provide immutable audit trails, while integrated compliance tools support automated monitoring and reporting. This improves governance, reduces fraud exposure, and simplifies regulatory engagement. For institutional clients, these features are essential for long-term adoption.

- Stronger Investor and Partner Confidence: Transparent settlement logic, predictable costs, and scalable infrastructure make payment platforms more attractive to investors and strategic partners. Platforms built through structured payment system development demonstrate operational maturity and long-term viability, which support fundraising and partnership negotiations.

For founders, executives, and investors, TRON-based stablecoin infrastructure is not merely a technology upgrade. It is a strategic lever for improving profitability, reducing operational risk, and accelerating market entry.

Request a Detailed Platform Architecture Review

Key Considerations Before Implementation

While the technology is mature, successful deployment requires careful planning.

1. Regulatory Compliance

A production-ready platform must support:

- Know Your Customer procedures.

- Anti-Money Laundering screening

- Transaction monitoring

- Regulatory reporting

2. Security Framework

Security must include:

- Multi-signature wallets

- Cold storage mechanisms

- Secure API authentication

- Disaster recovery systems

3. Scalability Planning

- Systems must handle future transaction growth without latency or failures.

4. Integration Capability

- Compatibility with ERP systems, accounting tools, and partner platforms is critical.

Professional stablecoin payment platform development teams design these elements from the start.

Practical Roadmap to Building a TRON-Based Payment System

For organizations considering implementation, the following phased approach works best for successful stablecoin payment platform development:

Phase 1: Business and Technical Assessment

Define transaction volumes, target markets, regulatory exposure, and operational requirements to align the platform with business goals.

Phase 2: Architecture Design

Develop wallet models, compliance workflows, API structures, and settlement logic to create a scalable foundation.

Phase 3: Platform Development

Build and test core modules for transaction processing, monitoring, and reporting to ensure operational reliability.

Phase 4: Compliance and Security Validation

Conduct audits, regulatory reviews, and penetration testing to meet institutional security and regulatory standards.

Phase 5: Deployment and Optimization

Launch in controlled environments, analyze performance data, and continuously optimize workflows for long-term stability.

Evaluating ROI: Is It Worth the Investment?

For decision-makers, return on investment is a critical factor when adopting new payment infrastructure. Implementing a solution on the TRON network offers both technical efficiency and measurable financial returns.

Well-designed stablecoin platforms built on TRON typically deliver:

- 40-70% reduction in processing costs by minimizing intermediaries and automating settlement workflows

- Significant improvement in settlement speed, enabling near-real-time fund availability

- Lower customer churn through faster transfers and transparent pricing

- Increased transaction volumes driven by improved user trust and operational reliability

In addition, the low transaction fees and high throughput of the TRON network help payment providers maintain profitability even at scale. When aligned with a long-term growth strategy, a well-implemented stablecoin payment platform becomes a revenue enabler rather than a cost center. It supports stronger cash flow management, higher platform adoption, and greater investor confidence, making it a strategic asset for fintech and enterprise payment leaders.

Final Takeaway

Cross-border delays are no longer acceptable in a real-time global economy. Fintech leaders and payment providers that continue relying on legacy rails risk losing customers, margins, and market relevance. A TRON-enabled settlement infrastructure offers speed, transparency, and scalability. However, realizing these benefits requires expert execution. This is why professional stablecoin payment platform development is essential.

Antier brings deep technical expertise, regulatory understanding, and proven delivery capabilities to help organizations build secure, high-performance payment platforms. With Antier, businesses reduce implementation risk and accelerate time-to-market. Now is the time to modernize your payment infrastructure.

Partner with Antier to Launch Your TRON-Enabled stablecoin platform. Start building a faster, compliant, and future-ready global payment system today!

Frequently Asked Questions

01. What are the main challenges of cross-border payments?

The main challenges include delays caused by multiple intermediaries, fragmented regulations, and inefficient reconciliation systems, which lead to higher costs and liquidity constraints.

02. How does a TRON-enabled stablecoin payment platform improve cross-border payments?

A TRON-enabled stablecoin payment platform enables near-instant, low-cost, and transparent international payments by combining blockchain settlement with fiat-pegged digital assets.

03. What are the key friction points in traditional cross-border payment systems?

Key friction points include unreliable speed, limited availability, compliance issues that slow execution, and inflated costs due to too many intermediaries.

Crypto World

SEC Adopts Final Rules Under HFIA Act to Boost Foreign Insider Transparency

TLDR:

- The HFIA Act was enacted on December 18, 2025, mandating SEC action within 90 days of enactment.

- FPI directors and officers must file Section 16 reports electronically and in English by March 18, 2026.

- The SEC removed the blanket Section 16 exemption, replacing it with narrower short-swing and short-selling carve-outs.

- Ten percent beneficial owners of FPI equity securities are excluded from the new Section 16(a) reporting rules.

The HFIA Act has prompted the Securities and Exchange Commission to adopt final rule and form amendments under Section 16 of the Securities Exchange Act of 1934.

These changes require directors and officers of foreign private issuers to disclose their holdings and transactions in equity securities.

The rules take effect on March 18, 2026. This move follows the enactment of the Holding Foreign Insiders Accountable Act on December 18, 2025, bringing greater transparency to FPI insider activity.

SEC Revises Section 16 Rules for Foreign Private Issuers

The HFIA Act amended Section 16(a) of the Exchange Act to expand reporting requirements. Directors and officers of FPIs with equity securities registered under Section 12 are now subject to these rules.

However, the law excludes “10 percent holders” who beneficially own more than 10 percent of any class of FPI equity securities.

Under the revised rules, covered insiders must file Section 16 reports electronically and in English. This requirement marks a clear shift from prior exemptions that FPI insiders previously enjoyed.

As a result, the reporting process becomes more standardized and accessible to U.S. investors.

The SEC amended Rule 3a12-3(b) to remove the existing blanket exemption from Section 16 entirely. In its place, the rule now provides narrower exemptions. These cover only the Section 16(b) short-swing profit rules and the Section 16(c) short selling prohibition.

Additionally, Rule 16a-2 was updated to formally exclude 10 percent holders of FPI equity securities from Section 16(a) requirements.

This exclusion ensures that minority beneficial owners are not swept into the new reporting framework. The change also aligns the rule text with the statutory language of the HFIA Act itself.

Reporting Deadlines and Compliance Timeline Under the HFIA Act

The HFIA Act set a firm deadline for the SEC to act. The Commission was required to issue final regulations no later than 90 days after the December 18, 2025 enactment date. The SEC met that mandate by adopting these amendments ahead of the March 18, 2026 effective date.

Directors and officers of qualifying FPIs must begin filing Section 16 reports starting March 18, 2026. This date serves as both the statutory effective date and the compliance start point.

Covered insiders should therefore prepare their disclosure systems well before that deadline.

The rule changes also revise the relevant Section 16 report forms to reflect the new requirements. These form updates ensure that the reporting structure matches the amended statutory framework. Moreover, they provide clarity on what information FPI insiders must include in each filing.

The SEC’s action brings FPI insiders closer in line with domestic reporting standards. This regulatory alignment gives investors better visibility into the trading activity of foreign company insiders. It also strengthens the overall integrity of U.S. equity markets.

Crypto World

Three cryptocurrencies trading under $0.10 attract investor attention in March

VET, HBAR, DOGE trade below $0.1 with neutral RSI as tax refund season sparks speculative March flows as cryptocurrencies continue to plummet.

Summary

- VET trades below $0.1 with RSI in neutral territory and key support around $0.0070–$0.0072 and resistance near $0.0082–$0.0089 as key cryptocurrencies face broader market decline.

- HBAR consolidates just under $0.1, with support around $0.08–$0.09 and resistance near $0.11; FedEx’s Hedera Council membership strengthens the project’s real‑world tokenization narrative.

- DOGE trades around $0.09–$0.10, with targets at $0.11–$0.16 into March 2026 as neutral RSI and healthy spot volume leave room for upside if BTC and ETH stabilize and U.S. tax refunds fuel risk appetite.

As Bitcoin (BTC) faces resistance and major cryptocurrencies trade within established ranges, several low-priced digital assets are drawing attention from traders seeking potential gains in March, according to market analysis.

The cryptocurrency market is experiencing volatility following a difficult 2026, with the U.S. Internal Revenue Service’s tax refund season potentially creating buying pressure for lower-priced tokens, market observers noted.

VeChain (VET), despite underperforming in 2026, has been implementing a network upgrade since late 2025. The blockchain project faces a March 15 deadline for legacy node migration, which stems from the StarGate upgrade to its staking system. The asset’s relative strength index indicates neither overbought nor oversold conditions, according to technical analysis. Market participants are monitoring support and resistance levels around the migration deadline.

Hedera (HBAR) has reduced its year-to-date losses following a decline in early February and is currently trading near key price levels. The platform has positioned itself in real-world asset tokenization and recently announced that FedEx joined the Hedera Council. Technical analysts identified current price levels as critical thresholds, with movement below support potentially signaling further declines, while a break above resistance could indicate upward momentum.

Dogecoin (DOGE), the largest meme coin by market capitalization, has experienced significant volatility in 2026 alongside broader market trends. The approaching tax refund season could generate buying activity as some investors receive additional funds, market watchers suggested. Analysts noted that Dogecoin’s performance in March may depend on the price action of larger cryptocurrencies including Bitcoin and Ethereum, with stability in those assets potentially supporting interest in more volatile tokens.

All three cryptocurrencies are currently trading below $0.10, according to market data.

Crypto World

Solana ETF Flow, DEX Activity, Fee Revenue Rise: Is SOL discounted?

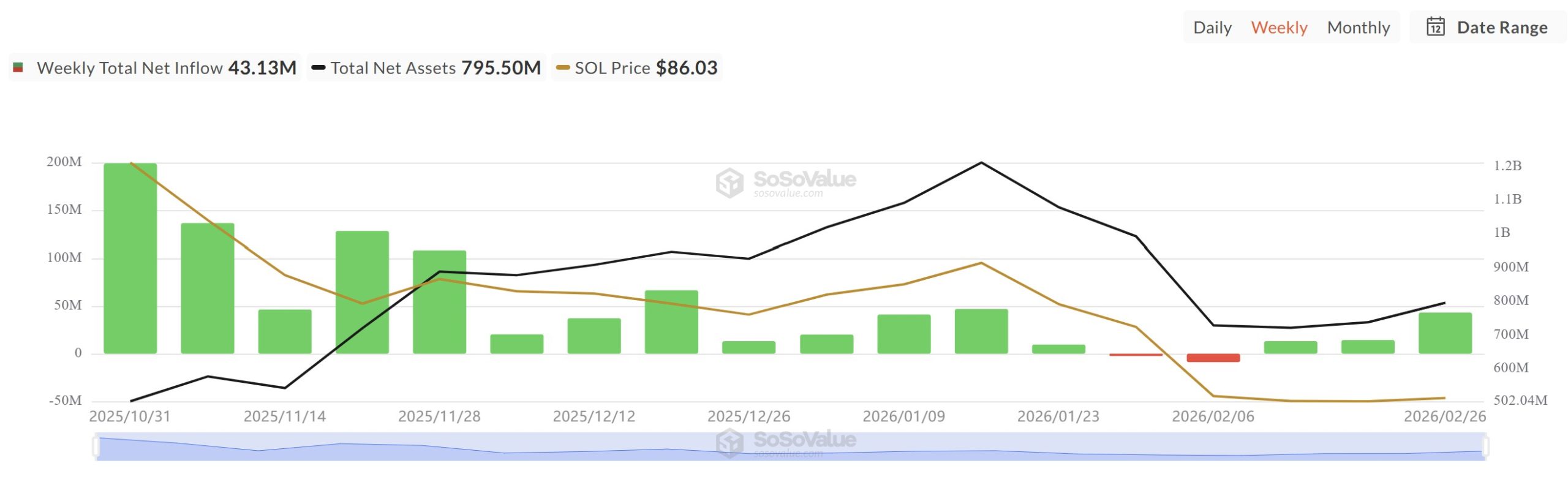

Solana’s SOL (SOL) is down 72% from its all-time high of $295 and well below the $188 level seen during its spot exchange-traded funds (ETFs) launch in October 2025. Since early December 2025, spot SOL ETF inflows have slowed while the price retraced sharply over four months.

At the same time, Solana’s onchain volumes and revenue metrics continue to rank higher against competitors, raising questions on whether SOL’s longer-term price prospects tilt toward a return to its all-time high.

SOL ETF resilience aligns with network use

Spot SOL ETFs launched in late October 2025, drawing over $100 million in average net inflows during their first five weeks. Since December 2025, the weekly inflows have decreased, averaging $20 million to $25 million as SOL price slid to $86 in February 2026.

Across the four-month drawdown, the cumulative outflows total just $11.3 million over two weeks. Spot Bitcoin (BTC) and Ether (ETH) ETFs, by comparison, have logged four consecutive months of negative flows in the same period.

Solana’s network activity tells a different story than its price. Over the past 30 days, Solana processed $108 billion in decentralized exchange (DEX) volume, ahead of Ethereum’s $63.7 billion and Base’s $31.48 billion. Volumes in January reached $117 billion, exceeding those in December and November for the chain as well. The weekly averages since January 2025 have hovered near $20 billion to $25 billion.

In the last 24 hours, Solana generated $3.1 million in app revenue versus Ethereum’s $2.95 million. Active addresses stood at 2.17 million against 682,236, while chain fees reached $722,706 compared to Ethereum’s $356,438.

Solana’s RWA sector has also climbed to an all-time high of $1.71 billion, up 45% in 30 days, but Ether holds $15 billion of the $25.37 billion distributed asset value in that industry.

Related: ETH’s next big move depends on daily close above $2.1K: Data

SOL support cluster and valuation gap

Crypto trader Scient noted two macro areas that may shape a potential bottom. The first is the 0.75 Fibonacci retracement zone of $60 to $70, a level associated with deeper pullbacks within larger uptrends.

The second is a weekly demand fair value gap (FVG) between $22 and $29, an area of prior liquidity imbalance that preceded the explosive rally to $200 from $25.

For now, the structure remains capped as the price holds below the weekly resistance of $120.

On the weekly chart, SOL has already tested the demand zone of $51 to $80, aligning with that retracement pocket, and may head for a recovery from its current price.

UTXO Realized Price Distribution (URPD) data adds context. Over 6% of the supply last moved within the current price cluster, creating a dense cost basis zone. The next significant concentration, above 3% of supply, sits between $20 and $30.

From a valuation standpoint, SOL is near a realized supply cluster, while the ETF positioning has not unwound, and DEX turnover leads other chains despite its lower total value locked (TVL).

The price compression alongside consistent capital inflows and rising network use reveals a measurable gap between activity and valuation.

Whether that gap resolves through SOL’s price action depends on how the $51 to $80 level and the $120 resistance level interact with these factors over the coming months.

Related: Solana leads crypto recovery with 10% gain: Is $100 SOL price next?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Traders’ Move Off Bitcoin, Shift Capital Flows To Gold, AI And Tech Stocks

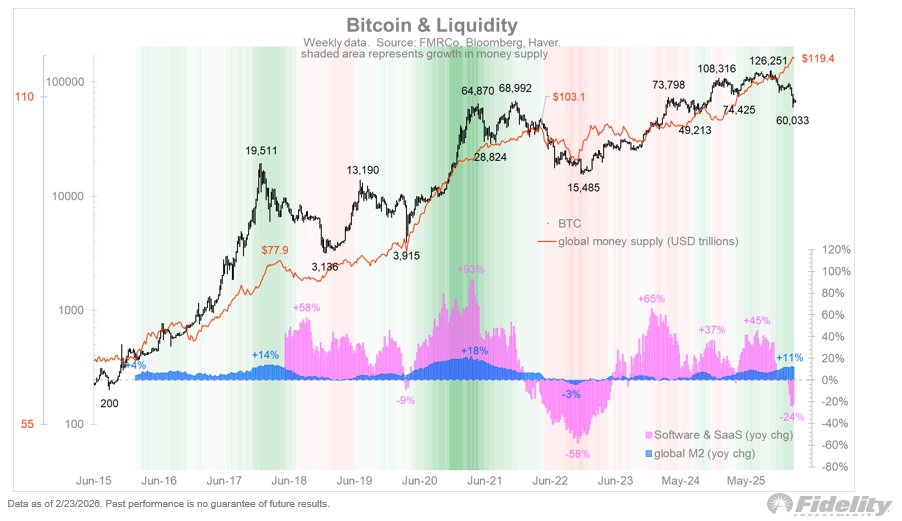

Bitcoin (BTC) and gold are showing very different profiles in 2026. Gold has climbed 153% since the start of 2024, while Bitcoin is down roughly 30% over the same stretch.

One analyst said that the gap lines up with steady growth in global money supply, cooling appetite for risky tech stocks, and falling crypto exchange balances. Together, these changes are shaping how both assets are trading in the market.

Rising liquidity and tech stock speculation fail to supercharge Bitcoin

In an X post, Fidelity director of global macro, Jurrien Timmer said that gold has behaved as expected in a bull market, with sharp pullbacks attracting short-term buyers. Timmer described gold as a pure “hard money” asset that has tracked global money supply growth closely.

Bitcoin follows the global money supply growth over time, shown by the steady rise in global M2 (orange line). When M2 expands, BTC has generally trended higher. However, the chart shows that Bitcoin’s strongest rallies occurred when liquidity growth aligned with rising software and Software-as-a-Service (SaaS) stocks, each being a proxy for speculative appetite.

In 2017–2018 and again in 2020–2021, the software stocks posted gains of roughly 58% and 93% year-over-year, and Bitcoin price rallied sharply during those periods. In 2022, software stocks fell by around 58%, and Bitcoin experienced a deep drawdown even as the money supply levels stayed elevated.

The data shows that money supply growth supports the long-term trend, while shifts in tech-sector speculation tend to amplify or dampen Bitcoin’s price swings. This indicates that Bitcoin carries hard money exposure and high-beta characteristics, amplifying moves in both directions.

Timmer noted that liquidity is ample while speculative sentiment sits in a bear phase. In this scenario, gold and money supply have rallied together, while Bitcoin has struggled to keep pace.

Related: Bitcoin threatens new breakdown as US PPI sends gold to 1-month high

Gold draws demand on crypto exchanges

Demand on crypto-native platforms has also rotated toward gold-linked products. On Jan. 5, Binance launched 24-hour, 7-day gold futures trading. The cumulative volume of this product is approaching $35 billion, with more than $4 billion recorded on the most active day. The weekly volume averages about $4.7 billion, according to crypto analyst Darkfost.

Activity accelerated immediately after gold posted a two-day correction exceeding 20%. The spike highlights the demand for tokenized exposure to traditional hard assets within crypto venues.

At the same time, CryptoQuant data shows Binance’s total portfolio value across BTC, ETH, XRP, and major ERC20 and TRC20 stablecoins has fallen to roughly $102 billion. That marks the lowest reading since April 2025, down from about $140 billion in August 2025.

The $38 billion decline reflects lower asset prices and user withdrawals into self-custody during bearish volatility.

For Bitcoin, this points to reduced capital on exchanges, which may signal cautious trader positioning and thin near-term liquidity.

Related: Bitcoin to $30K? Analysts debate when and at what price BTC will bottom

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Where Ethereum’s capital actually lives

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

A new report shows that 58% of Ethereum’s top-holder capital sits outside ETH, reshaping how dominance, concentration, and systemic risk are understood.

Summary

- Aggregated rankings reveal $426b in top-address holdings versus $189b under ETH-only measurement, with nearly half of the Top-1,000 addresses changing once tokens are counted.

- Smart contracts now control nearly 40% of top-holder capital, signaling a structural shift from individual holders to protocol-driven mechanisms.

- The newly introduced Printing-Press Index (PPI) shows DeFi balances cluster around ~50% self-issued tokens, highlighting rising wrong-way risk and potential systemic fragility in a token-heavy market.

Ethereum’s largest balances look dramatically smaller through an ETH-only lens. When address holdings are evaluated by total on-chain assets, ETH plus ERC-20 tokens and stablecoins valued in USD, the apparent capital at the top expands by more than 2x. This isn’t just a valuation tweak: once tokens and stablecoins are included, smart contracts and protocol-controlled entities represent over 40% of top-holder capital, fundamentally altering the visible structure of Ethereum’s market.

What to know

- Once addresses are ranked by total USD holdings (ETH plus ERC-20 tokens and stablecoins), the leaderboard captures far more capital than ETH-only rankings. In the Aggregated Top-10,000, total balances amount to $426B, compared with $189B when measured by ETH alone, a 2.2x difference in the capital visible at the top. The composition also shifts: in the Top-1,000, only 537 addresses overlap between the ETH-only and aggregated rankings.

- This view also changes who appears to control Ethereum’s largest balances. In the Aggregated Top-1,000, smart contracts account for nearly 40% of the capital. The shift implies that a large share of Ethereum’s economic weight sits in automated, protocol-controlled structures rather than externally owned accounts, altering how concentration, liquidity, and counterparty exposure should be interpreted.

- A Printing-Press Index (PPI) helps separate externally sourced value from self-minted balance-sheet mass. In DeFi-related balances, self-issued components cluster around 50%, a level that moves from “detail” to systemic fragility because even modest selling pressure can trigger wrong-way dynamics and accelerate a death-spiral-style unwind. A practical risk threshold often begins around ~20%.

About Ethplorer.io report

This report uses an aggregated ranking of Ethereum addresses based on totalBalanceUsd, which includes ETH, ERC-20 tokens and stablecoins valued in USD.

The Beacon deposit contract is excluded because it is a technical registry, not a wallet. It only logs staking deposits, meaning the ETH shown there is not withdrawable capital. While traditional rankings often display about 77.8M ETH (~$258B) at this address, the economically relevant staking balance is closer to ~36M ETH (~$118B) – roughly 2.2x lower.

Token contracts are also excluded to focus on economically meaningful holders.

Altseason already happened: Just not on the price charts

Crypto markets have moved beyond price discovery and into a phase of power discovery. Prices, market caps and TVL are transparent, but it remains unclear who actually controls liquidity, issuance and systemic risk across Ethereum’s on-chain economy.

In earlier cycles, this distinction mattered less. Through most of 2017–2021, ETH represented the majority of Ethereum’s economic value, while tokens and stablecoins played secondary roles. ETH price and market cap were often sufficient proxies for economic influence.

That structure has since changed. By 2022–2023, token-denominated balances reached ETH in economic weight.

In Ethereum’s aggregated rating, ETH no longer dominates portfolios

According to the Ethplorer.io report, the top addresses hold about $426.3B in total value. Of this amount, $177.5B is held in ETH, roughly 42%, while the remaining ~58% is denominated in tokens. Stablecoins alone account for around 26% of the average large-address balance.

Importantly, this is not just a matter of composition. When ranked by Aggregated value, only 537 addresses overlap with the ETH-based Top-1,000, meaning nearly half of the largest holders emerge only once tokens are counted.

In that sense, a form of “alt-season” may have already occurred, just not in the way markets traditionally expect. Dominance did not arrive through broad price appreciation or new all-time highs, but quietly, through balance-sheet accumulation.

This disconnect helps explain why the shift went largely unnoticed. Market participants were watching charts, while structural dominance was changing on-chain.

What this reveals is not a failed altseason, but a transformed one. Capital did not rotate into altcoins through explosive price appreciation. Instead, it expanded laterally, across a growing number of protocols, tokens and smart contracts, while prices remained largely range-bound.

When size stops signaling strength

Over the past year, Top-100 addresses did not preserve capital better than the broader Top-1,000. Despite expectations of superior information or positioning at the very top, concentration did not translate into structural outperformance.

By calculating the Median balance (~$122M), the Maximum balance ($35.2B), and their ratio (Max / Median ~290×) for the Aggregated Top-1000, a clear conclusion emerges. Taken together, these metrics point to a shift from market risk to system risk. A nearly 290× gap between the largest and median balances reflects structural concentration rather than distributed exposure. In such an environment, losses are driven less by adverse price movements and more by the liquidity conditions and mechanics of leading protocols.

For investors, the implication is practical rather than theoretical.

In a token-heavy, sideways market, strategies centered on capital preservation and yield capture, staking, liquid staking, restaking, and stablecoin-based returns appear more consistent with how large holders are actually positioning on-chain than speculative bets on illiquid tokens or leveraged exposure.

In other words, structural change is already reflected in balances, while expectations continue to follow charts.

If tokens now represent the majority of Ethereum’s economic weight, the more important question is no longer whether this shift exists, but what risks it introduces. Especially when a growing share of that capital is self-issued.

The Printing-Press Index: Measuring self-minted wealth

To separate externally sourced capital from value inflated by self-issuance, the Printing-Press Index (PPI) is calculated by Ethplorer as the share of a project’s own tokens within its total token-denominated portfolio:

PPI = Own tokens (USD) / Total tokens (USD).

*Only liquid assets are included. Spam tokens are filtered using Ethplorer.

At a group level, the results are uneven:

- DeFi protocols cluster around ~50% self-issued tokens (e.g. UNI, AAVE, MNT).

- Centralized exchanges average ~7% (BNB, CRO, LEO), but with notable outliers:

- Within the Bitget-linked address group, 31 related addresses hold roughly $11B in total assets, of which ~$3.25B is denominated in BGB, implying a group-level PPI of ~30%.

As Ethereum’s economy shifts toward tokens, balance size becomes a weaker indicator of risk. High PPI introduces a well-documented structural risk known as wrong-way risk, where a system’s stability depends on the value of its own token.

At low levels (roughly 10-20%), self-issued tokens function as a design feature. Beyond ~40-50%, the system enters a fragile regime: modest external pressure can impair confidence, compress liquidity, and trigger reflexive sell-offs characteristic of a death-spiral dynamic. At this point, PPI shifts from a descriptive metric to a signal of systemic vulnerability.

The UST-LUNA collapse represents the extreme case, with a PPI near 100%, where self-referential backing led to a reflexive unwind once confidence broke.

The FTX-FTT case shows that even ~40% self-issued exposure can destabilize a system when liquidity thins.

In both cases, balance-sheet size masked fragility rooted in token self-dependence.

In short

In a token-heavy market, what matters is no longer how big a balance is, but what it consists of. PPI provides a practical filter for assessing balance-sheet quality, separating externally sourced capital from value amplified through self-issuance. In a market where structural dominance has already shifted and prices remain range-bound, attention naturally moves from chasing expansion to managing exposure. For analysts and investors, monitoring how capital is composed, not just how much exists, becomes central to evaluating resilience, concentration and risk in a post-ETH-dominance landscape.

Smart contracts vs. HODLers: When risk moves from holders to mechanisms

When Ethereum was conceived in 2013, Vitalik Buterin framed it in his White Paper not as a currency system, but as a platform for self-executing smart contracts and decentralized applications. Aggregated on-chain data now shows that Ethereum’s largest holders increasingly reflect this architecture:

When viewed through an ETH-only lens, smart contracts appeared as a minority participant in Ethereum’s wealth distribution. Aggregated balances change that picture materially.

In the Aggregated Top, smart contracts control nearly 40% of total capital, roughly three times their share in ETH-only rankings.

This is not just a classification shift, it is a risk transfer.

When capital sits in externally owned accounts, risk is tied to individual behavior. When capital moves into smart contracts, risk becomes embedded in mechanisms: code logic, collateral design, liquidity assumptions and token economics.

For analysts and investors, this changes how exposure should be evaluated.

A large balance no longer implies resilience. What matters is whether that balance is externally sourced, or recursively backed by its own issuance. In a contract-dominated landscape, headline TVL or balance size can mask fragility rather than signal strength.

Operationally, this shifts analysis from protocol narratives to address-level balance inspection.

Evaluating a protocol increasingly means identifying its associated on-chain entities, aggregating their balances, and measuring how much of that capital is represented by the project’s own token. This process relies on address attribution and tagging rather than price charts alone.

This is where PPI becomes operational rather than theoretical.

Using tagged project addresses, available across modern blockchain explorers, analysts can quantify self-issued exposure directly. A PPI above roughly 20-30% signals rising wrong-way risk, where protocol stability increasingly depends on the market value of its own token rather than external capital.

Final insight: What the new structure of Ethereum actually means

Ethereum’s on-chain data no longer supports analysis based on ETH balances alone. Once capital is viewed in aggregated USD terms, a different market structure emerges, one that materially changes how exposure, dominance and risk should be interpreted:

- Smart contracts are no longer marginal holders, they are core economic actors.

With nearly 40% of top-holder capital controlled by contracts, risk increasingly resides in protocol mechanics rather than individual decision-making. - The altseason did not disappear, it changed form. Capital expanded across protocols and balance sheets rather than through price appreciation, explaining why structural dominance shifted without new All-Time Highs.

- Balance size is no longer a proxy for resilience. High PPI levels show that large balances can be internally reinforced by self-issued tokens, introducing wrong-way risk even in systems that appear well-capitalized.

- Exposure analysis must shift from narratives to balance composition. Evaluating protocols now requires inspecting aggregated balances, address attribution, and self-issued exposure, not just TVL, token price or brand perception.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

USDCx Launches on Cardano Backed 1:1 by USDC Through Circle’s xReserve Infrastructure

TLDR:

- USDCx is a Cardano-native stablecoin backed 1:1 by USDC held in Circle’s xReserve smart contract.

- IOG will subsidize USDCx bridge fees for the first 10 days to reduce onboarding costs for new users.

- Minswap, Liqwid, and SundaeSwap are live integrations at launch, enabling real DeFi utility from day one.

- Users with USDC on Base can deposit and withdraw USDCx without interacting with Ethereum at all.

USDCx on Cardano is now live, marking a key step in the blockchain network’s push toward real-world financial utility.

Input Output Global (IOG), in collaboration with Circle, has deployed the technical infrastructure for the stablecoin.

The asset is backed 1:1 by USDC held in Circle’s xReserve smart contract. To ease onboarding, IOG will subsidize bridge fees for the first 10 days. Pentad and Midgard Labs supported the build, operation, and security of the infrastructure.

How USDCx Works on Cardano

USDCx is a Cardano-native token linked directly to USDC held in Circle’s xReserve smart contract. Users can deposit USDC on Ethereum and mint USDCx on Cardano at a 1:1 ratio.

They can also burn USDCx to release USDC back on Ethereum. This removes the need for third-party bridges, keeping the process straightforward.

A dedicated USDCx Bridge web application supports these transfers. Through the app, users can also swap USDC directly into Cardano-native assets via Minswap.

Centralized exchange users with USDC on Base can deposit and withdraw without touching Ethereum at all. This removes extra steps for a wider group of users.

IOG shared the news directly, noting the role of community funding:

“This integration was delivered through the Cardano ecosystem’s Critical Integrations program, funded by the community. Your support has helped bring tier one stablecoin infrastructure to Cardano.”

At launch, Minswap, Liqwid, and SundaeSwap are already integrated with USDCx. This means the stablecoin is usable from day one across major Cardano DeFi platforms.

Early on-chain activity is observable, which adds credibility to the rollout. The integration is built on real usage, not just a technical deployment.

Use Cases and Ecosystem Growth

USDCx on Cardano targets several key financial use cases across the ecosystem. Lending, borrowing, and liquidity provisioning all benefit from a dollar-backed stablecoin.

Stable yields become more viable when dollar-denominated assets are readily available. DeFi markets also function more efficiently with a trusted stablecoin in circulation.

Beyond DeFi, USDCx supports cross-border payments and remittances. Users in regions with unstable local currencies gain access to dollar-denominated value on-chain.

Real-world asset settlement also becomes more practical with a reliable dollar rail. Tokenized securities and credit instruments require this kind of stable backing to function properly.

For institutional participants, USDC carries established compliance standards across global markets. Bringing that infrastructure to Cardano lowers the barriers for enterprise adoption.

Treasury management and dollar-priced applications also become more accessible as a result. This aligns Cardano with existing financial flows rather than operating outside them.

The rollout is designed for long-term reliability, not a short-term initiative. Progress will remain measurable through on-chain activity as more platforms integrate USDCx.

Crypto World

Brazil Solar Mega-Project Studies Bitcoin Mining Plan

TLDR

- Engie received full commercial approval for the Assu Sol solar complex in Brazil on February 13, 2026.

- The project has a peak capacity of 895 MWp and includes 16 plants with over 1.5 million panels.

- Brazil has faced recurring curtailment since 2023 due to grid bottlenecks and excess renewable generation.

- Engie is studying Bitcoin mining as a flexible offtaker to monetize surplus electricity.

- The company estimates it would need about two years to deploy any mining or storage solution.

Engie has secured full approval for its Assu Sol solar complex in Brazil and has begun studying Bitcoin mining to monetize surplus electricity. The project reached commercial clearance on February 13, 2026, and now operates as the company’s largest solar asset worldwide. Engie plans to evaluate mining and battery storage to capture value from recurring grid curtailment.

Brazil Grid Bottlenecks Drive Search for Flexible Demand

Brazil has expanded wind and solar generation faster than its transmission infrastructure has developed, and that gap has led to recurring curtailment since 2023. Grid operators have forced plants to shut down during oversupply periods, and producers have lost revenue on unused megawatt-hours. Engie now seeks a flexible demand solution that can consume excess electricity behind the meter and reduce financial losses.

The Assu Sol complex carries 895 MWp of peak capacity and 753 MW of installed capacity across 16 plants. The BRL 3.3 billion project spans more than 1.5 million photovoltaic panels in northeastern Brazil. Brazilian authorities granted full commercial approval on February 13, 2026, and Engie confirmed operational status.

Bitcoin Mining and Storage Under Review

Engie is assessing whether Bitcoin mining facilities can operate as a flexible offtaker for surplus power. Mining rigs can switch on and off quickly, and operators can match activity with excess generation periods. The company has stated that it does not seek speculative crypto exposure but aims to protect plant revenues.

Eduardo Sattamini, Engie’s country manager in Brazil, addressed the timeline for any deployment. He said, “We would need around two years to develop and implement a mining or storage solution.” He also confirmed that Engie continues to evaluate utility-scale battery systems as an alternative option.

Brazil’s foreign trade council has reduced import duties to zero on high-efficiency mining equipment through January 2028. That temporary measure lowers capital expenditure requirements for energy-linked mining operations. Engie is reviewing both mining and storage models before making a final investment decision.

The company has framed the initiative as a revenue management strategy tied to curtailed output. Engie plans to operate any mining capacity only during periods of excess supply. Company officials have confirmed that studies remain ongoing and that no final commitment has been announced.

Assu Sol now stands as Engie’s largest solar asset globally, and the company continues to monitor grid conditions in Brazil. Executives have stated that the project must align with regulatory requirements and operational standards.

Crypto World

Will Solana price rebound as its key metrics beat Ethereum?

Solana price remained under pressure this week, continuing a downward trend that started in September last year when it peaked at $252.

Summary

- Solana price continued its strong downward trend this week.

- Key network metrics like active addresses and transactions continued soaring.

- Its ETF inflows continued rising and is beating Ethereum.

Solana (SOL) token dropped for eight consecutive weeks and is now hovering near its lowest level since January 2024. It has dropped by over 73% from its highest level in January last year.

The ongoing Solana price crash continued even as the network growth gained momentum and beat Ethereum (ETH) on key metrics.

For example, data compiled by SoSoValue shows that spot Solana ETFs added over $61 million in inflows this month. They have added assets in the last five consecutive months, bringing the cumulative inflows to over $932 million. These funds now hold over $795 million in assets under management.

On the other hand, Ethereum ETFs shed over $326 million in assets in February. They have shed over $2 billion in the last four months, bringing the cumulative net assets inflows to over $11.6 billion.

Solana is also beating Ethereum in other areas, by far. For example, data compiled by Nansen shows that Solana handled over 2.6 billion transactions in the last 30 days, while Ethereum processed 66.7 million.

Similarly, Solana made over $25 million in fees, while Ethereum made $18 million in the same period. These fees made it the second most profitable chain in the crypto industry after Justin Sun’s Tron.

Meanwhile, the number of active addresses in Ethereum dropped by 5.3% in the last 30 days, while Solana’s rose by 30% to over 114 million.

Solana price prediction: Technical analysis

The weekly timeframe chart shows that SOL price has remained in a bear market in the past few months. It has dropped below the key support level at $107, the neckline of the head-and-shoulders chart pattern.

The token has dropped below the key support level at $93.75, the Bottom of trading range of the Murrey Math Lines tool. It also remains below the 50-week and 100-week Exponential Moving Averages.

Solana also remains below the Supertrend indicator. Therefore, the token will likely continue falling, potentially to the Strong, Pivot, and Reverse of the Murrey Math Lines tool at $62.5.

The coin will then bounce back when the ongoing crypto market crash fades, which may happen in the next few weeks or months.

Crypto World

Coinbase’s head of litigation says states are “gaslighting” on prediction markets

Why it matters: Ryan VanGrack, Coinbase’s VP of legal and global head of litigation, is sharpening Coinbase’s challenge to state regulators, saying they are trying to rewrite Congress’ authority over derivatives.

- Coinbase has filed lawsuits in Connecticut, Illinois, Michigan and Nevada after launching prediction markets in partnership with Kalshi.

- Some of those states issued cease-and-desist letters or public warnings, arguing sports event contracts amount to illegal gambling.

- VanGrack said those actions left customers facing “real and imminent” threats that forced Coinbase to seek clarity in federal court.

The argument: VanGrack says states are framing the issue incorrectly.

- Illinois officials argued in court that without state intervention, the markets would go unregulated due to limited CFTC resources.

- VanGrack called that claim “gaslighting,” saying the Commodity Futures Trading Commission has long overseen multi-trillion-dollar derivatives markets.

- He pointed to recent CFTC enforcement reminders around insider trading in event contracts as evidence the agency is actively policing the space.

Federal vs. state power: At the center is who gets to regulate sports-related event contracts.

- VanGrack argued the Commodity Exchange Act grants the CFTC exclusive jurisdiction over swaps and derivatives, including event contracts.

- The law contains a “special rule” allowing the CFTC — not states — to prohibit gaming event contracts on public policy grounds.

- States are attempting to carve sports contracts out of the federal definition of swaps, a reading VanGrack said is unsupported by the statute’s text or precedent.

Sports betting distinction: Coinbase says exchange-traded contracts differ fundamentally from sportsbook wagers.

- On a designated contract market like Kalshi, buyers and sellers set prices on an exchange overseen by the CFTC.

- In traditional sportsbooks, operators set odds and take the other side of the bet, a structure regulated by states.

- No one is arguing the CFTC regulates sportsbooks, VanGrack said — only that exchange-traded event contracts fall under federal derivatives law.

Bigger stakes: The dispute mirrors broader crypto fights over fragmented oversight.

- VanGrack said states retain authority over consumer protection and fraud.

- But subjecting national derivatives markets to “a patchwork of 50 regulators” would undermine investor confidence and market stability.

- Congress long ago chose a unified federal framework for derivatives, he said, and prediction markets should be treated no differently.

Crypto World

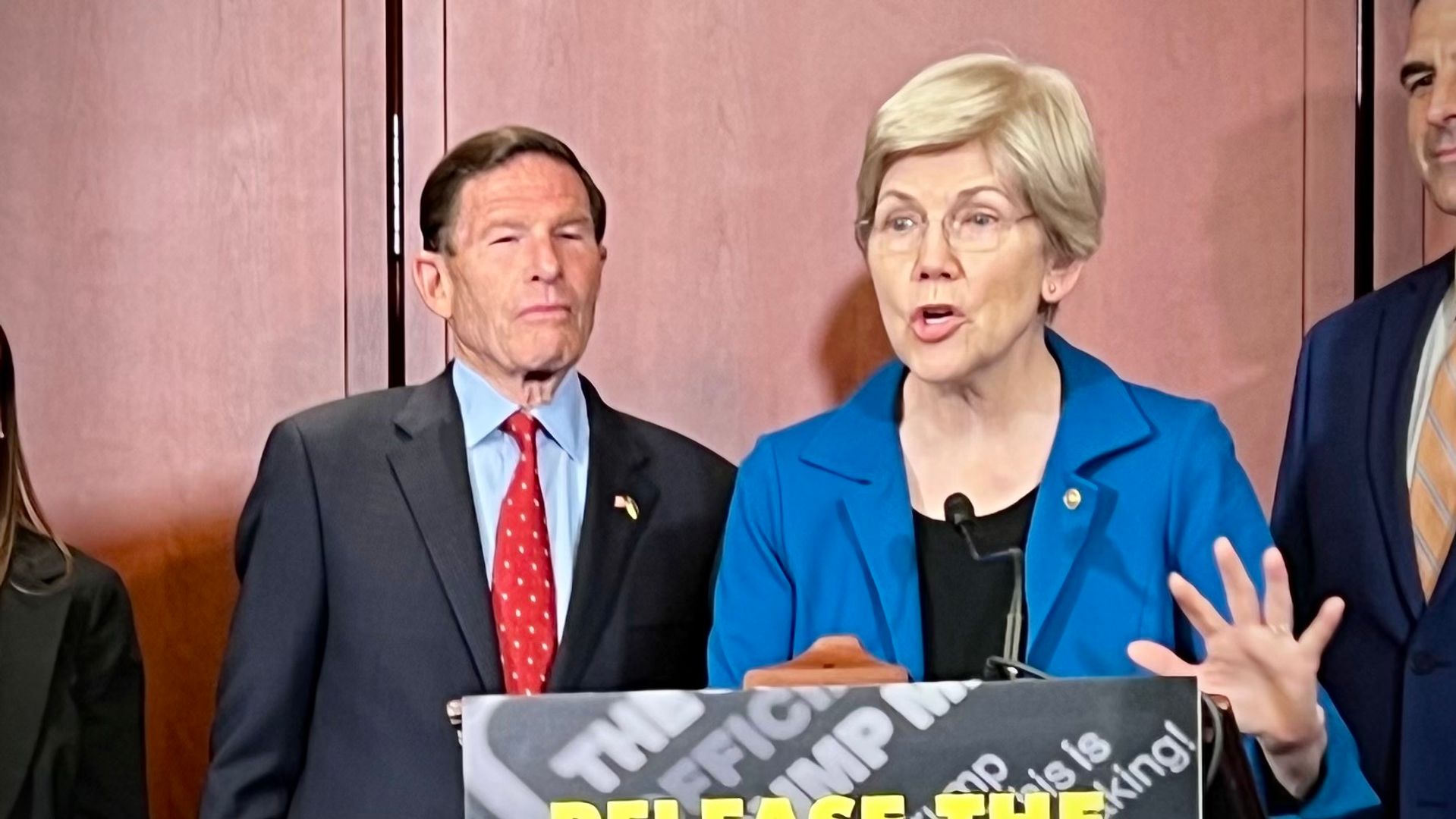

U.S. Senate Democrats asked Treasury, DOJ to probe Binance’s illicit finance controls

Democrats in the U.S. Senate continue to pile onto Binance, asking the Treasury and Justice departments to investigate its sanctions compliance and protections against illicit finance following reports of potential terrorism funding.

Nine senators, including a few that have been instrumental in negotiations over the crypto industry legislation known as the Digital Asset Market Clarity Act, sent a letter Friday to the chiefs of the federal agencies, requesting they probe the exchange after news reports on possible breaches, which also claimed the company had fired some of the compliance personnel involved in discovering the transactions.

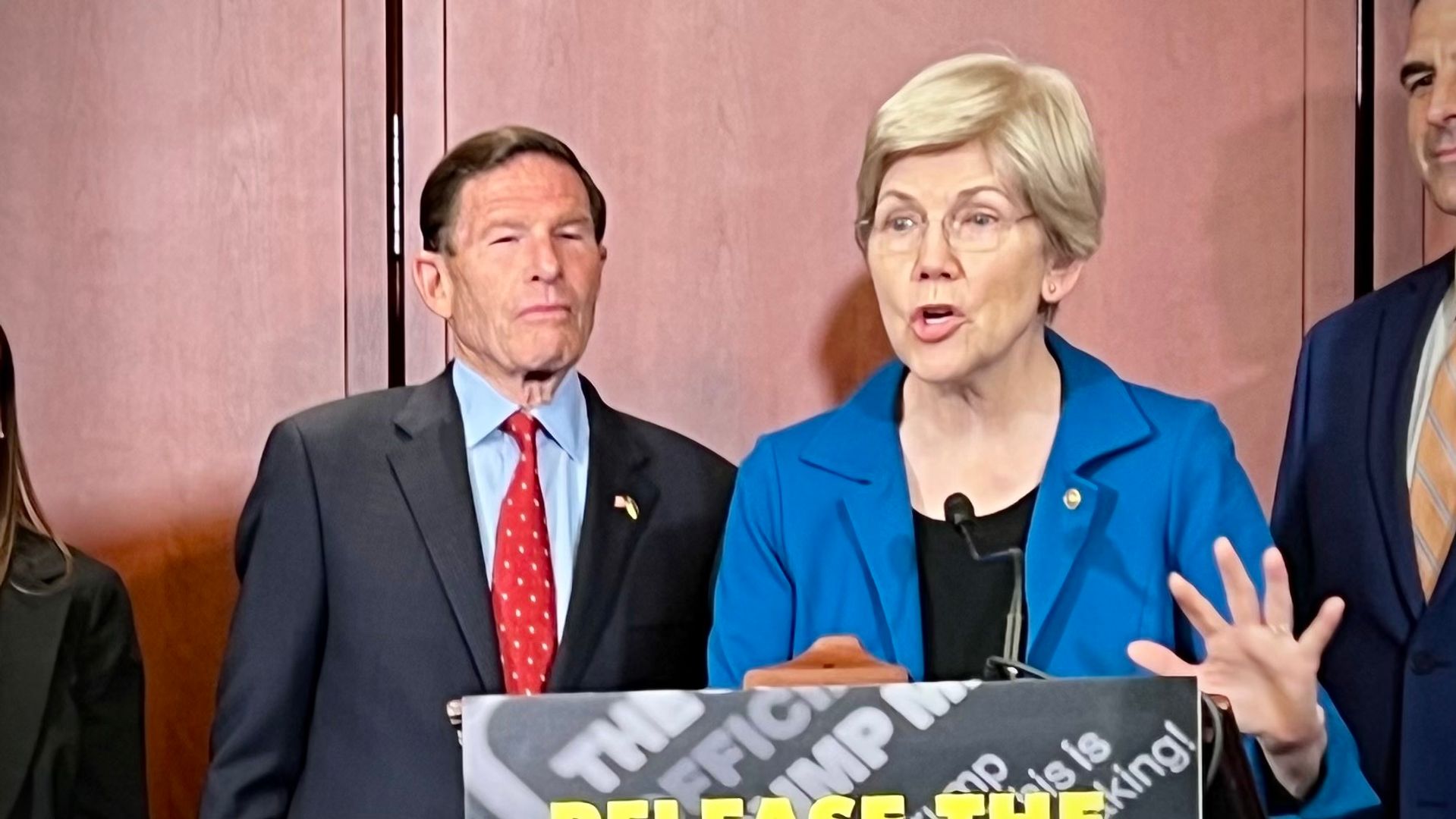

The latest move from Democrats follows an announcement earlier this week from Senator Richard Blumenthal, a Connecticut Democrat who is a senior member of the Senate Homeland Security Committee, that he was inquiring into Binance and had written a letter to the company asking for information. However, neither he nor the other Senate Democrats are in the majority, meaning they don’t currently have control over committee investigations.

Richard Teng, Binance co-CEO, has said some of the earlier media reports were “inaccurate” and “defamatory.” A spokesperson for the company didn’t immediately respond to a request for comment Friday on the senators’ request, which had been sent to Secretary of the Treasury Scott Bessent and Attorney General Pam Bondi.

“These allegations raise grave concerns that poor illicit finance controls at Binance remain a significant threat to national security,” according to the Friday letter from senators including Elizabeth Warren, Ruben Gallego, Angela Alsobrooks, Mark Warner and five others, who also asked for information about the company’s compliance with requirements from its 2023 settlement.

“Our illicit finance controls are dangerously compromised if enormous sums can flow through Binance to terrorist groups or sanctions evaders,” they wrote in the letter, which comes at a delicate point in the ongoing discussions over U.S. legislation that would govern the crypto markets.

The prevention of illicit finance in crypto is among the issues that are still being discussed in that bill. Senator Warner has taken a lead among Democrats seeking to hash out legislative language on the topic.

Another unresolved issue centers around U.S. President Donald Trump and his family’s crypto activities, which the letter also referenced. The lawmakers wrote that they “recognized” Binance had ties to World Liberty Financial, the Trump-backed crypto venture behind the USD1 stablecoin. They also referenced Trump’s pardon of Binance founder Changpeng “CZ” Zhao — he had pleaded guilty and served four months in prison tied to Binance’s past issues with anti-money laundering and know-your-customer provisions.

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports4 days ago

Sports4 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics4 days ago

Politics4 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business3 days ago

Business3 days agoTrue Citrus debuts functional drink mix collection

-

Politics23 hours ago

Politics23 hours agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 hours ago

Fashion4 hours agoWeekend Open Thread: Iris Top

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business5 days ago

Business5 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business5 days ago

Business5 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat2 days ago

NewsBeat2 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat2 days ago

NewsBeat2 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

Tech3 days ago

Tech3 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech5 days ago

Tech5 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat5 days ago

NewsBeat5 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics5 days ago

Politics5 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business2 days ago

Business2 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat3 days ago

NewsBeat3 days agoPolice latest as search for missing woman enters day nine

-

Sports5 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Business1 day ago

Business1 day agoOnly 4% of women globally reside in countries that offer almost complete legal equality