Crypto World

Hype Surges 20% After Hyperliquid Backs Prediction Markets

HYPE’s surge followed an announcement that Hyperliquid’s core infrastructure, powered by HyperCore, will back a proposal to bring prediction markets onto the platform. The HIP-4 proposal aims to expand the layer-1 ecosystem beyond traditional perpetuals by enabling outcomes trading with fully collateralized contracts on Hyperliquid, the largest decentralized perpetual futures venue in crypto. The plan envisions a payout cap on outcomes, with no leverage, no liquidations, and no margin calls. In practical terms, traders would be able to bet on events—from political elections to sports outcomes—using Hyperliquid USDH (CRYPTO: USDH) as the canonical settlement asset. The news arrived via Hyperliquid’s X feed on Monday, underscoring a push driven by what the team described as “extensive user demand” for prediction markets and bound options-like instruments. The rollout is described as a work in progress, with testing currently underway on a testnet as developers work to validate order flow and settlement logic before any mainnet deployment.

Key takeaways

- HIP-4 would introduce fully collateralized outcomes contracts on Hyperliquid, removing leverage, liquidations, and margin calls while delivering a capped payout structure akin to a betting slip.

- The feature is currently in testnet, with canonical markets expected to denominate in Hyperliquid USDH (CRYPTO: USDH).

- The move responds to strong user demand for prediction-market-style exposure and could unlock additional applications built atop Hyperliquid’s infrastructure.

- Hyperliquid’s native token, HYPE (CRYPTO: HYPE), reacted positively to the news, climbing as much as 19.5% to roughly $37.14 in the immediate aftermath, as investors weighed the potential for expanded use cases alongside ongoing price momentum.

- Trading activity in perpetuals remains structurally robust, with DeFiLlama data showing weekly volumes above $200 billion, even after a peak in early November at about $341.7 billion.

- The HIP-4 integration would fuse perpetuals with event-driven markets, echoing prior collaborations that tied on-chain derivatives to broader, event-based trading.

Tickers mentioned: $HYPE, $USDH

Sentiment: Bullish

Price impact: Positive. The announcement and ensuing price action point to renewed interest in Hyperliquid’s ecosystem and its potential expansion into prediction markets.

Trading idea (Not Financial Advice): Hold. The combination of testnet validation and potential mainnet rollout suggests patience may be rewarded as the platform proves the stability and usability of HIP-4 outcomes contracts.

Market context: The news sits within a broader landscape where on-chain perpetuals and tokenized prediction markets have gained traction, with liquidity and trading activity remaining resilient even amid intermittent market pullbacks. DeFiLlama’s data shows that weekly perps trading volumes have held above $200 billion, a sign of continued demand for crypto derivatives amid a backdrop of evolving regulatory and product considerations.

Why it matters

Hyperliquid’s pursuit of HIP-4 signals a strategic attempt to converge two of crypto’s most active use cases: perpetual futures and on-chain prediction markets. By anchoring canonical markets to USDH, the ecosystem aims to reduce counterparty risk while broadening the spectrum of tradable events. If successful, the design could create a more diverse suite of hedging tools for traders and offer builders a template for creating novel, bounded-outcome products on top of HyperCore’s infrastructure.

The potential integration is more than a technical upgrade; it reflects a broader shift in DeFi toward event-driven demand. Prediction markets, in particular, have long been cited for their appeal in aggregating information and forecasting outcomes. Pairing this with the liquidity and composability of on-chain perpetuals could yield a new class of hybrid instruments that combine the immediacy of marginless bets with the risk controls that users increasingly demand. Still, it is early in the development cycle—the team characterizes the feature as “work in progress” and emphasizes testnet validation and careful deployment planning to avoid systemic risk in live markets.

From an ecosystem perspective, HIP-4 underscores Hyperliquid’s ambition to remain at the intersection of high-velocity derivatives and real-world event exposure. While the immediate utility centers on prediction markets, the underlying architecture could enable other applications—such as bounded, collateralized options-like vehicles or cross-market bets anchored to diversified datasets. The potential for on-chain governance to influence product direction remains a focal point for builders and investors watching Hyperliquid’s roadmap unfold.

The broader market context remains nuanced. While HYPE (CRYPTO: HYPE) experienced a notable uptick on the HIP-4 news, the overall crypto market has retraced in parts of February, with traders closely watching liquidity distributions, regulatory signaling, and institutional participation. The price action is part of a broader narrative in which traders seek to balance risk across multiple on-chain arenas, including tokenized stocks and other decentralized derivatives. As data from CoinGecko shows, the community continues to monitor Hyperliquid’s price trajectory and the dynamics of its USDH stablecoin, while the project explores expanding use cases that could drive sustained engagement beyond perpetuals trading alone.

What to watch next

- Progress of HIP-4 on the testnet, including any finalized parameters for payout caps, settlement windows, and event eligibility criteria.

- Clear milestones toward a potential mainnet rollout, including any governance votes or audits that would de-risk a broader deployment.

- Further announcements tying HIP-4 to other Hyperliquid features, such as deeper integration with on-chain perps or cross-market instruments.

- Any partnerships or collaborations (for example, with wallet providers or DeFi rails) that might facilitate user onboarding to prediction-market-like products on Hyperliquid.

- Regulatory clarity around prediction markets and event-based collateralized contracts, which could influence design choices and geographic availability.

Sources & verification

- Hyperliquid’s X post announcing HIP-4 support and its motivation for demand-driven expansion: https://x.com/HyperliquidX/status/2018327360723202167

- DeFiLlama perps trading volume data and historical context: https://defillama.com/perps

- Hyperliquid price index and market performance reports: https://cointelegraph.com/hyperliquid-price-index

- CoinGecko market data referenced for price movements and market context: https://www.coingecko.com/en/coins/hyperliquid

- Metamask Infinex integration with Hyperliquid Perps (context for cross-use-case potential): https://cointelegraph.com/news/metamask-infinex-integrate-hyperliquid-perps

Hyperliquid expands into prediction markets with HIP-4

The plan to introduce HIP-4 outcomes trading marks a notable shift for Hyperliquid, aiming to weave a prediction-market layer into a platform already known for its high-velocity perpetuals. The proposed mechanism would allow traders to place fully collateralized bets on discrete outcomes, all anchored to Hyperliquid USDH. The design prioritizes risk controls—no leverage, no liquidations, no margin calls—while presenting a familiar “betting slip” experience with a capped payout. In practical terms, participants would be wagering on the probability of events within a fixed payout band, with final settlements determined by verifiable outcomes rather than discretionary counterparty behavior. The testnet phase is essential to stress-testing order matching, settlement timing, and the governance signals that could guide a broader deployment.

HyperCore’s endorsement of HIP-4 suggests a broader strategic intent: to test how event-based markets can coexist with, and complement, on-chain perpetuals. The canonical markets would settle in USDH, aligning with Hyperliquid’s current liquidity and risk framework. The X post frames the feature as a response to user demand for bounded, options-like instruments—an appetite that has grown as traders seek products with clear risk parameters and transparent settlement rules. If HIP-4 proves resilient on testnet, the roadmap could include additional revenue streams for developers who design novel contracts atop Hyperliquid’s infrastructure, potentially unlocking a new class of decentralized derivatives that blend real-world events with blockchain-native risk management.

Media coverage and market data reflect a crypto ecosystem that is actively experimenting with the boundaries between traditional risk transfer and decentralized finance. The price reaction to the HIP-4 signal—HYPE rising to the mid-$30s range in the wake of the development—underscores investor interest in expanded product capabilities. The DeFiLlama data showing persistent, multi-hundred-billion-dollar weekly volumes in perpetuals indicates a robust liquidity backbone that HIP-4 could leverage. Still, the journey from testnet to mainnet is non-trivial; the technical complexity of event-driven settlement, combined with the need for robust governance and regulatory alignment, means timing and execution will be critical. As Hyperliquid navigates these challenges, the broader market will watch how prediction-market-inspired instruments fare in real-world testing and whether they can coexist with the governance and security standards that underpin decentralized finance.

https://platform.twitter.com/widgets.js

Crypto World

Cross-Chain Governance Attacks – Smart Liquidity Research

The Governance Exploit Nobody Is Pricing In. Bridges get hacked. That’s old news. We’ve seen the carnage: nine-figure exploits, drained liquidity, emergency shutdowns, Twitter threads filled with “funds are safu” copium.

From Ronin Network to Wormhole, bridge exploits have become a recurring tax on innovation. But here’s the uncomfortable truth. The next systemic risk in crypto probably won’t be a bridge exploit. It’ll be a governance exploit enabled by cross-chain voting power. And almost nobody is pricing it in.

The Shift: From Asset Bridges to Power Bridges

Cross-chain infrastructure has evolved.

We’re no longer just bridging tokens for yield. We’re bridging:

Protocols increasingly allow governance tokens to exist on multiple chains simultaneously — often via wrapped representations or omnichain token standards (like those enabled by LayerZero Labs).

This improves capital efficiency and participation.

But it also introduces a new attack surface:

The separation of voting power from finality.

The Core Problem: Governance Is Local. Voting Power Is Not.

Governance contracts typically live on a single “home” chain.

But voting power can be represented across multiple chains.

This creates a dangerous gap:

-

Tokens are locked on Chain A

-

Voting power is mirrored on Chain B

-

Governance decisions are executed on Chain A

If the system relies on cross-chain messaging to sync voting balances, any delay, exploit, or manipulation in that messaging layer becomes a governance vector.

You don’t need to drain liquidity.

You just need to distort voting power long enough.

And governance proposals often pass with shockingly low turnout.

The Attack Path Nobody Talks About

Let’s walk through a hypothetical.

Step 1: Acquire or Manipulate Voting Power Cross-Chain

An attacker:

-

Borrows governance tokens

-

Bridges them to a secondary chain

-

Exploits a delay in balance updates

-

Or abuses inconsistencies in wrapped token accounting

In poorly designed systems, the same underlying tokens may temporarily influence voting in multiple domains.

Even if briefly.

Even if “just a bug.”

Governance doesn’t need hours. It needs one block.

Step 2: Flash Governance

We’ve already seen governance flash-loan exploits in DeFi.

The most infamous example? The attack on Beanstalk in 2022.

The attacker used flash loans to acquire massive voting power, passed a malicious proposal, and drained ~$182M.

Now imagine that dynamic — but across chains.

Flash-loaned tokens → bridged representation → governance vote → malicious proposal executed → unwind.

All before the watchers even understand what happened.

Step 3: Proposal Payloads as Weapons

Governance proposals can:

If cross-chain voting power is compromised, the proposal payload becomes the exploit.

No bridge drain required.

Just governance “working as designed.”

Why Markets Aren’t Pricing This Risk

Three reasons.

1. Everyone Is Still Fighting the Last War

After major bridge hacks, teams hardened signature validation and multisig thresholds.

But governance-layer risk is subtler.

It doesn’t show up as “TVL at risk” on dashboards.

It shows up as “who controls protocol direction.”

That’s harder to quantify.

2. Voting Participation Is Low

Many DAOs struggle to get 10–20% participation.

Which means:

You don’t need 51%.

You need slightly more than apathy.

Cross-chain voting power distortions don’t need to be massive. They just need to be decisive.

3. Composability Multiplies Complexity

Modern governance stacks combine:

-

Delegation contracts

-

Token wrappers

-

Cross-chain messaging

-

Snapshot systems

-

Execution timelocks

Each layer introduces potential inconsistencies.

And composability means failures cascade.

Where the Real Risk Lives

This isn’t about one protocol.

It’s systemic.

The more governance tokens become:

The more fragile governance assumptions become.

If a governance token is:

You’ve built a multi-dimensional voting derivative.

And derivatives break under stress.

Ask TradFi. They have scars.

The Governance Exploit Nobody Is Pricing In

Markets price:

-

Smart contract risk

-

Bridge exploit risk

-

Oracle manipulation risk

But they do not price:

Cross-domain voting synchronization risk.

No dashboards are tracking:

-

Governance message latency

-

Cross-chain vote desync windows

-

Wrapped-token vote inflation

-

Double-counted delegation

Yet these variables may determine who controls billion-dollar treasuries.

What Builders Should Be Doing (Now)

If you’re designing cross-chain governance:

1. Separate Voting Power from Bridged Liquidity

Avoid naïve 1:1 mirroring without strict finality checks.

2. Introduce Vote Finality Windows

Require:

-

Cross-chain state verification

-

Message settlement delays

-

Proof-of-lock confirmations

Before votes are counted.

3. Use Decay or Cooldowns on Newly Bridged Tokens

Voting power shouldn’t activate instantly after bridging.

If tokens just moved chains 5 seconds ago, maybe they shouldn’t decide protocol destiny.

4. Simulate Governance Stress Scenarios

Run adversarial simulations:

If your governance model breaks under simulation, it will break in production.

What Investors Should Be Asking

Before allocating to a multi-chain DAO:

-

Where does governance live?

-

How is voting power mirrored?

-

Can voting power be double-counted during bridge latency?

-

What happens if the messaging layer stalls?

-

Is there a time lock between the vote and execution?

If the answers are vague, the risk is real.

And it’s not priced in.

The Inevitable Wake-Up Call

Crypto learns through catastrophe.

-

Smart contract exploits → audits became standard.

-

Oracle exploits → TWAP and redundancy

-

Bridge hacks → validator hardening

Governance-layer cross-chain exploits are likely next.

And when it happens, it won’t look like a hack.

It’ll look like a proposal that “passed.”

That’s the scary part.

Final Thought

Cross-chain infrastructure is powerful. It enables capital mobility, global participation, and modular design.

But it also decouples authority from location.

And when authority becomes fluid across chains, attackers don’t need to steal funds.

They just need to win a vote.

That’s the governance exploit nobody is pricing in.

And by the time the market does, it’ll already be too late.

REQUEST AN ARTICLE

Crypto World

Payoneer Adds to Crypto, Fintech Firms Seeking Bank Charter

Global financial services firm Payoneer is the latest in a growing number of companies that have filed for a national trust banking charter in the US, which could enable it to issue a stablecoin and provide various crypto services.

Payoneer said on Tuesday it filed with the Office of the Comptroller of the Currency to form PAYO Digital Bank, a week after it partnered with stablecoin infrastructure firm Bridge to add stablecoin capabilities to its platform that is mainly focused on cross-border transactions.

Payoneer said that it is seeking to issue a GENIUS Act-compliant stablecoin, PAYO-USD, to serve as the holding currency in Payoneer wallets, in addition to allowing customers to pay and receive stablecoins.

OCC approval would also enable Payoneer to manage PAYO-USD reserves, offer custodial services and enable customers to convert between the stablecoins into their local currency.

“We believe stablecoins will play a meaningful role in the future of global trade,” said Payoneer CEO John Caplan.

The OCC gave conditional approval to Crypto.com for a charter on Monday, adding to the banking charters won by crypto companies Circle, Ripple, Fidelity Digital Assets, BitGo and Paxos in December.

Related: Better, Framework Ventures reach $500M stablecoin mortgage financing deal

The Trump family’s World Liberty Financial also applied for one in January to expand the use of its USD1 (USD1) stablecoin, but is still awaiting a decision.

Crypto trading platform Laser Platform also submitted an application in January, while Coinbase has been awaiting a decision on its application since October.

Stablecoins ideal for business cross-border transfers: Payoneer

Payoneer said OCC approval would allow it to offer its nearly two million customers, which are mostly small and medium-sized businesses, a regulated stablecoin solution to simplify cross-border trade.

“This offering will help advance the use of the USD in global trade, reduce barriers for American companies competing internationally, and expand the dollar’s presence across non-dollar payment corridors,” it said.

In December, Comptroller of the Currency Jonathan Gould said that new entrants to the federal banking sector was “good for consumers, the banking industry and the economy [as] they provide access to new products, services and sources of credit to consumers, and ensure a dynamic, competitive and diverse banking system.”

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

Crypto World

Bitcoin price prediction as Coinbase Premium flips positive

Bitcoin price is attempting a recovery near $65,000 as the Coinbase Premium turns positive despite recent exchange-traded fund outflows.

Summary

- Bitcoin price prediction leans towards trend reversal as the Coinbase Premium flips positive.

- The metric indicates strong U.S. demand returning after recent ETF outflows.

- Price must reclaim key resistance to confirm a stronger recovery.

Bitcoin was trading at $65,907 at press time, up 3.4% in the last 24 hours. The move follows a drop to $62,900 within the past week, where buyers stepped in.

Even with the bounce, Bitcoin (BTC) is still down 24% over the past month and about 50% below its October 2025 all-time high of $126,050.

Trading activity increased during the recovery. Spot volume reached $46 billion, up 22% day over day. In derivatives markets, CoinGlass data shows futures volume up 6.2% to $74.8 billion, while open interest slipped 0.1% to $43.9 billion.

This suggests some traders are closing positions rather than adding aggressive leverage.

Coinbase premium turns positive

On Feb. 25, the Coinbase Premium Index turned positive for the first time in 40 days, hitting 0.0525%, according to CoinGlass.

The index measures the price difference between Coinbase and global exchanges. A positive reading means Bitcoin trades slightly higher on Coinbase, which often reflects stronger U.S. demand.

This shift comes at a time when U.S. spot Bitcoin ETFs have recorded heavy outflows, with roughly $3.8 billion exiting recently. That contrast is important. While ETFs have seen capital leave, the premium suggests some U.S. buyers are stepping back in through exchange flows.

In past cycles, sustained positive premiums have aligned with accumulation phases and relief rallies. However, a single flip does not confirm a trend change. Traders will watch if the premium widens and holds over several sessions.

Bitcoin price prediction: Is the trend reversing?

Bitcoin is attempting to stabilize after a sharp corrective phase. On the daily chart, price is still trading below its short-term trend pivot near the mid-Bollinger band around the high -$67,000 area.

That zone now acts as the line that separates a relief bounce from a stronger recovery attempt.

Momentum indicators show improvement from oversold conditions, with the relative strength index climbing from sub-30 levels earlier in February. Bulls have not yet completely taken back control, though, as the RSI is still below the midpoint.

The recovery might reach the low -$70,000 area if the Coinbase Premium holds positive and Bitcoin breaks through the mid-band resistance with growing spot volume. A move into that zone would shift short-term structure and increase confidence that the trend has reversed.

On the other hand, failure to reclaim resistance would keep the price vulnerable to another pullback toward the mid -$64,000 area. A break below that support would raise the risk of a deeper move toward $60,000.

Crypto World

Binance Revives Tokenized Equities in Ondo Finance Deal

TLDR

- Binance has relaunched tokenized stocks trading through a partnership with Ondo Finance on Binance Alpha.

- The platform lists 10 tokenized U.S. stocks, ETFs, and commodity-linked products.

- Users in the United States cannot access the new tokenized stock offerings.

- Binance previously halted a similar service in 2021 after regulatory scrutiny in Europe.

- Ondo Finance has recorded over $550 million in locked value and $11 billion in cumulative trading volume since September 2025.

Binance has relaunched tokenized stocks trading through a new partnership with Ondo Finance. The exchange will list 10 tokenized U.S. stocks, ETFs, and commodity-linked products on Binance Alpha. The move marks Binance’s return to this market nearly five years after halting a similar service.

Binance and Ondo Finance Launch Tokenized Equities on Alpha

Binance has partnered with Ondo Finance to introduce tokenized versions of major U.S. equities on Binance Alpha. The platform operates within Binance Wallet and targets early-stage digital asset offerings. Users can trade blockchain-based versions of Apple, Google, Tesla, and Nvidia shares.

The lineup also includes the Invesco QQQ ETF, which tracks the Nasdaq index. Binance confirmed that users in the United States cannot access these tokenized stocks. Jeff Li, Binance’s vice president of product, said, “Our users now have even more convenient ways to explore and trade tokenized stocks.”

Binance Alpha allows access to projects before they reach the centralized spot marketplace. The company positions the platform as a gateway for higher-risk digital assets. Through this structure, Binance expands product access while keeping trading within its wallet ecosystem.

Ondo Finance issues the tokenized equities listed on the platform. The company focuses on bridging traditional financial assets with blockchain networks. Binance integrates these tokens directly into its wallet infrastructure.

Binance previously launched tokenized stocks in April 2021, starting with Tesla shares. The exchange later added Coinbase, Strategy, Microsoft, and Apple to the offering. However, regulators in the United Kingdom and Germany raised compliance concerns.

The U.K.’s Financial Conduct Authority and Germany’s BaFin reviewed the product structure. Following regulatory scrutiny, Binance discontinued the service within months. The company has now resumed tokenized equities through its collaboration with Ondo Finance.

Last month, Binance stated that it was considering a renewed push into tokenized equities. The latest listings on Binance Alpha confirm that plan. The rollout follows growing activity in blockchain-based stock trading platforms.

Tokenized Stocks Market Expands Across Exchanges

Tokenized stocks have grown across crypto exchanges and traditional brokerages. The sector’s total value approaches $1 billion, according to recent market data. Ondo Finance reports more than $550 million in locked value.

The company also recorded $11 billion in cumulative trading volume since September 2025. Other exchanges, including Kraken, Bybit, and Gemini, have introduced similar products. Robinhood has also launched tokenized equity trading services.

Traditional exchanges have also outlined plans involving stock tokens. Nasdaq and the New York Stock Exchange have presented proposals tied to blockchain-based trading models. These developments align with Binance’s renewed entry into tokenized equities through Ondo Finance.

Crypto World

Bitcoin Depot Introduces ID for All Transactions

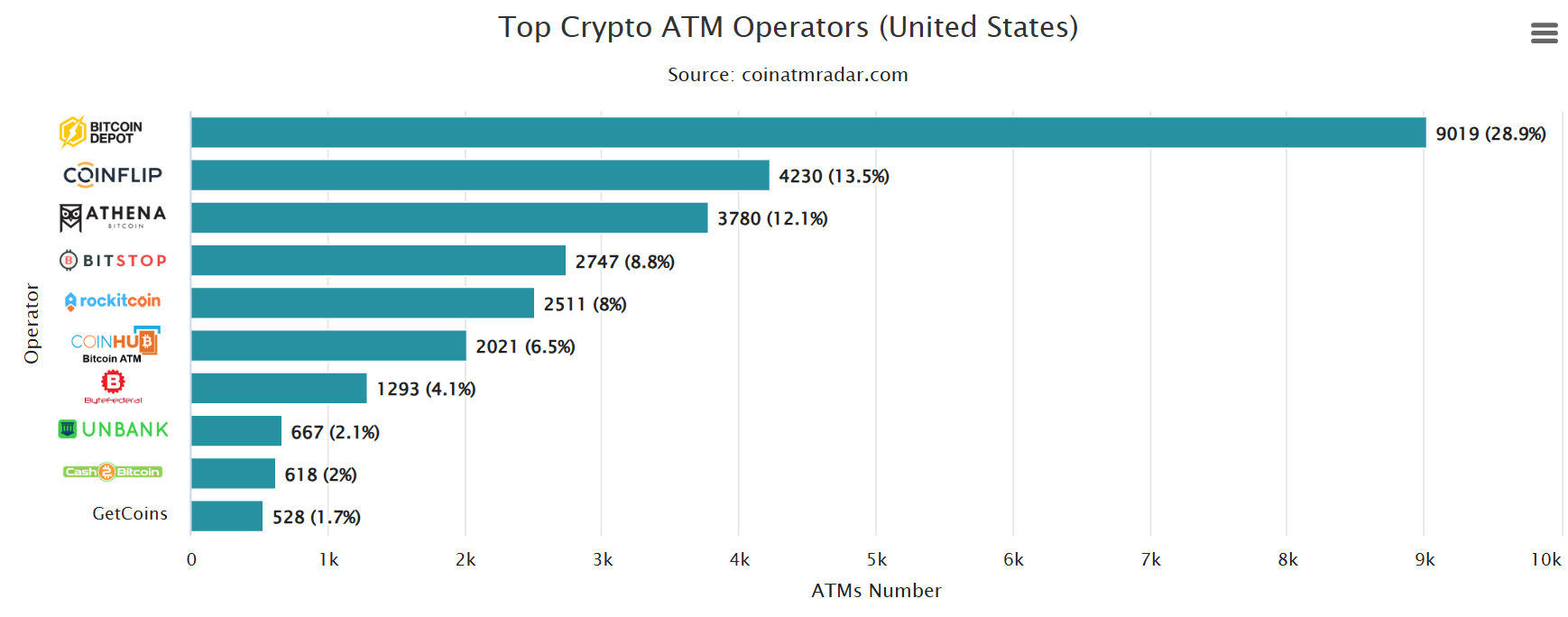

The biggest Bitcoin ATM operator in the US has begun phasing in a new requirement for users to provide identification for every transaction at its crypto ATMs amid increasing pressure from regulators and lawmakers for operators to curb illicit activity.

Bitcoin Depot said on Tuesday that it began the rollout earlier in February across the company’s US network ATMs, with the goal of helping to detect suspicious activity in real time and eliminate misuse by bad actors, such as account sharing, identity theft, and account takeover.

“Continuous verification allows us to detect suspicious activity based on customers, locations, or transaction amount before a transaction is approved,” Bitcoin Depot CEO Scott Buchanan said in a statement.

Bitcoin Depot implemented ID requirements in October, but only for all new users to its service. Buchanan said that “by requiring identity verification at every transaction, we are taking an additional step to strengthen security, protect customers, and maintain the integrity of our services.”

The US is the largest hub for Bitcoin (BTC) ATMs, with Coin ATM Radar listing 31,360 machines, accounting for 78% of the worldwide total. Bitcoin Depot is the market leader in the country with 9,019 kiosks.

Bitcoin Depot faces state-level lawsuits

Scammers have long used crypto ATMs as a way to receive funds from unwitting victims, as the kiosks are widespread and their transactions are irreversible, leading regulators and lawmakers to crack down on crypto ATM operators.

The advocacy organisation, the American Association of Retired Persons, reported in February that 17 US states have passed laws requiring crypto ATM operators to implement protections, including daily transaction limits, fraud warning signs, and licensing requirements.

Related: Crypto ATM limits and bans sweep across US: Here’s why

Bitcoin Depot has caught the ire of state regulators, as Massachusetts Attorney General Andrea Campbell sued Bitcoin Depot earlier this month, alleging the company has not implemented sufficient safeguards to prevent scams. Campbell is seeking a court order to bar Bitcoin Depot from processing large transactions without additional user protections.

In January, Maine Attorney General Aaron Frey reached a $1.9 million settlement with Bitcoin Depot to reimburse individuals who lost money to scams while using the company’s ATMs.

Last year, Iowa Attorney General Brenna Bird launched a lawsuit against both Bitcoin Depot and its rival Coinflip, alleging the operators failed to implement adequate protections to prevent scams.

Magazine: 6 massive challenges Bitcoin faces on the road to quantum security

Crypto World

Mastercard Hires for Crypto Just as Citrini Warns It Could Be Obsolete

Mastercard is hiring a Director of Crypto Flows to lead stablecoin-linked card issuance, scale DeFi payment flows, and rewrite network rules for Web3 transactions.

The job posting, first surfaced by crypto journalist Frank Chaparro on Feb. 24, signals a structural push beyond the pilot-stage experiments the payments giant has run so far.

The Timing That Writes Itself

Days earlier, Citrini Research published “The 2028 Global Intelligence Crisis,” a doomsday scenario that rapidly went viral on Substack. The report maps a chain reaction in which AI agents progressively dismantle fee-based intermediaries — and payment networks sit squarely in the blast radius. Citrini specifically names Mastercard’s Q1 2027 earnings as a potential inflection point, the moment when agentic commerce begins routing around card interchange via stablecoins.

The logic is straightforward. When AI agents transact on behalf of consumers, a 2-3% card interchange fee becomes an irrational cost. Stablecoin rails settle the same transaction for near zero. In that world, Mastercard doesn’t lose to a competitor. It loses to a protocol.

The gap Mastercard needs to close

The vulnerability is not hypothetical. Stablecoins transferred $18.4 trillion in value in 2024, surpassing both Visa ($15.7 trillion) and Mastercard ($9.8 trillion) in raw volume, according to Artemis Analytics. The comparison is imperfect — much of that is trading, not payments — but the directional signal is clear.

Mastercard’s own CEO, Michael Miebach, told analysts in January that the company is “leaning in” to stablecoins and agentic commerce, calling the latter a trend in which “the train is leaving the station.” Yet he framed stablecoins as “another currency we can support within our network.”

That framing is precisely what Citrini challenges. The doomsday thesis is not that stablecoins replace card payments at today’s checkout counter. It is that a new category of commerce — machine-to-machine, micropayment-dense, 24/7 — will emerge entirely outside the card network’s design envelope.

Building rails or getting routed around

The new role suggests Mastercard is beginning to internalize this risk. Mastercard has laid the groundwork: onboarding multiple stablecoins onto its network in June 2025, expanding Circle’s USDC settlement across the Middle East and Africa, and reportedly pursuing a $2 billion acquisition of crypto infrastructure startup zerohash.

But the gap with Visa persists. Visa’s on-chain stablecoin settlement reached an annual run rate of $3.5 billion by late 2025. Crypto-native issuers like Rain and Reap built their card programs primarily on Visa rails, with Rain scaling to over $3 billion annualized after securing direct Visa membership. Industry analysis suggests Visa’s early crypto-native alignment translated into share, while Mastercard’s exchange-focused approach generated less volume.

Coincidence or confirmation

Regardless of whether Mastercard’s hiring push was triggered by Citrini’s report, the more important reading is that the diagnosis is converging. A research outfit writing from 2028 and a payments giant hiring in 2026 point at the same fault line. Card networks that cannot accommodate stablecoin-native commerce will be bypassed, not disrupted.

The canary, as Citrini wrote, is still alive. The question is whether Mastercard is building a bridge to close the gap—or just hiring someone to watch it widen.

Crypto World

index falls 2% as nearly all constituents decline

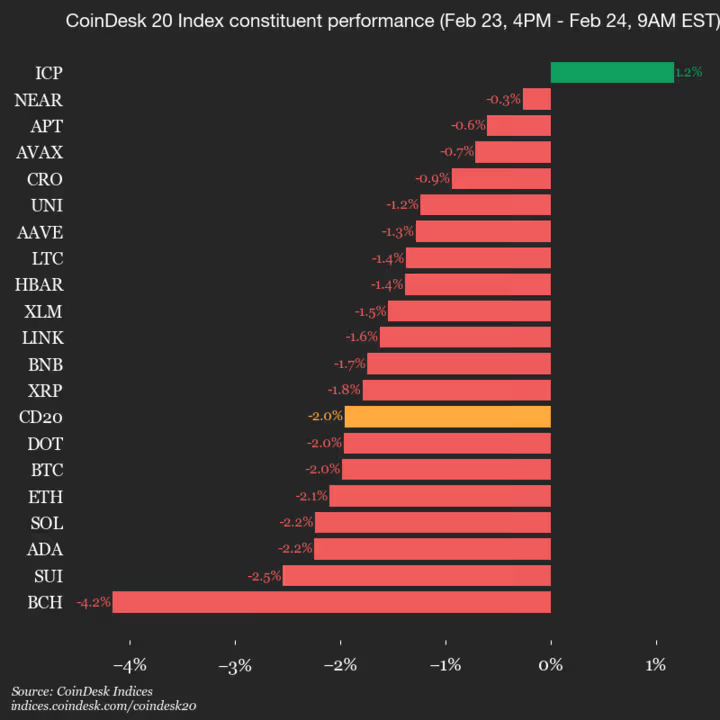

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1816.14, down 2.0% (-36.33) since 4 p.m. ET on Monday.

One of the 20 assets is trading higher.

Leaders: ICP (+1.2%) and NEAR (-0.3%).

Laggards: BCH (-4.2%) and SUI (-2.5%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Ethereum Foundation begins staking 70,000 ETH from treasury

The Ethereum Foundation has begun staking a portion of its treasury holdings, marking a significant shift in how the organization manages its ETH reserves.

Summary

- The Ethereum Foundation has begun staking its treasury, starting with a 2,016 ETH deposit and planning to stake approximately 70,000 ETH in total.

- Staking rewards will be directed back to the foundation’s treasury to help fund core operations, including protocol R&D, ecosystem grants and community development.

- The validator setup uses open-source tools from Attestant, including Dirk and Vouch, with a focus on distributed signing, minority clients and multi-jurisdiction infrastructure.

Ethereum Foundation puts treasury to work with 70K ETH staking plan

In a post on X, the foundation said it has made an initial deposit of 2,016 Ethereum (ETH) and plans to stake approximately 70,000 ETH in total, with staking rewards directed back into its treasury. The move follows a Treasury Policy announced last year and is designed to both support network security and help fund the foundation’s core operations.

The staking setup is being implemented using open-source tools developed by Attestant, including Dirk and Vouch.

Dirk functions as a distributed signer, allowing validators to be operated across multiple jurisdictions and reducing the risk of a single point of failure.

Vouch enables the use of multiple consensus and execution client pairings, helping mitigate client diversity risks, a key concern for Ethereum’s decentralization model. The foundation said its validator setup incorporates minority clients and a mix of hosted infrastructure and self-managed hardware spread across several regions.

The announcement comes at a notable moment for Ethereum. Recently co-founder Vitalik Buterin sold roughly $7 million worth of ETH amid a broader price pullback, sparking discussion about treasury management and market signals.

At the same time, the foundation has been expanding ecosystem support through new grant initiatives, including updates to its Ecosystem Support Program aimed at funding protocol research, community development and public goods projects.

By staking a portion of its holdings, the foundation is effectively putting dormant ETH to work, generating yield while reinforcing validator participation. The move aligns the treasury more closely with Ethereum’s proof-of-stake design and provides an additional funding stream for long-term development efforts without relying solely on asset sales.

Crypto World

Stripe Eyes PayPal Acquisition as Stock Hits Multi-Year Low

Payment processing firm Stripe is reportedly considering an acquisition of all or parts of its rival PayPal Holdings.

Stripe is in early talks and has expressed preliminary interest in PayPal or parts of its business, though no deal is guaranteed, Bloomberg reported on Tuesday, citing people familiar with the matter.

It comes as Stripe, which enables enterprises to accept payments, make payouts, and automate financial processes, said on Tuesday that it was valued at $159 billion in a tender offer to shareholders and employees, a 74% jump from a year ago.

The move comes as PayPal has been reportedly struggling to compete with the likes of Google Pay and Apple Pay, which are embedded in consumer smartphones.

Stripe president John Collison told Bloomberg that “PayPal has had, obviously, a tough time over the past few years, and the landscape has changed quite a bit with Apple Pay and Google Pay and everything like that.”

“I can’t talk about any, you know, M&A [mergers and acquisitions] hypotheticals, but they’ve definitely had a tough time,” he added.

PayPal stock gains on the day

PayPal is also in leadership transition, with new CEO Enrique Lores set to take over on March 1 following the ouster of Alex Chriss, amid missed earnings estimates and slowing payment volumes.

Related: PayPal draws takeover interest following 46% stock slide: Report

PayPal stock (PYPL) gained 6.74% on Tuesday to end the day trading at $47.02, according to Google Finance. However, shares in the payments platform have declined almost 20% since the beginning of this year and are down 85% from their 2021 all-time high of just over $300.

PayPal, Stripe have serious stablecoin ambitions

PayPal began offering crypto trading in the US in 2020 and launched its own stablecoin PYUSD in 2023. The dollar-pegged asset has gained traction in recent months with its market capitalization topping $4 billion for the first time on Feb. 14.

Stripe has also been dabbling in crypto with its stablecoin platform Bridge, which received conditional approval to operate as a federally chartered national trust bank under the US Office of the Comptroller of the Currency (OCC) on Feb. 17.

Stripe first offered stablecoin-based accounts globally in May 2025. A merger could see the new entity become a serious player in the stablecoin market.

Magazine: Bitdeer sells all Bitcoin, Metaplanet rejects misconduct claims: Asia Express

Crypto World

Bitcoin loses 200-week EMA, analysts eye deeper 3-day death cross

Bitcoin fell below 200-week EMA, over 52% off peak, risking death-cross capitulation.

Summary

- BTC closed last week under the 200-week EMA, a key confluence zone tied to post-halving re-accumulation range highs, after three weeks of elevated sell volume and weak demand.

- Analysts warn BTC may retest the underside of the 200-week EMA as new resistance, echoing 2018 and 2022 structures that triggered a second bearish acceleration wave.

- BTC has dropped over 52% from its October top and approaches a 3-day 50/200 SMA death cross by late February, historically followed by an additional 45%-52% drawdown.

Bitcoin (BTC) closed the week below a critical support level, falling beneath that threshold for the first time since early February and reaching a two-week low, according to market data. Analysts have warned that the cryptocurrency could face additional downward pressure.

Analyst Rekt Capital stated that Bitcoin closed last week below the 200-week Exponential Moving Average (EMA), which sits at the center of a major confluence zone. The 200-week EMA aligns with the Post-Halving Re-accumulation Range highs, while the Post-Halving Re-accumulation Range lows define the broader structure of Bitcoin’s current range, according to the analyst.

Over the past three weeks, the cryptocurrency attempted to develop a demand region around this area, which was previously a major supply area, Rekt Capital noted. The analyst stated that this level has not historically been a structurally reliable support, noting that it previously acted as a 10-month resistance.

“In the current structure, we have seen three consecutive weeks of elevated sell-side volume in this region, with limited meaningful buy-side response,” the analyst stated in a post. The imbalance led to a weekly close below the 200-week EMA, losing it as support in this timeframe, according to the analysis.

Rekt Capital stated that there is a strong probability that Bitcoin will press back toward the underside of that EMA to attempt turning it into new resistance. If the underside retest holds, the structure would shift from defending the support to confirming the resistance at this level, the analyst said. The analyst added that if that level begins to act as resistance, downside continuation will become increasingly probable.

The analyst also noted that Bitcoin’s recent performance aligns closely with its price action in prior cycles. In 2018 and 2022, a weekly close below the 200-week EMA acted as a structural trigger to the second wave of bearish acceleration, according to the analysis. “Bitcoin would attempt to reclaim the level, turn it into resistance, and then dissipate lower. That pattern is now attempting to replicate itself,” Rekt Capital stated.

Analyst Ali Martinez pointed to the cryptocurrency’s historical performance on the three-day chart, stating that this has been one of Bitcoin’s key timeframes from a macro perspective. Martinez said market observers must watch the upcoming interaction of the 50-day and 200-day Simple Moving Averages (SMAs), as the crossover between these two indicators on the three-day timeframe has historically preceded the final leg down of the bear market.

Bitcoin dropped approximately 50% to 72% from its cycle tops in past cycles before death crosses took place in subsequent years, according to historical data. Following those SMA crossovers, the cryptocurrency experienced another 45% to 52% decline, Martinez noted. Bitcoin has fallen more than 52% from its October peak and is approaching a potential death cross on the three-day chart by the end of February, according to the analyst.

“If history repeats — even partially — this could signal the beginning of the final leg down of this cycle,” Martinez stated. The analyst predicted that another substantial correction from current levels could follow, placing the cryptocurrency’s target near lower support levels. “If the cross confirms, it becomes a level to take very seriously,” Martinez said.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Entertainment7 days ago

Entertainment7 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech7 days ago

Tech7 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World21 hours ago

Crypto World21 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech10 hours ago

Tech10 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat6 hours ago

NewsBeat6 hours agoPolice latest as search for missing woman enters day nine