Crypto World

ICO Development Guide 2026 | Tokenomics, Compliance, and Launch Strategy

Raising capital is no longer the hardest part of building a blockchain project. Sustaining value after launch is. Today, many Web3 founders enter fundraising with strong technology, passionate teams, and promising roadmaps. Yet, within months of launching, their tokens lose momentum, investor confidence declines, and communities disengage. The problem is rarely the idea. It is usually the economic structure behind it.

Without clear token utility, disciplined emissions, and governance alignment, even well-funded projects struggle to survive volatile market cycles. This is why working with a proven ICO development company has become a strategic necessity rather than an optional choice. This guide is designed for serious founders, protocol teams, and enterprises who want to build scalable, investor-ready ecosystems. You will learn how sustainable tokenomics, structured governance, and professional execution can transform your ICO into a long-term growth engine.

Why Well-Funded ICOs Still Collapse After Launch

Many founders assume that once funding is secured, success will naturally follow. In reality, funding only creates opportunity. Execution determines survival. Capital can amplify progress, but it can also accelerate structural weaknesses if the foundation is not carefully designed. Even well-funded projects can unravel faster than undercapitalized ones, without a disciplined economic model and operational clarity.

Some of the most common reasons ICOs fail after raising capital include:

- Excessive token inflation that dilutes value

- Weak or unclear utility models

- Overgenerous early investor allocations

- Lack of post-launch engagement strategy

- Poor liquidity planning

- Absence of governance frameworks

When these issues combine, selling pressure increases while demand stagnates. The result is a rapid decline in market confidence. Investor sentiment shifts quickly, liquidity dries up, and community morale weakens. Founders then spend most of their time firefighting instead of building. A strong launch must be engineered with sustainability in mind from day one.

Get expert feedback on your tokenomics, compliance readiness, and launch plan.

How Weak Token Economics Destroys Long-Term Project Value

When token supply grows faster than real usage, price erosion becomes inevitable. When rewards are misaligned, participants exploit incentives instead of contributing value. When governance lacks structure, disputes paralyze development. Sustainable ICO development requires deep modeling of how tokens will circulate, accumulate value, and support growth over time. It is about aligning user behavior with network success.

Projects that ignore this reality often experience:

- Rapid investor exits

- Exchange delistings

- Reduced partnership interest

- Difficulty raising follow-on capital

- Long-term brand damage

Once trust is lost, rebuilding it is extremely costly.

What VCs & Strategic Investors Look for Before Backing an ICO

Institutional investors no longer invest based on whitepapers alone. They evaluate token launches using rigorous frameworks. Before committing capital, most professional investors examine:

Is the token essential to the ecosystem, or is it optional?

Tokens without core utility struggle to maintain demand. Investors look for clear, recurring use cases that generate consistent transactional activity and long-term relevance.

Are supply releases predictable and disciplined?

Uncontrolled inflation signals high risk. Well-structured emission schedules demonstrate financial discipline and protect early participants from excessive dilution.

Do founders and early backers have long-term lockups?

Short vesting often leads to early dumping. Extended vesting periods signal commitment and align leadership incentives with ecosystem growth.

Is there a clear plan for managing raised funds?

Poor treasury strategy weakens sustainability. Institutional backers expect transparent budgeting, reserve planning, and responsible capital deployment.

Do token holders have meaningful participation?

Governance builds long-term engagement. Clear voting systems and proposal mechanisms help prevent internal conflicts and promote community ownership.

Are security audits, compliance planning, and contingency strategies in place?

Strong risk management reduces operational uncertainty and protects both users and investors from avoidable losses.

Projects that satisfy these criteria attract stronger capital and long-term partners.

Uncover hidden gaps in your token model and strategy.

The Six Pillars of Scalable ICO Development Architecture

- Supply and Emission Control: Supply schedules must balance incentives and scarcity. Gradual emissions encourage participation without creating excessive selling pressure. Effective ICO development involves testing multiple scenarios to maintain stability across growth phases.

- Utility Driven Demand: Tokens must provide real access, functionality, or economic benefits. Utility should be embedded into core product operations, as artificial demand rarely sustains long-term engagement.

- Governance and Voting Rights: Transparent governance systems strengthen community trust and reduce centralization risk. Clear voting processes support sustainable decision-making.

- Treasury and Reserve Design: Capital allocation must support development, security, and operations for multiple years. Reliable ICO development services help structure treasuries for long-term financial discipline.

- Vesting and Lockups: Well-designed vesting protects against short-term speculation and reinforces long-term commitment from founders and early investors.

- Liquidity Strategy: Liquidity planning is essential to stabilize early trading and manage volatility through exchange partnerships and market-making support.

When these pillars work together, ecosystems remain resilient under pressure and are positioned for sustainable growth.

Why Strategic Development Partners Matter in High-Stakes ICO Launches

Building a compliant, secure, and scalable token ecosystem requires expertise across economics, technology, regulation, and community development. Professional ICO development services extend far beyond basic smart contract deployment by integrating multiple strategic functions into a unified launch framework. Experienced partners support founders by helping them:

- Identify economic vulnerabilities before they impact token stability

- Optimize token distribution and incentive structures for long-term sustainability

- Prepare institutional-grade technical, legal, and compliance documentation

- Coordinate comprehensive security audits and regulatory reviews

- Design transparent and scalable post-launch governance systems

- Enable long-term platform performance and infrastructure growth

This integrated approach minimizes execution risk, strengthens investor confidence, and supports sustainable ecosystem expansion.

Critical ICO Mistakes Even Experienced Founders Make

Common pitfalls in ICO development include:

- Copying popular token models without customization

- Underestimating liquidity requirements

- Ignoring regulatory exposure

- Overpromising roadmap milestones

- Delaying governance implementation

- Prioritizing hype over infrastructure

Avoiding these errors requires disciplined planning, experienced oversight, and regular external review.

Are You Ready for a High-Impact ICO Launch

The difference between a short-lived token launch and a scalable digital economy lies in preparation, structure, and execution. Serious founders understand that sustainable growth does not happen by chance. It is engineered through disciplined planning, economic modeling, compliance clarity, and technical precision. If you are raising capital, preparing for exchange listings, or designing tokenomics for long-term value, now is the moment to make strategic decisions. The right partner can help you identify blind spots, strengthen investor confidence, and protect your ecosystem from avoidable risk.

Antier brings deep expertise in end-to-end ICO development, combining tokenomics strategy, regulatory alignment, smart contract security, and ecosystem architecture into a unified execution framework. Our team works alongside funded founders and Web3 innovators to design investor-ready systems that are built to scale. If you are serious about launching a resilient and institutionally credible token ecosystem, let us evaluate your readiness and design a strategy tailored to your vision.

Frequently Asked Questions

01. What is the main challenge for blockchain projects after their launch?

The main challenge is sustaining value after launch, as many projects experience a decline in token momentum, investor confidence, and community engagement.

02. Why do well-funded ICOs still fail after raising capital?

Well-funded ICOs can fail due to issues like excessive token inflation, unclear utility models, poor post-launch engagement strategies, and lack of governance frameworks.

03. What can founders do to ensure the long-term success of their ICO?

Founders can ensure long-term success by focusing on sustainable tokenomics, structured governance, and professional execution from the very beginning of their project.

Crypto World

Base TVL Drops $1.4 Billion Amid Strategic Rift at Coinbase

Base, the Ethereum Layer-2 network incubated by Coinbase, has seen its total value locked (TVL) fall by $1.4 billion in the past few weeks.

The decline comes as public debate over the chain’s strategy and product direction intensifies.

Base TVL Slides as Builders, Critics, & Coinbase Leadership Clash Over the Chain’s Direction

Base TVL has dropped from about $5.3 billion in January to roughly $3.9 billion as of this writing.

Sponsored

Sponsored

The drop matters because TVL remains one of the most closely watched indicators of capital activity and developer confidence in blockchain ecosystems.

However, TVL fluctuations are common across L2 networks, particularly during broader market rotations or liquidity shifts.

As liquidity tightens, Base is also facing unusually open criticism (and responses) from founders, investors, and Coinbase leadership.

Base creator Jesse Pollak framed the moment as part of a typical growth cycle for fast-scaling ecosystems.

“Base went from not existing to one of the most important chains in the world in two years, which happened because of the builders. And as with all fast growth, along the way, some left, some pivoted, some gave up. The builders who remain are the ones who define the next era,” Pollak wrote.

His comments reflect a view held by many infrastructure teams: that early surges often attract speculative capital and short-term projects, followed by periods of consolidation before the next phase of development.

Sponsored

Sponsored

Critics Argue Base Lost Focus

Some founders and investors say Base’s recent challenges are strategic rather than cyclical. A builder and Coinbase shareholder known as Hish on X publicly criticized the rollout of the Base App, arguing it was marketed as a “super app” but delivered features users did not request.

Investor Mike Dudas echoed similar concerns, saying Coinbase Wallet had previously been positioned as a broad on-chain hub, only to have its priorities shifted by strategic pivots.

Coinbase Leadership Acknowledges Missteps

Coinbase CEO Brian Armstrong responded directly to criticism and accepted responsibility for earlier decisions.

“I’ll take ownership of that if you want to fire someone,” Armstrong wrote, adding that the Base App is now focused on being “the self-custodial version of Coinbase, and trading focused.”

Sponsored

Sponsored

He emphasized that self-custody is becoming increasingly important as more financial activity moves on-chain. However, the Coinbase executive also articulated that most company resources remain directed toward the main retail platform.

In separate remarks about Coinbase’s broader strategy, Armstrong also noted rising institutional engagement with crypto and highlighted growth in:

- Trading volumes

- Assets on the platform, and

- Product revenue streams,

According to Armstrong, the company remains well-positioned as the financial system grows.

Debate Expands to Ecosystem Design

The discussion has extended beyond immediate product changes to larger questions about how crypto ecosystems grow.

Sponsored

Sponsored

Uniswap founder Hayden Adams suggested that combining managed accounts and self-custody into a unified interface could improve usability. His remarks reflect ongoing industry efforts to simplify onboarding without sacrificing decentralization.

At the same time, some community commentators argue that Base must strengthen incentives and culture to retain developers and users.

Meanwhile, others counter that long-term adoption depends more on infrastructure, compliance, and institutional partnerships.

If Base can translate its infrastructure advantages and Coinbase distribution into sustained user growth, the current pullback may prove temporary.

If not, competition among Layer-2 ecosystems is likely to intensify as liquidity and developer attention remain highly mobile.

Crypto World

Bitcoin stuck in tight range; WLFI rallies ahead of crypto forum

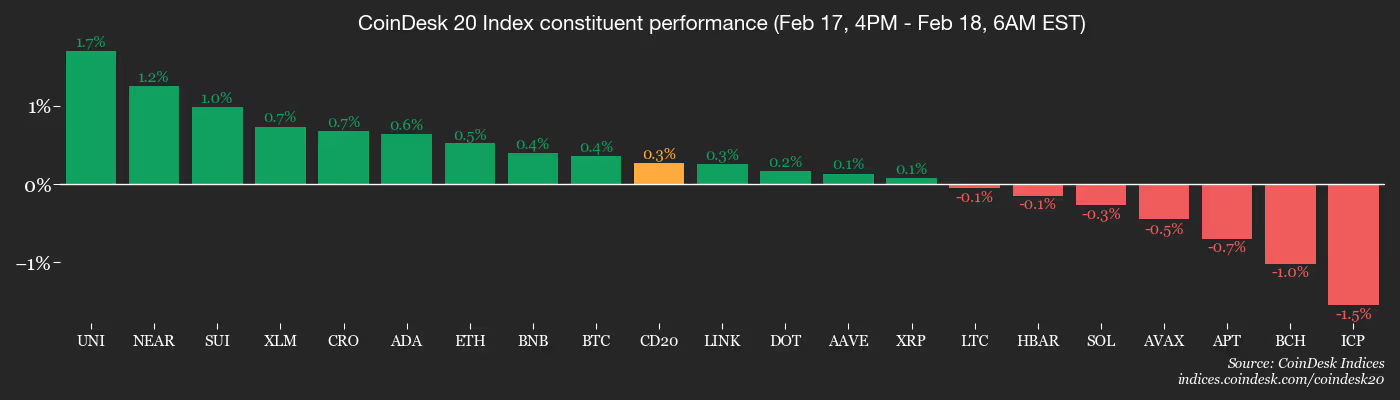

The crypto market continues to trade within a tight range on Wednesday, with bitcoin rising by 0.9% to around $68,000 since midnight UTC.

The largest cryptocurrency has held between $65,100 and $72,000 since Feb. 6 as market volatility has reduced following a Feb. 5 selloff that took BTC to its lowest point since October 2024.

The altcoin market is running its own race. Monero (XMR) and are posting gains of 3% and 1.7%, respectively, since midnight, while zcash (ZEC) and hyperliquid (HYPE) lost 3.5% and 1.1% over the same period.

The muted performance across the crypto market comes as U.S. equities begin to claw their way out of trouble — S&P 500 and Nasdaq 100 index futures are up 0.57% and 0.66% since midnight UTC as investors await hints on monetary policy when the Fed releases its meeting minutes later on Wednesday.

Derivatives

- Market dynamics have shifted toward stabilization as open interest holds firm at $15.5 billion, marking a transition from leverage cleanup to a steady floor.

- While retail sentiment has cooled with funding rates turning flat to slightly negative (Binance at -0.11%), institutional conviction remains anchored, the three-month annualized basis persists at 3%.

- The BTC options market has reached a state of relative equilibrium, with 24-hour volume split 49/51 between calls and puts.

- While the one-week 25-delta skew has eased further to 11%, the implied volatility (IV) term structure remains in short-term backwardation, as evidenced by the sharp front-end spike in the IV curve before leveling off near 49% for longer dated tenors.

- Coinglass data shows $193 million in 24-hour liquidations, with a 62-38 split between longs and shorts. BTC ($72 million), ETH ($52 million) and others ($12 million) were the leaders in terms of notional liquidations.

- The Binance liquidation heatmap indicates $68,800 as a core liquidation level to monitor in case of a price rise.

Token talk

- The “altcoin season” indicator has risen to 34/100, up from lows of 22/100 on Feb. 8, indicating relative strength across the altcoin market despite relatively low levels of volatility.

- The top performing asset on Wednesday has been , the Trump family-backed DeFi token, which is up 8.8% since midnight and 18.52% over the past 24 hours.

- Investors are betting on WLFI ahead of the projects’s crypto forum at Mar-a-Lago on Wednesday, which will be attended by executives from Goldman Sachs, Nasdaq and Franklin Templeton, among others.

- It should be noted that rallies leading up to real-world events or announcements often result in a “sell the news” scenario as those “buying the rumor” race to secure profits.

- Lending platform Morpho’s native MORPHO token has also been on a bullish run of late, rising by 36% in the past week and 7% in the past 24 hours as traders attempt to capitalize on an otherwise unmoving market.

Crypto World

While some big investors cash out, others double down: Crypto Daybook Americas

By Jacob Joseph (All times ET unless indicated otherwise)

Bitcoin remains within the tight $66,000-$70,000 range we’ve seen in the past few days. At the time of writing, the BTC price was about 1.04% higher over 24 hours. Ether was changing hands at $2,020, up 1.43% on the day.

Institutional positioning remains a central theme.

Digital asset treasury companies and public institutions were among the strongest sources of demand in mid-2025, helping propel prices to record highs. But with bitcoin down more than 50% from its October peak, the landscape has shifted. Many treasury-focused firms are now feeling the strain. Metaplanet reported a $619 million net loss earlier this week, while Harvard Management Company trimmed its exposure to bitcoin ETFs.

Ether treasury firms are also recalibrating. ETHZilla disclosed last evening that tech billionaire Peter Thiel and affiliated Founders Fund entities have exited their entire 7.5% stake in the company. The firm also reduced its ether holdings through multiple sales since October.

Still, not everyone is pulling back.

Michael Saylor’s Strategy continued to build its bitcoin position, adding 2,486 BTC earlier this week and bringing total holdings to 717,131 BTC. Meanwhile, two Abu Dhabi-based funds — Mubadala Investment Company and Al Warda Investments — disclosed yesterday that they collectively held more than $1 billion in BlackRock’s Bitcoin ETF at the end of last year.

BitMine Immersion Technologies announced yesterday that it continues to lean in, adding 45,759 ETH over the past week and bringing its total holdings to 4.4 million ETH. About 3 million of that is currently staked, generating additional yield on top of its core position.

Meanwhile, in a separate development disclosed yesterday, BlackRock advanced its plans for a U.S.-listed yield-generating ether product. An amended S-1 filing signaled further progress toward the iShares Staked Ethereum Trust ETF, with a BlackRock affiliate purchasing 4,000 seed shares at $25 each, providing $100,000 in initial capital for the trust.

While these developments provide constructive long-term signals, it may be premature to call an end to the recent drawdown even with bitcoin and ether trading roughly 50% and 60% below their all-time highs, respectively.

At the same time, TradFi indexes are beginning to show signs of fatigue, as rising AI-related capital expenditures outpace earlier estimates and place increasing pressure on corporate cash flows. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 18, 1 p.m.: Hedera to undergo a mainnet upgrade expected to take about 40 minutes to complete.

- Macro

- Feb. 18, 8:30 a.m.: U.S. durable goods orders MoM for December (Prev. 5.3%)

- Feb. 18, 9:15 a.m.: U.S. industrial production MoM for January est. 0.3% (Prev. 0.4%)

- Feb. 18, 2:00 p.m.: U.S. FOMC Minutes

- Earnings (Estimates based on FactSet data)

- Feb. 18: Figma (FIG), post-market, $0.45

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Unlocks

- Token Launches

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 0.86% from 4 p.m. ET Tuesday at $68,227.58 (24hrs: -0.09%)

- ETH is up 1.03% at $2,019.54 (+2.24%)

- CoinDesk 20 is up 0.55% at 1,994.39 (+0.54%)

- Ether CESR Composite Staking Rate is down 3 bps at 2.81%

- BTC funding rate is at 0.0018% (1.9425% annualized) on Binance

- DXY is up 0.13% at 97.28

- Gold futures are up 0.58% at $4,934.20

- Silver futures are up 2.92% at $75.68

- Nikkei 225 closed up 1.02% at 57,143.84

- Hang Seng closed up 0.52% at 26,705.94

- FTSE is up 1.03% at 10,664.40

- Euro Stoxx 50 is up 0.93% at 6,077.76

- DJIA closed on Tuesday unchanged at 49,533.19

- S&P 500 closed up 0.1% at 6,843.22

- Nasdaq Composite closed up 0.14% at 22,578.38

- S&P/TSX Composite closed down 0.54% at 32,896.55

- S&P 40 Latin America closed down 0.62% at 3,694.06

- U.S. 10-Year Treasury rate is up 1.9 bps at 4.073%

- E-mini S&P 500 futures are up 0.52% at 6,896.50

- E-mini Nasdaq-100 futures are up 0.59% at 24,914.00

- E-mini Dow Jones Industrial Average Index futures are up 0.47% at 49,844.00

Bitcoin Stats

- BTC Dominance: 58.56% (-0.01%)

- Ether-bitcoin ratio: 0.02947 (-0.11%)

- Hashrate (seven-day moving average): 1,062 EH/s

- Hashprice (spot): $34.12

- Total fees: 2.29 BTC / $155,681

- CME Futures Open Interest: 116,675 BTC

- BTC priced in gold: 13.7 oz.

- BTC vs gold market cap: 4.5%

Technical Analysis

- The chart shows bitcoin’s price against the dollar in one-week candles.

- The latest reading shows the price remains below the 200-week exponential moving average (EMA).

- Historically, breaks below the EMA have established a “bottom” in a bear market. Whether that’s the case now remains to be seen.

- The lack of divergences in the RSI suggests we are unlikely to see a sustained rebound in the short term.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $166.02 (+1.03%), +1.37% at $168.29 in pre-market

- Circle Internet (CRCL): closed at $61.62 (+2.63%), +2.21% at $62.98

- Galaxy Digital (GLXY): closed at $21.30 (-1.66%), +0.80% at $21.47

- Bullish (BLSH): closed at $32.00 (+0.85%), unchanged in pre-market

- MARA Holdings (MARA): closed at $7.51 (-5.18%), +1.33% at $7.61

- Riot Platforms (RIOT): closed at $14.65 (-3.75%), +1.43% at $14.86

- Core Scientific (CORZ): closed at $17.23 (-3.42%)

- CleanSpark (CLSK): closed at $9.28 (-5.79%), +0.86% at $9.36

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.00 (-3.24%)

- Exodus Movement (EXOD): closed at $10.09 (-10.47%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $128.67 (-3.89%), +1.27% at $130.30

- Strive (ASST): closed at $8.18 (-1.80%), +0.86% at $8.25

- SharpLink Gaming (SBET): closed at $6.66 (-2.77%), +0.30% at $6.68

- Upexi (UPXI): closed at $0.72 (-6.37%)

- Lite Strategy (LITS): closed at $1.10 (-1.79%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$104.9 million

- Cumulative net flows: $54.21 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: $48.6 million

- Cumulative net flows: $11.73 billion

- Total ETH holdings ~5.73 million

Source: Farside Investors

While You Were Sleeping

Crypto World

Crypto mortgage lender Milo surpasses $100 million in home loans

Milo, a U.S. cryptocurrency lending business that specializes in crypto-backed mortgages, has originated over $100 million in home loans, including the company’s largest single transaction to date, a $12 million crypto mortgage.

The firm, which holds mortgage provider licenses in ten U.S. states with more to follow, has a perfect track record of zero margin calls across its mortgage portfolio, despite enduring consistently choppy periods of volatility for bitcoin and other cryptos, Milo said in a press release on Wednesday.

The firm allows crypto holders to pledge their bitcoin or ether as collateral for loan amounts up to $25 million without having to sell their digital assets, eliminating the need for cash down payments and avoiding costly taxable events.

Stepping back, Milo founder Josip Rupena said people who were perhaps advised by a friend to buy some Bitcoin 10 years ago say, and had the courage to hold on to it through recurring cycles of volatility, may find that today maybe 95% of their net worth is in crypto.

Such people will typically be aged between 30 and 55, have a job, and perhaps a retirement account, but they don’t have enough income to buy the home they would like to, Rupena said.

“Our typical transaction is a million and a half dollar home,” Rupena said in an interview. “A customer might make $100k a year and their crypto net worth might be anywhere from three to seven million. If you were to replace Bitcoin with Apple stock, a product like ours would probably not need to exist. But because the consumer owns an asset that is not widely accepted, plus its concerns around the volatility, means that products like ours do need to exist to help them buy a home.”

Milo asks for 100% of the value of the property in crypto collateral, which can be held with qualified custodians like Coinbase or BitGo, or there is a self-custodial option for those who want to keep complete control of their assets. The loans, which start at 8.25%, can also be used for things like acquiring land, funding home improvements, and business investments.

Unlike regular crypto loans which can have margin calls at 25% drops, Milo designed the product to be more conservative and accommodate 65% drawdowns.

Even in turbulent times like the past few months, if a drawdown situation were to cross the necessary threshold, Milo would reduce the value of the loan, Rupena said, so that the customer could continue to have the mortgage.

“We would just essentially derisk the 100% and bring it down to a 65% or 70%, like a regular mortgage, and then they could continue to make payments. We designed it in a way that as long as a person can continue to make payments, they’re going to be able to continue to have this home. They’re not going to lose their home, because Bitcoin goes down,” he said.

So far Milo has done several transactions in the property hotspot of Miami and more in other parts of Florida, as well as Texas, California, Colorado, Connecticut and Arizona. The $12 million transaction mentioned in the press release was in Tennessee, Rupena said.

The product has been given the blessing of bitcoin pioneer and CEO of Blockstream, Adam Back.

“Milo’s product is a game changer in bitcoin lending and unlocks real world use cases for so many bitcoiners,” said Back in a statement. “While bitcoin continues to appreciate, buyers are able to build equity in real estate and don’t have to sell their long term conviction, bitcoin.”

Crypto World

Pump.fun launches Cashback Coins Rewards Feature

Solana-based memecoin launchpad Pump.fun has rolled out a new feature that shifts rewards toward memecoin traders rather than its deployers — a tweak to its fee model that once generated over $15 million in a single day at its peak.

In a post to X on Tuesday, Pump.fun said the platform’s memecoin creators can now decide whether a token “truly deserves” Creator Fees, or whether it’s best to redirect rewards to traders engaging with the token through “Cashback Coins.”

Pump.fun’s original model features Creator Fees, giving token creators 0.3% of all fees generated by the tokens they launch.

However, Pump.fun said not all tokens deserve Creator Fees because many tokens achieve success without a team or project lead, thereby disproportionately rewarding token deployers.

Creator Fees need change. Not every token deserves Creator Fees.

Now, users have the ability to decide whether a token truly deserves Creator Fees, or whether it makes more sense to reward the traders engaging with the token.

Cashback Coins are now live. Learn more 👇 pic.twitter.com/UbYoAbQ1Ya

— Pump.fun (@Pumpfun) February 17, 2026

“Now, traders can choose to engage with tokens they feel the most aligned with, ultimately letting the market decide who gets rewarded and where the bar is set.”

Pump.fun said coin creators must choose between the Creator Fees or Trader Cashback model before launching. Once chosen, the decision is irreversible.

Terminal, a crypto trading platform built into Pump.fun, said Cashback Coins are generated on every trade made and are only accessible through Terminal.

It comes as analysts from onchain analytics firm Santiment said on Friday that memecoins are showing signs of a potential bottom.

“This collective acceptance of the ‘end of the meme era’ is a classic capitulation signal,” Santiment said, explaining that when a sector of the market is completely written off, it is often the “contrarian time” to start paying attention.

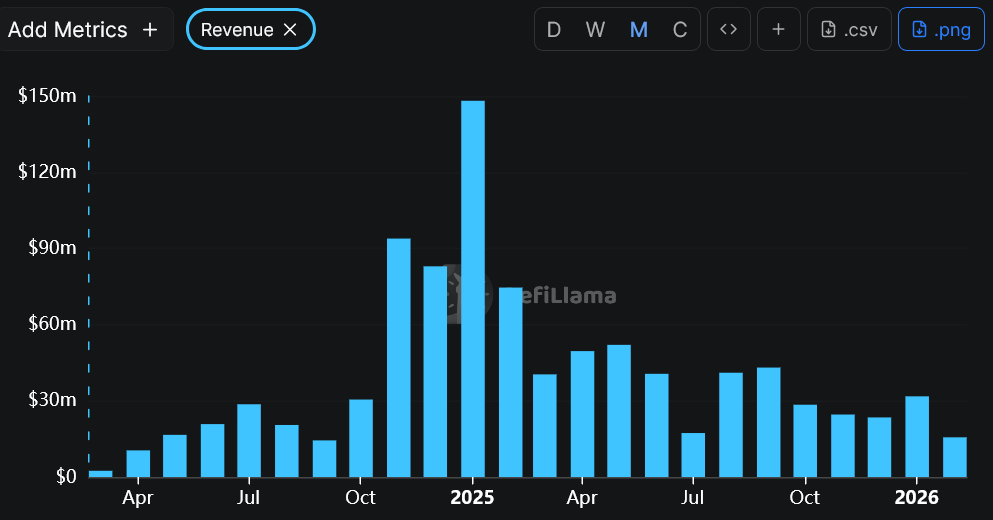

Pump.fun fees have fallen over the last year

Pump.fun’s new rewards feature comes as it recorded $31.8 million worth of fees in January, marking a 75.6% fall from the $148.1 million posted in January 2025 — the platform’s best-performing month to date.

Pump.fun has brought in $15.6 million so far in February, putting it on track to fall short of its January total.

The change to the rewards model also follows months of criticism that only a small number of traders were profiting on Pump.fun, while the vast majority of retail traders were incurring losses.

Data from Dune Analytics shows that of the 58.7 million crypto wallets that have interacted with Pump.fun, only 4.76 million have profited between $1,000 and $10,000, while 969,780 wallets have posted winnings between $10,000 and $100,000.

Less than 13,700 Pump.fun wallets have reached millionaire status on the platform.

The new feature was received well by many in the Pump.fun community, while others, such as X user Coos, pondered whether the rewards model could reduce incentives for developers to launch new coins:

“So devs have less reasons to push coins longer, as the most lucrative time is when coins are still on pf, and have just graduated where there is the most volume.”

Coinbase’s Base shut down its Creator Rewards offering

While Pump.fun has changed its rewards model, others have shut down their rewards programs entirely.

On Feb. 10, Coinbase’s Base App sunset its Creator Rewards program as part of a strategic shift to focus entirely on tradable assets.

Related: Zora debuts attention markets on Solana, betting on social trends

The Creator Rewards program launched in July and was intended to make Base, Coinbase’s Ethereum layer-2, a more social ecosystem, where activity translated into earnings.

The Base App X account said it had paid around $450,000 to 17,000 creators over seven months, with data suggesting that creators earned an average of $26.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

Why Altcoin Season Is Unlikely in Early 2026, Data Shows

Altcoin market capitalization (TOTAL2) remained below $1 trillion in February, while market sentiment fell to its most extreme level in years. Many investors expect altcoins to form a bottom soon after five consecutive months of decline.

The first quarter of 2026 may still offer opportunities. However, investors need objective signals to evaluate the broader picture.

Sponsored

Sponsored

Persistent Selling Pressure and Fragmented Liquidity Weigh on Altcoins

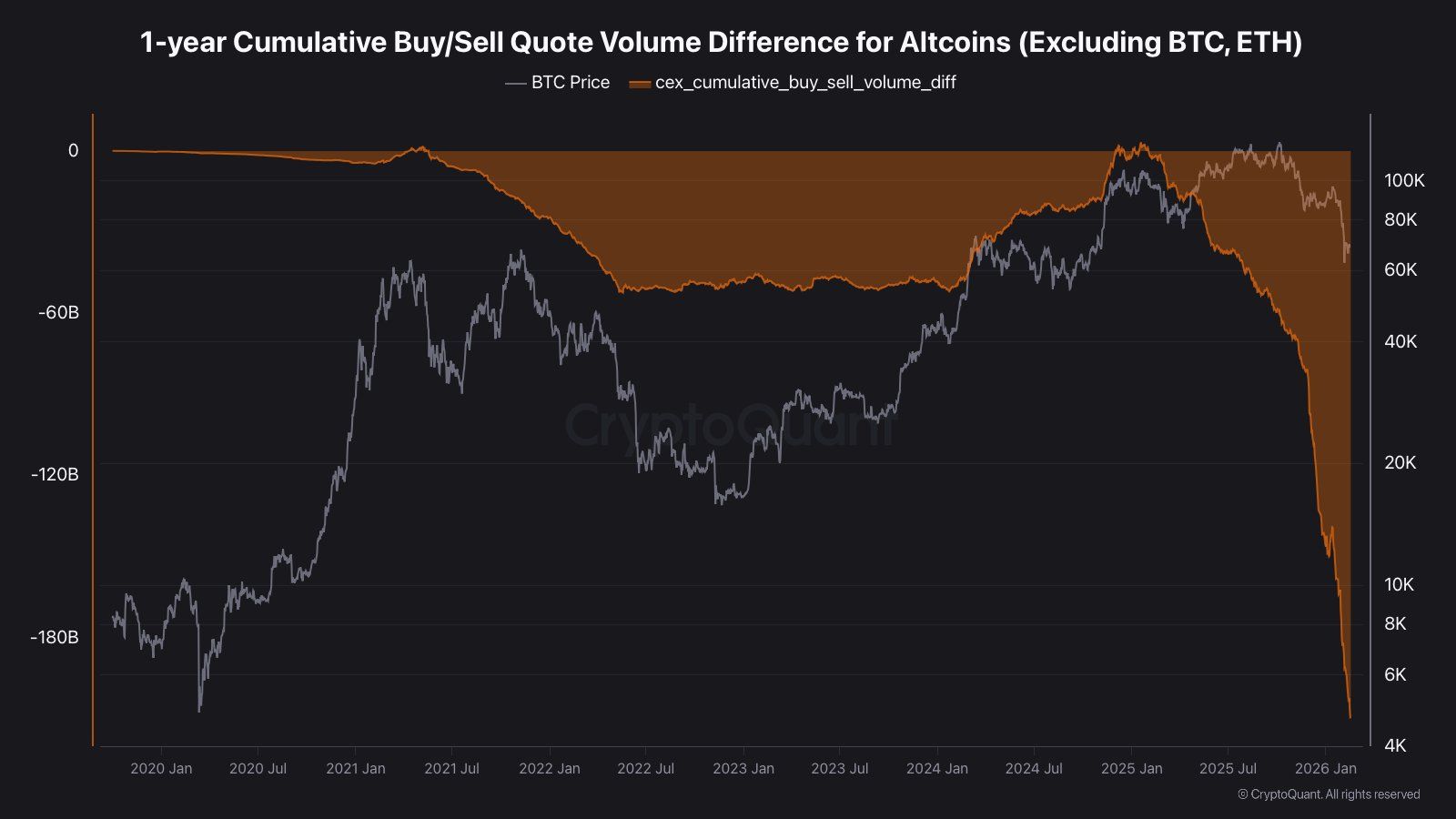

A report from CryptoQuant states that selling pressure on altcoins (excluding BTC and ETH) has reached its most extreme level in five years.

Cumulative buy/sell delta data has reached -$209 billion over the past 13 months. In January 2025, this delta was nearly zero, which reflected balanced supply and demand. Since then, it has continued to decline without any reversal.

This extreme condition differs completely from the 2022 bear market. During 2022–2023, selling pressure slowed, allowing the market to enter a sideways phase before recovering. That slowdown has not occurred in the current cycle.

“This is not a dip. It’s 13 months of continuous net selling on CEX spot. -209B doesn’t mean bottom. It means buyers are gone,” analyst IT Tech stated.

Additionally, derivatives data can provide additional short-term insights. Traders are currently holding significantly more long positions in Bitcoin than in altcoins, as reflected in Alphractal’s Long/Short Ratio data.

Sponsored

Sponsored

The chart shows that this is the first time in history that Bitcoin’s long ratio has remained above the altcoin average for four consecutive months. This indicates that short-term traders have reduced their exposure to altcoins and that expectations for altcoin volatility have weakened.

In addition, the total altcoin market capitalization has dropped back to levels five years ago, below $1 trillion. The altcoin analytics account OverDose pointed out that the biggest difference lies in the number of tokens. Five years ago, only about 430,000 coins were listed. Currently, that figure has surged to 31.8 million, an increase of roughly 70 times.

Too many tokens are competing for a market “pie” that has not grown larger. This dynamic makes recovery more fragile and threatens the survival of low-cap tokens.

Excluding the top 10, the remaining market capitalization stands at less than $200 billion. The technical structure shows a head-and-shoulders pattern, and this capitalization is moving toward its neckline support. Analyst Pentoshi commented that even if altcoins rebound, the gains will likely not be substantial.

“Even if alts bounce here, it likely won’t be substantial. I think eventually they make new lows… Imo it’s going to take some time to work through,” analyst Pentoshi predicted.

According to CoinGecko research, 53.2% of all cryptocurrencies listed on GeckoTerminal had failed by the end of 2025. In 2025 alone, 11.6 million tokens collapsed.

The current bear market may permanently reshape how investors allocate capital within the altcoin sector. Market participants may become more selective, prioritize liquidity and fundamentals, and reduce exposure to speculative low-cap assets.

Crypto World

Enso partners with Chainlink for live production deployments of cross-chain minting

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Enso announced live production deployments of cross-chain minting and execution flows powered by Chainlink, enabling assets to move across chains.

Enso today announced live production deployments of cross-chain minting and execution flows powered by Chainlink Cross-Chain Interoperability Protocol (CCIP). With this integration, issuers and asset strategy platforms can move capital across chains and deploy it into live strategies, atomically and pre-simulated, in a single transaction.

The integration is live in production with launch partners including Reservoir, World Liberty Financial (WLFI), Maple, Avant, Liquity, and Dolomite. Enso and Chainlink now enable assets to arrive on destination chains already deployed according to predefined logic.

Stablecoins and yield-bearing assets bridged via CCIP can be automatically routed through swaps, deposits, zaps, and protocol interactions, all executed in a single bundled transaction. This removes operational overhead, removes execution risk, and eliminates the need for manual post-bridge deployment.

At the center of the integration is Enso’s CCIP Receiver, a destination-side smart contract that combines Chainlink’s secure cross-chain messaging with Enso’s deterministic execution engine. Issuers define outcome-driven workflows, such as minting or distributing assets on one chain and programmatically deploying them into yield, liquidity, or treasury strategies on another, without building custom integrations for each network.

This integration also supports capital-efficient hub-and-spoke models for cross-chain asset expansion. Asset issuers such as USD1 by World Liberty Financial and BOLD by Liquity can mint on a primary chain while distributing and deploying across multiple ecosystems without pre-funding fragmented liquidity pools.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

AI Dominates Market Interest But Where Are the Crypto Gains?

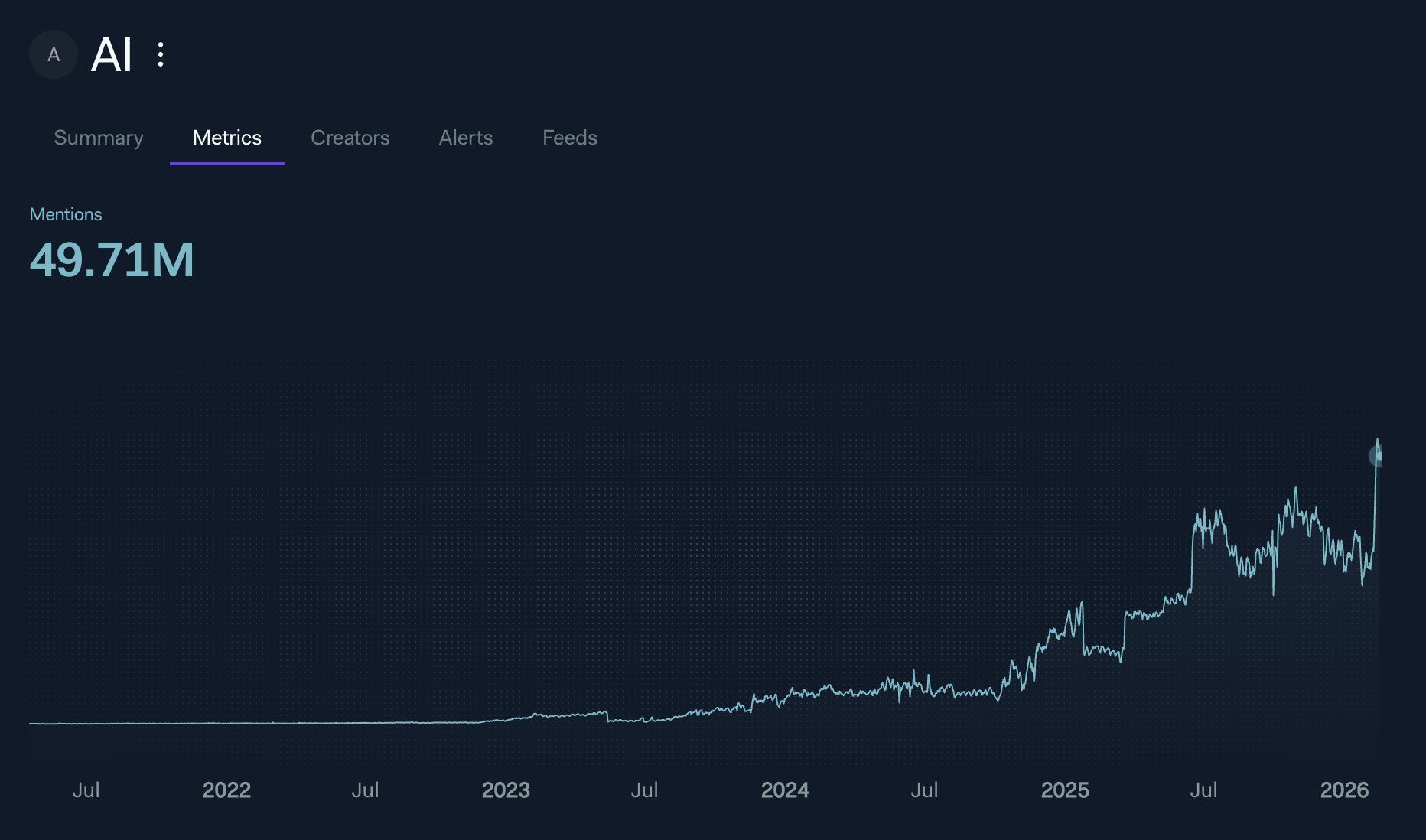

Mentions of artificial intelligence (AI) on social media reached record highs in February 2026, with attention focused on various applications and concerns.

However, this momentum has not extended to the crypto space. The divergence highlights a clear split: while global AI interest continues to climb, decentralized AI projects and blockchain-based AI tokens are experiencing weak performance and limited visibility.

Sponsored

AI Takes Center Stage Online and in Global Investment Markets

Social intelligence platform LunarCrush reported that daily social mentions of “AI” set all-time records, with distinct conversation themes. The analytics platform reported that discussions around new AI models, capabilities, and industry integration accounted for 40% of overall mindshare.

Creative use cases also represented a significant share of the conversation. AI in creative industries such as art, music, writing, and content creation captured 30% of mindshare.

Meanwhile, 20% of AI-related discussions centered on ethics and safety. These conversations focused on responsible development and deployment.

However, concerns appeared to outweigh optimism in several areas. Job displacement fears dominated sentiment, accounting for 60% of mindshare. AI misuse drove 30% of the discussion, while regulation captured 10%.

Sponsored

Interest in AI extends far beyond online conversations. Investment activity reflects the same momentum. According to Crunchbase data, AI attracted nearly half of all global funding in 2025, a sharp increase from 34% in 2024.

Total funds flowing into the sector surged more than 75% year over year, rising from $114 billion invested in 2024.

“The foundation model companies have raised $80 billion in 2025 to date, representing 40% of global AI funding, per Crunchbase data. Model company funding this year has more than doubled from $31 billion in 2024, when that investment totaled about 27% of all AI funding,” the report read.

At the same time, large-scale spending is accelerating across AI infrastructure. Recently, Adani Group unveiled plans to invest $100 billion to develop renewable-energy-powered, AI-ready hyperscale data centers by 2035.

Sponsored

AI Boom Leaves Crypto Tokens Behind

As momentum builds across the AI sector, one segment appears to be receiving comparatively little attention.

Noticeably, there is no major discussion of decentralized AI projects or crypto AI tokens. Blockchain AI lags as mainstream AI receives most of the enthusiasm.

The investment data points to a similar imbalance. BeInCrypto reported that during Q1 2026, Web3 funding was primarily directed toward core infrastructure and institutional-facing financial rails. The largest allocations went to stablecoin payment infrastructure, custody and trading platforms, real-world asset tokenization, and compliance tools.

Sponsored

Decentralized AI projects were largely missing from the list of top-funded categories, highlighting a widening gap between the broader AI boom and blockchain-based AI development.

Market numbers reveal the AI crypto tokens’ ongoing challenge. Over the past month, every major AI-related crypto subsector tracked by CoinGecko has recorded a decline in market capitalization.

The combined market cap of leading AI crypto categories has dropped over 16%. Still, it’s worth noting that the decline comes amid a broader market downturn, which has pulled asset prices lower.

This suggests that surging global interest in AI has not translated into equivalent demand for AI-focused crypto tokens. As capital and attention concentrate on sovereign AI infrastructure, robotics, and enterprise deployment, the key question is whether blockchain-based AI projects can meaningfully capture that momentum, or whether traditional systems will continue absorbing most of the value created by the AI revolution.

Crypto World

Lagarde May Leave ECB Early as Digital Euro Enters Key Phase

European Central Bank (ECB) President Christine Lagarde is considering leaving before her eight-year term ends in October 2027, the Financial Times reported, citing a person “familiar with her thinking.”

Lagarde, who took office in November 2019, is said to be weighing an early exit ahead of France’s April 2027 presidential election so that outgoing President Emmanuel Macron and German Chancellor Friedrich Merz can agree on a successor, the FT reported Wednesday.

An ECB spokesperson pushed back on the report, telling Cointelegraph: “President Lagarde is totally focused on her mission and has not taken any decision regarding the end of her term.”

ECB navigates digital euro and MiCA-era stablecoins

Her potential departure would come at a sensitive moment for the ECB’s digital agenda.

Under Lagarde, the ECB has pushed ahead with preparatory work on a digital euro and repeatedly highlighted the need to manage risks from privately issued digital money, including stablecoins, within the new European Union Markets in Crypto Assets Regulation (MiCA) regime.

ECB officials have warned that rapidly growing stablecoins could pose financial stability and monetary policy risks in the euro area, even under MiCA’s safeguards, and have argued for a strong market for well‑regulated euro-denominated stablecoins that can compete with dollar tokens.

Related: Digital euro key to payments sovereignty in ‘weaponised’ world: ECB exec

Lagarde herself has been a vocal critic of Bitcoin (BTC) and other crypto assets, calling them “highly speculative,” and saying in a 2022 television interview that crypto is “worth nothing” and based on no underlying assets, repeating that sentiment even with BTC close to all-time highs in November 2025.

A change at the top of the ECB could impact how the institution communicates on, and prioritizes, issues such as the digital euro, stablecoin oversight and crypto-related payment arrangements, even if the overall regulatory direction is set at the EU level.

Shortlist to replace Lagarde shares cautious line on crypto

Economists polled by the FT in December identified Spain’s former Central Bank Governor Pablo Hernández de Cos and his Dutch counterpart Klaas Knot as leading contenders to replace Lagarde, with ECB Executive Board Member Isabel Schnabel and Bundesbank President Joachim Nagel also seen as potential candidates.

All four have taken cautious stances on crypto. In past speeches, Hernández de Cos has framed crypto assets and stablecoins as a financial stability risk that demands strong regulation and supervision, while Knot has called for a robust global regulatory framework for crypto and stablecoins.

Nagel has linked the push for a digital euro to safeguarding European monetary and financial sovereignty, and has called Bitcoin a “digital tulip” that is “anything but transparent,” warning against treating Bitcoin as a reserve asset.

Related: Crypto’s next battle is privacy, but regulators face chicken-egg dilemma

Schnabel previously described Bitcoin as a “speculative asset without any recognizable fundamental value.”

Digital euro timeline hinges on EU lawmakers

The digital euro project still needs the green light from EU lawmakers, while the ECB has moved into a technical preparation stage and is rolling out collaborations to ensure the digital euro is universally accessible to all.

Despite rumors of a possible early departure of Lagarde, ECB Executive Board Member Piero Cipollone confirmed in a speech on Wednesday that EU co‑legislators were expected to adopt the digital euro regulation in the course of 2026.

He said that would enable a 12‑month pilot in a controlled Eurosystem environment starting in the second half of 2027, with real‑world transactions and a limited group of payment service providers, merchants and Eurosystem staff.

The Eurosystem aims to be ready for a potential first issuance of the digital euro during 2029, assuming the legislative process stays on track.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation — Santiment founder

Crypto World

Bitcoin Entering Phase 2 Bear Market, Analyst Warns

Analyst warns Bitcoin nearing Phase 2 bear market as volatility and liquidity trends point to further downside risk across crypto markets.

Veteran on-chain analyst Willy Woo has warned that the Bitcoin (BTC) market is strengthening its bear trend and approaching the second phase of a multi-stage downturn.

The forecast challenges persistent bullish narratives, suggesting the worst may be ahead for the world’s largest cryptocurrency.

Phase 1 Nears Its End as Volatility Spells Trouble

In a series of posts on X on February 18, Woo outlined a three-phase bear market framework, positioning Bitcoin at a crucial juncture. According to him, the first stage of the current bear market started in the third quarter of 2025 when liquidity first broke down, and the price started to follow.

He explained that the key signal comes from volatility metrics used by quantitative analysts, with Bitcoin entering a prolonged decline when volatility spiked upward. That volatility is still climbing, indicating the bear trend is gaining ground.

“In this phase, perma bulls will blindly say it’s a correction inside a broader bull market but will not give you any hard evidence of capital flowing in,” Woo wrote.

The analyst added that his internal liquidity models, released weekly to investors, currently match the volatility signals. In his opinion, the second part of the bear market will kick in when global equities begin to weaken.

He argued that the largest cryptocurrency often reacts faster than equities when capital exits markets because of its smaller size and higher sensitivity to liquidity shifts.

“Under this bear market framework, BTC is presently in Phase 1 and close to Phase 2,” stated Woo.

He characterized the final episode as “the light at the end of the tunnel,” predicting a turnaround in liquidity, with capital outflows hitting a high point before stabilizing. However, he warned that there could be one more price capitulation just before or immediately after the peak outflows.

You may also like:

Cycle Indicators Show Mixed Signals for Long-Term Outlook

Not all analysts are interpreting the data as outright bearish. In a recent post, Axel Adler Jr. wrote that Bitcoin’s Entity-Adjusted Liveliness metric peaked in December 2025 and has started declining, a pattern seen in past accumulation periods lasting between 1.1 and 2.5 years. The indicator tracks BTC movement relative to holding time and tends to fall after distribution periods end.

Another perspective from GugaOnChain focused on valuation. Using the MVRV Z-Score developed by Murad Mahmudov and David Puell, the analyst said the current reading near 0.48 places Bitcoin close to historical accumulation zones rather than overheated territory. That suggests some investors may see current prices as discounted compared with average acquisition costs.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business13 hours ago

Business13 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech4 hours ago

Tech4 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business5 hours ago

Business5 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show