Crypto World

Institutional Exit? US Investors Are Dumping ETH at a Record Rate

While retail traders hold or accumulate ETH, on-chain data shows US institutions selling Ethereum at a discount.

Ethereum (ETH) broke below the crucial $2,100 price level after a fresh 8% decline amid a severe market correction. On-chain data now points to a major shift in sentiment among US investors.

In fact, those market participants are aggressively de-risking the world’s largest altcoin, even pushing the Coinbase Premium to its most negative reading since July 2022.

Institutional Exit

According to CryptoQuant, the Ethereum Coinbase Premium Index, measured on a 30-day moving average, has fallen to its lowest level since July 2022. The index tracks the price difference between the ETH/USD pair on Coinbase Pro, which is widely used as a proxy for US institutional trading activity, and the ETH/USDT pair on Binance, often viewed as a proxy for global retail participation.

CryptoQuant said that the deeply negative reading on the 30-day basis indicates that selling pressure is largely coming from US entities. While global retail traders may be holding positions or buying into the price decline, US institutions appear to be actively de-risking or exiting their Ethereum holdings.

The analytics platform revealed that the last time the Coinbase Premium Index reached similarly negative levels was during the depths of the 2022 bear market. Based on this comparison, it detailed two possible interpretations. One is that bearish momentum could continue, as US demand, described as an important driver of crypto market rallies, is currently absent, potentially limiting any near-term price recovery.

The alternative interpretation presented is that such extreme negative premiums have historically aligned with capitulation phases, which can sometimes coincide with local market bottoms once aggressive selling pressure is exhausted. CryptoQuant concluded that the $2,100 level represents an important psychological and technical zone, and added that a reversal would likely require the Coinbase Premium to normalize or turn positive.

“As long as US investors are selling at a discount compared to the global market, upside momentum will likely remain capped.”

Another Historical Warning Signal

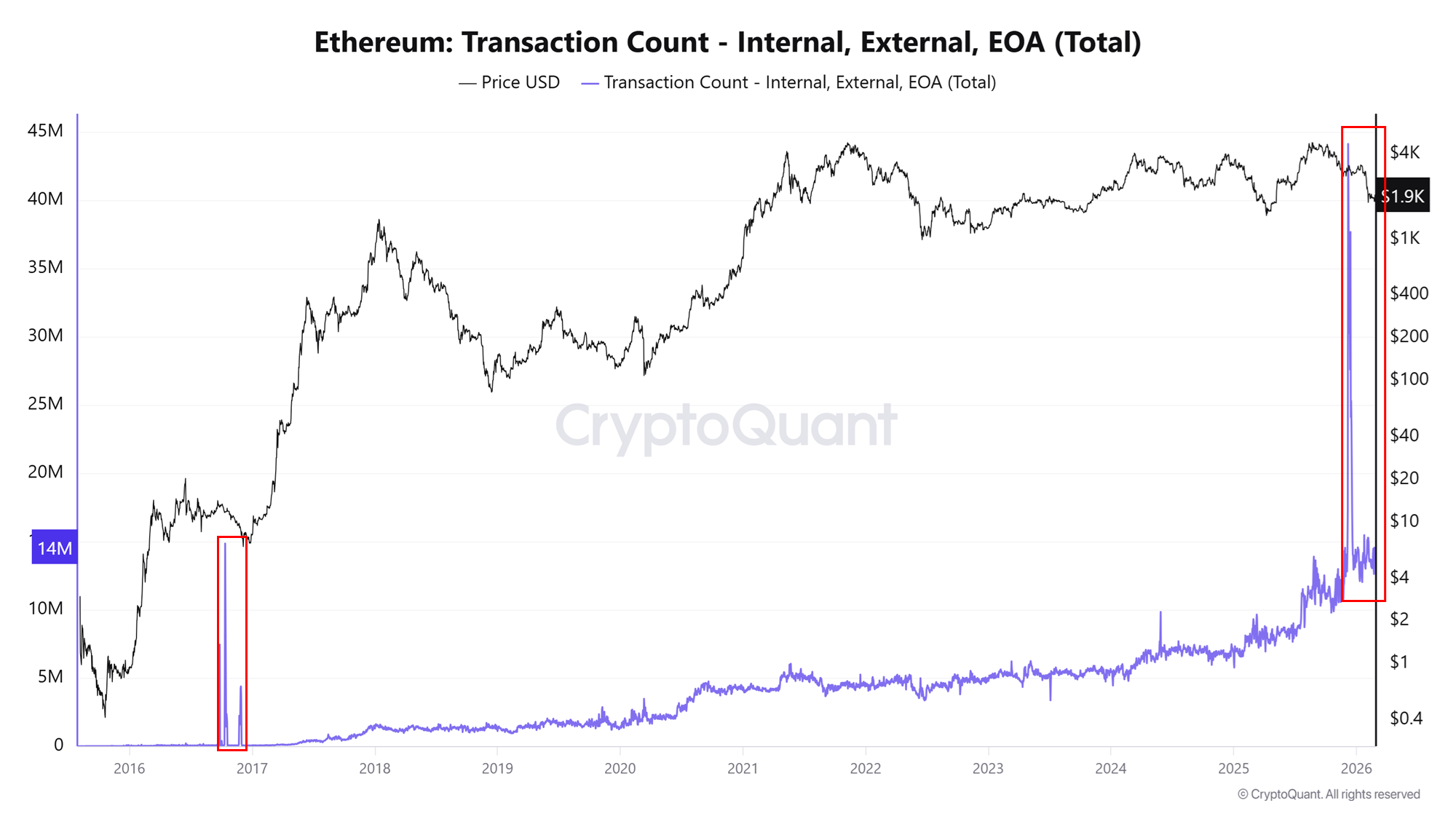

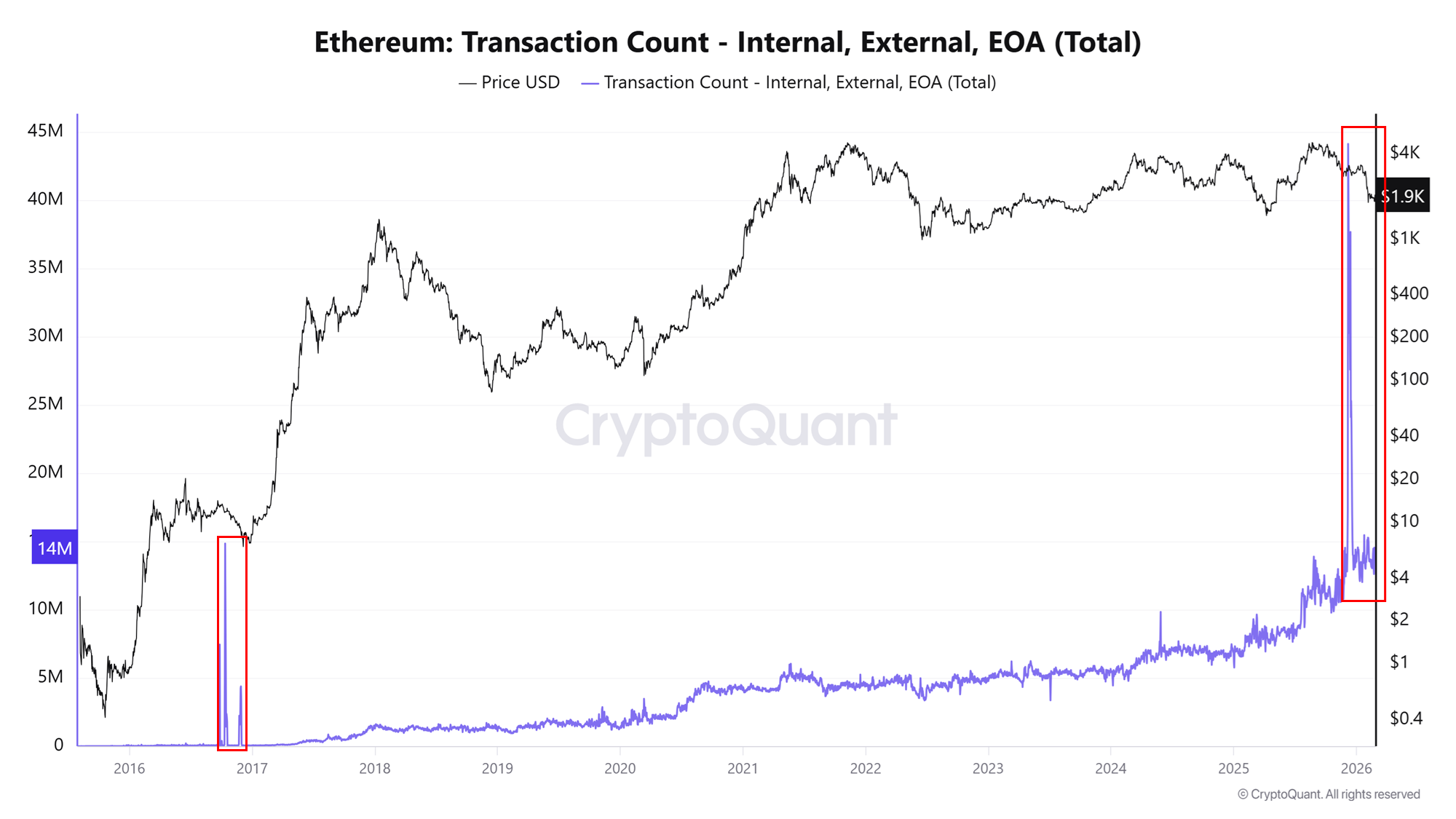

A sharp increase in Ethereum network activity has further raised questions about potential market risks. Ethereum’s total transfer count surged to 1.17 million on January 29th, in one of the highest recorded levels for the metric, and represents a sudden, vertical rise in transaction activity across the network. Historical comparisons reveal that similar spikes have previously occurred around major turning points in ETH’s price cycle. In January 2018, for example, a comparable surge in transfer counts coincided with the market cycle top and was followed by a prolonged bear market.

You may also like:

A similar pattern appeared on May 19, 2021, when a sharp increase in transfers aligned with a major market crash and a steep price correction. While high network activity is often associated with growing usage, CryptoQuant stated that rapid and parabolic increases near price highs have historically reflected periods of market stress.

Such conditions can indicate high volatility, large-scale asset movements, or distribution by long-term holders moving funds, potentially to exchanges. Based on these historical precedents, the current spike places the crypto asset in a “high-risk” zone, where past patterns have been followed by notable price drawdowns.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Vitalik Buterin Unveils Ethereum’s Comprehensive Quantum Resistance Roadmap

Buterin proposes replacing consensus-layer BLS signatures with hash-based schemes, such as Winternitz variants.

Ethereum co-founder Vitalik Buterin has shared a quantum resistance roadmap for the ecosystem.

This follows the identification of post-quantum readiness as a critical consideration across several areas of development.

Quantum Security Upgrades

In a post shared on social media, Buterin outlined specific parts of the network that could face vulnerabilities from advances in quantum computing, including consensus-layer BLS signatures, data availability systems using KZG commitments and proofs, externally owned account signatures based on ECDSA, and application-layer zero-knowledge proofs such as KZG or Groth16.

He went on to propose technical approaches to address these risk areas as part of a quantum resistance roadmap. For example, he suggested strengthening consensus-layer security by swapping BLS signatures for hash-based options like Winternitz variants, while using STARK-based aggregation to enable quick verification.

Buterin explained that this is because the transition toward lean consensus and finality could reduce the number of required signatures per slot, potentially eliminating the need for aggregation in early stages.

As part of this process, the network would also need to choose a long-term hashing method, selecting from several available options to ensure strong, reliable security in the future.

The Ethereum developer also suggested changing how the protocol stores and shares data across the system by introducing a newer method that is designed to improve long-term security. However, he noted that this adjustment would require additional technical work to handle larger verification processes.

You may also like:

Protocol-Level Adjustments

For externally owned accounts, Buterin wants to introduce native account abstraction through EIP-8141, a change that would allow them to support multiple signature methods, including those designed to withstand quantum threats.

Current ECDSA signature verification costs about 3000 gas, while quantum-resistant alternatives are far more resource-intensive and could require around 200,000 gas. Despite being expensive, he believes that ongoing improvements are expected to make them more efficient.

Additionally, the protocol plans to use aggregation techniques that combine many signatures into a single verification step in the long term to reduce the overall network load.

The roadmap also discusses proof systems, which play a role in validating transactions and applications on Ethereum. Similarly, while existing ZK-SNARK verifications are relatively efficient, quantum-resistant STARK proofs come with much higher costs.

To address this, he outlined a solution under EIP-8141 that would allow multiple transaction checks to be bundled and verified through a single proof before reaching the blockchain, reducing on-chain computation and improving scalability.

Last month, the Ethereum Foundation announced that the ecosystem’s next phase will prioritize expanding network capacity while maintaining long-term security and resilience.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Bitcoin Is Down 48%, But the Biggest Buyers in History Are Still Accumulating

TLDR:

- Bitcoin dropped 48% from ~$126K in Oct 2025, now trading near $66K amid heavy negative sentiment.

- U.S. holds 328,372 BTC in its Strategic Reserve; states like Texas, Arizona, New Hampshire joined in.

- Institutions absorbed ~697K BTC in 2025, over 4x the ~164K BTC produced post-halving that year.

- Only ~3.02M BTC remain on exchanges; ETFs and Strategy alone control ~1.97M of that supply.

Bitcoin is trading near $66,000, down roughly 48% from its October 2025 peak of approximately $126,000. Sentiment across crypto markets has turned sharply negative.

Headlines suggest the rally is finished and the momentum has faded. But a closer look at who owns Bitcoin tells a very different story.

Sovereign Governments and Institutions Are Buying Bitcoin at Record Levels

The United States now holds 328,372 BTC in its Strategic Bitcoin Reserve. Texas has gained exposure through a Bitcoin ETF. New Hampshire and Arizona have both passed reserve legislation. More states are moving toward similar positions.

Internationally, Abu Dhabi’s sovereign wealth fund Mubadala disclosed a significant Bitcoin ETF position. That marks a notable shift. Sovereign capital is no longer observing from the outside.

Corporate treasuries have accelerated alongside government buying. Strategy alone holds approximately 713,000 BTC. Institutions absorbed roughly 697,000 BTC throughout 2025, according to available data.

Post-halving, Bitcoin produces only about 164,000 new coins per year. That means institutional demand in 2025 ran at more than four times the rate of new supply.

Bitcoin’s Tradeable Supply Is Shrinking as Strong Hands Absorb the Float

Approximately 20 million BTC have been mined to date. Only about 3.02 million currently sit on exchanges. That is the pool available for active trading.

ETFs hold roughly 1.26 million BTC. Strategy holds around 713,000 BTC. Combined, those two categories control approximately 1.97 million BTC. That figure represents close to two-thirds of current exchange supply.

Bitcoin is not priced on total coins in existence. It clears on the small fraction still available to buy. That available fraction keeps contracting.

Price reflects fear. Supply structure reflects absorption. The divergence between those two signals is growing wider, not narrower.

Post shared by analyst David on X, framing it as an ownership shift story rather than a price story. The data support that framing. Buyers are not retail traders chasing momentum. They are governments and institutions with long holding horizons.

When scarce assets migrate to holders who do not face selling pressure, price dynamics change. The margin where Bitcoin actually trades keeps getting thinner.

Crypto World

Ethereum Price Hits Critical 5Y Volume Support Zone: Is a Multi-Month Reversal Setting Up?

TLDR:

- Ethereum is testing a major five-year high-volume node between $1,850 and $2,000 on the monthly chart.

- The latest monthly candle prints a long lower wick, signaling active defense by larger market participants.

- ETH structure remains heavy with lower highs from $4,000, keeping resistance firm between $2,700 and $3,600.

- On-chain transaction data mirrors the 2017 cycle pattern, which preceded a sustained one-year bull market run.

Ethereum is at a critical inflection point after tapping a major five-year volume node on the monthly chart. The asset was trading at $1,901.69 as of writing, down 2.09% in the last 24 hours.

The seven-day decline stands at 4.33%, with trading volume at $20.23 billion. Market participants are closely watching this zone. The monthly reaction here is expected to define the next multi-month directional move for ETH.

Ethereum Price Taps Key Demand Zone With Long Lower Wick on Monthly Chart

Ethereum at a critical inflection point means price is now testing the $1,850–$2,000 high-volume node on the monthly timeframe.

This zone has drawn heavy market participation over the past five years. Large positions were historically built here, giving it structural demand characteristics rather than acting as a random support level.

Analyst Bitcoinsensus noted that the latest monthly candle prints a long lower wick within this region. That pattern reflects aggressive buying activity below the support area. It suggests that larger participants are actively absorbing sell pressure and defending the zone.

However, a wick alone reflects reaction, not a confirmed reversal. The broader structure still carries weight from above, showing a pattern of lower highs from the $4,000+ region. ETH continues to trade beneath prior range resistance between $2,700 and $3,600.

Until momentum shifts and price reclaims the mid-range area, downside risk cannot be ruled out. A confirmed hold above $1,850 on a monthly close would support a move toward $2,700. From there, an expansion toward $3,300–$3,600 becomes the next area of interest.

On-Chain Transaction Data Draws Parallel to Ethereum’s 2017 Market Cycle

On-chain analyst CW8900 observed that Ethereum transaction activity is mirroring patterns seen during the 2017 cycle.

That period saw an explosive rise in ETH transactions, followed by a sharp decline. The correction eventually gave way to a roughly one-year bull market run.

The current setup shows a similar sequence. After a surge in transaction activity, ETH has experienced a notable price pullback. This parallel is drawing attention from analysts who monitor long-term cycle behavior on-chain.

Source: Cryptoquant

If history follows a similar path, the next phase could bring renewed bullish momentum for Ethereum. That said, historical patterns serve only as reference points.

Market structure and macro conditions today differ from those in 2017 in meaningful ways.

For now, Ethereum remains at a macro decision point. Acceptance below $1,850 on a monthly close would open the path toward the $1,500 level relatively quickly.

The price action over the coming weeks will be essential in confirming which direction the market commits to from this key zone.

Crypto World

MoonPay and PayPal Push PYUSDx to Accelerate Stablecoin Creation

TLDR:

- PYUSDx allows developers to launch application-specific stablecoins backed by PayPal USD without building full issuance systems.

- The platform combines MoonPay distribution tools with M0’s token framework for faster stablecoin deployment.

- PYUSDx tokens remain separate from PayPal and Paxos products and cannot be used inside PayPal or Venmo apps.

- USD.ai is the first project using PYUSDx to power a stablecoin designed for AI infrastructure payments.

Thestablecoin market is shifting toward tokens built for specific apps and ecosystems. MoonPay, M0, and PayPal have introduced PYUSDx as new infrastructure for issuing application-focused stablecoins.

The platform connects PayPal USD with developer tools designed for faster deployment. The move reflects rising demand for branded stablecoins that avoid complex back-end setup.

PYUSDx platform targets application-specific stablecoin growth

PYUSDx allows developers to create their own stablecoins backed by PayPal USD without building full issuance systems. The platform combines M0’s token framework with MoonPay’s distribution infrastructure.

According to a joint announcement from MoonPay and M0, the goal is to shorten launch timelines from months to days. Developers can issue branded tokens tied directly to PYUSD reserves.

The companies pointed to data showing a sharp increase in new stablecoins exceeding $10 million in supply during 2025. That trend signals growing interest in application-level monetary systems.

PayPal described the initiative as part of a broader shift toward building financial tools directly inside apps. PYUSDx supports this approach by offering a standardized base layer for developers.

The framework also aims to reduce regulatory and operational complexity. PYUSD itself is issued by Paxos Trust Company, giving the backing asset a regulated foundation.

How PYUSDx connects developers to PayPal USD liquidity

PYUSDx functions as a tokenization and issuance framework operated by MoonPay Digital Assets Limited. It enables third parties to create new stablecoins that remain fully backed by PayPal USD.

The platform supports cross-chain compatibility through M0’s ecosystem. Developers can deploy tokens across multiple blockchain networks using the same underlying reserve asset.

Reserve transparency forms another core feature. PYUSDx includes on-chain reporting tools and validation processes designed to show backing assets clearly.

The first project building on PYUSDx is USD.ai. The company is developing a stablecoin for payments tied to AI infrastructure services.

Regulatory distinctions remain central to the rollout. PYUSDx tokens are not issued by PayPal or Paxos and do not function inside PayPal or Venmo accounts.

MoonPay stated that licensing and compliance depend on the jurisdiction where each token launches. Responsibility remains with each issuer using the framework.

The companies framed PYUSDx as infrastructure rather than a consumer product. Its purpose is to let developers focus on product design while relying on existing stablecoin rails.

By connecting branded tokens to PayPal USD liquidity, the platform seeks to streamline how applications integrate stablecoin payments and settlements.

Crypto World

Rally, Stuck, or Drop Below $1?

XRP price has remained under pressure since the beginning of 2026, extending a steady downtrend that started in early January. The altcoin has repeatedly failed to reclaim major resistance levels.

Weak macro sentiment and geopolitical tensions have limited upside momentum across the broader crypto market. Despite the ongoing decline, several historical and on-chain indicators suggest XRP may be approaching a turning point.

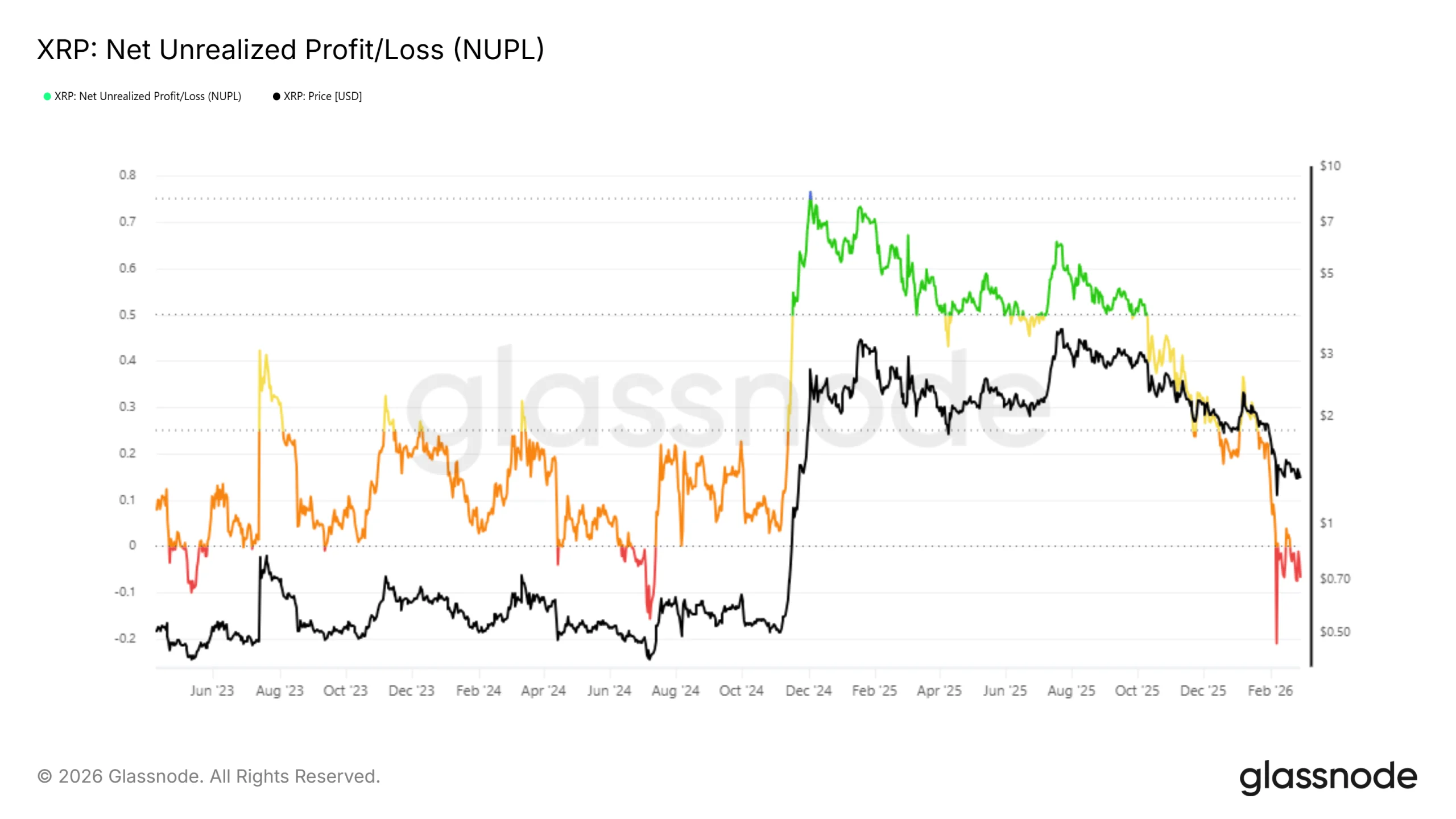

XRP Holders’ Losses Near End

The Net Unrealized Profit and Loss indicator shows XRP remains in capitulation territory. This phase reflects that a majority of holders are sitting on unrealized losses. Capitulation typically marks the late stage of a downtrend rather than the beginning.

Historically, XRP’s capitulation phases have lasted close to one month before reversing. The current stretch began at the start of February. If prior patterns repeat, this period could end for the XRP price in the first week of March. A reduction in panic-driven selling would allow price stabilization and open the door to recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Spent Output Profit Ratio, or SOPR, confirms that many XRP holders are still selling at a loss. A brief move above 1 occurred in mid-February, signaling temporary profitability. However, the metric quickly fell back below 1, showing renewed selling pressure.

SOPR approaching the 1 level again is significant. A sustained move above this threshold would indicate that coins are being sold at a profit. Historically, this shift often coincides with early recovery phases. If selling continues to saturate, the XRP price may gain room to rebound.

What Does XRP’s Past Say?

Seasonality data shows that over the past 12 years, March has delivered an average 18% return for XRP. This makes it statistically the strongest month in the first quarter.

While past performance does not guarantee future gains, historical trends matter. However, external risks remain. Escalating geopolitical tensions involving the US and Israel could affect risk appetite. Broader financial instability may delay seasonal bullish tendencies.

XRP Price Levels To Watch

XRP is trading at $1.29 at the time of writing, holding above the critical $1.27 support level. This level aligns with the 23.6% Fibonacci retracement, often referred to as the bear market support floor. Maintaining this threshold is essential to prevent a deeper correction.

If capitulation ends and macro conditions stabilize, XRP could bounce from $1.27 and challenge the descending trendline active since January. A move above $1.51 would confirm a structural shift. This level also coincides with the 61.8% Fibonacci retracement, a key recovery benchmark.

On-chain data suggests limited resistance until the $1.76 to $1.80 range. Approximately 1.85 billion XRP were accumulated within this zone, valued at nearly $2.83 billion. Holders who bought there may sell to break even, creating temporary resistance.

However, failure to hold $1.27 would invalidate the bullish outlook. A breakdown below the bear market support floor could send XRP toward $1.11. Continued sideways consolidation remains possible if global uncertainty persists. For now, March presents both risk and opportunity for XRP price recovery.

Crypto World

Buying Bitcoin? Hold at least 3 years to avoid losses, data shows

Bitcoin (CRYPTO: BTC) has repeatedly tested patient investors, and a long-hold thesis appears increasingly robust when examined through multi-year price histories. A Bitwise Europe study looking at BTC’s price data from mid-2010 through early 2026 finds that the odds of ending a multi-year position in the red shrink dramatically as the holding window extends. In particular, three-year holders show a loss probability of just 0.70%, with even smaller risk over longer horizons. The findings map onto a broader narrative: while near-term volatility and macro headwinds persist, the longest-dated exposure has historically delivered favorable outcomes for those who ride out cycles. The debate around price targets for 2026–2027 remains lively among analysts and researchers, with forecasts ranging widely.

Key takeaways

- A three-year BTC holding has a 0.70% chance of ending in loss; five-year horizons drop to 0.2%, and ten-year horizons sit at 0% based on the Bitwise Europe dataset covering July 2010–Feb. 11, 2026.

- Shorter horizons carry higher risk: intraday BTC positions were 47.1% underwater, with the probability staying elevated at 44.7% over one week, 43.2% over one month, and 24.3% over a one-year window.

- As of a recent Saturday, BTC traded near $65,000 after a roughly 50% decline from the October 2025 peak; the three-to-five year realized price sits around $34,780, meaning long-hold investors in that window remain roughly 90% in profit.

- Cost-basis insights show the depth of drawdowns varied by holding period: those in the 6–12 month band carried a cost basis near $101,250, while the 1–2 year cohort hovered around $78,150, illustrating how longer horizons dampen drawdowns during corrections.

- Forecasts for 2026–2027 remain divergent. Bernstein has kept a bullish target of $150,000 for 2026, while Standard Chartered warns of potential downside toward $50,000 amid weak ETF flows before a recovery toward $100,000 by year-end. Timothy Peterson’s framework points to around $122,000 by early 2027, with odds skewing toward a level above that mark. Some analysts even flag a scenario where a drop toward $30,000 could intensify, should negative forces persist.

Tickers mentioned: $BTC

Market context: The analysis arrives as the macro backdrop and spot-Bitcoin ETF dynamics shape liquidity and sentiment. While near-term moves remain volatile, the data emphasize a structural resilience for long-duration exposure, complicating calls that rely solely on short- or medium-term price actions.

Why it matters

The central takeaway for investors weighing risk and time horizons is that holding Bitcoin for longer stretches has historically reduced downside risk. The Bitwise Europe analysis synthesizes decades of price history to illustrate a simple trade-off: time in the market tends to smooth out volatility and limit losses, even as drawdowns occur along the way. For market participants who favor patient exposure over quick wins, the results reinforce the strategic value of a multi-year horizon when assessing BTC’s risk profile.

But the narrative is nuanced. While long-hold cohorts show impressive downside resistance, shorter-term traders faced meaningful drawdowns during correction cycles. The intraday and weekly metrics underscore that market timing remains a challenging game. Investors who entered positions within the last year or two found themselves under considerable pressure during bear-market rallies and capitulation phases. The realized-price framework adds another layer: even as Bitcoin’s price dips, the difference between current levels and multi-year realized prices can offer a proxy for whether a given entry remains profitable on a longer horizon.

What to watch next

- Track ETF flows and price action around key levels: Bernstein notes modest net outflows from spot Bitcoin ETFs (around 7%), a dynamic that could influence near-term price action.

- Watch for potential downside catalysts: some scenarios point to BTC testing the $30,000 region if macro and ETF dynamics worsen further, which would compress the cushion for long-term holders.

- Observe longer-horizon projections evolving: Peterson’s model suggests roughly $122,000 by early 2027, while other analysts maintain targets near six figures or higher depending on liquidity conditions and risk sentiment.

- Monitor realized-price indicators as a gauge of profitability across aging cohorts: data from Glassnode’s realized-price-by-age charts help contextualize whether current prices justify holding or adding to positions over time.

Sources & verification

- Bitwise Europe research lead Andre Dragosch’s data referencing BTC price history from July 17, 2010, to February 11, 2026, showing loss probabilities by holding period. Link: X post.

- Glassnode data on BTC realized price by age, used to illustrate realized-profit dynamics across holding windows: Realized price by age.

- Bernstein’s price target for Bitcoin at $150,000 in 2026: Bernstein analysis.

- Standard Chartered commentary on ETF flows and BTC price implications, including a potential move toward $50,000 and a recovery toward $100,000 by end-2026: Standard Chartered note.

- Timothy Peterson’s historical price-metric projection of around $122,000 by early 2027: Peterson model.

- Analyses discussing a potential price bottom around $30,000: BTC to $30k discussion.

Market reaction and key details

Bitcoin’s long-hold resilience narrative sits at the intersection of empirical price histories and forward-looking forecasts. The Bitwise Europe findings underscore a fundamental principle of risk management in crypto: time can be a mitigating factor against pronounced drawdowns, particularly for assets with long and volatile price trajectories like BTC. As of the latest data points, the price remains well above the 3–5 year realized-price band, suggesting investors who carried positions across that horizon stayed financially advantaged despite recent declines. Yet, with near-term price action vulnerable to ETF flow shifts and macro surprises, the timing of new entries or additions warrants careful consideration.

What this means for investors and the market

For builders and institutions, the message is clear: a multi-year exposure approach continues to be a meaningful risk management lever, provided entrants understand that near-term volatility can erase short-term gains. For traders and retail participants, the findings reinforce the importance of horizon management—knowing when to trim, when to accumulate, and how to interpret realized-price signals that contextualize profitability over time. As the debate over BTC’s fair value stretches into 2027, the balance between outflows from ETF products, macro momentum, and the technical price regime will increasingly shape the space. The data do not guarantee outcomes, but they do illuminate how holding patterns have historically influenced risk and reward in one of crypto’s most scrutinized markets.

What to watch next

- ETF flow dynamics and their impact on spot BTC liquidity (watch for updates on net inflows/outflows and price correlation).

- Key downside risk scenarios, including any approach toward the $30,000 level and the subsequent implications for longer-term holders.

- Updated price targets for 2026–2027 from major analysts, including revisions to mid- or high-five-figure forecasts.

- New data from realized-price analyses that track aging cohorts, offering updated insight into profitability by holding window.

Rewritten article: Understanding the enduring appeal of patience in BTC

Bitcoin (CRYPTO: BTC) has long been framed as a volatile asset class that tests the nerves of investors seeking quick profits. Yet, a synthesis of long-run price history and contemporary market dynamics suggests that the most durable gains may accrue to those who commit to time rather than timing. The Bitwise Europe analysis, which combs through BTC’s price journey from 2010 to early 2026, indicates a striking pattern: the longer you ride the cycle, the less likely you are to sit on losses. Specifically, a three-year holding period yields a loss probability of just 0.70%, while five-year and ten-year windows reduce the risk even further to 0.2% and 0%, respectively.

To put those figures into perspective, the risk calculus for traders who enter BTC positions with shorter horizons is markedly more precarious. Intraday entries show nearly half the time ending underwater, with 47.1% of positions in negative territory. The risk persists, albeit at different magnitudes, over one week (44.7%), one month (43.2%), and even a year (24.3%). These numbers illuminate a pattern: the shorter the time frame, the greater the exposure to abrupt price moves and regime shifts. It helps explain why many seasoned crypto investors emphasize patience and disciplined risk management as essential components of a successful strategy in this space.

The price action context is equally important. As of a recent Saturday, BTC traded around $65,000, roughly half its October 2025 high. Yet the longer-term perspective remains constructive when contrasted with realized-prices: the 3–5 year realized price sits near $34,780, implying that participants who bought around that window and held through the recent drawdown were still sitting on about a 90% profit. This contrast between current market price and multi-year realization offers a tangible signal for investors evaluating whether to add to positions or hold steady through volatility. The historical frame invites readers to consider not just where Bitcoin is today, but where it has been over the last decade and how those cycles tested the resilience of long-term holders.

Forecasts for the 2026–2027 horizon remain divergent, reflecting the many moving parts that drive crypto markets. Bernstein has maintained a bold target of $150,000 for Bitcoin in 2026, arguing that relatively modest outflows from spot-Bitcoin ETFs could sustain a price trajectory higher, even as the asset retrenched by roughly 50% from its prior peak. The analysts characterized the current price action as a “crisis of confidence,” suggesting that sentiment rather than fundamentals is a primary swing factor in the near term. On the other side of the ledger, Standard Chartered has warned of a possible “final capitulation” phase that could pull BTC toward $50,000, driven by weak ETF flows and a softer macro backdrop, before restoring momentum toward the $100,000 mark by year-end 2026. Timothy Peterson’s framework, which leverages a historical average-return approach, points to around $122,000 by early 2027, with a substantial likelihood of trading above that level.

Beyond these headlines, a broader data story centers on the aging of holders and the corresponding realized-price dynamics. Glassnode’s charts of realized price by age underscore a recurring pattern: the cost basis and drawdown profiles depend heavily on how long investors have held their BTC. The 6–12 month cohort, for instance, shows a cost basis near $101,250, translating to about a 35% unrealized loss at a given snapshot, while the 1–2 year cohort sits closer to $78,150, implying roughly a 15% unrealized loss. The practical takeaway is that longer holding horizons tend to dampen the severity of corrections, a trend that aligns with the three-year risk reductions highlighted in the Bitwise analysis. For readers tracking the macro picture, the conversation about ETF flows, risk sentiment, and regulatory signals remains essential, as these factors are likely to influence whether the market shakes off or sustains the next leg higher.

Looking ahead, the path for Bitcoin remains as much about risk management as about price discovery. The consensus between long-hold data and bearish risk scenarios suggests a bifurcated market: patient investors could ride out volatility and exit with meaningful gains, while shorter-term traders might face amplified drawdowns if macro or policy dynamics tilt unfavorably. As with prior cycles, the market’s future hinges on how liquidity, sentiment, and structural demand—whether via ETFs or institutional participation—interact with the entrenched volatility that has defined BTC since its inception. In that context, the discipline of holding—paired with vigilant risk assessment—appears to be the most durable approach for navigating Bitcoin’s evolving landscape.

Crypto World

Bitcoin, Ethereum, Dogecoin, and new utility protocols

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Investors shift focus as Bitcoin and Ethereum align with emerging high-utility crypto protocols.

Summary

- As BTC and ETH lead markets, investors shift focus toward secure, utility-driven DeFi protocols in 2026.

- Mutuum Finance advances to Phase 3, completing audits by Halborn and CertiK.

- Variable APY mtTokens reward lenders, offering passive yield as borrowing demand rises across the protocol.

While the primary focus remains on the price action of major cryptocurrencies, a deeper shift is happening in the background. Investors are increasingly looking at how the “majors” like Bitcoin and Ethereum interact with high-performance utility protocols. This balance between established store-of-value assets and new, functional financial tools is defining the current market cycle.

Today’s alert covers the essential movements across the top three assets by market interest and the rise of next-generation lending platforms. From Bitcoin’s defense of key support levels to Dogecoin’s community-driven momentum, the ecosystem is diverse.

The crypto market today

The global cryptocurrency market cap is currently holding steady near $2.65 trillion. Market sentiment is cautiously optimistic as traders digest recent economic data and look toward the upcoming month.

While volatility remains a factor, the “fear and greed” index is showing a healthy level of accumulation. This suggests that the current price levels are being viewed as a consolidation phase rather than a peak, allowing the market to build a stronger foundation for the next leg up.

Liquidity is also beginning to shift. While Bitcoin dominance remains high, there is a visible move toward Ethereum-based decentralized finance (DeFi) tools. This rotation is typical when the market seeks “productive capital” — assets that can be lent or staked to earn a return rather than just sitting idle in a wallet.

Bitcoin

Bitcoin is currently trading at approximately $67,600, maintaining its position as the market leader with a market cap of $1.32 trillion. After briefly touching the $70,000 psychological barrier earlier in the week, the asset is seeing a natural cooling-off period. Analysts are keeping a close watch on the $67,000 support zone. As long as BTC stays above this level, the mid-term trend remains firmly bullish.

The current price action is largely influenced by two factors: ETF inflows and macroeconomic data. While the “risk-off” mood ahead of the latest inflation reports caused a small dip, the demand from institutional spot ETFs like BlackRock’s IBIT remains a strong stabilizer. If Bitcoin can flip the $69,500 resistance into support, the path to a new all-time high appears clear. For now, the focus is on “sideways” movement as the market gathers strength.

Ethereum

Ethereum has shown remarkable resilience, successfully reclaiming and defending the $2,100 mark. Currently trading near $2,150, ETH is benefiting from the Ethereum Foundation’s renewed focus on the “Defipunk” initiative, which emphasizes privacy and security. With a market cap of over $250 billion, Ethereum continues to be the primary engine for the DeFi sector, attracting investors who want to use their assets for lending and yield.

The next major hurdle for Ethereum is the $2,300 resistance zone. A breakout here would signal a shift in the ETH/BTC ratio, potentially sparking a broader altcoin rally. The network’s move toward native “Shielded ETH” transfers and better L2 scaling has made it more attractive for institutional use. As more capital flows into Ethereum-based utility protocols, the demand for the underlying ETH token as gas and collateral continues to grow.

Dogecoin

Dogecoin remains the king of the memecoin sector, currently trading around $0.091. While it lacks the institutional backing of BTC or the smart-contract utility of ETH, its community strength is undeniable. DOGE has seen a 7% increase over the past week, driven by social media sentiment and a general “risk-on” mood among retail traders. Its market cap sits near $20 billion, keeping it firmly in the top 10 digital assets globally.

Technically, Dogecoin is struggling to break through a heavy resistance level at $0.15. It has tested this zone multiple times without a clean breakout. Support is currently found at $0.13, which has held up well during recent market dips.

While DOGE is often volatile, it serves as a sentiment gauge for the rest of the market. When Dogecoin rallies, it often signals that retail investors are feeling confident and ready to explore higher-risk altcoins.

Mutuum Finance

As the “majors” provide market stability, new utility protocols are gaining traction. Mutuum Finance (MUTM) is an Ethereum-based lending and borrowing platform designed for the modern DeFi era. The project has raised over $20.6 million and has built a community of more than 19,000 investors, with the MUTM token currently priced at $0.04.

What sets Mutuum Finance apart is its commitment to transparency and security. The project is currently in Phase 3 of its roadmap and has already undergone rigorous audits by Halborn and CertiK. This “security-first” approach is essential in 2026, where investors are wary of unverified code.

Lending and borrowing

The lending side of Mutuum Finance is built to be simple and rewarding. When users provide assets like ETH, WBTC, or USDT to the protocol, they receive mtTokens as a digital receipt. These are not static tokens; they are interest-bearing assets. As borrowers pay interest into the pool, the value of the mtTokens increases, allowing lenders to earn a passive yield.

The APY (Annual Percentage Yield) is variable, meaning it adjusts based on the demand for loans. For example, if many users want to borrow USDT, the APY for USDT lenders will rise. This ensures that the system stays balanced and that lenders are fairly compensated for providing liquidity. This “set-and-forget” model is ideal for long-term holders who want to grow their portfolios without active trading.

Borrowing on Mutuum Finance allows users to unlock the value of their crypto without selling it. This is done through an over-collateralized model. A user provides collateral — for example, $20,000 in ETH — and can borrow up to a certain Loan-to-Value (LTV) ratio. At a 75% LTV, that user could access $15,000 in liquidity for real-world expenses or other investments.

In addition to lending yield, users who stake their mtTokens are eligible to receive dividends in MUTM tokens. According to the protocol model, a portion of the fees generated by platform activity is used to purchase MUTM tokens at market price and distribute them to stakers. By connecting platform fees with open-market token purchases, the mechanism may also help support the token’s market demand over time.

The V1 protocol

The technical progress of Mutuum Finance is currently visible through its V1 protocol on the Sepolia testnet. This working beta allows the community to test every feature of the platform in a risk-free environment. With a tracked Total Market Size of $162.21m, the protocol is demonstrating its ability to handle large-scale financial activity. Users can practice depositing, borrowing, and monitoring their Health Factors, ensuring they are ready for the official mainnet launch.

The crypto market today is a mix of established strength and emerging innovation. Bitcoin and Ethereum are providing the necessary foundation of value and security, while Dogecoin keeps the retail community engaged. However, a chunk of growth is happening in utility protocols.

As we look toward March 2026, the focus will remain on how these different sectors interact. For the 19,000 investors in MUTM and the millions holding BTC and ETH, the goal is the same: a secure, decentralized financial system that offers both stability and growth.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Crypto community fears Iran choking oil supply and crashing markets, but that may be overblown

As tensions flare once again between Iran, Israel, and the U.S., social media, especially on crypto social media X (or Crypto Twitter), fears that Tehran could shut down the Strait of Hormuz, a vital oil chokepoint. Such a move, many worry, could send oil prices and global inflation soaring and roil financial markets, including bitcoin.

However, those concerns may be exaggerated, according to some observers.

Early Saturday, Israel and the U.S. launched airstrikes on Iran, aiming to dismantle the nation’s nuclear facilities and missile capabilities after failed negotiations. Iran retaliated by firing ballistic missiles at Israel and the U.S. bases in the region, escalating fears of a full-blown military conflict.

This sparked jitters in the crypto market, the only venue open for investors to express fear and risk, while traditional markets stay closed over the weekend.

Bitcoin , the leading cryptocurrency by market value, dropped to $63,000 from around $65,600 before rebounding to $65,000. Oil-linked futures on Hyperliquid surged more than 5%.

Hormuz fears

The Strait of Hormuz is a chokepoint (21 miles wide at its narrowest point) between Iran to the north and Oman to the south, and facilitated about 20 million barrels of oil shipments each day in 2024, according to the U.S. Energy Information Administration (EIA).

Naturally, amid simmering tensions, crypto accounts on X are worried that Iran may close the Strait of Hormuz, choking off oil supplies.

“If a direct conflict between the United States and Iran has begun, this isn’t just geopolitics. It’s a global economic event. If the Strait of Hormuz is threatened, oil could spike toward $120–$150,” an X handle called @Crypto_Diet said.

This could lead to an inflation shock, market sell-offs, a dollar surge, and depreciation in emerging-market currencies, the post added.

Several more accounts have posted similar views, with some savvy geopolitical experts sharing these concerns.

“Oil prices had already climbed to six-month highs ahead of the strikes. Iran is a founding OPEC member and the Strait of Hormuz, through which roughly 20% of global oil passes, is now directly implicated,” Geopolitical Strategist Velina Tchakarova said.

On top of that, some news outlets are already reporting that several oil majors, including trading houses, have suspended oil and fuel shipments through the strait.

Outright closure unlikely

Some observers, however, argued that an outright closure of the strait is not in Iran’s best interests and may be geographically impossible.

According to Daniel Lacalle, a PhD economist, fund manager, and chief economist at Tressis, Iran currently produces 3.3 million barrels per day of oil, but exports just half of that, which almost entirely goes to its ally China.

“It would shoot itself in the foot,” Lacalle said, downplaying fears of an eventual Iranian shutdown of the strait.

He added that OPEC members could quickly offset any potential disruption to oil supplies from Iran, while stressing that the United States, by itself, is the world’s largest oil producer.

In other words, any spike in oil prices could be measured and temporary.

The other aspect to consider is Geography. While the strait is split roughly in the middle between Iran and Oman, the shipping lanes are predominantly in Omani waters. It’s because water on the Iranian side is said to be shallower, while on the Omani side, it is deeper and better suited for the movement of large oil tankers.

So, technically, ships could pass through Oman’s yard, which means Iran’s closure of its territory may not have a big impact on supplies.

“Most waterways are in Oman, not Iran,” Energy Market Expert Dr. Anas Alhajji said on X.

“Hormuz strait has never been blocked despite all wars – It cannot be blocked. Too wide. Well protected,” he added.

All things considered, the odds of Iran shutting the strait and choking off oil supplies are low. That said, an all-out war can still trigger widespread risk aversion, potentially driving bitcoin below the widely watched $60,000 support level.

Meanwhile, bitcoin’s price chart also signals a potential for deepening of the bear market ahead amid the Middle East crisis.

Crypto World

Polymarket Trader Loses $6 Million Betting on the US Iran Strikes

US and Israeli military strikes in Iran triggered a $6.5 million loss for one cryptocurrency prediction market trader.

Meanwhile, the attacks generated hundreds of thousands of dollars in profit for others.

Iran Bombing Fuels Six Figure gains and $6 Million Loss on Polymarket

The financial fallout on the decentralized platform Polymarket underscores the rapid capital shifts tied to geopolitical betting.

Blockchain analysis reveals that a single trader, operating under the pseudonym anoin123, suffered a total wipeout of more than $6.4 million.

The trader had systematically placed massive wagers, fading the likelihood that President Donald Trump would authorize direct military intervention against the Islamic Republic.

When munitions hit Tehran and other Iranian cities, those contracts became worthless.

Conversely, the military escalation generated profits for a handful of persistent Polymarket users. A trader known as Vivaldi007, who began buying shares on February 8, anticipating a joint attack, realized a total profit of $385,000.

Notably, the trader had absorbed losses on earlier contracts as previous target dates passed without incident before capitalizing on Saturday’s strikes.

Meanwhile, the most closely scrutinized transaction involves a cryptocurrency wallet dubbed “Roeyha2026.”

According to the blockchain analytics platform Lookonchain, the wallet was funded 11 hours before the bombing campaign commenced. The anonymous user wagered $50,000 that a US strike on Iran would occur before March 1.

That position netted nearly $100,000, igniting debate among market analysts over the potential use of classified military intelligence for insider trading.

These betting volumes arrive as federal regulatory agencies shift their approach to prediction markets. Over the past year, the Trump administration has fostered a pro-crypto environment, allowing these platforms to thrive.

However, the commodification of global conflicts and the specter of defense insiders profiting off military action have alarmed federal lawmakers.

As a result, US lawmakers like Senator Chris Murphy are drafting legislative frameworks to curb these decentralized betting platforms.

Crypto World

Insider Trading Scandal? 6 Wallets Made $1.2M on Iran Strike Bets

The attacks had immediate impact on crypto prices, with many assets tumbling before staging modest recoveries.

As it happened with a few other global situations in the past several months, a group of suspected insiders seemingly knew what was going to transpire and profited substantially.

Recall that Israel and the US carried out organized strikes against Iran on Saturday, and Bubblemaps outlined that a group of wallets made a total of $1.2 million betting on these developments hours before they happened.

JUST IN: 🇮🇷 🇺🇸 Six suspected insiders made $1.2M betting on a US strike on Iran

Most of these wallets:

• were funded in the last 24h

• specifically bet for February 28

• bought “yes” hours before the strike pic.twitter.com/n3G6OIEOXt— Bubblemaps (@bubblemaps) February 28, 2026

Given the precision in their actions – funding the wallets in the past 24 hours before the events unfolded, choosing specifically February 28, and betting on “yes” shortly ahead of the strikes, the likely conclusion is that they had inside knowledge of what took place in the Middle East on Saturday morning.

Recall that at first reports emerged that Israel had initiated strikes against Iran, and then ordered a state of emergency within its borders, expecting retaliation. Then, US President Donald Trump confirmed that his country was also involved.

The POTUS doubled down in the following hours, categorizing the attacks as a “major combat operation.” It’s worth noting that Iran indeed retaliated by counter-attacking several US allies, such as Kuwait, the UAE, Qatar, and Bahrain.

The initial attacks from the morning harmed the cryptocurrency markets immediately. Bitcoin dumped from $66,000 to $63,000 in minutes, while most altcoins followed suit with 2-4% declines in less than an hour.

You may also like:

Nevertheless, BTC has recovered some ground since then and currently trades close to $65,000. ETH is down to $1,900, while BNB and XRP continue their fight for fourth place in terms of market cap.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports5 days ago

Sports5 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion22 hours ago

Fashion22 hours agoWeekend Open Thread: Iris Top

-

Business4 days ago

Business4 days agoTrue Citrus debuts functional drink mix collection

-

Politics5 days ago

Politics5 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Politics2 days ago

Politics2 days agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Sports13 hours ago

The Vikings Need a Duck

-

Business6 days ago

Business6 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech4 days ago

Tech4 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

Business6 days ago

Business6 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat3 days ago

NewsBeat3 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat5 hours ago

NewsBeat5 hours agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech6 days ago

Tech6 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat6 days ago

NewsBeat6 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics6 days ago

Politics6 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat4 days ago

NewsBeat4 days agoPolice latest as search for missing woman enters day nine

-

Business3 days ago

Business3 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026