Crypto World

IREN Joins MSCI USA Index, Elevating Visibility for Institutional Investors

TLDR

- IREN has been included in the MSCI USA Index, enhancing its visibility among institutional investors and index-tracking funds.

- The inclusion is expected to trigger automatic buying by index-tracking entities, potentially boosting IREN’s stock in the short term.

- IREN has shifted focus from BTC mining to AI-driven infrastructure, positioning itself as a leader in the tech sector.

- CEO Daniel Roberts believes the MSCI inclusion will broaden institutional access as the company executes its AI Cloud strategy.

- Since the announcement, IREN’s stock has increased by around 7%, reflecting investor optimism despite concerns over recent financial results.

IREN, a company transitioning from a BTC mining operation to a dual-focus entity, has announced its inclusion in the prestigious MSCI USA Index. This move is set to elevate the company’s profile, attracting more institutional investors and index-tracking funds. It is expected to create a short-term surge in the stock price as automatic buying from these entities takes effect.

The inclusion in the MSCI USA Index provides IREN with enhanced visibility. Investors and funds that track the index will now automatically consider IREN as part of their portfolios. This may trigger a short-term surge in its stock value, supporting the company’s broader business goals.

Why MSCI USA Index Inclusion Matters for IREN

Daniel Roberts, Co-Founder and Co-CEO of IREN, expressed that being added to the MSCI USA Index is a sign of the company’s growth. “We believe this milestone will broaden institutional access to IREN as we continue to execute on our AI Cloud strategy,” he said. This inclusion comes as IREN shifts its focus from BTC mining to AI-driven infrastructure, positioning itself as a leader in the tech space.

As IREN pivots towards AI, the company’s shift in priorities is evident in its investments. It is spending more on AI-centric assets, such as data centers, than on traditional Bitcoin mining operations. This strategic move aims to capitalize on the growing demand for AI infrastructure, with plans to expand its power portfolio and attract long-term partnerships.

IREN’s Stock Response and Future Plans

Since the MSCI inclusion announcement, IREN’s stock has seen an upward movement. The company’s share price rose by approximately 7%, demonstrating investor optimism. However, concerns about the company’s financial performance remain, as recent quarterly results showed lower-than-expected revenues and widening losses.

Despite these concerns, IREN’s long-term outlook remains promising. The company is in talks for several major deals, including a multibillion-dollar contract that could further drive its growth. As the AI infrastructure market expands, IREN aims to leverage its secured power capacity to attract new contracts and raise its recurring revenue.

IREN continues to make progress with its energy initiatives, securing new data center campuses and large power agreements. These efforts position the company to meet the growing demand for energy from tech giants, ensuring a robust pipeline for future growth.

Crypto World

UK Appoints HSBC for Blockchain-Based Digital Gilt Pilot

Key Insights

- UK Treasury chose HSBC Orion to test blockchain issuance and settlement for digital gilts in a controlled environment.

- The DIGIT pilot targets near real-time settlement and lower operational costs across the UK sovereign bond market.

- Parallel regulatory scrutiny continues as UK authorities monitor crypto-linked ETN access for retail investors.

UK Treasury has announced that HSBC is the platform provider to its Digital Gilt Instrument (DIGIT) pilot. The ruling upholds the proposal of the government to modernize the issue of sovereign debt issuance through distributed-ledger technology. Officials confirmed the appointment on February 12, 2026, following a competitive procurement process launched in late 2025.

🇬🇧 NEW: 2026 is marking the year of “Operationalizing Digital Debt” as the UK Treasury and HSBC move to tokenize Great Britain’s sovereign bonds.

Aims to test on-chain settlement and over-the-counter trading capabilities. pic.twitter.com/QReRyBCLss

— Nathan Jeffay (@NathanOnCrypto) February 12, 2026

The pilot will run within a regulated sandbox. It will allow authorities and market participants to test how digital gilts function across issuance, trading, and settlement. Policymakers expect the trial to provide operational evidence before any wider market rollout.

HSBC Orion Selected for DIGIT Pilot

HSBC will deploy its Orion blockchain platform as the core infrastructure for the DIGIT initiative. Orion already supports multiple large-scale digital bond issuances across Europe and Asia. These include sterling-denominated and green bond transactions for public-sector issuers.

The Treasury intends to make gilts digitally native through DIGIT instead of being tokenized replicas. The platform will enable the use of on-chain settlement that can reduce the settlement period of days to minutes. This model could also minimize reconciliation of intermediaries.

The pilot is consistent with the overall capital markets approach of the government. In 2024, Chancellor Rachel Reeves announced an intention to bring about the use of DLT in the UK gilt market. The DIGIT trial will be a pragmatic move in that direction, and existing regulatory control will be maintained.

Market Context and Regulatory Signals

Blockchain-based bond settlement can improve transparency and operational efficiency. Market participants can track ownership changes directly on a shared ledger. This structure may also widen participation by lowering technical barriers for investors and dealers.

The DIGIT announcement follows increased regulatory interest in digital asset exposure. It has been reported that Trading 212 enabled UK retail investors to access crypto-linked exchange-traded notes without appropriate approval. The regulators insist that firms must possess certain authorization to provide such products based on debentures.

In October 2025, the UK regulators removed a ban on retail crypto ETNs that existed since the 19th century. Regulators have since increased the level of supervision to keep the firms accountable to the rules of conduct. Together, these developments show a dual approach: encouraging financial innovation while maintaining strict market controls.

Crypto World

White House Adviser Says Banks Shouldn’t Fear

The regulatory dispute shaping crypto markets intensified as lawmakers push the CLARITY Act, a proposal aimed at reconciling jurisdiction between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) while introducing a formal taxonomy for digital assets. In this environment, White House crypto adviser Patrick Witt argued that allowing stablecoin reward programs offered by crypto platforms should not threaten traditional banks, urging room for compromise between the industry and incumbents. He described the current clash over stablecoin yields as “unfortunate,” insisting that platforms can offer yield products without disrupting existing bank models. A key line of debate centers on whether such yields amount to an unfair advantage or a natural extension of crypto services that banks are already pursuing through OCC charters.

Witt spoke publicly amid ongoing negotiations about the CLARITY Act, a comprehensive bill that would delineate regulatory authority between the SEC and CFTC and codify a framework for classifying crypto assets. He told Yahoo Finance that the industry and banks should be able to operate with shared, competitive product offerings, and that cooperation could unlock new services for customers while preserving financial stability. The interview underscored a broader stance within the administration: innovation should not be stifled, but it must be channeled through clear, enforceable rules.

“They can also offer stablecoin products to their customers, just the same as crypto. This is not an unfair advantage in either way, and many banks are now applying for OCC bank charters themselves to start offering bank-like products to their customers.”

As the debate continues, industry observers note that stablecoin yield programs—long a source of friction between crypto platforms and traditional banks—have become a focal point in how the market structures, and how lawmakers will eventually codify governance for digital assets. The tension has contributed to delays in passing the CLARITY market structure bill, even as proponents emphasize that regulatory clarity would reduce risk and foster legitimate growth. The discussion is not limited to the United States; its outcomes could influence international actors seeking a predictable framework for crypto activities and yield-bearing products.

The CLARITY Act is not just about power delineations; it is also about process. The proposal would establish a formal taxonomy for digital assets and set clear boundaries on which agency leads on what types of instruments. In doing so, it aims to reduce the ambiguity that many market participants say has slowed product development and investment decisions. Yet with the 2026 U.S. midterm elections looming, policymakers and industry executives warn that a shift in control or a politicized environment could derail momentum and threaten the timeline for implementing new rules.

Supporters of the bill have argued that the current regulatory haze is a drag on innovation and market integrity alike. Opponents worry about overreach and the potential for regulatory fragmentation to create compliance burdens. The administration’s line, echoed by Witt, is that a pragmatic path exists: a framework that protects consumers and ensures fair competition while allowing crypto firms to compete on a level playing field with traditional financial institutions.

The debate has drawn attention from high-level voices inside and outside government. Some officials warn that if the House shifts control or if the midterms redraw the political map, the chance to finalize the act could slip away, raising the specter of a regulatory rollback under future administrations. In the meantime, proponents are pushing to keep the window open, arguing that a timely compromise would deliver much-needed clarity and enable continued innovation in a sector that has already reshaped payments, asset custody, and yield strategies for many users.

As markets watch for signs of movement, Witt cautions that a sense of urgency remains essential. The White House Crypto Council has signaled a preference to have the CLARITY Act signed into law before the midterms absorb all policy energy, a reflection of how election cycles can impact regulatory priorities in Washington. The broader industry context remains one of cautious optimism tempered by the reality that policy change in this arena tends to unfold incrementally, with multiple committees, hearings, and competing priorities shaping the final form of any legislation.

Key takeaways

- The CLARITY Act seeks to resolve regulatory overlaps by defining clear jurisdiction for crypto markets between the SEC and CFTC and by creating an asset taxonomy.

- Stablecoin reward programs offered by crypto platforms have emerged as a central flashpoint in negotiations, affecting how banks perceive competition and the potential for OCC charters to offer similar products.

- White House and industry voices emphasize that allowing yield-bearing crypto products does not inherently threaten bank models and may spur collaboration between fintechs and traditional banks.

- The approach hinges on political timing: the 2026 U.S. midterm elections could derail momentum, prompting urgency from policymakers to secure legislation before the election cycle dominates attention.

- Market participants are watching for concrete signals on regulatory alignment, licence pathways for banks, and any new guidance from the White House Crypto Council ahead of meaningful legislative action.

- Beyond domestic debates, the outcome of CLARITY could influence global regulatory expectations and how exchanges, lenders, and wallets structure risk and compliance moving forward.

Sentiment: Neutral

Market context: The ongoing CLARITY discussions sit within a broader climate of regulatory scrutiny and evolving risk sentiment in crypto markets. Investors and institutions await a coherent framework that reduces ambiguity around asset classification, custody, and product permissions, all while remaining sensitive to political timelines and potential shifts in congressional control. As regulators debate jurisdiction, market participants recalibrate liquidity strategies and risk management practices in anticipation of clarity rather than ambiguity.

Why it matters

The core significance of these negotiations lies in the potential for a formal, nationwide framework that makes it easier for crypto firms to operate with confidence while offering consumers clearer protections. A codified taxonomy and clarified agency responsibilities would reduce the current patchwork of guidance, enabling more predictable product development and risk management for platforms that offer yield-based services tied to stablecoins. For banks, the debate tests their willingness to engage with digital-asset ecosystems in a way that preserves safety and soundness while exploring new revenue streams through regulated, bank-like products.

For users, regulatory clarity could translate into more robust consumer protections, standardized disclosures, and a more consistent set of custodial and settlement practices. For builders—exchanges, wallets, and fintechs—a stable, rule-based environment lowers compliance risk and potentially unlocks new partnerships with traditional financial institutions. Yet until legislation passes, the sector remains exposed to policy fluctuations, with funding cycles, product launches, and strategic investments hinging on regulatory signals rather than market fundamentals alone.

In a sector that has repeatedly demonstrated the rapidity with which innovation can outpace policy, the CLARITY Act represents more than a legal instrument; it is a test of the industry’s ability to coexist with traditional finance under a framework that seeks to prevent systemic risk. The administration’s emphasis on timely action underscores the stakes: jurisdictions, product categories, and the balance of powers in financial regulation are all at stake as negotiators weigh how to translate high-level principles into enforceable rules. The outcome could set a template for how the United States integrates crypto assets into the broader financial system, with potential ripple effects across markets, liquidity flows, and investor confidence.

What to watch next

- Progress in CLARITY Act negotiations in Congress, including committee votes and potential amendments (date-dependent).

- Election results and the political balance of the House and Senate in the 2026 midterms and their impact on crypto policy agendas.

- Official guidance or announcements from the White House Crypto Council regarding timelines for the bill’s signing or regulatory clarifications.

- Any movement on OCC charter applications or other pathways for banks to offer crypto-related, yield-bearing products to customers.

- Public disclosures or hearings that illuminate how the SEC and CFTC would implement the proposed asset taxonomy and jurisdictional boundaries.

Sources & verification

- What the CLARITY Act is actually trying to clarify in crypto markets — Cointelegraph

- White House crypto adviser says there’s no time to wait as CLARITY Act window closes — Yahoo Finance

- Delays in passing the CLARITY market structure bill — Cointelegraph

- White House crypto bill talks ‘productive,’ but no deal yet — Cointelegraph

Market reaction and key details

What the debate means for users and institutions

The conversations around the CLARITY Act reflect a pivotal moment for crypto policy: designers of the framework aim to secure a balance between encouraging innovation and maintaining financial stability. The tension over stablecoin yields reveals a deeper question about alignment between rapidly evolving digital-asset products and traditional financial services. As negotiators seek to codify roles and product allowances, market participants should monitor statements from policymakers and industry leaders, as these will influence funding choices, product roadmaps, and risk management practices in the near term.

Why it matters next

Regulatory clarity could enable more predictable product development and safer consumer experiences within the crypto-finance ecosystem. For lenders and exchanges, a clear taxonomy and jurisdictional split reduces the risk of misclassification and regulatory overlap, potentially easing cross-border participation and institutional involvement. For policymakers, the CLARITY Act offers a framework to reconcile innovation with oversight, aiming to prevent systemic risk while preserving competitive, diverse financial services in the digital asset space.

Crypto World

Liquidation Heatmap Reveals BTC’s Most Crucial Levels

Bitcoin continues to exhibit choppy price action, fluctuating within the $60K–$70K range as the market remains in a clear state of indecision. With neither side establishing dominance, further consolidation appears to be the most probable scenario for the week ahead.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, BTC’s rejection at the $70K level resulted in a gradual pullback toward the key $65K support area. The $70K region coincides with the midline of a multi-month descending channel, reinforcing its importance as both a structural and psychological supply zone.

A decisive reclaim of $70K, accompanied by a breakout above the channel’s midpoint, would be required to shift momentum and initiate a more sustainable bullish leg. Otherwise, Bitcoin is likely to remain confined within the $60K–$70K range until fresh demand or supply triggers a directional expansion.

BTC/USDT 4-Hour Chart

On the 4-hour timeframe, declining volume and overlapping candles reflect the market’s equilibrium state. The recent low-momentum drift lower suggests that neither buyers nor sellers are in firm control.

Price may continue to ease toward the $63K internal support level, where short-term stabilization could occur. More broadly, the $60K region remains the primary defense zone for buyers. Sustained accumulation around this level could eventually lay the groundwork for a renewed bullish attempt.

Sentiment Analysis

The 2-week liquidation heatmap on Binance shows Bitcoin trading between two major liquidity clusters that are likely to shape the next impulsive move. To the upside, a dense concentration of short liquidation liquidity is positioned between $78K and $82K, with additional buildup toward $85K.

A breakout above the intermediate $72K resistance could accelerate price toward this zone, potentially triggering a short squeeze if $80K is reclaimed. On the downside, liquidity remains relatively thin until the $60K–$62K region, which aligns with the recent swing low.

A decisive break below $60K could expose this pocket and lead to a deeper liquidation-driven move toward the mid-$50K area. For now, Bitcoin remains compressed between $72K resistance and $60K support. A breakout on either side is likely to trigger a volatility expansion, while continued range-bound movement would reinforce the current consolidation phase.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Paul brothers business partner claims ‘0% rug pull risk’ with new memecoin

A business partner of serial crypto scammer Jake Paul claims that there’s “0% rug pull risk” of his AI-themed memecoin because he’s “already rich.”

Forensic researcher ZachXBT called out the obvious problem with Geoffrey Woo claiming 0% rug pull probability after the Paul brothers’ projects CryptoZoo, Dink Doink, Animoon, Sacred Devils, and STICKDIX lost more than 99% of their peak value.

That’s before we consider Jake Paul’s promotion of TRX without disclosing compensation.

Dozens of publications openly refer to multiple crypto promotions by Paul brothers as scams or rug pulls.

Reiterating a claim that there is “no founder rug pull risk,” founder Geoffrey Woo repeated a bullish price prediction for the new token.

‘0% rug pull risk’ with Jake Paul

Entirely unconvinced and already foreseeing a day when Woo dumps his tokens, ZachXBT joked about an excuse Woo could invent: “the bot placed the sells, not the dev.”

In fact, ZachXBT is unconvinced Woo’s project hasn’t already sold tokens from its founding allocation.

The researcher cited three sales — specifically, swaps from the memecoin to other digital assets — that seem to violate Woo’s disclosure promise to pre-announce insider sales for operations.

Read more: Influencer ghosted Logan Paul NFT lawsuit to ‘save six figures’

Woo is a long‑time business partner of Jake Paul, co-founding a venture capital firm with him in 2021 and working with him on a men’s personal care brand.

Stanford educated and a professional money manager, Woo also knows enough to understand the financial implications of his promises to pre-announce sales and predict “0%” risk.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Crypto bros feel the burn

The honeymoon is over—for President Donald Trump and for crypto enthusiasts alike.

A new Morning Consult poll shows Trump’s approval slipping to 45%, with disapproval climbing to 52%, down slightly from two weeks ago and far below the 52% approval he enjoyed at the start of his second term.

Summary

- The Dow Jones surged past 50,000 earlier this month, but voters aren’t cheering.

- Republicans (86%) still approve of Trump, according to a new survey; while Democrats (11%) and Independents (33%) remain skeptical of his policies and actions.

- Critics view conflicts of interest from Trump and his family’s crypto ventures as problematic.

By party lines, he still commands near-universal support from Republicans (86%), while Democrats (11%) and Independents (33%) remain skeptical.

Even as the Dow Jones surged past 50,000 earlier this month, voters aren’t cheering. Only about half believe Trump has effectively tackled health care costs and grocery prices, with approval ratings of 42% and 44% for health care and the economy, respectively.

Disapproval is highest on these fronts, underscoring that record-breaking stock indexes aren’t translating into everyday relief.

Last year, crypto investors largely approved of Trump’s crypto policies and associated them with positive market impacts. Today, it’s a more mixed picture — some crypto holders are skeptical or critical of his approach or disappointed by outcomes.

The disappointment extends to cryptocurrency markets, where the post-election “Trump trade” rally is fizzling fast. Bitcoin, which soared above $125,000 in October 2025 on election euphoria, is down over 28% year-to-date. Enthusiasm for projects tied to the Trump administration, including memecoin $TRUMP, has evaporated, with some losing as much as 95% of their value.

Industry insiders cite a mix of factors: policy outcomes have underwhelmed, proposed legislation like the CLARITY Act may centralize control rather than enhance decentralization, and the market’s risk-off sentiment has replaced the previous speculative fervor.

Even supporters like Cardano founder Charles Hoskinson have labeled the administration’s crypto impact “somewhat useless,” while Nobel laureate Paul Krugman called the Bitcoin crash “the unraveling of the Trump trade.”

A survey from The Information shows that roughly 71% of respondents oppose the Trump administration’s cryptocurrency policies, with 59% strongly against them. Only about 20% expressed support.

Interestingly, even among crypto owners—around 40% of respondents—opposition outweighed support, bucking trends from other polls where crypto holders leaned pro-Trump.

Critics cited several concerns: potential conflicts of interest from Trump and his family’s crypto ventures, the risk that a strategic Bitcoin reserve could weaken the U.S. dollar, and broader worries over fraud, crime, and market volatility in digital assets.

Crypto World

Inside Israel’s Polymarket Security Scandal

Investigators say reservists accessed classified information through service and allegedly used it to bet on future military operations.

Israeli authorities have indicted an Israel Defense Forces (IDF) reservist and a civilian for allegedly using classified military information to place bets on the popular prediction market platform Polymarket.

According to The Times of Israel, Israeli authorities have indicted an IDF reservist and a civilian on suspicion of exploiting classified military information to place bets on the prediction market platform Polymarket.

Use of Classified Information

The indictments follow a joint investigation by the Defense Ministry, the Shin Bet, and the Israel Police, which led to the arrest of several suspects, including additional reservists. Investigators allege that reservists used sensitive information they were exposed to through their military duties to make bets tied to future military developments.

Prosecutors have filed charges against one reservist and one civilian for what authorities described as severe security offenses, along with bribery and obstruction of justice. A court-issued gag order is currently in place, preventing the release of further details about the investigation, including operational specifics and the full scope of those questioned.

In a joint statement, the defense establishment warned that placing bets based on classified information creates a real and serious threat to IDF operations and to state security. The agencies added that such conduct is treated with the utmost severity and that authorities will act decisively against anyone involved in the unlawful use of secret material.

The case comes a month after the Shin Bet was examining suspicions that someone within the defense establishment had used classified information to bet on Polymarket. That report drew attention to a Polymarket account operating under the name “ricosuave666,” which placed several highly accurate bets in June 2025 related to Israeli military operations in Iran.

According to the report, the user bet tens of thousands of dollars and made an estimated profit of around $150,000.

You may also like:

Market Manipulation Concerns

Polymarket’s growing popularity has attracted both casual traders and high-profile participants. Among them is Vitalik Buterin, who recently disclosed earning about $70,000 last year on the platform by betting against outcomes he believes were highly irrational. Polymarket also hosted more lighthearted but widely shared bets, such as comparisons showing that the odds of confirming alien life in 2025 were higher than Bitcoin reaching $200,000, especially during periods of extreme market stress.

While the platform has seen rapid growth and occasional large payouts, it has also faced scrutiny over concerns related to manipulation and the potential misuse of insider information.

According to a recent study by researchers at Columbia University, transaction patterns on Polymarket indicative of wash trading began rising in July 2024 and peaked at nearly 60% of reported volume in December of the same year. Researchers found that the activity continued through late April 2025, and later climbed again to about 20% of volume in early October 2025.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

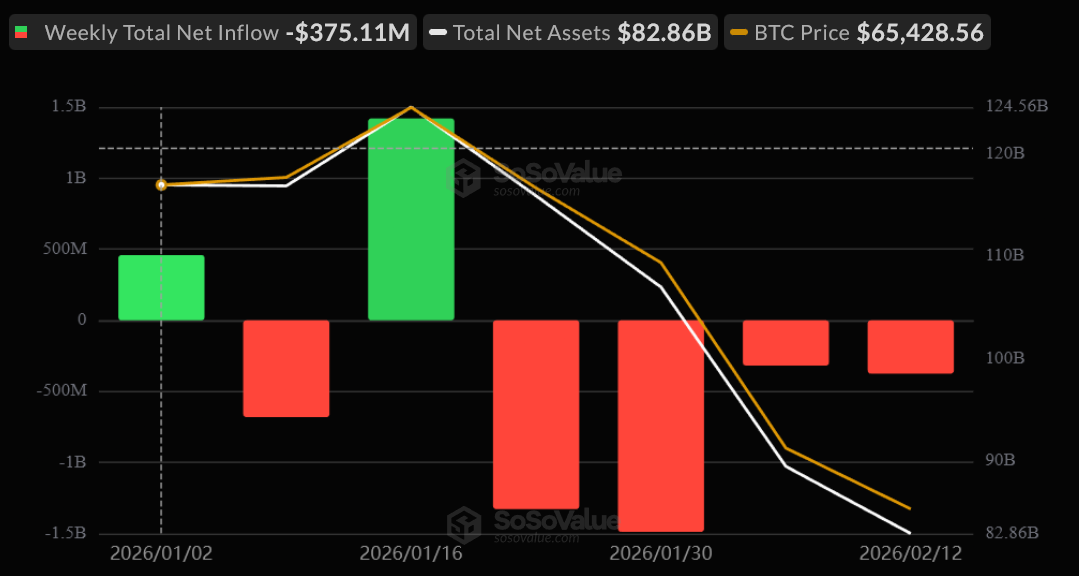

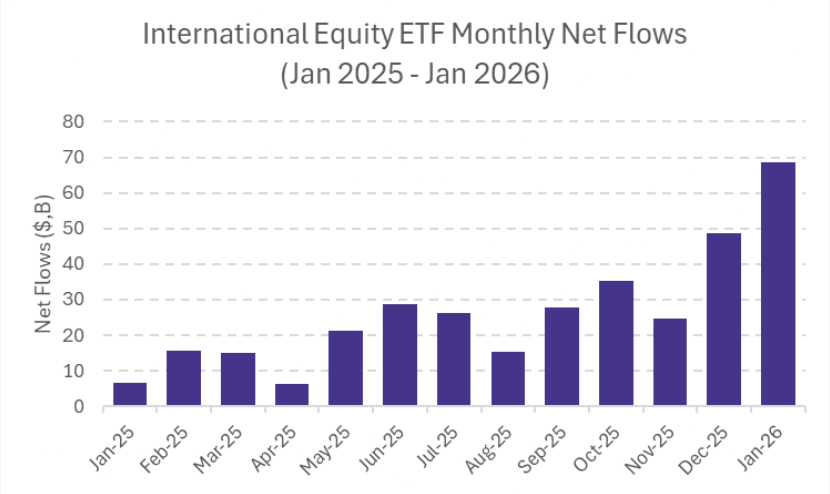

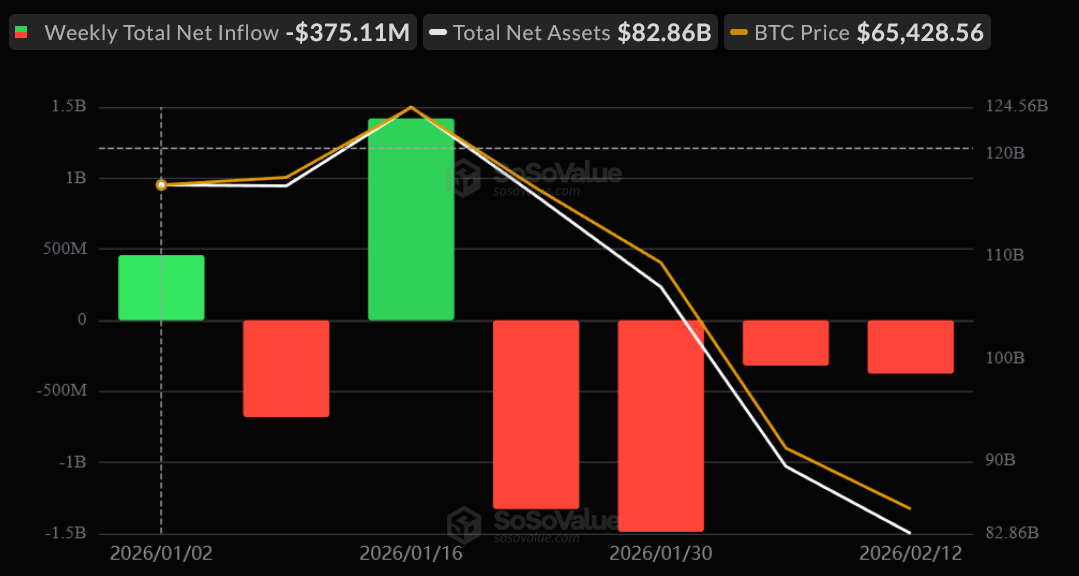

Real Reason Why Bitcoin and Ethereum ETFs are Bleeding Now

The US Spot Bitcoin and Ethereum ETFs are seeing sustained outflows as investors rotate capital into international equities. Both crypto ETFs have seen only 2 weeks of positive inflows so far in 2026.

The shift comes amid rising Treasury yields, a resilient US labor market, and record inflows into global ex-US stock funds.

Sponsored

Sponsored

Money is Shifting to International ETF Markets

Over the past several weeks, US spot Bitcoin ETFs have moved into clear net outflow territory. Total assets have dropped sharply from recent highs near $115 billion to roughly $83 billion.

Ethereum ETFs show an even steeper contraction, with assets declining from around $18 billion to near $11 billion.

This is not random volatility. It reflects capital leaving the asset class.

At the same time, international equity ETFs recorded their strongest inflows in years.

January saw record allocations into global ex-US funds, which absorbed roughly one-third of total ETF inflows despite representing a much smaller share of total assets.

That signals major rotation.

Sponsored

Sponsored

Institutional investors appear to be trimming exposure to crowded US growth trades — including crypto — and reallocating to cheaper overseas markets amid improving macro conditions abroad.

Meanwhile, stronger US jobs data pushed Treasury yields higher. Higher yields tighten financial conditions and increase the attractiveness of bonds relative to risk assets.

Bitcoin and Ethereum, which trade as high-beta liquidity plays, tend to weaken when capital moves toward safer or yield-generating assets.

The combination creates a structural headwind.

Crypto ETFs were a major source of demand in 2024, amplifying upward price moves through sustained inflows.

Now that mechanism is reversing. Instead of reinforcing rallies, ETFs are acting as distribution channels.

This does not invalidate the long-term crypto thesis. However, it weakens the short-term liquidity backdrop.

Until capital rotation slows or macro conditions ease, ETF outflows may continue to weigh on Bitcoin, Ethereum, and the broader crypto market.

Crypto World

Kalshi and Game Point Capital Launch Sports Hedging Partnership

TLDR

- Kalshi has partnered with Game Point Capital to offer sports risk hedging solutions for teams and players.

- The deal focuses on hedging performance bonus payouts tied to milestones like playoff berths or championships.

- Kalshi’s CEO Tarek Mansour highlighted the advantages of exchanges in expanding liquidity and bringing competition.

- Game Point Capital specializes in sports insurance and has already executed hedges for NBA teams using Kalshi’s platform.

- Kalshi experienced a surge in trading volume, reaching over $1 billion during Super Bowl Sunday in early 2026.

Kalshi, a leading prediction marketplace, has entered the institutional sports risk hedging space with a new partnership. The collaboration with broker Game Point Capital will allow teams to hedge performance bonus payouts. This deal comes after Kalshi recorded over $1 billion in trading volume during Super Bowl Sunday.

Kalshi’s Partnership with Game Point Capital

Kalshi’s recent deal with Game Point Capital marks a significant expansion into the sports insurance market. Game Point focuses on team and player performance bonus coverage, an area that has grown significantly in recent years. By partnering with Kalshi, Game Point aims to bring more liquidity and transparency to the industry, which has traditionally been dominated by opaque, over-the-counter reinsurance markets.

Kalshi CEO Tarek Mansour highlighted the advantages of using exchanges like Kalshi for hedging.

“Exchanges are a better alternative because they expand liquidity and bring competition,” Mansour wrote in a post on X.

This partnership offers an institutional solution to traditional markets and is expected to generate millions in trading volume from Game Point’s contracts alone in the coming months.

Kalshi has recently seen a surge in sports trading volume, contributing to the platform’s overall growth. The company reported a significant spike in activity beginning with the 2025 NFL season. By Super Bowl Sunday, Kalshi had processed over $1 billion in trades, showing how quickly sports have become the platform’s dominant sector.

The rapid growth of Kalshi is in line with the broader rise of sports betting in the United States. Companies like DraftKings are also seeing record revenues, particularly from states where traditional betting is still restricted. Kalshi’s ability to offer diverse trading options for major events like the Super Bowl has positioned it as a competitive player in the market.

Kalshi Faces Regulatory Challenges Amid Record Trading Volumes

Despite the strong growth, Kalshi is facing legal hurdles that could impact its future operations. The company is currently appealing a ruling in Nevada, where regulators have demanded compliance with state gaming rules. Kalshi also faces litigation in Massachusetts, where a court ruled that the platform cannot offer sports contracts without a state gaming license.

At the same time, Kalshi is challenging a cease-and-desist order from Tennessee, which temporarily halted its operations in the state. These legal battles come as the company continues to experience record trading volumes, including $9.6 billion in January 2026 alone.

Crypto World

Elon’s Grok AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026

When prompted with a precisely crafted query, Grok AI reveals bold outlooks for leading cryptos XRP, Cardano, and Bitcoin.

According to its analysis, all three have the potential to print fresh all-time highs (ATHs) before the end of 2026, a timeframe that may surprise investors.

Below, we examine how these AI-driven forecasts align with current chart signals and ongoing developments, and what the implications are for current HODLers.

XRP ($XRP): Grok AI Says Ripple’s Strategy Could Propel XRP to $8

In a recent blog post, Ripple reaffirmed that XRP ($XRP) remains foundational to its goal of positioning the XRP Ledger as a global, enterprise-grade payments network.

With near-instant transaction finality and ultra-low fees, XRPL is also likely to capture growth in two fast-expanding areas: stablecoins (RLUSD) and real-world asset tokenization.

XRP is currently trading around $1.36. Grok’s projection suggests a possible rally toward $8 by late 2026, representing nearly a sixfold increase (500%) from today’s levels.

Technical indicators also hint at a potential trend shift. XRP’s Relative Strength Index (RSI) sits at a low 30 after a couple days in oversold territory, often interpreted as a signal that selling pressure may be fading.

Upcoming potential catalysts include institutional inflows following approval of U.S.-listed spot XRP exchange-traded funds, Ripple’s expanding partnership network, and the strong possibility of U.S. lawmakers advancing the CLARITY bill later this year.

Cardano (ADA): Grok AI Forecasts a Potential 2,200% Upside

Created by Ethereum co-founder Charles Hoskinson, Cardano ($ADA) focuses on peer-reviewed development, strong security, scalability, and long-term network resilience.

With a market capitalization close to $10 billion and more than $125 million in total value locked (TVL), Cardano’s ecosystem continues to build despite broader market volatility.

Grok estimates that ADA could climb a little over 2,200%, rising from roughly $0.26 today to around $6 by the end of 2026, nearly double its 2021 ATH of $3.09.

That said, ADA is currently trading at its lowest price since October 2024.

Given the choppy conditions seen this year, further downside remains possible, including a retest of the $0.20–$0.25 support range if selling pressure persists.

Bitcoin (BTC): Grok AI Sees a Path Toward $225,000 and Beyond

Bitcoin ($BTC), the first and largest digital asset by market value, reached a record high of $126,080 on October 6 before retracing 47% to its current level near $67,000.

Often touted as digital gold, Bitcoin continues attracting both institutional and retail capital as investors seek hedges from inflation and global macro uncertainty.

Recent geopolitical tensions tied to U.S. military activity in Iran and Greenland has made general investors fearful of riskier assets. Even so, Grok’s assessment suggests Bitcoin’s broader bullish structure remains intact, with a 2026 target of $225,000.

The AI highlights accelerating institutional adoption and post-halving supply dynamics as major drivers that could push Bitcoin to multiple new highs this cycle.

Should U.S. policymakers follow through on Donald Trump’s Executive Order to establish a Strategic Bitcoin Reserve, Bitcoin’s upside could exceed even Grok’s already aggressive projections.

Maxi Doge: A New Meme Coin Steps Into the Spotlight

While Grok AI focuses on the steady climb of market leaders, risk-tolerant traders are diversifying into Maxi Doge ($MAXI), a new high-beta presale project that has already raised $4.6 million from savvy investors betting on a new meme supercycle this year.

The project features Maxi Doge, a degen, gym-obsessed Dogecoin rival (and distant relative) who claims to be the next alpha in the meme coin space, channeling the competitive and irreverent humor that originally fueled the space.

Presale participants can currently stake MAXI tokens for yields of up to 68% APY, with returns tapering as the staking pool expands.

MAXI is $0.0002803 in the current presale phase, with incremental price increases planned at each funding milestone. Prospective investors can purchase it using wallets such as MetaMask and Best Wallet or a bank card.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post Elon’s Grok AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026 appeared first on Cryptonews.

Crypto World

Praetorian Group Scandal Echoes FTX Collapse

The US DOJ (Department of Justice) has secured a 20-year prison sentence against the founder of a sprawling crypto investment scheme.

According to prosecutors, this scheme had defrauded more than 90,000 investors worldwide of over $200 million.

Sponsored

Sponsored

DOJ Exposes and Dismantles $200 Million Bitcoin Ponzi as Founder Receives 20-Year Prison Term

In a statement released on Thursday, the DOJ confirmed that Ramil Ventura Palafox, 61, was sentenced after pleading guilty to wire fraud and money laundering charges.

Palafox was the founder, chairman, and CEO of Praetorian Group International (PGI), a multi-level marketing company that claimed to generate outsized returns through Bitcoin trading and crypto-related strategies.

According to court documents, PGI operated from December 2019 to October 2021, raising more than $201 million from investors worldwide. The company promised daily returns of 0.5% to 3%, marketed as profits from sophisticated Bitcoin arbitrage and trading activities.

In reality, investigators found PGI was not conducting trading at the scale required to generate such returns. Instead, it functioned as a classic Ponzi scheme, using funds from new investors to pay earlier participants.

Authorities said at least $30.2 million was invested in fiat currency, alongside 8,198 Bitcoin valued at approximately $171.5 million at the time of investment.

Confirmed losses reached at least $62.7 million, though prosecutors indicated the total financial harm could be significantly higher.

Lavish Lifestyle and Fabricated Profits: How Palafox Hid the Collapse Behind a Luxury Facade

To maintain the illusion of profitability, Palafox allegedly created and controlled an online investor portal that displayed fabricated account balances.

Sponsored

Sponsored

Between 2020 and 2021, the platform consistently misrepresented investment performance. It falsely showed steady gains and reinforced investor confidence even as the scheme unraveled behind the scenes.

Court filings detail how Palafox diverted substantial amounts of investor funds to finance a lavish personal lifestyle.

According to prosecutors, he spent roughly $3 million on 20 luxury vehicles. He also spent approximately $329,000 on penthouse accommodations at a luxury hotel chain and purchased four residential properties in Las Vegas and Los Angeles worth more than $6 million.

Additional expenditures included around $3 million on designer clothing, jewelry, watches, and home furnishings from high-end retailers.

Prosecutors further alleged that Palafox transferred at least $800,000 in fiat currency and 100 Bitcoin—then valued at approximately $3.3 million—to a family member.

The scheme began to collapse in mid-2021 after PGI’s website went offline and withdrawal requests mounted. Although Palafox resigned as CEO in September 2021, authorities said he initially retained control over company accounts.

Sponsored

Sponsored

Prosecutors described this case as one of the more significant crypto-related Ponzi schemes in recent years. The sentencing marks a decisive conclusion to a scheme that thrived on exaggerated crypto profits and global recruitment networks.

Parallels with FTX: How PGI Echoed a Larger Crypto Collapse

Despite differences in scale and sophistication, this case is similar in many ways to the FTX collapse and associated contagion. Both exploited the crypto boom, promising investors outsized, unrealistic returns:

- Palafox with daily Bitcoin gains of 0.5–3%,

- FTX through high-yield exchange products tied to Alameda Research.

Investor funds were misappropriated for lavish personal spending:

- Palafox on luxury cars, real estate, and designer goods

- SBF on Alameda’s risky bets, properties, and political donations.

Sponsored

Sponsored

Both schemes used deceptive methods to maintain investor confidence:

- PGI with a fake portal showing steady gains

- FTX with hidden liabilities and inflated valuations.

PGI defrauded over 90,000 investors with confirmed losses exceeding $62.7 million, while FTX affected millions and billions in missing funds.

Federal prosecutions followed, with Palafox sentenced to 20 years in February 2026 and SBF to 25 years in 2024.

All these highlight a trend among bad actors in crypto while also revealing the DOJ’s ongoing crackdown on crypto-related fraud.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video12 hours ago

Video12 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?