Crypto World

Is $1.8K the Bottom? ETH Hits Critical Demand Zone (Ethereum Price Analysis)

Ethereum remains under heavy bearish pressure, with recent price action confirming a continuation of the broader downtrend. The market is currently reacting to a major sell-side expansion, and both technical structure and on-chain liquidity dynamics suggest that the asset is still navigating a critical phase where downside targets remain relevant, even if short-term relief bounces occur.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, ETH is clearly trading within a well-defined descending channel, with the price recently accelerating toward the lower boundary of this structure. The most important observation on the chart is the clean breakdown below multiple prior support levels, followed by a sharp impulsive leg to the downside. This move confirms strong bearish acceptance rather than a simple liquidity sweep.

The asset has now reached a major higher-timeframe demand zone, located around the $1.8K region, which previously acted as a base during earlier accumulation phases. The reaction off this zone has produced a modest bounce, but so far this move lacks structural strength and remains corrective in nature.

Nevertheless, the market is likely to enter a consolidation-correction phase above this crucial support until a decisive breakout occurs. The main supply zone during this consolidation range is the channel’s middle line, located at the $2.3K threshold. A break above this resistance will open the door for an extended bullish retracement toward the $2.5K significant resistance.

ETH/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the bearish structure becomes even clearer. The most recent price action shows a sharp sell-off into demand, followed by a shallow bounce that lacks impulsive follow-through.

Crucially, the rebound appears corrective and technically opens the door for a pullback toward the most recent supply zones and Fibonacci levels, located around the $2.3K to $2.6K region. These areas align with prior breakdown levels and correspond to zones where sellers previously intervened aggressively. If the price retraces into these levels without strong volume or momentum, they are likely to act as rejection zones rather than breakout points.

Until Ethereum can reclaim and hold above these supply areas, the 4-hour structure continues to favour continuation to the downside or extended consolidation within the lower range, rather than a trend reversal.

Sentiment Analysis

The ETH liquidation heatmap over the last 6 months provides critical confirmation of the bearish technical structure. A significant concentration of liquidity has been built around and just below the $2K level, which has recently acted as a strong magnet for price. The sharp sell-off into this area confirms that downside liquidity was actively targeted, resulting in a large flush of leveraged long positions.

Despite this liquidation event, the heatmap still reveals residual liquidity pockets extending slightly below current price levels, indicating that the market may not have fully exhausted its downside objectives yet. These remaining clusters continue to exert gravitational pull on price, especially if spot demand remains weak and derivatives positioning rebuilds on the long side too quickly.

That said, the intensity of liquidations around the $2K zone suggests that a meaningful portion of forced selling has already occurred. This reduces immediate liquidation pressure and explains the short-term stabilization seen after the drop. However, from an on-chain perspective, this behavior supports consolidation or corrective rebounds, not a confirmed trend reversal, unless liquidity interest decisively shifts back above current levels.

In summary, on-chain data aligns closely with the technical picture: Ethereum is still operating in a bearish liquidity-driven environment, with downside risks remaining active as long as price fails to reclaim key supply zones and attract sustained spot demand.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

80% of Corporate Holders Now Underwater

Nearly 80% of corporate Bitcoin holders are sitting on unrealized losses as BTC trades well below the average treasury purchase price.

Around 80% of companies holding Bitcoin (BTC) as a treasury asset are sitting on unrealized losses, according to an analysis by Charles Edwards, founder of Capriole Investments.

The data comes at a time BTC is pushing back toward $71,000, raising questions of whether the widespread institutional pain is a warning sign or a contrarian buy signal.

The Numbers Behind the Corporate Pain

Edwards shared a series of charts on X on March 10 showing that the simple average cost basis for Bitcoin treasury holdings is at around $90,000, which is well above where BTC is trading today.

On a weighted basis, which gives more weight to larger holders such as Strategy, the average purchase price dropped to about $81,000, showing that the biggest buyers got in earlier and at a lower level. But either way, the number one cryptocurrency is currently below both figures.

“At 80%, almost all treasuries are at a loss on their Bitcoin purchase today,” Edwards wrote. “Though history suggests this could get worse if 2026 is like 2022. There is no free Bitcoin yield.”

In the same thread, Edwards noted that institutions are also broadly down on their BTC positions, with the average institutional purchase price sitting near $78,000. He also said that ETF holders were in the red as well.

However, the analyst did flag one piece of data that stood out, namely that treasury and ETF buying had flipped net positive by 200% on the day of his post.

“The last time it was this high, Bitcoin was at $90,000,” he stated, calling it “very good news, especially amid war.”

That appetite Edwards was referring to was typified by Strategy, which yesterday announced a purchase of 17,994 BTC at an average price of approximately $71,000 per BTC, bringing its total holdings to 738,731 BTC bought for $56 billion. At current prices, the firm’s position is carrying an unrealized loss in the region of $6 billion.

You may also like:

Separately, Strategy’s perpetual preferred stock posted a new 2026 trading volume high of $299 million on March 9, which BitcoinTreasuries estimated was enough to fund another 1,360 BTC purchase.

The broader supply picture adds some context to why institutional accumulation is drawing attention, with analyst Darkfost noting that Bitcoin reserves on centralized exchanges have fallen to levels last seen in 2019.

Additionally, ETFs have absorbed around 1.3 million BTC since their January 2024 launch, while corporate treasury companies collectively hold about 1.1 million BTC, which is nearly 5% of the total supply.

Bitcoin Price Overview

Bitcoin was changing hands near $71,000 at the time of this writing, up over 4% in 24 hours after bouncing from around $67,500. In the last seven days, the asset gained 6.4% and has almost doubled that over 14 days. Still, it remains down nearly 13% year-on-year and about 44% below its October 2025 all-time high.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Polymarket Teams Up With Palantir and TWG AI to Monitor Sports Bets

The prediction market is deploying AI-powered surveillance tools as the industry faces mounting scrutiny over insider trading and market manipulation.

Prediction market Polymarket has partnered with Palantir Technologies and TWG AI to develop a surveillance system designed to detect manipulation and insider trading across its sports markets.

The new platform will be powered by the Vergence AI engine, a joint venture between Palantir and TWG AI created last year. It will monitor trading activity in real time, flag anomalous patterns, screen users against existing banned-bettor lists, and generate compliance reports that can be shared with regulators and sports leagues.

“Our partnership with Palantir and TWG AI allows us to apply world-class analytics and monitoring to sports markets while building tools that can help leagues and teams maintain confidence in the games themselves,” said Polymarket founder and CEO Shayne Coplan in a press release.

Palantir CEO Alex Karp called the collaboration a new standard for prediction markets, adding that the companies are working to ensure the platform can scale as the sector expands.

The partnership comes as interest in sports betting on prediction markets continues to rise.

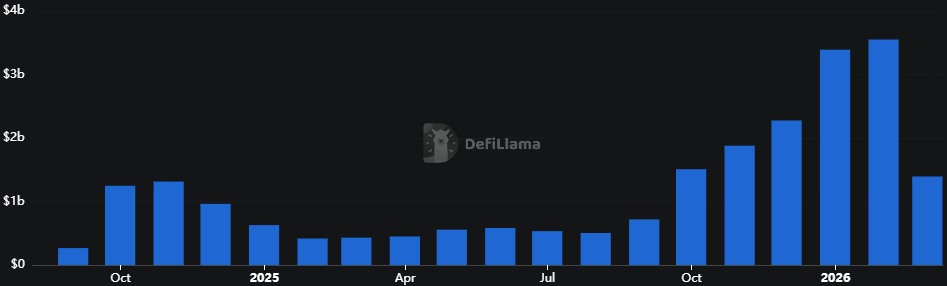

Meanwhile, Polymarket trading volumes hit an all-time high of $3.55 billion in February, marking a sixth straight month of growth, according to DeFiLlama.

Crypto World

Kraken’s xStocks starts points program, hinting at possible ecosystem token

Kraken-linked tokenized equities platform xStocks plans to launch a rewards program aimed at traders liquidity providers and DeFi builders using its onchain stock tokens.

The initiative dubbed xPoints will track activity across supported trading venues and integrations. Participants can earn points by trading tokenized U.S. equities providing liquidity or using the assets in decentralized finance (DeFi) applications.

Points programs have become a common strategy in crypto to drive early usage of new platforms. In many cases projects later convert accumulated points into governance tokens or other ecosystem rewards. While xStocks has not announced a token yet, the initiative could pave the way for a potential token launch.

xStocks said the points program is meant to align long-term contributors with the growth of its ecosystem. Participants who accumulate points may gain access to future benefits tied to the platform once the program concludes though details have not been disclosed.

The move comes as tokenized equities have emerged as one of the fastest-growing sectors in crypto. The category now holds more than $1 billion in value locked, tripling in size over the past six months, RWA.xyz data shows.

xStocks said its tokenized stock offering has processed more than $25 billion in transaction volume during the eight months since launch and has expanded across several blockchain networks.

Traditional financial firms have also showing interest in tokenized stocks. Earlier this week, Nasdaq said it plans to work with Kraken to distribute tokenized versions of public stocks to investors outside the U.S., part of a broader push by the exchange operator to bring blockchain infrastructure into capital markets.

Read more: Tokenization still at start of hype cycle, but needs more use cases, specialists say

Crypto World

DOJ seeks October retrial for Tornado Cash dev Roman Storm

US Attorney Jay Clayton, the former chairman of the SEC and head of the Southern District of New York, has requested a re-trial of Tornado Cash developer Roman Storm on charges of conspiracy to commit money laundering and evade sanctions.

The requested date for the re-trial is October 5-12, 2026.

Clayton filed a two-page letter confirming his prosecution is willing to bring Count 1 and Count 3 of the original indictment back before a new jury.

Count 1 was a conspiracy to commit money laundering. Here, the US government alleged Storm knowingly helped criminals conceal over $1 billion in stolen crypto through Tornado Cash, including hundreds of millions from a Ronin hack involving North Korea’s Lazarus Group.

Although not up for jury re-trial, Count 2 involves a conspiracy to operate an unlicensed money transmitting business. A Manhattan jury convicted Storm in August 2025 on Count 2.

However, Storm filed a post-trial motion under Criminal Rule 29 which is due for a court to rule sometime soon, even as early as April 9, 2026. Storm hopes to gain acquittal on Count 2 on a legal technicality.

A Rule 29 motion asks a judge to declare that trial evidence was legally insufficient. Legal sufficiency of evidence is a constitutional minimum for sustaining a conviction.

The test for legal sufficiency is whether a rational trier of fact found the essential elements of the offense beyond a reasonable doubt. Rule 29 acquittals are rare but possible.

Also up for re-trial, Count 3 involved a conspiracy to violate sanctions. Specifically, prosecutors claimed Storm kept operating Tornado Cash after the US Treasury sanctioned the protocol in August 2022.

Read more: What does Roman Storm’s guilty verdict mean for the wider DeFi sector?

After five days of deliberation, jurors deadlocked on the money laundering and sanctions counts. As a result, the case was a partial mistrial.

Storm’s attorney Brian Klein said after the first trial that he expected “full vindication.” The defense has continued to fight on First Amendment, venue, and sufficiency of evidence grounds.

Storm remains free on a $2 million bail but April and October will be critical months. For anybody wanting to help him out, he’s currently asking for donations to fund his legal battle.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Assassination markets are legal now but Trump doesn’t have to worry

While the world watched with growing consternation as the US and Israel attacked Iran and the Strait of Hormuz was shut down to sea vessels, a financial problem was quietly festering beneath the surface: assassination markets were now legal, and available to almost anyone in the world.

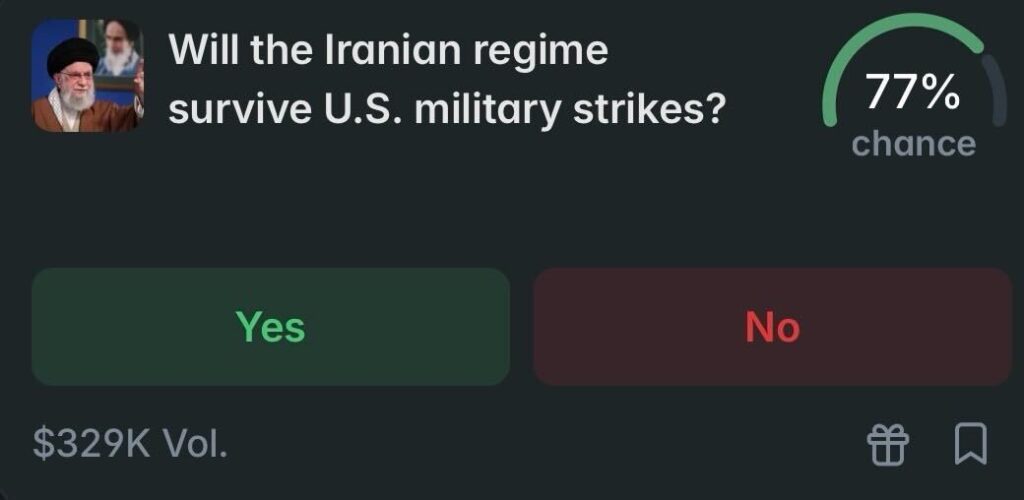

Polymarket hosts a future hellscape

Polymarket, a prediction market platform owned by New York-based company Blockratize, currently has open assassination markets on its website.

They’re easy to find because they’re some of the most heavily traded markets on the platform.

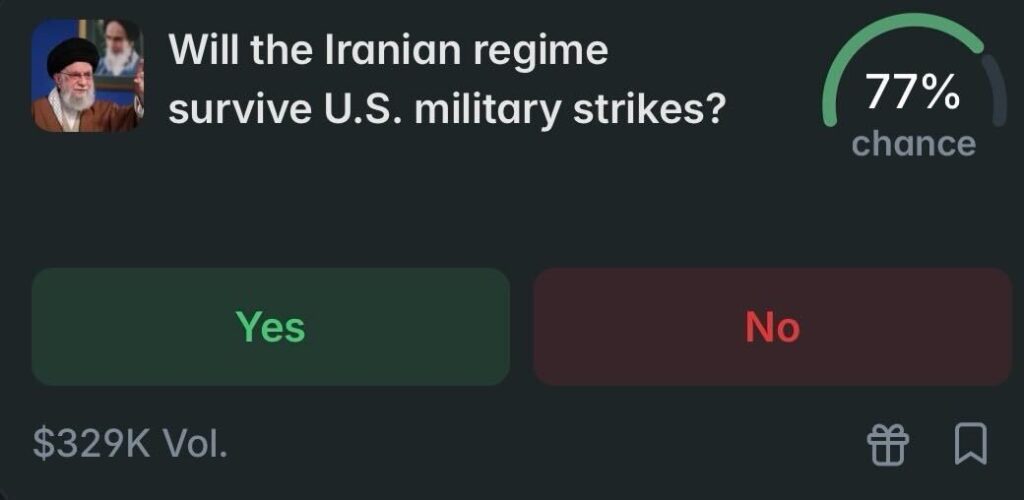

Among these markets are:

- Iran leader by end of 2026? (the current Ayatollah is on the list)

- Will the Iranian regime fall by (numerous dates available to bet on)?

- Will the Iranian regime survive US military strikes?

Read more: Kalshi uses ‘death carve-out’ to avoid paying out on Ali Khamenei ousting

Despite the death of Ayatollah Khamenei being among the most popular prediction markets, Kalshi, as per its terms and conditions, didn’t pay out when he died. Polymarket, however, did, and half a billion dollars changed hands in the process.

Donald Trump and US politicians noticeably absent

Polymarket seems to purposely avoid including US politicians or the current US president in any possible assassination markets, but the same cannot be said for nearly every other major leader in the world.

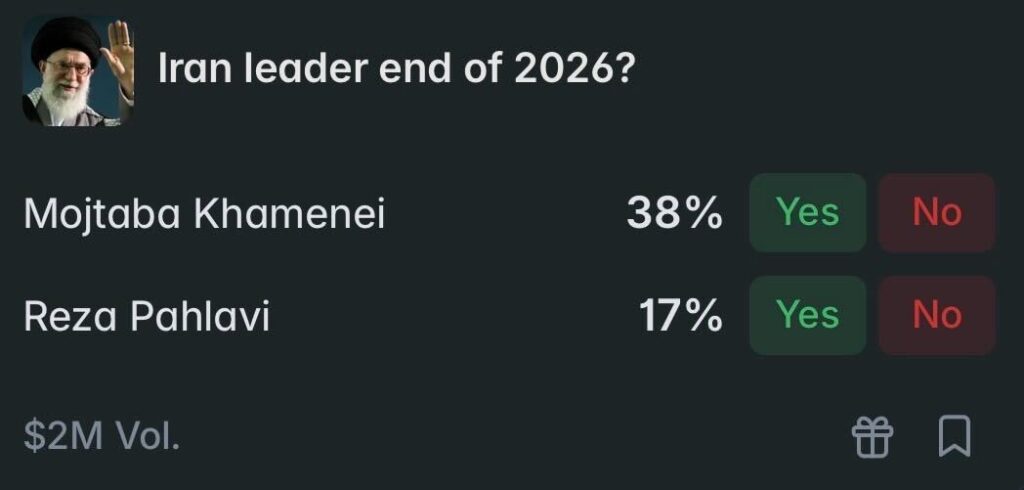

For Xi Jinping the platform hosts markets including “China coup attempt before 2027?” and “Xi Jinping out before 2027?”

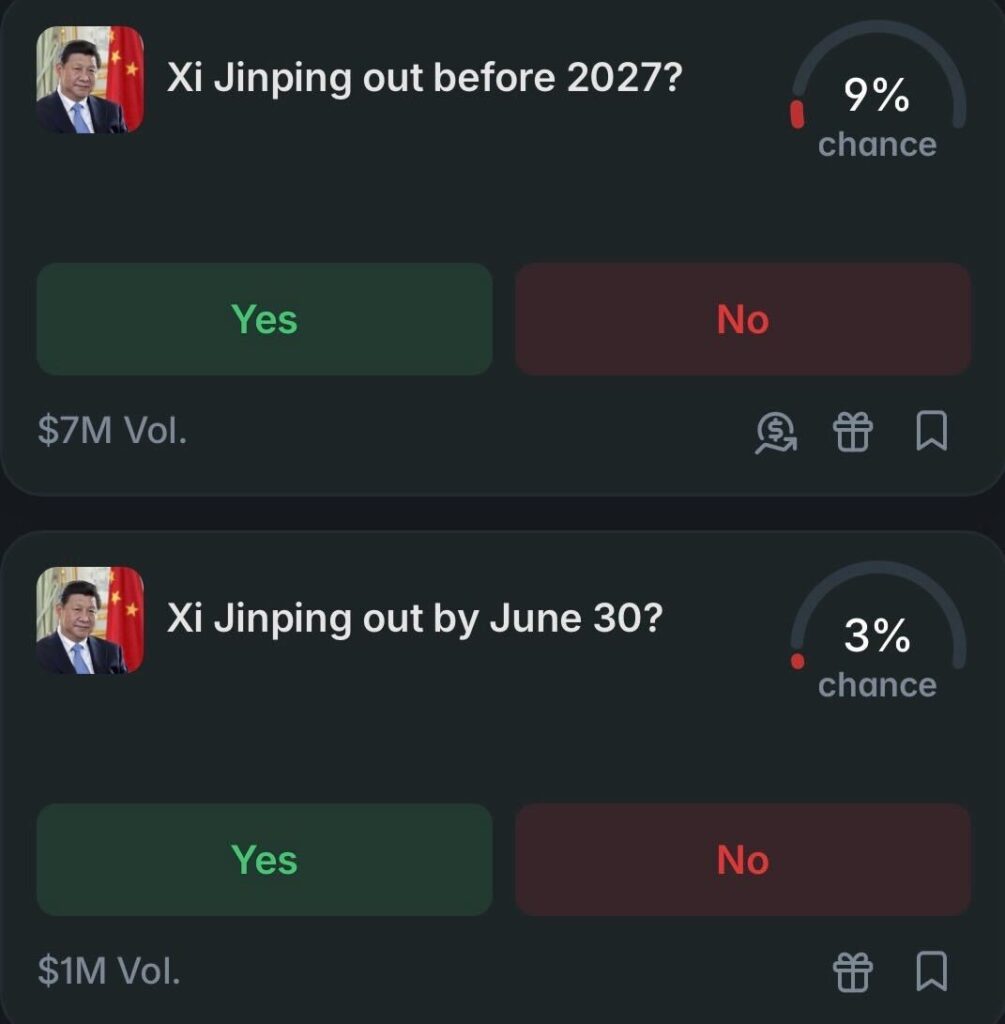

For Putin, a market is available that asks “Putin out as president of Russia by 2026?” and even more markets are available that ask similar questions about Zelenskyy.

Nothing like these assassination markets exist for Donald Trump, who is older and less popular domestically than Xi, Putin, or Zelenskyy.

While Polymarket could previously have claimed that these markets are only related to these individuals’ political oustings, they can’t any more after paying out on Khamenei’s death.

Read more: Polymarket ends trading loophole for bitcoin quants

Why won’t Polymarket list similar markets for Trump?

Though probably obvious to most people, the fact that Polymarket offers no assassination markets on Trump or US politicians is likely nothing to do with moral or ethical concerns.

Rather, it’s almost certainly down to the fact that Polymarket is based in the US, that its founder, Shayne Coplan, is a US citizen, and that Donald Trump Jr. is an advisor to and investor in the company.

Polymarket simply doesn’t want to ruffle any feathers or bite the hand that feeds it.

In that same vein, the Biden administration had effectively stopped Polymarket from advertising to or onboarding US citizens. These hinderances to the platform’s growth came to end in 2025 thanks to the Trump administration dropping multiple probes into its practices, which could have led to lawsuits and possible criminal prosecutions.

Instead, Polymarket now finds itself at the forefront of a world where leaders of countries have public hits put on them via vague market questions that leave murder open as an interpretation and solution.

Read more: Are Polymarket and Kalshi decentralized?

Can Polymarket be stopped?

Whether or not Polymarket can continue to functionally operate as an assassination market platform remains to be seen.

While it’s been stopped from operating in specific countries and regions via regulatory actions and lawsuits, such as Ontario, Singapore, Thailand, and Belgium, as long as the US fails to bring criminal prosecutions against the executives offering to host markets for murders, there’s little that can be done.

For the record, platforms like Polymarket deny they list assassination markets, though, as detailed previously, many markets can easily be linked to the deaths of public figures.

Protos reached out to Polymarket with questions about its assassination markets but we’ve yet to receive a response.

So, in the meantime, whose death are we betting on today and what’s the liquidity look like?

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Jito Foundation acquires and revives SolanaFloor following shutdown over $27 million exploit

The Jito Foundation announced its acquisition of SolanaFloor, a data platform and news site focused on the Solana blockchain, and plans to relaunch the publication after its recent shutdown.

SolanaFloor ceased operations last month after an $27 million exploit involving its parent organization, Step Finance. The team considered external financing and acquisition but was unable to continue operating the platform.

Jito stepped in to bring the site back online but did not reveal the acquisition value. The foundation said SolanaFloor will resume publishing immediately while maintaining editorial independence. The newsroom will continue covering network activity, market movements and technical development across the Solana ecosystem.

“When SolanaFloor went dark, the ecosystem lost something difficult to replace,” said Brian Smith, president of Jito Foundation. He described the acquisition as a commitment to supporting information infrastructure that enables market participants to understand onchain developments.

The relaunch comes as the Solana network remains resilient. Spot exchange-traded funds tied to the token now hold nearly $1 billion in assets, while total value locked on the network’s DeFi ecosystem is at $6.7 billion.

Jito itself plays a role in Solana’s infrastructure. The project develops software used by validators to manage transaction ordering and capture maximum extractable value, or MEV, a form of additional revenue that can arise during block production.

The network also runs a liquid staking system that allows users to deposit SOL and receive a token called JitoSOL that remains usable across decentralized finance applications while still earning staking rewards.

Under the new ownership, SolanaFloor’s editorial team will retain control over story selection and coverage priorities. Jito stated that details about the platform’s team, partnerships, and commercial offerings will be provided as the relaunch progresses.

Crypto World

Arthur Hayes predicts Hyperliquid’s HYPE will hit $150 by August

Hyperliquid’s (CRYPTO: HYPE) token has emerged as a flashpoint for traders watching how decentralized derivatives platforms can redraw liquidity away from traditional venues. In a post published on Monday on Cryptohayes Substack, BitMEX co-founder Arthur Hayes laid out a bull case in which the project could reach as high as $150 by August, contingent on a sustained rotation of derivatives volume from centralized exchanges to crypto-native venues and a broader expansion of Hyperliquid’s product lineup. The core premise rests on a rapid lift in the platform’s 30-day annualized revenue run rate—from about $843 million in March to $1.40 billion by August—fueled in part by the company reinvesting a large share of its earnings into HYPE token buybacks. This framework sits at the intersection of macro asset demand and crypto-native execution, with HIP-3 mechanics and new listings shaping the potential trajectory.

Key takeaways

- The CEX-to-DEX rotation is central to the bull case: Hyperliquid has already absorbed roughly 6% of centralized-exchange derivatives volume as of March, and Hayes estimates a further gain of about 3.96 percentage points if growth continues.

- Revenue momentum matters: the target rise from $843 million in March to $1.40 billion by August is the lynchpin for the projected upside toward $150 per HYPE.

- Tokenomics as a price driver: about 97% of Hyperliquid’s revenue is used to repurchase HYPE on the open market, creating a feedback loop where rising activity supports the token’s price strength.

- HIP-3 expands the product map: the mechanism enables permissionless perpetual markets by staking HYPE, with new listings tied to oil, gold, silver, and major US indices gaining traction and contributing to revenue growth (nearly 10% of total revenue).

- Oil and macro assets as catalysts: oil-linked perpetuals have become top-traded pairs, indicating traders are diversifying beyond crypto into macro assets via the platform.

Tickers mentioned: $HYPE, $ETH

Sentiment: Bullish

Price impact: Positive. The thesis hinges on sustained liquidity growth and ongoing macro-asset demand, which could lift HYPE if the revenue-and-volume trajectory proves durable.

Trading idea (Not Financial Advice): Hold. The scenario depends on continued platform expansion and macro liquidity, which are not guaranteed, but the structure suggests potential upside if momentum persists.

Market context: The analysis sits within a broader pattern of crypto-native venues absorbing traditional-asset trading activity, as liquidity seeks alternative venues amid macro volatility and evolving regulatory considerations affecting derivatives and tokenomics.

Why it matters

Hyperliquid’s bull case rests on a deliberate strategy: move more derivatives activity away from centralized exchanges to a DEX-like platform, and reinvest most revenue into the native token to reinforce upside incentives. If the platform sustains its growth trajectory, the implications extend beyond a single token. It would signal a shifting landscape where specialized crypto-native marketplaces become primary venues for macro-trading strategies—expanding liquidity pools, attracting institutional-like flows, and intensifying price discovery for digital assets linked to traditional markets. The emphasis on HIP-3, which enables permissionless perpetual markets by staking HYPE, could diversify the platform’s revenue streams and reduce reliance on pure crypto volatility, aligning more with real-world assets such as oil and precious metals.

The oil-and-commodity angle underscores a broader narrative: as geopolitical tensions affect traditional markets, traders increasingly view crypto-native venues as hedges or proxies for macro exposures. In Hyperliquid’s case, the CL-USDC perpetual pair has spiked to the top of the platform’s volume rankings, signaling a meaningful tilt toward macro-asset liquidity within a crypto framework. This shift could alter correlation dynamics across digital and traditional markets, inviting investors to reevaluate risk budgets and correlation assumptions. Yet the track record of outsized calls by Hayes—some of which did not materialize—serves as a sober reminder that macro-driven theses can unravel quickly if liquidity conditions relax or if platform execution stalls.

The takeaway for users and builders is quantitative rather than rhetorical: a successful CEX-to-DEX migration and stronger macro-asset liquidity on a platform like Hyperliquid could redefine the risk-reward calculus for derivatives activity in crypto. On the other hand, token unlocks and shifts in market sentiment remain meaningful headwinds that investors must monitor alongside regulatory developments and macro policy shifts. The evolving HIP-3 ecosystem will be a critical barometer of whether Hyperliquid can translate trading activity into durable revenue growth and, ultimately, into sustained token demand.

What to watch next

- Track whether the 30-day annualized revenue run rate reaches the $1.40 billion target by August, and assess how any deviations affect HYPE’s price trajectory.

- Monitor HIP-3 expansions and new listings tied to macro assets like oil, gold, silver, and major US indices, plus their contribution to quarterly revenue numbers.

- Watch liquidity metrics on CL-USDC and ETH-USDC to gauge macro-asset demand on Hyperliquid and any shifts in trading preferences between crypto and traditional markets.

- Observe HYPE’s price action around the neckline near $35.50 and the potential breakout toward $50, with attention to how the 50-day moving average interacts with price development.

- Check for further commentary from Hayes or Hyperliquid about product expansion, tokenomics changes, or new risk-management features that could influence user adoption and liquidity.

Sources & verification

- Hayes, Arthur. Post on Cryptohayes Substack outlining a fivefold potential move for HYPE and the CEX-to-DEX rotation. https://cryptohayes.substack.com/p/hype-man

- Hyperliquid price index overview and discussion of HYPE’s price dynamics. https://cointelegraph.com/hyperliquid-price-index

- HIP-3 revenue impact and market activity data, including commodity listings. https://cointelegraph.com/news/hyperliquid-hip-3-open-interest-hits-793m-on-commodities-surge

- Oil-linked trading volume context and related macro considerations. https://cointelegraph.com/news/oil-pulls-back-g7-emergency-reserve-hyperliquid-volume

- Maelstrom’s analysis on HIP-3 revenue contributions and token dynamics. https://cointelegraph.com/news/maelstrom-warns-hype-token-pressure-11-9b-unlocks

Market reaction and key details

Hyperliquid’s bull thesis anchors on shifting derivatives liquidity and a disciplined reinvestment approach. Hayes argues that if the platform can sustain the migration of derivatives volume from centralized exchanges and broaden its product suite, HYPE could traverse a multifold path—from roughly $30 toward targets near $150 by August. The revenue math is explicit: a move from $843 million in March to $1.40 billion in the 30-day window would imply a meaningful acceleration in platform activity, which in turn would support continued token-buyback pressure in the open market. Importantly, Hyperliquid directs the majority of its earnings back into HYPE; about 97% of revenue is used to purchase more of the token. This design creates a price-supporting dynamic that could amplify gains if demand remains resilient and trading volumes hold steady or rise.

The HIP-3 mechanism adds another layer. By staking HYPE, users can launch perpetual markets permissionlessly, and the project has already seen interest in oil, gold, silver, and major US indices. The latest data suggests HIP-3 accounts for roughly 10% of Hyperliquid’s revenue, with proponents expecting revenue growth to accelerate as onboarding of macro assets intensifies. If the macro environment remains conducive and Hyperliquid continues to add tokens and assets to its catalog, the combination of higher volumes and ongoing token buybacks could support a sustained move higher in HYPE. However, the path is not guaranteed; token unlocks from previous periods have historically weighed on price, and investors should factor in the potential for volatility amid shifting liquidity and risk sentiment.

The oil-linked trading—exemplified by CL-USDC—illustrates how macro exposure is translating into crypto-native activity. As the platform reports sustained volumes on commodity pairs, traders appear to be using Hyperliquid as a bridge between traditional markets and crypto risk assets. This trend is reinforced by the growing volume of ETH-USDC pairs, which demonstrates continued appetite for Ethereum-denominated exposure within Hyperliquid’s ecosystem. All told, the story emphasizes a broader trend: the market is increasingly pricing macro dynamics within crypto-native venues as liquidity moves away from conventional order books and toward more specialized, asset-diversified platforms.

Crypto World

Solana ETFs find institutional backing while XRP funds depend more on retail

U.S. exchange-traded funds tied to Solana (SOL) and XRP (XRP) are attracting investors despite falling crypto prices, though the two products are drawing very different types of buyers.

Solana ETFs are seeing stronger participation from institutional crypto investors, while XRP funds appear to rely more heavily on retail demand, according to a new report from Bloomberg Intelligence analysts James Seyffart and Sharoon Francis.

“Early Solana ETF demand is being driven largely by industry-native capital rather than broader institutional adoption,” the analysts wrote about Solana ETFs.

About 49% of assets in U.S. spot Solana ETFs were identifiable through 13F filings as of Dec. 31, a regulatory disclosure required for large institutional investment managers. Investment advisers accounted for the largest share of reported holdings, with roughly $270 million in exposure. Hedge funds followed with about $186 million.

“The early holder base remains top-heavy and skewed toward crypto-focused investment firms and market makers, suggesting broader institutional participation is still building,” the analysts wrote. The largest known holders include Electric Capital, Goldman Sachs and Elequin Capital.

Solana is a blockchain network designed to support decentralized applications such as trading platforms, lending services and NFT marketplaces. The network aims to process transactions quickly and cheaply, making it a popular platform for crypto trading and decentralized finance.

Some of the initial capital likely reflects investors shifting existing Solana exposure into the ETF structure rather than entirely new buying. Still, the data suggests that does not explain the full picture. Because about half of the ETF assets are disclosed through 13F filings, even assuming those positions represented swapped exposure would leave a significant share of inflows coming from new buyers.

Solana ETFs have attracted $173 million in net inflows so far in 2026, even as the token has fallen sharply. The report notes that cumulative inflows into the funds have reached about $1.45 billion since launch. That is about 2.5% of the amount that spot bitcoin ETFs have amassed, but it is still a relatively strong figure for such young products.

The products debuted during a difficult market environment. Solana has dropped more than 50% since October, when new spot ETFs launched under the Securities Act of 1933.

Some common ETF trading strategies also appear limited. Futures basis yields — often used by hedge funds to run arbitrage trades — have compressed, leaving fewer incentives for those positions. “With basis yields now compressed, hedge funds and market makers have little incentive to enter new positions in spot Solana ETFs,” the analysts wrote.

XRP ETFs present a different ownership pattern.

Only about 16% of XRP ETF assets were identifiable through 13F filings at the end of December, suggesting a smaller institutional footprint. Advisers again led among disclosed holders with about $165 million in exposure, while hedge funds accounted for around $37 million.

The remaining shares are likely held by investors who do not file 13Fs, including retail buyers.

“We believe a large portion are held by retail investors, who aren’t required to file 13Fs,” according to the report.

XRP is the native token used on the XRP Ledger, a blockchain focused on payments and cross-border money transfers. The network is designed to help financial institutions move funds between countries quickly and at a lower cost than traditional banking rails.

Despite that retail tilt, XRP ETFs have gathered significant assets. The funds attracted more than $1.4 billion in the six weeks after launching in November and have largely held those gains into 2026, even with XRP down about 26% this year.

The analysts said the stability in assets despite weaker futures activity suggests demand may reflect direct market views rather than derivatives-driven arbitrage.

“ETF assets have largely held their gains, suggesting demand may become increasingly directional rather than mechanical,” they wrote.

Together, the findings show how newer crypto ETFs are still developing their investor bases.

While bitcoin funds have drawn broad institutional adoption, Solana and XRP products appear to be carving out different paths as the market matures, with Solana attracting more crypto-native institutional capital and XRP drawing a larger share of retail investors.

Crypto World

Sonic price eyes reversal as bullish RSI divergence forms.

Sonic price forms bullish RSI divergence near the value area low. Holding $0.03 support could trigger a corrective rally toward $0.04 resistance.

Summary

- Bullish Signal: RSI divergence forming near the value area low.

- Key Support: Price must hold $0.03 and the 0.618 Fibonacci level.

- Upside Target: Potential rally toward $0.04 high-timeframe resistance.

Sonic (S) is currently trading at a critical technical level where early signs of a potential trend reversal are beginning to emerge. After an extended period of downside pressure, the token is now showing bullish RSI divergence around the value area low, a level that has historically attracted buying interest.

This divergence suggests that while price has been printing lower lows, the Relative Strength Index (RSI) has started to form higher lows. In technical analysis, this type of momentum shift often signals that bearish pressure may be weakening and that the market could be preparing for a potential corrective rally.

Sonic price key technical points

- Bullish Divergence: RSI forming higher lows while price prints lower lows.

- Key Support: Sonic holding critical support near $0.03.

- Upside Target: Holding support could open a move toward $0.04 resistance.

Sonic’s recent price action highlights a potential shift in momentum as the market attempts to stabilize after a prolonged decline. The most notable signal on the chart is the presence of a bullish RSI divergence, which has developed near the value area low. This technical formation occurs when price continues to move lower while momentum indicators begin trending higher, suggesting that selling pressure may be gradually fading.

Bullish divergences are commonly observed during the late stages of a downtrend. As the market approaches key support levels, sellers begin to lose momentum while buyers start stepping in at discounted prices. This gradual shift in control between sellers and buyers can often lead to a reversal or, at the very least, a corrective bounce.

In Sonic’s case, the $0.03 level has now emerged as a critical support zone. This level represents an area where buyers have begun defending price, preventing further downside expansion in the immediate short term. The market’s ability to hold above this level will likely determine whether the current bullish divergence develops into a sustained rally or simply results in a temporary relief bounce.

Meanwhile, Sonic Labs has launched USSD, a USD-pegged stablecoin backed by tokenized U.S. Treasury assets, adding a new source of stable liquidity to the Sonic blockchain ecosystem.

Another key technical factor supporting the potential for a reversal is the 0.618 Fibonacci retracement, which aligns closely with the current support structure. The 0.618 Fibonacci level is widely recognized in technical analysis as an important retracement level where markets frequently experience reversals or strong reactions.

When Fibonacci levels align with other technical indicators, such as value areas or support zones, they often create strong areas of technical confluence. In this case, the combination of the value area low, Fibonacci support, and bullish RSI divergence strengthens the probability that the market could attempt a corrective move higher.

Meanwhile, Sonic Labs is entering a new phase under CEO Michael Demeter, who has outlined a long-term roadmap aimed at reshaping how the layer-1 blockchain generates and sustains value.

However, confirmation of this reversal will depend heavily on price behavior in the coming sessions. If Sonic continues to hold above the $0.03 support, it would reinforce the bullish divergence and increase the probability of a structural shift in market behavior.

A successful defense of this support could allow price to rotate higher toward the next major technical barrier, which sits near the $0.04 high-timeframe resistance. This level represents the next area where sellers may attempt to regain control of the market.

From a market structure perspective, a rally toward $0.04 would represent the first meaningful higher high following the recent downtrend. Such a move could signal the early stages of a broader recovery phase if buying momentum continues to strengthen.

What to expect in the coming price action

Sonic is currently positioned at a key technical inflection point as bullish RSI divergence develops near the value area low. As long as price holds above the $0.03 support and respects the 0.618 Fibonacci retracement, the probability increases for a corrective rally toward $0.04 resistance.

A break below $0.03, however, would invalidate the bullish setup and suggest that bearish momentum remains dominant.

Crypto World

Societe Generale FORGE Launches EURCV Stablecoin on Stellar

Societe Generale-FORGE, the crypto arm of the French lender, has completed a multichain expansion of its euro-denominated stablecoin, EUR CoinVertible (EURCV), by deploying it on the Stellar network. The move closes a circuit in a rollout the firm began outlining in 2025 and signals a broader push to normalize euro-backed digital assets across major blockchains. EURCV is designed to be MiCA-compliant and fully collateralized on a one-to-one basis with reserves comprised of bank deposits and high-quality liquid assets. The Stellar deployment aims to unlock new on-chain uses for tokenized assets and digital markets, leveraging Stellar’s fast settlement, low fees, and built-in support for tokenized assets. The euro-stablecoin’s on-chain footprint now spans Ethereum, Solana, and the XRP Ledger, with Stellar added to the roster and multiple deployments planned to expand liquidity and interoperability. DefiLlama places EURCV’s market cap at around $452 million, reflecting steady interest in euro-denominated liquidity tools in a market still dominated by dollar-pegged assets.

Key takeaways

- SG-FORGE’s EURCV is now live on the Stellar network, adding a fourth major chain to a multichain rollout that began with Ethereum and Solana and included the XRP Ledger previously.

- Stellar’s on-chain DEX and low transaction costs are highlighted as features that could improve the accessibility and efficiency of euro-denominated tokenized assets.

- EURCV remains fully backed 1:1 by reserves of bank deposits and high-quality liquid assets, aligning with MiCA requirements in the European Union.

- A January SWIFT pilot demonstrated the exchange and settlement of tokenized bonds using both fiat and digital currencies, underscoring cross-border interoperability for euro-denominated instruments.

- The euro-stablecoin push in Europe continues amid MiCA and licensing debates, while the broader stablecoin market in the United States has gained regulatory clarity after recent legislative developments; US dollar-backed tokens still dominate market share.

Tickers mentioned: $ETH, $SOL, $XRP, $USDT, $USDC, $EURT

Market context: European policymakers are pursuing MiCA compliance as a framework for issuers, with a regulatory emphasis on licensing and oversight that contrasts with the more permissive or evolving regimes in other regions. In the United States, regulatory clarity for stablecoins gained momentum after supporting legislation, while the sector remains heavily weighted toward dollar-backed assets, a dynamic underscored by the ongoing growth of USDT and USDC in global markets.

Why it matters

The expansion of EUR CoinVertible onto Stellar matters because it demonstrates a deliberate effort to diversify the on-ramp and liquidity options for euro-denominated digital assets beyond the dominant Ethereum ecosystem. By placing EURCV on Stellar, SG-FORGE taps into an infrastructure designed for speed and scale, including a built-in decentralized exchange component that can facilitate on-chain trading of tokenized assets without requiring users to leave the network. The move also signals confidence that MiCA-compliant euro stablecoins can operate effectively across multiple rails, potentially reducing fragmentation in European digital asset markets while preserving the ability to settle tokenized instruments in a regulated framework.

From a risk and liquidity perspective, EURCV’s 1:1 backing by bank deposits and high-quality liquid assets anchors its value and aligns with European regulators’ expectations for reserve quality. The euro-stablecoin ecosystem in Europe has lagged behind the US dollar-centered stablecoin crowd, but the EU’s regulatory regime—emphasizing licensing, consumer protections, and capital requirements—aims to create a more stable operating environment for issuers and users. The DefiLlama data cited in the broader narrative shows EURCV as a meaningful, if still niche, component of the euro-denominated segment, contributing to greater diversification within a market that has grown from roughly $260 billion in July 2025 to over $314 billion in more recent readings. In parallel, the U.S. landscape has benefited from regulatory clarity around stablecoins, even as competition remains intense among USDT and USDC, underscoring a global race to build trusted, compliant euro- and dollar-pegged assets on-chain.

Another layer of significance is the cross-border interoperability demonstrated by the SWIFT tokenized-bonds pilot. By bridging fiat and digital currencies in a tokenized-bonds context, the pilot points to a potential path for faster settlement and greater liquidity for euro-denominated debt instruments. While the technical and regulatory hurdles are nontrivial, the episode illustrates how traditional financial infrastructure can converge with blockchain rails to create more efficient capital markets. Taken together, the Stellar deployment, the SWIFT pilot, and MiCA’s evolving requirements underscore a broader shift: euro-denominated stablecoins are moving from proof-of-concept experiments to practical tools for everyday settlement, collateralization, and liquidity provisioning in regulated markets.

The trajectory also highlights a fundamental tension in the crypto ecosystem: regulatory clarity versus market opportunity. European authorities aim to codify safeguards and licensing, while market participants seek speed and utility across diverse networks. EURCV’s emergence on Stellar illustrates how institutions can align with regulatory expectations while exploring value-adding features such as native on-chain trading, faster settlement, and broader access for tokenized assets. The ongoing dialogue between policymakers, banks, and crypto-native issuers will influence how quickly such euro-stablecoins achieve scale, and which networks emerge as the most effective rails for cross-border, on-chain euro settlements.

What to watch next

- Adoption metrics for EURCV on Stellar: transaction volume, on-chain liquidity, and any new issuer partnerships.

- Additional network deployments: any further moves to other blockchains beyond Stellar, and the timeline for potential integrations with major on/off-ramp providers.

- MiCA regulatory developments: licensing decisions and any updates to capital requirements or disclosure standards that could influence future euro-stablecoin issuance.

- Cross-border use cases: uptake in tokenized euro-denominated assets and further SWIFT-like interoperability experiments beyond bonds.

Sources & verification

- Official page: SG-FORGE — Stellar network stablecoin launch details (https://www.sgforge.com/stellar-network-stablecoin/)

- EURCV on Ethereum: historical launch information (https://cointelegraph.com/news/societe-generale-launches-euro-pegged-stablecoin-on-ethereum)

- DefiLlama: EURC stablecoin data and market cap (https://defillama.com/stablecoin/eurc)

- EURCV on XRP Ledger deployment reference (https://cointelegraph.com/news/societe-generale-forge-expands-euro-stablecoin-to-xrp-ledger-in-multi-chain-push)

- MiCA framework and European stablecoin regulation discussion (https://cointelegraph.com/learn/articles/markets-in-crypto-assets-regulation-mica)

Market reaction and key details

Societe Generale-FORGE’s multi-chain approach to EURCV reflects a broader push to de-risk and diversify euro-denominated liquidity in a crypto market that has been historically dominated by U.S. dollar-backed tokens. The Stellar deployment aims to enhance throughput and reduce friction for on-chain settlements and tokenized asset services, aspects that could become important as European issuers seek regulated, interoperable rails for cross-border activity. The ongoing regulatory backdrop—MiCA’s licensing requirements and the EU’s caution around euro-denominated assets—frames the pace and scale of adoption, even as the U.S. market advances new regulatory clarity around stablecoins. With EURCV now live on Stellar, the door opens to additional use cases such as tokenized bonds, on-chain collateralization, and more efficient settlement flows in a regulated European context.

Looking ahead, investors and builders will watch not only the rate of EURCV’s on-chain activity but also how Stellar’s ecosystem, DeFi integrations, and stablecoin usage converge with MiCA’s licensing standards. The cross-chain momentum—moving from Ethereum to Solana, XRP Ledger, and now Stellar—suggests a potential template for other euro-denominated assets seeking regulated, scalable rails. As with all stablecoins, the ultimate test will be resilience under stress: reserve quality, transparency, and the ability to maintain 1:1 parity in diverse market conditions. If EURCV maintains robust backing and gains practical traction on Stellar, it could become a more visible, trusted option for institutions and decentralized markets seeking regulated euro exposure within a crypto-enabled settlement infrastructure.

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

News Videos1 day ago

News Videos1 day ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World1 day ago

Crypto World1 day agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business5 hours ago

Business5 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Business7 days ago

Business7 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment4 days ago

Entertainment4 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

NewsBeat20 hours ago

NewsBeat20 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech1 day ago

Tech1 day agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World6 days ago

Crypto World6 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech6 days ago

Tech6 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment6 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business1 day ago

Business1 day agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs