Crypto World

Is a Bullish Bounce on the Way?

TLDR

- FLOKI price has decreased by 5.9% in the last 24 hours, now at $0.00003812.

- The price fluctuated, briefly rising to $0.00004046 before declining steadily.

- Despite the price dip, FLOKI’s trading volume surged by 53.17%, reaching $59.49 million.

- Market analysts suggest a potential change, with FLOKI nearing a key support zone in its descending channel.

- Key target levels to watch for are $0.000052, $0.000078, $0.000117, and $0.000160.

For a month now, the FLOKI price has been trending lower, with a 4% dip. During today’s Asian trading session, the meme coin opened at $0.00003899 and then traded in an up-and-down manner. However, market analysts have hinted at a potential change following the formation of a historical downtrend channel that followed a pullback.

FLOKI Price Dips 5.9% in 24 Hours

At the time of writing this article, CoinMarketCap data reveals that the price of FLOKI has decreased by 5.9% in the last 24 hours, now standing at $0.00003812. Throughout the observation period, the price fluctuated.

The FLOKI price briefly rose to about $0.00004046 before declining steadily. This dip followed an earlier surge, reflecting a moderate price movement. FLOKI’s market cap has decreased by 5.9% to $363.72 million.

Despite the price drop, FLOKI’s trading volume has increased by 53.17% over the past 24 hours, reaching $59.49 million. The volume-to-market cap ratio stands at 16.1%, suggesting relatively high trading activity relative to market value. The price chart displays a period of decline, with the value steadily decreasing throughout the timeframe.

FLOKI Nears Key Support: Bullish Reversal Expected Soon

While current market data indicates negative price performance, market analysts have identified a potential change. According to Jonathan Carter’s observation, the FLOKI price chart shows the price moving within a descending channel. The FLOKI price has consistently bounced between the top resistance zone and the bottom support zone.

Currently, the price is approaching the support zone, where it has previously found buying interest. FLOKI price action shows that the market is defending this key support zone, indicating a potential shift in momentum towards the bulls. As the price nears the midline of the descending channel, a bounce is becoming more likely. This shift could lead to an upward move.

The key target levels to watch for are $0.000052, $0.000078, $0.000117, and $0.000160. These levels represent potential areas of resistance where the price could face challenges. The FLOKI token is currently at a critical point in the descending channel. If the support holds, the price could rise toward these targets, reflecting a possible trend reversal.

Crypto World

BTC slides to $65,000, Solana, XRP, dogecoin down 6%

Bitcoin’s attempt to reclaim $70,000 earlier in the week lasted about 48 hours.

The largest cryptocurrency slid to $65,735 in early Asian hours on Saturday, down 3% over the past day and 2.8% on the week. Wednesday’s rally, which came within touching distance of $70,000, has now given back more than half its gains as broader risk sentiment deteriorated through Thursday and Friday’s U.S. sessions.

Altcoins took a harder hit. Solana dropped 6.7%, ether fell 6.2%, dogecoin shed 5.1%, and XRP lost 4%. The losses pushed most major tokens into the red on a weekly basis, erasing the altcoin outperformance that had been the week’s most encouraging signal. BNB held up better than most, down just 2.5%.

The trigger was familiar. Friday’s U.S. session saw the S&P 500 close down 0.4%, the Nasdaq 100 drop 0.3%, and the Dow fall 1.1%. Nvidia, still digesting its post-earnings reaction, shed another 4.2%.

A hotter-than-expected 0.5% jump in producer prices added fuel, signaling inflationary pressure that may keep the Fed from cutting rates anytime soon. Block Inc.’s massive layoffs fanned broader anxiety that AI is starting to displace jobs across the economy rather than just creating them.

Crypto followed equities lower, but as usual, with amplified magnitude. A 0.4% drop in the S&P became a 3% drop in bitcoin and a more than 6% drop in altcoins. The leverage that re-entered the system during Wednesday’s rally got flushed on the way back down.

The irony is that the institutional flow data this week was actually strong.

U.S. spot bitcoin ETFs added $1.1 billion in three days, putting them on pace for their best week in months. But ETF inflows haven’t been enough to overcome the broader macro headwinds.

“Over-analysis of short-term price movements is misguided,” said Dom Harz, co-founder of bitcoin finance firm BOB said in an email. “Bitcoin’s volatility is no surprise, particularly for early investors who have experienced previous cycles. What’s different this time is the type of capital behind the emerging asset class.”

Meanwhile, CryptoQuant data shows USDT stablecoin reserves on exchanges have fallen from $60 billion to $51.1 billion over the past two months, a decline the firm warned could trigger a “massive sell-off” if reserves drop below $50 billion.

Elsewhere, Strategy shares topped the list of large U.S. companies by short interest volume as markets increasingly question the sustainability of the firm’s debt-funded bitcoin buying program.

And on the Ethereum side, large holders have started selling at a loss, with DAT company ETHZilla officially abandoning its ETH accumulation strategy and rebranding to focus on tokenized real-world assets instead.

Bitcoin is now back in the middle of the $60,000-$70,000 range it has been stuck in since the Feb. 5 crash. Wednesday proved the top of that range is resistance. The question heading into March is whether the bottom still holds.

Crypto World

MetaMask debit card goes live across the U.S.

MetaMask and Mastercard have officially launched the MetaMask Card across the United States, marking a significant step in bringing cryptocurrency spending into everyday commerce.

Summary

- MetaMask and Mastercard begin offering the self-custodial MetaMask Card in 49 states, including New York.

- Users spend directly from their wallets, with up to 1% back in mUSD for standard users and up to 3% for premium members.

- The card works at over 150 million Mastercard merchants and supports Apple Pay and Google Pay.

New MetaMask and Mastercard card lets users spend crypto

The announcement follows successful pilot programs in Europe and the UK, and now brings the self-custodial crypto payment card to 49 U.S. states, including New York for the first time.

The MetaMask Card connects users’ self-custodied digital assets to traditional payment infrastructure, allowing holders to spend crypto directly from their wallets anywhere Mastercard is accepted, online or in physical stores, without needing to pre-load balances onto custodial accounts.

Users retain full control of their funds until the point of sale, where conversion and payment happen seamlessly.

“We designed MetaMask Card to make crypto disappear. Not go away, but become so seamlessly woven into daily life that the line between onchain and offchain fades away entirely,” said Gal Eldar, Product Lead at MetaMask.

Issued by FDIC-insured Cross River Bank and powered by Mastercard’s global network with technology from Monavate (formerly Baanx), the card works with Apple Pay and Google Pay, making it compatible with contactless digital wallets. The rollout follows a year-long U.S. trial that began in late 2024, with broader access now available nationwide.

A key feature of the program is on-chain rewards: standard MetaMask Card holders earn up to 1% back in MetaMask’s stablecoin mUSD on purchases, while premium MetaMask Metal subscribers, available for a $199 annual fee, can earn up to 3% back on the first $10,000 spent each year alongside additional travel and spending benefits.

The launch represents a strategic effort to integrate decentralized finance into traditional payment rails, making crypto use more intuitive for everyday purchases while preserving self-custody principles at the heart of Web3.

It also positions MetaMask alongside other crypto-native payment cards, expanding crypto’s real-world utility.

Crypto World

Bitcoin ETFs Log $1B Inflows During 50% Drawdown

Spot Bitcoin exchange-traded funds pulled in more than $1 billion of net inflows over three trading sessions this week, a reversal that came even as Bitcoin remained well below its peak.

The US-listed spot Bitcoin (BTC) ETFs logged a combined $1.02 billion in inflows from Tuesday to Thursday, according to data from SoSoValue. The funds pulled in $506.51 million on Wednesday, the largest single-day total during the three days.

On Friday, ETF analyst Nate Geraci said in a post on X that investors appeared to be “buying the dip” amid the recent downturn.

He said spot Bitcoin ETFs have seen about $6.5 billion in outflows since Bitcoin’s record high in early October, a figure he described as modest relative to the $55 billion the category has absorbed since January 2024.

Related: Bitcoin’s 100 BTC club edges toward 20K wallets in a ‘bullish sign’

“50% drawdowns are walk in the park for long-time BTC investors,” Geraci wrote. “But appears newer ETF investors aren’t worried either.”

Flows reverse multi-week outflow streak

This week’s inflows follow five consecutive weeks of net withdrawals, with the last two weeks of January recording a combined $2.82 billion in outflows.

The rebound was led by BlackRock’s iShares Bitcoin Trust (IBIT), which logged $275.82 million in net inflows on Thursday alone. Fidelity’s FBTC and Ark 21Shares’ ARKB posted outflows, but were outweighed by gains in other funds including Bitwise’s BITB and Grayscale’s BTC.

Altcoin ETFs have also turned positive in recent trading sessions. Spot Ether (ETH) ETFs added about $173 million over the same three-day period, while Solana funds logged roughly $35 million in inflows. Meanwhile, XRP (XRP) ETFs logged a modest $7 million in inflows.

Related: Bitcoin bear market not over as BTC fails to reclaim $68K trend line

Analysts flag ETF flows as sentiment gauge

The inflows come as market participants discuss whether the recent selling pressure is easing. On Friday, several analysts said Bitcoin’s roughly 50% drawdown may be approaching exhaustion.

CoinEx chief analyst Jeff Ko previously told Cointelegraph that improvements in spot ETF inflows suggest aggressive selling pressure may be fading. However, he said a sudden V-shaped recovery is unlikely after a steep decline.

Bitrue research lead Andri Fauzan Adziima similarly pointed to oversold technical indicators and said sustained ETF inflows could serve as a catalyst for stabilization.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

MARA partners with Starwood to build AI data centers, shares rally 17%

Bitcoin miner MARA Holdings has announced a partnership with Starwood Property Trust to develop AI-focused data centers.

Summary

- MARA has entered a strategic partnership with Starwood Capital Group to convert select U.S. Bitcoin mining sites into AI focused hyperscale data centers.

- The joint venture will target roughly 1 gigawatt of short-term IT capacity, with plans to expand beyond 2.5 gigawatts

According to a Feb. 26 announcement, the two companies have entered into a strategic agreement to “jointly develop, finance, and operate digital infrastructure projects across MARA’s existing, power-rich portfolio.”

As part of the agreement, MARA will work with Starwood Capital Group’s data center development arm, Starwood Digital Ventures, to convert and expand select U.S. Bitcoin mining sites into hyperscale data center campuses capable of serving enterprise, cloud, and AI workloads.

“MARA’s power rich sites give customers what they need most: predictable access to energy at scale. Our partnership with Starwood will allow us to turn that power certainty into capacity certainty, so customers can run diverse workloads close to their data and users,” MARA’s Chairman and CEO Fred Thiel said in a statement.

The partnership will focus on sites that have access to low-cost energy and strong grid interconnection positions, which would then support both Bitcoin mining operations and AI-driven high-performance computing workloads.

The companies expect to deliver approximately 1 gigawatt of near-term IT capacity, with plans to scale that figure to more than 2.5 gigawatts over time.

MARA shares surged more than 15% in after-market trading following the announcement of the Starwood partnership. Shareholders perceived the joint venture as a strategic diversification move, especially after the company’s disappointing earnings report revealed a $1.7 billion quarterly net loss and falling revenues.

As previously reported by crypto.news, crypto mining stocks, including MARA, have struggled over the past months as a result of a market-wide downturn and tight profit margins.

At the same time, a powerful winter storm in January pushed Bitcoin hashrate to a seven-month low as several U.S. miners had to power down or throttle operations to ease pressure on strained electricity grids.

Crypto World

Flip These Key Resistance Levels to Support

Bitcoin bulls were battling to flip three resistance levels back into support by the end of the week, but history shows they may need to wait another month.

Bitcoin (BTC) is battling three key resistance levels at once, and the end of the bear market may depend on breaking them in March.

Key takeaways:

-

Bitcoin still faces three resistance levels on the weekly chart after its midweek gains.

-

Bitcoin is down 14% in February, the fifth consecutive red month for BTC price.

Bitcoin bulls attempt three support flips

Data from TradingView showed the BTC/USD pair hovering around $67,720 after being rejected by the $70,000 psychological level.

An analysis of the current market structure points to a cluster of barriers that have merged into a resistance area, as shown in the chart below.

The 200-week exponential moving average (EMA) at $68,330, the old 2021 all-time high at $69,000, and the psychological level at $70,000 are capping the price rebound at the time of writing.

BTC failed to reclaim any of these levels following its climb to $70,040 on Wednesday. Commenting, analyst Captain Faibik said that Bitcoin needs a weekly candlestick close above the 200-week EMA for the bulls to maintain momentum.

If this happens, “we can then expect a bounce back toward 80k in the coming days,” the analyst said in a recent post on X, adding:

“I think March is going to be a bullish month.”

As Cointelegraph reported, the bear market may end if the BTC price breaks above the cost basis of the 18-24-month age band at $74,500.

Bitcoin heads for five straight months of losses

Historical price data from CoinGlass confirmed Bitcoin is facing its fifth consecutive red month, down 14% in February. The last time this happened was toward the end of 2018 at the depths of the bear market.

“Bitcoin is nearing a rare bearish streak,” Alex said in a recent post on X, adding:

“Last time in 2018 and 2019, the streak was followed by five strong green candles and a 4x rally.”

After a 57% decline between August 2018 and January 2019, Bitcoin then recorded five consecutive green months, gaining 317% to $13,880 from $3,329.

If history repeats, the reversal could begin in April, particularly as selling pressure nears exhaustion levels.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Morgan Stanley plans to offer in-house Bitcoin custody, trading, and yield products

Banking giant Morgan Stanley has plans to offer multiple Bitcoin-related product offerings in the future, according to its digital assets strategy head Amy Oldenburg.

Summary

- Morgan Stanley is weighing plans to let clients custody and trade Bitcoin directly on its platform, with yield and lending services also under discussion.

- The bank plans to build its Bitcoin infrastructure in-house to meet reliability standards.

Morgan Stanley currently manages roughly $9 trillion worth of assets, and it will consider giving its clients the option to custody and trade Bitcoin directly on its platform, Amy Oldenburg said during her appearance at the Bitcoin for Corporations conference in Las Vegas on Feb. 26.

Regarding Bitcoin-based yield and lending services, she said that it was a “natural part of the roadmap to continue to explore,” but added that the firm is still “early in the journey.”

However, the banking giant plans to develop its Bitcoin infrastructure from scratch through an in-house offering to ensure reliability and control over the technology stack.

“People expect Morgan Stanley—they trust our brand—to be no-fail. When you sit in that position, you have a significant responsibility to your clients to make sure that you’re delivering that in any level of technology,” Oldenburg said.

Further, she confirmed that the bank already has “a considerable number” of cryptocurrencies that its clients hold off-platform, but added that she does not expect all of those assets to flow into Morgan Stanley’s custody solutions, noting that self-custody remains a natural part of the space, particularly within the Bitcoin community.

Morgan Stanley was once cautious toward crypto-related offerings, but the Wall Street giant has gradually warmed up to the space under a more favourable regulatory climate following the election of United States President Donald Trump.

Last year, analysts at the firm increased their recommended crypto allocation from 1% to 2% for income and balanced growth portfolios to up to 4% for strategies focused on what they described as “opportunistic growth.” They have also called Bitcoin “akin to digital gold,” describing it as a scarce asset that can potentially offer long term value within diversified portfolios.

The bank has also confirmed plans to offer retail trading services for Bitcoin, Ethereum, and Solana through its E*Trade app as part of its broader digital asset push. Last month, it filed three separate crypto fund registrations tied to these assets.

Crypto World

Morgan Stanley applies for OCC Bank Charter to Custody Crypto Assets

Morgan Stanley is moving deeper into digital assets by pursuing a de novo national trust charter that would let the firm custody crypto assets for clients and facilitate related trading activities. A public filing with the Office of the Comptroller of the Currency on February 18 identifies the applicant as “Morgan Stanley Digital Trust, National Association.” If approved, the charter would empower the bank to act as a fiduciary, offering custody and asset safekeeping, as well as handling purchases, sales, swaps and transfers to support client portfolios, including activities such as staking. The initiative marks a formal expansion of the firm’s crypto ambitions and aligns with a broader push among Wall Street institutions to embed digital assets into traditional banking models. Bitcoin (CRYPTO: BTC) and Solana (CRYPTO: SOL) figures loom large in the charter’s contemplated scope, signaling Morgan Stanley’s intent to cover both base assets and more complex crypto strategies under a regulated umbrella.

The bank’s business outline emphasizes that the de novo trust would custody digital assets on behalf of clients, execute trades, and support investment activities across a spectrum of crypto products, including staking services. In practice, that means the unit would be positioned to handle fiduciary duties for crypto assets, while offering a suite of services common to traditional trust operations—trust accounts, safekeeping, and other custody functions—tailored to digital assets. While the document remains the initial filing stage, the emphasis on custody, transfers and staking underscores a trend toward regulated, bank-based crypto infrastructure rather than standalone crypto-only firms.

This charter would mark Morgan Stanley’s first trust filing with a crypto-specific focus, following a wave of other de novo applications that emerged in 2025. The OCC oversees roughly 60 national trust banks in the United States, and the agency has been weighing how best to supervise crypto-focused custody among legacy financial players. The development sits within a broader, growing race to secure national trust banking charters related to digital assets. In December, the OCC conditionally approved five crypto-related national trust bank applications, including First National Digital Currency Bank, Ripple, BitGo, Fidelity Digital Assets and Paxos, signaling a warming yet tightly regulated path for institutions seeking regulated custody of crypto assets for clients.

As the hunt for crypto-banking licenses intensifies, other prominent approvals have flowed in recent months. Stablecoin-focused platforms Bridge, owned by Stripe, announced it had received conditional approval for a national trust bank charter, which was subsequently followed by Crypto.com’s own charter developments. The rapid succession of approvals highlights the OCC’s willingness to grant governance access to entities building regulated crypto rails, while simultaneously raising questions about standards, custodial practices and risk controls across a rapidly expanding ecosystem. The broader policy backdrop includes ongoing discussions about how to resolve questions around stablecoins, yield, and reserve management—issues that the OCC has signaled it intends to address through proposed rulemaking and clarifications for crypto-related banking activities.

Morgan Stanley’s deeper crypto push is reinforced by internal leadership moves and recruitment drives. In January, the bank elevated equity markets veteran Amy Oldenburg to lead its new digital asset unit, a signal of the firm’s intent to scale up expertise in tokenized strategies and custodial services. Public job postings show the bank aiming to grow its crypto team with roles such as digital assets strategy director and digital assets product lead, underscoring a structured, long-term commitment to crypto capabilities. Beyond staffing, Morgan Stanley has been pursuing a broader slate of crypto products, including exchange-traded funds tied to major crypto assets. The firm filed in January to launch spot Bitcoin and Solana ETFs, and later sought approval for a staked Ether ETF, underscoring a multi-asset approach that blends traditional finance with digital-native instruments.

The current filing and related moves illuminate a strategic shift at Morgan Stanley, reflecting both client demand for regulated exposure to crypto and the bank’s appetite to own a larger piece of the crypto value chain. The OCC’s evolving stance—facilitating de novo charters while pushing for clear risk controls and regulatory guardrails—appears to be shaping a landscape in which banks that embrace digital assets can build outsized roles in custody, settlement, and complex crypto transactions. For Morgan Stanley and peers, the practical implications go beyond branding; they are about creating a regulated, scalable platform that can support a wide array of crypto activities within the bank’s existing risk management and compliance framework.

Yet this environment remains nuanced. The OCC’s charters come with explicit expectations around fiduciary obligation, customer protections and robust governance. The broader debate around stablecoins—how they should be regulated, how yields should be treated, and how reserve backing is managed—continues to shape how these charters are structured and what activities are permitted. The agency has floated proposals and engaged with market participants on these issues, signaling that while the path to crypto custody within a bank charter is becoming clearer, it is not yet fully settled. As Morgan Stanley and others push forward, observers will be watching how the regulators balance innovation with resilience, liquidity management and systemic risk considerations.

Why it matters

The filing signals a significant step in the normalization of digital asset custody within mainstream financial institutions. If approved, Morgan Stanley would be among a cohort of banks offering regulated fiduciary services for crypto holdings, moving beyond advisory relationships into direct custody and execution capabilities tied to client portfolios. This could reduce friction for institutional investors seeking regulated exposure to digital assets and related strategies, potentially expanding the addressable market for crypto products within traditional wealth management and brokerage channels.

For the broader market, the move contributes to a more formalized, bank-led crypto infrastructure. The OCC’s involvement and the concurrent approvals of other crypto-focused national trust banks suggest a maturing regulatory pathway for custody, settlement and staking services—areas where risk controls and compliance frameworks are crucial. As regulated options proliferate, custody and financing arrangements may become more accessible to a wider audience, including sophisticated institutional players who require strong governance, transparent reserve practices and clear accountability. The development also reinforces the ongoing convergence between conventional financial services and digital asset technology, a trend that could influence product design, risk management practices and client expectations across the sector.

From a user perspective, a Morgan Stanley-led custody capability could translate into more integrated experiences: secure storage, easier access to a range of crypto products, and the potential to combine digital asset strategies with traditional portfolios under a single risk framework. For builders and policymakers, the evolving charter landscape underscores the need for clear standards around custody, custody risk, liquidity, settlement finality and disclosure. It also highlights the role of banks in providing the operational depth necessary to support regulated crypto markets, which could help attract more capital and liquidity into the sector while reassuring risk-conscious investors.

What to watch next

- OCC decision on Morgan Stanley Digital Trust, National Association’s de novo charter filing (watch for a published decision in the coming months).

- Reactions and approvals for other crypto-related national trust banks (Bridge, Paxos, Fidelity Digital Assets, Ripple, BitGo) and any new entrants (regulatory filings and conditional approvals).

- Morgan Stanley’s ongoing ETF filings and product launches related to BTC, SOL and ETH, including any updates to staking-related offerings.

- Regulatory developments around stablecoins and yield in the OCC framework, including any finalized clarifications or policy proposals that could influence custody charter risk controls.

SOURCES & verification

- Office of the Comptroller of the Currency: Filing details for Morgan Stanley Digital Trust, National Association — https://apps.occ.gov/CAAS_CATS/CAAS_Details.aspx?FilingTypeID=2&FilingID=344925&FilingSubtypeID=1093

- Forbes: 8 trillion Morgan Stanley quietly files for national trust charter — https://www.forbes.com/sites/jasonbrett/2026/02/27/8-trillion-morgan-stanley-quietly-files-for-national-trust-charter/

- Bloomberg: To Goldman with Love, Lloyd Blankfein’s life on Wall Street — https://www.bloomberg.com/news/articles/2026-02-27/to-goldman-with-love-lloyd-blankfein-s-life-on-wall-street

- Morgan Stanley appoints digital asset head Amy Oldenburg — https://cointelegraph.com/news/morgan-stanley-appoints-digital-asset-head-amy-oldenburg

- Morgan Stanley files Bitcoin and Solana ETFs — https://cointelegraph.com/news/morgan-stanley-files-bitcoin-solana-etf

Key takeaways

- Morgan Stanley filed on February 18 for a de novo national trust charter named Morgan Stanley Digital Trust, National Association, with the OCC to custody digital assets and execute related trades and transfers for clients.

- The filing follows a wider OCC-driven wave of crypto-charter activity, including December approvals for First National Digital Currency Bank, Ripple, BitGo, Fidelity Digital Assets and Paxos, and other recent charter events involving Bridge and Crypto.com.

- The bank’s plan emphasizes custody, safekeeping and staking, signaling a broader strategy to embed crypto services within traditional banking infrastructure.

- Internal leadership moves underscore a scaling effort: Amy Oldenburg was appointed to lead the new crypto unit, and job postings indicate a broader recruitment drive for crypto-focused roles.

- Beyond custody, Morgan Stanley has pursued crypto product initiatives, including ETF filings for BTC and SOL, followed by a staked Ether ETF filing, illustrating a diversified, multi-asset approach.

Tickers mentioned: $BTC, $ETH, $SOL

Sentiment: Neutral

Market context: The filing sits within a widening regulatory and market push to normalize crypto custody within regulated banking channels, as the OCC signals cautious expansion of crypto-enabled services alongside ongoing debates on stablecoins and risk controls.

Why it matters

The development highlights a path to regulated, bank-led crypto custody that could lower barriers for institutional investors seeking compliant exposure. If approved, Morgan Stanley could offer integrated custody and execution services for digital assets within a framework that aligns with existing risk and compliance practices, potentially attracting more capital to crypto strategies managed under traditional financial oversight.

For market participants, this trend may translate into more predictable custody standards and greater liquidity for crypto products distributed through major banks. It also reinforces the importance of robust governance, reserve management and transparency as crypto services migrate from boutique fintechs to mainstream financial institutions. Regulators’ ongoing work—balancing innovation with financial stability—will shape how quickly and where such charter-enabled services scale in the near term.

Ultimately, Morgan Stanley’s push, alongside concurrent approvals and ETF filings, suggests that the line between traditional banking and digital asset services is continuing to blur. Investors and builders should monitor regulatory updates, endorsements by the OCC, and any official guidance that clarifies permissible activities, reserve requirements and disclosure norms for crypto custodians operating under national trust charters.

Crypto World

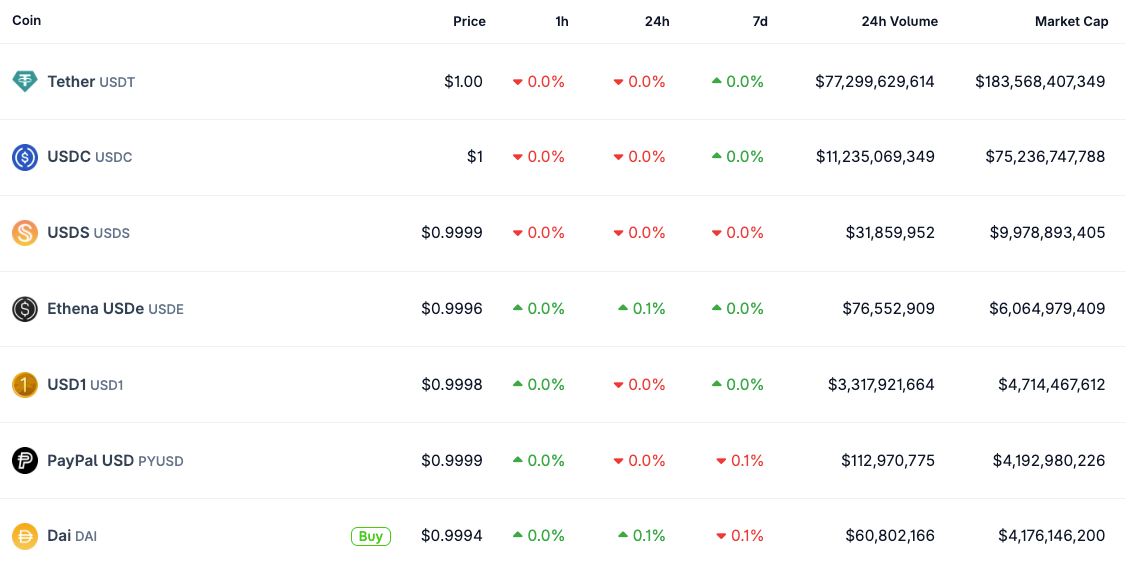

PayPal USD to Power App-Specific Stablecoins via PYUSDx

Payment giant PayPal is expanding access to its stablecoin through a new platform it says will allow devleopers to create their own US dollar-pegged tokens backed by PayPal USD.

PayPal, MoonPay and stablecoin platform M0 on Friday announced PYUSDx, a product aimed at helping developers launch PayPal USD (PYUSD)-backed stablecoins for use within applications, or tokens designed for use inside a particular app, platform or ecosystem, according to a joint announcement shared with Cointelegraph.

The companies said the rollout is planned for next month.

“The next phase of stablecoin adoption is happening at the application layer. Developers want to build differentiated experiences, but they shouldn’t have to rebuild trusted monetary infrastructure from scratch,” said May Zabaneh, PayPal’s head of crypto.

The launch comes as competition intensifies in the stablecoin market, with companies including Meta reportedly planning stablecoin-based payments across its suite of apps including Facebook, Instagram and WhatsApp.

PYUSDx combines M0’s universal stablecoin and MoonPay platform

Launched in August 2023, PayPal USD is a US dollar-pegged stablecoin issued by Paxos Trust Company, a federally regulated national banking association.

PYUSDx is separate from PYUSD and is described as a tokenization and issuance framework offered by MoonPay Digital Assets, the announcement said.

The companies said PYUSDx combines M0’s universal stablecoin and digital token platform with MoonPay Group’s infrastructure to simplify the launch of US dollar-backed stablecoins by reducing technical and operational burdens.

It also features fast launch speed, cross-chain compatibility, flexible economics, reserve transparency and the ability to create branded stablecoins.

“We’re excited to see MoonPay and M0 use PYUSDx to help bring new, application-specific stablecoins to market, anchored in a regulated, trusted foundation,” PayPal’s Zabaneh said.

Related: Stripe considers acquiring some or all of PayPal: Report

USD.ai, a decentralized finance protocol that issues stablecoins including USDai and yield-bearing sUSDai, is the first developer building on PYUSDx, using the platform to support an application-specific stablecoin for AI infrastructure.

PYUSDx tokens are separate from PayPal USD and cannot be used, sent or stored in PayPal or Venmo accounts, the announcement noted.

The launch of PYUSDx comes as PayPal continues expanding real-world use cases for its stablecoin. In late 2025, video-sharing giant YouTube reportedly enabled US-based creators to accept payouts in PYUSD, highlighting the growing adoption of the digital dollar beyond traditional finance.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

BTC Stuck Below $70K, Japan Inflation Below 2%: Month In Charts

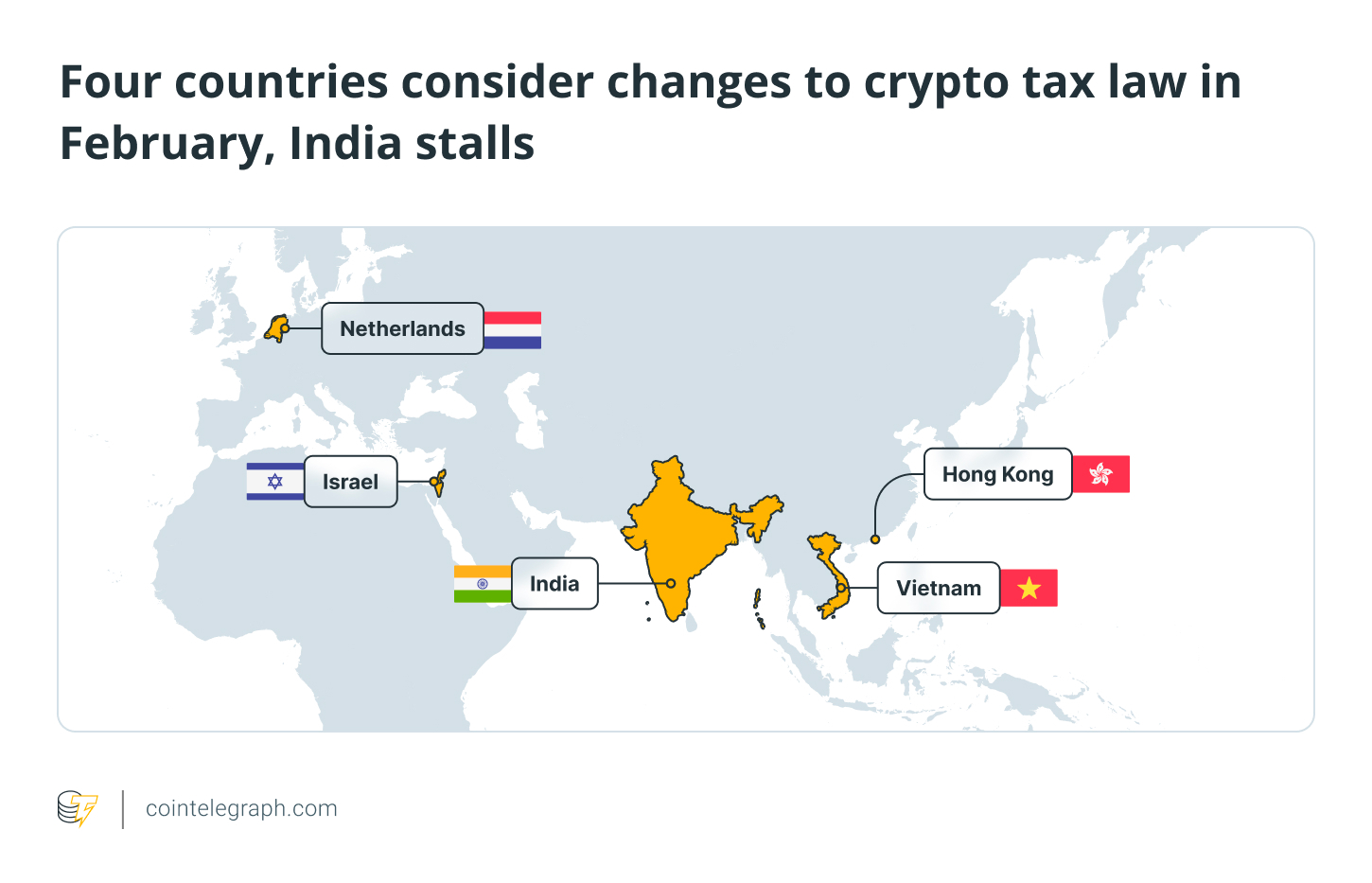

The taxman cometh. In February, the tax authorities of four countries began to reconsider how they tax crypto.

In the US, the number of crypto ATMs hit nearly 40,000, returning to 2021 levels of interest in crypto kiosks. The number of installations had dipped significantly after the crypto crash of 2022.

Japan’s inflation dipped below 2% in February, less than in the United States. Berkshire Hathaway CEO Warren Buffett said earlier this year that dollar investments were looking less attractive as the yen is providing a more stable currency.

Bitcoin (BTC) was stuck below $70,000 this month. Many crypto observers have noted that US tariffs are putting pressure on the asset. US President Donald Trump’s new 10% levy has done nothing to alleviate this.

Here’s February by the numbers:

Four countries consider changes to crypto tax laws in February

The Netherlands’ House of Representatives, the lower house of the country’s parliament, advanced a tax proposal on Feb. 12. The draft law would introduce a 36% capital gains tax on unrealized gains on savings and liquid investments, including crypto.

Critics say the tax, which is supported by 93 of the 150 representatives, will chase money out of the country.

Detractors appear to have won out. The new Dutch cabinet said that it will reconsider the measure.

“There is a lot of criticism of the Actual Return Act. We are not deaf to that … The bill needs to be amended. The Minister and State Secretary will discuss this with the Senate and parliament,” a cabinet spokesperson said.

In Israel, the Israeli Crypto Blockchain & Web 3.0 Companies Forum launched a lobbying effort to reform the country’s crypto tax laws. Forum leader Nir Hirshmann-Rub said there is broad public support to relax laws on stablecoins and tokenization, as well as simplify compliance.

He noted that many Israelis already own and invest in crypto. “More than 25% of the public already has had crypto dealings in the last five years and more than 20% currently hold digital assets,” he said.

In Hong Kong, Financial Secretary Paul Chan said that the special administrative region is tweaking its tax laws. He said the Inland Revenue Ordinance will implement the Organisation for Economic Co-operation and Development’s Crypto-Asset Reporting Framework (CARF).

The CARF is a global tax exchange standard for crypto that aims to tackle tax evasion. It requires crypto service providers to report on client activity.

Vietnam has proposed a crypto transaction tax. Crypto transfers and trading would be exempt from the usual value-added tax. But transferring crypto assets through licensed service providers would incur a 0.1% personal income tax on the transaction value.

In India, which imposes a flat 30% tax on crypto gains and doesn’t allow users to offset losses, calls to reform the law have fallen on deaf ears. Despite intense lobbying, the proposed 2026 Union Budget did nothing to reform crypto tax.

Bitcoin stays below $70,000; Trump raises tariffs 10%

Bitcoin has had a rough past couple of months, and in February, it struggled to breach the $70,000 mark.

Analysts have cited several macro pressures on Bitcoin’s price. One is the lack of progress on the CLARITY Act, the US’ proposed framework for cryptocurrency markets. Lawmakers can’t agree on ethics provisions or possible bailout provisions, and prominent lobbies, namely the crypto and banking lobbies, are at loggerheads over stablecoin interest.

Related: When will crypto’s CLARITY Act framework pass in the US Senate?

Chris Waller, a governor of the United States Federal Reserve, said, “The lack of passing of the CLARITY Act I think has kind of put people off on this.”

Another issue is tariffs. The US Supreme Court invalidated the tariffs Trump implemented using the 1977 International Emergency Economic Powers Act (IEEPA). Trump responded by hiking global tariffs 10% using the Trade Act of 1974 as a legal foundation.

Crypto analysts and observers have noted the negative effect Bitcoin has on markets. Swan CEO Cory Klippsten said, “The biggest drag on Bitcoin price the past year has been tariffs … That’s the drag on risk assets in general, and in particular [with] Bitcoin, there’s just uncertainty around what’s gonna happen.”

Japan’s inflation dips below 2%, and Takaishi takes elections

The inflation rate of the Japanese yen has dipped below that of the dollar, falling below 2%, its lowest in three years.

The new inflation low for the yen comes after Prime Minister Sanae Takaichi called for snap elections. The gamble hoped to restore the majority of the Liberal Democratic Party (LDP) to a parliamentary majority.

The gambit paid off, and now the LDP dominates the Japanese House of Representatives, the National Diet’s lower house, with a 316-member two-thirds majority.

Stock markets in Japan responded well. The Nikkei 225 (JP225) increased 10% on the month, spiking significantly after the Feb. 9 election.

[chart]

Japanese JP225 is up over 10% in February.

This could spell short-term trouble for Bitcoin, which tends to correlate with US equities, according to XWIN Research Japan. The increasing attractiveness of Japanese bonds could slow into US equity exchange-traded funds.

Related: BTC traders wait for $50K bottom: Five things to know in Bitcoin this week

Buffett said that his company will increase its investments in Japanese trading houses. These include five major “sogo shosha,” or wholesale companies: Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo.

Crypto ATMs number 40,000 as companies add new requirements

The number of cryptocurrency kiosks worldwide grew by 290 in February, bringing the total number up to nearly 40,000, according to data from Coin ATM Radar.

[graph]

290 crypto ATMs opened globally in February.

The number of cryptocurrency kiosks has fluctuated over the years. The total number dropped significantly after the crypto crash of 2022.

[graph]

Crypto ATMs globally now number nearly 40,000.

Regulators worldwide have raised concerns over crypto ATMs and the possibility of their use in money laundering, as well as scams. Some companies have taken strides to allay these concerns.

In February, the biggest Bitcoin ATM operator in the US, Bitcoin Depot, began phasing in user ID requirements for its terminals in the United States. The move followed pressure from regulators and lawmakers nationwide.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

XRP price prediction as Ripple announces funding push for XRP Ledger

Ripple’s latest funding push for the XRP Ledger is drawing renewed attention to XRP, with traders closely watching whether the ecosystem expansion can translate into sustained price momentum.

Summary

- Ripple boosts XRPL funding: New grants and investments aim to accelerate DeFi, tokenization, and enterprise adoption.

- XRP consolidating near $1.40: Price remains range-bound between $1.35 and $1.50 after February volatility.

- Breakout level to watch: A move above $1.50–$1.60 could signal bullish continuation, while $1.35 remains key support.

While the Ripple token (XRP) remains range-bound near $1.40, the announcement might reinforce bullish long-term sentiment around the network’s growth prospects.

In a recent blog post, Ripple detailed expanded financial backing for developers building on the XRP Ledger (XRPL), including grants and strategic investments targeting compliance-first DeFi, real-world asset (RWA) tokenization, and enterprise-grade blockchain solutions.

The initiative is designed to deepen liquidity, expand institutional participation, and strengthen core infrastructure.

By prioritizing regulated DeFi applications and tokenization frameworks, Ripple is positioning XRPL as a scalable, enterprise-ready network aligned with global financial standards. The move shows Ripple’s strategy of pairing institutional partnerships with grassroots developer growth, a combination that could enhance long-term demand for XRP as a utility asset within the ecosystem.

XRP price analysis

XRP is currently trading around $1.40, up modestly on the day, as price action consolidates following a sharp early-February decline that briefly drove the token toward $1.20 before a rebound.

Since that capitulation move, XRP has traded within a tight $1.35–$1.50 range, signaling potential accumulation. Immediate resistance stands near $1.50, with a stronger ceiling around $1.60, where prior rejection occurred.

A confirmed breakout above $1.60 could open the door toward $1.80. On the downside, key support remains at $1.35, followed by the psychological $1.20 level.

Meanwhile, the RSI (14) sits near 42, below the neutral 50 mark, indicating subdued bullish momentum but no longer oversold conditions. Meanwhile, the DMI shows the negative trend line still leading, though the gap is narrowing, suggesting bearish pressure may be weakening.

A decisive move above $1.50, particularly on rising volume, would be needed to confirm a bullish shift.

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports4 days ago

Sports4 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion9 hours ago

Fashion9 hours agoWeekend Open Thread: Iris Top

-

Politics4 days ago

Politics4 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business3 days ago

Business3 days agoTrue Citrus debuts functional drink mix collection

-

Politics1 day ago

Politics1 day agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business6 days ago

Business6 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business5 days ago

Business5 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat2 days ago

NewsBeat2 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Tech3 days ago

Tech3 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat2 days ago

NewsBeat2 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech5 days ago

Tech5 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat5 days ago

NewsBeat5 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics6 days ago

Politics6 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business2 days ago

Business2 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat3 days ago

NewsBeat3 days agoPolice latest as search for missing woman enters day nine

-

Business1 day ago

Business1 day agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Sports5 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week