Crypto World

Is Now the Best Time to Buy the Dip or Sell?

Join Our Telegram channel to stay up to date on breaking news coverage

Pepe (PEPE) has experienced a volatile week, reigniting debate among traders and investors over whether the meme coin’s recent decline presents a buying opportunity or signals deeper downside ahead.

At the time of analysis, PEPE is down more than 2% on the day and roughly 17% over the past week, reflecting broader weakness across the cryptocurrency market.

This downturn comes as the wider crypto sector faces heavy selling pressure, with both major assets and meme coins posting notable losses. The key question now is whether the market is nearing a reversal or if the current move marks the early stages of a broader downward trend.

Crypto Market Under Pressure, but Analysts See Opportunity in Pepe

Market-wide conditions remain challenging in late January 2026. Most meme coins have dropped more than 5% on the day, and many large-cap cryptocurrencies continue to trade lower.

Bitcoin has struggled to maintain momentum and now trades near the $86,000 level after more than $700 million in liquidations. Despite the selling pressure, some analysts view Bitcoin’s ability to hold key support levels as a sign of underlying market resilience.

In the past, similar periods of sharp but contained weakness near the start of a new month have often led to short-term rebounds.

This dip has pushed many investors toward established assets with a strong recovery history, with some pointing to Pepe (PEPE) as one of the best meme coins to buy during market pullbacks.

To stay updated on these shifting trends and potential reversal points, the 99Bitcoins YouTube channel provides essential market deep-dives.

Pepe Price Analysis

From a price perspective, PEPE shows mixed signals across multiple timeframes. As of January 26, 2026, the token has dropped about 6% on the day and 17% on the week, yet it has gained more than 16% on the monthly chart.

This performance shows that despite recent volatility, PEPE continues to hold higher support levels compared to its 2025 price action.

Although the token still trades more than 60% below its previous all-time highs, many analysts argue it sits just one major catalyst away from a meaningful recovery, driven by rising market confidence and steady accumulation from long-term holders.

Technical indicators support a potential bullish recovery. On the daily and weekly charts, PEPE forms a classic cup-and-handle pattern, which traders often associate with strong breakout moves. The Relative Strength Index (RSI) has stabilized in neutral territory around 45 to 50, while the spot taker cumulative volume delta (CVD) has shifted toward buy-side dominance.

These signals suggest accumulation during the current consolidation phase rather than distribution. Analysts now target a potential 45% rally toward the $0.0000069 resistance zone if buyers maintain control of the spot market.

Pepe Price Prediction

Optimism extends beyond technicals, as community sentiment remains strong despite limited updates from official channels. Influential voices such as Steph Is Crypto suggest PEPE could create a new wave of millionaires within the next two to three months.

$PEPE will create many new millionaires in the next 2-3 months! pic.twitter.com/pmcNcfER4I

— STEPH IS CRYPTO (@Steph_iscrypto) January 24, 2026

While extreme targets like a $1 PEPE remain highly speculative due to the token’s large supply, a move toward higher fractional valuations would still deliver significant upside from current levels.

At the same time, a more cautious group of traders, including CryptoLinx, warns that a head-and-shoulders pattern may be forming. This bearish structure recently retested and rejected its neckline, raising the risk of a deeper pullback if broader market conditions weaken.

$PEPE has formed a head and shoulders pattern.

We just had a retest of the neckline and got rejected.

The target remains ~73% lower from here.

This would likely be my bear-market target. pic.twitter.com/JOU0GZPgTK

— CryptoLinx (@Aidanisenor123) January 20, 2026

In that scenario, PEPE could retrace by as much as 73%, with a break below the $0.0000043 support level likely confirming a trend reversal.

The next few days remain critical. If PEPE holds its current base, the cup-and-handle setup stays intact. If it breaks down, the head-and-shoulders pattern could drive a sharp but healthy market reset.

As investors weigh the risks of high-cap meme coins, many now diversify into low-cap crypto projects in search of higher upside potential. Bitcoin Hyper (HYPER) stands out in this space, operating as a high-performance Layer-2 solution that brings Solana-level speed to the Bitcoin network.

Pepe Traders Eye Bitcoin Hyper as a High-Upside Alternative

Bitcoin Hyper aims to fix one of Bitcoin’s biggest problems, transaction speed. Bitcoin offers strong security, but it cannot handle fast, low-cost payments or modern decentralized apps.

Bitcoin Hyper takes a different approach by combining the Solana Virtual Machine with Bitcoin’s network. This setup lets $HYPER process transactions at Solana-like speed and low cost while relying on Bitcoin for final security.

According to the whitepaper, users can move their BTC into the network, and developers can bring over existing high-speed applications without rewriting code. This design allows trading, lending, and even gaming to run with near-instant finality, far faster than Bitcoin’s 10-minute block times.

Bitcoin Hyper fills a clear gap in the ecosystem. Instead of moving assets to other chains, users can send BTC quickly and cheaply within the Bitcoin environment. After focusing on development through much of 2025, the project now appears close to launch.

The team has submitted the smart contracts for full audits by Coinsult and SpyWolf, and while no official date exists, the protocol likely launches in the first half of 2026. Until then, presale holders can stake $HYPER tokens and earn up to 38% APY.

Cryptonews YouTube channel has consistently featured the project on their website. If you are interested in the best crypto presales, visit and subscribe to their site for updates.

With the token priced just above one cent during the presale, Bitcoin Hyper still carries a relatively low market cap compared to established Layer-2 networks. If the project reaches valuations similar to mid-tier scaling solutions after launch, $HYPER could deliver strong upside from current levels.

So far, the project has raised $30.9 million, showing solid market confidence even before exchange listings.

Related News

- Get Educational Courses & Tutorials

- Free Content & VIP Group

- Jacob Crypto Bury Market Analysis Videos

- Leverage Trading Signals on Bybit

- Next 10x Altcoin Gems

- Upcoming Presales & ICOs

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Key Bitcoin On-Chain Signal Could Ignite BTC’s Next Demand Revival

Bitcoin’s on-chain signals have cooled after a run of elevated profitability and aggressive selling, suggesting a potential valuation reset rather than a definitive bottom. In the latest data reads, investor profitability has drifted back toward the long-run mean, while spot order flow shows signs of calmer unloading even as trading activity remains subdued. The interplay between valuation metrics and liquidity conditions is shaping expectations for when genuine spot demand could re-emerge and whether that would accompany a sustained trend reversal. Across the metrics, there is a defensively postured market rather than a clear pivot higher, at least for now.

Key takeaways

- Bitcoin’s market value to realized value (MVRV) has normalized after previously trading at extremes, signaling a shift back toward historical baselines rather than an overt undervaluation.

- Realized capitalization declined to about $1.09 trillion from a peak near $1.12 trillion in November 2025, reflecting roughly $33 billion in on-chain value leaving the network.

- Coins aged three to six months now represent 25.9% of the supply, the largest cohort in the dataset, indicating a substantial portion of holders purchased higher and are underwater on many positions.

- Spot cumulative volume delta (CVD) improved to -$161.5 million from -$177.1 million, while spot trading volume slipped to $6 billion from $7.6 billion, pointing to thinner participation and a more cautious posture among traders.

- Bitcoin has remained range-bound around $62,000–$64,000, suggesting supply absorption could pick up pace only if spot participation and risk appetite recover from current levels.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Neutral. On-chain signals suggest a balanced view rather than a clear, imminent move higher or lower.

Trading idea (Not Financial Advice): Hold. The combination of a mean-reverting valuation backdrop and thinner spot activity argues for patience until clearer demand signals emerge.

Market context: The data aligns with a broader phase of cautious liquidity in crypto markets, where on-chain metrics and macro- and risk-off sentiment influence how quickly fresh spot demand can materialize. While some coins’ outflows have stabilized, the absence of a decisive upshift in participation keeps near-term catalysts subdued.

Why it matters

The evolving on-chain picture matters because it reframes the risk-reward calculus for Bitcoin holders and potential entrants. A move back toward the long-run mean in MVRV implies that the market is not yet deeply undervalued, even as some segments of investors have capitulated in the sense of exiting positions near peak prices. The retrace in realized capitalization reinforces the notion that capital has been reallocated away from high-cost entrants, a behavior consistent with risk-off dynamics rather than aggressive accumulation.

From a supply-demand perspective, the aging cohort — coins held for three to six months — being the largest on record signals that much of the newly minted supply may be sitting underwater. That concentration creates a potential for a more pronounced impact if macro conditions or on-chain signals improve, but it also poses a risk: a wave of unprofitable sellers could re-emerge if price pressure intensifies. The literature around realized cap and MVRV suggests caution, as movements toward positive momentum have historically required renewed, broad-based demand rather than a few strong rallies.

On the liquidity side, the improvement in spot CVD alongside a drop in trading volume paints a portrait of restrained selling pressure rather than a sudden flood of buy orders. In prior cycles, periods where CVD tightened and price action stabilized often foreshadow a bottom, but only when participation recovers meaningfully. In this cycle, BTC has held within a relatively narrow corridor, which implies the market is digesting recent action rather than signaling an imminent breakout.

Analysts have pointed to a neutral-to-defensive posture in the current regime. The data does not indicate a forced capitulation, but it also stops short of confirming the onset of a sustainable upturn. The resulting stance mirrors a broader crypto market landscape where liquidity remains episodic, and traders await clearer macro cues and on-chain signals before reestablishing aggressive exposure.

In related analyses, researchers have flagged similar themes in other data points. For instance, discussions around excessive loss realization have highlighted potential pressure points that could push BTC below certain thresholds, while other research has underscored the possibility of a fair-value gap guiding price targets in different market environments. Taken together, these threads reinforce a cautious approach to near-term positioning until volatility and participation trends tilt decisively in favor of bulls.

What to watch next

- BTC price stability within the $62k–$64k range and any sustained breakout above or below these levels.

- Momentum in realized capitalization — whether the roughly $33 billion drawdown since November 2025 begins to reverse as new capital re-enters the market.

- The share of the supply held by the 3–6 month cohort and any shifts toward older or younger age bands, which could signal changing holder behavior.

- On-chain liquidity signals, particularly if spot volume begins to rebound from current lows and CVD moves toward positive territory.

- Any regulatory or institutional developments that could influence risk sentiment and bid/offer dynamics in spot markets.

Sources & verification

- On-chain profitability and MVRV normalization observations attributed to expert commentary on X, including excerpts from Chris Beamish.

- Realized capitalization levels and monthly change data tracked by on-chain analytics datasets (noting the $1.09 trillion level and the $33 billion decline from the November 2025 peak).

- Spot CVD and trading volume figures, including the move from -$177.1 million to -$161.5 million and the drop in spot volume from $7.6 billion to $6.0 billion.

- Analyses describing the distribution of coins by age, with the 3–6 month cohort comprising 25.9% of supply.

- Related studies and articles cited in the original material for context on potential price implications and fair-value considerations.

Bitcoin valuation indicators in focus

Bitcoin (CRYPTO: BTC) has been navigating a delicate balance between on-chain fundamentals and the psychology of risk markets. The normalization of MVRV away from extreme deviations suggests that investors are no longer chasing outsized upside with the same intensity as earlier in the cycle, while realized cap has cooled after peaking in late 2025. The 30-day realized cap is down about 2.26%, signaling that capital outflows have persisted, even as some long-term holders remain reluctant to surrender positions wholesale.

The market’s price behavior in the $62,000 to $64,000 zone has become a focal point. In many periods when CVD trends toward stability and the bid-ask dynamics thin out, price action tends to consolidate before the next leg — if there is one — depends on the injection of fresh demand. The current mix of data implies a neutral stance on near-term direction, with the potential for a more decisive move only if spot participation and new inflows pick up meaningfully.

These dynamics illuminate how market participants are weighing risk, returns, and capital preservation in an environment where on-chain signals can diverge from short-term price action. While the trajectory remains uncertain, the analytical framework suggests that bulls will need a sustained improvement in on-chain demand and liquidity to push BTC beyond a fresh milestone, beyond the immediate range that has defined recent trading sessions.

Crypto World

Jane Street Accused of Intentionally Attacking Terra

Terraform Labs is suing quantitative trading firm Jane Street for its role in the collapse of the Terra ecosystem.

Terraform Labs’ estate has filed a lawsuit against quantitative trading firm Jane Street, alleging that the firm abused insider knowledge to profit from Terra and that it inadvertently contributed to the downfall of the ecosystem.

“In this case, however, Jane Street Capital and its traders exploited the public’s participation in crypto markets and contributed to the collapse of Terraform’s cryptocurrency ecosystem. They did so by misappropriating confidential information and manipulating market prices,” the suit reads.

The filing is heavily redacted, but focuses on a move related to the UST Curve 3pool. Per Snyder, Terraform withdrew $150 million of UST from the pool, a move that “was not publicly announced,” to deploy it to 4pool in the coming week.

Nine minutes later, Jane Street allegedly made its “first and only sale of UST in that pool,” selling $85 million of UST in a single transaction.

Snyder says that the swap directly led to a steep selloff in UST that resulted in Terra’s subsequent death spiral, and accuses Jane Street of using its connections with Terraform Labs to “maximize its own profits and avoid losses suffered by other investors who did not have this confidential information.”

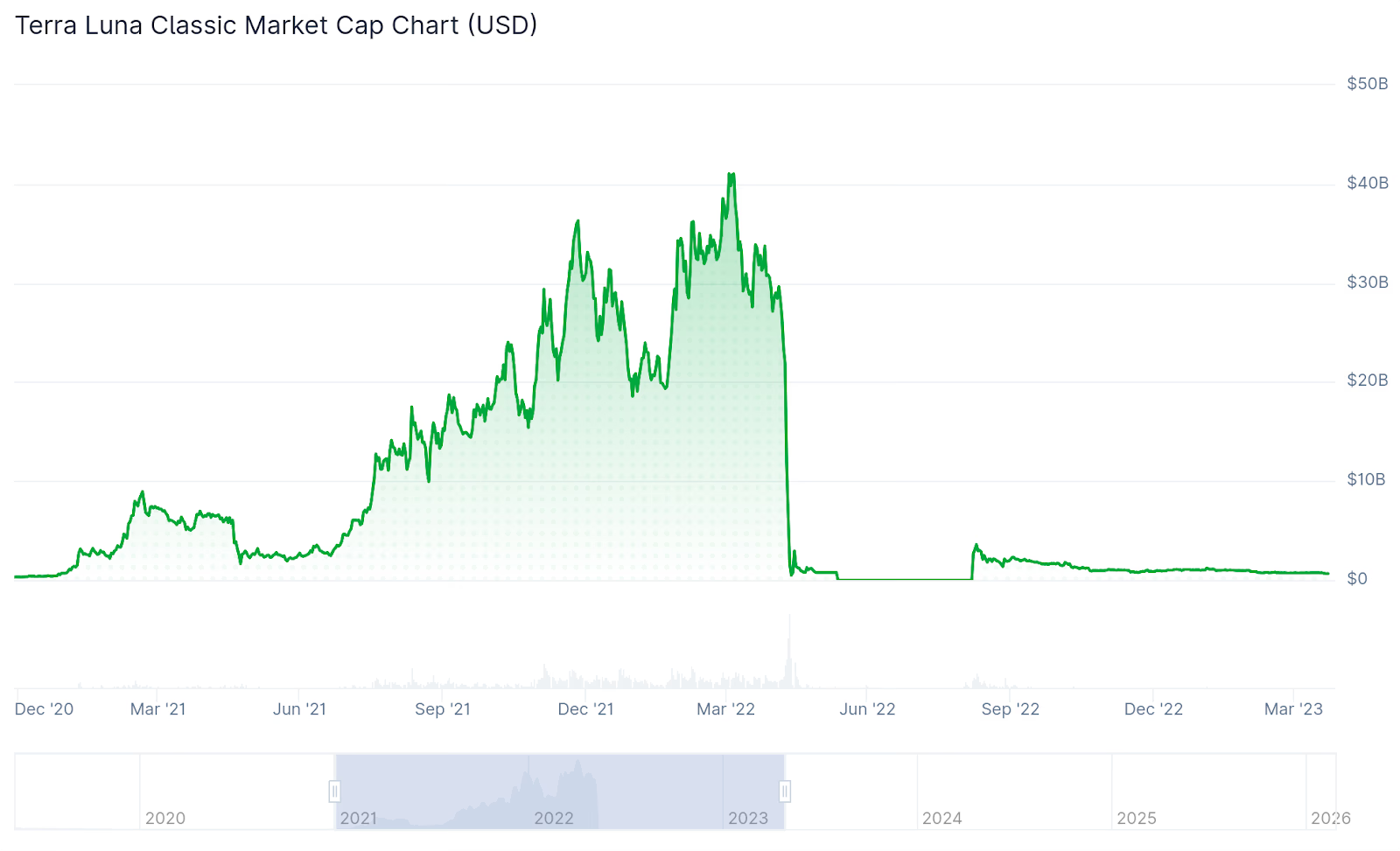

Following the UST depeg, LUNA, now LUNC, plummeted from a $29 billion market capitalization to nearly zero in a matter of days, after reaching as high as $41 billion in April 2022.

In December, Terra founder Do Kwon was sentenced to 15 years in prison, a sentence that exceeded the Department of Justice’s 12-year target, after Kwon pleaded guilty to fraud charges in August 2025.

Jane Street is one of the largest quantitative firms in traditional finance and crypto, with more than $650 billion in assets under management (AUM).

Crypto World

LINK price rebounds as SEC taps former LINK lawyer to head crypto task force

- SEC hires ex-Chainlink lawyer Taylor Lindman to head Crypto Task Force counsel.

- LINK rebounds near $8 but is still down about 51% over the past year.

- Chainlink (LINK) price analysis shows support at $6.80 and resistance near $8.19.

Chainlink (LINK) has rebounded slightly, though it is still in the red as the US SEC taps Chainlink’s veteran Taylor Lindman to head the Crypto Task Force counsel.

At press time, LINK was currently trading at around $8.18, recovering slightly from a low of $8.13. This rebound comes amid broader market volatility that has seen LINK fall roughly 51% over the past year.

SEC taps Chainlink veteran for crypto regulation

The US Securities and Exchange Commission (SEC) has appointed Taylor Lindman, formerly a senior legal officer at Chainlink Labs, as chief counsel for its Crypto Task Force.

Lindman brings over five years of experience in blockchain and regulatory compliance.

He played a key role in advising Chainlink on legal matters and navigating complex digital asset regulations before his departure in February 2023.

Lindman’s move to the SEC signals that regulators are increasingly interested in professionals with hands-on experience in decentralised finance (DeFi) and smart contract ecosystems.

SEC Commissioner Hester Peirce, who leads the Crypto Task Force, welcomed Lindman’s appointment.

Analysts suggest that Lindman’s expertise could influence future guidance and enforcement actions around digital assets.

LINK price performance

The market appeared to respond positively with institutional investors, including firms like Grayscale, steadily accumulating LINK tokens.

The continued institutional interest, combined with Lindman’s transition to the SEC, has reignited confidence in Chainlink’s long-term positioning.

Short-term technical indicators show that LINK recently found support at around $6.80, while the resistance at $8.19 has limited upward movement in the past.

The rebound above $8 could open the door for higher price action, while a fall below $6.80 might signal further downside risk.

Short-term LINK price prediction

With regulatory developments and institutional interest converging, LINK is drawing attention from both traders and long-term investors.

Its price movement over the next few weeks will likely reflect a mix of market sentiment, technical pressure, and evolving regulatory signals.

For short-term traders, analysts have highligted $6.80 as the immediate key short-term support level to watch. Holding above this level would suggest that the market is stabilising after recent volatility.

If LINK can break through the $8.19 resistance, the next target would be $9.51.

A sustained move above $10.80 could indicate stronger bullish momentum, attracting further buying interest.

On the downside, if the $6.80 support fails, traders should monitor the $5.38 zone as a potential safety net.

Price action around these levels will be critical in defining LINK’s short-term trend.

Crypto World

Bitcoin price defends $62,000, low volume signals weakness

Bitcoin price is holding above $62,000 support, but weak volume participation raises concerns that the current bounce lacks strength and downside risk remains.

Summary

- Bitcoin defending $62K support within broader range structure

- Low volume signals weak bullish conviction

- $60,000 range low remains key downside target if weakness continues

Bitcoin (BTC) price action has entered a consolidative phase after weeks of corrective movement, with the market recently testing daily support near the $62,900 region. This level has so far held firm, preventing an immediate breakdown and allowing price to stabilize within the broader trading range. While the defense of support may appear constructive on the surface, underlying market signals suggest caution remains warranted.

The recent bounce from support lacks convincing momentum, particularly when analyzing volume behavior. In healthy reversals or sustained rallies, price expansion is typically accompanied by strong bullish participation. However, current market conditions reveal subdued trading activity, raising questions about whether the move represents genuine accumulation or merely a temporary oversold reaction.

As long as volume remains weak, Bitcoin may struggle to transition into a sustained bullish trend, leaving the market vulnerable to further downside rotation.

Bitcoin price key technical points

- $62,900 daily support defended: Buyers preventing immediate breakdown

- Low volume weakens recovery: Lack of strong bullish participation

- $60,000 range low remains magnet: Continued rotation within broader range likely

Bitcoin’s recent reaction at the $62,900 support level demonstrates that buyers are still active within this region. The market has shown resilience by holding above support, preventing a rapid continuation lower. From a structural standpoint, this defense keeps Bitcoin trading within its established high-timeframe range rather than confirming a trend collapse.

However, price stability alone does not confirm strength. The bounce from support has occurred with noticeably low volume participation across the volume profile. Strong reversals typically require an influx of directional buying pressure capable of shifting market sentiment.

Without this participation, rebounds often fail to sustain momentum, even as broader institutional and regulatory developments, such as Arizona lawmakers advancing a digital assets reserve fund bill, continue to highlight growing adoption narratives.

This dynamic suggests that the current move may represent an oversold reaction rather than the beginning of a broader bullish recovery.

Volume profile reveals lack of conviction

Volume remains one of the most critical indicators in assessing market intent. In Bitcoin’s current structure, volume profile nodes reveal limited bullish conviction during the recovery phase. Despite holding support, buyers have not entered the market aggressively enough to drive expansion toward higher resistance levels.

When price rises on declining or weak volume, it often indicates short covering or temporary relief rather than genuine demand. These conditions frequently lead to renewed selling pressure once the initial bounce loses momentum.

The absence of strong bullish influx increases the probability that Bitcoin continues rotating within its broader range rather than initiating a breakout. Until volume expands meaningfully, the market remains susceptible to further corrective movement.

Range structure keeps $60,000 in focus

Bitcoin continues to trade within a clearly defined high-timeframe range between resistance near $72,000 and range-low support around $60,000. Markets operating within ranges often rotate between extremes when neither buyers nor sellers establish dominance.

Given the weak nature of the current bounce, the $60,000 range low becomes an increasingly likely destination. This level represents a significant liquidity zone and has historically attracted strong market reactions.

A move toward $60,000 would not necessarily invalidate the broader market structure but instead reinforce the ongoing consolidation phase. Range environments commonly feature multiple tests of support and resistance before a decisive directional move emerges.

This type of price behavior has recently been amplified by macro-driven volatility, with Bitcoin swinging sharply as tariff-related headlines triggered heightened discussion across crypto social media.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Bitcoin’s defense of $62,000 support remains constructive but fragile. Without a clear expansion in bullish volume, the current bounce risks fading into continued downside rotation.

If low participation persists, price is likely to revisit the $60,000 range-low support while continuing to trade within the broader $72,000 to $60,000 high-timeframe range.

Crypto World

Bitcoin Bloodbath: $370M Liquidations as Corporates Defend $60K

Bitcoin markets suffered a severe deleveraging event overnight, with over $370 million in forced liquidations flushing out leveraged longs as prices tumbled toward the $60,000 threshold.

While retail traders capitulated under the pressure of the sudden crypto market crash, corporate treasuries, led by aggressive accumulators like Metaplanet, stepped in to absorb the selling pressure.

The immediate direction of the market now hinges on whether bulls can defend the critical $60,000 level, a psychological and technical floor that separates a healthy correction from a deep bear market structure.

Key Takeaways

- Over $370 million in total crypto liquidations occurred in the last session, with Bitcoin futures open interest plunging 20% from its peak.

- Institutional accumulation persists despite the drop, with firms like Metaplanet executing strategic spot purchases to defend their average cost basis.

- Technical indicators mark $60,000 as the decisive line in the sand; a confirmed breakdown targets $55,000 as the next major liquidity zone.

Discover: The best meme coins in the world right now.

Why Is the Crypto Market Crashing?

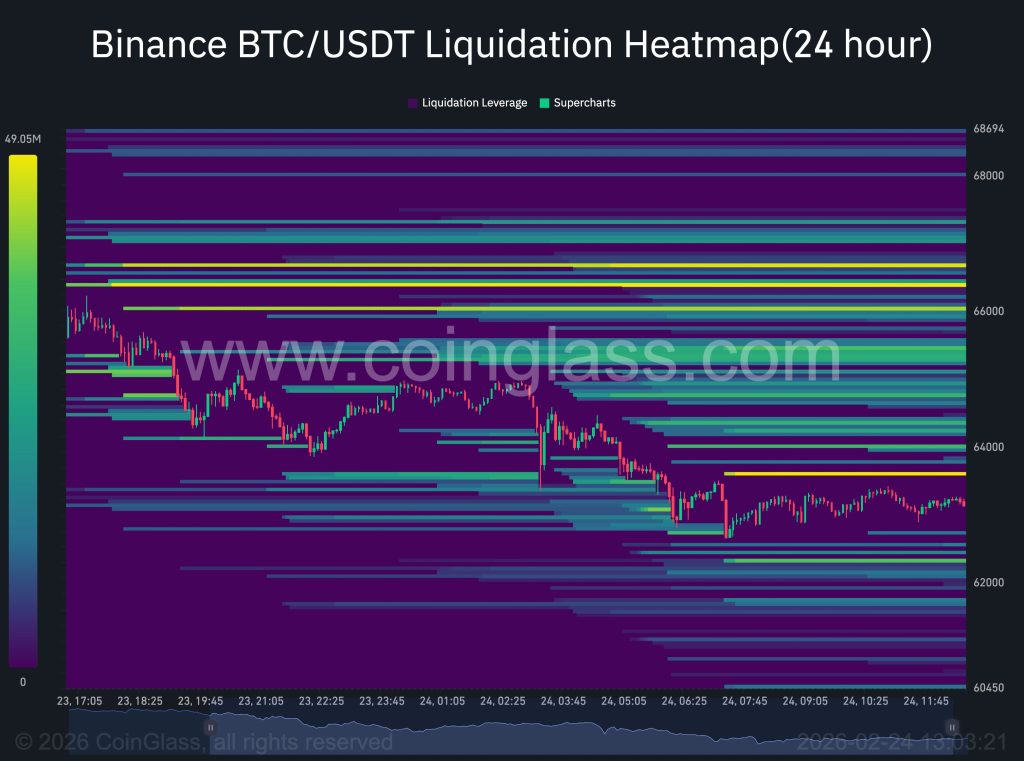

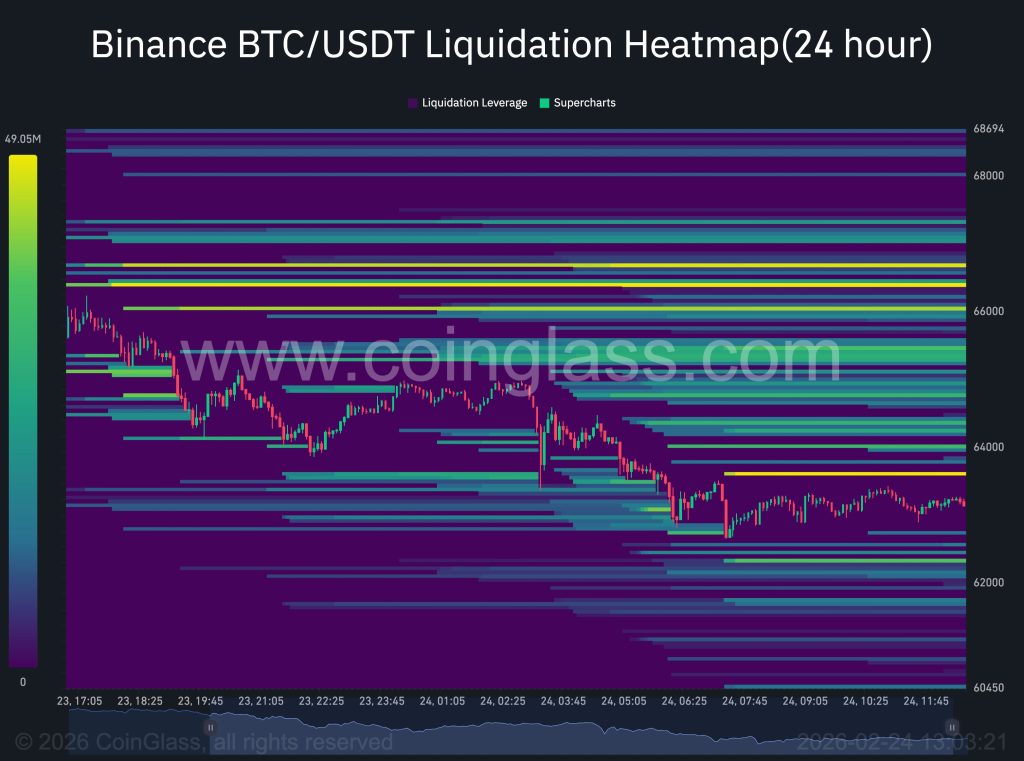

The sell-off was driven by a cascading liquidation loop rather than a fundamental breakdown. According to data from CoinGlass and major exchanges, the market wiped out over $370 million in positions, with long traders accounting for $275 million, or 74% of the losses.

This flush was exacerbated by a sharp decline in Bitcoin futures open interest, which dropped from $61 billion to $49 billion in a few days, a sign that speculative froth is being aggressively removed from the system.

Traders were caught off guard by the speed of the move. Earlier this month, in another drawdown, Bitcoin registered a -6.05σ rate-of-change drop, statistically comparable to the volatility seen during the FTX collapse.

The trigger for this volatility appears to be macro-driven, as fears regarding imminent tariff policies sent risk assets spiraling. When the price of Bitcoin dipped below the 200-day moving average, it triggered a chain reaction of stop losses, accelerating the Bitcoin liquidations.

Metaplanet and Treasuries Buy the Dip

While retail panic dominated the headlines, on-chain data reveals a different story among institutional accumulation desks.

Metaplanet, the Japanese investment firm modeling its treasury strategy after U.S. counterparts, is reportedly adding to its Bitcoin holdings during the downturn, according to X posts by CEO Simon Gerovich.

This behavior aligns with a broader trend of strategic accumulation, where corporates utilize sharp drawdowns to lower their cost basis rather than fleeing to cash.

This follows the precedent set by MicroStrategy. Michael Saylor hints at Strategy’s 100th Bitcoin buy often coincides with market fear, reinforcing the divergence between short-term speculators and long-term treasury hold strategies.

While the paper losses for these entities mount during a correction, their continued buying provides a localized floor, preventing the price from entering a complete freefall.

Bitcoin Price Analysis: Critical BTC Support Levels

The technical picture has reached a decisive juncture. Bitcoin is currently testing the BTC support levels at $60,000, a zone that aligns with high-volume nodes from late 2025.

The Relative Strength Index (RSI) on the daily chart has plunged into oversold territory, currently reading just under 30. Historically, such low RSI readings often precede a sharp mean reversion bounce, but the structural damage on the weekly timeframe remains a concern.

If bulls fail to defend $60,000, the path of least resistance flips to the downside. One CryptoQuant analyst recommends watching the $54,700 price level as the ultimate invalidation point for the bull case.

Sentiment markets are already pricing in this risk; Polymarket odds on a Bitcoin price drop to $55K have surged, reflecting growing skepticism about an immediate V-shaped recovery.

To reclaim bullish momentum, price action must first stabilize above $62,500 and then challenge the $67,500 resistance block. Until a daily close above that level occurs, the trend remains firmly in bear territory.

Discover: The next crypto to explode

Tariff Fears Fuel Record Outflows

The current drawdown extends a rough start to the year, with digital assets logging their longest streak of negative weekly returns since 2022.

Much of this selling is precautionary, driven by the ongoing debate over U.S. tariff implementation under the 1974 Trade Act. The uncertainty has spiked the dollar, effectively siphoning liquidity out of high-beta assets like crypto.

Institutional flows reflect this risk-off rotation. Spot Bitcoin ETFs lodged their fifth straight week of outflows, signaling that traditional finance allocators are de-risking until the regulatory fog clears.

Until these flows reverse, spot markets lack the relentless bid needed to counter derivative sell pressure.

The post Bitcoin Bloodbath: $370M Liquidations as Corporates Defend $60K appeared first on Cryptonews.

Crypto World

How to Buy Pepeto (PEPETO) in 2026: 5 Easy Steps Before the 100x Window Closes Forever

You can buy Pepeto in five simple steps: visit the official presale website at pepeto.io, set up a crypto wallet, deposit or buy crypto for payment, select the amount of PEPETO you want, and confirm the purchase. That is all it takes to get in before exchanges list this token and the presale price disappears.

This guide explains in full detail how to buy Pepeto before its presale ends, how the meme coin infrastructure platform works, and why analysts project 100x or more from the current price of $0.000000185.

Pepeto is only available through the official presale at pepeto.io. It is not listed on any exchange, DEX, or trading platform. Any token you see on Uniswap, PancakeSwap, or DEXTools using the Pepeto name is fake. The real PEPETO token does not exist on chain yet. It will only become tradable after the presale closes and the Token Generation Event takes place.

This is important because the presale has raised over $7.3 million and is more than 70% filled. Once it closes, the current price of $0.000000185 is gone permanently. The only safe place to buy Pepeto is pepeto.io.

How to buy Pepeto: step by step guide

Step 1: Set up a crypto wallet

Download MetaMask or Trust Wallet on your phone or browser. Create a new wallet and write down your recovery phrase on paper. Store it somewhere safe and never share it with anyone.

Step 2: Fund your wallet with ETH, USDT, or BNB

The Pepeto presale accepts ETH, USDT, and BNB. You can also pay with a credit card directly on the website. Send crypto from Coinbase or Binance to your wallet address. Keep a small amount for gas fees.

Step 3: Go to pepeto.io and connect your wallet

Visit pepeto.io and click “Connect Wallet.” Select your wallet provider and approve the connection. Always double check the URL before connecting.

Step 4: Choose your investment amount

Enter the amount you want to spend. The dashboard shows exactly how many PEPETO tokens you will receive. There is no minimum investment.

Step 5: Confirm and stake your tokens

Click “Buy” or “Buy and Stake” to start earning 212% APY immediately. Approve the transaction in your wallet. Tokens are claimable after the Token Generation Event.

What is Pepeto and why is it projected for 100x?

Pepeto is not just another meme coin. It is the first dedicated trading infrastructure platform built for the $45 billion meme coin economy. Three working demo products are live right now at pepeto.io. A cross chain swap lets traders move meme coins between networks. A blockchain bridge connects different chains. And a zero fee decentralized exchange saves money on every trade.

SolidProof and Coinsult both completed independent security audits. Zero percent tax on every buy and sell. The project traces back to an original Pepe Coin cofounder who watched $PEPE hit $7 billion with zero products and decided to build what the market was missing. A confirmed Binance listing is approaching.

At $0.000000185, a 100x needs just $50 million market cap. SHIB reached $40 billion with zero infrastructure. DOGE hit $90 billion on tweets alone. The math is simple. The window is now.

Is Pepeto safe to buy?

SolidProof and Coinsult both audited the smart contract with no critical issues found. Zero tax on every transaction. Standard Web3 wallet connections with no KYC required.

The bottom line on buying Pepeto

The Pepeto presale is simple to join. Connect a supported wallet and buy PEPETO with ETH, USDT, BNB, or credit card at $0.000000185. There is no minimum purchase. Staking currently offers 212% APY, which adds serious value on top of the projected 100x from presale to exchange listing. Over $7.3 million raised and 70% filled. Once the presale closes, this price is gone forever.

Click To Visit Official Website To Buy Pepeto

FAQs

How to buy Pepeto in 2026?

Visit pepeto.io, connect MetaMask or Trust Wallet, fund with ETH, USDT, BNB, or credit card, select the amount, and confirm. Pepeto is only available through the official presale website.

Where can I buy Pepeto tokens?

Pepeto can only be purchased at pepeto.io during the presale. It is not on any exchange. Any PEPETO token appearing on exchanges or DEXs is fake and not connected to the real project.

Is Pepeto a good investment in 2026?

At $0.000000185 with three working demos, dual audits, 212% APY staking, and a confirmed Binance listing ahead, Pepeto offers 100x math to just $50 million market cap. The presale is 70% filled.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

U.S. demand turns negative for a record 40 days as “bitcoin zero” searches peak

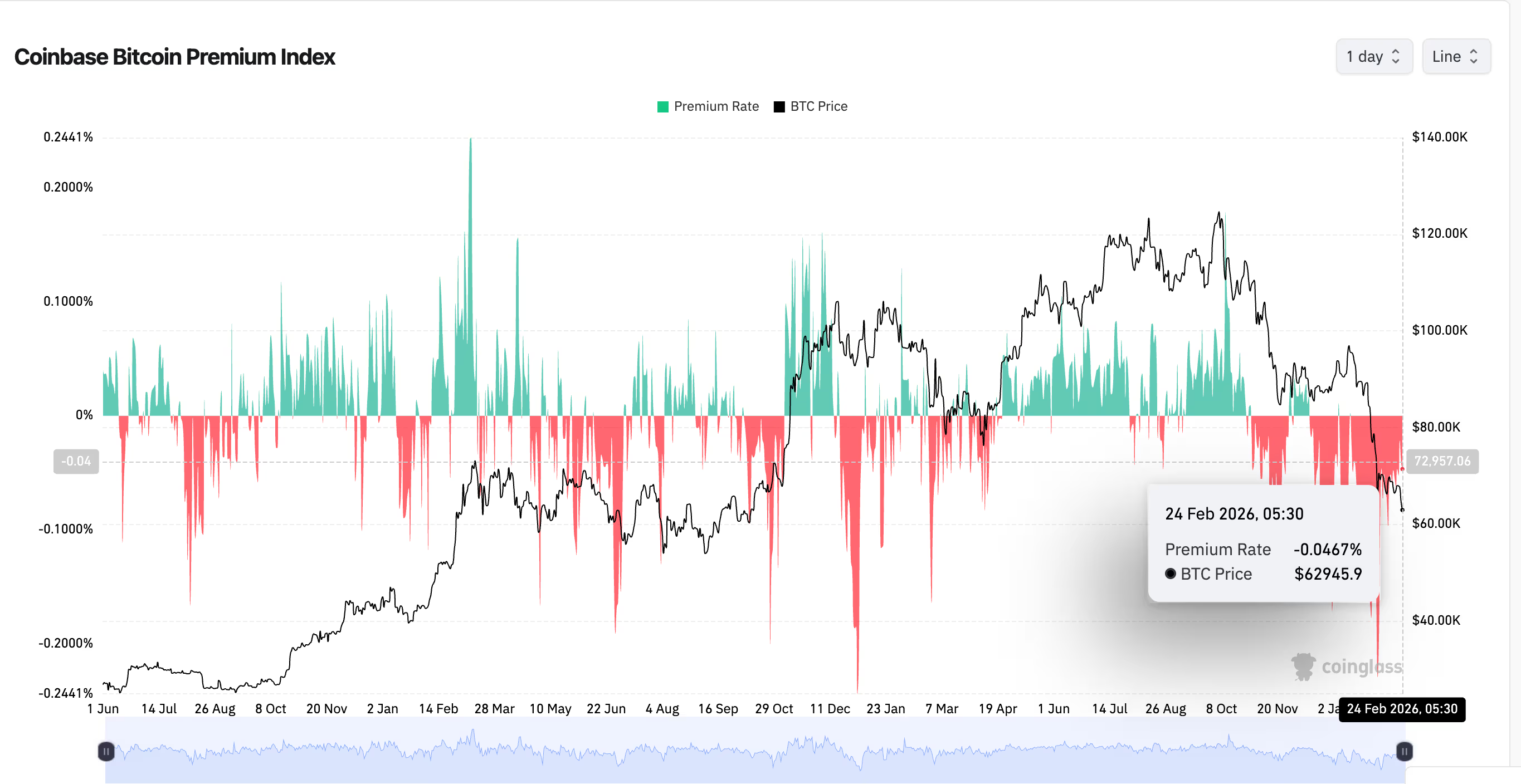

The well-followed Coinbase Bitcoin Premium Index briefly looked like it was recovering after the Feb. 5 crash. It wasn’t.

The premium has now been negative for 40 consecutive days, according to Coinglass data, setting the longest streak of sub-zero readings since 2023. The current reading sits at -0.0467%, barely changed from two weeks ago, when a sharp narrowing from -0.22% suggested U.S. buyers had stepped in near the lows.

The index measures the price gap between bitcoin on Coinbase and the global market average. Coinbase is widely used as a proxy for U.S. institutional and dollar-denominated flows, so a persistent negative reading means American investors are consistently paying less than the rest of the world — either selling more aggressively or simply not showing up.

The previous record was roughly 30 days of continuous negative premium during the October 2025 drawdown. That streak broke when a sharp bounce brought U.S. buyers back into the market. This time, the bounce came, as bitcoin recovered as much as 15% from its Feb. 5 intraday low. But the premium never followed.

That divergence shows that while price recovered, the composition of demand didn’t. Whatever buying drove bitcoin back above $62,000 came from outside U.S. hours, outside Coinbase’s order books, or both.

The one constructive read is that the premium has been gradually less negative since early February, creeping from -0.22% back toward -0.05%. It’s improving, just not fast enough to flip positive, a threshold that historically coincides with sustained accumulation phases rather than relief rallies.

Interestingly, Google searches for “bitcoin zero” in the U.S. hit record highs earlier this month, as CoinDesk reported, even as global search interest for the term remained flat.

Both signals point to American investors specifically losing conviction at a pace that hasn’t shown up elsewhere.

Crypto World

Fed proposes rule to deal with crypto debanking by scrapping ‘reputation risk’

Days after JPMorgan Chase & Co. admitted to debanking President Donald Trump after the Jan. 6, 2021 attack on the Capitol, the Federal Reserve seeks comments on its proposal that would stop government supervisors from pushing banks to sever ties with lawful customers based on their activities, including crypto companies.

“We have heard troubling cases of debanking — where supervisors use concerns about reputation risk to pressure financial institutions to debank customers because of their political views, religious beliefs or involvement in disfavored but lawful businesses,” including cryptocurrency, said Vice Chair for Supervision Michelle W. Bowman.

“Discrimination by financial institutions on these bases is unlawful and does not have a role in the Federal Reserve’s supervisory framework,” she added.

The Office of the Comptroller of the Currency, in its capacity as the supervisor of national banks, had already moved to cut reputational factors from its supervision last year, and the Federal Reserve had similarly announced in July that such risk would no longer be a part of its bank examinations, so this rule process would codify that move.

Crypto debanking has been well documented and freely acknowledged by banking regulators appointed by Trump, though new examples continue to emerge. In a response to a lawsuit filed last month by Trump and the Trump Organization, JPMorgan, the nation’s largest bank, said for the first time that it cut off more than 50 Trump accounts in February 2021. JPMorgan did not specify a reason for closing the accounts. On Nov. 23, 2025, Jack Mallers, CEO of crypto payments company Strike, wrote a social media post that immediately went viral, saying JPMorgan closed all his accounts without cause.

In a Jan. 26 memo to the Board of Governors, the Fed’s staff wrote that the board’s proposal would “codify the removal of reputation risk from the Board’s supervisory programs” and prohibit the Fed from “encouraging or compelling” banks to deny or condition services to customers involved in “politically disfavored but lawful business activities.”

In the proposal, the Fed Board said it intends to include “permitted payment stablecoin issuers” within its definition of covered banking organizations after completing separate rulemakings, a move that could directly affect crypto-native firms seeking access to the banking system.

The Fed said comments on its proposal to remove reputation risk from its supervision of banks are due in 60 days from Feb. 23.

Crypto World

Ether Whale Orders Shrink as $2B Short Cluster Sits Near $2K

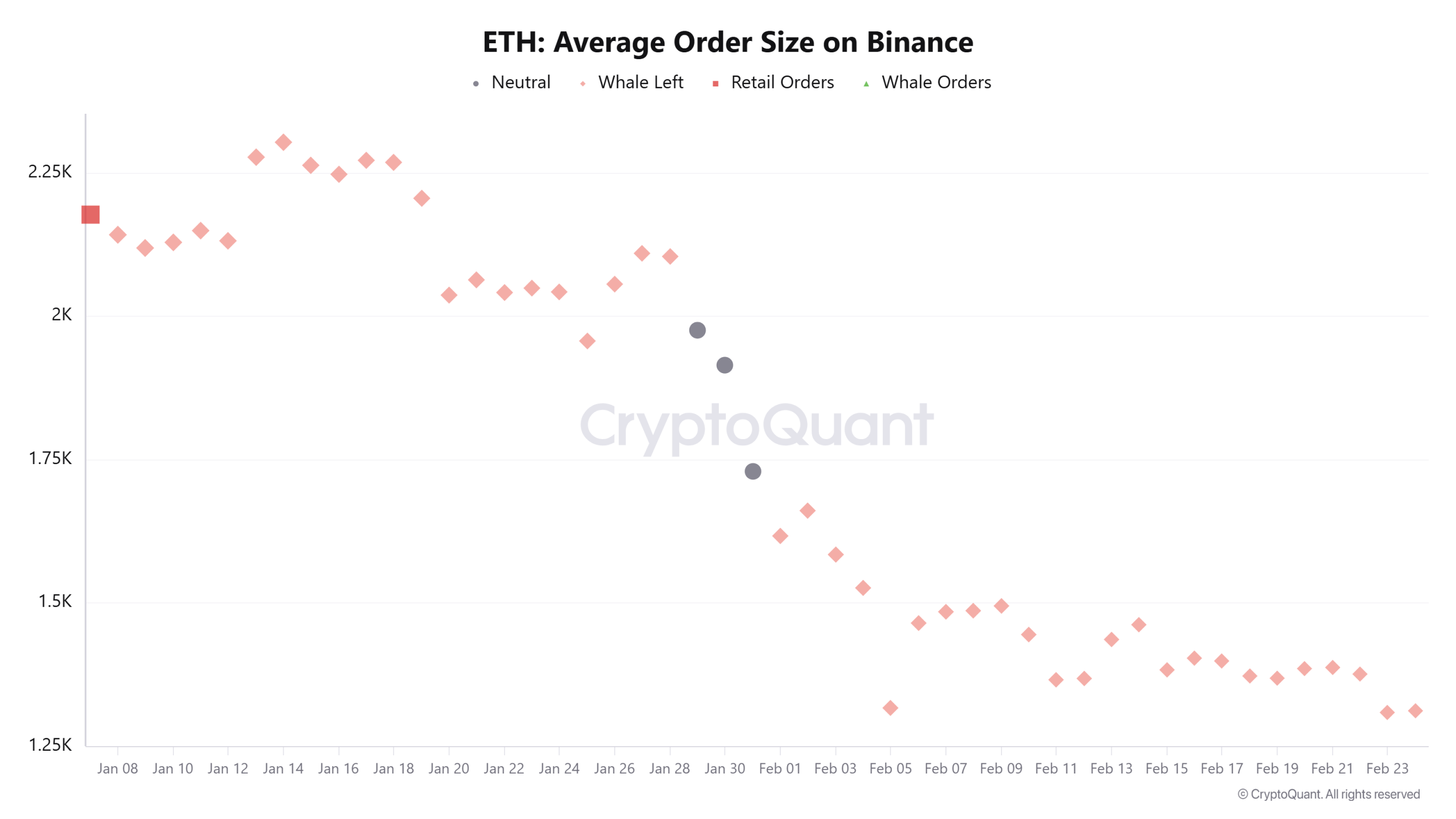

Ether (ETH) whale activity on a major exchange has slowed since the start of 2026, with roughly 2 million ETH traded in large-sized transactions over the past 45 days.

ETH is currently in the midst of its worst weekly losing streak since 2022, with exchange flow trends and futures market liquidation data impacting investor expectations for Ether’s short and long-term price direction in the broader market.

Ether whale order size hints at fading participation

CryptoQuant data shows that the average ETH whale sell orders on Binance have fallen to around 1,350 ETH in recent weeks, down from roughly 2,250 ETH in early January. Assuming 15 to 35 whale-sized executions per day, the cumulative gross sell-side turnover since Jan. 8 is estimated at around 1.8 to 2 million ETH over the past 45 days.

Using an average price of $2,400, this activity equates to roughly $4.3 billion to $4.8 billion in large-order executions. The figure reflects gross traded volume, not confirmed net outflows, as part of the flows may relate to hedging or liquidity provision within the derivatives market.

Crypto analyst Darkfost said the decline in the average order size points to a “gradual disengagement” from larger participants. According to the analyst, smaller traders continue to transact at stable volumes, while bigger players are reducing direct interaction with the order books.

This shift indicates a temporary thinning of market depth. With fewer large resting orders, ETH’s capacity to absorb sharp price imbalances narrows in the short term.

Parallel to exchange flows, ETH accumulation addresses added more than 2.5 million ETH in February as the price fell about 20%. Total holdings climbed to 26.7 million ETH from 22 million at the start of 2026, signaling steady demand beneath the surface.

Related: Ethereum price drops to $1.8K as data suggests ETH bears are not done yet

Will Ether break its longest bearish streak since 2022?

Ether is now in its sixth straight week of losses, marking the longest uninterrupted weekly decline since the 10-week drawdown between March 2022 and June 2022. That earlier stretch unfolded during a broader bear market and led to a cycle bottom before price stabilized.

While the current pullback is not as long, the streak highlights sustained selling pressure and weakening momentum on the higher timeframe.

Historical market cycle data suggests that if the decline continues, a broad weekly demand zone between $1,384 and $1,691 may come into focus, an area that previously acted as accumulation during the early stages of the rally in 2023.

Futures market liquidation data shows more than $2 billion in short positions clustered around $2,000. This creates a dense liquidity pocket that may act as the near-term magnet for Ether price.

On the downside, approximately $682 million in long positions remain at risk if Ether drops to $1,600, indicating thinner liquidity compared to the upside cluster.

Crypto trader RickUntZ said he still sees potential for a V-shaped rebound from current levels, citing signs of underlying demand in the current structure. For now, data suggests that the $2,000 liquidation band remains the next key resistance to break.

Related: Ethereum Foundation starts staking ETH as client diversity concerns persist

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Millions in crypto funded tools to exploit U.S. software, Treasury says in new sanctions

The U.S. Treasury Department has sanctioned a Russian company, Operation Zero, and the individuals behind it after accusing them of buying stolen cyber tools for millions in cryptocurrency and re-selling those technologies, which were created to be used by the U.S. government.

The tools bought and sold by newly sanctioned Sergey Sergeyevich Zelenyuk and his business, Operation Zero, were said to be originally stolen by an Australian national, Peter Williams, who once worked at the defense contractor that made the national-security focused software “for the exclusive use of the U.S. government and select allies.” Williams pleaded guilty last year to selling trade secrets.

“Treasury will continue to work alongside the rest of the Trump Administration to protect sensitive American intellectual property and safeguard our national security,” said Secretary of the Treasury Scott Bessent in a statement.

Zelenyuk and the others are said to be the first people to be sanctioned under the Protecting American Intellectual Property Act. The sanctions by the Office of Foreign Assets Control block U.S. people from any business dealings with those flagged or with others who do business with them.”Operation Zero has sought to recruit hackers to support its activities and develop business relationships with foreign intelligence agencies through use of social media,” the Treasury Department said in its statement. The accusations say the tools were offered for sale to those seeking to exploit vulnerabilities in computer software.

While the Treasury’s Office of Foreign Asset Control alleged that cryptocurrencies were used in the transactions, it did not list specific addresses for blacklisting.

Read More: Criminal use of crypto spikes after years of steady decline, TRM report says

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World13 hours ago

Crypto World13 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech3 hours ago

Tech3 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting