Crypto World

Is the U.S. Economy Heading Into a Recession? Multiple Indicators Signal Growing Risk N

TLDR:

- January 2026 recorded 108,435 layoffs, the highest January figure since the 2009 recession period.

- Job openings plummeted to 6.54 million while hiring plans hit record lows at just 5,306 in January.

- Housing market shows 47% more sellers than buyers, creating 630,000 excess sellers—a record imbalance.

- Corporate credit stress affects 14-15% of bond segments as inflation trends below 1%, risking deflation.

The U.S. economy faces mounting questions about a potential recession as critical economic indicators deteriorate across multiple sectors.

January 2026 witnessed 108,435 announced layoffs, the highest January figure since the 2009 recession, raising alarm bells about economic health.

Labor market weakness, housing imbalances, and credit stress are converging in patterns that historically precede economic contractions, prompting analysts to assess whether the nation is approaching a downturn.

Labor Market Collapse Points Toward Economic Slowdown

The labor market is delivering the strongest early warning signals of potential recession, with job data weakening at an alarming rate.

According to Bull Theory, a market analysis platform, the situation is particularly concerning because “jobs usually weaken before the economy officially slows.”

Weekly jobless claims jumped to 231,000, exceeding expectations and indicating more workers are filing for unemployment benefits.

This acceleration in layoffs suggests companies are not conducting normal seasonal restructuring but preparing for significantly weaker growth ahead.

Bull Theory emphasized that January’s layoff numbers represent something more serious, noting “that is not normal seasonal restructuring” but rather “companies preparing for weaker growth ahead.”

Job openings have fallen sharply to approximately 6.54 million according to JOLTS data, marking the lowest level since 2020.

When job openings decline while layoffs simultaneously increase, displaced workers face fewer opportunities for reemployment.

Hiring has effectively collapsed, with companies announcing just 5,306 hiring plans in January, the lowest level ever recorded for that month. Businesses are freezing expansion rather than growing their workforce, a clear sign of anticipated economic weakness.

Housing and Bond Markets Flash Recession Warnings

The housing market is displaying critical recession indicators through unprecedented imbalances between supply and demand.

Approximately 47% more sellers than buyers currently exist, equal to roughly 630,000 excess sellers representing the widest gap ever recorded.

Bull Theory analyzed this phenomenon, explaining that “when sellers heavily outnumber buyers, it means people want liquidity” as they prefer “cash instead of holding property risk.”

Housing slowdowns create cascading effects throughout the broader economy, impacting construction, lending, materials, and employment sectors simultaneously.

When real estate transactions freeze, the economic slowdown broadens beyond housing into adjacent industries. Consumer confidence surveys are already showing multi-year lows as job uncertainty spreads, leading households to reduce spending on homes, cars, travel, and discretionary purchases.

The Treasury yield curve is bear steepening again, with long-term yields rising faster than short-term rates near four-year highs.

Investors are demanding higher returns to hold long-term U.S. debt, reflecting concerns the analysis identifies as worries about “fiscal deficits, debt levels, and long-term growth outlook.”

Historically, yield curve shifts of this nature have preceded recessions multiple times, making the current trend particularly concerning for economic forecasters.

Credit Stress and Deflation Risks Intensify Recession Probability

Corporate credit markets are showing dangerous stress levels, with approximately 14% to 15% of certain bond segments either distressed or facing high default risk.

When companies encounter debt pressure, they respond with aggressive cost-cutting measures including layoffs, reduced spending, and halted expansion.

Business bankruptcy filings have been climbing steadily, disrupting supply chains and removing liquidity from the financial system.

Another overlooked recession risk involves disinflation moving dangerously close to deflation territory. Real-time inflation trackers like Truflation show inflation trending near or below 1%, far beneath the Federal Reserve’s 2% target.

Bull Theory warned that “if inflation falls too fast, spending slows because people expect lower prices later,” adding that “deflation cycles are historically more damaging than inflation.”

The Federal Reserve maintains a relatively hawkish tone despite weakening forward indicators, continuing to emphasize inflation risks while labor, housing, and credit data soften.

Bull Theory assessed the overall situation, stating that when combining all these factors, “you get a macro backdrop that historically aligns with late-cycle slowdown phases.”

However, the analysis clarified that “this does not mean recession is officially here yet” but rather “the economy is becoming fragile and markets are starting to react to that risk.”

Crypto World

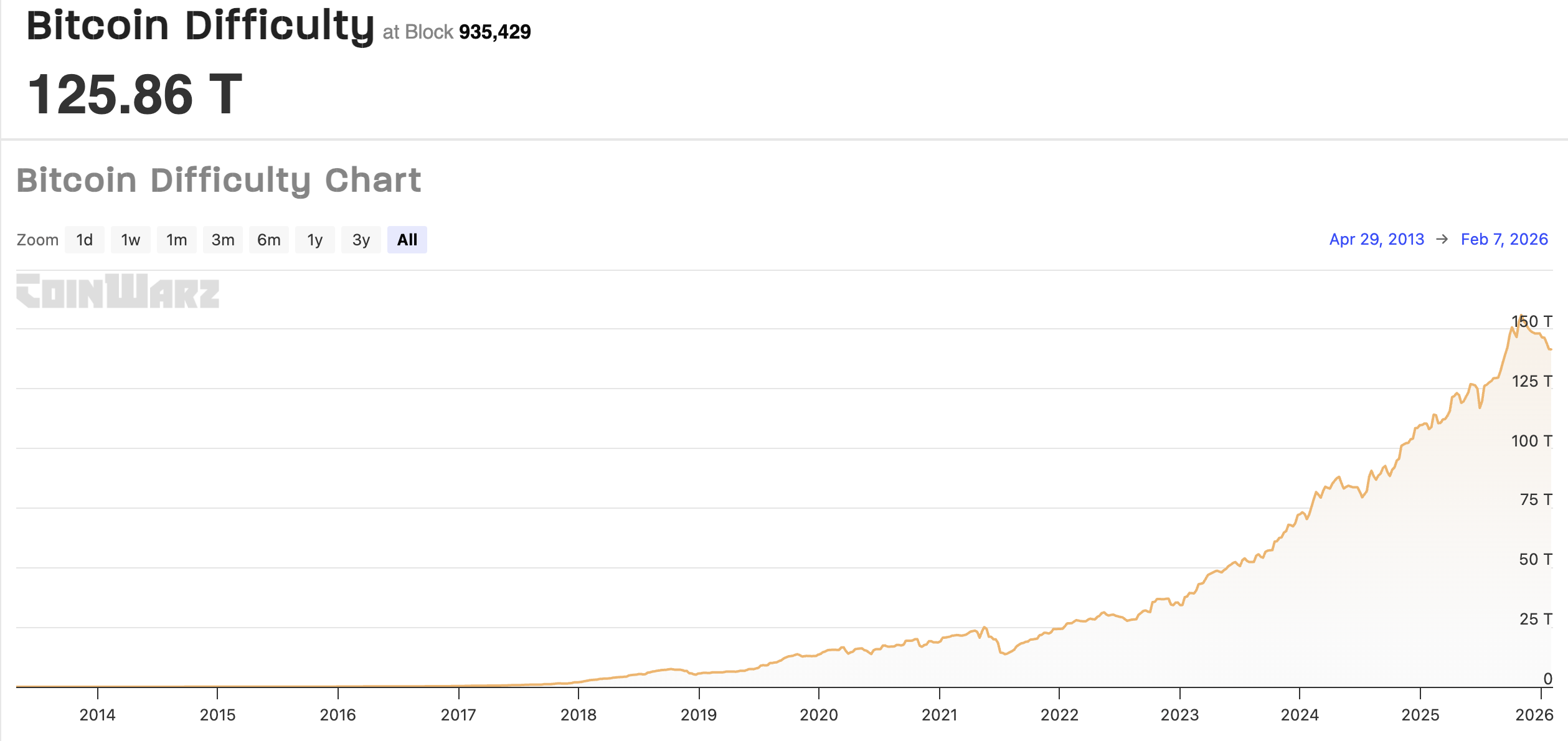

Bitcoin Mining Difficulty Drops by 11% Amid Steep Market Downturn

The Bitcoin network mining difficulty, a metric tracking the relative challenge of adding new blocks to the Bitcoin (BTC) ledger, fell by about 11.16% in the last 24 hours, the worst drop in a single adjustment period since China’s 2021 ban on crypto mining.

Bitcoin mining difficulty is at 125.86 T and took effect at block 935,429, data from CoinWarz shows. The average block time is over 11 minutes, overshooting the 10-minute target.

Difficulty is projected to fall again in the next adjustment on February 23 by about 10.4% to 112.7 T, according to CoinWarz.

China announced a ban on crypto mining and began enforcing a crackdown on digital assets in May 2021, resulting in several downward difficulty adjustments between May and July 2021, ranging from 12.6% to 27.9%, according to historic data from CoinWarz.

The steep downward adjustment came amid a broad crypto market downturn, which crashed the price of Bitcoin by over 50% from the all-time high of over $125,000 to a low of $60,000, and a winter storm in the US that caused temporary miner downtime.

Related: Bitcoin’s ‘miner exodus’ could push BTC price below $60K

Winter Storm Fern sweeps through the US and curtails miner hashrate

A severe winter storm swept through the United States in January, impacting 34 states across 2,000 square miles with snow, ice and freezing temperatures that disrupted electrical infrastructure.

The disruption to the power grid caused US-based Bitcoin miners to temporarily curtail their energy usage and halt operations, reducing the total network hashrate, the amount of computational power expended by miners to secure the Bitcoin protocol.

Foundry USA, a US-based mining pool and the biggest mining pool by hashrate in the world, briefly lost about 60% of its hashing power amid winter storm Fern.

The mining pool’s total hashing power declined from nearly 400 exahashes per second (EH/s) to about 198 EH/s in response to the storm.

Foundry USA’s hashrate recovered to over 354 EH/s, the mining pool’s hashing power at the time of this writing, and it still commands 29.47% of the market share, according to Hashrate Index.

However, the total Bitcoin network hashrate declined to a four-month low in January amid deteriorating crypto market conditions and miners shifting operations to AI data centers and other forms of high-performance computing.

Magazine: Bitcoin mining industry ‘going to be dead in 2 years’: Bit Digital CEO

Crypto World

2026’s Best Presale Crypto: Can IPO Genie, Ruvi AI, & Nexchain Really Compete with ZKP Crypto?

New crypto presales release every week, but what truly sets apart the heroes? If we’ve learned anything from 2025, traders find value in real-life utility, spotlighting projects like IPO Genie, Ruvi AI, and Nexchain as standout choices in Q1 2026.

IPO Genie at $0.000119 unlocks private investments from $10, promising 1000x returns on $1,000 amid $1 million raises. Ruvi AI at $0.020 powers a creator rewards super app with over $5 million secured, while Nexchain at $0.12 bridges chains for multi-chain scalability.

But, Zero Knowledge Proof (ZKP), towers above the other names as the best presale crypto of 2026. What makes this project special is that it’s self-funded over $100 million for privacy-protected AI on a ready Layer-1. Its 17-stage auction is actively targeting a record $1.7 billion accumulation. Read on to see what makes these projects special in 2026.

1. Zero Knowledge Proof (ZKP): AI & Privacy-Based Auctions Target 600x Upside

ZKP crypto or Zero Knowledge Proof (ZKP) leads 2026 presales with a ready Layer-1 blockchain, self-funded by over $100 million for robust infrastructure. This platform enables privacy-protected AI computations, letting enterprises process encrypted data without exposing sensitive details. Its focus on real technology sets it apart in a crowded market.

The presale runs as a 450-day Initial Coin Auction across 17 stages, ensuring fair and transparent pricing. Stage 2 now releases 190 million ZKP tokens daily from a 4.75 billion pool, with unallocated tokens burned permanently to enforce scarcity. Already $1.78 million raised signals accelerating interest toward a $1.7 billion target.

Stage 1 launched with 11.8 billion tokens at 200 million daily, building early momentum. Each phase reduces supply progressively, ramping up competition as buyers secure shares at uniform prices by connecting wallets. This structure creates natural demand pressure.

By Stage 17, daily releases drop 80% to just 40 million tokens, compounding tightness over time. Burns remove unsold supply daily, tightening circulation as awareness builds through 2027. Participants compete harder in later rounds for dwindling allocations.

Analysts project 100x to 600x returns from current levels. This math stems from controlled distribution and rising utility in finance, healthcare, and AI sectors. ZKP stands as the best presale crypto for blending privacy innovation with proven tokenomics.

2. IPO Genie: Democratizing Private Investments

IPO Genie revolutionizes access to private and pre-IPO deals, letting everyday investors start with just $10 using AI-driven vetting for company data, growth, and risks. The $IPO token powers platform access, voting on deals, priority entry, and participation rights. Priced at $0.000119, it has raised nearly $1 million in two months, signaling strong early traction in Q1 2026. This utility-focused model positions IPO Genie as the best presale crypto for bridging Web3 with traditional private markets.

A $1,000 investment secures 8.4 million $IPO tokens, boosted to 11.59 million with 20% welcome and 15% referral bonuses. Potential returns shine: 100x hits $138,000, 500x reaches $690,000, and 1000x yields $1.38 million. Analysts track it alongside peers for real tokenomics over hype, making early entry a calculated play on democratized wealth creation.

3. Ruvi AI: Rewarding Creators & Engagement Incentives

Ruvi AI stands out as a Web3 AI super app bundling image, video, and text generation tools, where users earn RUVI tokens for usage and content creation shared in its marketplace. At $0.020, token utility covers advanced features, payments, buying/selling, voting, and rewards distribution. Having raised over $5 million in later presale phases, it taps AI and creator economy trends, differentiating from fee-based platforms by fostering ownership. Ruvi AI earns its spot as the best presale crypto through practical utility that aligns user activity with token demand.

This reward system fuels engagement, as creators monetize directly while accessing premium AI capabilities. Analysts highlight its momentum in 2026, where AI integration meets sustainable economics, promising growth as adoption scales across content creators seeking fair compensation.

4. Nexchain: Bridging Chains

Nexchain tackles blockchain interoperability as a Layer-1 solution for seamless cross-chain communication, using AI to optimize network performance and reduce transfer costs. Priced at $0.12 per NEX, its token handles transaction fees, staking, voting, and developer tools. Long-term value hinges on developer adoption for infrastructure plays, making Nexchain the best presale crypto for builders eyeing multi-chain futures.

Analysts group it with utility peers for its focus on real-world scalability in Q1 2026. Success builds gradually as ecosystems interconnect, rewarding patient investors with staking yields and governance influence amid rising demand for unified blockchain operations.

To Summarize

Not all crypto presales are built the same, and 2026 is proving that utility-driven projects consistently outperform hype-led launches. IPO Genie, Ruvi AI, and Nexchain each solve real problems, opening private markets to retail investors, rewarding creators through AI-powered tools, and enabling seamless cross-chain scalability.

However, Zero Knowledge Proof (ZKP) clearly separates itself from the pack. Unlike early-stage concepts, ZKP launches with a fully funded Layer-1 blockchain, over $100 million in self-backed capital, and live infrastructure purpose-built for privacy-preserving AI computation. Its 17-stage Initial Coin Auction introduces enforced scarcity through daily token burns, shrinking supply by 80% by the final phase while targeting a historic $1.7 billion raise.

For traders prioritizing long-term upside, disciplined tokenomics, and enterprise-grade utility, ZKP crypto’s 600x potential stands out as the best presale crypto of 2026,

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Cardano (ADA) Make-or-Break Moment: Why $0.13 Could Trigger a 4,500% Expansion

TLDR:

- Cardano ADA trades at $0.27 within a critical higher timeframe bullish order block spanning $0.13 to $0.18

- Weekly closes above $0.13 maintain bullish structure; breaks below signal invalidation to $0.0755

- Historical pattern mirrors 2021 setup when ADA rallied 3,400% from similar accumulation zones

- Technical targets project sequential moves to $1.20, $3, $5, and $10 if current support holds firm

Cardano trades at $0.27 after a brutal 93% correction from recent highs, positioning the asset at a crossroads that could determine its entire cycle trajectory.

Technical analysis reveals a higher timeframe bullish order block between $0.18 and $0.13, where price action now consolidates.

The $0.13 level has emerged as the single most critical support, with analysts suggesting its defense or breach could unlock vastly different outcomes for ADA holders.

Critical Support Zone Holds Multi-Cycle Significance

The current price structure shows ADA testing support levels that haven’t been relevant since early accumulation phases.

After dropping 78% from the $1 local high reached six months ago, the asset now rests on multi-year support above $0.24.

This consolidation zone represents more than temporary support—it marks the battleground where cycle direction gets determined.

Crypto analyst Patel’s recent assessment emphasizes the importance of the $0.13 to $0.18 range as a higher timeframe bullish order block.

This technical zone has absorbed selling pressure while maintaining structural integrity. The key observation centers on weekly closes rather than intraday wicks, suggesting institutional participants are defending this range on meaningful timeframes.

Historical context adds weight to the current setup. During the 2021 bull run, ADA surged 3,400% to reach its all-time high of $3.10.

The subsequent bear market erased 92.89% of that value through a grinding correction lasting into 2026. Price action now sits within the same type of accumulation zone that preceded the previous explosive rally.

The distinction between a 10x cycle and continued downside rests entirely on the $0.13 threshold. Weekly closes above this level maintain the bullish structure and keep expansion targets in play.

Conversely, a confirmed break below invalidates the accumulation thesis and opens the door to deeper retracement toward the $0.0755 level, which represents the final line for high-risk positions.

Expansion Potential Hinges on Support Defense

The path forward splits into dramatically different scenarios based on how price interacts with current support. Bulls defending the $0.18 to $0.13 zone position ADA for what analysts describe as the last accumulation opportunity before parabolic movement.

The technical framework projects sequential targets that extend well beyond previous all-time highs if the base holds.

Immediate resistance appears at $0.4374, identified as the reclaim zone requiring confirmation. Breaking this level would shift momentum and validate that accumulation has concluded.

Beyond that point, the technical roadmap outlines targets at $1.20, $3, $5, and ultimately $10 during a full bull market expansion phase. These projections assume the current support structure remains intact through weekly timeframes.

The magnitude of potential upside reflects patterns observed in previous cycles. Cardano’s 2021 performance demonstrated the explosive potential when accumulation zones break into expansion phases.

The current compression from $1 down to $0.27 has created similar conditions—extended consolidation that historically precedes major directional moves.

Risk management parameters are unusually clear in this setup. The $0.13 weekly close functions as an unambiguous invalidation point for the bullish thesis. Traders can structure positions within the order block while maintaining defined exit strategies.

The asymmetric setup offers compelling upside if support holds, with downside risk clearly mapped to specific price levels that would trigger structural breakdown and force reassessment of cycle expectations.

Crypto World

Bitcoin Crash Mentions Spike at $60K as Crypto Rebounds 13%

Social media mentions of crypto “crash” spiked when Bitcoin fell to $60,000 on February 5, causing an immediate price rebound according to Santiment data.

Summary

- Santiment data shows “crash” mentions spiked as Bitcoin hit $60K on Feb. 5.

- BTC rebounded 13% to $67K as panic selling marked a local bottom.

- Arthur Hayes links the selloff to IBIT structured product hedging, not fundamentals.

The sentiment analytics platform found that when traders declare a crash has happened rather than simply observing a dip, prices typically bottom and reverse course.

Bitcoin (BTC) recovered 13% from the $60,000 low to reach $67,000 today. However, mainstream media continued amplifying crash narratives after the rebound had already occurred.

Santiment noted this lag allows key stakeholders to buy from panicked retail investors who sell at losses based on delayed coverage.

BitMEX co-founder Arthur Hayes attributed the selloff to dealer hedging tied to iShares Bitcoin Trust structured products rather than organic selling pressure.

Crypto crash mentions function as reliable bottom indicators

Santiment data showed multiple high-frequency spikes in “dip” mentions across social media during January, with January 26 producing a cluster of observations about falling crypto prices.

These mentions serve as bottom indicators but do not generate the severe panic associated with crash declarations.

“Dip” references typically happen when prices decline enough to warrant comment without causing mass liquidations.

“Crash” mentions emerge when panic selling begins, with traders capitulating and selling bags at losses.

The February 5 drop to $60,000 crossed the threshold where traders shifted from observing a dip to declaring a crash.

Hayes links dump to IBIT structured product hedging

Arthur Hayes posted on X that the Bitcoin selloff likely resulted from dealer hedging related to iShares Bitcoin Trust structured products rather than fundamental selling.

Banks issuing structured notes tied to IBIT create hedging requirements that can cause quick price movements as dealers adjust positions.

Hayes stated he is compiling a complete list of bank-issued notes to map trigger points that could cause sharp price rises or falls. “As the game changes, u must as well,” Hayes wrote.

Crypto World

Trend Research Forced to Sell 612K ETH as $958M Leveraged Position Implodes

TLDR:

- Trend Research sold 612,452 ETH valued at $1.26 billion over six days to avoid total liquidation.

- The firm’s leveraged position peaked at $958 million in borrowed stablecoins backed by 601K ETH.

- Only 39,301 ETH worth $80.93 million remains after aggressive deleveraging near $1,800 threshold.

- Market observers suggest yesterday’s flush to $1,800 specifically targeted the firm’s known position.

Trend Research has offloaded 612,452 ETH worth $1.26 billion over six days as its leveraged position collapses. The firm built a risky $958 million stablecoin debt through Aave’s lending protocol at the position’s peak.

Only 39,301 ETH valued at $80.93 million now remains from holdings that once reached 601,000 ETH. The aggressive deleveraging highlights dangers of excessive leverage during volatile market conditions.

Massive Liquidation Risk Forces Emergency Sales

Jack Yi’s Trend Research constructed one of crypto’s largest leveraged positions before market conditions turned unfavorable.

The structure borrowed stablecoins against Ethereum collateral in a loop that amplified exposure. As prices declined, the collateral value dropped while debt obligations remained fixed. This classic leverage trap forced increasingly desperate defensive maneuvers.

MartyParty, a market observer, called out the risky nature of this position on X. He suggested yesterday’s market drop to $1,800 specifically targeted Trend Research’s liquidation threshold.

According to his analysis, this flush aimed to trigger forced covering and position reduction. The observation underscores how large leveraged positions become known targets during market stress.

The firm sent 423,864 ETH worth $830.63 million to exchanges in just 24 hours. This selling pressure contributed to Ethereum’s brutal 40% decline over ten days.

Early February marked when Trend Research began scrambling to reduce exposure. The company sold 33,589 ETH for roughly $79 million and deployed $77.5 million in USDT for debt repayment.

These emergency actions lowered the liquidation threshold from $1,880 to $1,830. However, continued price weakness forced additional sales.

On February 4, another 10,000 ETH went to Binance for liquidation. The cascade of forced selling exemplifies how leverage amplifies losses during downturns.

Collapse Coincides with Deteriorating Market Sentiment

The Trend Research debacle unfolds as broader crypto sentiment reaches multi-year lows. Tom Lee, quoted by CryptosRus, compared current conditions to the post-FTX crash of November 2022.

The “is crypto even viable?” narrative has returned amid the carnage. Ethereum’s 40% drop in ten days shattered confidence across markets.

Lee noted that Ethereum has survived seven drawdowns exceeding 60% over eight years. Each instance produced V-shaped recoveries according to historical data.

Yet the Trend Research collapse adds another layer of concern for market participants. Large leveraged positions unwinding create additional downward pressure that extends declines.

The risky bet by Trend Research now serves as a cautionary tale. Building nearly $1 billion in stablecoin debt against volatile collateral proved catastrophic.

The position quintupled downside risk through leverage mechanics. When Ethereum fell, the spiral became self-reinforcing and unavoidable.

Market observers debate whether this forced selling represents a capitulation event. The combination of extreme negative sentiment and leverage flushing sometimes marks bottoms.

However, $80 million in remaining collateral suggests more selling could occur. Additional declines might trigger final liquidation of Trend Research’s position.

The collapse demonstrates why excessive leverage remains dangerous regardless of conviction in an asset’s long-term prospects.

Crypto World

Why machine-to-machine payments are the new electricity for the digital age

We are moving toward an economic system in which software and devices transact with one another without human involvement.

Instead of simply executing transactions, machines will be able to make decisions, coordinate with each other and purchase whatever they need in real time. Sensors and satellites will sell data streams by the second. Factories will price power purchases in real-time based on supply and demand. Supply chains could even become completely autonomous — reordering materials, booking transport, paying customs fees and rerouting shipments without any human involvement.

But such an economy cannot be built on large infrequent payments. It needs to run on billions of tiny, continuous transactions, executed autonomously at machine speed. Just as electricity pricing enabled mass production, micro-transactions and machine-to-machine (M2M) payments will make full automation economically viable.

And if continuous M2M payments are the new electricity, then blockchains — the rails upon which these microtransactions will occur — must be seen as the new power grid. They’re a critical piece of infrastructure that unlocks new business models, new technologies and ultimately, this new machine economy.

How will these innovations develop? The electrical revolution has plenty of lessons to teach.

A new revolution

Before electrification, power was local, manual, inconsistent and expensive. Factories relied on steam engines or water wheels, which constrained where production could happen and how it could scale. Power was something you built into each operation.

Electricity changed that. Once power became standardized and always available, it stopped being a feature and became the substrate of modern industry.

Payments today still resemble the pre-electric era of power. They are episodic, usually processed in batches, and heavily mediated by humans and institutions. Even digital payments involve discrete events such as invoices, settlements, reconciliations or billing cycles.

But M2M payments (autonomous financial transactions between connected devices), when combined with micro-transactions (worth a few cents), turn value exchange into something ambient and infrastructure-like. Instead of stopping to pay, machines can simply operate continuously, exchanging value as they consume resources or provide services.

Tech leaders have discussed microtransactions since the early days of the Internet, but it was impossible to realize that vision with the current banking system. Now, blockchain technology enables sending value across the world instantly and at almost no cost. The crypto sector’s infrastructure is fundamental for the birth of continuous M2M payments.

And just as electricity enabled the creation of computers and the Internet, M2M payments and micro-transactions will allow a completely new economy to flourish.

How electricity changed the world

The continuous power provided by electricity enabled automation. Mass production did not happen because factories hired more workers, but because machines could run constantly and relatively independently.

Today’s machines are technically autonomous but economically constrained. An AI agent can make decisions, route traffic, or optimize logistics, but it cannot pay for compute on the fly. Economic friction forces human intervention in systems that are otherwise independent. But M2M payments, combined with micro-transactions, will provide continuous economic power in the same way electricity provides continuous mechanical power.

Also, electricity unlocked industries that simply could not exist before it. M2M payments will have the same property, providing economic infrastructure for industries that cannot function without fine-grained, real-time payments.

What does that look like? We could have autonomous supply chains, in which machines coordinate purchases and logistics continuously. Or we could see the emergence of AI services with pricing models that reflect milliseconds of inference time. Global data markets could depend on pay-per-byte access. Infrastructure itself — from roads to charging stations — could continuously and automatically price access.

It’s worth noting that shifting to usage-based pricing also transformed electricity’s business models. Paying per kilowatt-hour allowed firms to scale without renegotiating contracts or investing in fixed capacity. You paid for what you used when you used it. M2M payments will provide the same flexibility to 21st-century businesses.

Lessons from the electrical revolution

At the beginning of electrification, the focus was mostly on developing generators. However, that wasn’t the most important technological innovation. What mattered was transmission. Only once electricity could be delivered everywhere, cheaply and predictably, did it reshape industry and society.

The same lesson applies to M2M payments. The blockchain rails on which the payments will occur matter way more than the specific M2M payment application (like Coinbase’s x402 protocol) being used. The priority should therefore be to build the best blockchains possible — chains with near-zero fees, very low latency, and predictable performance. In other words, M2M payments hit the same frictions as ordinary stablecoin payments: they need the underlying infrastructure to be tip-top if they want to function properly.

Moreover, the blockchains used for machine payments need to be perceived as neutral infrastructure. They must be interoperable across vendors, jurisdictions and machines. After all, machines cannot negotiate bespoke payment systems any more than appliances can negotiate voltage standards. That means decentralization may play an important role in the growth of the machine economy. In that case, public blockchains could have the advantage over private alternatives.

If M2M payment rails achieve this neutrality, they become the coordination layer of autonomous systems, just as electricity is the coordination layer of physical power. At that point, innovation can safely shift to building entirely new machine-driven industries.

The machine economy will arrive when machines gain the ability to transact continuously, autonomously, and invisibly thanks to the power of blockchain. M2M payments are not just a feature of that future. They are its electricity.

Crypto World

Sub-$60K Next for BTC or a Strong BTC Rebound?

Bitcoin has entered a highly sensitive phase after an aggressive downside continuation. The recent sell-off has pushed it into a historically reactive demand region of $60K, while broader risk sentiment remains fragile. The market is approaching a juncture where technical structure, higher-timeframe demand, and on-chain liquidity dynamics converge, making the coming sessions critical for short- to mid-term direction.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, Bitcoin has decisively broken below its recent structure and continued to respect the descending channel, while the rejection from the middle boundary of $75K confirms that sellers remain firmly in control. The most important development is the impulsive breakdown toward the lower boundary of the channel, where the asset is now testing a major demand zone at the $60K price region that previously acted as a strong buyers’ base earlier in the cycle.

This demand area, located at the $60K region, is structurally significant as it represents the last major consolidation before the previous impulsive expansion. While prior price action on the chart confirms this zone’s historical relevance, the current interaction is far more aggressive, suggesting that any bullish reaction from this region would likely begin as a corrective bounce rather than an immediate trend reversal.

As long as Bitcoin remains below the descending channel resistance and the 100- and 200-day moving averages, the daily structure remains decisively bearish, with downside continuation still a valid risk if demand fails to absorb selling pressure.

BTC/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the bearish structure becomes even clearer. The most recent move shows a sharp sell-side expansion into the current demand zone at $60K psychological support, followed by a minor reactive bounce, which so far lacks strong follow-through.

From a short-term perspective, the key level to monitor is the nearest supply zone overhead at the $75K, formed after the last impulsive breakdown. Any corrective rebound is likely to face selling pressure as the price approaches this area, especially if volume and momentum remain weak.

As long as Bitcoin fails to reclaim and hold above this supply region, rebounds should be treated as pullbacks within a broader bearish trend rather than confirmation of a trend shift. A failure to hold the current demand zone would expose the price to a deeper downside extension toward the channel’s lower boundary of $55K.

Sentiment Analysis

The liquidation heatmap provides valuable context for the recent price behavior. The one-year BTC/USDT liquidation heatmap shows a dense liquidity pocket concentrated around and slightly below the $60K–$65K region, which aligns closely with the current price area. This clustering of liquidity suggests that this zone has been a magnet for price, driven by forced liquidations of over-leveraged long positions during the recent sell-off.

Notably, as price approaches this region, liquidation intensity declines relative to current levels, indicating that a substantial portion of downside leverage has already been unwound. This dynamic increases the probability of short-term stabilization or a reactive bounce, particularly if aggressive sellers begin to lose momentum.

However, the absence of significant liquidation clusters above current price levels implies that upside liquidity is limited in the short term, reinforcing the idea that any rebound is more likely to be corrective rather than trend-changing.

Overall, while the broader structure remains bearish, the convergence of strong historical demand and reduced downside liquidation pressure suggests that Bitcoin may attempt a relief move or consolidation phase from this zone.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Arthur Hayes Explains How BlackRock IBIT Hedging Shaped Recent Bitcoin Sell-Off

TLDR:

- Dealer hedging from BlackRock IBIT structured notes amplified Bitcoin price swings at key triggers.

- Structured products with knock-ins, auto-callables, and buffers force automatic BTC market flows.

- Mapping issuance and barrier levels helps traders anticipate short-term Bitcoin price movements.

- Bitcoin volatility driven by flows often occurs independently of broader market sentiment shifts.

BlackRock IBIT Bitcoin crash is drawing attention as Arthur Hayes connects dealer hedging and structured notes to BTC volatility. Traders face flows driven by automated mechanisms, not sentiment.

Bitcoin is trading at $69,324.50, up 0.86% over the past 24 hours, supported by strong trading volume of $94.1 billion. Despite the short-term rebound, BTC remains down 16.56% over the past seven days, reflecting elevated volatility.

Recent price action shows how short-term gains can occur even as broader pressure persists, with market flows and positioning continuing to influence Bitcoin’s near-term direction.

Dealer Hedging Drives Bitcoin Volatility

Structured products tied to BlackRock’s IBIT create complex hedging dynamics. Dealers sell these notes to clients and hedge the embedded options using BTC spot or futures.

As positions grow, their rebalancing can directly influence prices. These notes often include auto-callables, knock-ins, and downside buffers.

As BTC approaches key barriers, dealers must act. They buy when prices rise and sell when prices fall. This creates mechanical pressure that can resemble sudden market moves.

Arthur Hayes explained that these flows are not directional bets. Instead, they are systematic hedging responses.

For example, when a Morgan Stanley note struck near $105,000, its 75% knock-in at $78,700 forced the dealer to sell once BTC fell below that level.

In quiet markets, these actions are subtle. However, when positions are crowded, they can dominate price movements.

As BTC crosses trigger points, flows accelerate automatically, affecting volatility clusters and market perception.

Such mechanisms also extend to correlated assets. Precious metals like silver and gold experienced heightened volatility during the Bitcoin sell-off.

Silver fell more than 18%, and MSTR stock declined as bearish sentiment spread. Transitioning from calm to stressed conditions amplifies these effects further.

Mapping Trigger Points and Market Flows

Hayes is mapping bank-issued notes to identify key trigger zones. Each note contains invisible barriers that influence dealer hedges.

Understanding these levels is now essential for traders seeking to anticipate flow-driven price swings.

CryptoQuant analysts confirmed that ETFs, including BlackRock IBIT, have reduced positions accumulated last year.

This steady selling creates pressure independent of market sentiment. Therefore, price moves may reflect hedging mechanics rather than investor pessimism.

Community discussions on X support Hayes’ observations. Traders note that auto-call and knock-in levels create predictable flow points.

These mechanical triggers can lead to accelerated selling or buying, often before public narratives emerge.

Moreover, the recent BTC rebound to $70,000 highlights how flows can reverse. Dealers adjust as triggers reset, showing how structured product mechanics shape short-term volatility.

Hayes emphasizes that traders must adapt strategies according to issuance, positioning, and barrier geometry.

Overall, the BlackRock IBIT Bitcoin crash illustrates a shift. BTC is no longer influenced solely by macro trends or sentiment. Instead, structured product flows and hedging dynamics now play a critical role in price movements.

Crypto World

Tether Just Took Down Crypto Gambling Syndicate in Turkey

Tether, the issuer of the world’s most widely traded stablecoin, has frozen more than $500 million in digital assets.

The funds are linked to a massive illegal gambling and money-laundering syndicate in Turkey.

Sponsored

Sponsored

Tether Marks One of Crypto’s Largest Crackdowns

The freeze targets assets reportedly owned by Veysel Sahin, an individual Turkish prosecutors accuse of orchestrating a sprawling illegal betting network.

Notably, this move marks one of the largest single-asset seizures in the cryptocurrency sector to date.

Tether CEO Paolo Ardoino confirmed the company’s role in the crackdown, emphasizing the firm’s increasing cooperation with international law enforcement.

“Law enforcement came to us, they provided some information, we looked at the information and we acted in respect of the laws of the country. And that’s what we do when we work with the DOJ, when we work with the FBI, you name it,” he reportedly said.

Meanwhile, the enforcement action highlights a significant pivot for the British Virgin Islands-incorporated firm. Once criticized by regulators for a perceived lack of transparency, Tether has repositioned itself as a proactive partner to global police agencies.

Sponsored

Sponsored

Earlier this year, the company froze more than $180 million worth of its USDT token. In total, Tether has now frozen more than $3 billion in assets since its inception.

With a circulating supply exceeding $187 billion, Tether’s USDT token serves as the primary source of liquidity for the global cryptocurrency market. BeInCrypto previously reported that this asset serves more than 534 million users globally.

Its widespread use allows traders to move funds quickly between exchanges without relying on traditional banking rails.

However, the speed and scale of recent interventions have dismantled the “censorship-resistant” reputation that once defined the digital asset sector.

Beyond enforcement, Tether has been aggressively diversifying its USDT reserves over the past year.

The company recently announced a $150 million investment in Gold.com, and a $100 million strategic investment in Anchorage Digital, America’s first federally regulated digital asset bank.

Meanwhile, these investment follows a record-breaking financial year for the stablecoin giant.

Buoyed by $10 billion in 2025 profits, Tether has expanded its reach beyond stablecoins. The firm is now deploying capital across a diverse portfolio of internal initiatives, ranging from sports to Bitcoin mining, decentralized communications, and artificial intelligence.

Crypto World

BlockDAG’s $0.00025 Entry is the 2026 Opportunity DOGE and SHIB Can No Longer Offer

Crypto markets continue to shift as investors balance caution with the search for fresh opportunities. Established meme coins are offering mixed signals, with Dogecoin price today hovering near key levels after light gains, while volume remains soft. At the same time, the shiba inu price is moving sideways following recent volatility, keeping traders focused on whether consolidation will turn into a breakout or further decline.

Against this backdrop, BlockDAG is drawing stronger attention by offering access before public trading begins. Its final private round is live at a fixed price of $0.00025, with no vesting and full token delivery at launch. Early buyers also receive limited early trading access, a structure rarely available to retail participants. For investors tracking potential top crypto gainers, BlockDAG (BDAG) presents a clearer, earlier entry point than most market options today.

Dogecoin Price Today Shows Mixed Signals Near $0.11 Level

Dogecoin is showing mixed signals as the crypto market remains uncertain. Fear is still present, but selling pressure has slowed for now. The meme coin sector rose 3% in the last day, reaching a market value of $38.10 billion. Dogecoin gained about 2%, trading between $0.1058 and $0.11. Dogecoin price today sits near $0.1079, while daily trading volume fell sharply by over 43% to $1.26 billion. Recent data also shows $2.40 million in liquidations.

If weakness continues, Dogecoin price today could slip toward the $0.1068 support level, and deeper losses may push it below $0.1057. On the upside, a recovery could lift Dogecoin price today toward $0.1090 and possibly above $0.1102 if buying strength improves.

Shiba Inu Price Trades Sideways Amid Market Uncertainty

Shiba Inu starts February 2026 in a consolidation phase as traders closely watch price trends, on-chain data, and overall market sentiment. After strong volatility in recent months, price action has slowed, raising questions about whether a breakout or sideways movement will follow. Shiba Inu price is currently trading near $0.000006521, reflecting a 5.91% daily decline. The token holds a market cap of about $3.85 billion, while trading volume stands near $144.75 million.

Technical charts show downward pressure, with resistance around $0.00000702. Strong buying could push prices toward this level. However, if selling increases, support lies near $0.00000661, with further downside toward $0.00000600. Indicators show mixed signals, keeping the Shiba Inu price in focus for the coming weeks.

BlockDAG Final Private Round Goes Live at $0.00025

Most traders chase top crypto gainers after the move has already happened. The BlockDAG private sale flips that script by letting participants step in before price discovery even begins.

This final private round is live at $0.00025, locking in a launch valuation that public buyers won’t see again. With a projected launch price of $0.05, BDAG is positioned for a 200× upside, but only for those who secure allocation now. Once this round closes, the opportunity window shuts with it.

What makes this setup different is execution. There’s no vesting, no delayed claims, and no waiting periods. On launch day, your full allocation is delivered straight to your wallet. Clean. Simple. Immediate.

Then comes the edge most people never get: nine hours of early trading access before public markets open. That window exists for one reason: to let private sale participants position ahead of the initial volatility wave. While others rush in blind, you’re already active.

This isn’t a rolling sale or an evergreen offer. The final allocation is finite. When it fills, BDAG becomes fully distributed, forever. From that point on, exposure is limited to open-market buys at whatever price demand sets.

For anyone scanning the market for the top crypto gainers of the next cycle, this private sale isn’t about hype. It’s about timing, structure, and access, three things public markets never offer equally. The dashboard is open. Supply is moving. The clock isn’t slowing down.

BlockDAG Makes Its Case as a Future Top Crypto Gainer

As markets pause, the contrast between hesitation and opportunity is becoming clearer. Dogecoin price today and Shiba Inu price continue to reflect uncertainty, with both assets locked in tight ranges and waiting on a broader market push. For investors chasing momentum, patience is being tested.

BlockDAG, however, is operating on a different timeline. Its final private round at $0.00025 offers fixed pricing, instant ownership, and early trading access before the public rush begins. Once this window closes, entry shifts to open markets at unknown prices. For those scanning the horizon for the next wave of top crypto gainers, the choice is simple. Act early, or watch from the sidelines as demand takes over.

Private Sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

-

Video5 days ago

Video5 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics6 days ago

Politics6 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech23 hours ago

Tech23 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports15 hours ago

Sports15 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Sports5 hours ago

Former Viking Enters Hall of Fame

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports1 day ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat1 day ago

NewsBeat1 day agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat16 hours ago

NewsBeat16 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World4 days ago

Crypto World4 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”