CryptoCurrency

Is This the Bullish Signal for a 2026 Market Rally?

Ripple (XRP) Holds Key Support as Supply Reduction Sparks Optimism for 2026 Recovery

Ripple’s XRP continues to demonstrate resilience, maintaining support above a critical demand zone that has persisted throughout 2025. Recent data highlights a significant decline in the token’s supply held on exchanges, fueling speculation about a potential bullish turnaround as the cryptocurrency approaches the new year. With supply tight and accumulation rising, market analysts are cautiously optimistic about XRP’s prospects heading into 2026.

Key Takeaways

- Supply of XRP on exchanges has plummeted to its lowest levels in eight years, indicating diminished selling pressure.

- Recent exchange outflows suggest strong accumulation by large holders moving into cold storage or investment products.

- Support remains firm above $1.78, with historical recoveries often preceded by holding this level.

- Market sentiment hints at a possible structural shift towards institutional acceptance in the near term.

Supply on Exchanges Dips to Year-High Lows

According to data from Glassnode, XRP’s supply held on exchanges has sharply declined over the past 60 days, reaching levels last seen in August 2018. The supply shrank by approximately 2.16 billion tokens, from 3.76 billion to 1.6 billion. This decrease reflects waning selling interest, with investors seemingly hoarding tokens in anticipation of future gains.

Market analysts emphasize that the declining exchange balances, coupled with record outflows, are signs of accumulating interest from large investors. Data shows that record net outflows, totaling over 1.4 billion XRP on October 19, mark the largest withdrawal in the asset’s history, signifying increasing buy-side activity.

“Supply is tightening, with about 1.5 billion XRP left on exchanges,”

noted analyst Levi Rietveld, adding, “Bullish, grab yours now!”

Such movements typically indicate institutional interest, with tokens transferred into cold storage or investment vehicles like ETFs. Traders suggest that as liquidity continues to restrict, XRP could establish a more robust foundation for future price appreciation, potentially transforming it into an institutional-grade asset by 2026.

Strong Support at $1.78 Outlined

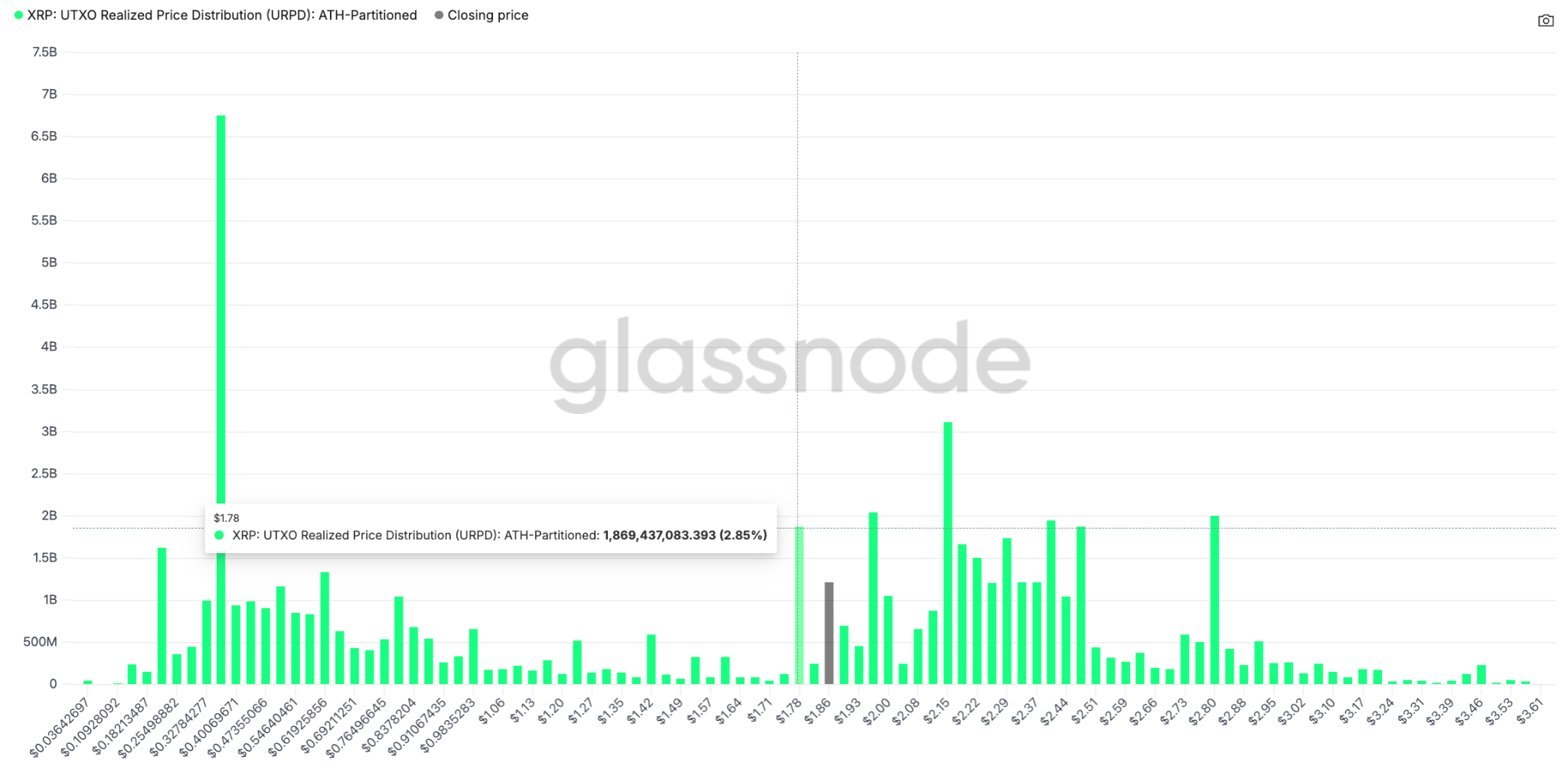

The recent downturn in XRP’s price was halted by resilient demand between $1.60 and $1.84—a zone that has provided consistent support throughout 2025. Maintaining above this level has historically led to price recoveries and a potential breakout scenario. The most significant support lies near $1.78, where approximately 1.87 billion tokens were originally acquired at this price level, according to Glassnode’s UTXO realized price distribution.

Failure to hold this critical support could diminish prospects for a 2026 recovery. However, a bounce from this zone might signal a triple-bottom breakout, with targets near $3.79, according to technical analysts. A break above the downtrend channel would confirm a bullish reversal, yet some experts see XRP likely to remain range-bound until renewed bullish catalysts emerge.

Overall, XRP’s technical landscape points to a cautiously optimistic outlook, contingent upon its ability to sustain key support levels and actualize the current accumulation trends into sustainable price movement as the market enters 2026.