Crypto World

JPMorgan cuts Coinbase (COIN) price target to $290 ahead of earnings

The crypto market downturn has been particularly hard on leading American exchange Coinbase (COIN), which has seen its stock plunge more than 50% since bitcoin’s early October record above $126,000, including a 27% decline in 2026 alone.

Attempting to catch up to that fast tumble, JPMorgan’s Ken Worthington slashed his price target on COIN to $290 from $399 ahead of the company’s fourth quarter earnings report coming after the close on Thursday.

Worthington remains a bull on the stock and his reduced target still suggests 75% upside from COIN’s current price of $1655.

Worthington projects adjusted EBITDA of $734 million, down from $801 million in the third quarter. That would mark a sharp drop from prior quarters, driven mainly by lower trading volumes, weaker crypto prices and slower growth in USDC stablecoin balances, he said.

Worthington estimates spot crypto trading volume of $263 billion for the quarter. He also pointed to lower USDC in circulation, modeling stablecoin-related revenue of $312 million. Those headwinds were partially offset by a full quarter of contributions from Deribit, the crypto derivatives exchange Coinbase acquired in August.

Including Deribit, JPMorgan models total transaction revenue of $1.06 billion, with Deribit contributing about $117 million on an estimated $586 billion in trading volume. In the previous quarter, the exchange reported $1 billion in transaction revenue.

On the subscription and services side, the bank expects revenue of $670 million, below Coinbase’s prior guidance range of $710 million to $790 million, reflecting softer crypto prices, lower staking yields and slower USDC growth. Worthington also expects operating expenses to come in below guidance as the company reins in costs.

Other sell-siders weigh in

Barclays analyst Benjamin Budish said his estimates sit roughly 10% below consensus on adjusted EBITDA, driven by weaker retail trading and blockchain rewards revenue. “We are notably lower on retail trading revenues, based on read-throughs from Robinhood, and blockchain rewards revenues,” Budish wrote, adding that consensus estimates may not yet fully reflect publicly available volume data.

Barclays estimates Coinbase exchange volume of about $261 billion in the quarter. He said Robinhood’s (HOOD) reported retail crypto volumes, which have historically tracked closely with Coinbase’s, fell about 15% quarter over quarter.

Compass Point struck a more bearish tone. Analyst Ed Engel said he is negative on the stock into earnings, expecting disappointment in the subscription and services segment. “While investors place a premium multiple on COIN’s S&S segment, we expect 4Q results to affirm overall revenue remains tied to overall crypto prices,” Engel wrote. He also expects January trading revenue to reflect what he described as Coinbase’s weakest retail engagement since the third quarter of 2024.

Beyond the headline numbers, investors are likely to focus on commentary on trading activity early in 2026, the sustainability of USDC-related income, and whether newer initiatives, such as Deribit and Coinbase’s futures business, can meaningfully offset swings in spot crypto markets.

Crypto World

UK Central Bank to Launch Onchain Settlement Infrastructure Pilot

The Bank of England has launched a new industry experimentation initiative to explore how tokenized assets could be settled using synchronized, atomic settlement in British pounds sterling as part of efforts to modernize the UK’s real-time gross settlement (RTGS) infrastructure.

The Synchronisation Lab initiative will allow 18 selected companies to test delivery-versus-payment and payment-versus-payment settlement between the BoE’s next-generation RTGS core ledger, known as RT2, and external distributed-ledger platforms, in a non-live environment without using real money, according to a bank statement.

The six-month pilot, scheduled to start in spring 2026, is intended to validate the central bank’s design choices for synchronized settlement, assess interoperability between central bank money and tokenized assets, and inform the development of a potential future live RTGS synchronization capability.

Originally announced in October, the initiative brings together 18 participants, including market infrastructure providers, banks, fintechs and decentralized-technology companies to test use cases spanning tokenized securities settlement, collateral optimisation, foreign exchange and digital-money issuance.

Among the Web3 participants, Chainlink and UAC Labs will test decentralized approaches to coordinating synchronized settlement between central bank money and assets issued on distributed-ledger platforms. Companies such as Ctrl Alt and Monee will focus on delivery-versus-payment settlement for tokenized gilts and other securities.

Other participants, including Tokenovate and Atumly, will test conditional margin payment workflows and digital-money issuance and redemption flows designed to coordinate with RTGS settlement. The roster also includes Swift and LSEG.

The bank said the work of the lab initiative will be used to refine the design of its RTGS synchronization capability and support further development work, with participants expected to present their use cases and findings following the conclusion of the program.

Related: UK Lords launch stablecoin inquiry as Bank of England moves to finalize rules

Global central banks expand pilots

The Bank of England is just one of a roster of central banks exploring how tokenization, programmable settlement and digital currencies could reshape their core monetary and payment systems.

In May, the Federal Reserve Bank of New York and the Bank for International Settlements published research from Project Pine examining how smart contracts could support monetary policy in tokenized financial systems, including a prototype toolkit for faster and more flexible central bank actions on programmable ledgers.

In October, the Monetary Authority of Singapore announced BLOOM, an initiative aimed at expanding settlement infrastructure to support transactions in tokenized bank liabilities and regulated stablecoins.

Beyond tokenization pilots focused on settlement and market infrastructure, central banks have also been running experiments with central bank digital currencies (CBDCs).

In Australia, the central bank launched a wholesale digital currency trial in July using stablecoins, tokenized bank deposits and a pilot CBDC.

This was followed by the United Arab Emirates completing its first government payment with a digital dirham in November, and China-led mBridge reporting in January that it had processed $55 billion in cross-border CBDC transactions across multiple jurisdictions.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

X Creators $1M prize winner exposed as memecoin pump-and-dumper

A week ago, X’s million dollar Creators competition drew to a close, with user “beaverd” awarded the grand prize for their article entitled “Deloitte, a $74 billion cancer metastasized across America.”

“Congratulations, you’re a millionaire,” the announcement read, though it appears the winner was already over halfway there.

An investigation by crypto analytics company Bubblemaps claims that beaverd is a “serial rugger who made $600,000 from memecoin pump and dumps.”

Read more: Clawdbot creator Peter Steinberger: ‘Crypto folks, stop harassing me’

Bubblemaps describes how the crypto crowd was pleased to see a “web3 native with a Milady PFP” win the competition.

However, examination of addresses connected to beaverd’s public address, including one registered as adolfnigler.sol with Solana Naming Service, uncovered less than exemplary behaviour.

Bubblemaps states it found a connection to the deployer of Pump Fun token SIAS. The token “soared to $6 million mcap, dumped to 0 minutes later, deleted all its social media.”

Beaverd made $600,000 in the process by “sniping” the launch.

The thread claims Bubblemaps identified “dozens of memecoins,” with names such as PISS, 4am, RACISM, ExitStrat and EGG, all of which “went to zero.”

Apparently unbothered by the attention being given to their extra curricular activities, beaverd replied to Bubblemaps’ thread.

Rather than denying the allegations, they suggest that plenty of other, more lucrative, examples remain unidentified: “cry me a river, also these arent (sic.) even the top 5 greatest hits.”

Read more: Bubblemaps links MYX team to $170M airdrop farm

‘I’m a little bit racist’

X awarded $1 million to beaverd’s post for being the “Top Article by US Verified Home Timeline impressions.”

The announcement says the piece “examines the role of a major government consulting firm in federal and state IT systems, analyzing contract data, audits, and documented system failures.”

Its author, who admits to being “a little bit racist,” and isn’t sorry about it, is also behind SomaliScan which purports to be a government payments transparency dashboard.

Both on the site and on X, beaverd describes themself as “God’s most retarded soldier.”

Beaverd replied to the winning post, plugging the contract address for their Pump Fun memecoin somaliscan. The token is down 86% since its all-time-high (the day after the Creator prize was announced), according to CoinGecko data.

The irony of a seemingly unrepentant “serial rugger” being awarded $1 million for an article on government spending wastage isn’t lost on us here at Protos.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

LINK price slips as Bank of England selects Chainlink for its Synchronization Lab

Chainlink price continued its downward trend on Tuesday, February 10, continuing a downward trajectory that started in August when it peaked at $27.8.

Summary

- Chainlink price has dropped in the last four consecutive weeks.

- The Bank of England selected it as a member of its Synchronization Labs.

- Technical analysis suggests that the LINK price will continue falling.

Chainlink (LINK) token was trading at $8.60, down by 70% from its highest point in 2025. It is hovering near its lowest level since Aug. 2024.

LINK token retreated even after the Bank of England selected Chainlink as part of the Synchronization Lab, where it will provide decentralization solutions. It joins other major entities like Swift, Quant (QNT), the London Stock Exchange, ClearToken, and Nuvante that will participate in the program.

The Synchronization Lab is a new project that will allow synchronization operators to demonstrate how they will interact with the upcoming RT2 synchronization capability. It will build on Project Meridian, which has demonstrated that the synchronization operator concept is technically feasible.

According to the statement, the Synchronization Lab will also demonstrate synchronization’s flexibility and supporting ecosystem readiness.

The Bank of England becomes the next major organization to select Chainlink as its oracle provider. Some of its top partners are companies like UBS, Euroclear, JPMorgan, DTCC, ANZ Bank, and Fidelity.

These partnerships have helped boost Chainlink’s revenue over time, which has helped it boost the Strategic LINK Reserves. Data shows that the network has accumulated 1.9 million tokens worth over $16.2 million.

Meanwhile, spot Chainlink ETFs have continued doing well this month and are beating other coins like Bitcoin and Ethereum. Spot BTC ETFs have accumulated over $5.58 million in assets this month, while Bitcoin funds have shed over $173 million. Ethereum funds have shed $108 million in outflows this month.

LINK price technical analysis

The weekly chart shows that the LINK price has slumped in the past few months, moving from a high of $27.46 in August to a low of $8.5.

It has dropped below the crucial support level at $10.24, the neckline of the giant head-and-shoulders pattern, which has been forming since October 2023.

It has moved below the 50-week and 100-week Exponential Moving Averages, while the Relative Strength Index has continued moving downwards. The two averages have formed a bearish crossover.

Therefore, the next key support level to watch will be at $5.541, its lowest level in June 2023. If this happens, the coin will fall by about 35% from the current level.

Crypto World

Bitcoin Trades Like Growth Stock, Not Gold: Grayscale

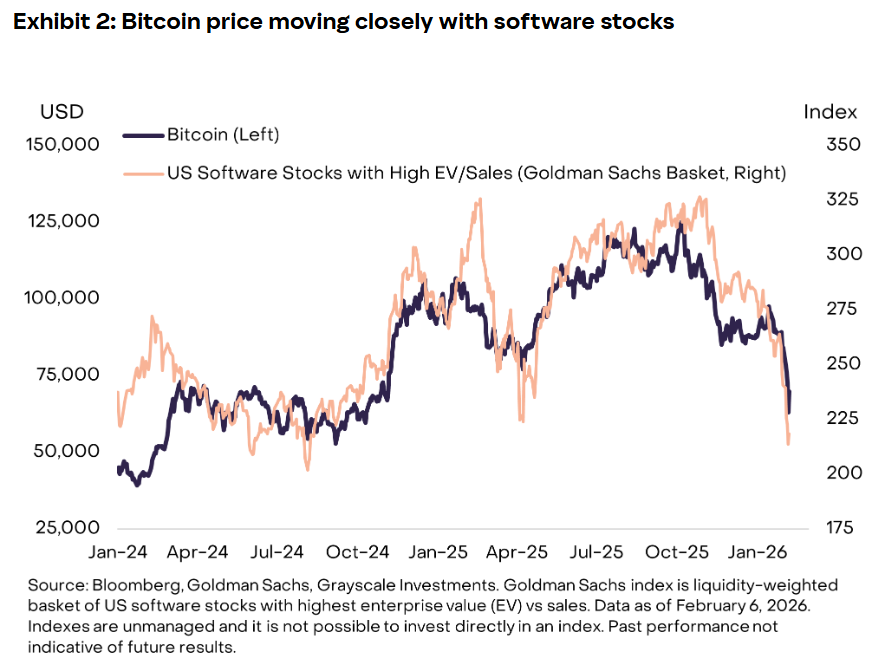

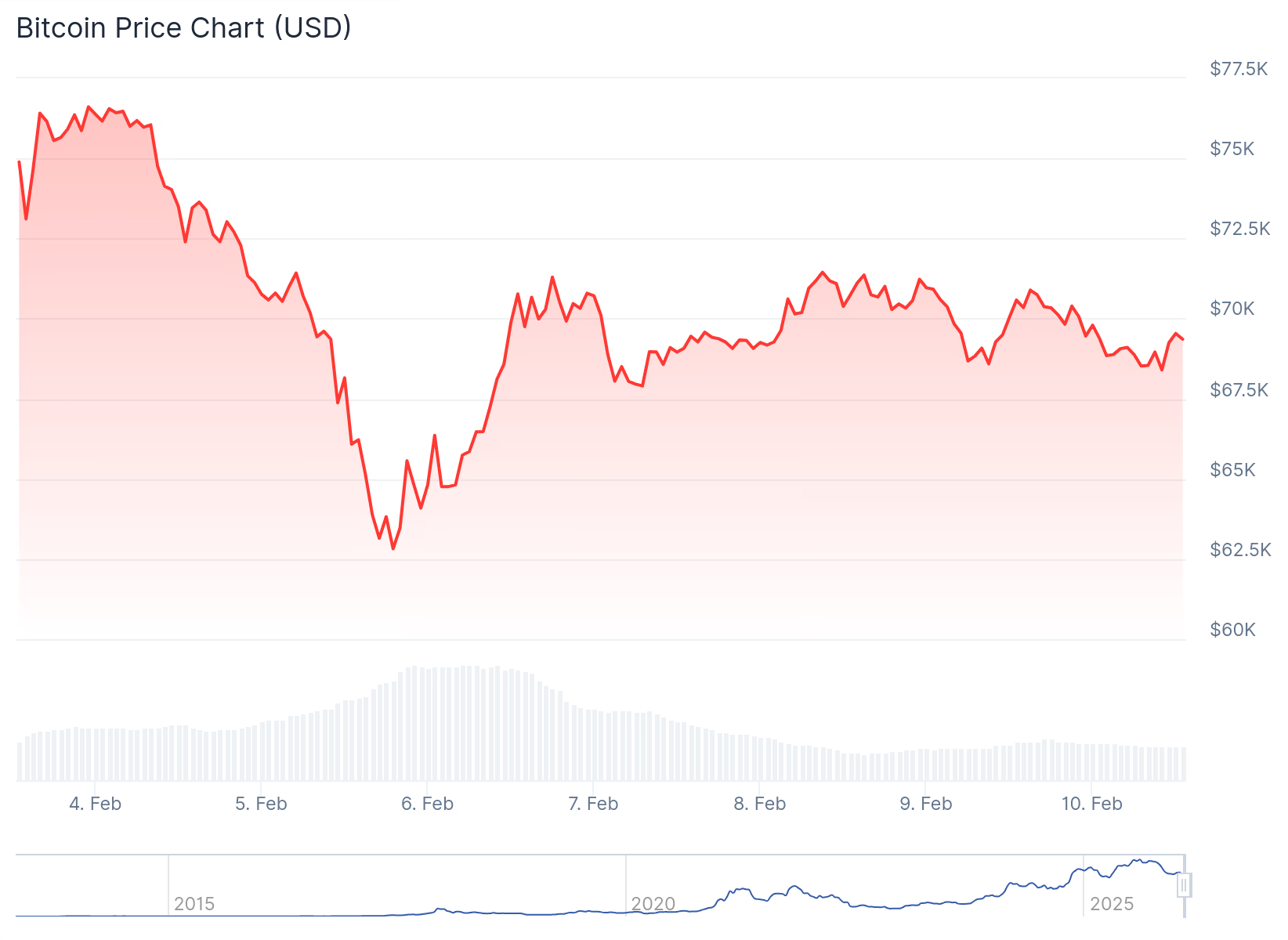

Bitcoin’s long-standing narrative as “digital gold” is being put to the test as its recent price action increasingly resembles that of a high-risk growth asset rather than a traditional safe haven, according to new research from Grayscale.

Report author Zach Pandl said on Tuesday that while Grayscale still views Bitcoin (BTC) as a long-term store of value due to its fixed supply and independence from central banking authorities, recent market behavior suggests otherwise.

“Bitcoin’s short-term price movements have not been tightly correlated with gold or other precious metals,” Pandl wrote, pointing to record rallies in bullion and silver prices.

Instead, the analysis found that Bitcoin has developed a strong correlation with software stocks, particularly since early 2024. That sector has recently come under intense selling pressure amid concerns that artificial intelligence could disrupt or render many software services obsolete.

The report suggests Bitcoin’s growing sensitivity to equities and growth assets reflects its deeper integration into traditional financial markets, driven in part by institutional participation, exchange-traded fund activity and shifting macroeconomic risk sentiment.

The shift comes as Bitcoin has experienced about a 50% drawdown from its October peak above $126,000. The decline unfolded in several waves, beginning with a historic October 2025 liquidation event, followed by renewed selling in late November and again in late January 2026. Grayscale also pointed to “motivated US sellers” in recent weeks, citing persistent price discounts on Coinbase.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

Part of Bitcoin’s ongoing evolution

Bitcoin’s recent failure to live up to its safe-haven narrative should not be viewed as a setback but rather as part of the asset’s ongoing evolution, according to Grayscale.

Pandl said it would have been unrealistic to expect Bitcoin to displace gold as a monetary asset in such a short period.

“Gold has been used as money for thousands of years and served as the backbone of the international monetary system until the early 1970s,” Pandl wrote.

While Bitcoin’s failure to reach similar monetary status is “central to the investment thesis,” he said, it could evolve in that direction over time as the global economy becomes increasingly digitized through artificial intelligence, autonomous agents and tokenized financial markets.

In the near term, Bitcoin’s recovery may depend on fresh capital entering the market, either through renewed ETF inflows or a return of retail investors. Market maker Wintermute said retail participation has recently been concentrated in AI-related stocks and growth narratives, limiting near-term demand for crypto assets.

Related: Wall Street’s crypto debate is over as banks go all-in on BTC, stablecoins, tokenized cash

Crypto World

HBAR $5 Million Short Positions Are At Risk: Here’s How

Hedera has remained under pressure after a sustained decline kept HBAR trapped within a month-long downtrend. Price has struggled to attract meaningful demand, leaving recovery attempts muted.

A breakout from this structure requires stronger investor support, which remains limited for now. This lack of conviction is giving derivatives traders time to position cautiously.

HBAR Traders Are Under Threat

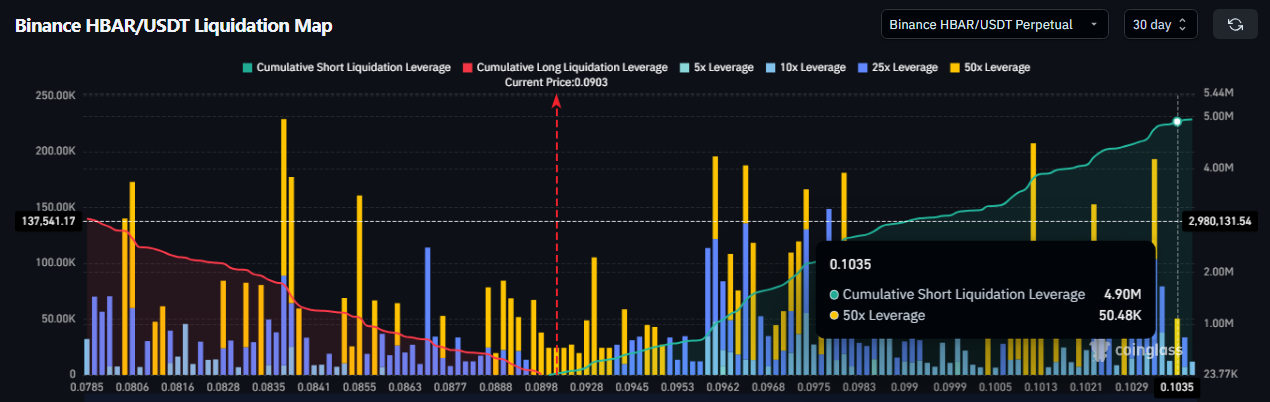

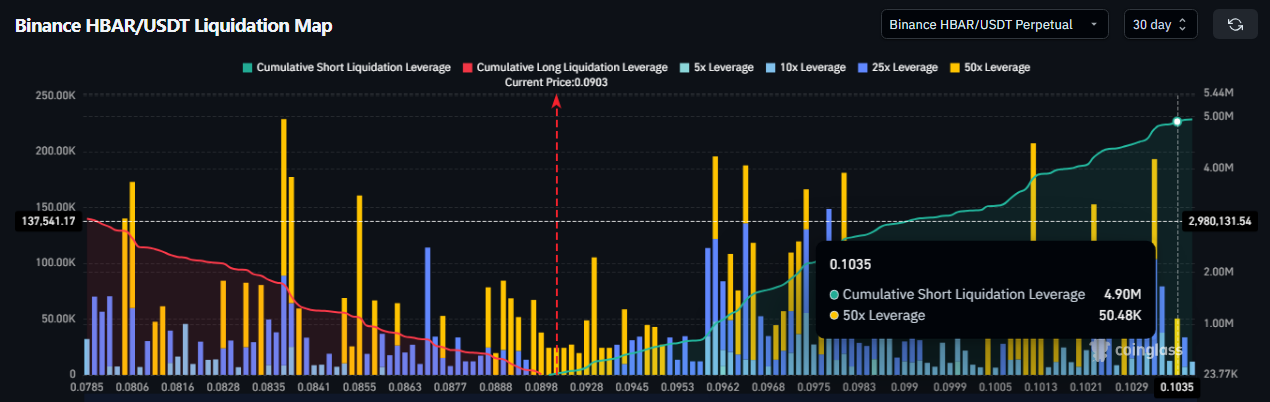

Futures positioning shows a clear bearish skew. The liquidation map indicates that short contracts carry greater exposure than longs across key price levels. This imbalance reflects traders’ expectations that HBAR may continue to face downside pressure before any durable recovery takes shape.

Sponsored

Sponsored

However, this setup creates a potential squeeze scenario. If HBAR escapes its downtrend and rallies toward the $0.1035 resistance, nearly $5 million in short positions could face liquidation. Such an event would force bearish traders to cover, potentially injecting sudden buying pressure and shifting short-term sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain momentum signals offer a mixed picture. The Chaikin Money Flow formed a bullish divergence against the price’s lower lows earlier this week. While price continued falling, CMF trended higher, suggesting selling pressure was easing rather than intensifying.

Despite this divergence, confirmation remains absent. CMF has yet to cross above the zero line, which would signal inflows dominating outflows. Capital continues leaving HBAR, albeit at a slower pace. Until this shift completes, the bullish signal remains tentative rather than decisive.

HBAR Price May Not See a Bounce Back Just Yet

HBAR is trading near $0.0903 at the time of writing. Price action at this level has not inspired confidence among investors. Weak participation continues to limit capital inflows, reinforcing bearish conviction among futures traders who see little reason to unwind positions prematurely.

The near-term outlook hinges on whether HBAR can break its downtrend. Continued consolidation above the $0.0901 support would reduce immediate downside risk. If inflows begin improving alongside price stability, HBAR could advance toward the $0.1030 resistance. Reaching this level would place short positions under pressure and potentially trigger liquidations.

Downside risk remains prominent if conditions deteriorate. A breakdown below the $0.0901 support would expose HBAR to further losses. Under that scenario, price could slide toward $0.0830. Continued weakness could extend declines to $0.0751, fully invalidating the bullish thesis and confirming continuation of the broader downtrend.

Crypto World

Why ZKP is the Best Crypto to Buy with 9,000% Potential, While Bitcoin Cash Price Stalls & Hyperliquid Price Dips

Global stock markets are tumbling, sparking massive sell-offs that have frozen the digital asset space near $2 trillion. As a result, older tokens are stalling; the Bitcoin Cash price is stuck below $850, while the Hyperliquid price has dropped 10% from its peak. This loss of steam brings up a vital point: does keeping sluggish assets with capped growth still justify your financial risk?

Searching for rapid gains, specialists now name ZKP crypto as the premier choice. Unlike dormant leaders, this Layer 1 presale employs a supply-squeeze mechanism that has already fueled a 2,100% climb since stage 1. Since the current $0.00012 cost is built to increase, experts forecast a massive 9,000% jump by Stage 17.

This proven growth path offers an uneven risk-reward ratio similar to early Ethereum profits. By providing planned growth rather than erratic swings, ZKP beats the rivals as the best crypto to buy for huge returns.

ZKP Crypto: A High-Speed Wealth Catalyst

ZKP crypto is moving fast through a high-demand presale as a private Layer 1 network. Unlike hype-based ideas, this chain debuts with $100 million in functional tech, establishing an instant lead. Therefore, this technical maturity turns the presale into a vital buying phase, putting early backers far ahead of the general public.

Because old markets are crowded and sluggish, they fail to produce high returns for newcomers. In contrast, ZKP provides a high-energy setting built for rapid growth, prompting top wealth experts to call it the best crypto to buy for bold expansion.

The system ignores fickle trends, using a firm auction model to drive value up through software. With the entry price at $0.00012, logic shows this rate is fleeting. As buying interest hits falling supply, the token’s worth must climb sharply.

Proof is clear; the shift from stage 1 to stage 2 sparked a documented 2,100% rally. Using these facts, estimates suggest a giant 9,000% gain by Stage 17, creating a scenario where a $100 buy could mimic early Ethereum wins.

In the end, this proven rarity makes the profit potential certain. Because the protocol mandates a shrinking supply, analysts agree that ZKP is the best crypto to buy to build lasting wealth.

Hyperliquid (HYPE) Price: Big Tech Joins the Chaos

Hyperliquid is growing its reach quickly, recently linking with Ripple Prime to offer over 300 corporate users direct market entry. This major win arrived with the “Outcomes” debut via the HIP-4 patch, a new tool adding safe betting markets to the hub. Thus, these moves sparked a big climb earlier this week, sending the Hyperliquid price toward $38 as it nearly beat Cardano in market rank.

Yet, the market is now bracing for a massive upcoming token release. Because roughly $287 million in coins will unlock on February 6, sellers have cashed out, causing a quick 10% dip. This “supply glut” has pushed the Hyperliquid price down to the $32 zone, leaving traders to see if new big-money backing can absorb the upcoming selling wave.

Successes & Obstacles for the Bitcoin Cash Price

Growth plans are picking up as the St. Kitts leaders debut a tax-free crypto hub for shops, boosting the chain’s daily use. At the same time, coders shared the final plans for the “Dragonfly” patch arriving in May 2026, which aims to make CashTokens much faster for DeFi. Still, despite these solid tech wins, market interest is low, leaving the Bitcoin Cash price fighting to cross the vital $850 wall.

The drive faces a sharp hurdle from big-money and tech pressures. Records show that fund inflows have stalled for two weeks as major wealth shifts elsewhere. Additionally, mid-tier miners are selling bags to pay for higher power costs, creating steady sell-side heat. Consequently, these trends have trapped the Bitcoin Cash price in a flat range between $815 and $842, showing a 1.5% dip as traders wait for a real spark.

The Bottom Line

The crypto world shows a split in momentum. The Bitcoin Cash price stays still despite tech updates, while the Hyperliquid price fights selling heat from new unlocks. Therefore, these crowded tokens lack the sharp growth needed for fast wallet building.

On the other hand, pros view the ZKP crypto presale as the smart move. Unlike coins moved by mood, ZKP uses a fixed math system. Experts stress that the $0.00012 buy-in is set to jump 9,000% by Stage 17, a claim backed by the proven 2,100% hike seen since stage 1.

Ultimately, this planned rise provides a rare win for small buyers. Because the system forces price growth, researchers confirm ZKP is the best crypto to buy for capturing huge market wins.

Explore ZKP:

Website: https://zkp.com/

Buy: buy.zkp.com

Telegram: https://t.me/ZKPofficial

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Ethereum Classic (ETC) price struggles near $8 amid broader crypto weakness

- Ethereum Classic price hovered around 8.30 as Ethereum held the $2,000 level.

- The ETC coin has dropped more than 12% in the past week and could extend the decline.

- Analysts say Bitcoin remains bearish, and this could impact ETC price movement.

Ethereum Classic (ETC) traded in the red in early afternoon hours during the US session on Tuesday, February 10, 2026, down nearly 3% as top coins continued to struggle with bearish pressure.

With the price of Ethereum delicately poised near $2,000 and Bitcoin dropping to lows of $68,000, analysts at CryptoQuant say downside momentum could intensify.

Ethereum Classic, a proof-of-work cryptocurrency created after an Ethereum hardfork, changed hands around $8.30.

The technical picture suggests it could mirror potential broader market losses and touch new multi-year lows.

Ethereum Classic price today

The broad sell-off that hit altcoins on February 5, 2026, pushed Ethereum Classic down sharply to around $7.40.

Panic selling, driven by investors seeking to lock in profits amid heavy liquidations, deepened losses.

Many buyers who entered near the July 2025 highs of about $25 saw their positions turn into unrealised losses, most of which remain underwater at current levels.

Sentiment showed tentative improvement on February 10, when ETC climbed to intraday highs of $8.69.

The move was supported by a 5% rise in daily trading volume to around $64 million, pointing to the possibility of a short-term shift in momentum.

The rebound came as Ethereum posted modest declines but continued to hold above the $2,000 level on increasing volume.

CryptoQuant analysts on bear market

Analysts at CryptoQuant say the bear market is likely in its early stages and fresh losses for BTC and alts are possible.

According to an on-chain analyst at the firm, Bitcoin currently suffers from a lack of new capital injection, and that strengthens the prevailing bear conditions.

“New investor inflows have flipped negative. The sell-off is not being absorbed by fresh capital. In bull markets, drawdowns attract accelerating capital. In early bear markets, weakness triggers withdrawal,” the platform shared on X.

If downside pressure for Bitcoin cascades further into altcoins, ETH may retest recent lows below $1,800. ETC likewise could drop below the key support zone, with a sharper downturn.

ETC price forecast

Bulls need to defend the $8 level or engineer a quick rebound from support if selling pressure intensifies again, a move that could help limit further downside.

If this scenario unfolds, Ethereum Classic may begin to signal a potential trend reversal.

On the daily chart, the relative strength index has stabilised in oversold territory, pointing to the possibility of an upward shift in momentum.

Analysts note that signs of seller exhaustion and the emergence of a bullish divergence could increase the likelihood of a stronger recovery move.

The Moving Average Convergence Divergence (MACD) indicator is pointing to a potential bullish crossover, while improving on-chain accumulation metrics have added to tentative optimism.

However, the near-term technical outlook remains mixed and continues to lean toward downside risks, given persistent weakness across the broader market.

As noted by CryptoQuant, this pressure has remained in place as Bitcoin trades below $70,000 and Ethereum faces resistance near $2,000.

Against this backdrop, Ethereum Classic’s price action around the $8 level, closely linked to movements in ETH, is likely to determine its next major move.

On the downside, analysts point to primary support near $6.33 as a key level to watch.

Crypto World

Bitcoin Holds Near $69,000 as Near-Term Backdrop ‘Remains Fragile’

Most large-cap crypto assets are flat or slightly down today, while ETF flows turned positive.

Crypto markets slumped slightly on Tuesday morning, Feb. 10, with prices stabilizing among large-caps but conviction still thin as total market capitalization sank 2% to $2.43 trillion.

Bitcoin (BTC) is trading near $69,300 at press time, down about 1% over the past 24 hours, with weekly losses at 9%.

Ethereum (ETH) is holding out just above $2,000, slipping 3.3% on the day and down about 10% on the week. Price action across other large-cap altcoins were mixed, with most flat or slightly down today. Hyperliquid’s HYPE saw the biggest losses among the top-20 assets, down 7% on the day and over 15% on the week.

Groundwork for Stronger Returns

On-chain analytics firm Keyrock said in an update on Monday, Feb. 9, that investors remain cautious, with a liquidity-driven risk reset still underway and little sign the market is nearing a sustained recovery.

As speculative liquidity continues to retreat, crypto prices have become more sensitive to shifts in macro conditions and spot demand. And even though Bitcoin has stabilized above recent lows, the analysts say the broader backdrop remains fragile.

“While the near-term backdrop remains fragile, periods marked by pessimism, compressed liquidity, and elevated volatility have historically laid the groundwork for stronger long-term returns once expectations reset and macro clarity improves,” the Keyrock analysts said.

James Harris, chief executive of European crypto firm Tesseract Group, told The Defiant in commentary that macro conditions “are mixed but leaning supportive,” noting that the dollar has weakened over the past year and “rate markets are pricing cuts for later in 2026, though near term policy uncertainty remains.”

As for the on-chain perspective, Harris said exchange outflows and accumulation by larger holders “support the idea of inventory moving from weak hands to stronger hands.”

According to the Crypto Fear & Greed Index, investor sentiment still remains in the “extreme fear” zone, despite flatter markets.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, Aster (ASTER) outperformed the broader market, jumping nearly 8%, while Quant (QNT) and MemeCore (M) rose about 5% and 3%, respectively.

On the downside, decentralized perpetual futures exchange MYX Finance (MYX) was today’s biggest loser, down 4.5%, followed by centralized exchange tokens KuCoin (KCS) and Bitget (BGB), also down about 4%.

As for liquidations, CoinGlass data shows that roughly $260 million in positions were liquidated over the past 24 hours. Bitcoin accounted for about $95.5 million in liquidations, followed by Ethereum at roughly $82.7 million.

ETFs and Macro Conditions

On Monday, Feb. 9, spot Bitcoin ETFs recorded $145 million in net inflows, lifting cumulative inflows to $54.83 billion, according to SoSoValue data. Total value traded reached $4.48 billion, with total net assets at $90.05 billion.

Spot Ethereum ETFs flows were also in the green with $57 million in net inflows yesterday, pushing cumulative inflows to $11.87 billion, despite recent price weakness.

In macro markets, fresh U.S. data reinforced concerns about slowing consumer momentum.

Retail sales were flat in December, missing expectations for a 0.4% increase, according to Commerce Department data published today. Annual retail sales growth slowed to 2.4%, down from 3.3% in November.

Crypto World

Bitmine Ignores $7.8B Paper Losses, Buys $83M Worth of ETH as Market Dips

Tom Lee’s BitMine added 40,000 ETH during the dip, brushing off $7.8 billion losses as Ethereum trades near lows.

BitMine, the Ethereum-focused treasury firm chaired by Fundstrat’s Tom Lee, bought roughly $83 million worth of ETH on Monday, with its existing holdings sitting deep in the red.

The purchases came during another volatile session for Ethereum, with on-chain data showing heavy selling from other large holders and ETH trading near multi-month lows.

BitMine Adds to ETH Stash While Others Exit

Data from the analytics platform Lookonchain, posted on February 10 and 11, shows Bitmine executed two large purchases of 20,000 ETH each from institutional platforms BitGo and FalconX.

Last week, the firm bought 40,613 ETH, and the week prior, it added 41,788 tokens. It now holds approximately 4.32 million ETH, acquired at an average cost of $3,850 per coin. However, at current levels around $2,040, Lookonchain estimates BitMine’s average entry price leaves its position down more than $7.8 billion on paper.

Despite that, Lee has publicly dismissed the recent sell-off as disconnected from Ethereum’s on-chain activity. In comments reported earlier this month, he said BitMine viewed the pullback as attractive, given his view of strengthening Ethereum fundamentals, such as record-high daily transactions. He attributed the price weakness to factors like a rally in gold and a lack of leverage rather than problems with the Ethereum network itself.

Lee also stressed that Bitmine has no debt obligations that would force it to sell any of its ETH, a position that is in contrast to other large players like Trend Research, which, according to Lookonchain, has sold nearly all of its Ethereum since early February, locking in losses of about $747 million after depositing more than 650,000 ETH to Binance during the drop.

Ethereum Price Struggles Amid Heavy On-Chain Movement

Looking at the market, ETH is down about 1% over the past 24 hours, and nearly 13% in the last seven days. The world’s second-largest cryptocurrency by market cap has also lost more than 34% of its value over the past month, according to CoinGecko data.

You may also like:

It fell below $2,000 on February 5 for the first time in months, but despite the volatility and evident selling from some large holders, other data points to a potential reduction in available sell pressure. For example, analyst CoinNiel recently reported that exchange reserves for ETH have dropped to multi-year lows, suggesting longer-term holders are moving assets off trading platforms.

The market now presents a clear divide: one side is cutting losses after a severe downturn, while the other, led by firms like Bitmine, is doubling down on a long-term conviction play, betting that current prices do not reflect the network’s underlying utility.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

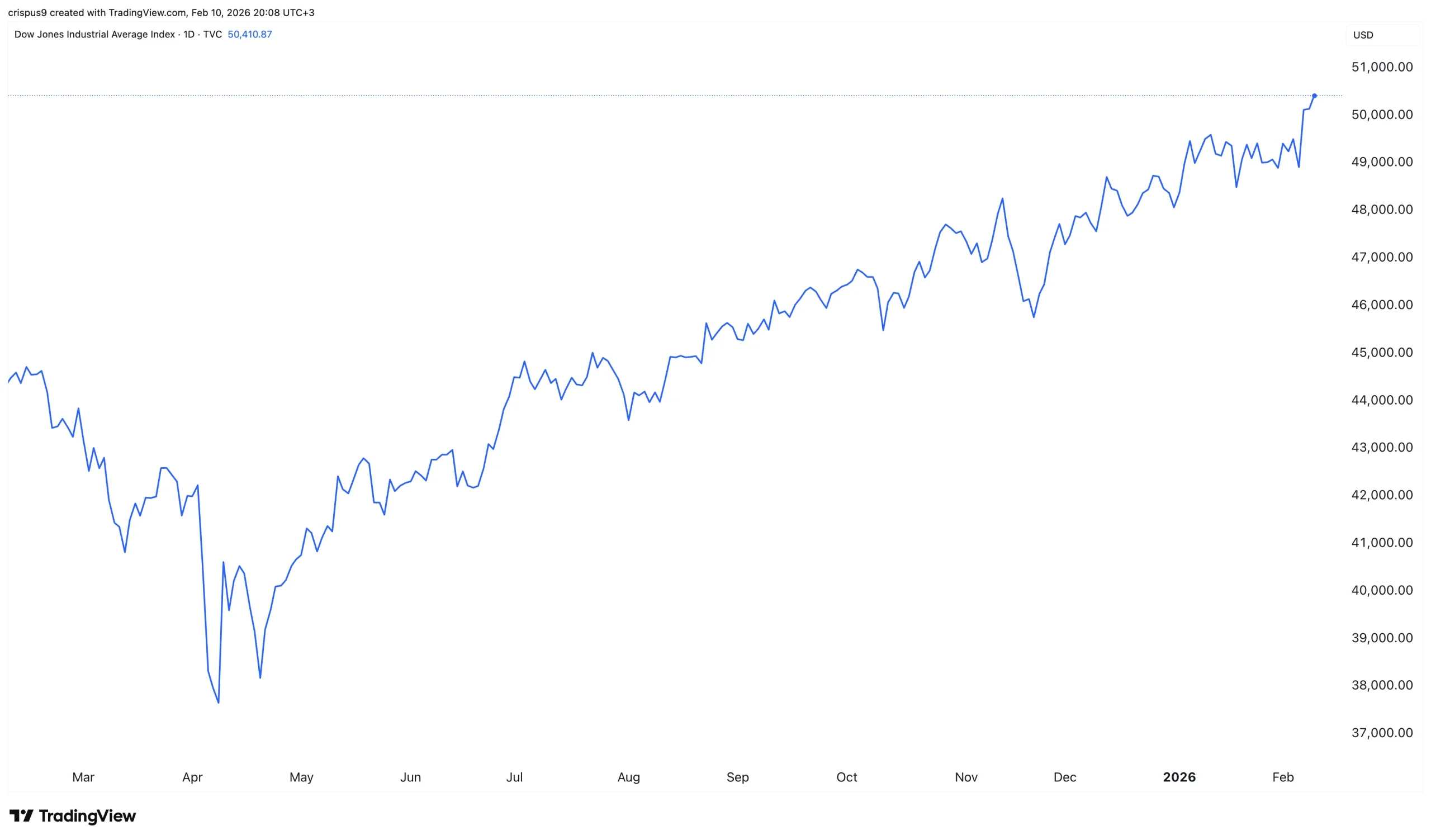

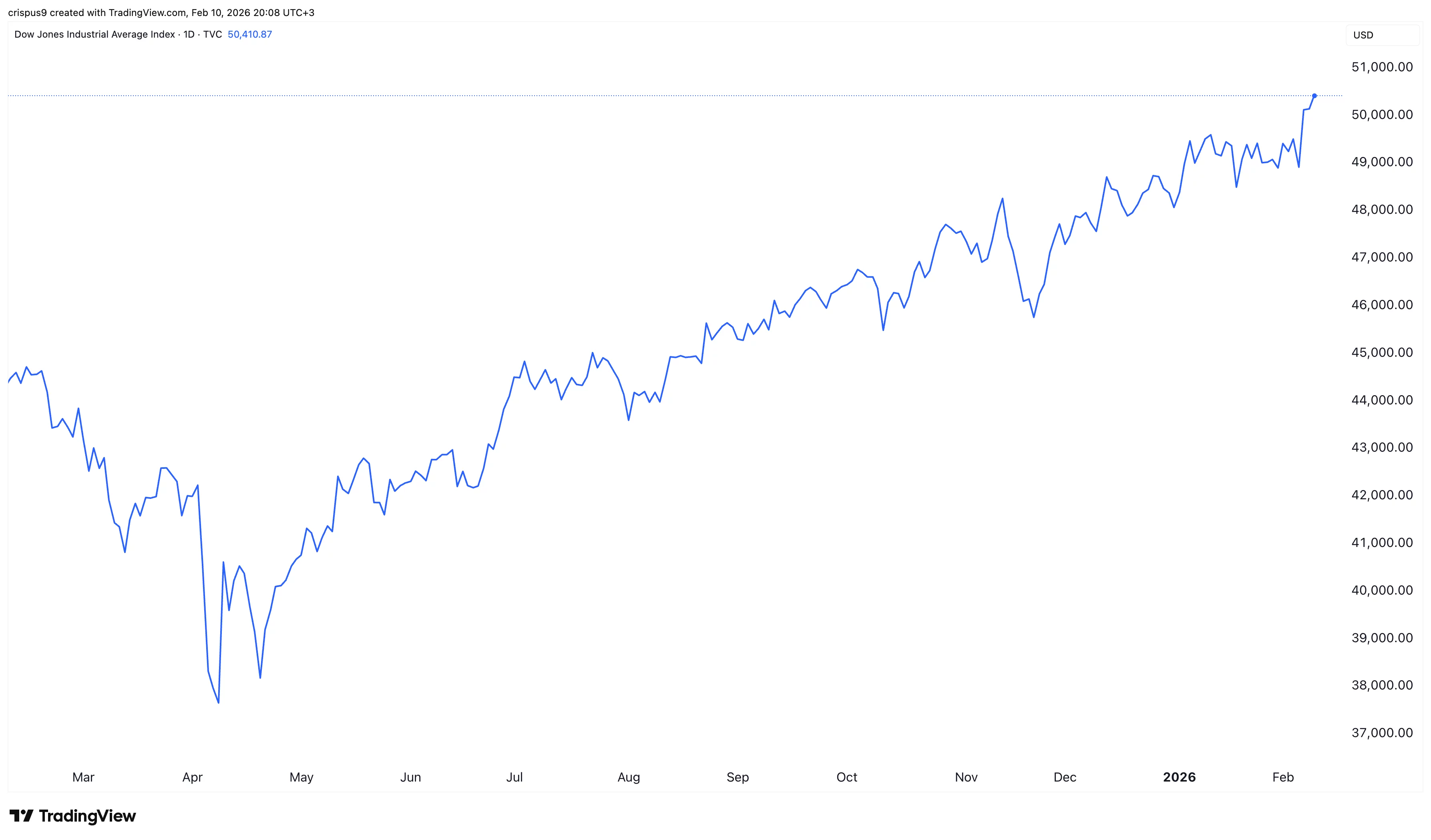

Dow Jones Index gains steam ahead of key earnings, US inflation, and NFP data

The Dow Jones Index continued its strong bull run, reaching a new all-time high on Tuesday, as investors waited for the upcoming corporate earnings and key macro data.

Summary

- The Dow Jones Index continued its strong bull run ahead of the upcoming earnings.

- It has jumped by 37% from its lowest level in April last year.

- The US will publish key macro data on Wednesday and Friday.

Dow Jones, which tracks 30 diverse companies, reached a record high of $50,520, three days after it crossed the important $50,000 milestone. Other blue-chip indices like the S&P 500 and the Nasdaq 100 continued their uptrend.

Dow Jones Index rallies

The Dow Jones has done well in the ongoing earnings season. Data compiled by FactSet show that most American companies have reported strong financial results, with 76% of S&P 500 companies reporting a positive surprise.

The blended earnings growth of all S&P 500 Index companies that have reported is 13%. If this is the final number, it will be the fifth consecutive quarter of double-digit growth.

Dom key companies in the Dow Jones will publish their numbers this week. The most notable ones will be Cisco and McDonald’s. Other notable companies to watch this week will be Applied Materials, Arista Networks, T-Mobile, Shopify, and Ford.

US stocks to react to key macro data

The Dow Jones Index will also react to upcoming U.S. macroeconomic data.

The first will be the delayed U.S. non-farm payrolls report, which comes out on Wednesday. Economists polled by Reuters expect the upcoming report to show that the economy created 70,000 jobs in January, higher than the 50k it created in December. The unemployment rate is expected to remain at 4.4%.

These numbers come as some major American companies have recently announced layoffs. Amazon is shedding over 16,000 layoffs on top of the 15,000 it announced last year.

Other top companies, including UPS, Dow Inc., Verizon, Citigroup, and Salesforce, have announced large layoffs. According to Challenger & Gray, companies announced over 108k layoffs.

The most important data will come out on Friday when the United States will publish the latest consumer inflation report. Economists expect the data to show that inflation softened a bit in January, with the headline CPI falling to 2.5%.

A lower inflation figure than expected will be highly bullish for the Dow Jones as it will lead to higher odds of Federal Reserve interest rate cuts this year.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat22 hours ago

NewsBeat22 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World11 hours ago

Crypto World11 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports21 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World11 hours ago

Crypto World11 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World2 hours ago

Crypto World2 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process