CryptoCurrency

Key Global Regulations Every Founder Must Know

Launching an ICO in 2026 isn’t the chaotic gamble it used to be. It’s now a fast-maturing, regulation-aware ecosystem where founders who plan well raise faster, attract better investors, and scale across global markets with confidence. And the numbers prove it. Globally, the ICO services market is projected to reach USD 11.53 billion by 2032, growing at a steady 12.5 percent CAGR.

This surge isn’t driven by hype. It’s driven by founders who treat compliance, documentation, and infrastructure as strategic advantages rather than afterthoughts. If you’re preparing to launch in 2026, you’re entering a landscape where professionalism beats speed, transparency beats buzzwords, and well-structured ICO development is the new path to unlocking serious capital.

This guide walks you through the regulatory challenges that matter most and how to navigate them with the clarity, confidence, and precision investors expect.

The 2026 ICO Development Landscape: What Changed and Why It Matters

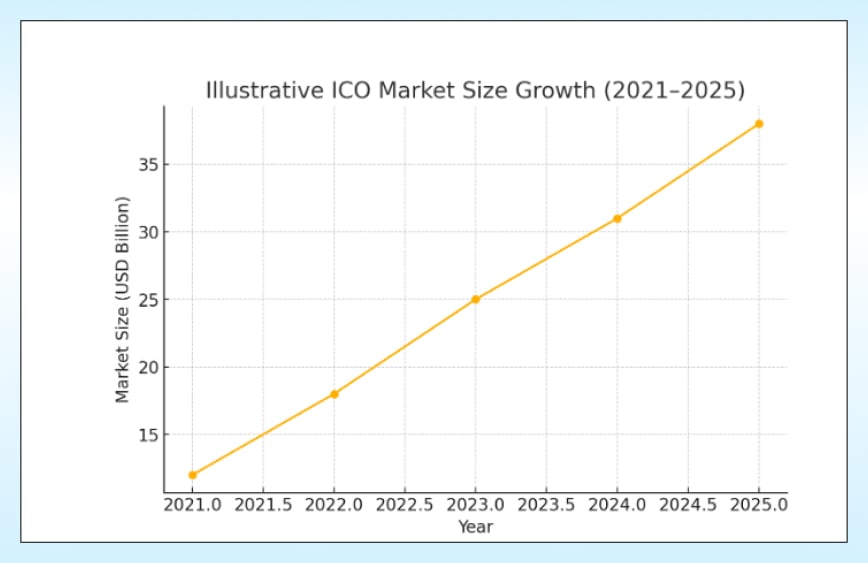

The ICO ecosystem of 2026 is a far cry from the chaotic experimentation of 2017. The market has matured into a structured, regulation-aware fundraising environment supported by serious investors and institutional oversight. In 2025, the ICO software development market reached $38.1 billion, growing by more than 21% YoY, marking its strongest expansion cycle since 2021.

This growth signals one thing clearly: investors are ready to fund compliant, well-structured projects, and they expect founders to meet that standard from day one.

Regulations Have Become the New Operating System

Regulatory tightening has become a global theme. Enforcement is stricter, disclosures are more detailed, and investor protection frameworks are deeper. Founders can no longer treat ICO development as a simple token launch. It now resembles building a regulated digital asset product that must withstand the scrutiny of:

- National regulators

- Global exchanges

- Institutional investors

- Compliance auditors

This shift is most visible in regions adopting MiCA-style frameworks. The EU requires all Crypto Asset Service Providers to be fully licensed by July 2026, and several member states have already accelerated their transition timelines. By mid-2025, nearly 85% of CASPs had either applied for or secured MiCA licenses, signaling how quickly compliance-ready infrastructure is becoming the industry standard.

For founders, this means every decision, token design, treasury strategy, vesting logic, and whitepaper disclosures will be evaluated through a regulatory lens. This is exactly why serious teams begin working with an experienced ICO development company early, long before the token reaches investors.

Ready To Go Global? Book Your ICO Strategy Call Now.

Top ICO Development Regulatory Challenges in 2026

The global regulatory landscape has evolved quickly, making it essential for founders to launch token sales with a compliance-first mindset. For founders planning global fundraising, these are the key challenges shaping ICO development in 2026.

- Token Classification Confusion

Determining whether a token qualifies as a security, utility, governance asset, or payment token is still one of the biggest blockers for founders.

- The U.S. continues to rely on interpretations of the Howey Test

- The EU uses MiCA-defined token categories

- Asian regulators apply their own classification frameworks

A misclassified token can lead to exchange rejections, compliance penalties, or forced restructuring. This is why classification is now a mandatory early milestone in any token launch strategy.

- MiCA Enforcement in the EU

MiCA becomes fully enforceable across all EU member states by July 2026, creating one of the clearest regulatory frameworks in the world. Founders must now meet:

- CASP licensing rules

- Capital adequacy requirements

- Standardized whitepaper disclosures

- Strict operational transparency

Projects targeting European investors must begin preparation months in advance. Early alignment with MiCA dramatically improves investor trust and regulatory acceptance, which is why many teams seek guidance from an experienced ICO development company when planning EU market entry.

- Conflicting Global Rules

Launching an ICO across multiple jurisdictions means navigating a maze of inconsistent regulations.

- The U.S. applies securities-focused enforcement.

- The EU follows MiCA’s structured guidelines.

- Singapore’s MAS prioritizes investor protection.

- Hong Kong applies licensing regimes.

- Dubai’s VARA offers a regulatory sandpit with rigorous checks.

There is no single global compliance strategy. Founders must build a jurisdiction-specific plan before raising capital across borders to avoid roadblocks and misaligned expectations.

- Rising KYC and AML Demands

Modern ICO software development must implement far more advanced compliance measures than ever before. This includes:

- Identity verification

- Sanctions list screening

- Enhanced due diligence for high-risk investors

- Transaction monitoring

- Automated reporting

Stronger KYC and AML are not just regulatory expectations. They also enhance institutional investor confidence and protect the project from legal exposure.

- Securities Registration Pressure

When a token resembles an investment product, regulators may require:

- A formal prospectus

- Registration filings

- Treasury disclosures

- Token distribution logic

- Detailed risk statements

Most early-stage projects underestimate how demanding this process is. Preparing early avoids delays during market entry and speeds up investor approvals.

- Tougher Exchange Listing Standards

Exchanges have strengthened listing requirements significantly. Founders must now present:

- Clean legal documentation

- Full team identity verification

- Transparent tokenomics

- Audited smart contracts

- Fair vesting schedules

- Governance clarity

Non-compliant projects rarely make it through listing reviews, especially as exchanges now evaluate the depth of a team’s ICO development standards. They prioritize maturity and operational integrity over hype.

Need Clarity on regulations? Let’s simplify it in one call.

- Data Protection Restrictions

ICO projects collecting investor information must comply with GDPR, DPDP, PIPL, and other privacy frameworks that govern:

- Data collection

- Storage requirements

- Cross-border transfers

- Consent and deletion rights

Cross-border data movement now requires legal safeguards like Standard Contractual Clauses or explicit consent. This is why data compliance is now a core part of discussions around ICO development services, especially for global fundraising strategies.

- Higher Capital and Compliance Costs

New regulatory expectations have raised the financial threshold for ICOs. Costs now include:

- Legal advisory

- Licensing filings

- KYC/AML tools

- Smart contract audits

- Cybersecurity standards

- Documentation and reporting workflows

Large teams benefit from the added credibility, while small teams must plan carefully to stay compliant without burning resources unnecessarily.

- Decentralization Grey Zones

Regulators are examining real project control, not just marketing claims. A project can still fall under regulatory scope if the core team controls:

- Protocol upgrades

- Treasury decisions

- Governance keys

- Core parameters

Regulators want decentralization to be proven in structure and behavior, not assumed through branding.

- Growing Enforcement Risk

Governments and regulators worldwide have intensified enforcement. Penalty risks include:

- Heavy fines

- Exchange delistings

- Market bans

- Legal disputes

- Platform or URL blocking

The rise in enforcement actions from 2025 to 2026 shows that regulators are no longer tolerating non-compliance. Serious founders now rely heavily on structured ICO software development to enforce transparency and protect long-term scalability.

How an Expert Partner Simplifies Compliance for Founders

Compliance is less about memorizing regulations and more about designing your token sale so it naturally fits global standards. The right partner helps founders move faster and avoid costly mistakes by handling the most complex parts of the process:

- Structuring tokenomics that satisfy investor expectations and regulatory logic across regions.

- Developing secure, audit-ready smart contracts aligned with compliant ICO development practices.

- Integrating KYC and AML workflows, including identity checks, sanctions screening, and automated monitoring.

- Building investor dashboards with transparent reporting, fund tracking, and jurisdiction controls.

- Preparing all required documents, disclosures, and risk statements for regulators.

- Mapping target jurisdictions and identifying which laws apply to each investor group.

- Supporting cross-border expansion through region-specific advisory, audit preparation, and technical validation.

This is why founders planning serious, multi-region token launches look for an experienced firm that understands both technology and regulatory nuance. It gives teams the stability, structure, and execution speed needed to meet institutional standards, and often becomes the deciding factor when selecting the right ICO development services partner before entering high-stakes markets.

Closing Thoughts

ICO regulation in 2026 is no longer unpredictable. It has evolved into a structured, mature framework built to protect founders, investors, and the long-term credibility of the market. Teams that prioritize compliance from the start earn stronger trust, attract higher-value capital, and expand across global jurisdictions with far fewer barriers.

With the right strategy, expert ICO Development support, and a partner who understands both regulation and technology, launching a global token sale becomes practical, predictable, and fully scalable. This is exactly where Antier helps founders stay ahead.

Frequently Asked Questions

01. What is the current state of the ICO ecosystem in 2026?

The ICO ecosystem in 2026 has matured into a structured, regulation-aware environment where founders who prioritize compliance and documentation can raise funds faster and attract better investors.

02. How has regulatory tightening affected ICO development?

Regulatory tightening has made ICO development resemble building a regulated digital asset product, requiring compliance with national regulators, global exchanges, institutional investors, and compliance auditors.

03. What is the projected growth of the ICO services market by 2032?

The ICO services market is projected to reach USD 11.53 billion by 2032, growing at a steady 12.5 percent CAGR.