Crypto World

Key Trends ARK Invest Says Will Reshape Bitcoin Adoption in 2026

TLDR:

- ETFs and DATs held 12% of Bitcoin supply by end of 2025, exceeding new supply absorption.

- Sovereign holdings now include 325,437 BTC in the U.S. Strategic Bitcoin Reserve.

- Bitcoin drawdowns remain below 50% in the current cycle, reflecting deeper market liquidity.

- ETFs reached adoption levels in under two years that gold ETFs took over 15 years to achieve.

Bitcoin is increasingly viewed as a strategic asset for institutional investors.

Spot ETFs, corporate treasuries, and sovereign holdings absorbed more supply than miners produced in 2025. The U.S. Federal Reserve’s early rate cuts and monetary easing have increased demand for scarce digital assets.

Regulatory clarity, including the U.S. CLARITY Act, supports broader adoption across traditional financial platforms.

Structural Demand and ETF Expansion

Spot Bitcoin ETFs reshaped the supply-demand balance, absorbing 1.2 times the newly mined supply and recirculated coins in 2025, according to ARK Invest data.

By year-end, ETFs and digital asset treasuries (DATs) controlled over 12% of bitcoin’s total supply. Morgan Stanley and Vanguard expanded access to regulated Bitcoin products, including ETFs, creating a bridge to traditional capital pools.

Even amid a major October liquidation and market volatility, ETF growth outpaced supply expansion, reflecting stronger structural demand.

Corporate adoption also expanded, with S&P 500 and Nasdaq 100 indices including bitcoin-exposed companies like Coinbase and Block. Digital asset treasury firms now hold over 1.1 million BTC, representing 5.7% of total supply, mostly long-term holdings.

Strategy, formerly MicroStrategy, maintains 3.5% of bitcoin’s total supply as a treasury reserve. Sovereign involvement increased, highlighted by the U.S. Strategic Bitcoin Reserve holding approximately 325,437 BTC, or 1.6% of supply.

The expansion of regulated vehicles and institutional demand coincides with regulatory progress. The CLARITY Act aims to define the lifecycle of digital assets and streamline oversight between the SEC and CFTC.

Texas and other states continued state-level Bitcoin adoption, further signaling government acceptance. Clear guidelines support allocation by institutional investors, strengthening bitcoin’s role as a macro instrument.

Bitcoin’s Relationship to Gold and Market Maturity

Historically, Bitcoin has followed gold’s lead during macro shocks. In 2025, gold surged 64.7% amid inflation concerns, while Bitcoin declined 6.2%, echoing patterns seen in 2016 and 2019.

ETFs indicate growing confidence in Bitcoin as a store-of-value, achieving in two years what gold ETFs required 15 years to reach. Weekly correlation data show low alignment between Bitcoin and gold, suggesting Bitcoin can diversify portfolios independently of traditional assets.

Market volatility is declining, with drawdowns from record highs under 50% since 2022, compared to 70–80% in prior cycles.

Time-in-market strategies continue to outperform timing-focused approaches, with hypothetical investors from 2020–2025 gaining 29–61% despite corrections. These trends suggest Bitcoin is maturing from a speculative asset into a liquid macro instrument with robust trading infrastructure.

Long-term holders, including ETFs, corporations, and sovereigns, now absorb a meaningful portion of new supply. With regulatory clarity and growing institutional access, Bitcoin is increasingly recognized as a strategic allocation rather than an optional investment.

Low correlations with traditional assets and diminished volatility reinforce its potential to improve portfolio risk-adjusted returns.

Crypto World

Here’s What Triggered a 50% Rally in ORCA Price in 24 Hours

Orca stunned the market with a sharp 50% surge in the past 24 hours. The price climbed quickly without any major development announcement. The rally appears driven by renewed investor interest rather than protocol upgrades.

However, strong upside moves often carry elevated risk. Sudden spikes can attract speculative capital and trigger volatility.

Sponsored

Orca Buying Spree Contributed To The Rally

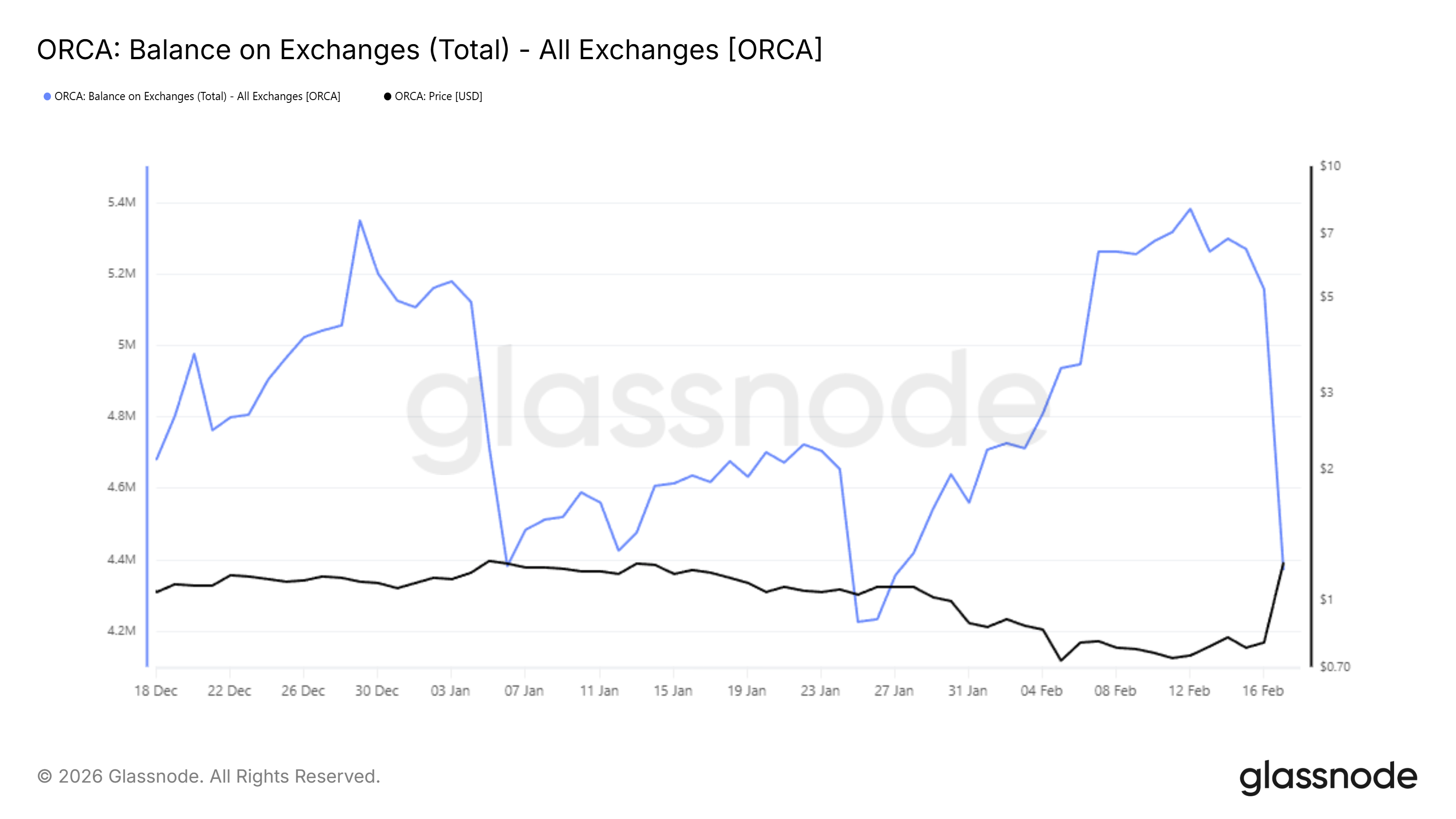

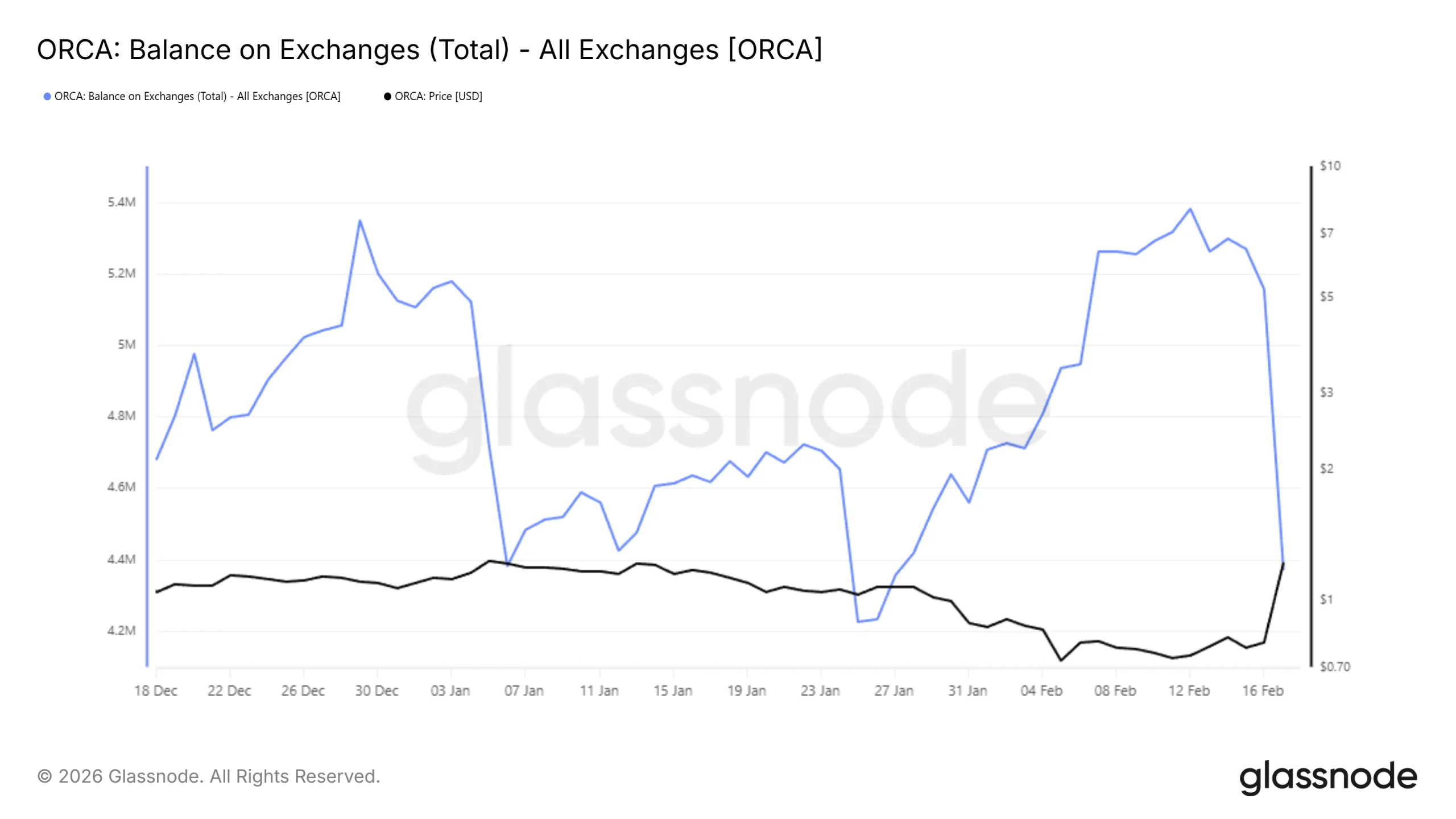

ORCA balances on exchanges declined significantly over the past day. Nearly 1 million ORCA tokens were bought off exchanges within 24 hours. At the current price of $1.23, that supply is worth approximately $1.23 million.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This marks the largest single-day accumulation of ORCA this year. Reduced exchange supply typically reflects rising investor conviction. Organic demand appears to have fueled the rally. Utility metrics support this view.

USDC total value locked on Orca increased 100% year over year, reaching nearly $90 million.

Sponsored

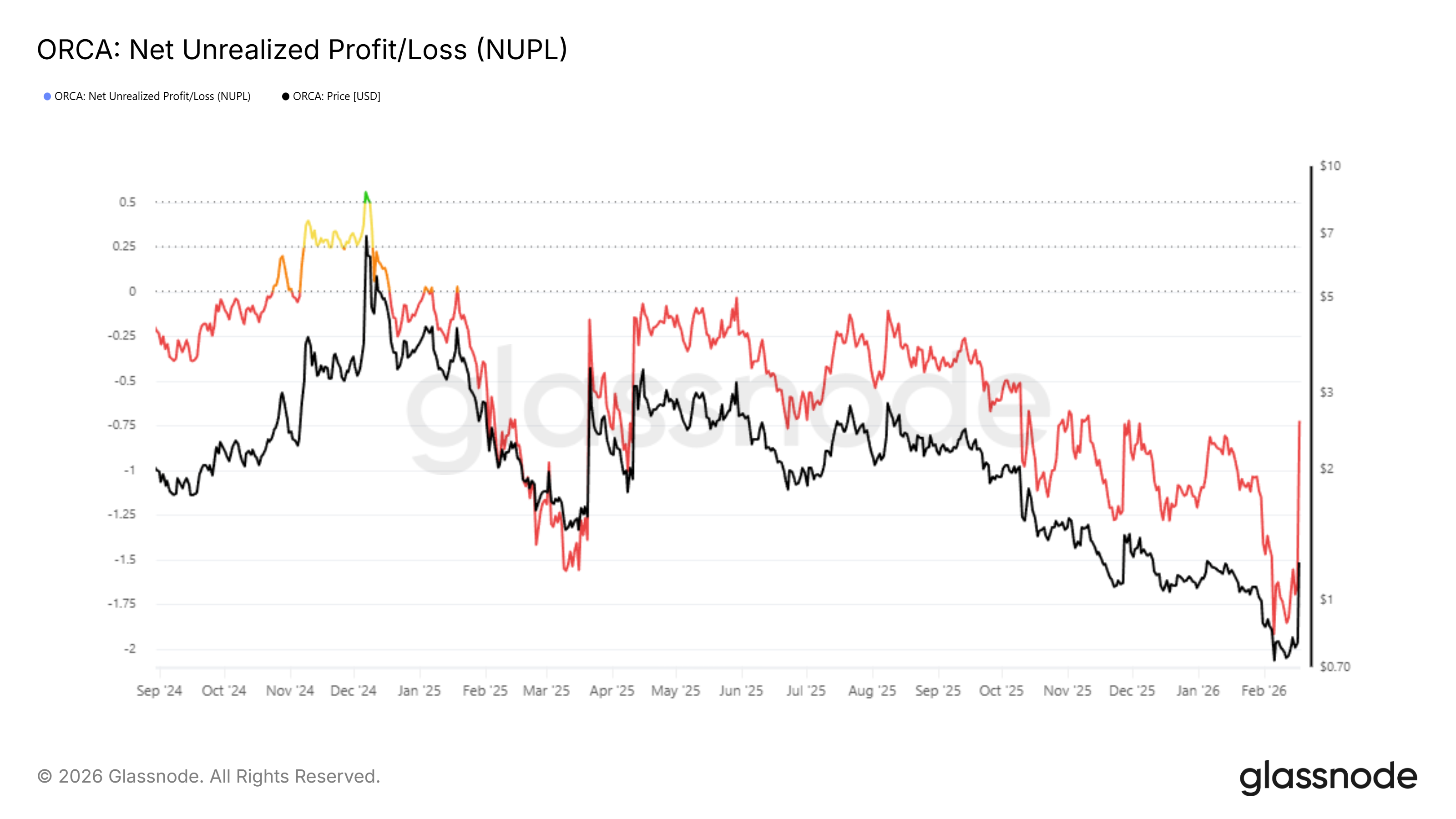

The Net Unrealized Profit and Loss, or NUPL, indicator provides additional context. Recent readings show that prior losses had saturated. High unrealized losses often reduce selling pressure as holders stop capitulating.

A similar pattern appeared in March 2025. At that time, ORCA rallied nearly 119% after a prolonged downside. Loss saturation can trigger accumulation at perceived value zones. Current data suggests investors stepped in aggressively at discounted levels.

Sponsored

ORCA Price Finds Support

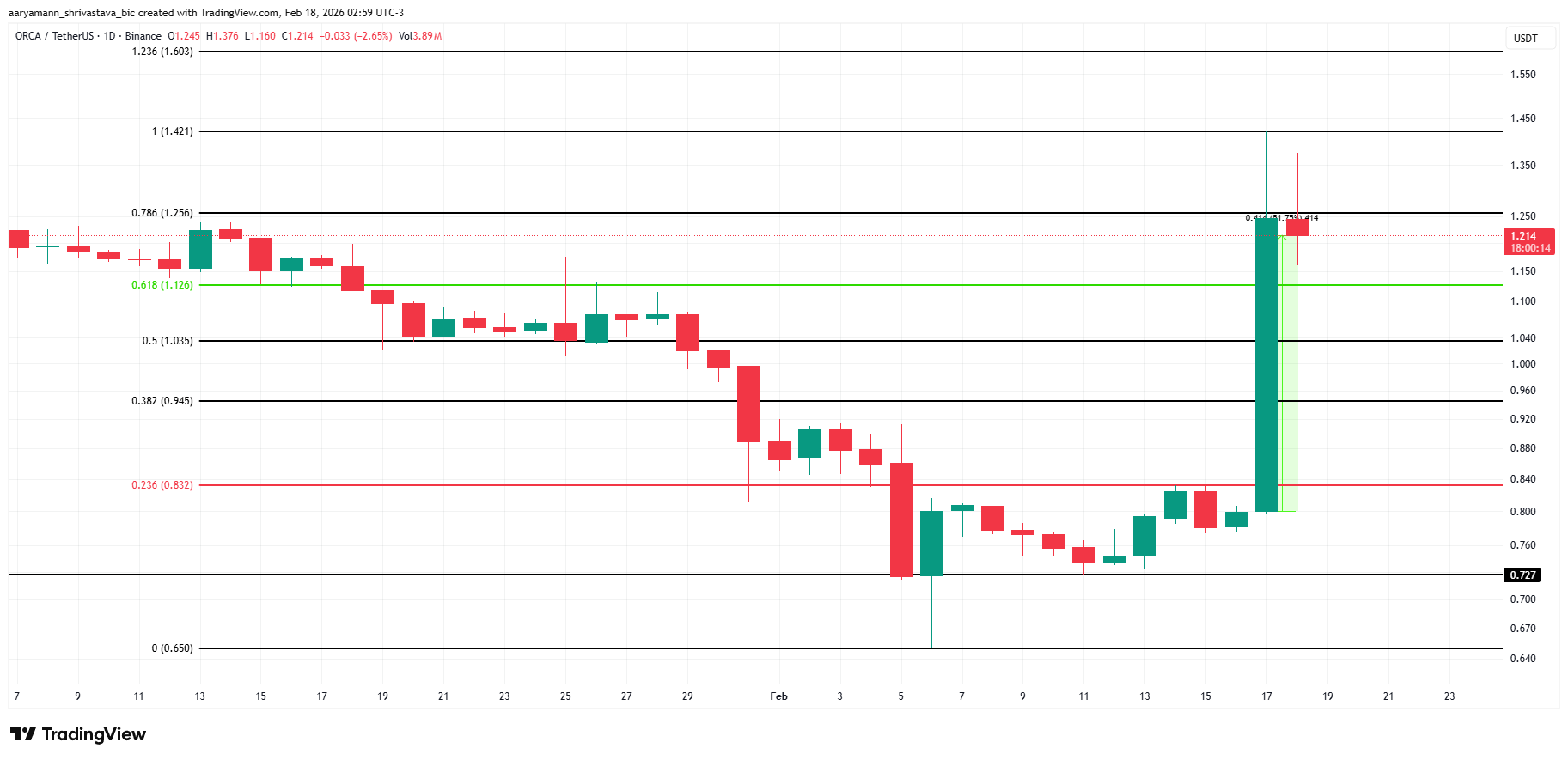

ORCA trades at $1.214 after posting a 51.7% gain in 24 hours. The token reached an intraday high of $1.421 before retreating below $1.256. This pullback suggests early profit-taking.

The altcoin remains above the 61.8% Fibonacci retracement level. This zone acts as a bullish support floor. Holding above it could encourage renewed buying. Sustained demand may push ORCA back toward $1.421. A confirmed breakout could extend gains to $1.603.

However, sharp rallies can reverse quickly. If investors prioritize short-term profits, selling pressure may intensify. A drop below $1.126 would signal weakening structure. Further downside toward $1.025 becomes likely in that case. Losing this support could send ORCA below $1.000 to $0.945, invalidating the bullish thesis.

Sponsored

ORCA Warning Signs

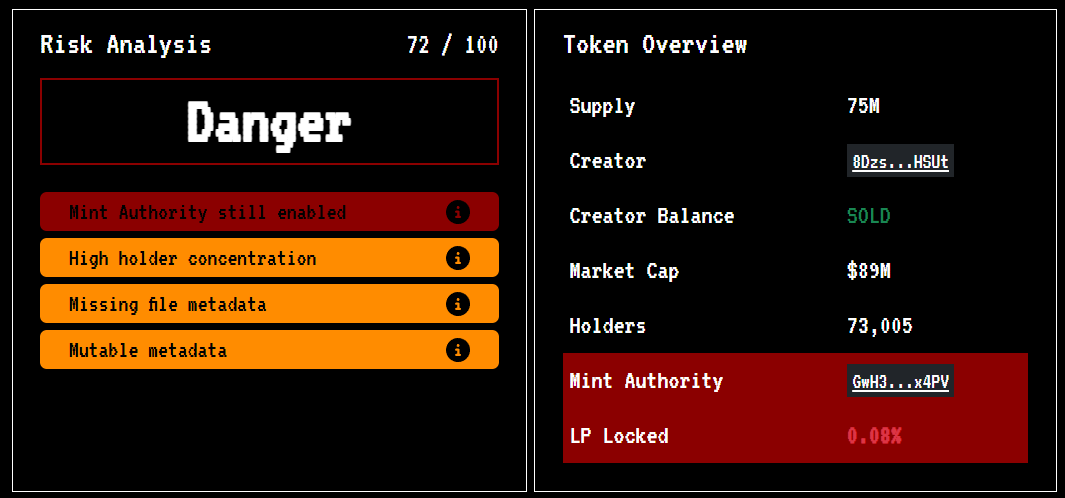

Risk analysis data introduces another factor. Rugcheck Risk Analysis flagged that Mint Authority remains enabled for the owner’s wallet. This setting can allow token issuance beyond the current supply.

In many cases, mint authority exists for technical reasons. Some projects use lock-and-mint or burn-and-mint mechanisms for cross-chain transfers. However, governance clarity is essential. Orca operates with a decentralized autonomous organization structure.

Typically, a DAO should control token issuance. If a single wallet retains mint authority, concerns may arise. Transparency remains critical for investor trust. BeInCrypto has provided Orca’s team with a Right of Reply. An update will follow upon receiving formal clarification. Until then, investors should monitor this risk factor carefully.

Crypto World

Bitcoin Long-Term Holders Realize Losses as Binance Inflows Hit Alarming Levels

TLDR:

- Bitcoin’s LTH SOPR has dropped to 0.88, a level not seen since the close of the 2023 bear market cycle.

- Long-term holders are now realizing losses on average, marking a sharp shift from historically resilient behavior.

- Daily BTC inflows to Binance have reached twice the annual average across several consecutive days recently.

- Rising exchange inflows from long-term holders signal sustained selling pressure that may weigh on Bitcoin’s short-term recovery.

Bitcoin long-term holders are beginning to feel the weight of a prolonged market correction. The asset remains more than 45% below its previous all-time high.

This sustained decline is creating financial pressure across a wide range of investors. Even the most resilient market participants are now adjusting their behavior in response. The shift marks a notable change for a group known for holding up under difficult conditions.

LTH SOPR Drops Below Key Threshold

The LTH Spent Output Profit Ratio (SOPR) has recently crossed below the critical level of 1. It currently sits at 0.88, a level not recorded since the close of the 2023 bear market.

This reading means long-term holders are, on average, selling at a loss. That alone represents a meaningful change in market behavior.

Analyst Darkfost noted in a post on X that the annual average LTH SOPR remains at 1.87. However, the short-term reading has moved well below that average.

The gap between the two figures reflects how quickly conditions have shifted. It points to growing financial strain within a historically patient group of investors.

When long-term holders begin realizing losses, it often signals a deeper phase of market stress. These participants typically sell only when they see value or face genuine pressure.

A move into negative SOPR territory suggests the latter is increasingly the case. The trend warrants close attention from market observers.

The drop below 1.0 also carries weight because of the size of this investor group. Long-term holders control a substantial portion of Bitcoin’s circulating supply.

Their decisions carry more influence over price than those of short-term traders. A sustained pattern of loss realization could weigh on recovery efforts.

Rising Binance Inflows Point to Increased Activity

At the same time, long-term holder inflows to Binance have increased sharply in recent weeks. Daily inflows have reached roughly twice the annual average on several consecutive days.

This level of activity is considered exceptionally elevated by historical standards. It points to a clear and deliberate shift in behavior among this group.

Darkfost also noted that this pattern has been building since the last all-time high. The acceleration in recent weeks adds further context to the SOPR data.

Together, the two indicators tell a consistent story about how long-term holders are responding. They are actively managing their exposure rather than simply waiting out the correction.

Binance remains the platform of choice for this activity due to its liquidity. Large holders need deep markets to move significant volumes without major price disruption.

The exchange’s market depth makes it practical for participants managing large positions. Their preference for Binance is therefore a logical outcome of their size.

Rising inflows from long-term holders to exchanges are generally viewed as a bearish signal. More Bitcoin moving onto platforms increases the available supply for sale.

This dynamic could continue to apply downward pressure in the short to medium term. The market may need time before this adjustment phase runs its course.

Crypto World

Nevada Sues Kalshi After Appeals Court Greenlights Action

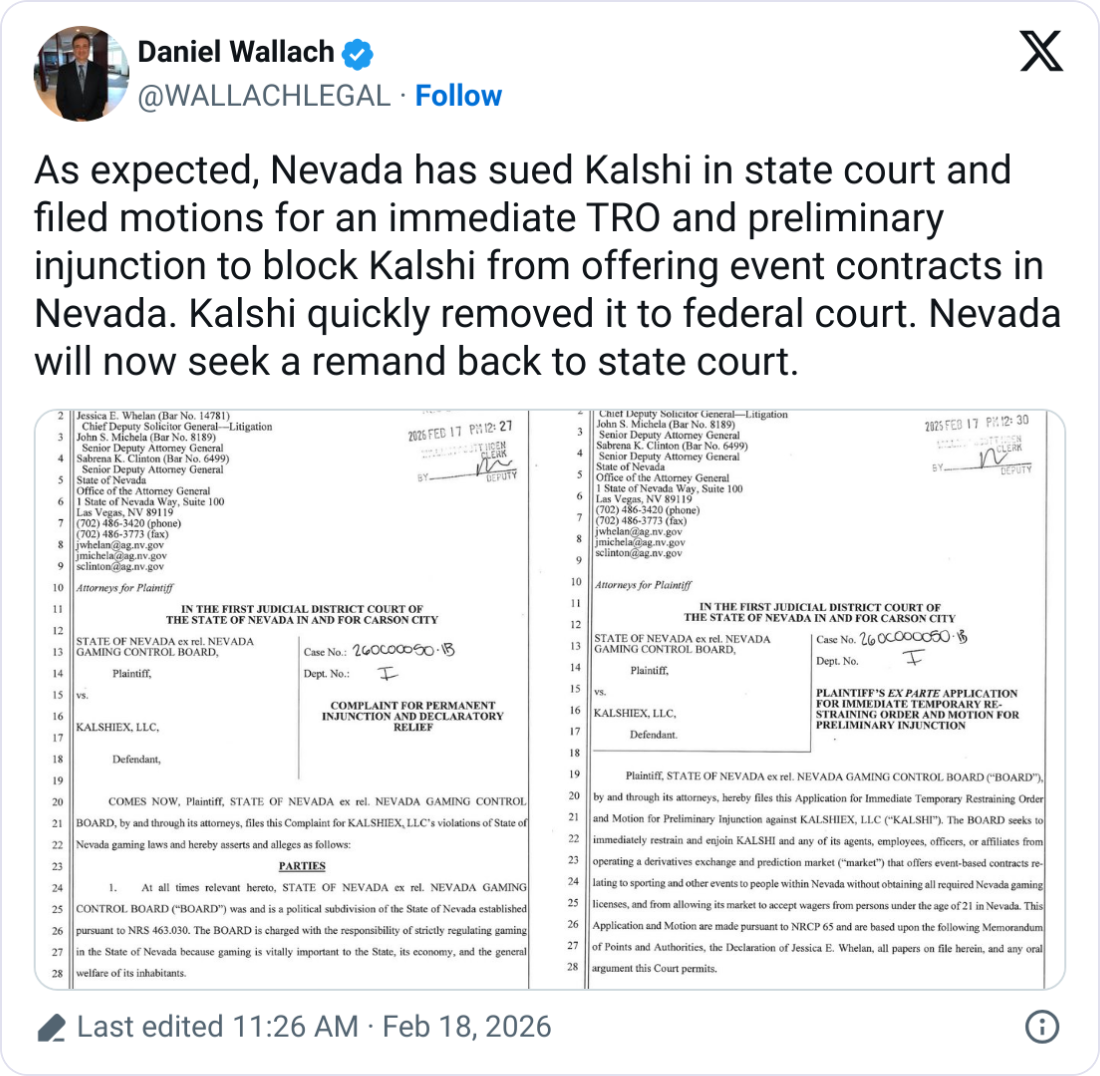

The US state of Nevada has sued Kalshi after the prediction market company lost its court challenge to stop the state’s regulator from taking action over its sports prediction markets.

The US Court of Appeals for the Ninth Circuit on Tuesday denied Kalshi’s bid to stop Nevada’s gaming regulator from taking action on its sports event contracts, removing a block on the regulator launching a civil suit against the company.

After the decision, the Nevada Gaming Control Board promptly filed a civil enforcement action in state court against Kalshi, which it said sought to block the company “from offering unlicensed wagering in violation of Nevada law.”

Kalshi swiftly filed a motion to have the suit heard in a federal court, repeating its long-held argument that it is “subject to exclusive federal jurisdiction” under the Commodity Futures Trading Commission.

The appeals court order and subsequent lawsuit are a blow to Kalshi in its nearly year-long battle against Nevada to keep its sports contracts active in the state. The company and other prediction markets are facing multiple similar lawsuits from other states.

The company sued the state last year in March after receiving a cease-and-desist order to halt all sports-related markets within the state. In April, a federal court backed Kalshi’s bid to temporarily block Nevada from taking action amid court proceedings.

Kalshi did not immediately respond to a request for comment.

Nevada says Kalshi is flouting state law

In its latest lawsuit, the Nevada Gaming Control Board repeated its past claim that Kalshi’s sports event contracts meet the requirements to be licensed under state law, as they allow “users to wager on the outcomes of sporting events.”

Despite making wagers, sports betting and other gaming activities accessible in the State of Nevada, Kalshi is not licensed in Nevada and does not comply with Nevada gaming law, the regulator argued.

In its federal court motion, Kalshi argued that such a claim means the court “must adopt a narrow interpretation” of federal commodity exchange laws, which it asserts it is regulated under by the CFTC.

CFTC chair asserts jurisdiction over prediction markets

Earlier on Tuesday, CFTC chair Mike Selig said his agency filed an amicus brief backing Crypto.com in a similar lawsuit the crypto exchange had brought against Nevada.

Crypto.com had sued Nevada’s regulators in June after similarly receiving a cease-and-desist letter. It also appealed to the Ninth Circuit in November after losing a federal court motion to block the state from taking action.

Related: Crypto lobby forms working group seeking prediction market clarity

The CFTC argued in its brief to the Ninth Circuit that “states cannot invade the CFTC’s exclusive jurisdiction over CFTC-regulated designated contract markets by re-characterizing swaps trading on DCMs as illegal gambling.”

Selig said that event contracts “are commodity derivatives and squarely within the CFTC’s regulatory remit,” and the agency would “defend its exclusive jurisdiction over commodity derivatives.”

The CFTC’s push comes after Trump Media and Technology Group said in October that it was looking to bring prediction markets to its flagship social media platform, Truth Social, via a partnership with Crypto.com.

Donald Trump Jr., the US president’s son, has also been an advisor to Kalshi since January 2025. He has also served as an advisor to rival Polymarket after investing in the company in August.

AI Eye: IronClaw rivals OpenClaw, Olas launches bots for Polymarket

Crypto World

Token Launch Timing Doesn’t Matter, Says Dragonfly’s Qureshi

New research by Dragonfly managing partner Haseeb Qureshi looked at long-term performance of Binance-listed tokens in bull and bear markets.

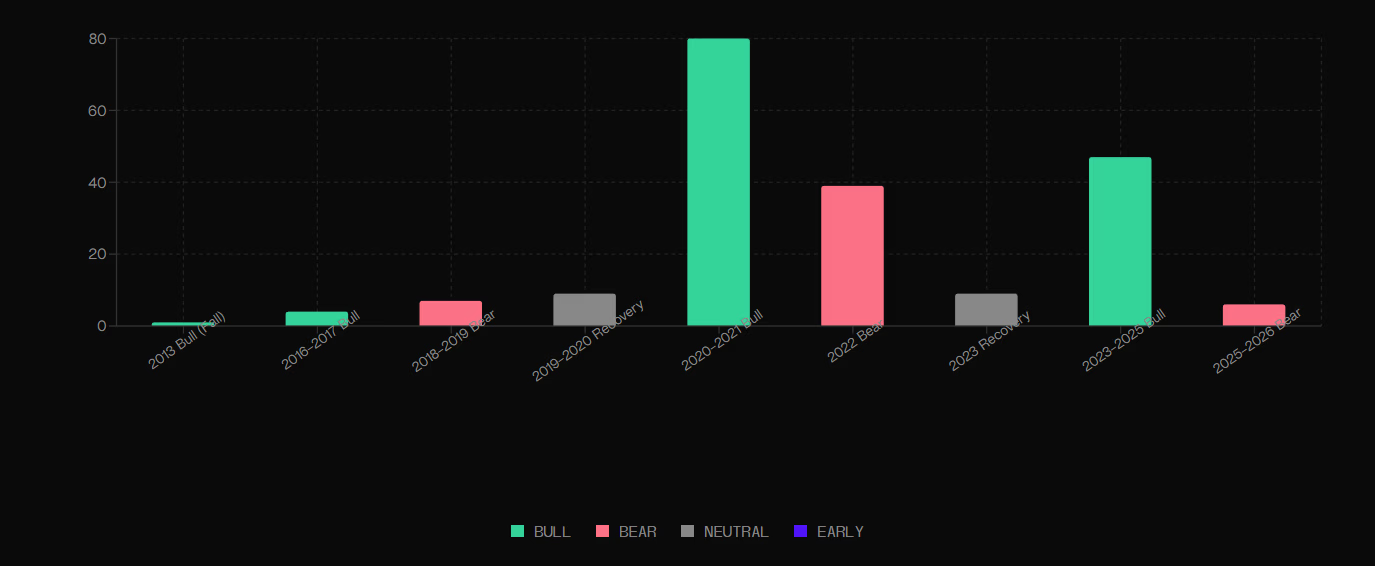

A new study suggests that token launch timing barely changes how the asset performs in the long run. The report by Haseeb Qureshi, a managing partner at crypto VC firm Dragonfly Capital, analyzed every token that had its listing announced by Binance, filtering out stablecoins, wrapped assets and other non-independent tokens.

The sample covers 202 tokens in total. When the tokens were split by launch environment — 101 tokens went to market in bull markets and 33 in bear markets — the performance gap all but disappeared.

Also, Qureshi noted, regardless of the timing, most tokens don’t perform well over time. Bull-market launches recorded a median annualized return of about 1.3%, while bear-market launches came in at -1.3%.

Even when the data was sliced in different ways, the results stayed broadly the same. Qureshi emphasized that timing does not appear to matter, and shouldn’t be a primary consideration for founders:

“There is no statistically significant difference in performance between tokens launched in bull markets vs bear markets. There may be other considerations in when you choose to launch your token: cost, exchange fees, marketing expenses, etc. But if anything, those likely cut against launching in a bull market, as they tend to be higher in bulls vs bears.”

Less Competition in Bear Markets

Qureshi noted in an X post on Sunday, Feb. 15, presenting the research that this doesn’t settle every key question founders face. Bear markets may still offer cheaper talent and less competition for listings, while bull markets tend to boost demand for token sales.

Also, the data only captures tokens that made it to Binance — by far the largest centralized exchange by trading volume — meaning projects that died quietly elsewhere aren’t reflected in the report. Additionally, some market cycles include fewer tokens than others, and defining where one cycle ends and another begins is never exact, the study notes.

Nonetheless, Qureshi says it “it doesn’t matter that much when you launch,” pointing to Solana’s debut just days after the March 2020 market crash as a reminder that execution, not timing, tends to do the heavy lifting.

That said, survival itself appears to be the real hurdle. Of the roughly 24,000 tokens created since 2014, more than 14,000 are now defunct, according to a 2024 report from CoinGecko.

Even among those that do survive, meaningful revenue is rare. As The Defiant reported previously, a study by 5Money and Storible found that about 95% of nearly 5,000 crypto projects generate less than $1,000 a month, including the majority of projects valued at over $1 billion.

Crypto World

Spot Trading Volume Climbs 10% in January 2026 While Derivatives Market Holds Steady

TLDR:

- Spot trading volume on major crypto exchanges rose approximately 10% in January 2026 versus December 2025.

- Bitfinex led all exchanges with a 67% spot trading surge, followed by Uniswap at 62% and Upbit at 44%.

- Derivatives trading volume grew just 0.5% month-on-month, with Hyperliquid posting the top gain at 46%.

- Website traffic across major exchanges fell 0.3%, with HTX recording the steepest drop at 22% in January.

January crypto exchange volumes painted a mixed picture across major trading platforms in early 2026. Spot trading jumped 10% month-on-month, derivatives remained nearly flat at 0.5%, and website traffic across major exchanges dipped 0.3%, per Wu Blockchain data.

Spot Trading Jumps 10% With Notable Gains Across Select Exchanges

January crypto exchange volumes reflected a recovery in spot market activity compared to December 2025. The 10% overall increase came as several exchanges posted sharp month-on-month gains.

Others, however, recorded notable declines that offset some of the broader market growth. The data, sourced from CoinGecko, was processed to account for wash trading and bot-related activity.

Bitfinex recorded the strongest spot trading growth among all exchanges in January 2026, rising 67%. Uniswap followed with a 62% month-on-month gain, while Upbit posted a 44% increase over the same period.

These three exchanges drove much of the overall 10% rise seen across the broader spot market.

Wu Blockchain published the monthly exchange report on X, noting that preprocessing was applied to the dataset. The adjustments included outlier removal, metric normalization, and methodological changes.

These steps were taken to reduce the effect of artificial trading activity on the final figures. The firm cited CoinGecko for both spot and derivatives data in the report.

Not all exchanges benefited from the January surge in spot trading activity. HTX posted the steepest decline among tracked platforms, falling 17% month-on-month.

Bybit dropped 16%, and KuCoin recorded a 14% decrease in spot trading volume over the same period.

Derivatives Trading Stays Flat While Traffic Data Shows Modest Shifts

January crypto exchange volumes in the derivatives segment showed little movement, gaining just 0.5% over December 2025. The near-flat result came despite strong performances from a few individual platforms.

Wide variation across exchanges kept the overall figure from moving in either direction meaningfully. The derivatives market showed more stability than the spot segment throughout the month.

Hyperliquid led derivatives trading growth in January 2026 with a 46% month-on-month increase in volume. Crypto.com followed with an 18% gain, and Gate posted an 11% rise during the same period.

Their performances helped counterbalance the sharp declines recorded at other exchanges in the derivatives segment.

MEXC saw the largest drop in derivatives trading volume among tracked exchanges, falling 27% in January 2026. KuCoin declined 17% month-on-month, while Deribit posted an 8% decrease over the same period.

These three exchanges ranked at the bottom for derivatives volume changes in the January report.

Website traffic across major exchanges fell 0.3% in January 2026 compared to December 2025. Upbit led traffic growth with a 9% increase, while KuCoin and Bitfinex each gained 7%.

HTX recorded the sharpest traffic drop at 22%, followed by Bitget at 9% and MEXC at 8%. Traffic figures in the report were sourced from Similarweb.

Crypto World

Bitcoin losing $70,000 is a warning sign for further downside

Bitcoin is back below $68,000, making the earlier bounce to above $70,000 look weaker.

The largest cryptocurrency briefly tried to reclaim the level on Monday, only to be pushed down toward $67,000 as sellers emerged around the breakout zone. It was trading near $68,000 early Wednesday, roughly flat on the day but now sitting under what had been short-term support.

That shift matters. The $68,000–$70,000 range had acted as a floor through the first half of February. Losing it increases the risk that rallies are sold rather than bought, and a clean break under $67,000 would put $65,000 and possibly $60,000 back in focus.

Bitcoin, Ethereum and BNB are all down as much as 3% over seven days, while smaller tokens such as Zcash’s ZEC and Cosmos’ ATOM have posted gains of as much as 20% in the past week. Historically, when majors lag, the rest of the market struggles to sustain upside momentum.

“The decline of the largest coins is an ominous sign for smaller ones, as it may soon pull them down with it at an accelerated pace,” said Alex Kuptsikevich, chief market analyst at FxPro, in an email.

On-chain analysts at CryptoQuant say the market has entered a stress phase but has not yet seen the kind of heavy loss realization that typically marks a definitive cycle bottom – suggesting the unwind may not be finished.

Adding to the unease, quantum computing has resurfaced in market conversations, with some investors questioning long-term cryptographic risk while developers push back on timelines that place meaningful threats decades away.

Meanwhile, Blockstream CEO Adam Back criticized a proposed BIP-110 update aimed at reducing spam on the network, arguing it could create new reputational risks by changing the rules around what transactions should be allowed, as CoinDesk noted.

Institutional flows are also shifting. Harvard’s endowment cut more than 20% of its bitcoin ETF exposure in the fourth quarter, though it remains the fund’s largest public crypto position.

Outside crypto, Asian equities advanced in thin Lunar New Year trading. The MSCI Asia Pacific Index rose 0.6%, led by gains in Japan, while US futures edged higher after recent AI-related turbulence cooled.

For bitcoin, however, the technical battle remains front and center. Reclaim $70,000 and momentum resets. Fail again, and the market starts pricing a deeper retracement.

Crypto World

CFTC Says Prediction Markets Should Be Federally Regulated

The CFTC’s legal action and statement comes as popular prediction marketplaces like Kalshi and Polymarket face lawsuits from U.S. state gambling regulators.

The U.S. Commodity Futures Trading Commission (CFTC) took a firm stance on prediction market regulation, arguing that the markets should fall under federal, not state, oversight.

On Feb. 17, the CFTC filed a “friend-of-the-court” brief in the Ninth U.S. Circuit Court of Appeals in support of Crypto.com amid its fight with the Nevada Gaming Control Board, according to a video statement from CFTC Chairman Mike Selig.

“The CFTC will no longer sit idly by while overzealous state governments undermine the agency’s exclusive jurisdiction over these markets by seeking to establish statewide prohibitions on these exciting products,” Selig said in a statement.

This move comes as Kalshi, a CFTC-regulated prediction marketplace, faces legal action from the New York Gaming Commission for allegedly operating illegally within the state. The New York action is just one of many lawsuits filed by state regulators, including Nevada’s, against the platform.

The expansion of established sportsbook operators like DraftKings and FanDuel into prediction markets further complicates the landscape.

Kalshi’s co-founder Luana Lopes Lara has criticized the lawsuit against Kalshi, and prediction markets, in general.

“It’s not surprising that entrenched interests are seeding false narratives to discredit prediction markets: this is very similar to what the banks did to discredit the crypto industry (a good reminder not to blindly trust what you read online),” Lopes Lara wrote in a post on X in Nov. 2025.

The CFTC’s involvement highlights the ongoing debate regarding the classification of these markets. The platforms, and now the CFTC itself, argue that prediction market contracts should be classified as derivatives and under the federal oversight of the CFTC, while some state gaming regulators argue that they should be seen as gambling markets and regulated on the state level as such.

This article was generated with the assistance of AI workflows.

Crypto World

World Markets Launches ‘No ADL’ DEX on MegaETH

The DEX is one of the first dApps to launch on the new Layer 2 and offers on-chain spot and perps trading, as well as lending.

Decentralized crypto exchange World Markets (WM) launched today, Feb. 17, becoming one of the first decentralized applications (dApps) on the MegaETH network. WM bundles spot, perps and lending under one on-chain account.

In commentary to The Defiant, World Markets co-founder Kevin Coons framed the launch as an effort to fix broken incentives, arguing that traders often get punished even when their positions are properly hedged. Coons explained:

“On other platforms, a profitable hedged position can still get liquidated on a price swing. Even worse, winners are often forcibly closed out to cover losses from reckless traders. That’s not risk management; it’s a tax on the responsible! WM’s risk engine understands net market exposure. If you’re delta neutral, you’re protected.

No ADL [auto-deleveraging]. No unfair liquidations. Just a unified trading layer where your entire portfolio becomes your power.”

Auto-deleveraging, or forced liquidation, of leveraged crypto positions came into focus more broadly across the industry after the Oct. 10 market crash, which resulted in an ADL cascade, bringing total daily liquidations to a record high near $20 billion.

On its plans after protocol launch, the World Markets team suggested that a token remains a long-term possibility but without a set timeline, citing a desire to stay flexible as new products roll out. Nearer-term protocol featuers include vaults, expected within one to two months, covering automated leveraged basis trades.

For now, World Markets is prioritizing asset listings over fundraising and has no venture capital backers, Coons told The Defiant. Liquidity support is instead coming from MegaETH, with plans for a mobile app later this year as the platform gauges which markets gain the most traction.

The launch comes as MegaETH itself has seen early capital inflows since its Feb. 9 mainnet launch, with total value locked rising about 65% in the past week to roughly $66.5 million, driven largely by stablecoins.

World Markets is currently the third largest protocol on MegaETH by TVL, with about $6.3 million. The largest protocol, Kumbaya, leads by far with $51.37 million.

As The Defiant reported earlier, the L2 network has yet to meet the on-chain usage and revenue thresholds tied to a future MEGA token launch, leaving its token generation event conditions unmet for now.

Crypto World

65% of CEX Stablecoins Sit on Binance as Exchange Reserves Hit $47.5B, CryptoQuant Reports

TLDR:

- Binance holds $47.5B in USDT and USDC reserves, a 31% year-over-year increase from $35.9B in 2024.

- CryptoQuant confirms Binance commands 65% of total stablecoin liquidity across all centralized exchanges globally.

- OKX, Coinbase, and Bybit trail with 13%, 8%, and 6% shares of total CEX stablecoin reserves respectively.

- Bear market outflows have slowed to $2B in the past month, down sharply from $8.4B recorded by December 23.

65% of all stablecoin reserves across centralized exchanges now sit on Binance, according to data from CryptoQuant.

The exchange holds $47.5 billion in combined USDT and USDC, far ahead of every competing platform. That figure marks a 31% year-over-year increase from $35.9 billion.

As the broader crypto market navigates a bear phase, capital does not appear to be leaving the space. Instead, it is consolidating at one address.

Binance Pulls Ahead as the Central Hub for CEX Stablecoins

CryptoQuant shared the data in a recent post, stating that “$47.5B in stablecoins now sits on one exchange.” The firm noted that Binance holds 65% of all exchange stablecoin liquidity. Competitors, it added, remain far behind by comparison.

OKX is the next largest holder with $9.5 billion, giving it a 13% share. Coinbase follows with $5.9 billion, representing 8% of total CEX stablecoin reserves. Bybit holds $4 billion, accounting for a 6% share across the Ethereum and TRON networks.

The gap between Binance and its closest rivals is considerable. OKX, in second place, holds roughly one-fifth of what Binance carries in stablecoin reserves. That distance reflects how dominant Binance has become within centralized exchange liquidity.

USDT makes up the overwhelming portion of Binance’s stablecoin position. The exchange holds $42.3 billion in USDT, up 36% from $31.0 billion recorded a year ago. USDC holdings have stayed relatively flat at $5.2 billion over the same period.

Outflows Tied to Bear Market Begin to Ease

Stablecoin reserves across exchanges climbed sharply ahead of the late-2025 market downturn. In the 30 days leading up to November 5, reserves grew by $11.4 billion across centralized platforms. That build-up came just before crypto prices entered a sharp correction.

Once the bear market took hold, those reserves began falling. By December 23, exchange stablecoin holdings had dropped by $8.4 billion from their peak. The decline tracked closely with falling crypto prices during that same window.

The rate of those outflows has since slowed. Over the past month, reserves fell by only $2 billion, a much smaller drop than in prior weeks.

CryptoQuant noted that “the pace of outflows has recently moderated,” pointing to a stabilization in exchange-held capital.

Binance’s year-over-year growth in stablecoin reserves tells a longer story. Its total holdings rose 31% despite the broader bear market pressure on the space.

As CryptoQuant put it, capital is not exiting crypto — it is concentrating. And by the numbers, it is concentrating primarily on Binance, reinforcing its position as the dominant liquidity center among all centralized exchanges globally.

Crypto World

European banking giant Intesa reveals $100M Bitcoin ETF position

Italian banking giant Intesa Sanpaolo has disclosed significant exposure to bitcoin exchange-traded funds (ETFs) and crypto-linked assets in its latest U.S. Securities and Exchange Commission (SEC) Form 13F filing for the quarter ending December 31, 2025.

Summary

- Intesa Sanpaolo disclosed nearly $100 million in Bitcoin ETF holdings in its latest Form 13F filing with the U.S. Securities and Exchange Commission for Q4 2025.

- The bulk of the exposure comes from positions in U.S.-listed spot Bitcoin ETFs, signaling growing institutional adoption among major European banks.

- The filing highlights continued integration of regulated crypto investment products into traditional banking portfolios amid rising institutional demand.

Italy’s Intesa Sanpaolo joins institutional Bitcoin ETF rush

According to the SEC filing, the lender held approximately $96 million in spot bitcoin ETF positions at the end of last year, marking a notable step by a major European financial institution into regulated crypto markets.

The largest individual stake was in the ARK 21Shares Bitcoin (BTC) ETF, valued at roughly $72.6 million, followed by about $23.4 million in iShares Bitcoin Trust.

In addition to these core bitcoin ETF positions, Intesa Sanpaolo also listed a smaller $4.3 million holding in the Bitwise Solana Staking ETF, broadening its exposure to digital assets beyond bitcoin.

Beyond ETF holdings, the filing revealed a sizable put option position tied to MicroStrategy, a corporation known for holding large quantities of bitcoin, suggesting a hedge strategy that could benefit if that company’s stock trades down toward the value of its bitcoin assets.

Intesa Sanpaolo’s 13F filing also included minor equity stakes in several crypto-linked companies, such as Coinbase and Circle, reflecting a diversified digital asset strategy that extends past passive ETF index exposures.

Investment analysts see the disclosure as part of a broader institutional trend of regulated financial firms incorporating digital asset products into client offerings and treasury strategies, even amid volatility in the cryptocurrency markets.

The news shows the evolving interface between traditional banking giants and crypto-linked financial instruments.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Business8 hours ago

Business8 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video23 hours ago

Video23 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World22 hours ago

Crypto World22 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

Business6 days ago

Business6 days agoAn Activist Investor Enters Wall Street Banks’ Cozy Club