Crypto World

Larry Lepard ragequits after Bloomberg analyst forecasts $10k BTC

A recent conversation between Bloomberg’s Mike McGlone and bitcoin (BTC) advocate Lawrence Lepard on Scott Melker’s show devolved into expletives and a ragequit. On one side, a BTC price forecast of $10k. On the other side, a BTC forecast of $140k to over $1 million.

The shouting match is a case study in how polarized beliefs about the value of BTC have become.

On one side of the argument, McGlone forecasted a BTC drop to $10,000 and laughed at Lepard’s buy-and-hold investment strategy. “You’re dollar cost averaging in an asset that has an unlimited supply, that’s done, that’s over,” McGlone stated.

That forecast earned immediate backlash. “Whoa, whoa, whoa. Unlimited supply? What the f*** are you talking about?” Lepard countered.

McGlone recast his claim about unlimited supply to the asset class of altcoins, even though he made the initial claim about bitcoin specifically.

“OK, maybe you should let me speak before you interrupt,” McGlone continued. “You’re at the start of a classic bear market. You’re denying it, you’re trying to buy every dip. You’ll sell out. You’ll stop out when – and I’ll say it now – it reads as a pretty low plateau around $10,000. That’s usually how markets work.”

Read more: CHART: BTC underperforms in Trump’s first year in office

McGlone called 2024 “as good as it gets” for crypto amid that initial euphoria about Donald Trump’s presidential election. Indeed, on November 18, 2024, the Fear & Greed rocketed to 83 on a scale from 0 to 100, its highest reading in 3.5 years.

McGlone concluded that the crypto industry is “done” and recommended everyone to immediately “get out.” “From the future, we will look back at the crypto mania as very comparable to tulips.”

Lawrence Lepard responds to a BTC $10k forecast

After McGlone’s rant, Lepard said he would clip that video of McGlone as the “dumbest fucking comments.” Within six minutes, Lepard ragequit the interview entirely.

After a brief moment of ambiguity over whether McGlone had said the acronym ETF or ETS, and after McGlone reiterated his view that inflows into ETFs as a bullish catalyst for BTC had failed to sustain prior rallies, Lepard claimed that McGlone was not letting him finish his bullish comments about BTC.

“Fuck you, I mean fuck you, seriously,” Lepard concluded. “Bye guys.”

Lepard is a professional money manager and a BTC permabull. McGlone is a senior commodity strategist at Bloomberg Intelligence.

After Lepard ended the exchange abruptly, his supporters celebrated. Soon, McGlone apologized on X for cutting-in. “I have apologized to Larry for interrupting him on Macro Mondays.”

Lepard has incorrectly predicted the price of BTC before, including a failed forecast for BTC to hit $140,000 last year.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Binance Whale Inflows Surge as Bitcoin Tests Critical Support

Key Insights:

- Binance whale inflow ratio surged, showing growing dominance of large BTC transactions.

- Bitcoin’s 22% YTD decline has pushed sentiment into extreme fear territory.

- Falling stablecoin liquidity makes whale moves more influential on price action.

Market Weakness Deepens Across Crypto

The larger crypto market is still under intense pressure with Binance registering a massive increase in whale activity. Bitcoin is trading around $68,000, dropping over 22% in the year, the lowest first-quarter performance since 2018.

The month of January ended with a sharp loss of 10% and February has been unable to provide relief yet. This decline is reflected in investor sentiment, where the Crypto Fear & Greed Index is solidly in the extreme fear zone. The range of $60,000 to $65,000 has been cited by analysts as one of the key support zones that might dictate the direction in the near future.

Whale Inflows on Binance Spike Suddenly

Despite bearish price action, on-chain data points to a notable shift in large-holder behavior. According to CryptoQuant, Binance’s whale inflow ratio jumped from 0.40 to 0.62 between February 2 and February 15, indicating that a large portion of exchange inflows is currently taken over by large holders.

A single large holder, known as the Hyperunit whale, allegedly transferred close to 10,000 BTC to Binance as the volatility increased. A number of other high-value transfers occurred in their turn, indicating that institutional-scale players are actively repositioning as prices get weaker.

🐳 Whale Inflow ratio surges on Binance amid market correction.

This correction is testing all types of investors, from retail participants to whales and even institutions.

According to the whale inflow ratio, we are seeing a clear surge in whale activity on Binance,… pic.twitter.com/TVJiUAWy1O

— Darkfost (@Darkfost_Coc) February 17, 2026

In the past, increasing numbers of whales may cause sell-side pressure. They can, however, reflect tactical actions in times when deep liquidity on the major exchanges becomes crucial.

Liquidity Tightens as Capital Pulls Back

Binance has seen declining stablecoin liquidity. The exchange has registered three consecutive months of negative netflows of stablecoins, with almost $3 billion leaving the platform this month. Since November, the total stablecoin reserves have been decreasing by nearly $9 billion.

This tightening of liquidity increases the effect of the whale movement since big transfers can more readily influence the short-term price action.

Selling Pressure or Strategic Accumulation?

The statistics provide a varied picture. The low liquidity and risk-off flows suggest caution, but the rise in whale activity implies that the large players are finding opportunities at these levels. It remains unclear whether this signals distribution, hedging, or silent accumulation.

Crypto World

AAVE Drops 86% From ATH; Can This Key Support Zone Trigger a $1,000 Rally?

TLDR:

- AAVE is trading around $124, sitting above a major support zone between $90 and $110 on the weekly chart.

- A multi-year ascending trendline active since 2021 converges with the 0.618 Fibonacci level at current prices.

- Price is compressing between descending resistance and rising support, signaling a potential breakout is approaching.

- Upside targets range from $190 to $1,000, representing a 10x return from the base of the accumulation zone.

AAVE is currently sitting at a critical support zone following an 86% decline from its all-time high. The DeFi token is trading around $124, holding above a major weekly trendline that has remained intact since 2021.

Analysts are now watching whether this level can sustain buying pressure and trigger a larger recovery. Crypto analyst CryptoPatel has outlined a detailed technical case suggesting a potential 10x move from the current accumulation range.

Price Holds Above Key Support as Accumulation Signs Emerge

AAVE is trading above a high-timeframe support zone between $90 and $110. This range has attracted considerable attention from technical analysts tracking the asset’s long-term structure.

The zone aligns with a multi-year ascending trendline, adding weight to its relevance as a demand area.

CryptoPatel flagged the setup on social media, stating that price is showing a “liquidity sweep and reaction from a multi-year ascending trendline that has held since 2021.”

That trendline converges with the 0.618 Fibonacci retracement level, forming a strong area of technical confluence. Together, these factors point to a historically significant support region for the asset.

Beyond the trendline, price action is compressing between a descending resistance level and rising support. This type of compression pattern often builds tension before a directional move. Traders are watching closely to see which side resolves first.

10x Targets in Focus as Breakout Conditions Take Shape

The $74 level stands as the line in the sand for bulls. A weekly close below that price would cancel the bullish scenario outlined in the analysis. As long as AAVE holds above that threshold, the setup remains technically intact.

CryptoPatel mapped out a series of upside targets starting at $190, followed by $345, then $579, and eventually $1,000 or more.

These levels represent roughly a 10x return calculated from the base of the accumulation zone near $90. Each target corresponds to a technical resistance level identified on higher timeframes.

The analyst described the current range as trading between the 0.618 and 0.786 Fibonacci support levels, calling it a “generational accumulation range before massive expansion.”

This Fibonacci band is commonly associated with deep retracements that precede strong recoveries in trending assets.

Whether AAVE confirms this pattern depends on price holding current support and broader market momentum supporting a DeFi recovery.

Crypto World

Brutal Collapse on the Way?

Is PIPPIN headed for a collapse below $0.10?

The meme coin pippin (PIPPIN) is deep in red territory today (February 17) after posting substantial gains over the past few weeks.

The question now is whether this will be a temporary correction or the beginning of a major collapse.

What Comes Next?

The asset’s price has retraced by nearly 20% on a daily scale and now trades at around $0.59 (per CoinGecko’s data). PIPPIN’s market capitalization has tumbled below $600 million, putting it at risk of losing its prestigious spot among the 100 largest cryptocurrencies.

Several analysts have recently warned that the meme coin could be a high-stakes gamble, advising traders to stay away from it. Earlier this week, X user Ted said he doesn’t know a single person who holds PIPPIN and wondered what might have driven the rally.

He thinks the whole thing is “a CEX cabal play,” similar to Mantra (OM). In crypto slang, “cabal” refers to a small, coordinated group of insiders who are believed to manipulate a token’s price with their actions. Recall that just a year ago, OM was worth almost $9, whereas its market cap briefly exceeded $8 billion. Since then, the asset has crashed by staggering 99%.

Crypto Rug Muncher shared a similar thesis. The X user argued that the only people still active in the PIPPIN ecosystem are “the cabal members who crimed it to $700 million MC in the first place.”

“This isn’t a project holding the active interest of the space; it’s organized manipulation designed to bait in naive retail for exit liquidity. The project is a hollow, abandoned shell with no fundamentals, and as soon as the insiders manipulating this get bored, it’s headed straight back to shitcoin hell where it belongs,” they added.

Crypto GVR and ALTSTEIN TRADE also gave their two cents. The former spotted the price reversal that occurred in the past hours to forecast that a major collapse to $0.10 may be coming next. The latter argued that PIPPIN’s “top is in,” predicting that all the gains will be lost and that the valuation will tumble below $0.10.

You may also like:

Something for the Bulls

Despite the grim forecasts from the aforementioned analysts, the meme coin’s Relative Strength Index (RSI) suggests a short-term rebound could be on the horizon.

The technical analysis tool tracks the speed and magnitude of recent price changes and helps traders spot potential turning points. It runs on a scale from 0 to 100, and ratios below 30 indicate that PIPPIN is oversold and might be on the verge of a resurgence. On the contrary, readings above 70 are considered precursors of a correction. Currently, the RSI stands just north of the bullish zone.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ethereum Staking Breaks New Highs as Price Slumps

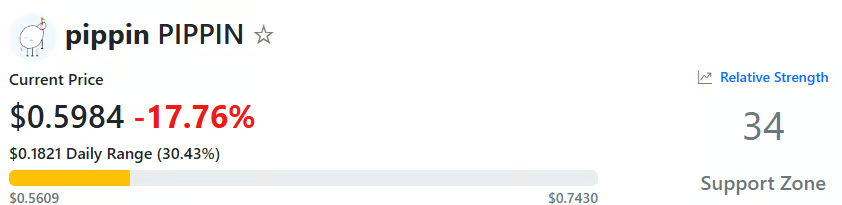

The amount of ETH that’s being used to secure the network recently crossed 30% of Ethereum’s circulating supply for the first time.

More than 30% of ETH’s circulating supply is now locked in staking contracts, per data from Validator Queue. The percent of supply staked continues to break new highs this month, climbing over 30% for the first time at the end of January.

As of today, Feb. 17, data shows that about 36.9 million ETH, or roughly 30.4% of total supply, is currently staked across nearly 967,000 active validators.

Meanwhile, the price of ETH rallied to new highs this summer, reaching nearly $5,000 in late August, but has since given back much of those gains, and is currently struggling to stay around $2,000.

The jump in staking, however, has also created a clear backlog for new validators. About 3.92 million ETH is currently sitting in the validator entry queue, waiting to be staked, and the wait time for staking has reached nearly 68 days.

Getting out of staking, however, is finally far easier. The exit queue is empty, although withdrawals still face an additional eight-day sweep delay before funds reach withdrawal addresses. This fall, the validator exit queue also faced congestion, and in September it took more than 45 days to exit Ethereum staking.

The network APR, or annual staking rewards, currently sits at around 2.84%. As for players, Lido remains the largest staking entity, controlling roughly 24% of all staked ETH, or about 8.7 million tokens, according to data from Dune Analytics. Centralized exchanges and centralized staking providers also account for a sizable share.

The data shows staking inflows rising through 2024 and early 2025, before turning negative later in 2025 as some participants began pulling ETH back out.

Last summer, alongside ETH’s price, the total value locked across liquid staking protocols — which let ETH holders stake their tokens while keeping funds liquid — rose to record highs above $85 billion, which extended through early October.

But after the Oct. 10 crash, liquid staking TVL began to drop and is currently sitting just below $40 billion.

Crypto World

Crypto VC firm Dragonfly raises $650 million despite ‘gloom of a bear market’

Crypto venture firm Dragonfly Capital completed a $650 million fourth fund, marking one of the largest raises in the sector at a time when many blockchain-focused VCs are struggling, Managing Partner Haseeb Qureshi said.

“It’s a weird time to celebrate,” Qureshi wrote on a social media post on Tuesday, describing low spirits and “the gloom of a bear market” for crypto. However, he noted that Dragonfly has historically raised capital during downturns, including the 2018 ICO crash and just before the 2022 Terra collapse, ‘vintages,’ he said, ultimately became the firm’s best performers.

In September, the firm said it was aiming to raise $500 million for its fourth fund, which would target early-stage projects. It has not yet identified any of them. In May 2023, Dragonfly Capital raised $650 million for its third crypto fund for later-stage companies.

‘Biggest bet yet’

The new vehicle comes as token prices slumped this year and fundraising across crypto ventures has slowed sharply. Bitcoin has lost roughly 46% of its value since its all-time high of more than $126,000 in October of last year, and the crypto downtrend has wiped out more than $1.4 trillion in market cap.

While market sentiment remains bearish, Qureshi is bullish on crypto’s financial use cases, saying the sector “is exploding,” while other non-financial use cases are failing. In fact, Dragonfly has increasingly leaned into crypto-financial infrastructure, from stablecoins to tokenization and on-chain payments, reflecting a broader shift away from speculative Web3 applications and toward blockchain-based financial services.

“Stablecoins are eating the world. DeFi has grown so big it’s rivaling CeFi. Financial institutions around the world are racing to build out their crypto strategies. And prediction markets are becoming the most trusted source of truth on the internet,” he wrote.

Qureshi also noted the growth in Dragonfly’s recent investments, including Polymarket, Ethena, Rain, and Mesh, as examples of his thesis that crypto’s financial use cases are having a moment.

His comments come after VC firms at Consensus Hong Kong 2026 struck a cautious tone about the state of the crypto market amid prevailing bearish sentiment. The crypto VCs that included Qureshi, Maximum Frequency Ventures’ Mo Shaikh and Pantera Capital’s Paul Veradittakit all echoed the same sentiment: invest in what’s working, like stablecoins and tokenizations, while selectively betting on sectors such as AI and prediction markets.

Qureshi seems to be doubling down on the idea that the crypto industry isn’t dead, despite the gloom, but just realigning and noted that the new fund is his firm’s “biggest bet yet that the crypto revolution is still early in its exponential.”

Fortune was first to report Dragonfly’s recent raise.

Crypto World

Hayden Davis Resurfaces After LIBRA Crash, But His Latest Trades Are Deep in the Red

Bubblemaps found that Hayden Davis, who was involved with LIBRA and YZY tokens, has resumed on-chain trading, but recent Solana meme coin bets resulted in nearly $3 million losses.

A year after Bubblemaps first detailed the on-chain mechanics behind the LIBRA meme coin collapse, the blockchain analytics firm has released a new update tracking the renewed trading activity of the project creator Hayden Davis.

This time, it has highlighted significant trading losses rather than insider gains.

From Insider Wins to Meme Coin Losses

According to Bubblemaps’ latest findings, Davis has resumed on-chain activity after a period of wallet inactivity, but is now down roughly $3 million after trading multiple Solana-based meme coins, such as PUMP, TROVE, and PENGUIN.

The update stated that Davis had largely disappeared from on-chain trading following Bubblemaps’ August 2025 investigation, which showed he had made millions by sniping the hip-hop star Kanye West’s YZY token shortly after launch. After those profits, the wallets linked to him went dormant.

However, Bubblemaps reports that new wallets within the same cluster have become active again this year. In fact, over the past 30 days, the firm identified several large transfers into a deposit address linked to Davis, labeled CPGZ1i, which ultimately led to six active wallets under the same cluster.

Transaction analysis further indicated that Davis was trading as recently as five days ago and focused primarily on trending Solana meme coins. Unlike previous episodes, the majority of these trades were unprofitable. Bubblemaps estimated losses of approximately $2.5 million on PUMP, $100,000 on PENGUIN, $29,000 on KABUTO, and smaller losses on tokens such as LOUD and BAGWORK.

LIBRA Fallout Didn’t End It

The findings show Davis did not exit the market following the LIBRA collapse, which had previously been linked to over $100 million in insider profits, according to Bubblemaps’ report published exactly a year earlier. That earlier investigation mapped a network of wallets connected to LIBRA and MELANIA token launches, and demonstrated coordinated sniping activity, cross-chain fund transfers, and quick cash-outs tied to addresses associated with Davis and related entities.

You may also like:

On Monday’s update, Bubblemaps observed that instead of disappearing, Davis’ financial position evolved in other ways. For instance, a judge unfroze $57 million of his assets, he continued to generate profits through opportunistic trades such as YZY, and he received a sizable MET airdrop. The latest data now shows Davis engaging in routine on-chain trading activity again.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

MicroStrategy Expands Bitcoin Holdings to $50 Billion Despite Market Woes

MicroStrategy, now known as Strategy (NASDAQ: MSTR), expanded its Bitcoin holdings last week amid continued market challenges. The company purchased 2,486 Bitcoin, bringing its holdings to over 717,000 coins. This purchase, valued at nearly $50 billion, reflects Strategy’s unwavering commitment to Bitcoin, despite bearish market conditions.

Last week, Strategy bought 2,486 Bitcoin, spending $168 million. With this latest acquisition, its Bitcoin stash now exceeds 717,000 coins. This purchase came as the company continued using its stock sales to fund the Bitcoin buys, causing shareholder dilution.

Strategy has acquired 2,486 BTC for ~$168.4 million at ~$67,710 per bitcoin. As of 2/16/2026, we hodl 717,131 $BTC acquired for ~$54.52 billion at ~$76,027 per bitcoin. $MSTR $STRC https://t.co/wvxRYZlQ3Y

— Michael Saylor (@saylor) February 17, 2026

The company has sold over $7.8 billion in shares and is set to sell more. In addition to the stock sales, Strategy holds over $20 billion in preferred STRK. The number of outstanding shares now surpasses 312 million, a significant rise from previous years. As the company’s Bitcoin strategy endures, Michael Saylor, the firm’s former CEO, pledged to keep purchasing Bitcoin indefinitely. He also mentioned plans to swap company debt for additional shares in the future.

Technical Indicators Point to Bitcoin’s Potential Decline

Bitcoin’s price continues to struggle, showing a bearish pattern in the charts. Analysts are concerned that Bitcoin may drop further before any potential rebound. The technical setup suggests a bearish pennant pattern, signaling a price drop.

Bitcoin’s price is moving toward a potential crash, with projections hinting at a fall to $60,000. The bearish pattern emerges from a confluence of a vertical line and a symmetrical triangle. If Bitcoin fails to rise above the $80,000 resistance, the negative outlook will remain intact.

In the past, Bitcoin’s behavior has shown vulnerability to market sentiment shifts. Standard Chartered recently adjusted its Bitcoin price forecast, lowering it from $150,000 to $100,000. The bearish sentiment comes as Bitcoin struggles to break above critical resistance levels, keeping the coin under pressure.

Geopolitical Risks Amplify Bitcoin’s Struggles

Bitcoin faces additional pressure from geopolitical concerns, which weigh heavily on its performance. Tensions in the Middle East, including rising conflict risks between the U.S. and Iran, could impact Bitcoin’s price. Despite negotiations between the U.S. and Iran, ongoing military movements create uncertainties for the market.

The ongoing geopolitical uncertainty has contributed to Bitcoin’s volatility, as the coin fails to establish itself as a safe-haven asset. Bitcoin’s price has been closely linked to broader market sentiment, especially during times of conflict. This ongoing instability is likely to exacerbate the challenges faced by Bitcoin in the short term.

As the Middle East crisis develops, it is unclear how Bitcoin will respond. While some might view it as a hedge against traditional markets, Bitcoin has proven to be vulnerable to large-scale geopolitical events. With global events continuing to influence cryptocurrency prices, Bitcoin’s future remains uncertain.

Crypto World

Bitcoin Traders Say Watch These BTC Price Levels Next

Bitcoin (BTC) analysts mapped out the key BTC price levels to watch as the market’s focus shifted to the $58,000 to $65,000 zone as the last line of defense.

Bitcoin price is wedged between two key levels

Bitcoin is currently wedged between the 200-week simple moving average (SMA) at $68,300 and the 200-week exponential moving average (EMA) at $58,400.

Generally, in Bitcoin’s trading history, major BTC bottoms have formed between the 200-week SMA and EMA, according to analyst Jelle. This suggests that Bitcoin is possibly forming a bottom between these trendlines.

Related: Bitcoin accumulation wave puts $80K back in play: Analyst

While Bitcoin has produced a weekly close above the 200-week EMA for the second week in a row, “this doesn’t mean it is now in the clear,” trader and analyst Rekt Capital said in a Monday X post, adding:

“The absence of any meaningful upside from here going forward, there is a risk that BTC loses the 200-week EMA in time, triggering additional downside.”

Crypto investor and entrepreneur Ted Pillows had an expanded view, focusing on $71,000 for a bullish breakout.

In a Tuesday post on X, Ted Pillows said that Bitcoin needs a daily close above the $71,000 level to increase the chances of an upside rally, adding:

“And if a breakdown happens below $66,000, BTC might revisit $60,000.”

Cointelegraph reported that the CME gap between $80,000 and $84,000 could act as a magnet, representing the upper price target for Bitcoin. With nine out of 10 CME gaps filled since August 2025, the $80,000–$84,000 range stands out as the key level to watch on the upside.

Bitcoin bulls must hold the price above $65,000

After turning away from $72,000 last week, Bitcoin found support at $65,000. Glassnode’s cost basis distribution heatmap reveals a significant support area recently established between $63,000 to $65,000, where long-term holders recently acquired approximately 372,240 BTC.

A decisive break below this level “would likely open the path toward the realized Price” around $55,000, Glassnode said in a Monday post on X.

Current analysis suggests that the bears may aim to hold BTC price below $65,000 to remain in control. If they succeed, the BTC/USDT pair may then retest the critical $60,000 level. If the $60,000 support cracks, the next stop is likely to be $52,500.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Shiba Inu coin dies slowly as new rival Based Eggman reclaims memecoin momentum, GGs vs SHIB

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Based Eggman (GGs) challenges SHIB as investors shift toward utility-driven memecoins built on real ecosystem value.

Summary

- Shiba Inu’s momentum has slowed since 2021, while emerging utility memecoins like Based Eggman draw renewed investor attention.

- Analysts compare SHIB’s stalled growth with Based Eggman’s Base-linked utility, low fees, and governance-driven ecosystem model.

- Growing interest in scalable, utility-focused memecoins signals a shift from hype toward functional blockchain ecosystems in 2026.

The power structure of the memecoin world has changed a lot. Shiba Inu coin (SHIB), which used to be very popular as a “Dogecoin Killer,” is losing steam, which was a significant thing during the 2021 bull run. The prices have been hard to get back to where they were before, and the community’s joy has diminished because construction is going so slowly and in parts.

In this open arena, a new rival has arrived, not just to compete, but also to set a new standard for what a successful memecoin should be. Based Eggman (GGs) is swiftly capturing the attention — and money — of SHIB investors who are unhappy with their investments. This puts it in a good position to get back the explosive growth that used to define its opponent. This analysis looks at Based Eggman GGs and SHIB to figure out why one project is stuck, and the other is meant to explode out.

The stagnation of Shiba Inu coin: A record of broken promises

Shiba Inu made history with a huge surge, but its current route reveals how hard it is to keep a legacy memecoin running.

- The “Ghost Chain” Problem of Shibarium: Shibarium, SHIB’s Layer-2 solution, was expected to revolutionise the game by lowering fees and making new uses possible. But not many people have used it yet. The ecosystem hasn’t been able to get many significant, independent projects to join, which means that a lot of the use cases it promised haven’t happened. A lot of people are thinking of a “ghost chain,” which is infrastructure that doesn’t have a vibrant economy.

- Not being able to focus and being tired of the community: There are a lot of tokens (SHIB, BONE, LEASH, TREAT) and projects (ShibaSwap, Shiboshis) in the SHIB ecosystem. This dilution sometimes confuses new investors and makes it hard for the community to stay on track. Diversification can be wonderful, but it can also make people not care if there isn’t a clear, focused momentum. The SHIB price’s persistent attempts to break through crucial resistance levels reveal that it is exhausted.

- The Market Cap Anchor: SHIB’s high market cap is now its worst enemy, just like Dogecoin’s was before it. For new investors to obtain the same 100x or even 10x returns, they need to bring in a lot more money than a smaller, newer business does. The rule of decreasing returns is now firmly in force.

Because of this, a group of SHIB holders is trapped with their bags and is actively looking for the next project that can bring back the community-driven fun they had at the beginning. They are looking for Based Eggman.

The blueprint SHIB wanted Based Eggman to have a presale

Based Eggman (GGs) is not trying to kill SHIB. It is pursuing a better, more up-to-date plan that fixes the issues that have been holding SHIB back. It depicts what a memecoin for the next generation should be: useful first, lean, and focused.

1. The unbeatable launch strategy: The CEX listing catalyst

SHIB is slowly developing on DEXs and its own chain, but Based Eggman has made it easier for people to get into the market. The Based Eggman CEX Listing, which is coming up in the second quarter of 2026, is a scheduled event to add liquidity. This is the nicest thing that could happen to consumers who buy before the sale. Anyone can get in on the ground floor price of GGs tokens (CA: 0x7f23e5fc401bdfcdc9ad3970ff52f65de73ba8ed) now, before they go on sale on a big exchange. In the past, this has caused prices to go up a lot.

2. Lean, focused utility on superior infrastructure

Based Eggman doesn’t fall into the trap of dilution. The first thing it does is set a clear, singular goal: to be the gas and governance token for its ecosystem, which is based on Coinbase’s Layer-2, Base. This gives you perks right now that SHIB doesn’t have:

Low expenses and immediate scaling: Base offers institutional-level scalability and nearly no transaction costs right away. This is not like the slow and costly problems that early SHIB and even current Shibarium customers had to deal with.

The Based Eggman’s GGs dashboard is a great approach to get people involved because it interacts with the Shibarium blockchain. This makes it easier for SHIB holders to maintain track of their Shibarium assets in the Based Eggman ecosystem. It also makes it easier for new users to join and welcomes SHIB veterans.

Limited Supply: There are only 389 million GGs tokens available, therefore it’s a wonderful choice for people who desire something that’s hard to get. This is extremely different from SHIB’s approach, which has a quadrillion-supply and needs big burns all the time to keep prices up.

3. Bringing back the community spirit

Based Eggman’s Presale is bringing back the fierce, dedicated ethos that made early SHIB so great. The processes are clear: a presale, staking activation, a listing on a CEX, and expansion of the ecosystem. There is no confusion, and the tokenomics are not broken. This clarity is attracting SHIB holders who miss the days when everyone had the same goal, and it was easy to see how to attain it.

The memecoin decision: GGs vs. SHIB

It’s easy to tell the difference:

Shiba Inu (SHIB) is a well-known but old project that is having problems because it is too big, its ecology isn’t growing quickly enough, and there are too many things to do. It will grow slowly and be connected to the bigger market.

Based Eggman (GGs): A presale projectile with a timed ignition sequence (CEX listing), built on superior tech (Base), featuring smart integrations (Shibarium dashboard), and optimised for viral, focused growth.

The energy has shifted. SHIB isn’t “dead,” but the days of easy, large multiples are over. Capital and community energy are gravitating towards projects that show a clear, modern path to move forward.

In conclusion, the presale window is the new battlefield.

People who used to be in the SHIB army and want to know where the next 100x memecoin chance is should not wait for an old project to learn how to run again. It’s important to know what the planned benefit of a presale like Based Eggman is.

Based Eggman isn’t just a new memecoin; it’s a new way of doing things. It provides SHIB holders with what they’ve been asking for: a fresh start with professional execution, a large event that is sure to happen, and a community-focused vision based on better technology. The Based Eggman Presale is where the memecoin momentum that was lost is now centred. This is the best trade between GGs and SHIB for 2026.

For more information, visit the official website, blog, X, and Telegram.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Kraken Joins ICE Chat to Boost Institutional OTC Access

Kraken has expanded its institutional reach by linking its over-the-counter (OTC) desk to ICE Chat, Intercontinental Exchange’s real-time messaging platform used by banks and trading desks. Announced February 17, 2026, the arrangement makes Kraken the first cryptocurrency platform to be approved for ICE Chat, enabling quote requests and negotiations to flow directly within a system that aggregates more than 120,000 market participants. The move positions Kraken’s liquidity alongside traditional assets across a familiar workflow, signaling a broader push to incorporate digital assets into mainstream financial-market infrastructure. The OTC desk at Kraken handles large block trades in crypto spot and options, and the partnership with ICE is expected to evolve as institutions look for deeper, more integrated access to crypto liquidity.

Key takeaways

- Kraken’s OTC desk is now integrated with ICE Chat, enabling institutional traders to access Kraken’s crypto liquidity directly through a widely used messaging platform.

- ICE Chat connects more than 120,000 market participants, including banks, brokers, and trading desks, allowing real-time deal negotiation within established workflows.

- Kraken is the first crypto platform approved to connect to ICE Chat, situating digital asset liquidity alongside traditional asset classes.

- The integration is expected to expand over time, reflecting broader efforts to embed digital asset trading into traditional financial-market infrastructure.

- ICE’s broader crypto initiatives include on-chain data collaborations, large-scale investments in crypto markets, and potential partnerships with wallet and payments providers, signaling a more integrated financial ecosystem.

Market context: Link the story to broader crypto conditions (liquidity, risk sentiment, regulation, ETF flows, macro, or sector trends) WITHOUT inventing facts.

Why it matters

The Kraken-ICE Chat linkage marks a notable step toward deeper institutional access to crypto liquidity. By enabling quote requests and negotiations to occur within ICE’s established messaging network, hedge funds, asset managers, and banks can integrate crypto trading into their existing workflows without resorting to separate channels or processes. The arrangement reduces friction for large crypto block trades, a key consideration for participants handling significant volumes in both spot and options markets. In practical terms, traders can coordinate, price, and settle trades within a single, familiar interface, potentially improving execution efficiency and speed while preserving governance and compliance controls.

The move also highlights ICE’s broader strategy to bring digital assets into mainstream capital-markets infrastructure. ICE operates ICE Chat, the New York Stock Exchange, and a suite of data, clearing, and technology services. Its push into crypto markets aligns with the industry-wide trend of bridging traditional finance with digital assets, leveraging established market infrastructure to widen participation and liquidity. In recent months, ICE has pursued a series of crypto-related initiatives, including a collaboration with Chainlink to pull FX and precious metals data on-chain, substantial investments in crypto-native ventures, and explorations into crypto payments capabilities. These steps underscore a broader ambition to weave crypto more deeply into the fabric of conventional trading and risk management.

The partnership comes amid a wider set of tokenization and on-ramp developments across major exchanges. Nasdaq has signaled a willingness to explore tokenized equities through regulatory channels, while the NYSE has discussed plans to operate a 24/7 trading platform for tokenized stocks and ETFs, integrating traditional post-trade settlement with blockchain-based processes. These efforts reflect a synchronous push from traditional venues toward digitized asset classes, where liquidity, transparency, and execution efficiency are often cited as critical advantages. The ecosystem is evolving rapidly, with market participants watching how these initiatives will interact with evolving regulatory standards and the pace of adoption by institutional users.

The timing of Kraken’s announcement overlaps with other notable industry moves. Earlier in the year, Kraken pledged to support a government-backed initiative to create “Trump Accounts,” a savings program for Americans under 18—an effort that reflects the broader intersection of crypto policy and retail-facing programs. This backdrop illustrates how crypto firms are navigating public policy while expanding their institutional capabilities, seeking to demonstrate value beyond consumer-focused products and toward core market infrastructure.

Why it matters (continued)

The integration could help amplify liquidity for large crypto trades by tapping into ICE’s global network, potentially reducing spreads and improving price discovery for institutional participants. It also signals to regulators and incumbents that crypto liquidity can be treated as part of the same market ecosystem that handles equities, bonds, and other traditional asset classes. For Kraken, the collaboration with ICE Chat may expand its reach among asset managers who prefer operating within standardized, risk-managed environments—furthering the normalization of digital assets within regulated financial marketplaces.

What to watch next

- Expansion updates: Follow announcements about extending ICE Chat access to additional Kraken clients and other Kraken desks or counterparties.

- Broader ICE crypto initiatives: Monitor developments tied to ICE’s data services, on-chain integrations, and potential partnerships in payments or custody.

- Tokenization momentum: Track regulatory progress and product launches related to tokenized stocks and ETFs at Nasdaq and NYSE, which could influence liquidity and settlement paradigms.

- Data and settlement enhancements: Look for updates on ICE’s Consolidated Feed and how it interoperates with on-chain data streams and DeFi-native pricing mechanisms.

Sources & verification

- Kraken Integrates with ICE Chat to Expand Institutional OTC Access — Business Wire press release (official announcement of the integration).

- ICE Chat and Market Participation — ICE corporate communications outlining the platform’s reach beyond traditional markets.

- Chainlink and ICE Forge On-Chain Data Collaboration — Cointelegraph coverage detailing ICE’s data-on-chain initiative.

- ICE Invests in Polymarket — Cointelegraph reporting on ICE’s $2 billion investment and the valuation context.

- Nasdaq and NYSE tokenization efforts — Cointelegraph coverage of Nasdaq’s tokenized-stocks push and NYSE’s plans for 24/7 tokenized-trading platform.

What the announcement changes

The Kraken-ICE Chat integration represents a concrete step in the ongoing evolution of institutional crypto access. By embedding Kraken’s liquidity within ICE’s established communications platform, the move lowers barriers for large-scale crypto trading and aligns digital asset execution with the workflows many institutions already use for other asset classes. The collaboration reinforces the idea that cryptos are not merely retail instruments but elements of a broader, interconnected market infrastructure that includes data, clearing, risk management, and settlement. As the ecosystem expands, institutions may increasingly rely on a combination of on-chain data, centralized exchanges, and OTC desks to manage exposure, price risk, and execution efficiency across diverse crypto products.

What to watch next

- Monitoring quarterly updates from Kraken and ICE for new client onboarding and expanded platform access.

- Regulatory developments affecting crypto-asset trading infrastructure and tokenized securities, including any policy shifts impacting tokenization and cross-market liquidity.

- Progress on ICE’s partnerships with data providers and on-chain data feeds, and how these integrations affect price discovery and risk management.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech16 hours ago

Tech16 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video11 hours ago

Video11 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World10 hours ago

Crypto World10 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports17 hours ago

Sports17 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal