CryptoCurrency

Launch Revolut-Style Banking App With Antier’s White Label Neo Bank Software

Building a Revolut-style neo banking app today means combining modern digital UX, regulatory certainty, and deep technical rigor. A visionary investor must focus on designing a platform that supports instant onboarding, multi-currency accounts, payments and cards, asset custody, and programmable finance, while meeting institutional standards for security and compliance. This guide explains what institutional investors look for, the core features an institutional-grade crypto neo bank must include, how a white-label BaaS platform accelerates enterprise launches, and a concise step-by-step launch plan. The smartest move you can make before investment is by partnering with a blockchain company that holds hands-on experience building regulated, crypto-native banking stacks and showing how ideal white-label BaaS helps turn strategy into a live, compliant product.

What Do Institutional Investors Expect From a Crypto Neo Banking Software?

1. Enterprise-grade security and custody

- Proof: MPC/HSM or qualified custodian contracts.

- Controls: separation of keys, role-based access, encryption.

- Evidence: recent independent pentest and incident playbook.

2. Strict, auditable compliance and KYC/AML controls

- Flow: automated KYC + escalation for high-risk cases.

- Rules: configurable AML engine and sanctions screening.

- Evidence: searchable case logs and SAR reporting capability.

3. Scalable and resilient architecture with high availability

- Design: stateless services, autoscaling, multi-region failover.

- Observability: monitoring, alerts, and error tracing.

- SLA: published uptime targets and tested DR drill results.

4. Clear regulatory pathway and licensing support

- Strategy: documented license plan per launch market.

- Options: partner bank/e-money provider fallback.

- Evidence: counsel opinion, compliance officer with jurisdictional experience.

5. Deep liquidity and on/off-ramp integrations

- Providers: multiple liquidity sources and FX partners.

- Performance: API latency and settlement SLAs.

- Treasury: automated hedging and reconciliation workflows.

6. Audit trails, reporting, and transparency for risk teams

- Logs: immutable transaction and admin action records.

- Reporting: exportable regulator and audit reports.

- Access: role-based dashboards for risk and finance.

7. Interoperability with core banking systems and payment rails

- APIs: SDKs, webhooks, and standard data formats.

- Connectors: IBAN/SEPA/SWIFT and card network integrations.

- Validation: sample integrations and reference customers.

8. Strong product-market fit and monetization roadmap

- Proof: pilot customers, conversion metrics, and pricing tiers.

- KPIs: CAC, LTV, and payback timelines.

- Strategy: clear ICP and expand/upsell pathways.

9. Experienced leadership and operational playbook

- Team: proven payments, banking or regulated-finance hires.

- Ops: documented SOPs for onboarding and incidents.

- Metrics: onboarding time, incident MTTR, staff retention.

10. Roadmap for tokenization, programmable assets, and API-first extensibility

- Architecture: modular ledger and token primitives.

- Tools: SDKs, sandbox, and audited smart contracts.

- Roadmap: Timelines for Token Features and Governance Model.

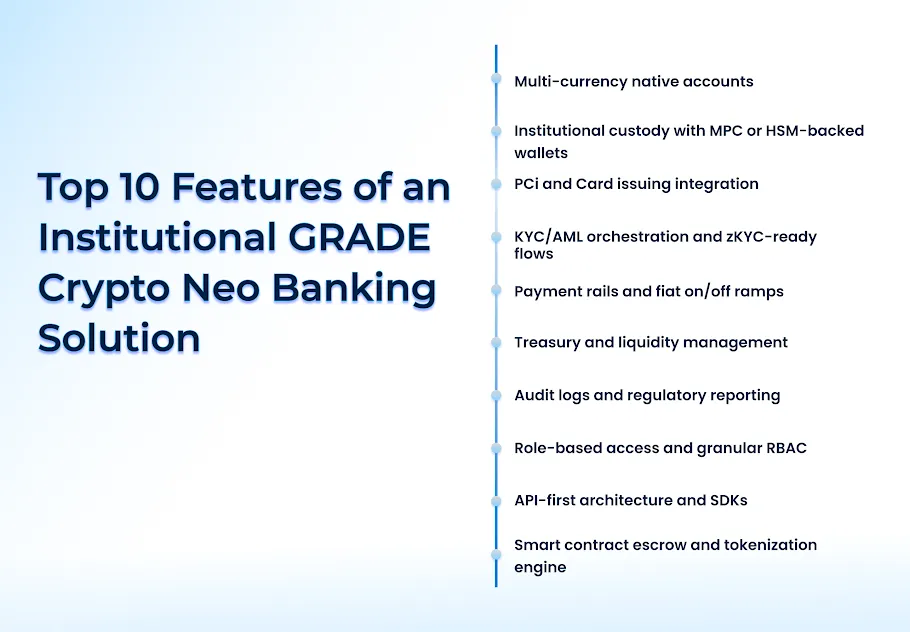

Institutional-Grade Crypto Neobanking: The 10 Essential Features

How Does White Label Crypto Banking App Development Support Institutional-Grade Launches?

White-label crypto-friendly neo banking solutions eliminate repetitive engineering work and accelerate time to market. Instead of building every piece from scratch, enterprises get a pre-certified core that covers card issuance, custody, compliance workflows, payments, and ledger services. This reduces integration risk and gives time back to focus on product differentiation, pricing, and go-to-market.

White label BaaS solution stacks also provide clarity for compliance teams because many components have pre-audited integrations and configurable policy engines. For enterprises targeting multiple jurisdictions, a white label approach simplifies regional configurations and accelerates regulatory submissions. For investors, this translates into lower execution risk and earlier revenue visibility.

Hire Certified Blockchain Experts To Build a Revolut-Style Neo Banking Stack!

How to Launch an Institutional-Grade Neo Bank Platform with a White Label Neo-bank App?

Step 1: Define product, market, and regulatory strategy

Document target customer segments, product scope, and revenue model. Map the regulatory regime for each launch market. Decide whether you will operate under a partner bank, obtain a license, or use a sandbox approach. Capture SLAs required by institutional clients.

Step 2: Choose a white label BaaS partner and core stack

Select a white label neo banking app development partner with proven banking integrations, custody options, and compliance orchestration. Verify their certifications, card networks, and settlement partners. Confirm support for crypto-native architecture if you need token custody or programmable assets.

Step 3: Build integrations and security posture

Integrate custody providers, payment rails, FX liquidity sources, and virtual crypto card issuing platforms. Implement multi-layered security: multi-party computation wallets or HSMs, key management, encryption at rest and in transport, DDoS mitigation, and progressive security testing.

Step 4: Compliance, testing, and controls

Set up KYC/AML rules, transaction monitoring, and reporting pipelines. Run end-to-end compliance and penetration tests. Prepare audit artifacts and stress-test settlement flows and liquidity management under peak volumes.

Step 5: Go-to-market and institutional onboarding

Onboard early pilot clients using graduated limits and white-glove support. Provide sandbox APIs and dedicated integration engineers. Offer SLAs, escrow accounts, and configurable custody policies for institutional clients.

Step 6: Scale and continuous improvement

Automate operational tasks, add localization, and extend product features like tokenization, programmable treasury, and advanced analytics. Maintain a prioritized roadmap with investor and enterprise feedback loops.

Compliance Orchestration for Multi-Jurisdiction Launches

1. Regulatory mapping and classification

- Maintain a jurisdiction matrix with required licenses and filing timelines.

- Map core products to local regulatory categories (e-money, payments, crypto services).

2. Central rule engine

- Single engine that loads region profiles to apply KYC, AML, and transaction rules.

- Versioned rule sets so legal can update policies without code deployments.

3. Risk-tiered onboarding

- Dynamic flows: light-touch onboarding for low risk, escalations for high risk.

- Automated risk scoring using identity, behavior, and transaction signals.

4. Sanctions, PEP, and travel-rule coverage

- Integrate multiple sanctions/PEP providers for wide coverage and failover.

- Automate escalation packaging for hits and enable travel-rule messaging where required.

5. Data residency and recordkeeping

- Tag data by jurisdiction and enforce region-locked storage when mandated.

- Timestamp and version compliance evidence to ensure audit readiness.

6. Automated reporting and audit readiness

- One-click exports for regulator reports and SARs in required formats.

- Append-only, tamper-evident logs and role-based report access for auditors.

Transparent Cost Framework for Institutional-Grade Banking Deployment

A transparent cost framework for institutional blockchain-based digital banking deployments requires focusing on the decisions that drive capital and operating budgets. Important factors are regulatory and licensing requirements, which determine legal expenses, localization needs, and compliance tooling. Custody model selection, whether in-house MPC or third-party custodians, influences insurance and service-level costs.

Integration scope with payment rails, card issuance, foreign exchange, and core banking connectors affects development and settlement overhead. Data residency and infrastructure architecture choices govern hosting, encryption, and disaster recovery spending. Operational staffing, support tiers, and SLAs determine ongoing headcount and outsourcing costs. Third-party provider fees for KYC, sanctions screening, and liquidity provision are major recurring items. Finally, product roadmap choices such as tokenization or programmable assets introduce additional development and audit costs. Transparently presenting these factors helps investors model scenarios and budget with confidence.

Conclusion

Launching an institutional-grade Revolut-style banking app requires a balanced approach across product, security, compliance, and liquidity. White label BaaS accelerates the journey by providing a pre-built, auditable core while letting your team focus on differentiation. Choose a partner with hands-on experience across blockchain, wallets, neobanking, and AI-driven services. At Antier, our cross-functional teams combine deep domain expertise in blockchain engineering, custody and wallet solutions, regulatory integrations, and data-driven product design. We help enterprises move from concept to regulated operations quickly and confidently.

Frequently Asked Questions

01. What are the key features required for a crypto neo banking app to meet institutional standards?

Key features include enterprise-grade security, strict compliance controls, scalable architecture, clear regulatory pathways, deep liquidity integrations, audit trails, and interoperability with core banking systems.

02. How can partnering with a blockchain company benefit the launch of a neo banking app?

Partnering with a blockchain company provides hands-on experience in building regulated, crypto-native banking stacks and helps turn strategic plans into compliant, live products more efficiently.

03. What compliance measures should a crypto neo banking app implement?

A crypto neo banking app should implement automated KYC processes, configurable AML engines, and maintain auditable case logs and SAR reporting capabilities to ensure strict compliance.