Crypto World

Metaplanet CEO denies lack of transparency in BTC strategy

Metaplanet Chief Executive Simon Gerovich has rejected claims that the company lacks transparency in its Bitcoin investment strategy, following criticism shared on X.

Summary

- Metaplanet CEO Simon Gerovich denied claims that the company hides Bitcoin purchases, saying all transactions and wallet addresses are publicly disclosed.

- He defended the firm’s options strategy and financial reporting, arguing they reduce costs and reflect long-term holdings rather than short-term speculation.

- Management re-affirmed its commitment to Bitcoin accumulation while addressing concerns over borrowing, profits, and shareholder funding.

In a detailed public response, Gerovich addressed allegations that Metaplanet failed to disclose purchases, mismanaged options trading, and withheld key financial information. He said the claims were misleading and ignored data already available to shareholders.

The comments came after an anonymous post accused the company of hiding losses and buying Bitcoin at market peaks using shareholder funds.

CEO responds to disclosure and trading claims

Gerovich said Metaplanet has consistently announced all Bitcoin (BTC) purchases when they were made. He added that the company maintains a public dashboard showing wallet addresses and holdings in real time.

According to him, four Bitcoin purchases made in September were disclosed promptly, even though prices were near local highs at the time. He said the company’s strategy does not focus on short-term market timing, but on long-term accumulation.

He also pushed back against criticism of the firm’s options activity. Gerovich explained that selling put options is meant to lower the effective cost of acquiring Bitcoin through premium income.

As an example, he said selling a put at $80,000 with a $10,000 premium would reduce the effective purchase price to $70,000. He argued that this approach benefited shareholders during periods of high volatility.

The CEO said this strategy helped raise Bitcoin per share by more than 500% in 2025, which remains the company’s main performance indicator.

Financial results, borrowing, and shareholder concerns

Gerovich also addressed concerns about Metaplanet’s financial statements. He said net profit figures do not accurately reflect the performance of a Bitcoin-focused treasury company, due to unrealized valuation changes.

He pointed instead to operating profit, which rose sharply year over year, as evidence that the business remains healthy. Losses, he said, were mainly accounting adjustments on long-term Bitcoin holdings that the company does not plan to sell.

On borrowing practices, Gerovich said Metaplanet disclosed its credit facility, drawdowns, and collateral terms when they occurred. However, he noted that lender identities and exact interest rates were withheld at the counterparty’s request.

He added that the terms were favorable and fully approved under disclosure rules.

The CEO also responded to claims that the firm relies solely on shareholder funding. He said he is a major shareholder and has invested personal funds in the company. He pointed to the hotel business, which recorded solid revenue and profit in 2025, as proof that Metaplanet still operates outside crypto.

Gerovich concluded by saying he remains open to direct questions from investors and will continue publishing detailed updates on the company’s activities.

Crypto World

CME Group to launch 24/7 crypto futures and options trading

CME Group, the world’s largest regulated derivatives marketplace, announced plans to begin 24-hour, seven-day-a-week trading of its cryptocurrency futures and options contracts on May 29, 2026, pending regulatory review.

Summary

- Pending regulatory approval, crypto products will move to a 24/7 schedule on the CME Globex platform, with only a brief weekly window for maintenance.

- The shift follows a massive 2025 where CME saw $3 trillion in notional activity, driven by professional traders seeking regulated risk-management tools.

- Beyond Bitcoin and Ether, CME recently broadened its reach by launching futures for Cardano (ADA), Chainlink (LINK), and Stellar (XLM).

CME Group adopts 24/7 crypto trading as competition heats up

The decision marks a significant step in aligning regulated digital-asset derivatives with the continuous nature of global crypto spot markets.

Under the new schedule, CME’s cryptocurrency products will trade continuously on its CME Globex platform, with a brief weekly maintenance window. Any trading conducted from Friday evening through Sunday evening will receive the following business day’s trade date for clearing, settlement and reporting.

CME said that client demand for regulated crypto risk-management tools is at an historic high, driven by record volumes in 2025 when its crypto futures and options saw $3 trillion in notional activity. Average daily volume and open interest have both climbed sharply year-over-year in 2026, underlining robust participation from institutional and professional traders.

The expansion builds on CME’s broader push into digital assets. In early February, the exchange successfully launched futures contracts for Cardano (ADA), Chainlink (LINK) and Stellar (XLM), including both standard and micro sizes, broadening its altcoin derivatives lineup beyond Bitcoin and Ether. Market participants have viewed this as a key step in giving regulated access to a wider range of crypto assets.

However, CME’s push to modernize its markets has faced operational challenges. In November 2025 a cooling-system failure at a CyrusOne data center triggered a major outage that halted futures trading across cryptocurrencies, commodities, equities and FX, highlighting infrastructure risks as trading demand intensifies.

As crypto continues its integration into mainstream finance, round-the-clock regulated trading at CME could help close the gap between always-on digital markets and traditional exchange hours — offering traders more flexibility and risk management options around the clock.

Crypto World

Fed’s Kashkari dismisses crypto as “utterly useless” at 2026 midwest summit

Minneapolis Federal Reserve President Neel Kashkari delivered a blistering critique of the cryptocurrency industry on Thursday, dismissing digital assets as “utterly useless” and characterized by “word salad” marketing rather than functional utility.

Summary

- Kashkari argued that after over a decade, crypto has failed to provide a compelling use case for U.S. consumers, unlike AI tools which have seen rapid, practical adoption.

- He dismissed the “instant” cross-border payment narrative, noting that recipients must still pay high costs to convert crypto into local currency for daily essentials.

- The Fed official asserted that existing domestic tools like Venmo and Zelle already outperform stablecoins, and warned that nations will not abandon independent monetary policies for a unified crypto platform.

Speaking at the 2026 Midwest Economic Outlook Summit, Kashkari challenged the fundamental value proposition of cryptocurrencies and stablecoins.

During a fireside chat, he contrasted the tangible economic impact of Artificial Intelligence with the decade-long history of crypto, which he argues has failed to integrate into the real economy.

Kashkari’s crypto “grocery store” test

Kashkari was particularly skeptical of the claim that crypto excels at cross-border payments. Using a personal example, he described the hurdles of sending money to family in the Philippines. While proponents claim crypto offers “instant” transfers, Kashkari argued the logic falls apart at the point of sale.

“How does [a recipient] buy groceries with it?” Kashkari asked the audience.

“They still have to convert it to the local currency, and that is still expensive. What advocates are really saying is that if everyone in the world used the same platform, friction would disappear, but nations are not going to abandon their own monetary policies.”

Demanding clarity over “buzzwords”

The Fed official urged the public and policymakers to stop settling for vague explanations. He described much of the industry’s rhetoric as a “buzzword salad,” noting that most “innovations” offered by stablecoins are already handled efficiently by existing domestic tools like Venmo or Zelle.

“Ask the most basic questions and don’t settle for nonsense,” Kashkari warned. “Whenever I make people really explain how this thing actually works, there’s just nothing there.”

The remarks highlight a growing divide in 2026 between the central bank’s skepticism and the commercial sector’s expansion, coming just hours after the CME Group announced plans to move toward 24/7 crypto derivatives trading to meet institutional demand.

Crypto World

Will Crypto Markets React to $2B Bitcoin Options Expiring Today?

Another week has ended, and Friday has arrived, which means another batch of Bitcoin options contracts is expiring while spot markets remain sideways.

Around 30,600 Bitcoin options contracts will expire on Friday, Feb. 20, with a notional value of roughly $2 billion. This event is a little smaller than last week’s expiry, so there is unlikely to be any impact on spot markets.

Crypto markets are in bear market territory, but have remained flat over the past week as volume and volatility dry up.

Bitcoin Options Expiry

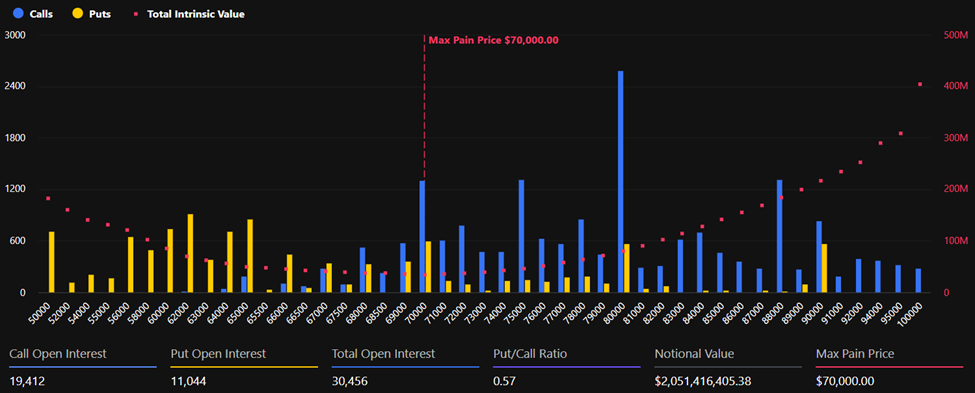

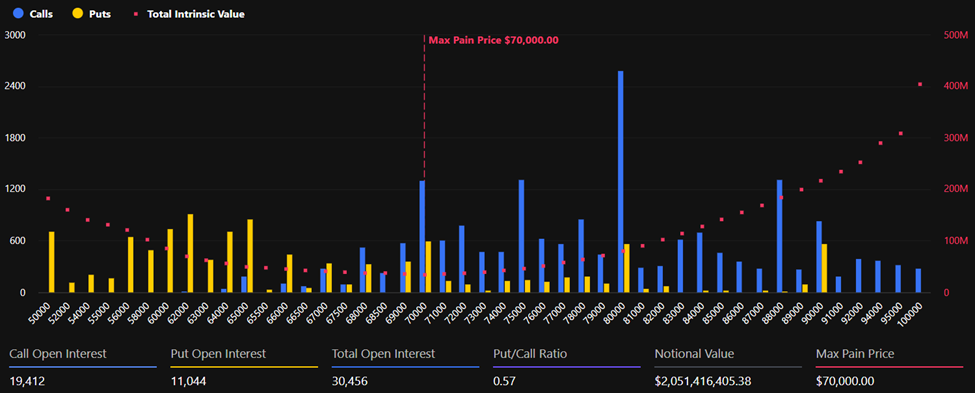

This week’s batch of Bitcoin options contracts has a put/call ratio of 0.59, meaning that there are more expiring calls (longs) than puts (shorts). Max pain is around $70,000, according to Coinglass, which is above current spot prices, so many will be out of the money on expiry.

Open interest (OI), or the value or number of Bitcoin options contracts yet to expire, remains highest at $60,000 with $1.2 billion and $1 billion at $50,000 strike prices on Deribit as bearish bets increase. Total BTC options OI across all exchanges has been climbing this month and is at $36.5 billion.

“Positioning skews call heavy across both assets, with BTC showing the stronger upside skew,” said Deribit.

Meanwhile, derivatives analyst Laevitas observed that “downside protection remains in demand,” noting 2,140 BTC worth of puts at $58,000 recently bought.

🚨 Options Expiry Alert 🚨

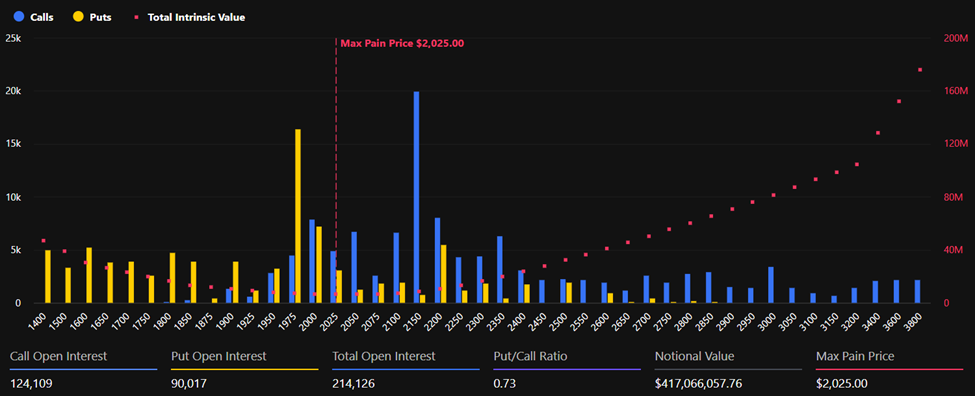

At 08:00 UTC tomorrow, over $2.4B in crypto options are set to expire on Deribit.$BTC: ~$2.0B notional | Put/Call: 0.59 | Max Pain: $70K$ETH: ~$404M notional | Put/Call: 0.75 | Max Pain: $2,050

Positioning skews call heavy across both assets, with… pic.twitter.com/pgl2z4ZGJ6

— Deribit (@DeribitOfficial) February 19, 2026

You may also like:

In addition to today’s batch of Bitcoin options, around 212,000 Ethereum contracts are also expiring, with a notional value of $404 million, max pain at $2,050, and a put/call ratio of 0.75. Total ETH options OI across all exchanges is around $6.8 billion.

This brings the total notional value of crypto options expiries to around $2.4 billion.

Spot Market Outlook

Total market capitalization has been flat for the past 24 hours and since the beginning of the week, hovering around $2.37 trillion, down 46% from its peak. Bitcoin has slowly eroded since Monday, hitting a weekly low of $65,700 in late trading on Thursday before recovering to $67,290 at the time of writing on Friday morning in Asia.

Resistance is forming at $70,000, with support still just above $60,000, and this seems to be the closest target. There has been no movement in Ether prices, which have started to consolidate around $1,950. The rest of the altcoins remain flat at bear market bottoms.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

What next for bitcoin as BTC nears $68,000 on fresh US-Iran tensions

Crypto prices firmed during Asia’s Friday morning session, with bitcoin climbing toward $68,000 after a choppy week that tested nerves across risk markets.

The bounce was broad. XRP, Solana’s SOL, and Cardano’s ADA added upto 2% while ether lagged with a small dip, hovering below $2,000 as traders treated the level as a line that needs defending rather than celebrating.

The move had the feel of a relief rally more than a clean turn. After weeks of sharp swings, the market has started reacting in waves. A quick push higher draws in dip buyers, then selling appears as soon as price reaches a level where trapped holders can exit with less pain. The difference this week is that each rebound has looked a little less fragile, suggesting forced selling is easing even if conviction buying has not returned in size.

Macro and geopolitics are doing their part to keep traders cautious. Gold steadied near $5,000 an ounce after two sessions of gains as investors priced rising Middle East risk.

US President Donald Trump said Thursday he would allow 10 to 15 days for talks on a nuclear deal with Iran, while American forces reportedly built up in the region. That mix has supported haven demand and made it harder for risk assets to build momentum.

FxPro chief market analyst Alex Kuptsikevich framed the broader backdrop as bearish.. He said that given the market’s prior dynamics and the more cautious tone in US stocks, the odds increase of a retest of local lows, pointing to levels last seen in the second half of 2024.

On ether, he said the token is sitting on a long running support line that traces back to 2020 and lines up with the $2,000 area, but added that a true breakdown would need confirmation through a drop below recent lows around $1,500.

Under the surface, some indicators hint that big holders may be positioning to sell into strength. CryptoQuant says bitcoin inflows from large holders to Binance have reached record levels, a pattern that can precede heavier spot supply.

Research shop K33 has compared current conditions to the later stages of the 2022 bear market that gave way to a long, grinding consolidation.

The result is a market that can bounce, but struggles to turn rebounds into a trend until spot demand grows louder than the sellers waiting at the next round number.

Crypto World

Bitcoin Holders Defend Range as $55K Floor Looms: Glassnode

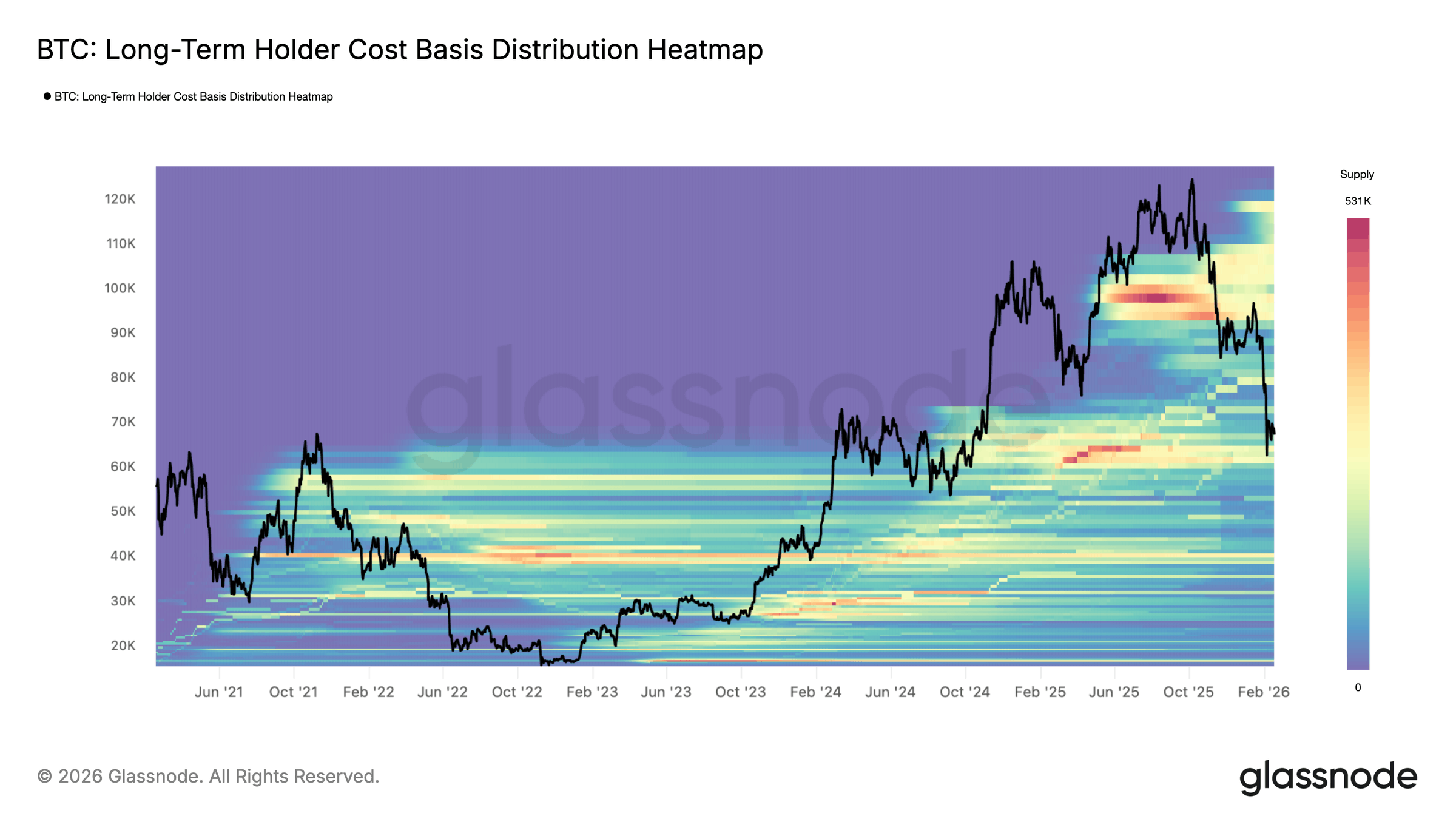

Bitcoin’s (BTC) market structure shifted into a corrective phase after losing a key onchain valuation level in late January.

Glassnode data shows that BTC’s price is compressing within a 2024-era demand zone as liquidity conditions soften. At the same time, BTC’s supply is steadily shifting into long-term, retail-linked wallets while exchange activity has cooled.

This mix of technical and onchain data, along with the current capital rotation, may shape the next steps for Bitcoin price.

Bitcoin lost its active supply cost price, but holders defend $60,000

In its weekly “The Week On-chain” report, Glassnode said that BTC’s recent price dip accelerated due to breaking below its true market mean near $79,000 in January, which is the cost basis of the tracked active supply.

Since then, the price has stabilized inside a dense $60,000 to $69,000 range, which is being defended by medium-term holders. One of the reasons this zone has been a strong support is because of the age of coins within this range for the majority of 2024.

Coins accumulated in that range have aged more than a year, placing a large cohort close to breakeven. This supply may be acting as a backstop on the current sell pressure.

Market analyst Ardi pointed to a similar dynamic, writing on X:

“We’re trading inside the same $53-73K range that took 245 days to build last year. Think about how much volume went through this zone. This is the most contested zone on BTC’s entire chart right now.”

Glassnode also highlighted that, in past cycles, deeper bear phases have gravitated toward the realized price, which now stands near $54,900. The metric estimates the average acquisition cost of all circulating coins.

Bitcoin’s liquidity conditions also remain compressed. The 90-day realized profit/loss ratio has declined back into the 1–2 range, a level associated with limited capital rotation. A sustained move below 1 has aligned with stressed bear environments.

Related: Google searches for ‘Bitcoin going to zero’ at highest since 2022

BTC accumulation rises even as activity slows down

CryptoQuant data shows that the balances held by accumulating address cohorts have continued rising into early 2026. Total BTC held by these cohorts has expanded to over 4 million BTC, up from roughly 2 million BTC in early 2024, which reflects a steady supply absorption.

The retail-linked accumulation addresses have increased their holdings by 850,000 BTC, while the accumulating pattern wallets, addresses that steadily add BTC in recurring intervals with minimal outflows, increased their size to 1.27 million BTC. This expansion occurred even as the price dropped in 2026.

In contrast, the inflows from centralized-exchange addresses and highly active addresses have moderated. Compared with the 2023 to 2024 expansion phases, where inflow spikes frequently exceeded 1.2 million to 1.5 million BTC, the recent activity has remained significantly lower, averaging 300,000 BTC to 400,000 BTC.

The divergence shows that more BTC is being absorbed into long-term wallets while fewer coins are rotating through major exchanges. That reduces the liquid supply and slows down short-term trading activity.

Related: Bitcoin’s consolidation nears ‘turning point’ as $70K comes in focus: Analyst

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Metaplanet CEO Fires Back at Anonymous Critics Over Bitcoin Strategy Claims

TLDR:

- Metaplanet CEO Simon Gerovich rejects anonymous claims of hidden Bitcoin buys and poor disclosure practices.

- Four September Bitcoin purchases were each disclosed promptly via the company’s live public dashboard.

- Selling put options lowers Bitcoin acquisition costs below spot, not a directional price bet.

- Metaplanet’s Bitcoin-per-share KPI surged over 500% in 2025 despite stock price volatility.

Metaplanet’s CEO has gone on the offensive. Simon Gerovich addressed a wave of anonymous allegations targeting the Japanese Bitcoin treasury firm.

The criticism questioned the company’s disclosure practices, options trading approach, and September Bitcoin purchases. Gerovich pushed back point by point, calling several claims factually inaccurate.

Metaplanet CEO Challenges Claims Over Bitcoin Purchases and Disclosure Practices

The September Bitcoin purchases drew particular scrutiny. Critics alleged the company bought near a local price peak and stayed quiet about it.

Gerovich acknowledged the timing but rejected the narrative entirely. He confirmed four separate purchases were made that month, each disclosed promptly through the company’s public dashboard.

Metaplanet publishes all Bitcoin wallet addresses openly. Shareholders can verify holdings in real time through a live dashboard the firm maintains.

Gerovich cited this as evidence the company operates with unusual transparency for a listed entity. He described it as one of the most open corporate structures in the market.

The company’s accumulation approach is systematic, not speculative. Gerovich emphasized that Metaplanet does not attempt to time Bitcoin’s price.

Every purchase gets disclosed regardless of prevailing market conditions. That policy has remained consistent throughout the firm’s accumulation period.

Gerovich took direct aim at anonymous accounts spreading the allegations. He stated he would not tolerate the distribution of false information to shareholders navigating a volatile market.

He also noted his personal financial exposure as a major shareholder, having invested his own capital into the company.

Options Trading Strategy and Financial Metrics Addressed Directly

The criticism around options trading reflected a misreading of strategy, according to Gerovich.

Selling put options is not a directional bet on Bitcoin rising. It is a method to acquire Bitcoin below the spot price by collecting option premiums upfront. He walked through a specific example to illustrate the mechanics.

In his post, Gerovich described a scenario where spot Bitcoin trades at $80,000.

Selling a put at that strike and collecting a $10,000 premium brings the effective acquisition cost to $70,000. The strategy exploits elevated volatility to lower average entry prices. In Q4, he said, the approach meaningfully reduced Metaplanet’s effective Bitcoin costs.

On financials, Gerovich challenged the use of net profit as an evaluation metric. He pointed to 6.2 billion yen in operating profit, representing 1,694% year-over-year growth.

Ordinary losses stem from unrealized valuation changes on long-term Bitcoin holdings the company has no plans to sell. He called drawing negative conclusions from that line item a misreading of the statements.

Bitcoin per share, the company’s primary KPI, rose over 500% in 2025. The hotel business generated 437 million yen in sales revenue and 169 million yen in operating profit. Borrowing arrangements were disclosed three times across facility establishment and two drawdowns.

Specific lender details and interest rates were withheld at the counterparty’s request, Gerovich said.

Crypto World

White House Floats Limited Stablecoin Rewards in 3rd Crypto, Bank Mtg

The White House is pressing ahead with negotiations between crypto industry representatives and banking lobbyists to shape stablecoin provisions within a broader crypto market-structure bill. In the third face-to-face session held in about two weeks, participants attempted to close gaps that have stalled the legislation amid broader regulatory scrutiny. While no deal emerged on Thursday, attendees signaled progress as a White House adviser urged a compromise: allow third parties, such as exchanges, to offer stablecoin rewards only in connection with transaction activity rather than linking yields to customers’ idle balances. The talks followed earlier meetings on February 2 and February 10, underscoring the urgency of delivering a coherent framework for how U.S. regulators would police the evolving crypto landscape.

Key takeaways

- The current round of talks produced incremental language alignment but stopped short of a binding agreement on how stablecoin rewards should be governed under the market-structure bill.

- A prominent proposal centers on tying stablecoin rewards to transactional activity rather than balances, a stance intended to address banking concerns about competitive pressures.

- Participants highlighted the need for clear legislative language to unlock broader crypto-market structure reform, with industry and banking voices urging pragmatism and collaboration.

- Public remarks from executives at Coinbase (EXCHANGE: COIN) and Ripple underscored a constructive and cooperative tone, even as substantive policy divides remain.

- The Senate’s path for the related market-structure bill remains uncertain, with prior House passage of a CLARITY Act variant not yet mirrored in Senate approval.

- Plans for continued negotiations were already on the table, with banks slated to reconvene to decide whether the trade-off could win broader support.

Tickers mentioned: $COIN

Sentiment: Neutral

Market context: The unfolding discussions sit at the crossroads of regulatory clarity, innovation incentives, and risk management as policymakers weigh how to normalize stablecoins within the traditional financial system while maintaining consumer protections and financial stability.

Why it matters

At stake is a path to regulatory clarity that could unlock broader participation in the crypto economy while preserving the safeguards that lawmakers insist are necessary for a rapidly evolving sector. The debate over stablecoin rewards directly touches liquidity, market integrity, and how digitized fiat-backed assets integrate with traditional banking rails. By steering a compromise toward transaction-based rewards rather than balance-based yields, policymakers aim to strike a balance between incentivizing innovative finance and preventing scenarios that could undermine deposit stability or create unfair competitive dynamics for banks.

The discussions reflect a broader tension in Washington: policymakers want to enable responsible innovation without ceding market stability or consumer protection. The involvement of high-profile industry players signals that the issue has moved beyond a narrow policy skirmish and into a cornerstone debate about how stablecoins will function within the U.S. financial system over the coming years. As negotiators press on, the outcome could influence how wallets, exchanges, and other third parties design reward structures and attract user participation in a regulated, compliant manner.

Observers note that the White House is prioritizing a pragmatic, language-driven approach—one that narrows disagreements step by step while keeping the door open to a broader legislative package. The degree of progress achieved in the latest talks—though not a resolution—suggests that a consensus on core concepts may still be within reach, provided sufficient alignment on the role of third-party reward programs and the safeguards designed to protect depositors and the broader financial system.

What to watch next

- Whether banks will sign off on the transaction-based rewards framework and what concessions might be required to gain bipartisan support.

- The timing and framing of the next White House-facilitated session, including any public statements from the involved parties.

- Any movement in the Senate on the market-structure bill or related amendments, following earlier House passage of a CLARITY Act variant.

- Follow-up remarks from Coinbase (EXCHANGE: COIN) and Ripple, and whether new language clarifies the role of third-party reward programs.

Sources & verification

Progress, trade-offs shape White House discussions on stablecoins and market structure

The third formal session between White House policy staff, crypto executives, and banking lobbyists unfolded as part of a broader push to finalize language for a market-structure bill that would redefine how regulators oversee the crypto sector. The gathering, described as constructive but inconclusive, occurred roughly 16 days after the initial February meeting and followed a second discussion eight days later. A central theme was a proposed compromise that would permit third parties—such as exchanges and other service providers—to offer stablecoin rewards only in relation to transaction activity, not as returns on idle balance holdings. This shift aims to dampen potential incentives for large sums to accumulate in wallets simply to generate yield, a factor cited by banks as a competitive pressure that could distort traditional banking models.

During the talks, participants signaled progress in narrowing differences on language that would codify how stablecoins are treated within the broader regulatory framework. The dynamic highlighted the delicate balance between fostering innovation and maintaining financial stability. In a notable development, the session included representatives from the crypto industry who advocate for reward programs that align with transaction-based engagement, balanced by bankers’ concerns about depositor protection and systemic risk. The discussions also foregrounded the practical role of third-party platforms in delivering stablecoin rewards, a line of inquiry that could influence how wallets, exchanges, and payment rails interoperate under a regulated regime.

On the record, executives from the involved crypto firms described the session as a step forward. After the meeting, Ripple’s chief legal officer offered a succinct update: the teams had “rolled up our sleeves and went through language today,” signaling that specifics were being mapped out in detail. In parallel, Coinbase described the tone as constructive and cooperative, underscoring a shared interest in advancing policy that would provide clarity without stifling innovation. A separate note from the Blockchain Association framed the meeting as a productive progression toward resolving outstanding questions about stablecoin rewards and moving the legislation closer to a vote.

The concessions under discussion would have to survive scrutiny from both chambers of Congress and the White House, given the competing priorities that have characterized crypto regulation for years. A point of friction remains the concept of “idle balance yields” versus activity-based rewards, a distinction that lawmakers and industry participants have wrestled with since early discussions. Semafor’s coverage referenced internal discussions and comments from participants indicating that the debate has shifted toward activity-based incentives, while the idea of earning yield simply from holding stablecoins has been effectively sidelined in the near term.

The banking sector has framed its concerns around competitive pressures more than deposit flight, a nuance echoed by some participants who emphasized that the issue is as much about maintaining a level playing field as about liquidity risk. The broader regulatory conversation includes a separate line of analysis around the potential macro implications of widespread stablecoin use, with Treasury authorities having previously estimated that rapid mass adoption could catalyze significant deployment shifts within the traditional banking system. Those considerations underscore why the White House and lawmakers are approaching the negotiation with both urgency and caution, seeking a policy that can be implemented without triggering abrupt dislocations in financial markets.

Looking ahead, observers expect another round of discussions among banking groups to determine whether the proposed language can gain acceptance. The next steps will likely hinge on a mutual willingness to compromise on the reward structure, as well as a clear signal from lawmakers about how quickly the bill could progress through committee and to a floor vote. The ongoing negotiations illustrate the complexity of delivering a unified U.S. stance on stablecoins—one that accommodates the rapid evolution of digital assets while preserving the oversight and safeguards that underpin the mainstream financial system.

Crypto World

3350 CEO rebuts critics over BTC strategy and transparency

Simon Gerovich, CEO of Metaplanet (3350), has responded to online criticism of the Tokyo-listed bitcoin treasury company, as bitcoin is down almost 50% from its October all-time high and now trading near $67,000, while Metaplanet shares have fallen roughly 85% from their 2025 all-time high.

Addressing anonymous critics, Gerovich said, “It’s easy to hide behind anonymous accounts, criticize others, and incite outrage without taking any responsibility.” Gerovich added, “I have no qualms about taking public responsibility for all my statements and Metaplanet’s actions.”

匿名アカウントの裏に隠れて、何の責任も負うことなく他者を非難し、炎上させることは簡単です。しかし、私は自らの発言とメタプラネットの行動すべてに対して公の場で責任を負うことに何の抵抗もありません。そのため、寄せられている各主張に対して、直接お答えします。… https://t.co/e0ieMGq29N

— Simon Gerovich (@gerovich) February 20, 2026

Metaplanet uses options, specifically selling put options and put spreads, to generate premium income and potentially acquire bitcoin below the prevailing market price.

Defending this approach, Gerovich said, “Selling put options is not a bet on bitcoin’s price rising.”

Gerovich explained that the strategy is designed to lower the company’s effective purchase cost and monetise volatility.

On transparency, Gerovich said, “we are one of the most transparent listed companies in the world.” Gerovich pointed to real-time wallet disclosure and repeated announcements of purchases, including those made in September.

Gerovich also acknowledged market timing concerns, he said, “September marked a local peak. I have no intention of denying that.” Gerovich stressed that the strategy is systematic accumulation, not short-term trading.

Lastly, Gerovich responded to criticism of financial results, saying, “Net profit is not an appropriate metric for evaluating a bitcoin treasury company.” Gerovich also rejected claims about the hotel division, stating the business is not in ruins and highlighting its profitability.

Metaplanet shares trade at 307 yen, while the company holds 35,102 BTC.

Crypto World

Crypto, Banks Meet Again to Move Forward Crypto Bill

The White House has reportedly refocused talks between crypto and bank lobbyists on limiting how stablecoin rewards should be paid in the third meeting between the two groups over a crypto market structure bill.

Crypto and banking industry representatives met at the White House on Thursday for the third time in 16 days to discuss stablecoin provisions that have stalled the crypto bill which the Senate is looking to pass.

No agreement was reached on Thursday, but executives at Coinbase and Ripple said progress was made as one of the White House’s crypto advisers urged a trade-off to let third parties, such as exchanges, offer stablecoin rewards only on transaction activity, not balances.

“We rolled up our sleeves and went through specific language today,” Ripple’s chief legal officer, Stuart Alderoty, posted to X on Thursday. Coinbase’s legal head, Paul Grewal, said the meeting was “constructive and the tone cooperative.”

Blockchain Association CEO Summer Mersinger said the meeting was a “step forward” in resolving issues related to stablecoin rewards and ensuring that crypto market structure legislation is advanced.

It’s the third meeting between the three parties, who first met on Feb. 2 and again eight days later on Feb. 10, as the Senate is looking to pass a bill to define how US market regulators will police crypto.

The House passed a similar version of the bill, called the CLARITY Act, in July, but the effort has stalled as the Senate Banking Committee has not yet secured enough bipartisan support to move it forward.

Semafor reporter Eleanor Mueller and journalist Eleanor Terrett both reported that White House crypto adviser Patrick Witt drove the discussion at the latest meeting.

Witt pushed for a previously pitched proposal that would allow third parties to offer stablecoin rewards to customers tied to transactions and activity, and not balances, the latter of which has been a sticking point for banks.

“Earning yield on idle balances, a key crypto industry goal, is effectively off the table,” Terrett said, citing those who attended the meeting. “The debate has narrowed to whether firms can offer rewards linked to certain activities.”

Semafor’s Mueller reported that the banks will start meeting tomorrow to decide whether to agree to the trade-off, and added that discussions would continue in the coming days.

Related: Banks can’t seem to service crypto, even as it goes mainstream

The Bank Policy Institute, American Bankers Association and Independent Community Bankers of America represented the banking industry, none of which have publicly commented on the latest White House meeting.

Banks fear competitive pressures, not deposit flight risk

Banking groups have argued that stablecoin rewards will compete with and undermine the banking system and lead to bank deposits shifting to stablecoins.

The US Treasury estimated in April that mass stablecoin adoption could trigger $6.6 trillion in deposit outflows from the banking system.

However, according to Terrett, one banking member at the meeting said their concerns stem more from competitive pressures than from deposit flight.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

$40,000 BTC Put Stands Out In $2.5 Billion Options Expiry

Nearly $2.5 billion in Bitcoin and Ethereum options expire today, setting up a potentially volatile end to the month as traders juggle upside bets with deep downside insurance.

On the surface, positioning appears constructive. But beneath the call-heavy skew lies a striking anomaly: one of the largest open interest clusters in Bitcoin sits far below spot — at the $40,000 strike.

Calls Dominate, But Max Pain Sits Higher

Bitcoin is currently trading around $67,271, with max pain positioned at $70,000. Open interest shows 19,412 call contracts and 11,044 put contracts. This gives a put-to-call ratio of 0.57 and reflects an overall upside bias. The total notional volume tied to the expiry is roughly $2.05 billion.

Ethereum mirrors that constructive tilt, though in a more balanced fashion. ETH trades near $1,948, with max pain at $2,025.

Calls (124,109 contracts) outnumber puts (90,017), resulting in a put-to-call ratio of 0.73 and a notional value of approximately $417 million.

“…positioning skews call heavy across both assets, with BTC showing the stronger upside skew. Max pain levels sit below dominant call open interest in BTC, while ETH positioning is more balanced but still constructive,” analysts at Deribit noted.

Max pain refers to the price at which the greatest number of options expire worthless, minimizing payouts to buyers.

With both BTC and ETH trading below their respective max pain levels, price gravitation toward those strikes into expiry could reduce losses for option sellers.

The $40,000 Put: A Tail-Risk Signal

Despite the headline bullish skew, a massive concentration of puts at the $40,000 strike has caught market attention.

The $40,000 Bitcoin put is now the second-largest strike by open interest, representing roughly $490 million in notional value. This comes after Bitcoin’s sharp retracement from prior highs, which reshaped hedging demand across the board.

“While aggregate positioning into expiry skews call heavy, one strike stands out: The $40K BTC put remains among the largest open interest strikes ahead of February expiry. Deep OTM downside protection demand remains visible on the board, even as headline put/call ratios lean constructive,” Deribit analysts indicated, highlighting the unusual size of the position.

In short, traders may be positioned for upside, but they are unwilling to rule out another volatility shock.

Hedging, Premium, and Structural Implications

The dynamic suggests a broader change in Bitcoin’s derivatives market. Options are increasingly used for directional bets, yield strategies, and volatility management.

Analyst Jeff Liang argued that extracting premium from the options market could reduce structural selling pressure.

“If we can stably extract the premium from the options market and empower Bitcoin HODLers, it means: HODLers no longer need to sell their Bitcoin to improve their lives… Selling pressure on Bitcoin will reduce… This will further drive Bitcoin’s price upward,” he stated.

The analyst described options premium as a “localized pump” driven by fear and greed, one that redistributes value to long-term holders without contradicting Bitcoin’s fixed supply cap.

Overall, calls outweigh puts across both BTC and ETH, signaling that traders retain exposure to a rebound. Yet the sheer scale of deep out-of-the-money hedges reveals a market that remains cautious.

With billions in notional value set to expire, the key question is whether prices drift toward max pain—or whether hidden crash-protection demand proves prescient, reigniting volatility just as traders expect calm.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Video4 hours ago

Video4 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World9 hours ago

Crypto World9 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market