Crypto World

Metaplanet CEO Fires Back at Critics as $1.2 Billion Bitcoin Paper Losses Mount

Metaplanet CEO Simon Gerovich fired back at critics, accusing the Japanese Bitcoin-holding firm of misusing shareholder funds and hiding key disclosures.

Why it matters:

- Metaplanet holds over $1.2 billion in unrealized Bitcoin losses, making transparency around fund use a direct concern for shareholders.

- Allegations of undisclosed borrowing against BTC holdings raise governance red flags for public-company crypto investors.

The details:

- Critics alleged Metaplanet bought BTC at a market top, stayed silent during the drawdown, and borrowed against those holdings without disclosing interest rates or counterparties.

- Gerovich confirmed Bitcoin wallet addresses are publicly listed, with a live shareholder dashboard tracking holdings in real time.

- Gerovich called September’s purchase price a “local top” but defended a long-term, non-market-timed strategy.

- The company reported 6.2 billion yen in operating profit — up 1,694% year-over-year.

- Gerovich attributed reported accounting losses solely to unrealized mark-to-market BTC fluctuations on unsold holdings.

- Meanwhile, CoinGecko currently tracks Metaplanet’s unrealized BTC losses at over $1.2 billion.

The big picture:

- Metaplanet follows the MicroStrategy playbook — using equity and debt to accumulate Bitcoin as a primary treasury asset.

- Corporate BTC holders now face growing pressure to meet traditional disclosure standards as unrealized losses mount across the sector.

- The allegations expose a structural tension: Bitcoin’s on-chain transparency does not automatically satisfy securities law disclosure requirements.

The post Metaplanet CEO Fires Back at Critics as $1.2 Billion Bitcoin Paper Losses Mount appeared first on BeInCrypto.

Crypto World

Blockchain Data May Predict Drug Overdose Surges, Chainalysis Says

Blockchain transaction data tied to cryptocurrency payments may provide an early signal of emerging drug crises, according to a new report from blockchain analytics firm Chainalysis.

The study, which examined illicit market activity across darknet drug and fraud ecosystems, found that crypto flows connected to darknet markets reached nearly $2.6 billion in 2025, showing that online drug markets continue to operate at scale despite repeated law-enforcement takedowns. Vendors typically receive payments from personal wallets and centralized exchanges.

Beyond measuring criminal activity, Chainalysis argued that the data can track real-world health outcomes. Crypto payments to suppliers of fentanyl precursor chemicals declined sharply beginning in mid-2023. Months later, overdose deaths also fell in the United States and Canada after peaking in 2023.

According to the report, monitoring transactions linked to precursor suppliers could provide three to six months of advance warning before overdose trends appear in official public-health statistics.

Crypto drug purchases linked to higher hospitalizations

The analysis also compared transaction data with Canadian hospital records. Small payments of less than $500 showed no clear relationship with emergency visits or deaths. Larger transfers were associated with rising stimulant-related hospitalizations and fatalities, suggesting the transactions likely reflect bulk purchasing or redistribution rather than personal consumption.

Related: Crypto launderers are turning away from centralized exchanges: Chainalysis

“Money moves before the crisis hits. People buy drugs before they redistribute them, and users consume them before they overdose and require medical care,” the report said, adding that since blockchain records update instantly, they can serve as a high-fidelity “early warning system.”

The report also revealed that following the closure of Abacus Market in July 2025, activity quickly migrated to successor platforms such as TorZon. It said that vendors routinely resupply across platforms and relocate after disruptions.

Related: Moonwell hit by $1.78M exploit as AI vibe coding debate reaches DeFi

Fraud shop volumes drop to $87.5 million

Fraud marketplaces showed a different trend. Onchain volumes fell from about $205 million to $87.5 million year-over-year after infrastructure takedowns, but activity shifted toward wholesale operations, particularly Chinese-language networks operating on Telegram that handle large bulk sales of stolen payment data.

Chainalysis reported Friday that crypto transactions linked to suspected human-trafficking networks rose 85% in 2025, reaching hundreds of millions of dollars. The activity was largely tied to Southeast Asia and closely connected to scam compounds, online casinos and Chinese-language money-laundering groups, per the report.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

Crypto payments tied to alleged sale of Five Eyes cyber secrets to Russian broker

An Australian executive has been accused of accepting cryptocurrency payments in exchange for selling sensitive cyber tools that threatened the national security of Five Eyes allies.

Summary

- An Australian executive received $1.26 million in crypto for selling eight protected cyber tools to a Russian broker.

- Prosecutors said the breach caused $35 million in losses and threatened the security of Five Eyes allies.

For those unaware, Five Eyes is a long-standing intelligence sharing alliance between the United States, the United Kingdom, Canada, Australia, and New Zealand.

According to a report from the Daily Telegraph, the accused Peter Williams sold eight protected cyber exploit components, including zero-day capabilities, to one of Russia’s most notorious exploit brokers for roughly $1.26 million worth of cryptocurrencies.

Williams later diverted these funds through anonymized crypto transactions to fund a lavish lifestyle of luxury cars, jewellery, and holidays, including a $1.5 million down payment for a Washington property.

Williams is a former Australian Air Force staffer and defence contractor who resided in the United States.

A sentencing memo published earlier this month claims Williams was set to receive additional payments of up to $4 million under his cooperation agreements with the Russian broker.

It added that Williams’ actions have resulted in losses amounting to $35 million as he repeatedly sold exploits through July 2025 even after he knew that the FBI had launched an investigation into the matter.

Prosecutors are pushing for a nine-year prison sentence and $35 million in mandatory restitution alongside a $250,000 fine and three years of supervised release.

Cryptocurrencies, due to their borderless nature and privacy features, allow transactions to be conducted outside of traditional financial surveillance frameworks. Multiple cases of crypto-linked espionage have surfaced over the past year.

Last year, Poland’s national security chief Sławomir Cenckiewicz alleged that Russia was using cryptocurrencies to fund espionage operations across European countries by recruiting local operatives.

Across the globe, an Israeli man was arrested in June 2025 for accepting crypto payments to spy on public officials in the country.

Meanwhile, U.S. Federal agencies began investigating a Beijing-based crypto mining firm in November over concerns around potential surveillance.

Crypto World

100M FXRP bridged into Flare DeFi stack

FXRP supply tops 100M, ~70% deployed in XRPFi DeFi via staking, lending, vaults.

Summary

- Nearly 100M XRP bridged as FXRP, with ~70% actively deployed in DeFi.

- Firelight holds about 21% of FXRP staked, while Upshift vaults scaled from ~$6M to ~$25M capacity.

- Lending via Kinetic and Morpho saw roughly $39M and $8M in early borrowing, deepening onchain liquidity.

Flare’s bid to become the execution layer for “XRPFi” just cleared a hard milestone: nearly 100 million XRP has now been bridged to the network as FXRP, with close to 70% of that capital actively deployed in DeFi rather than sitting idle.

Flare frames FXRP as ‘growing capital deployment’

Flare frames the 100 million FXRP mark as “growing capital deployment into XRPFi infrastructure rather than speculative bridging activity,” pointing to three concrete demand drivers. First is Firelight, an XRP staking and DeFi cover protocol where “21% of FXRP is currently staked,” with a fresh capital raise slated for this month. Second is structured vaults such as Upshift, where initial vault capacity “filled quickly, expanding from $6M to $25M in response to demand.” Third is lending across protocols like Kinetic and Morpho, which “saw roughly $39M and $8M in borrowing activity respectively within weeks of launch.”

Flare executives insist the pitch is full‑stack rather than a simple wrapped‑asset bridge. The network is “building an integrated XRPFi execution layer,” where FXRP “transforms XRP into programmable collateral that can move across lending markets, DEX liquidity, structured vaults, and cross‑chain environments.” Crucially, they emphasize that FXRP “is not confined to a single execution domain” and can extend into environments such as HyperEVM and Ethereum while maintaining “onchain collateralization and issuance transparency.” Wallet, custody, and DeFi integrations are being designed to “reduce operational friction for both crypto‑native and institutional participants,” a posture Flare says has already made it “the largest EVM ecosystem for XRP DeFi activity today,” a representative told crypto.news.

Recent integrations appear to be changing network behavior, not just narrative. Lending on Morpho and vault allocations via Upshift have “materially deepened onchain liquidity,” with structured strategies drawing “interest from exchanges and wallet providers” and pushing adoption “beyond individual users and into platform‑level capital allocation.” Firelight’s staking and risk‑coverage layers further “increase capital efficiency by allowing XRP to secure infrastructure while remaining economically productive.”

Looking ahead, Flare points to “continued lending expansion, deeper stablecoin liquidity, and additional vault integrations” as levers to “bridge onchain liquidity with regulated financial instruments” and push XRPFi into institutional territory.

Broader macro headwinds

This push comes as digital assets continue to trade as one of the purest expressions of macro risk appetite. Bitcoin (BTC) changes hands near $67,830, with a 24‑hour range between roughly $65,700 and $67,900 on more than $32.8B in volume. Ethereum (ETH) trades around $1,960, having swung between about $1,915 and $1,981 over the last day. XRP (XRP) sits close to $1.42, with a 24‑hour low near $1.35 and a recent high around $1.64 as liquidity thins. Solana (SOL) is quoted around $81.67, down about 4.5% on the day on more than $3.3B in turnover.

Additional crypto.news reporting on Flare’s FXRP rollout and XRP yield products can be found via Genfinity’s breakdown of the 100 million FXRP milestone, Phemex’s coverage of Flare’s mint, and CoinMarketCap’s look at the earnXRP vault strategy.

Crypto World

Here’s what crypto traders should watch in PCE inflation data release today

Crypto traders are bracing for fresh volatility as the U.S. prepares to release December Personal Consumption Expenditures (PCE) data, the Federal Reserve’s preferred inflation gauge, later today.

Summary

- Forecasters anticipate both headline and core PCE rising 0.37% in December (4.5% annualized), pushing core to 3.0% year-over-year — the highest since February 2025 — and headline to 2.9%, the highest since March 2024.

- BTC is trading around $67,852, up 1.27% on the day, with RSI at 36.86, recovering from oversold levels but still showing muted momentum as traders await macro direction.

- The BTC/ETH ratio stands at 34.5806, reflecting continued Bitcoin dominance as investors remain defensive ahead of the inflation print.

According to Wall Street Journal chief economics correspondent Nick Timiraos, forecasters expect both headline and core PCE to rise 0.37% month-over-month in December, equivalent to a 4.5% annualized pace. That would lift core PCE to 3.0% year-over-year, the highest since February 2025, while headline PCE is estimated at 2.9%, the highest since March 2024.

The median forecast aligns with those expectations: 0.37% month-over-month for both headline and core readings, compared with November’s softer 0.21% headline and 0.16% core increase.

For crypto markets, the implications are clear: a hotter-than-expected print could reinforce higher-for-longer rate expectations, pushing Treasury yields and the U.S. dollar higher, typically a headwind for risk assets including Bitcoin (BTC) and altcoins.

A cooler print, however, could revive rate-cut bets and trigger a relief rally.

Bitcoin’s technical setup ahead of PCE inflation data

Bitcoin is trading at $67,852, up 1.27% on the day, according to the daily BTC/USDT chart on Binance. Price action shows consolidation following a sharp early-February drop that briefly pushed BTC toward the low-$60,000s before rebounding.

Since that recovery, Bitcoin has been ranging just below the $70,000 psychological level.

The daily RSI stands at 36.86, with its moving average at 33.81, suggesting momentum remains weak but no longer deeply oversold. The indicator has been gradually recovering from sub-30 levels earlier this month.

The balance of power indicator remains negative at -3,298, highlighting that sellers still hold a slight edge despite the recent stabilization.

For traders, a hot inflation surprise could send BTC back toward the mid-$60,000 support zone, while a softer reading may open the door for a renewed test of $70,000 resistance.

Watch the Bitcoin–Ethereum ratio

Another key signal is relative strength within crypto. The BTC/ETH daily chart shows Bitcoin trading at 34.5806 ETH, up 0.69% on the session.

The pair recently surged from below 30 in late January to above 34 in early February, indicating strong Bitcoin outperformance versus Ethereum (ETH) during the broader market pullback. The recent consolidation around the 34–35 region suggests capital remains defensive, favoring BTC over higher-beta altcoins.

If inflation comes in hot and macro risk aversion rises, Bitcoin dominance could extend further. A cooler print, however, may encourage rotation back into Ethereum and altcoins.

Macro reaction is key

Beyond the headline number, traders should watch the immediate reaction in the U.S. 10-year Treasury yield and the dollar index. Crypto has remained highly sensitive to shifts in rate expectations, particularly as inflation data tests the narrative that price pressures are easing sustainably.

With core PCE potentially rising to 3.0% year-over-year, its highest level in nearly a year, today’s print could shape expectations for the Fed’s next move and set the tone for digital assets into March.

For now, Bitcoin is coiling below resistance. The PCE release may decide whether it breaks higher or rolls.

Crypto World

Blockdaemon Outlines Solana’s 2026 Path to Institutional Adoption Through Executive Guide and Technical Roadmap

TLDR:

-

- Blockdaemon’s executive guide frames Solana’s 2026 roadmap around the Internet Capital Market vision for institutions.

- Alpenglow and IBRL target predictable sub-second finality, narrowing the gap between blockchain and exchange-style settlement.

- ACE introduces application-level transaction control, reducing MEV exposure and aligning execution with best-execution standards.

- Validator client diversity across Agave, Firedancer, and Rakurai builds network resilience for custody, ETFs, and treasuries.

Blockdaemon has published a comprehensive two-part series on Solana’s 2026 outlook, targeting financial institutions evaluating on-chain infrastructure.

The release includes an executive guide and a technical roadmap, each addressing a different layer of institutional readiness.

The series examines Solana’s shift from a high-throughput retail chain to a network built for predictable finality and execution integrity.

It arrives as institutions move closer to production-grade deployment of tokenized assets and on-chain settlement systems.

Executive Guide Positions Solana Around the Internet Capital Market Vision

Blockdaemon’s executive guide opens with Solana’s broader strategic ambition: becoming an Internet Capital Market.

This concept describes an internet-native environment where listings, trading, and settlement operate entirely on-chain.

For financial institutions, it reframes Solana less as a crypto network and more as specialized financial infrastructure.

“Solana has moved beyond its early reputation as ‘the fast retail chain.’ Its ambition to become an Internet Capital Market reframes it as a potential backbone for next-generation on-chain finance.” — Blockdaemon, Solana in 2026: A Guide for Financial Institutions

The guide outlines four institutional traits that Solana’s 2026 roadmap prioritizes. These are predictable low-latency finality, order-flow privacy, deterministic execution, and application-level control.

Each trait maps directly to operational requirements that traditional trading and treasury teams already work within.

Blockdaemon further notes that Solana’s 2026 upgrades address three critical institutional pillars. On compliance, ACE enables protocol-level identity checks before trade execution takes place.

On liveness risk, validator client diversity, and the Alpenglow upgrade together reduce fault sensitivity across the network.

Technical Roadmap Details Four Pillars of Institutional-Grade Infrastructure

Blockdaemon’s technical roadmap centers on Alpenglow as the foundation for consensus stability. Alpenglow is Solana’s next consensus protocol upgrade, designed to stabilize block production under heavy network conditions.

It reduces uncertainty in transaction ordering and confirmation times, which matter most to funds and market operators.

“Rather than chasing headline TPS, the focus shifts to predictable finality, execution integrity, and redundancy.” — Blockdaemon, Solana in 2026: Technical Roadmap

IBRL, standing for Increase Bandwidth, Reduce Latency covers the broader performance improvement effort. It groups bandwidth, scheduler, and latency upgrades under one coordinated program alongside Alpenglow.

Trading and treasury systems gain more consistent confirmation windows that align with traditional financial service-level expectations.

ACE, or Application Controlled Execution, addresses the MEV problem that has long affected institutional adoption. Without ACE, validators and builders control transaction ordering, creating room for exploitative sequencing.

ACE allows financial applications to define their own sequencing rules, batching logic, and matching behavior for compliance and risk reasons.

Block Building Infrastructure and Validator Diversity Round Out the Roadmap

Blockdaemon’s series covers the full validator client ecosystem currently active on Solana. Clients include Agave, Firedancer, Frankendancer, Jito-Solana, and Rakurai, each operating on independent codebases.

This diversity means no single software failure can bring down the network, which is critical for staking that supports custody, ETFs, or corporate treasuries.

“For leading, network-conscious infrastructure providers like Blockdaemon, client diversity means resilience, performance optimization, and investor confidence.” — Blockdaemon, Solana in 2026: Technical Roadmap

Firedancer, developed by Jump Crypto, is a ground-up reimplementation in C targeting maximum throughput and fault isolation.

Frankendancer provides a hybrid approach, combining Firedancer’s networking stack with Agave’s execution runtime.

Rakurai achieves 5x higher TPS and up to 35% greater block rewards through proprietary scheduling and pipeline optimizations.

On the block building side, Blockdaemon covers JitoBAM and Harmonic as early ACE implementations. JitoBAM operates through Trusted Execution Environments, creating encrypted mempools that keep transactions private until execution.

This reduces sandwich attacks and other exploitative MEV practices that conflict with institutional best-execution standards.

“ACE’s promise is infrastructure-level fairness, giving institutional applications predictable, auditable control over how trades, payments, or transactions are realized on-chain.” — Blockdaemon, Solana in 2026: Technical Roadmap

Harmonic turns block building into a competitive marketplace by aggregating proposals from multiple independent builders.

Builders include Jito, Temporal, JitoBAM, and Paladin, with validators selecting from their proposals in real time. This model lowers concentration risk and makes order flow more transparent and auditable for regulated institutions.

Blockdaemon also maps the roadmap to concrete strategic use cases for financial institutions. Tokenized money markets benefit from sub-second settlement that removes intraday timing risk.

On-chain FX, derivatives, structured products, and institutional staking all gain from deterministic execution and improved network resilience across the upgraded Solana infrastructure.

Crypto World

Sustainable Tokenomics in DeFi: How to Design Revenue-Driven Crypto Tokens That Last

Learn how sustainable tokenomics in DeFi works. Explore revenue-backed tokens, emission models, token sinks, and protocol-owned liquidity strategies.

Sustainable tokenomics refers to crypto token design that prioritizes long-term value creation over short-term hype.

In early DeFi, many projects relied on:

-

High token emissions

-

Liquidity mining rewards

-

Unsustainable APYs

-

Speculative demand

Today, DeFi tokenomics is evolving. The focus has shifted toward:

-

Revenue-backed tokens

-

Smart emission schedules

-

Token supply control mechanisms

-

Protocol-owned liquidity (POL)

-

Long-term governance alignment

If a DeFi token only performs during bull markets, its tokenomics model is likely inflation-driven rather than value-driven.

Why Sustainable Tokenomics Matters in DeFi

DeFi operates in cycles. When liquidity dries up, weak token models collapse under inflation pressure.

Strong tokenomics ensures:

-

Reduced selling pressure

-

Predictable value accrual

-

Capital-efficient liquidity

-

Long-term protocol resilience

-

Stronger investor confidence

In other words, sustainable tokenomics separates real protocols from short-term experiments.

1. Revenue-Backed Tokens: The Foundation of Sustainable DeFi

The most durable DeFi tokens are tied to real protocol revenue.

Revenue sources may include:

The critical question:

How does protocol revenue flow back to token holders?

Common Revenue Capture Models

Fee Sharing

Protocol revenue is distributed to token stakers.

Benefits:

-

Clear value proposition

-

Easier token valuation

-

Strong holder alignment

Token Buybacks

Revenue is used to repurchase tokens from the market.

Benefits:

Buyback and Burn

Repurchased tokens are permanently removed from supply.

Benefits:

Revenue without value capture creates weak token economics.

Revenue with structured capture creates sustainable demand.

2. Emission Design: Controlling Token Inflation

Token emissions are one of the most important variables in DeFi tokenomics.

Poor emission design leads to:

Strong emission frameworks include:

Fixed Supply Models

Hard caps limit total token issuance.

Decaying Emissions

Token issuance reduces over time.

Dynamic Emissions

Supply adjusts based on protocol metrics such as:

-

Total value locked (TVL)

-

Revenue growth

-

Volatility

-

Liquidity depth

Dynamic emissions turn token supply into a strategic control system rather than a growth gimmick.

3. Token Sinks: Reducing Circulating Supply Pressure

A critical but overlooked aspect of DeFi tokenomics is token sinks.

A token sink is any mechanism that removes tokens from active circulation or locks them for extended periods.

Examples include:

Without token sinks, inflation dominates.

With token sinks, supply becomes structurally constrained.

4. Protocol-Owned Liquidity (POL) vs. Liquidity Mining

Liquidity mining helped bootstrap DeFi growth. But it created mercenary capital.

Mercenary liquidity:

Protocol-Owned Liquidity (POL) changes this model.

Instead of renting liquidity through emissions, protocols acquire and control their own liquidity.

Benefits of POL:

-

Long-term liquidity stability

-

Reduced dependency on yield farmers

-

Improved capital efficiency

-

Stronger treasury backing

In bear markets, protocols with POL outperform emission-heavy competitors.

5. Governance Alignment and Long-Term Incentives

Many governance tokens fail because voting power is disconnected from long-term commitment.

Sustainable governance models align:

-

Voting rights

-

Lock duration

-

Economic exposure

-

Protocol decision-making

Lock-based governance systems incentivize participants to think long term.

Governance without economic alignment leads to short-term decisions.

Aligned governance builds durable ecosystems.

How to Evaluate DeFi Tokenomics (Checklist)

When analyzing a DeFi token, ask:

-

Does the protocol generate real revenue?

-

Does the token capture revenue?

-

Are emissions sustainable or inflationary?

-

Are there strong token sinks?

-

Is liquidity owned or rented?

-

Are governance incentives aligned long-term?

If most answers are weak, the token likely depends on market sentiment instead of structural strength.

The Future of Tokenomics in DeFi

The next phase of DeFi will be defined by:

-

Revenue-generating protocols

-

Reduced token inflation

-

Capital-efficient liquidity strategies

-

Strong treasury management

-

Data-driven token supply adjustments

Speculation accelerated DeFi’s growth.

Sustainable tokenomics will determine which protocols survive.

REQUEST AN ARTICLE

Crypto World

European Currencies Decline Ahead of Key Data from Europe and the US

EUR/USD and GBP/USD extended their decline, revisiting recent extremes after last week’s corrective rebound. The recovery attempt was largely technical in nature and did not alter the broader structure of the move. Additional pressure on European currencies came from dollar strength following Wednesday’s release of the Federal Open Market Committee minutes, which signalled a cautious stance and offered no indication of imminent policy easing. This reinforced support for the US currency and triggered a fresh downward impulse in both EUR/USD and GBP/USD.

At present, the market’s focus has shifted to upcoming macroeconomic data from both Europe and the United States. These releases are likely to determine whether the current downward trend gathers further momentum or whether the pairs begin to establish medium-term support levels.

Overall, the euro and sterling remain under pressure after the recent correction faded and the dollar strengthened on the back of the minutes. Further direction will depend on incoming data: either the bearish trend will be confirmed, or the market will begin searching for more sustainable levels of stabilisation.

EUR/USD

As anticipated, EUR/USD buyers failed to overcome resistance in the 1.1900–1.1930 range. The unsuccessful test of this area last week reinforced the downward impulse and led to fresh moves towards recent lows near 1.1800. Technical analysis suggests a potential test of support in the 1.1650–1.1720 zone. The bearish scenario would be invalidated by a firm break and consolidation above 1.1800.

Key events for EUR/USD:

- Today at 10:30 (GMT+2): Germany’s Manufacturing PMI;

- Today at 15:30 (GMT+2): US Gross Domestic Product;

- Today at 15:30 (GMT+2): US Core PCE Price Index.

GBP/USD

A rejection from the key 1.3700 resistance level intensified downward pressure on GBP/USD. Sellers pushed the pair to fresh recent lows near 1.3500. Should UK data disappoint, a further decline towards 1.3320–1.3360 cannot be ruled out. A weakening of the bearish pressure would require either a decisive move back above 1.3500 or the formation of a reversal pattern on higher time frames.

Key events for GBP/USD:

- Today at 09:00 (GMT+2): UK Core Retail Sales Index;

- Today at 11:30 (GMT+2): UK Composite PMI;

- Today at 16:45 (GMT+2): Speech by FOMC member Bostic.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Parsec shuts down after 5 years as crypto volatility claims another platform

Decentralized finance analytics platform Parsec is shutting down after five years, marking the latest casualty in a volatile crypto market that continues to reshape the industry.

Summary

- Parsec shuts down after five years, with its CEO citing shifting market dynamics and declining DeFi leverage following the 2022 crypto collapse and FTX fallout.

- The platform rose to prominence during the 2020–2021 DeFi boom, helping traders navigate major unwind events including Terra, OHM, Wonderland and the 3AC/stETH crisis.

- Parsec’s closure reflects broader strain in the crypto sector, following recent shutdowns of smaller platforms such as Arkham’s exchange and ZeroLend amid persistent volatility and thinning liquidity.

Parsec calls it quits after 5 years

In a post on X, the company said: “After 5 years, Parsec is shutting down. Not how we wanted our story to end, but we are proud of what we built and the value we provided along the way.” The team thanked users who “traversed the ups and downs onchain” with them, calling the journey “quite the ride.”

Parsec’s CEO described the closure as “the end of the road,” adding that “the market zigged while we zagged a few too many times.” The platform began in early 2020 as a side project charting Uniswap v1 activity before evolving into a full DeFi terminal during the 2020 “DeFi summer” and the bull market frenzy of 2021.

The company gained traction during the 2022 market collapse, when major protocols and firms, including Wonderland, OlympusDAO, Terra, and the 3AC/stETH unwind, imploded under extreme leverage. According to the CEO, traders and firms relied on Parsec’s dashboards to navigate cascading liquidations.

However, after the collapse of FTX, on-chain activity shifted. “DeFi spot lending leverage never really came back in the same way,” the CEO wrote, noting that crypto activity “changed hugely” in ways the team struggled to fully anticipate.

While Parsec saw brief spikes of engagement, including during the Friend.tech boom and a high-traffic Polymarket election dashboard, sustained growth proved elusive.

The shutdown reflects a broader trend. Smaller crypto venues and projects have been winding down amid thinning liquidity, shifting user behavior and persistent volatility. Recent examples include Arkham’s exchange closure and ZeroLend’s decision to cease operations after three years, underscoring the harsh operating environment for niche platforms.

Despite Parsec’s closure, its CEO said he remains committed to DeFi’s long-term vision of reinventing finance. “I’m not going anywhere,” he wrote. “Onwards.”

Crypto World

Growth, Challenges, and What’s Ahead

Despite notable advancements, PI has collapsed by almost 95% from its ATH.

The controversial cryptocurrency project Pi Network has been around since 2019, but users had to wait until February 2025 before they could finally trade the native token PI.

Over the past 12 months, the Core Team has rolled out multiple upgrades as the ecosystem has continued to develop. Yet, PI’s price has suffered a steep decline, the project is still grappling with several challenges, and some Pioneers have voiced growing criticism. The key question now is whether the upcoming advancements can trigger a decisive comeback for PI or whether the bears will remain in charge.

Happy First Birthday, PI

Exactly one year ago, Pi Network launched its Open Network. The initiative made PI publicly accessible and enabled exchanges to list it as the first to hop on the bandwagon were Bitget, OKX, and MEXC.

On the debut day, the asset’s valuation varied across platforms, ranging from $1.68 to $1.72. Interest from traders and investors was high over the following days, and PI reached a historical peak of approximately $3 by the end of February last year. Meanwhile, its market capitalization exploded above $18 billion, placing the coin among the 15 largest cryptocurrencies.

However, the peak was short-lived, and PI headed straight south in the following months. Some reasons potentially suppressing the price include ongoing token unlocks, fading interest from market participants, accusations that the project could be a scam, and Binance’s inaction.

The world’s largest crypto exchange was rumored to follow Bitget, OKX, and MEX in listing PI: a move that could lift the token’s value by increasing its liquidity, visibility, and overall legitimacy. It even held a community vote to ask its clients whether they wanted the asset available on the platform. While more than 86% of the participants selected the “yes” option, Binance has yet to honor their wish.

PI has seen sporadic price revivals over the last several months, driven by upgrades announced by Pi Network’s team, but currently trades at around $0.17, representing a staggering 94% decline from the all-time high.

You may also like:

Some of the updates targeted the verification process, which has long been a source of frustration for many users. In September 2025, for instance, the team unveiled Fast Track KYC – a feature that allows Pioneers to participate in the Mainnet ecosystem “earlier than ever before.”

In October, it was revealed that more than 3.36 million additional users had successfully completed the required verification procedures following the release of a system process that conducts vital checks on Tentative KYC cases. Just a few weeks ago, the team unveiled a technical upgrade that should allow multiple Pioneers to pass the Miannet migration. Specifically, they claimed the roughly 2.5 million users who were previously unable to migrate will be unblocked.

Other standout developments over the past 12 months include the launch of Pi Network Ventures (a Pi-related fund targeting $100 millin in investments in innovative startups), the project’s entry into the AI space through Pi App Studio, the introduction of the first Hackathon, and a partnership with CiDi Games to accelerate Web3 gaming engagement.

Most recently, the Core Team disclosed that migration to Protocol v19.6 was successfully completed. “Next up is v19.9 – the final step before v20. Node operators should make sure they’re upgraded and stay tuned for further instructions,” the X post read.

What Lies Ahead?

Many members of Pi Network’s community believe that 2026 could be successful, claiming that something “big” is on the horizon. Some have pointed out March 12 as a key date, as a major upgrade related to the Pi DEX activation is expected to go live then. If confirmed, the launch could play an important role in strengthening user trust and increasing real-world use of PI.

Meanwhile, rumors have circulated that leading exchanges, such as Kraken, may soon offer trading services for the token.

Pioneers are also closely watching March 14 – a date, known across the community as Pi Day due to its symbolic resemblance to the mathematical constant π (3.14). Pi Network expanded its ecosystem on that day in 2025, and it remains to be seen whether a similar move will occur this year.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

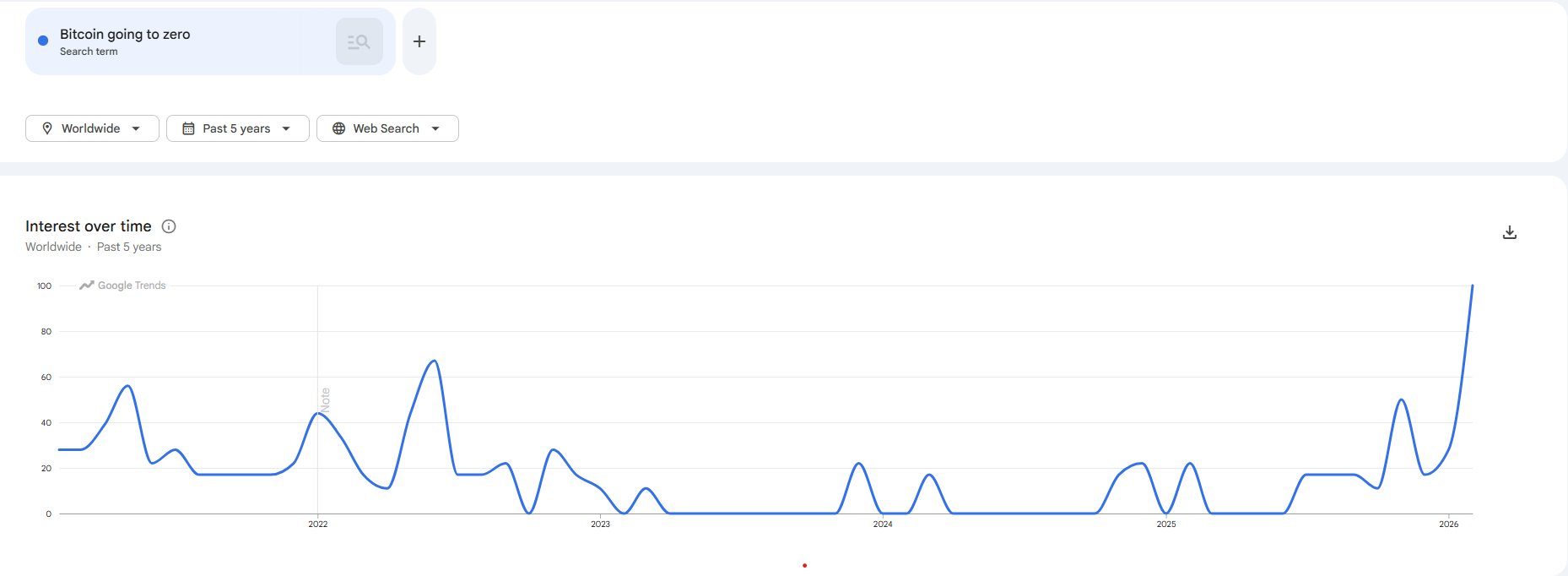

‘Bitcoin Going to Zero’ Google Searches Hit Highest Level Since FTX

Google searches for “Bitcoin going to zero” have surged to their highest level since the post‑FTX panic in November 2022, according to Google Trends data for the past five years.

The spike aligns with Bitcoin’s latest drawdown from its Oct. 6, 2025, all‑time high near $126,000 to about $66,500 at the time of writing on Thursday, according to data from CoinGecko, leaving the asset almost 50% below its peak.

At the same time, the Bitcoin Fear and Greed Index has plunged into extreme fear around 9, levels previously seen during the Terra ecosystem collapse and the FTX fallout in 2022.

Google Trends shows that worldwide interest in the phrase “Bitcoin going to zero” last hit comparable levels in early November 2022, when FTX froze withdrawals, and Bitcoin (BTC) crashed to around $15,000.

Today’s Bitcoin fears different from 2022

Crypto intelligence platform Perception analyzed narrative intelligence across 650+ crypto media sources and shared its findings with Cointelegraph.

Founder Fernando Nikolic said that fear in 2022 was driven by internal events, such as cascading failures of centralized lenders and one of the industry’s largest exchanges, while today’s fear is “driven by macro fears and being amplified by a single bearish voice.”

Related: Bitcoin passes $69K on slower US CPI print, but Fed rate-cut odds stay low

Nikolic said that Bloomberg’s Mike McGlone has been the loudest single voice driving the “Bitcoin could go to zero (or near-zero)” narrative, and that he has been a “one-man content machine this cycle,” calling Bitcoin to $10,000 on Feb. 3, saying markets were headed for a 2008-style crash and continuously calling for Bitcoin’s decline throughout the past month.

He told Cointelegraph that McGlone is repeatedly amplified by crypto media sites and has “essentially been the go-to bearish quote for the past three weeks.” “This media saturation likely contributes directly to the Google search spike,” he said.

Retail fear lags professional media sentiment

Nikolic said that the actual counterpoint that “nobody is synthesizing” is that, while “Bitcoin to zero” searches are spiking, institutional buyers are accumulating more BTC, pointing to the fact that sovereign wealth funds, such as Abu Dhabi, are increasing their Bitcoin exchange-traded fund holdings, and large corporations like Strategy continue to stack BTC.

According to Perception data, he said, media sentiment bottomed on Feb. 5, but has been recovering for two weeks, while Google “Bitcoin going to zero” searches are peaking now in mid-February.

Related: Willy Woo warns quantum risk is eroding Bitcoin’s edge over gold

Retail fear lags professional media sentiment by about 10-14 days, he said. “By the time the public is most scared, the professional narrative has already started to stabilize. The retail narrative and institutional behavior are moving in opposite directions.”

Macro fears and quantum angst

The surge in “Bitcoin going to zero” searches is also unfolding against a backdrop of record‑high macro anxiety.

The World Uncertainty Index, which counts references to “uncertainty” in Economist Intelligence Unit country reports, is sitting at its highest level in the Federal Reserve Bank of St. Louis (FRED) time series, exceeding the peaks seen around the 2008 global financial crisis and the 2020 COVID‑19 shock.

Research underpinning the index finds that spikes in global uncertainty tend to precede weaker output and slower growth as companies delay investment and hiring.

Quantum fears have also been a persistent background narrative since October 2025, according to Nikolic, but he said that quantum fear spikes alongside price drops, not independently.

“Bitcoin quantum” searches peaked in November 2025 and have been falling steadily since, according to Google Trends.

“It’s an amplifier of existing bearish sentiment, not a standalone driver. The “Bitcoin going to zero” search trend is likely a composite of price-crash fear + quantum existential fear + McGlone-style macro doom, all converging in the same window.”

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 hours ago

Video7 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World12 hours ago

Crypto World12 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market