CryptoCurrency

Michael Saylor Hints At New Bitcoin Buy As BTC Slips Below $90K

Join Our Telegram channel to stay up to date on breaking news coverage

Michael Saylor hinted Strategy will buy more Bitcoin this week as BTC slid below $90k amid fears the Bank of Japan is about to hike interest rates to the highest level in about 30 years.

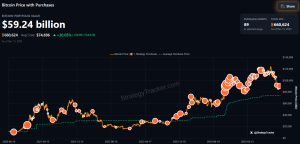

Saylor posted a SaylorTracker chart on X captioned “₿ack to More OrangeDots,” a phrase that has frequently preceded new Bitcoin buying.

₿ack to More Orange Dots. pic.twitter.com/rBi1aagDVO

— Michael Saylor (@saylor) December 14, 2025

The signal came as Bitcoin plunged as low as $87,634.94 in the past 24 hours, with some market observers pointing to macro pressure ahead of the Bank of Japan’s upcoming interest-rate decision later this week.

BTC has since pared losses to trade at $89,623.51 as of 1:10 a.m. EST, according to CoinMarketCap.

The next interest rate decision from Japan’s central bank will be delivered on Friday, with traders on the decentralized prediction market platform Polymarket seeing 97% odds that there will be a 25 basis point increase.

“People are seriously underestimating what Japan is about to do to Bitcoin,” said analyst “NoLimit” on Sunday, citing past market reactions to Japan rate hikes.

Other analysts argue that the interest rate hike has already been priced in. Among them, pseudonymous analyst “Sykodelic” said that Japan’s next move is already known.

“Markets are forward-thinking, forward-moving,” the analyst said. ”They move in anticipation of events, not when those events happen.”

Strategy Is Largest Corporate Bitcoin Holder

Strategy’s last Bitcoin buy was announced on Dec. 8, when it purchased 10,624 BTC for around $963 million, data from Strategy’s website shows. This was also the firm’s largest BTC acquisition since late July.

Currently, the company holds 660,624 BTC on its balance sheet, which was purchased at an average price of $74,696 per coin.

Strategy’s BTC purchases (Source: SaylorTracker)

The firm is sitting on an unrealized gain of more than 20%, equating to approximately $9.891 billion.

BTC May Be Preparing For An 11% Surge

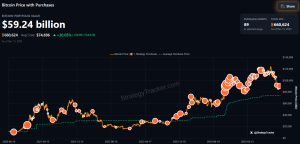

While traders wait to see what Japan’s central bank will do this week, BTC has been in a consolidation pattern over the past few days. TradingView shows that Bitcoin has been oscillating between $84,099.37 and $93,757.24 since escaping a downtrend around two weeks ago.

Daily chart for BTC/USDT (Source: TradingView)

If the potential Japan interest rate hike has indeed been priced in, Bitcoin might attempt to break out of the consolidation channel.

If there is a breakout towards the upside, BTC will likely try to breach the $93,757.24 resistance level and flip it into support. This could then serve as a launchpad for a rally to the next resistance at $104,622.34. In this scenario, BTC would gain approximately 11% from current levels.

On the other hand, a downside move might see Bitcoin lose the $84,099.37 support and fall to as low as $80,477.67.

Technical indicators on the daily chart show mixed signals. The Moving Average Convergence Divergence (MACD) signals that momentum is currently in favor of buyers. However, this momentum seems to have cooled down in the last 48 hours as the MACD line starts to drop towards the MACD Signal line.

Meanwhile, the Relative Strength Index (RSI) is attempting to cross above its Simple Moving Average (SMA). If this happens, it would be a major bullish technical signal, indicating a shift in power towards buyers.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage