CryptoCurrency

Michael Saylor is running out of ways to boost Strategy’s BTC per share

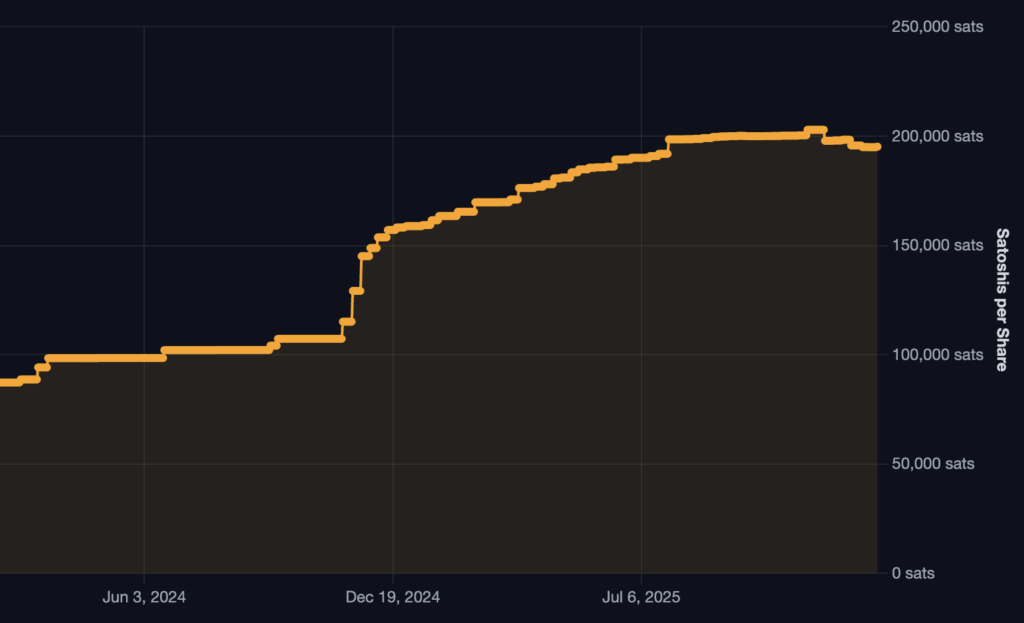

Strategy (formerly MicroStrategy) bought a lot of bitcoin (BTC) last week, but shareholders still have less BTC per share now than a couple of months ago.

As of January 5, Strategy disclosed 345,632 assumed diluted shares outstanding of MSTR. As of Sunday, and after last week’s purchase of BTC, that count increased 1.9% to 352,204.

Over the same time period, the company’s BTC purchases increased its holdings by a mere 2.0% from 673,783 to 687,410.

Unlike prior purchases, shareholders enjoyed barely one-tenth of a percentage point of accretive dilution, a dilution-adjusted metric for tracking founder Michael Saylor’s promise to accrue long-term value for shareholders.

The 0.1% increase is almost no consolation for 28% losses in the value of MSTR over the past two months. In fact, shareholders have suffered the punishment of not just USD decline but also non-accretive dilution over that time frame, losing BTC per share since mid-November 2025.

Indeed, Strategy funded less than 10% of the recent purchase by selling STRC, which isn’t immediately dilutive to MSTR shareholders.

More than 90% of the fundraise to buy BTC came from direct MSTR dilution.

Rather than instill enough investor confidence about Strategy’s business prospects to bid up the price of MSTR, Saylor’s common stock has been crashing toward a $0 premium to its BTC holdings.

After reneging on a promise to avoid dilution below a 2.5x multiple-to-Net Asset Value (‘mNAV’), slashing earnings guidance by at least 76%, and deciding to dilute MSTR to buy USD instead of BTC, the company has lost tens of billions of dollars in market capitalization.

Worse, as of last week, both the company’s market capitalization and its enterprise value were at or below the value of its BTC — imputing $0 of optimism about the company’s actual business.

‘People shouldn’t buy BTC? Is that what you’re trying to say?’

This morning, one of the most popular Bitcoin podcasts released a new episode featuring Saylor. The fiery interview included questions about the declining sentiment about his company and dismal performance across the BTC treasury industry, which Strategy emphatically encouraged.

“The shareholders in some of these other treasury companies are getting absolutely crushed,” asked host Danny Knowles. “Is there any way that some of these companies ever get back to a 1x mNAV?”

Read more: Strategy’s bitcoin premium vanishes as mNAV crashes to 1x

“I just don’t accept the criticism,” responded Saylor. “You made an investment in a company. Why did you invest in the company, right?

“My problem with the premise is, you somehow think that it’s okay for 400 million companies to not buy BTC, and you like that? And you’re going to criticize the 200 companies that bought BTC? And that’s your brilliance?

“How is it brilliant for you to ignore the fact that 400 million companies didn’t buy BTC — and somehow that’s okay — and you’re going to criticize the 200 companies that bought BTC.

“You’re just criticizing someone that bought an equity at the wrong price. Why don’t you actually put the focus upon the people that make the investment decision? The companies don’t determine the price their stock trades at.

“So my point here is, what is your brilliant insight, Danny, that people shouldn’t buy BTC? Is that what you’re trying to say?”

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.