Crypto World

Michael Saylor missed out on a $33 billion profit at Strategy

Strategy (formerly MicroStrategy) managed to turn an unrealized bitcoin (BTC) profit of $32.6 billion into a $2.2 billion loss thanks to founder Michael Saylor’s reluctance to sell.

To be specific, four months ago on October 6, the company owned 640,031 BTC acquired for $73,983 apiece but worth $125,000 apiece at prevailing market prices.

As of yesterday’s Nasdaq close, however, Strategy now owns 713,502 BTC acquired for $76,052 and worth just $72,925.

In other words, Strategy had an unrealized BTC profit of $32.6 billion on October 6 that has turned into a $2.2 billion loss.

Even excluding the last four months of purchases to restrict yesterday’s figure to the original 640,031 BTC, that still recalculates to an equally embarrassing swing from a $32.6 billion profit to a $670 million loss on only the BTC the company owned four months ago.

Read more: Michael Saylor is running out of ways to boost Strategy’s BTC per share

New lows across multiple metrics

Management’s choice to not sell means Strategy’s balance sheet has $33 billion less in assets than it could have, less capital gains tax.

This figure also ignores the effects on BTC’s price of Strategy selling such large sums.

As of yesterday’s close, the company’s common stock MSTR had a market capitalization of just 0.82x the value of the company’s BTC holdings — down 75% from its November 2024 high of 3.4x.

In addition to a 76% loss since its November 2024 high, including its latest 52-week decline of 61%, Strategy leadership has also failed to capture those tens of billions of dollars of investment income along the way.

It might seem tempting, given these losses, to point to a reminder of Saylor’s previously devout and confident proclamations that he never intended to sell Strategy’s BTC.

Unfortunately, he did say those things in the distant past, but even that promise has been deteriorating along with most other metrics at Strategy.

Indeed, Saylor now discusses the possibility of selling Strategy’s BTC, including official statements from the company and its CEO, albeit in euphemisms such as raising capital or covering dividend obligations.

Moreover, the company recently diluted equity holders for $1.44 billion with $0 in associated BTC purchases in order to shore up USD, not BTC, for a rainy day. That day might be arriving soon.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

These bitcoin-linked stocks are doing better than BTC: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

Traders chasing alpha might want to take a look at U.S.-listed bitcoin mining stocks. Some of these companies are surging, boldly decoupling from the cryptocurrency’s choppy price action.

Shares in Terawulf (WULF) have gained 31% this month, even as bitcoin’s spot price has dropped nearly 17%. Cipher Digital (CIFR) and HUT 8 (HUT) have gained 8% and 6%, respectively, while Core Scientific (CORZ) is largely steady.

According to Markus Thielen, founder of 10x Research, these are among the most heavily shorted stocks by hedge funds and could gain due to positive economics.

“With long-term energy contracts secured at attractive rates, these firms possess a strategic advantage that extends well beyond pure Bitcoin mining,” Thielen said in a note to clients.

He added that capital is increasingly flowing toward structural winners, while legacy operators risk being left behind.

Bitcoin has bounced to over $65,000, likely tracking gains in futures tied to the Nasdaq 100 index. The advance occurred even though President Donald Trump didn’t mention crypto in his State of the Union address.

Spot bitcoin ETFs recorded $257.7 million in net inflows on Tuesday, the most since early February, according to data from SoSoValue. Analysts said inflows need to hold up over the coming days to spark a real market rebound from this slump.

In terms of price, bitcoin is trading close to well-watched pivots, Vikram Subburaj, CEO of Mumbai-based Giottus.com, said.

“A sustained break below $60,000 is widely framed as a downside trigger, with ~$57,500 cited as the next notable level. Conversely, reclaiming $72,000-$75,000 would be a cleaner signal that risk appetite is returning,” Subburaj said in an email.

In traditional markets, the Dollar Index reversed early losses, pressuring dollar‑denominated assets such as gold and bitcoin. Oil prices slipped as U.S. stockpiles surged, though downside remained muted amid the risk of a potential military conflict between the U.S. and Iran. Stay alert.

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Macro

- Feb. 25, 4:30 p.m.: U.S. Fed balance sheet for week ending Feb. 25 (Prev. $6.61T)

- Earnings (Estimates based on FactSet data)

- Feb. 25: Circle (CRCL), pre-market, $0.16

- Feb. 25: Core Scientific (CORZ), post-market, -$0.18

- Feb. 25: MARA Holdings (MARA), post-market, -$0.11

- Feb. 25: Hut 8 (HUT), pre-market, -$0.13

- Feb. 25: NVIDIA (NVDA), post-market, $1.50

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Feb. 25: EigenCloud to host a livestream with Puffer Finance on “Preconfirmations & the Future of Rollups”

- The Sandbox DAO is voting to pause operations and transfer control to the project team to realign with “The Sandbox 3.0”. The proposal currently has the support of 80% of voters. Voting ends Feb. 25.

- Decentraland DAO is voting to create a customizable “Windfall Lotto Scene” template for land owners. Voting ends Feb. 25.

- Unlocks

- Feb. 25: Humanity (H) to unlock 4.37% of its circulating supply worth $17.71 million.

- Token Launches

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 2.37% from 4 p.m. ET Tuesday at $65,564.62 (24hrs: +3.55%)

- ETH is up 3.31% at $1,915.35 (24hrs: +4.89%)

- CoinDesk 20 is up 2.97% at 1,901.09 (24hrs: +4.17%)

- Ether CESR Composite Staking Rate is up 2 bps at 2.83%

- BTC funding rate is at -0.0007% (-0.7643% annualized) on Binance

- DXY is unchanged at 97.82

- Gold futures are up 0.58% at $5,206.50

- Silver futures are up 3.82% at $91.50

- Nikkei 225 closed up 2.20% at 58,583.12

- Hang Seng closed up 0.66% at 26,765.72

- FTSE is up 0.79% at 10,764.79

- Euro Stoxx 50 is up 0.5% at 6,147.32

- DJIA closed on Tuesday up 0.76% at 49,174.50

- S&P 500 closed up 0.77% at 6,890.07

- Nasdaq Composite closed up 1.04% at 22,863.68

- S&P/TSX Composite closed up 0.57% at 33,970.38

- S&P 40 Latin America closed up 1.53% at 3,800.72

- U.S. 10-Year Treasury rate is up 2.1 bps at 4.054%

- E-mini S&P 500 futures are up 0.11% at 6,911.25

- E-mini Nasdaq-100 futures are up 0.15% at 25,066.25

- E-mini Dow Jones Industrial Average Index futures are unchanged at 49,277.00

Bitcoin Stats

- BTC Dominance: 58.52% (+0.13%)

- Ether-bitcoin ratio: 0.02917 (0.9%)

- Hashrate (seven-day moving average): 1,034 EH/s

- Hashprice (spot): $28.69

- Total fees: 2.7 BTC / $171,903

- CME Futures Open Interest: 114,890 BTC

- BTC priced in gold: 12.6 oz.

- BTC vs gold market cap: 4.38%

Technical Analysis

- The chart shows daily price swings in solana (SOL) in candlestick format.

- The drop from September highs could be described as a stair-step decline, where prices fall, then move sideways in consolidation, and then resume selling.

- Lately, the price has been consolidating between roughly $75 and $91. A move below the lower end of the range would imply resumption of the broader downtrend, potentially yielding a deeper slide.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $162.03 (+1.12%), +2.14% at $165.49 in pre-market

- Circle Internet (CRCL): closed at $61.37 (+0.33%), +16% at $71.00

- Galaxy Digital (GLXY): closed at $21.54 (+5.90%)

- Bullish (BLSH): closed at $30.76 (+0.42%), -1.63% at $30.26

- MARA Holdings (MARA): closed at $8.05 (+2.16%), +1.61% at $8.18

- Riot Platforms (RIOT): closed at $16.50 (+5.43%), +1.94% at $16.82

- Core Scientific (CORZ): closed at $17.87 (+5.80%), +0.78% at $18.01

- CleanSpark (CLSK): closed at $10.35 (+5.40%), +1.93% at $10.55

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $42.71 (+7.42%)

- Exodus Movement (EXOD): closed at $9.76 (+2.20%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $124.61 (+0.73%), +2.51% at $127.74

- Strive (ASST): closed at $7.16 (-2.65%), +0.35% at $7.19

- SharpLink Gaming (SBET): closed at $6.55 (+0.92%), +2.90% at $6.74

- Upexi (UPXI): closed at $0.61 (+7.61%)

- Lite Strategy (LITS): closed at $1.11 (+3.74%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $257.7 million

- Cumulative net flows: $54.05 billion

- Total BTC holdings ~1.26 million

Spot ETH ETFs

- Daily net flows: $9.2 million

- Cumulative net flows: $11.51 billion

- Total ETH holdings ~5.64 million

Source: Farside Investors

While You Were Sleeping

Crypto World

Ripple (XRP) Price Predictions for This Week

XRP falls again under $1.4. When will the downtrend end?

Ripple (XRP) Price Predictions: Analysis

Key support levels: $1

Key resistance levels: $1.4

XRP’s Downtrend Continues

XRP made a brief attempt to hold the support at $1.4, but sellers returned and pushed the price lower, which turned this level into a key resistance. Hopefully, buyers will show up soon to reverse this trend before it is too late.

Sellers Dominate

Since the start of the year, XRP has closed 6 of 7 weekly candles in the red. That is extremely bearish and left no space for a relief rally. Considering how aggressive this selloff is, a future bounce will likely be just as significant and sharp.

Daily MACD is Bullish

Even if the price action remains bearish, the MACD momentum indicator on the daily timeframe is bullish with a positive histogram. As long as this holds, XRP may be forming a complex reversal pattern that could see it attempt to move higher soon.

Watch closely the level at $1.4. If reclaimed again, bulls may be returning.

You may also like:

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Nvidia Smashes Earnings, Stock Price Briefly Breaks $200

Nvidia shares surged in after-hours trading Wednesday after the company reported another strong earnings beat driven by relentless demand for artificial intelligence chips.

The stock briefly crossed the $200 mark before pulling back, reflecting both investor optimism and profit-taking following the announcement.

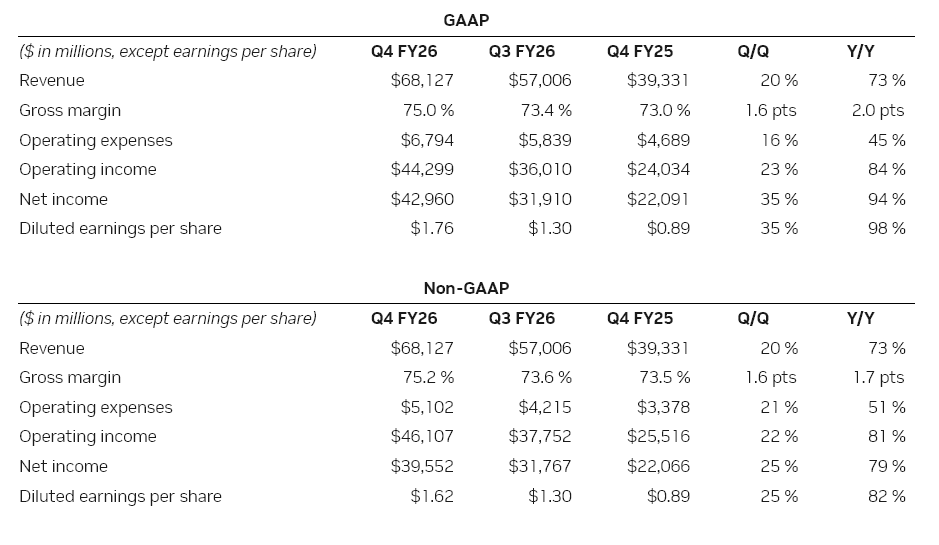

Nvidia Earnings Beat All Wall Street Forecasts

The company reported quarterly revenue of $68.1 billion, up sharply from a year earlier and above Wall Street expectations. Adjusted earnings per share came in at $1.62, also beating forecasts.

The results reinforced Nvidia’s dominant position as the primary supplier of AI computing hardware powering cloud providers, startups, and enterprise AI deployments.

However, the stock reaction showed mixed sentiment. Nvidia initially jumped after the report, pushing past $200 in after-hours trading.

Yet gains faded quickly, and the stock dropped back toward the mid-$190 range as traders locked in profits and reassessed future growth expectations.

Investors focused heavily on Nvidia’s outlook. The company projected around $78 billion in revenue for the next quarter, exceeding analyst estimates.

This suggested that AI infrastructure spending remains strong, despite recent concerns about slowing demand or overspending in the sector.

Meanwhile, Nvidia’s data center business continued to drive most of its growth. Cloud companies and governments are racing to build AI infrastructure, and Nvidia’s chips remain central to that expansion.

CEO Jensen Huang said customers are investing aggressively in AI compute to support future services and automation.

Still, the pullback after the initial surge highlights investor caution. Nvidia has already delivered massive gains over the past two years, and expectations remain extremely high.

Even strong results can trigger volatility if traders were positioned for larger surprises.

Ultimately, the earnings report confirmed one key point: AI spending remains strong, and Nvidia continues to capture the bulk of that demand.

Crypto World

Phemex AI Bot automates grid, Martingale and futures strategies

Phemex launches AI Bot in Feb 2026, automating grid strategies for 10m users under its AI-native initiative.

Summary

- AI Bot supports Futures Grid, Spot Grid and Martingale systems with machine-learning driven, real-time market analysis.

- Built-in risk controls dynamically tune leverage and parameters using historical volatility to curb drawdowns.

- “AI Bot Carnival” offers loss protection for new users plus volume-based rewards for running multiple bots.

Cryptocurrency exchange Phemex announced the launch of its AI Bot trading system, according to a company statement released Thursday, marking a development in the platform’s transition to an AI-integrated exchange model.

The trading bot represents a deployment of artificial intelligence technology for the exchange’s 10 million users globally, the company stated. The system automates quantitative trading strategies across Futures Grid, Spot Grid, and Martingale trading systems.

Earlier in 2024, Phemex announced an AI-Native Initiative aimed at integrating artificial intelligence across its operations and product infrastructure, according to the company. The AI Bot launch serves as an implementation of that strategy, moving from planning into operational deployment.

The trading system utilizes machine learning to analyze data points in real-time and automates trading strategies, according to the company. The bot includes risk management features that adjust leverage and parameters based on historical volatility data, Phemex stated.

The company has initiated an “AI Bot Carnival” promotional program featuring a loss protection program for new users, along with volume-based rewards and incentives for users operating multiple bots, according to the announcement.

“Phemex AI Bot is solid proof that our AI-Native strategy is not theoretical — it is operational,” stated Federico Variola, CEO of Phemex. “We are not experimenting with AI at the margins. We are actively building an exchange where intelligent systems are embedded into how products function.”

Phemex was founded in 2019 and operates as a cryptocurrency exchange offering spot and derivatives trading, copy trading, and wealth management products, according to company information. The platform serves over 10 million traders worldwide.

Crypto World

Aave Delegate Slams Aave Labs’ Track Record as Governance Dispute Continues

Aave-Chan Initiative’s Marc Zeller took to the governance forum to criticize Aave Labs in light of its latest funding request.

The dispute between Aave Labs and the Aave DAO appears to be escalating, with DAO delegates ramping up their hostility after Labs’ “Aave Will Win” proposal requested another $51 million in development funding from the DAO.

On Feb 20, delegate BGD Labs announced its intent to halt its work with the DAO due to Labs’ focus on Aave V4 rather than “a very mature and successful V3.” The decision came after Aave Labs co-founder Stani Kulechov stated in the proposal that “Once V4 is mature, V3 parameters should be gradually adjusted to encourage migration, following the same approach used in past version transitions.”

Marc Zeller, the founder of Aave-Chan Initiative (ACI), another service provider to the Aave DAO, called BGD’s impending departure from the DAO a major change and sold a portion of his AAVE holdings.

Today, the feud between the DAO and Labs was cranked up a notch after Zeller published a full audit of Labs’ performance in the Aave governance forum, bashing Aave Labs’ product delivery, profitability, and business development (BD).

Zeller referred to Labs’ standalone products, including Lens Protocol, GHO v1, and Horizon, as “The Product Graveyard,” citing “zero successes.” He went on to point out that even its more successful launches, such as Horizon, which has commanded over $500 million in total value locked (TVL), still resulted in a negative 96% return on investment (ROI), and that Aave’s stablecoin, GHO v1, depegged and had to be rebuilt by BGD and TokenLogic.

The report went on to criticize Aave Labs’ BD department, noting that Labs was set to work with prominent entities in DeFi and traditional finance like Coinbase’s Layer 2 Base, World Liberty Financial, Apollo, and Mantle.

Morpho emerged as the most notable competitor in these relationships and now serves as the backend of Coinbase’s decentralized lending product, and recently announced a partnership with $800 billion asset manager Apollo Global Management.

While the relationship between the DAO and Labs continues to crack, Aave remains DeFi’s leading protocol by TVL, accounting for more than 28% of the DeFi market with $27.5 billion across all chains.

Meanwhile, Morpho is the second largest lending protocol and sixth largest in DeFi with $5.8 billion.

Despite Aave’s leading position in terms of TVL and brand recognition, its native AAVE token is trading near multi-year lows at just $122, or a $1.9 billion fully diluted valuation, after reaching as high as $380 in December 2024 and $660 in 2021.

Aave Labs did not respond to The Defiant’s request for comment.

Crypto World

Bitcoin Price Prediction: Major Miner Just Expanded in Texas: Is a Massive BTC Production Surge Coming?

A major mining manufacturer just made a decisive move in Texas.

Canaan Inc. spent $39.75M in stock to acquire Cipher Mining’s 49% stake in three operational Texas projects, instantly adding 4.4 EH/s to its mining fleet and securing 120 MW of power capacity.

For a company long known as a hardware seller, this marks a clear pivot toward direct Bitcoin production.

This is vertical integration in action. Canaan is no longer just selling ASICs. It is operating them. The deal also brings thousands of its own Avalon rigs back under its control, tightening its grip on both equipment and output.

The Texas location matters. Low power costs within the ERCOT grid make it one of the most competitive mining regions in the U.S. Locking in that energy exposure signals confidence in long term network profitability.

The timing is notable. While some miners have recently sold down BTC reserves to manage liquidity, Canaan is expanding capacity instead. That suggests management sees value in increasing production rather than reducing exposure.

Bitcoin Price Prediction: The Major Support Held, Now Send It?

Bitcoin just bounced cleanly off the $64,000 support. That level did its job for now.

This is the decision point.

If BTC builds momentum here and stays above the descending trendline, the next target sits around $71,000. Clear that, and $80,000 opens up, with $90,000 back on the table if continuation follows.

But if this bounce fades and price rolls over again, a second test of $64,000 becomes dangerous. Support levels weaken with repeated hits.

A clean break below would likely drag BTC toward $60,000, where the broader macro base sits.

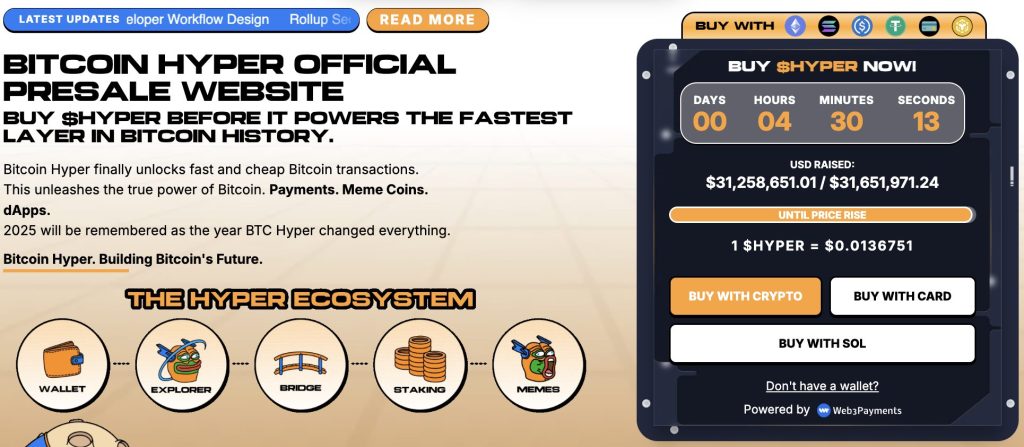

New Bitcoin Presale Brings Solana Technology to The BTC Blockchain

Bitcoin Hyper ($HYPER) is a new presale built to make Bitcoin faster and cheaper to use.

This Bitcoin-focused Layer-2, powered by Solana technology, brings speed, lower fees, and real on-chain functionality while preserving Bitcoin’s core security.

It takes Bitcoin from being just a chart you watch all day and turns it into something you can actually use, payments, staking, real apps, the whole thing.

And this is not just hype. The Bitcoin Hyper presale has already raised over $31 million, with $HYPER sitting at $0.0136751 before the next price jump.

Staking rewards are going up to 37% right now, which definitely grabs attention.

If Bitcoin explodes, Bitcoin Hyper moves with it. If Bitcoin keeps moving sideways, Bitcoin Hyper still benefits from activity on the network. Either way, it is not just sitting there waiting for candles to move.

To buy HYPER before it lists on exchanges, simply visit the official Bitcoin Hyper website and connect a wallet (such as Best Wallet).

Visit the Official Bitcoin Hyper Website Here

The post Bitcoin Price Prediction: Major Miner Just Expanded in Texas: Is a Massive BTC Production Surge Coming? appeared first on Cryptonews.

Crypto World

CFTC Enforcement Division Issues Prediction Markets Advisory Following Kalshi Fraud Cases

TLDR:

- The CFTC issued a prediction markets advisory on February 25, 2026, following two Kalshi enforcement cases.

- A political candidate received a five-year Kalshi ban and a $2,246.36 penalty for trading on his own candidacy.

- A YouTube editor was fined $20,397.58 and suspended two years for trading on material nonpublic information.

- The CFTC confirmed full federal authority to prosecute fraud, insider trading, and manipulation on any DCM platform.

The CFTC Enforcement Division issued a prediction markets advisory on February 25, 2026. The advisory came after two enforcement cases surfaced involving fraudulent trading on KalshiEX, a Designated Contract Market.

Both cases involved misuse of nonpublic information on event contracts, also known as prediction markets. The CFTC used this opportunity to remind market participants that it holds full authority to prosecute illegal trading on any DCM, including Kalshi.

CFTC Confirms Full Authority Over Prediction Market Violations

The CFTC Enforcement Division made its position clear in the advisory released this week. While Kalshi handled both cases through its internal compliance program, the Division stressed it retains independent prosecutorial power.

The agency cited multiple sections of the Commodity Exchange Act to back its authority. This move signals that federal oversight of prediction markets is becoming more active.

The Division pointed to Section 6(c)(1) of the Act as the primary legal basis for action. Regulation 180.1(a)(1) and (3) also applies, covering manipulative schemes and fraudulent conduct.

The CFTC referenced prior enforcement actions, including CFTC v. Clark, to show its track record. These citations reinforce that prediction markets are not beyond the reach of federal law.

The advisory also addressed other prohibited practices beyond insider trading. These include pre-arranged trading, wash sales, and disruptive trading under Section 4c(a).

Fraud and manipulation under various sections of the Act were also listed. The CFTC made clear these rules apply to event contracts just as they do to traditional futures markets.

The Division further noted that DCMs carry an independent duty under Section 5(d) of the Act. This includes maintaining audit trails, conducting market surveillance, and enforcing rules.

The CFTC stated it will continue coordinating with exchanges on enforcement referrals where needed.

Two Kalshi Cases Prompted the CFTC Advisory

The first case involved a political candidate who traded on his own candidacy in May 2025. Social media videos surfaced showing the trades, prompting Kalshi’s compliance team to act immediately.

The trader admitted knowing the trades were improper under Kalshi’s rules. Kalshi imposed a $2,246.36 penalty and a five-year suspension from the exchange.

The CFTC noted this conduct potentially violated prohibitions on manipulative or deceptive trading practices. The candidate’s trades represented a direct conflict of interest with the outcome of the contract.

This type of self-interested trading threatens the integrity of prediction markets. The Division made clear it could have pursued this matter independently.

The second case involved a YouTube channel editor who traded between August and September 2025. The trader placed bets on a prediction market tied to the very channel where they worked.

Kalshi investigated the unusually profitable trades and discovered the employment connection. The trader likely accessed material nonpublic information through their editorial role before videos were published.

Kalshi imposed a $20,397.58 penalty, including $5,397.58 in disgorgement and a $15,000 fine. A two-year suspension from the exchange was also handed down.

The CFTC identified this as a potential misappropriation of confidential information in breach of a duty of trust. The Division’s advisory serves as a formal warning that such conduct on prediction markets carries serious federal consequences.

Crypto World

SOL AI bot misfires, sends $250k LOBSTAR, holder nets ~$6k

LOBSTAR jumped ~190% in 24h after SOL AI agent mistakenly sent 5% supply to a random user, highlighting agentic risk. An artificial intelligence agent operating a Solana blockchain wallet mistakenly transferred 52.4 million LOBSTAR tokens to an unintended recipient due…

Crypto World

Pi Network (PI) Price Predictions for This Week

PI is attempting to break away from its longstanding downtrend. Will it succeed?

PI Network (PI) Price Predictions: Analysis

Key support levels: $0.15

Key resistance levels: $0.20

PI Breakout

The current price action suggests that buyers are attempting to break out of the existing downtrend. PI found good support above 15 cents, and as long as this holds, buyers have a good shot at higher levels. The current resistance is at 20 cents.

Bounce in Progress

After PI was rejected at 20 cents, the price entered into a pullback that is now bouncing on the downtrend line. If the bulls can hold the price here and push it to a higher high later, the breakout from this downtrend will be successful.

RSI Higher Highs

A key signal that bulls are on the offensive can also be seen on the 3-day RSI, which made a higher high. This could be an early sign that the buyers mean business and they will also attempt to send the price into a higher high above 20 cents next.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

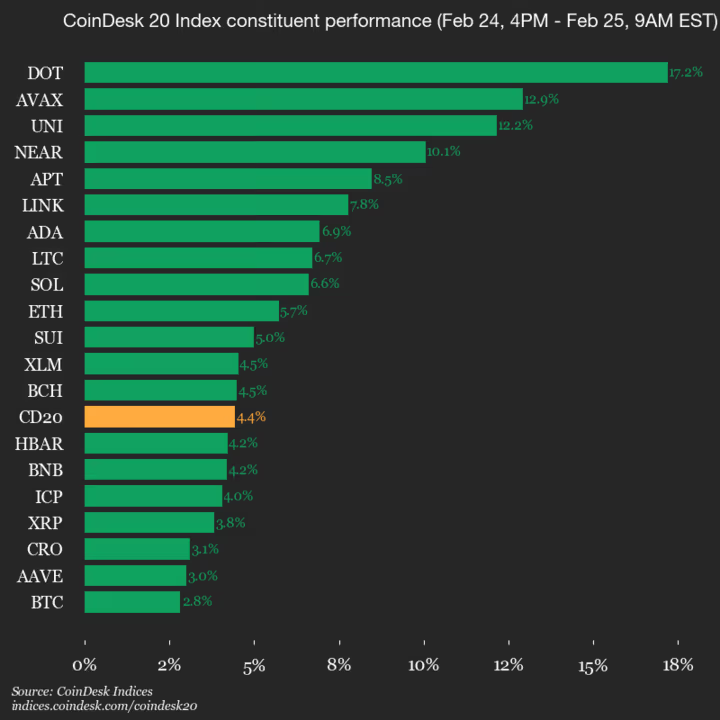

Polkadot (DOT) surges 17.2% as all assets rise

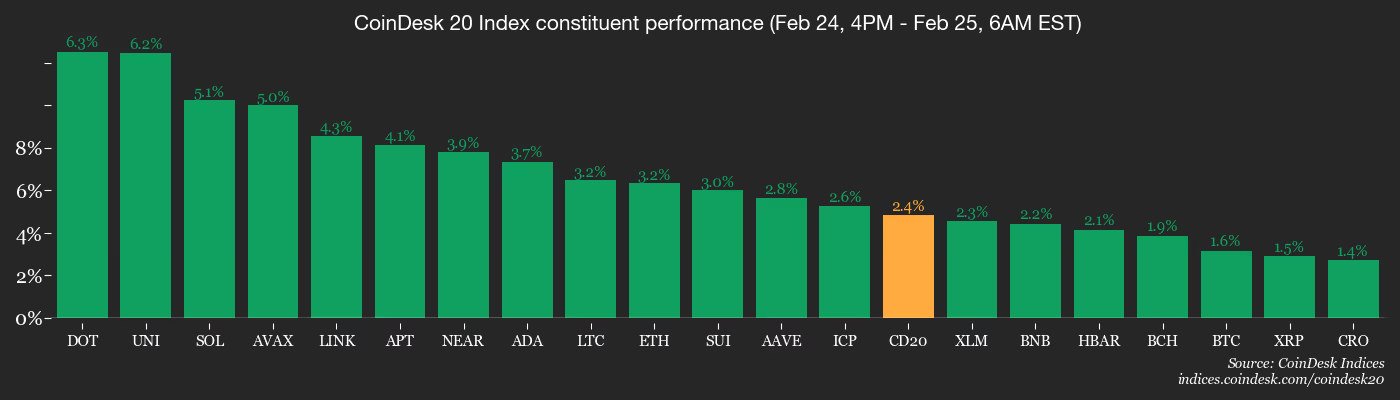

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1937.2, up 4.4% (+82.19) since 4 p.m. ET on Tuesday.

All 20 assets are trading higher.

Leaders: DOT (+17.2%) and AVAX (+12.9%).

Laggards: BTC (+2.8%) and AAVE (+3.0%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

-

Video6 days ago

Video6 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics4 days ago

Politics4 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports7 days ago

Sports7 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World2 days ago

Crypto World2 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Tech1 day ago

Tech1 day agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat3 days ago

NewsBeat3 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business1 day ago

Business1 day agoTrue Citrus debuts functional drink mix collection

-

NewsBeat1 day ago

NewsBeat1 day agoPolice latest as search for missing woman enters day nine

-

Crypto World1 day ago

Crypto World1 day agoEntering new markets without increasing payment costs

-

Sports3 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Business1 day ago

Business1 day agoWBD says Paramount makes higher bid, board will weigh offer against Netflix deal