Crypto World

Miner Offloads $305M Bitcoin as Network Difficulty Sees Sharp Decline

Bitcoin mining stress deepened as difficulty fell 14% and Puell dipped below 0.8, even as Cango sold $305M in BTC.

Bitcoin mining conditions tightened sharply in late January and early February after network difficulty fell 14% over three weeks and publicly traded miner Cango disclosed a $305 million BTC sale over the weekend.

The combination of falling profitability metrics and selective balance sheet sales shows pressure spreading across the mining sector, even as broader on-chain data shows no signs of disorderly selling.

Difficulty Drops as Miners Cut Capacity

According to a February 10 brief published by on-chain analyst Axel Adler Jr., Bitcoin’s network difficulty dropped by a combined 14.1% between January 22 and February 6, following two consecutive downward adjustments of 3.3% and 11.2%. Such back-to-back cuts usually occur when less efficient mining equipment is taken offline, often during periods of weak price action.

During the same window, the price of BTC fell about 25%, briefly touching $60,000 before rebounding toward $70,000. At the time of writing, the flagship cryptocurrency was trading at around $69,000, down nearly 1% in the last 24 hours and more than 12% over the past week, based on CoinGecko data.

The asset has also lost 24% of its value over the past month and about 29% year over year, underperforming earlier-cycle expectations and keeping mining margins tight.

Against this backdrop, Cango confirmed it sold 4,451 BTC for approximately $305 million, citing balance sheet strengthening. The sale, approved by the company’s board, drew an immediate reaction from equity investors, with Cango shares closing 8% lower on the first trading day after the disclosure.

Adler described the transaction as a point event rather than evidence of widespread forced liquidation, noting that aggregate miner flows to exchanges are still holding steady.

You may also like:

Data from miner exchange inflows supports that view, with the 30-day moving average of daily miner transfers hovering near 82 BTC, only slightly lower than mid-January levels and well within recent norms, according to the market watcher. Furthermore, he reported that there have been no sustained spikes that would suggest broad reserve dumping.

Profitability Pressure and What Comes Next

Profitability metrics still point to strain. For instance, Adler pointed out in his brief that the Puell Multiple, which compares daily miner revenue to its annual average, slipped to a 30-day average of 0.77 in early February, down from 0.86 in mid-January. He added that spot readings briefly fell to around 0.61, levels historically associated with miner stress and capacity exits.

The analyst noted that miners earning below their annual average tend to prioritize liquidity, increasing the chance of selective reserve sales rather than aggressive expansion. According to him, completion of this stress phase typically requires a reversal in difficulty adjustments and a recovery in the Puell Multiple toward the 0.85 to 0.90 range.

For now, the data suggests the adjustment is playing out mainly through hashrate reductions instead of heavy selling. The risk, in Adler’s opinion, is a renewed price drop below $60,000, which could push profitability metrics lower and prompt similar sales from other public miners.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Robinhood reports Q4 revenue of $1.28b, up 27%

Robinhood Markets Inc. reported fourth-quarter 2025 earnings showing revenue of $1.28 billion, representing a 27% increase compared to the same period in the previous year, according to the company’s financial results.

However, the company missed its $1.33 billion forecast. The shortfall was largely due to a slump in the cryptocurrency market, with crypto-related revenue falling 38% year over year to $221 million.

Summary

- Robinhood reported $1.28 billion in revenue for Q4 2025, up 27% year-over-year, driven by higher trading activity and subscription services.

- For all of 2025, Robinhood’s total revenue reached $4.5 billion, a 52% increase compared to 2024.

- The company’s expansion was fueled by both transaction-based revenue and recurring subscription income, highlighting sustained growth under CEO Vlad Tenev and co-founder Baiju Bhatt.

Still, Robinhood’s Q4 earnings per share came in at 66 cents. That’s slightly above analyst expectations of 63 cents.

The revenue growth was driven primarily by increased trading activity and subscription services, the company stated.

For the full year 2025, Robinhood reported total revenue of $4.5 billion, a 52% year-over-year increase, according to the earnings report.

The financial technology company, led by CEO Vlad Tenev and co-founder Baiju Bhatt, has seen sustained growth throughout the fiscal year, the results indicated.

The quarterly and annual figures reflect continued expansion in the company’s core business segments, including transaction-based revenue and recurring subscription income, according to the financial disclosures.

The fact that Robinhood’s revenue from crypto-related transactions plummeted 38% year over year underscores how lower digital asset prices continue to cut into trading activity.

Robinhood’s stock price slipped more than 7% after hours on Tuesday, trading at around $79.48 per share.

Crypto World

Bitcoin Top Traders Hold Tight Despite 14% Price Recovery

Key takeaways:

-

The Bitcoin long-to-short indicator at Binance hit a 30-day low, signaling a sharp decline in bullish leverage demand.

-

US-listed Bitcoin exchange-traded funds reversed a negative trend with $516 million in net inflows following a period of heavy liquidations.

Bitcoin (BTC) has fluctuated within a tight 8% range over the last four days, consolidating near $69,000 after an abrupt slide to $60,130 on Friday. Traders are currently grappling with the primary catalysts for this correction, particularly as the S&P 500 holds near record highs and gold prices have climbed 20% over a two-month period.

The uncertainty following the 52% retreat from Bitcoin’s $126,220 all-time high in October 2025 has likely prompted an ultra-skeptical stance among top traders, stoking concerns of further price declines.

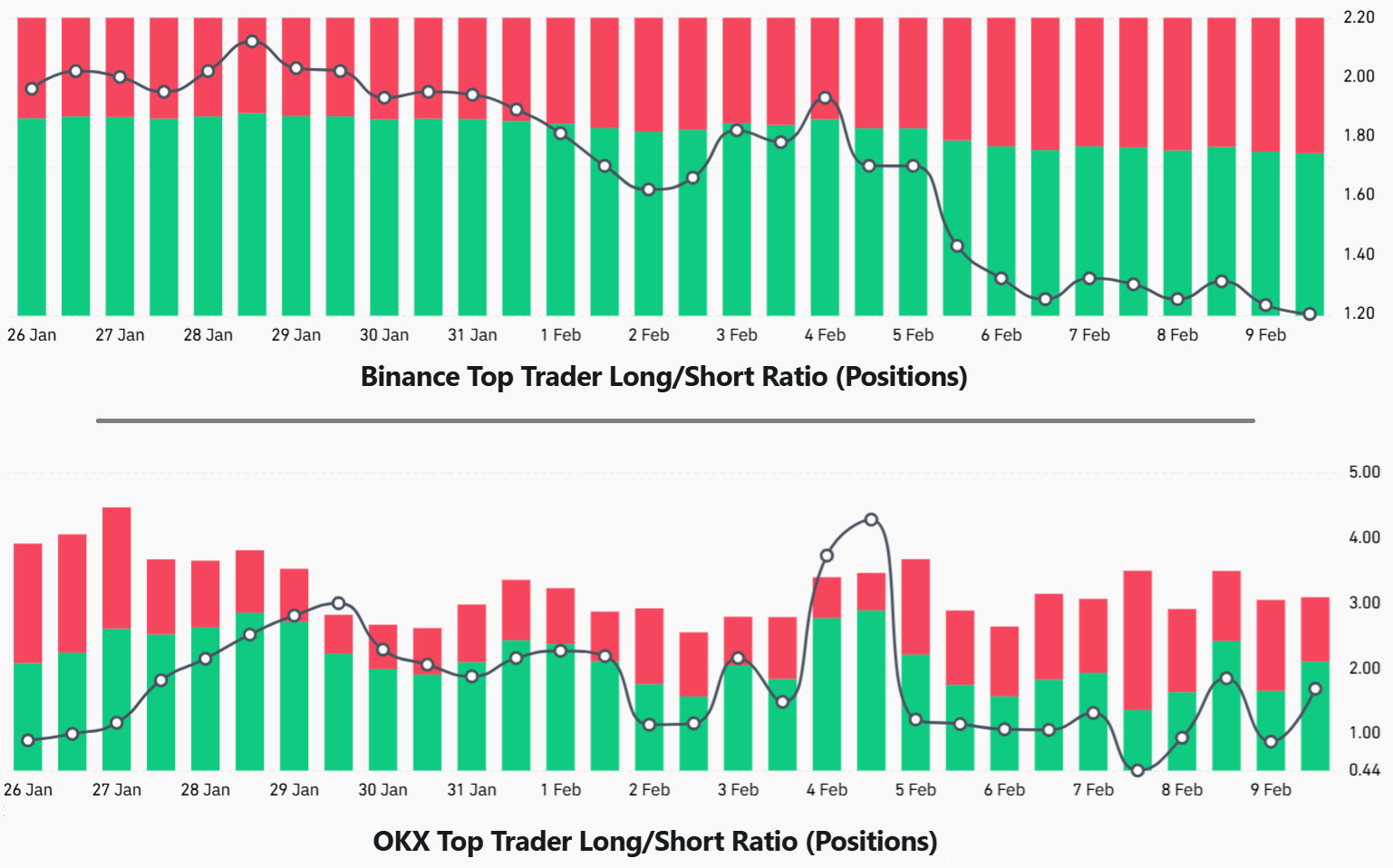

Whales and market makers on Binance have steadily pared back bullish exposure since Wednesday. This shift is reflected in the long-to-short ratio, which dropped to 1.20 from 1.93. This reading represents a 30-day low for the exchange, suggesting that demand for leveraged long positions in margin and futures markets has cooled, even with BTC hitting 15-month lows.

Meanwhile, the long-to-short ratio for top traders at OKX hit 1.7 on Tuesday, a sharp reversal from its 4.3 peak on Thursday. This transition aligns with a $1 billion liquidation event in leveraged bullish BTC futures, where market participants were forced to close positions due to inadequate margin. Importantly, this specific data point reflects forced exits rather than a deliberate directional bet on further downside.

Strong ETF demand suggests Bitcoin whales are still bullish

Demand for spot Bitcoin exchange-traded funds (ETFs) serves as strong evidence that whales haven’t flipped bearish, despite recent price weakness.

Since Friday, US-listed Bitcoin ETFs have attracted $516 million in net inflows, reversing a trend from the previous three trading days. Consequently, the conditions that triggered the $2.2 billion in net outflows from Jan. 27 to Feb. 5 appear to have faded. A leading theory for that pressure pointed to an Asian fund that collapsed after leveraging ETF options positions via cheap Japanese yen funding.

Franklin Bi, a general partner at Pantera Capital, argued that a non-crypto-native trading company is the most likely culprit. He noted that a broader cross-asset margin unwind coincided with sharp corrections in metals. For instance, silver faced a staggering 45% decline in the seven days ending Feb. 5, erasing two months of gains. However, official data has yet to be released to validate this thesis.

The Bitcoin options market followed a similar trajectory, with a spike in neutral-to-bearish strategies on Thursday. Traders pivoted after Bitcoin’s price slipped below $72,000 rather than anticipating worsening conditions.

Related: Bitcoin sentiment hits record low as contrarian investors say $60K was BTC’s bottom

The BTC options premium put-to-call ratio at Deribit surged to 3.1 on Thursday, heavily favoring put (sell) instruments, though the indicator has since retreated to 1.7. Overall, the past two weeks have been marked by low demand for bullish positioning through BTC derivatives. While sentiment has worsened, lower leverage provides a healthier setup for sustainable price gains once the tide turns.

It remains unclear what could shift investor perception back toward Bitcoin, as core values like censorship resistance and strict monetary policy stay unchanged. The weak demand for Bitcoin derivatives should not be interpreted as a lack of confidence. Instead, it represents a surge in uncertainty until it becomes clear that exchanges and market makers were unaffected by the price crash.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

US credit card customers are saddled with $1.28T in debt

U.S. credit card balances reached $1.28 trillion by the end of the fourth quarter, marking a $44 billion increase in debt over the three-month period, according to data released Tuesday by the Federal Reserve Bank of New York.

Summary

- The increase reflects growing reliance on credit cards as household finances remain under pressure.

- Balances are up 5.5% year-over-year.

- The figures are part of the Fed’s quarterly household debt report, which monitors credit cards alongside mortgages, auto loans, and student debt.

The figures represent the highest level of credit card debt on record for American consumers. The quarterly increase reflects growing reliance on credit cards as household finances face continued pressure.

Year-over-year data showed balances climbed 5.5% compared to the same period in 2023, according to the Federal Reserve Bank of New York report.

The Federal Reserve Bank of New York releases quarterly reports on household debt and credit as part of its ongoing economic monitoring activities. The data tracks various forms of consumer debt including mortgages, auto loans, student loans and credit card balances.

Credit card debt represents one component of total household debt in the U.S., which includes multiple categories of consumer borrowing tracked by federal banking authorities.

Crypto World

BNB Chain Adopts ERC-8004 Identity Standard for Autonomous AI Agents

TLDR:

- ERC-8004 provides autonomous agents with persistent onchain identity that survives across sessions.

- The standard enables agents to build verifiable reputation instead of resetting in each platform.

- BNB Chain’s low fees and fast transactions make frequent identity verification economically viable.

- Verifiable agent identity allows software to collaborate and transact with reduced human oversight.

ERC-8004 has been implemented on BNB Chain to provide autonomous agents with verifiable onchain identity. The standard addresses a growing need as AI-powered software moves beyond responding to commands and begins taking independent action.

Traditional login-based systems fail when agents operate across multiple platforms. This new identity framework allows software agents to carry reputation and history across different environments, enabling more reliable autonomous operations.

Building Identity Infrastructure for Agent-Driven Systems

The shift from platform-locked applications to autonomous software requires new identity mechanisms. Current AI tools typically reset between sessions, leaving no verifiable record of past performance. This limitation prevents agents from building trust or operating independently in open systems.

ERC-8004 creates a persistent onchain identity for software agents. The standard functions similarly to a passport, allowing agents to prove their identity across different platforms.

Unlike traditional account-based systems, this approach enables agents to maintain their operational history as they move between applications and services.

BNB Chain highlighted the development in a recent post, noting that agents need to prove who they are and carry their history rather than starting from zero in every application.

The announcement emphasized that while the design shift appears small, its practical applications are substantial. Agents can now operate more reliably across systems instead of being confined to single platforms.

The identity standard addresses three core requirements for autonomous operations. Agents gain persistent identity that survives between sessions.

They also receive verifiable records of past behavior and performance. Additionally, other agents and services can evaluate trustworthiness before deciding whether to interact.

Practical Implementation on Low-Cost Infrastructure

BNB Chain’s infrastructure makes frequent identity verification economically viable for autonomous agents. The network provides low transaction fees that support small, frequent interactions typical of machine-to-machine operations. Fast settlement times match the speed requirements of automated agent activity.

The combination of affordability and speed proves essential for practical deployment. High costs or slow confirmation times would render frequent identity updates impractical. BNB Chain’s architecture supports the volume and velocity needed for active agent economies.

Verifiable identity enables several downstream improvements for users. AI tools become more reliable when their historical performance can be checked onchain.

Services face increased competition as agents select partners based on verified reputation rather than brand recognition.

Users also gain greater control since agents can operate across platforms without being locked to a single provider.

The standard represents foundational infrastructure rather than a complete solution. Once agents establish verifiable identity, additional capabilities become possible.

Automated payments between agents, machine-verifiable work completion, and reputation-based selection all build on this identity layer.

The framework provides a base for an open agent economy where software can collaborate and transact with reduced human oversight.

Crypto World

Saylor shoots down any idea of forced BTC sale

Concerns that Strategy (MSTR) will be forced to sell bitcoin amid falling prices are “an unfounded concern,” chairman Michael Saylor said during a CNBC interview, affirming the company’s commitment to ongoing purchases.

“Our net leverage ratio is half the typical investment grade company,” Saylor said. “We’ve got 50 years worth of dividends and bitcoin, we’ve got two and a half years worth of dividends just in cash on our balance sheet … we’re not going to be selling, we’re going to be buying bitcoin. I expect we’ll be buying bitcoin every quarter forever.”

Last week, the company added 1,142 BTC to its holdings for roughly $90 million, at an average price of $78,815 per coin. The company’s total stack now stands at 714,644 coins, purchased for about $54.35 billion, bringing the average cost per bitcoin to $76,056 — well above the current price of around $69,000.

Saylor’s comments come as bitcoin has seen significant volatility (almost exclusively downward) over the past months, though he emphasized that swings are part of the asset’s design. “The key to keep in mind is that bitcoin is digital capital,” he continued. “It’s going to be two to four times as volatile as traditional capital like gold or equity or real estate. It’s got two to four times the performance this decade of traditional capital. It’s the most useful global capital asset in the world, you can put more leverage on it. You can trade it in more ways than any other kind of capital assets. So the volatility is the bug, but the volatility is the feature.”

Strategy reported an operating loss of $17.4 billion and a net loss of $12.6 billion for the fourth quarter, reflecting largely non-cash mark-to-market accounting tied to bitcoin’s price decline. The results highlight how swings in the cryptocurrency’s value continue to influence the company’s financial statements despite its long-term investment strategy.

Saylor also addressed the notion that bitcoin’s current price levels could represent a new form of market maturity, which he characterized as a good thing.

Strategy’s balance sheet and its digital credit business are central to its strategy, Saylor said. The firm’s digital credit structure has emerged as one of the most actively traded credit instruments of the decade, generating substantially higher cash flow than traditional fixed-income products and far exceeding the trading volume of preferred stocks.

“There isn’t any credit risk in the balance sheet of the company,” he said.

Saylor declined to offer a short-term bitcoin price prediction but reiterated confidence in long-term performance. “I don’t really make predictions over 12 months. I think that bitcoin is going to double or triple the performance of the S&P over the next four to eight years. And I think that’s the only thing we need to know.”

Shares of the company are down 3% on Tuesday, bringing the year-to-date decline to 15% and the year-over-year fall to 60%.

Crypto World

Crypto’s banker adversaries didn’t want to deal in latest White House meeting on bill

Crypto industry negotiators arrived at the White House on Tuesday ready to talk about a legislative deal on stablecoin yields, but their banking counterparts brought further demands for a ban on such rewards in the Senate’s crypto market structure bill, according to people familiar with the talks.

The fight over whether stablecoins should be able to offer rewards — a lobbying battle between Wall Street bankers and crypto insiders — is one of the chief headwinds keeping the Senate Banking Committee from advancing the Digital Asset Market Clarity Act. It’s now been a sticking point for months, and the banking side held their ground on prohibiting the rewards activity and more, according to a principles document circulated by the bank negotiators, despite the White House’s insistence last week that both sides come with ideas for compromising.

The document called for a general prohibition on stablecoin yield, according to a copy obtained by CoinDesk, suggesting a ban on “any form of financial or non-financial consideration to a payment stablecoin holder in connection with the payment stablecoin holder’s purchase, use, ownership, possession, custody, holding or retention of a payment stablecoin.”

The crypto team at the table was said to include executives from Coinbase, Ripple, a16z, the Crypto Council for Innovation and the Blockchain Association, according to people familiar with the plans. The White House sought to pare down the numbers of participants in the most recent gathering there last week, which hadn’t produced significant progress on the question of stablecoin rewards programs that are a key component of crypto platforms’ business models.

Despite the lack of significant progress, crypto representatives struck a hopeful note in statements about the meeting.

“We’re encouraged by the progress being made as stakeholders remains constructively engaged on resolving outstanding issues,” said Blockchain Association CEO Summer Mersinger, who was said to participate in the meeting.

“The important work continues,” said Ji Kim, the CEO of CCI, in a statement after the meeting, saying his group “appreciates the banking industry for their continued engagement.”

Banking groups involved in the meeting, including the Bank Policy Institute and American Bankers Association, issued a statement after the meeting, though it included no details about next steps on the legislation.

“As we noted during the meeting, that framework can and must embrace financial innovation without undermining safety and soundness, and without putting the bank deposits that fuel local lending and drive economic activity at risk,” the group said in the combined statement.

The document they were said to have shared insisted that stablecoin activity “must not drive deposit flight that would undercut Main Street lending.” It asked that the requested ban come with an enforcement stick for regulators, and the document suggested a study by regulators that examines the effect of stablecoin activity on deposits.

After two White House meetings on the topic and no significant movement of the line on yields, the matter may return to the discretion of lawmakers working on the bill.

Before the Senate can approve a bill, the banking panel needs to clear it through a majority vote. The legislation already has its necessary backing from the Senate Agriculture Committee, and a similar bill with the same name won a vote in the House of Representatives last year. But bankers have raised their concerns about the threat to deposits at the core of their industry.

However, stablecoin yield isn’t the only major sticking point. Senate Democratic negotiators have demanded that the effort include a ban on deep crypto involvement from senior government officials, driven primarily by President Donald Trump’s personal crypto interests. The Democratic lawmakers have also insisted on greater protections against crypto’s use in illicit finance and also that the Commodity Futures Trading Commission get fully staffed by commissioners — including Democratic appointees — before it can get to work on crypto regulations.

While Trump’s crypto adviser, Patrick Witt, has predicted the negotiators will find common ground soon, he also told CoinDesk that the White House won’t support an effort that targets the president. Witt was said to lead the meeting on Tuesday, as he did the one last week.

The Clarity Act faces a number of practical challenges beyond the policy disputes, including the Senate’s ongoing friction over a last remaining budget issue: the funding of the Department of Homeland Security, which runs Immigration and Customs Enforcement (ICE). The Senate is always a tough place to secure necessary floor time to move legislation, and the closer the chamber gets to the lengthy breaks before the midterm elections this year, the more difficult it is to find enough time to handle a major crypto bill.

Read More: Crypto industry, banks not yet close to stablecoin yield deal at White House meeting

UPDATE (February 10, 2025, 23:16 UTC): Adds comment from the bank lobbying groups.

UPDATE (February 10, 2025, 00:12 UTC): Adds details about the bankers’ document stating their principles on yield.

Crypto World

Onchain Options Volumes Hit All-Time Highs as Lending Yields Dry Up

Options premium volumes and trading activity are ramping up as users explore new areas in DeFi.

As decentralized finance (DeFi) matures, users are turning to alternative platforms, such as onchain options, to generate higher yields.

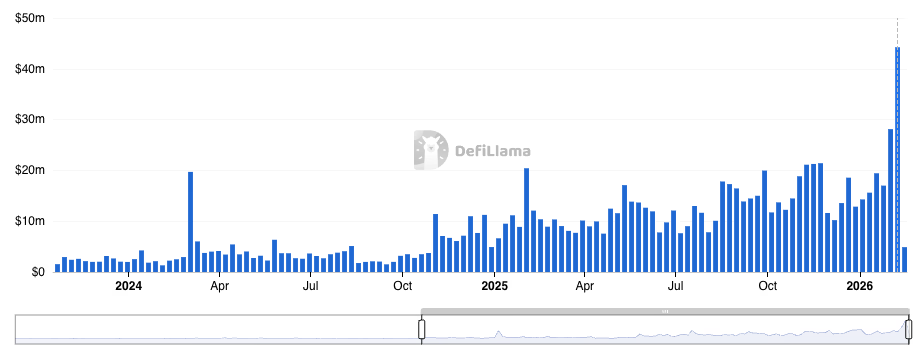

Onchain options activity reached all-time highs over the last two weeks, with $44 million of volume in the first week of February and $28 million during the last week of January.

More than 80% of the total onchain options volumes are concentrated in leading protocols, Ithaca and Derive. Over the last week, Ithaca processed $26 million in volume and Derive recorded $11 million, while the third-busiest protocol, Overtime, recorded just $2 million.

While the exact catalyst for the growth isn’t clear, it could be a combination of traditional lending platforms like Aave offering lower yields than in prior years, and also potentially some anticipation of Hyperliquid’s upcoming HIP-4 markets, which will allow users to trade binary outcomes that function similarly to options.

Just yesterday, a popular DeFi trader known as Route 2 Fi posted on X, “Where are people getting yield these days? 2% APR on USDT at Aave isn’t exactly sexy.” The post gained significant traction online, indicating that many DeFi participants are also seeking new, lucrative yield sources.

Crypto World

Sub-$2K ETH Price Levels Emerge As Key Long-Term Demand Zones

Ether (ETH) struggled to hold prices above $2,000 on Tuesday, and against this backdrop, analysts noted that Ether’s 31% decline in 2026 fits a familiar price fractal from previous bull markets.

Key takeaways:

-

ETH’s recent dip to $1,736 may mark only the first of many lows in a larger consolidation phase.

-

Onchain cost-basis data clusters from $1,300 to $2,000, reinforcing this range as a potential demand zone.

ETH fractal hints at a longer base-building phase

A long-term fractal comparison between the 2021-2022 and 2024-2025 cycles suggests that Ether’s sharp sell-off mirrors a pattern in which an initial bottom is formed before the price revisits lower levels due to further market weakness.

On the weekly chart, ETH’s drop toward the $1,730 region resembles its “first low,” rather than a definitive market floor.

In 2021, ETH spent 12 months consolidating around the first low ($1,730) and a lower support band ($885), allowing leverage to reset and spot demand to rebuild.

Applying this framework, ETH may continue ranging from about $1,300 to $2,000, with downside tests toward the $1,500–$1,600 zone possible before a sustained base is formed.

Onchain cost basis data cites $1,300–$2,000 as a demand zone

Ether’s UTXO realized price distribution (URPD) data underlines the chances of an extended consolidation. Large supply clusters remain above current prices, with $2,822 accounting for 5.86% of the ETH supply and $3,119 holding 6.15%, forming heavy overhead resistance.

Below current spot prices, notable clusters appear at $1,881 (1.58 million ETH) and $1,237, suggesting potential demand zones if the price continues to retrace.

Structurally, $1,237 stands out as a potential cycle floor, followed by intermediate support near $1,584 and stronger acceptance around $1,881, where the realized supply concentration increases.

Derivatives data aligns with this view. The liquidation heat map shows cumulative long liquidations at risk of $4 billion to $6 billion, ranging to $1,455 from $1,700, and these are levels that may still be targeted by sellers.

However, more than $12 billion in short liquidity is stacked up to $3,000, implying that once downside liquidity is absorbed, the directional bias may shift higher in the coming months.

Related: Analysts debate whether Ether has capitulated or has further to fall

What is giving Ether structural support?

Data from CryptoQuant shows Ether withdrawals from exchanges have surged to their highest level since October 2025, with net outflows exceeding 220,000 ETH. Binance recorded daily net outflows of about 158,000 ETH on Thursday, the largest since August 2025.

These flows coincided with ETH trading from $1,800 to $2,000, suggesting accumulation or risk-off repositioning at these levels.

MNCapital founder Michaël van de Poppe highlighted a similar dynamic, noting that price often lags network and narrative growth.

Stablecoin transaction volume on Ethereum has risen about 200% over the past 18 months, even as the ETH price remains about 30% lower, a divergence that may lead to a parabolic repricing for the altcoin.

Related: Ethereum Foundation teams up with SEAL to combat wallet drainers

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Big Demand Zone Below $2K Signals ETH’s Next Move

Ether faced resistance to hold above $2,000 on Tuesday as market sentiment cooled, and a 31% drop in 2026 has drawn comparisons to price fractals seen in prior bull markets. The slide to roughly $1,736 underscored a broader consolidation, with traders weighing the risk of further draws versus the potential of a patient, bottoming process. On-chain watchers have repeatedly highlighted a defined demand zone spanning approximately $1,300 to $2,000, a band that could attract buyers if price action continues to meander lower. The narrative here centers on whether Ether can form a durable base or slip into a protracted period of range-bound trading that delays a meaningful breakout. For context, market participants continue to monitor liquidity flows, derivative risk, and evolving network fundamentals that often foreshadow macro moves.

Key takeaways

-

ETH’s drop to about $1,736 may mark the initial low in a broader consolidation phase rather than a final bottom.

-

On-chain cost-basis data clusters between $1,300 and $2,000, reinforcing this range as a potential demand zone.

-

A fractal comparison of the 2021–2022 cycle with 2024–2025 suggests a pattern where an early bottom is followed by retests to lower levels before a durable base forms.

-

UTXO Realized Price Distribution (URPD) points to meaningful overhead resistance near $2,822 and $3,119, concentrations that could cap rallies unless substantial demand emerges below current levels.

-

Derivatives data show concentrated long-liquidation risk around $1,455 from $1,700, while more than $12 billion in short liquidity sits up to $3,000, implying a potential shift in momentum once downside liquidity is absorbed.

Tickers mentioned: $ETH

Sentiment: Neutral

Price impact: Neutral. Near-term risk remains balanced by base-building signals and a defined demand zone.

Market context: The broader crypto backdrop continues to digest on-chain signals alongside macro risks. Ethereum withdrawals from exchanges have spiked to the highest levels since October 2025, with net outflows exceeding 220,000 ETH, and Binance alone recording roughly 158,000 ETH in daily net outflows—the largest since August 2025. These flows coincided with ETH trading in a $1,800–$2,000 range, suggesting a combination of accumulation and risk-off repositioning. Meanwhile, stablecoin activity on Ethereum has risen markedly, with stablecoin transaction volume up about 200% over the past 18 months even as the price has lagged. This divergence can foreshadow a re-rating if network fundamentals and liquidity conditions align with price action.

Why it matters

The unfolding pattern matters because it frames Ether’s potential trajectory in the context of a longer base-building phase rather than a quick recovery. If the fractal framework holds, the asset could spend more time coiling within a defined band, testing lower supports before a durable upside breakout emerges. This matters for traders and risk managers who must gauge how much exposure to maintain during a broad consolidation while tracking evolving on-chain activity and derivatives signals that historically precede major moves.

From a broader market perspective, the interaction between on-chain demand zones and subtle shifts in exchange flows could signal how liquidity is reallocated as institutions and retail participants reassess risk. The observed uptick in stablecoin settlements and the outflows from centralized venues imply a transfer of risk away from exchanges in favor of self-custody and potentially longer-duration holding patterns. If this trend persists, it could set the stage for a renewed bid when price action tests critical levels in the $1,500s or higher.

Additionally, the ongoing dialogue around whether Ether is capitulating or merely consolidating highlights the nuanced nature of market cycles. The fractal approach, which aligns current action with prior periods of broad basing, suggests that patience and disciplined risk management may be more prudent than chasing short-term rallies during uncertain liquidity regimes. Independent observers are watching for confirmations from on-chain metrics and derivatives markets that could either reinforce a gradual re-rating or expose the market to sharper, faster moves once liquidity conditions flip.

What to watch next

-

Price tests of the $1,500–$1,600 zone and whether buyers re-emerge at the lower end of the demand band.

-

Verification of key URPD levels around $1,237 and $1,881 as potential cycle floors and pockets of demand if price retraces further.

-

Monitoring long versus short liquidity dynamics, including long-liquidation risks around $1,455 from the $1,700 area and substantial short liquidity up to $3,000, which could shape the slope of any ensuing rally.

-

Trends in exchange withdrawals and stablecoin turnover on Ethereum, which may presage shifts in market participation and risk tolerance.

-

Derivative market signals, including any evolving bias after absorption of near-term liquidity pressures, to gauge whether the market transitions from distribution to accumulation.

Sources & verification

- Ether UTXO Realized Price Distribution (URPD) data and interpretations from Glassnode.

- Rising Ethereum withdrawals from exchanges and related net flows, with Binance’s outflows highlighted as a notable datapoint from CryptoQuant.

- Derivatives risk indicators, including the Cuingood-style liquidation heat map from Coinglass, detailing long-liquidation risk levels and short liquidity concentrations to $3,000.

- Weekly chart framing and fractal comparisons published with reference to ETHUSDT data on TradingView (Cointelegraph/TradingView).

- Ethereum Foundation SEAL collaboration articles on wallet security and related efforts to curb drainers.

Ether fractal signals an extended base-building phase

Ether (CRYPTO: ETH) has again drawn analysts to a familiar price-action pattern where a pronounced dip is followed by a prolonged period of range-bound activity rather than an immediate leg higher. On the weekly chart, a move toward the $1,730 area resembles a “first low” rather than a definitive market floor, echoing structures seen during the 2021–2022 period when ETH spent roughly a year consolidating near a first low of approximately $1,730 and a broader support band around $885. These historical touchpoints, when viewed through a fractal lens, suggest the current cycle may unfold similarly: a first phase of downside risk that yields to a more extended base-building phase before demand returns with greater resilience. The weekly framing in this narrative is anchored by the ETHUSDT pair on TradingView, which has provided the visual reference for these comparisons. The fractal interpretation is not a guarantee, but it offers a framework for interpreting the sequence of on-chain activity and price movements against the backdrop of a market still digesting liquidity and macro cues.

In the near term, the market’s focus shifts to whether Ether can sustain a bid above the immediate support around $1,500–$1,600 or if price testing compounds the pressure toward the $1,237 level, a region that previous analyses identify as a potential cycle floor. The on-chain support is reinforced by URPD observations, which show substantial realized price concentration at higher levels, underscoring a stubborn overhead that could keep rallies in check unless fresh demand emerges. At the same time, the index of supply concentration at $2,822 and $3,119 constitutes a ceiling that traders must clear to generate meaningful upside momentum. These resistance pillars remind investors that any attempt to re-rate Ether will require a combination of technical durability and sustained capital inflows.

Meanwhile, market participants should monitor the interplay between on-chain signals and derivatives dynamics. The heat map of long liquidations suggests a risk horizon near $1,455 when price drifts from $1,700, while a large pool of short liquidity up to $3,000 implies a potential upside framework once sellers exhaust liquidity pressure. The balance between these forces—realized price levels, withdrawal trends, and the evolving derivative landscape—will shape whether Ether can complete a longer, steadier base or remains vulnerable to periodic risk-off episodes that push the price toward the lower bound of the current range.

As observers parse these signals, one constant remains: the market’s attention to demand zones and supply barriers. The convergence of on-chain data with macro risk sentiment can either reinforce a patient, base-building narrative or catalyze a more decisive move if new catalysts emerge. The evolving ecosystem continues to attract attention from developers and investors who watch for signs of renewed network activity, institutional participation, and regulatory clarity that could shift the risk calculus in Ether’s favor.

Crypto World

Crypto PAC Fairshake leaps into first midterm Senate race with $5 million in Alabama

Crypto’s $193 million campaign-finance force, the Fairshake political action committee, is launching into congressional midterm season with a massive $5 million injection into the Republican primary campaign of Barry Moore, a U.S. congressman now running for Senate.

One of Fairshake’s affiliates, Defend American Jobs, is committing that spending to support Moore, even though the general election remains almost nine months away. That marks one of the group’s first major forays into what promises to be a high-stakes, high-spending election season.”We are proud to stand with Barry Moore, a leader who will fight for economic growth and make America the crypto capital,” Fairshake said in a Tuesday statement.

Fairshake had also recently devoted funds to Representative French Hill, the chairman of the House Financial Services Committee who has led the charge on crypto legislation in the U.S., according to a representative of the PAC. Hill and his allies already managed to get a crypto market structure bill through the House of Representatives last year and are now awaiting a matching effort in the U.S. Senate.

Such crypto legislation is the central purpose of Fairshake’s giving — promoting pro-crypto candidates ready to pass friendly bills and opposing those who stand against such legislation.

As with all the super PAC’s giving, the money for Moore will be through “independent expenditures” under federal election law, meaning the cash can buy ads for the candidate, but they can’t deal directly with the campaign. Fairshake-backed ads in the 2024 election didn’t mention crypto at all, and this broadcast ad for Moore intends to feature the candidate’s endorsement from President Donald Trump.

Moore has served five years in the House, and he’s now campaigning to replace Senator Tommy Tuberville, a Republican who is aiming for the governor’s mansion this year. The Alabama congressman has so far served in the House’s Agriculture Committee, where crypto legislation was on the agenda last year.

“Crypto is not a fad,” Moore wrote in a December post on social media site X. “It is part of our future. It is part of Alabama’s future.”

Moore is one of five Republican candidates who announced their participation in that primary. Early polling has so far seen Moore generally in second place behind state Attorney General Steve Marshall. Both have “A” crypto ratings from Stand With Crypto, a group that reviews the digital assets views of political figures.

Read More: Industry’s PAC Keeps Seeking to Add Allies as Congress Hashes Out Crypto Legislation

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World9 hours ago

Crypto World9 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World17 hours ago

Crypto World17 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World17 hours ago

Crypto World17 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition