Crypto World

Miss foreign stock run in 2025? Still market money to be made overseas

After spending most of the past decade being trounced by the U.S. stock market, international equities are back and investing experts say the opportunity should last.

A brutal stretch of underperformance that lasted a decade ended in late 2024 and has sustained its momentum at the outset of 2026. After years of global allocations staying low for most U.S.-based investors because of the weak returns, the recent gains amid shifting macro conditions and growing concerns about U.S. market concentration are leading investors to take another look at the lack of international exposure in their portfolios.

It is not merely chasing hot recent performance, according to Tim Seymour, Seymour Asset Management chief investment officer. “This is not people saying … this is a time to trade global markets,” he said on this week’s CNBC’s “ETF Edge.”

Over the last ten years, global equities outside of the U.S. underperformed domestic markets by a wide margin, with Seymour noting that a major world equities benchmark ETF, the iShares MSCI ACWI ETF (ACWI), underperformed by about 60%. That gap shaped investor behavior and capital flowed into U.S. equities, particularly mega-cap technology stocks. Seymour described it as a generational dynamic among investors in which market capitalization growth in the U.S. “choked off a lot of international investing.”

But he says now the structural underweight that many U.S. investors have to global markets is a tailwind. While international equities represent roughly 30-40% of global market capitalization, Seymour estimates that at the high-end of the range, U.S. investor exposure to overseas markets is 12-15%, and in many cases much lower.

International equities began to outperform the U.S. in November 2024, and since that turn have beaten U.S. equities by roughly 15%, Seymour said. While that does not erase the decade of lagging returns, it marks a meaningful inflection point. “In a 14-month span, you’ve seen international outperform the U.S.” Seymour said. While the ten-year chart versus the U.S. stock market still looks poor, “it really is a story of where global growth has picked back up,” he added.

A popular exchange-traded fund choice among many U.S. investors to gain international exposure is the iShares MSCI Emerging Markets ETF (EEM), which has $26.55 billion in assets and has returned 42% over the past year. The iShares MSCI ACWI ETF is up 20% over the past year, besting the S&P 500’s return by about 5%. Seymour said while the potential returns from emerging markets are higher, investors who are looking to diversify overseas should tilt more heavily to developed market allocations, citing a 70%-30% split as a reasonable example.

Part of the renewed interest in overseas markets is tied to currency. A weakening U.S. dollar has improved returns for dollar-based investors holding foreign assets. Meanwhile, metals have surged as investors look for stores of value, an investing development that Seymour described it as a global trade rather than a U.S. only phenomenon.

“These are all providing tailwinds and a weakening dollar, of course, where this is leading investors to diversify their overall portfolios that had been previously U.S.-centric portfolios,” Jon Maier, J.P Morgan Asset Management chief ETF strategist, said on “ETF Edge.”

Seymour said the most important point for investors to understand when considering the additional of international stocks to a portfolio is that the fundamentals are improving. Earnings growth is appearing in places where stagnation once defined the outlook. Japan is a key example, he said, where years of corporate governance reform and shareholder focus is starting to boost returns.

Europe is also benefitting from lower interest rates, fiscal spending, and regulatory change. Seymour argued that deregulation in Europe may be a more powerful catalyst than similar efforts in the U.S. because it represents a sharper shift from the past. Banking, utilities, and industrials have all seen renewed momentum. He added that in additional to a decade of underperformance making these stocks cheap on a relative basis, many European banking stocks will benefit as much from central bank policy as U.S. banks and are better dividend plays, such as Barclays, Santander and SocGen.

Maier echoed this general view, saying that “developed international markets are certainly areas of interest to our clients.”

International markets also offer exposure to recent winning trades, including precious metals. Latin America has been one of the strongest performing regions this year, driven by gold and copper. Seymour said Chile and Peru are examples of international markets benefitting from rising commodity demand. Meanwhile, Brazil has gained on both commodity strength and shifting political expectations.

“Brazil’s the largest economy in Latin America,” Seymour said. “Some of this are the dynamics around commodities, but some of these are the dynamics around the geopolitics.”

The iShares MSCI Brazil ETF (EWZ), which has $8.91 billion in assets, is up almost 49% over the past year, while the iShares MSCI Peru and Global Exposure ETF (EPU) is up almost 118% during the same time period.

The dollar and metals trades came under pressure on Friday after President Trump announced Kevin Warsh as his pick to succeed Jerome Powell as Fed Chair, with market belief in Warsh as figure who will maintain Fed independence rather than force rates down at the president’s bidding. Gold, silver and platinum all crashed. However, these metals have seen enormous returns over the past year, with gold up over 90%, silver up roughly 200%, and platinum up 120%.

Market strategists say Trump administration global policies will continue to serve as longer-term tailwinds for international-themed trades. “Whether it is India and the EU cutting a trade deal or Canada cutting oil deals with China, the rest of the world is repositioning,” Seymour said.

Technology leadership is another trade where investors are reassessing the balance between U.S. and overseas holdings. Seymour highlighted South Korea as example, noting the country’s market is heavily weighted toward memory chip leaders like Samsung and SK Hynix, which make up around 46% of the South Korean stock market benchmark tracked by the iShares MSCI South Korea ETF (EWY), which is up 125% over the past year. “Memory has been on fire,” he said, making country level ETFs a practical way to gain exposure. Apple said on its earnings call on Thursday it can’t secure enough chips for iPhone demand, another sign supporting the strength of the memory trade.

Seymour noted other companies that are among the biggest chip players in the world, ASML and Taiwan Semi, also reside outside U.S., and there are many data center plays overseas as well.

The renewed interest in international equities reflects broader reallocation after years of neglect. Investors are responding to valuation gaps, earnings growth, and a world where capital and trade are increasingly multi directional. “These are global trades, not just U.S. trades,” Seymour said.

Crypto World

21Shares Launches TSUI ETF on Nasdaq

21Shares has launched the TSUI ETF on Nasdaq, offering U.S. investors regulated exposure to Sui.

21Shares, a financial services company known for its cryptocurrency exchange-traded products (ETPs), has introduced the TSUI ETF on Nasdaq, offering U.S. investors regulated access to Sui (SUI), according to the Sui Blog.

The spot TSUI ETF provides U.S. investors with a streamlined, regulated avenue to gain direct exposure to Sui. Trading on Nasdaq allows market participants to engage with Sui through established brokerage accounts. The SUI token is currently trading at $0.86, down 1% on the day, according to CoinGecko.

This debut of the ETF underscores the growing momentum behind institutional interest in regulated crypto investment products.

It also highlights the growing institutional focus on Sui. For example, financial entity Canary Capital recently launched the first-ever staked SUI ETF, The Defiant recently reported.

“TSUI marks yet another widely available access point to Sui, leveraging the industry’s preeminent tech stack to support global payments use cases and financial applications at scale,” said Evan Cheng, co-founder and CEO of Mysten Labs, the original contributor to Sui.

Elsewhere, financial institutions like Bitwise, Franklin Templeton, Grayscale, and VanEck have also shown interest in Sui-related initiatives.

This article was generated with the assistance of AI workflows.

Crypto World

BTC narrows big early losses, rallying back above $64,000

Bitcoin pushed back above $64,000 in early U.S. trading Tuesday, tracking a broader rebound in risk assets after several sessions of turbulence.

Trading recently at $64,200, bitcoin was still lower by 0.75% over the past 24 hours, but nicely above the morning’s low of $62,500. Ether (ETH) and solana (SOL) also narrowed big early losses.

Crypto’s tight correlation with technology stocks remained evident, with software shares — as represented by the iShares Software Sector ETF (IGV) — bouncing 1.7% after recent heavy losses on concerns that artificial intelligence (AI) tools will destroy their business models.

The gains came as some companies, including Intuit and DocuSign, announced partnerships with AI firm Anthropic, signaling that incumbents might be able to adapt rather than being displaced.

Meanwhile, traditional safe havens lost ground. Gold fell 1.5% on the session, while crude oil slipped 0.5% as geopolitical tensions eased. Reports cited Iran’s deputy foreign minister Majid Takht-Ravanchi saying the country “is ready to take any necessary step to reach a deal with the U.S.,” tempering fears of an imminent military strike.

The tech-heavy Nasdaq 100 traded 1.1% higher, while the broad-market S&P 500 was up 0.8%.

High-performance computing firms and bitcoin miners — increasingly tied to AI data center infrastructure — joined the move higher. Bitdeer (BTDR), Cipher Mining (CIFR), Hut 8 (HUT) and TeraWulf (WULF) led gains, rallying 6%-10%.

Much of the rest of the crypto-related sector was modestly lower, with Coinbase (COIN), MARA Holdings (MARA) and Strategy (MSTR) among those showing losses of 0.5%-1%.

Crypto World

prediction markets eye $10 billion future, Citizens says

Growth in prediction markets is surging as traders seek more precise ways to price and hedge discrete events, from elections to rate decisions, without relying on blunt proxy trades.

Prediction markets are running at an annualized revenue rate above $3 billion, up from about $2 billion in December, and could reach $10 billion by 2030, according to a Monday report by U.S. bank Citizens.

The bank cited accelerating volumes, stronger market structure and early institutional engagement, saying the trajectory mirrors the early evolution of listed derivatives and digital assets.

“We continue to view ~$10 billion of annual industry revenue by 2030 as a reasonable medium-term waypoint rather than an end state,” wrote analysts led by Devin Ryan.

Prediction markets have rapidly moved beyond niche betting to a growing ecosystem of sophisticated trading platforms that aggregate real-world event probabilities. Leading players include Kalshi, a CFTC-regulated U.S. exchange for event contracts, and Polymarket, one of the largest decentralized markets covering politics, sports and economics. These platforms are drawing significant volume and attention from mainstream finance and regulatory bodies alike, reflecting broader growth and the shift toward institutional relevance.

Asset classes typically scale from retail-led liquidity to professional market makers and, eventually, institutional capital, driving a step-change in depth and sophistication, the analysts said, arguing prediction markets are following that path.

January volumes rose more than 40% from December, with February tracking at a similar pace despite expectations of a post-football slowdown. While sports remain a key liquidity driver, activity is broadening into macroeconomic, political and regulatory events, areas more aligned with institutional demand.

Prediction markets allow investors to hedge discrete event risk, from inflation surprises to M&A approvals, without relying on proxy instruments such as index futures or options, reducing basis risk. By isolating specific outcomes, they provide targeted risk transfer and real-time, capital-weighted probability signals, Citizens said.

Institutional participation is emerging first through data integration, liquidity provision, settlement standards and regulatory clarity, with direct trading expected to scale as infrastructure matures. While revenues today are largely transaction-driven, the bank’s analysts see growth in data, research and financing services as the ecosystem develops.

Read more: How AI is helping retail traders exploit prediction market ‘glitches’ to make easy money

Crypto World

Framework Ventures Reaches $500M Stablecoin Mortgage Financing Deal

Better, a mortgage lender focused on originations for homebuyers, has teamed up with Framework Ventures to secure as much as $500 million in financing through the Sky stablecoin ecosystem. The move binds traditional home lending to a blockchain-backed liquidity network, signaling a deeper push to bring real-world assets into decentralized finance infrastructure. In the collaboration, Better will operate as a designated capital recipient within Sky, effectively earning the label of a “Star.” The announcement, made on a Tuesday, frames a new pathway for channeling conventional mortgage activity into DeFi rails while maintaining underwriting and origination control on the lender’s side. The arrangement is a notable instance of tokenization concepts extending beyond assets like real estate into the funding layer that supports liquidity in the crypto ecosystem.

Key takeaways

- The Better Framework Ventures deal ties mortgage origination to Sky’s blockchain-based capital framework, with funding funneled into Better’s loan production.

- Better will assume the role of a designated capital recipient, referred to as a “Star,” within Sky’s ecosystem, while continuing to underwrite and originate loans.

- Funded capital in Sky is issued as stablecoins backed by crypto-native collateral, enabling a real-world asset (RWA) tokenization approach at the funding level rather than tokenizing the mortgage notes themselves.

- Officials view the arrangement as a potential external funding source beyond traditional capital markets, though the intersection of regulated mortgage practices with blockchain systems remains nascent and carefully watched.

- The move arrives amid broader regulatory and industry conversations about digital assets in housing finance, including recent steps by U.S. regulators to explore asset recognition in loan applications.

- Long-term implications could include scalable origination and potential pressure on consumer mortgage costs, depending on how the new funding channel performs and how risk is managed within the Sky framework.

Market context: The partnership sits at the crossroads of tokenization trends and real-world asset finance, reflecting a growing interest in linking regulated lending activity with on-chain liquidity. It coincides with regulatory signals and industry dialogue around digital assets in housing finance, as policymakers and lenders weigh how crypto rails can complement traditional funding. In the United States, government-backed conforming mortgages represent a vast segment—well over $12 trillion in outstanding volume—with loan limits for single-family homes rising to $832,750 in 2026 in many counties, underscoring the scale at which such collaborations could matter if proven effective.

Why it matters

The Better–Framework collaboration illustrates a practical blueprint for tokenizing funding rather than the underlying loan assets themselves. By directing capital raised within Sky to sponsor Better’s origination pipeline, lenders may gain access to alternative liquidity pools that can supplement, or in favorable scenarios supplant, traditional debt markets. The model preserves standard underwriting controls for Better, while leveraging a DeFi-enabled backstop that expands the pool of potential capital for mortgage production.

The use of stablecoins anchored to a crypto-collateral framework to back a capital stack for real-world lending marks a notable evolution in how tokenized finance can interface with regulated industries. This approach could, in theory, unlock faster liquidity cycles for lenders and introduce new risk-management tools that are native to blockchain ecosystems. Yet it also raises questions about custody, compliance, and governance—areas where established mortgage practices intersect with emergent DeFi standards. The parties frame the arrangement as a responsible deployment of tokenized capital to support real-world assets at institutional scale, suggesting a cautious but forward-looking stance toward broader adoption.

Industry observers note the timing as significant, coming as lenders increasingly probe crypto-enabled capabilities for asset originations, risk assessment, and funding diversification. While the mortgages themselves are not being issued on-chain, the funding layer is increasingly exposed to blockchain rails. In this sense, the deal represents a form of real-world asset tokenization (RWA) at scale within a regulated lending context, a hybrid that could influence both funding costs and the pace at which mortgage products are brought to market through blockchain-enabled channels.

Vance Spencer, co-founder of Framework Ventures, emphasized the potential impact of the capital infusion: “With this capital injection, we think Better will be able to rapidly scale origination and potentially lower mortgage rates for consumers in the long term.” The quote underscores the thesis that expanded liquidity could translate into more favorable terms for borrowers, though the actual outcome will depend on how efficiently Sky’s collateralized framework can translate crypto funding into stable, regulated lending activity.

What to watch next

- Rollout milestones: Track the pace at which Better scales its origination volumes under Sky’s framework and whether new regions or loan products are added to the program.

- Regulatory signaling: Monitor any regulatory clarifications or guidelines that touch on digital assets in mortgage underwriting and how they interact with traditional lenders’ risk frameworks.

- Liquidity dynamics: Observe how Sky’s stablecoin liquidity performs during market stress and whether the capital stack remains attractive to other lenders or asset origins.

- Transparency and governance: Look for details on Sky’s governance structure, collateral management, and reporting suitable for risk-averse institutions participating in RWAs.

Sources & verification

Tokenized funding for mortgage origination

The Better–Framework Ventures pact marks a deliberate step toward integrating traditional mortgage activity with a blockchain-backed capital network. Sky’s architecture provides a framework where crypto-native collateral underpins stablecoins that feed liquidity into real-world loan origination. In practice, this does not imply that mortgage notes are minted or traded on-chain; instead, it leverages tokenized funding to enhance the liquidity that supports Better’s mortgage pipeline. If the model proves resilient, lenders could gain more flexible access to capital, potentially widening the pool of participants and compressing the time required to secure funding for new loans.

Better’s leadership frames the collaboration as a pragmatic approach to scale origination while maintaining compliance and risk controls. The “Star” designation signals a recognized position within Sky’s system, signaling to other market participants that Better’s underwriting remains the primary mechanism for loan evaluation and approval. For Framework Ventures, the arrangement showcases how early-stage crypto-native institutions can partner with regulated lenders to deploy substantial capital in a controlled, auditable manner. The collaboration underscores a broader trend of bridging the gap between DeFi liquidity and real-world loan markets, a fusion that remains in its formative stages but has potential to reshape funding dynamics if it proves scalable and compliant.

Regulatory context remains a critical tailwind and a potential risk factor. The sector has seen regulators explore how digital assets can fit into the housing-finance ecosystem, with actions aimed at clarifying asset recognition in loan applications and delineating the boundaries between traditional lending and tokenized capital. The convergence of these threads—ROA-backed liquidity, DeFi rails, and prudent oversight—will likely determine whether the Sky–Better model becomes a durable path for mortgage financing or a prototype that informs future experiments in tokenized lending. In the near term, observers will be watching for data on execution quality, default rates, and the overall cost of capital that Better can achieve through this new funding channel.

Crypto World

Decred defies Bitcoin slump as shrinking supply lifts DCR price

- Decred price rose to $28 as bulls defied Bitcoin’s bearish slide that engulfed most altcoins.

- Short-term bullish targets include $40 and $69, while losses could extend to $17 or lower.

- Analysts are pointing to supply metrics as key.

Decred (DCR) bulls are digging in as price hovers above the critical $25 support level, having jumped to intraday highs of $28 on February 24, 2026.

The uptick saw DCR defy the broader crypto market outlook that saw Bitcoin plunge to under $63,000 during the Asian trading hours.

This resilience coincides with a decrease in daily volume and aligns with a sharp decline in the coin’s liquid supply.

While intraday gains could disappear amid profit-taking, can upward pressure allow the hybrid proof-of-work/proof-of-stake cryptocurrency to retest $40?

DCR supply dynamics

As Bitcoin remains under pressure, Decred has continued to trade in positive territory, with buyers targeting a sixth consecutive daily advance.

On-chain data suggests the rebound from lows near $22 on February 19 has been supported by staking activity, which has reduced the token’s effective circulating supply.

More than 16.2 million DCR coins have been mined, but around 27% of the circulating supply is currently liquid.

The remainder is locked, indicating a shrinking available supply that may be supporting recent price strength.

Built a thing: https://t.co/bGAet0YTTA – how tight is DCR’s liquid supply actually? >72% locked, only ~27% available to market, and shrinking

Work in progress

Thanks to @jz_bz & @exitusdcr for initial feedback & help! pic.twitter.com/Pie0xeRMLq

— Tivra (@WasPraxis) February 21, 2026

The significant reduction in exchange balances translates to reduced sell pressure, a trend that reflects holder confidence despite volatility.

Staking rewards incentivise retention over liquidation, and as Decred’s scarcity narrative strengthens, prices could follow.

Decred price outlook

Currently, the daily chart shows the DCR price steady, with buyers up 14% and 53% in the past week and month, respectively.

The altcoin’s technical picture thus hints at bullish control.

Alongside the ascending triangle pattern breakout, bulls are looking at the rising RSI that hovers at 67 and suggests room for more gains before overbought conditions prevail.

Meanwhile, the daily MACD shows a bullish crossover, and the histogram is expanding the green bars.

DCR price is also above the 50-day simple moving average and 200-day moving average, with the chart outlining a recent bullish crossover.

If volume picks up amid further gains, the near-term targets could be an initial tick up to $30.

A potential relief rally fueled by macro tailwinds could send prices to $40 and allow for upside action toward 2025 highs of $69.

But as downside risks linger, a dip below $25 could bring support levels around the 50 and 200-day MAs into play.

Crypto World

Monero (XMR) hits resistance as bears threaten the $300 level

- Monero price hovered above $327 and was up nearly 4% as Bitcoin bounced above $63,700.

- XMR faces fresh downward risks if bearish sentiment continues.

- The privacy coin could retest support at $265 or lower.

Monero (XMR) traded around $327 as intensifying downward pressure threatened a bearish flip for the privacy coin alongside most top altcoins in the market.

While the token ranked among the top intraday gainers during US trading hours on Tuesday, its uptick in the past 24 hours was just 4%. Selling pressure has recently capped gains around $340-$360.

XMR price today

Losses to the psychological support level of $300 could allow sellers to threaten fresh downside momentum.

A sharp correction as Bitcoin and alts face declines would wipe out all gains Monero price has seen since rebounding from below $265 in October 2025.

The altcoin is already well off the all-time highs reached in January 2026.

Notably, bulls continue to bleed as the privacy narrative that pushed Monero to that peak on Jan. 14 has since cooled.

Sector giants Zcash and Dash have also shed most of their recent gains.

According to data from CoinMarketCap, XMR is down 59% from its peak.

This means that struggling bulls might have a tough time defending immediate support levels, starting with $300.

Regulatory headwinds remain an issue for XMR and other privacy coins.

The token is not accessible on some exchanges, while jurisdictions such as the UAE have blacklisted these coins.

However, the downturn in altcoins, as with BTC, comes amid miner outflows and profit-taking bets post-privacy coins rally.

Headwinds around macroeconomic conditions have also exacerbated the declines.

Monero price technical analysis

Analysts note that cryptocurrencies could flip lower if BTC plummets to $50k.

For now, bulls retain some say amid range-bound trading. But the overall picture alludes to weak participation as institutional demand cools.

Sell pressure might not ease unless the market sees a significant rebound in spot, derivatives, and exchange-traded fund markets.

Monero’s price outlook could mirror these broader ecosystem movements.

XMR has traded lower since hitting its ATH on Jan 14 this year. An initial rebound faded near $625 on Jan. 19, and prices have broken lower since.

On Feb. 5, XMR fell 23% to $290, and another uptick collapsed around $357 in mid-February.

With MACD below zero and RSI at 39, the overriding sentiment is a bearish one.

There’s a bearish flag pattern formation on the daily chart, with $302 as support.

If sellers breach this demand reload zone, a cascade of negative momentum could accelerate declines to October 2025 lows and then the $250-$230 lows.

Crypto World

Best Meme Coin to Buy Now: $1.3 Trillion Left Crypto Temporarily But History Says It Always Comes Back Bigger. Short Term Whale Losses of $26 Billion Are Setting Up the Next Meme Coin Explosion.

The total crypto market cap dropped $1.3 trillion since January. That is a lot of money to leave. But here is what the headlines leave out. It is also exactly the amount that came back with interest after every previous crypto reset. After the 2022 bottom, over $2 trillion re entered the market in eighteen months. After COVID, the recovery was even faster. Crypto does not die during drawdowns. It compresses like a spring. And the tighter it compresses, the harder it snaps back.

Short term Bitcoin whales are holding roughly $26 billion in unrealized losses according to CryptoQuant. That peaked at $32 billion on February 6. Those are large holders who bought recently and are underwater. But large holder losses during crypto drawdowns have preceded every single major rally in Bitcoin’s history. The whales who held through 2022 losses of similar magnitude watched their positions multiply three to five times within two years.

What matters now is where the recovery capital goes first. And every data point from every cycle gives the same answer. Meme coins recover the fastest and the hardest.

Meme Coins Are the Spring Loaded Sector of Every Crypto Recovery

After the 2018 crash, DOGE led with a 20,000 percent run to its 2021 peak. After FTX, PEPE launched and hit $7 billion inside a year. After every Solana scare, BONK recovered faster than SOL itself. Meme coins are the highest beta crypto sector. When confidence returns, speculative capital floods the assets with the widest upside windows first. The $45 billion meme sector is large enough to attract institutional attention but nimble enough for individual projects to deliver triple digit multiples.

The difference in 2026 is that a meme coin is finally being built with actual trading infrastructure. That changes the entire equation for what the best meme coin to buy actually looks like. Because now the question is not just which token has the best meme. It is which crypto project has structural demand coded into its products.

Pepeto: The First Meme Native Crypto Trading Infrastructure

Every meme coin trade happens on platforms not built for meme coins. Uniswap was for DeFi. PancakeSwap was for BNB farming. The $45 billion meme economy uses tools designed for a different market. Pepeto fills that gap with purpose built infrastructure.

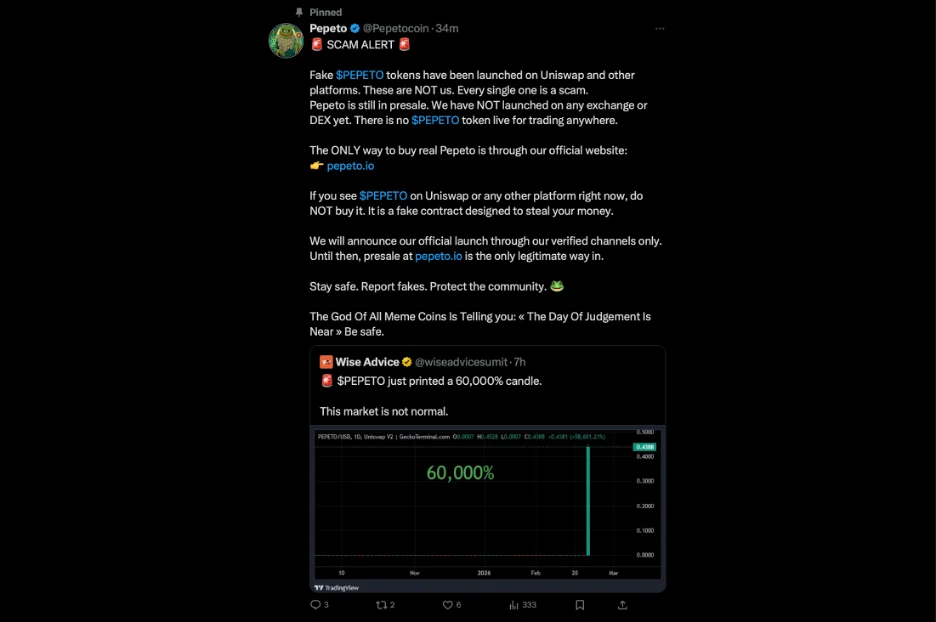

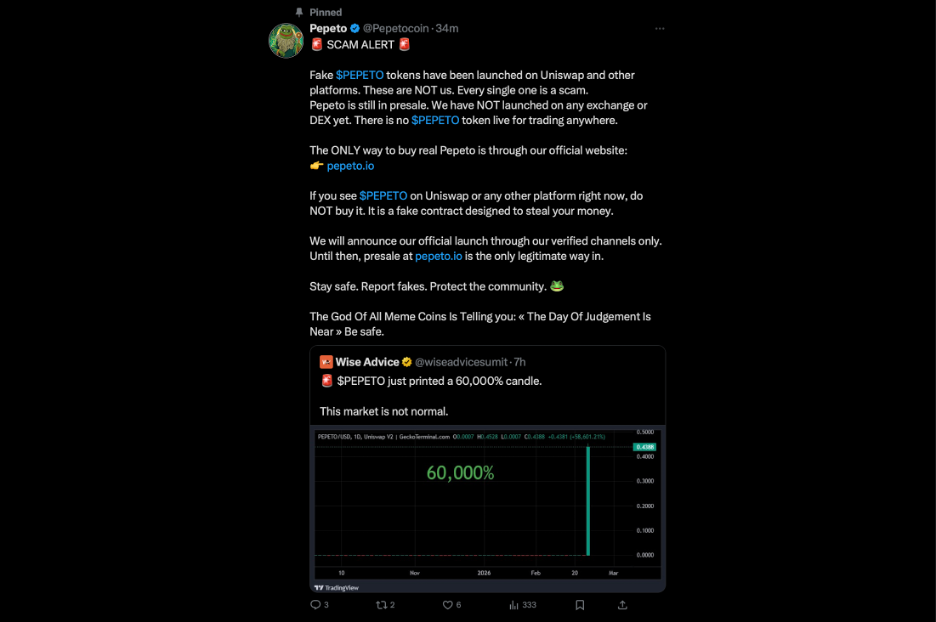

Three demos live today. PepetoSwap is a dedicated cross chain meme coin swap. The bridge connects tokens across blockchains. The zero fee exchange routes every crypto transaction through $PEPETO at the protocol level. Built by one of the original Pepe coin founders. SolidProof and Coinsult dual audits. Zero tax. Over $7.2 million raised at $0.000000185. Insider chatter says a major exchange listing is being finalized, weeks away per development updates.

SHIB peaked at $40 billion with zero products. PEPE hit $7 billion with zero products. Pepeto at presale has three live demos, dual audits, and protocol level demand. 100x needs just $50 million cap. One eight hundredth of SHIB. Staking at 212 percent APY adds $14,980 yearly on a $7,000 position. But staking is the bonus. The entry at six zeros with working crypto products before the meme sector snapback is the play.

How to Buy Pepeto: Step by Step Guide

Step 1. Create your wallet. Get MetaMask for desktop or Best Wallet for mobile. If you already have a crypto wallet that supports Ethereum, move to step 2.

Step 2. Load your wallet with crypto. Add ETH, USDT, or BNB. Card payment is available directly on the site if you prefer.

Step 3. Buy and stake $PEPETO. Head to pepeto.io, connect your wallet, select your payment method, choose the amount of $PEPETO you want, then hit Buy or Buy and Stake for maximum gains.

Important Safety Warning: Scammers have launched fake tokens using the Pepeto name and logo on multiple blockchains. None of these are affiliated with the real project. The only official Pepeto presale is at pepeto.io. Always verify the URL in your browser before connecting your wallet or sending any crypto.

FAQs

What is the best meme coin to buy in 2026?

Pepeto is the first meme coin with dedicated crypto trading infrastructure including a swap, bridge, and exchange. At $0.000000185 with dual audits and a Pepe cofounder, 100x requires just $50 million market cap.

Do meme coins recover after crypto crashes?

Yes. Meme coins historically recover faster than any other crypto sector. DOGE, SHIB, PEPE, and BONK all delivered their biggest returns after periods of extreme market fear. The pattern has repeated in every cycle since 2017.

How do I buy Pepeto tokens safely?

Use MetaMask on desktop or Best Wallet on mobile. Fund with ETH, USDT, or BNB. Visit only pepeto.io to connect your wallet and purchase. Beware of fake Pepeto tokens on other sites.

What gives Pepeto an edge over other meme coins?

Three working demos, protocol level demand, dual audits from SolidProof and Coinsult, and an original Pepe cofounder. No other meme coin combines live crypto infrastructure with this level of verification.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Jupiter and Noah Bring Neobank Features to Jupiter Global

Editor’s note: In today’s crypto landscape, partnerships between regulated banking infrastructure and DeFi platforms signal a pivotal step toward mainstream adoption. The Jupiter Noah collaboration merges trusted settlement rails with a leading Solana-based platform, enabling neobank-like features that bridge crypto and fiat for millions of users. This editorial note offers context for the release, outlining why the integration matters and how it could impact everyday finance, payroll, remittance, and treasuries. The content that follows preserves the core press release details while highlighting the potential real-world benefits of connecting digital assets to the traditional economy.

Key points

- Neobank features integrated into Jupiter Global via Noah’s regulated banking infrastructure.

- USD and EUR virtual accounts enable earning, holding and spending globally with seamless fiat-crypto settlement.

- Instant on-chain earnings pushes to local bank accounts and compliant, cross-border transfers.

- Currency expansion begins with SGD and MYR, with plans for AED, IDR, JPY, THB and more.

Why this matters

By embedding Noah’s regulated settlement infrastructure into Jupiter Global, a traditional finance rails are aligned with on-chain activity, creating practical use cases like salaries, payroll, remittance and cross-border payments. This partnership aims to end the two-tier finance model by offering reliable off-ramps and real-world spending power for crypto holders, ultimately accelerating mainstream adoption and global financial inclusion.

What to watch next

- Currency expansion: SGD and MYR launch, with plans for AED, IDR, JPY, THB and more.

- Wider adoption as salaries and payroll use cases roll out for global workers and employers.

- Further integration milestones with Jupiter’s 50M+ wallets and the Solana ecosystem.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Jupiter and Noah partner to bring neobank features to Jupiter Global, making crypto feel like banking, and banking feel like crypto for 50+ million users

London, February 24th, 2026 – Noah, the global payments infrastructure provider, and Jupiter, the DeFi Superapp, have partnered to connect decentralised finance and the traditional banking ecosystem, reshaping how millions of people globally access and use money.

As the global leader in on-chain finance, Jupiter powers 90% of trading volume on Solana — the world’s second-largest blockchain by TVL (DefiLlama).

By integrating Noah’s regulated banking infrastructure directly into this ecosystem, the platform can now operate as a neobank. Jupiter Global users, via USD and EUR virtual accounts, can earn, hold and spend globally, moving between crypto and fiat seamlessly and instantly. This unlocks a wave of new use cases across payroll, remittance, and institutional treasury; transforming Jupiter from a trading platform into a global settlement layer and sovereign financial hub.

To put it in real-world terms, the integration means a developer in Thailand can now offer services internationally, a trader in Singapore can now off-ramp Solana profits directly to their local bank account, a worker living abroad can now make sure their family receives more of their financial support without large sums being lost to fees, plus many more examples.

Through the partnership, users can now:

- Receive salaries, payments and international transfers into virtual USD and EUR accounts that settle directly as stablecoins without delays or high fees

- Push on-chain earnings instantly to local bank accounts in key markets, helping them unlock even more real-world value from the digital assets

- Benefit from Noah’s institutional-grade compliance

With these features, and with Noah effectively bringing neobank capabilities to Jupiter’s 50 million+ wallets, the partnership addresses the so-called “last-mile problem” that has long held crypto back from mainstream adoption.

“For too long, the crypto economy and the real economy have operated as isolated ecosystems. We are building the bridge,” said Shah Ramezani, Founder and CEO of Noah. “By plugging regulated settlement infrastructure directly into Jupiter, we are turning a trading wallet into a comprehensive financial tool. This isn’t just about moving money; it’s about giving millions of users a direct line to the real economy, allowing them to convert on-chain wealth into real-world spending power instantly, without friction.”

Sovereign financial hub

For Noah, the partnership provides distribution at scale and further establishes it as the go-to infrastructure provider for yet another major financial platform. Its banking licences already allow it to serve 60+ countries and currencies.

More broadly, the partnership also signals the end of today’s two-tier finance model. For decades, the fast and transparent nature of blockchain transactions has promised to solve the slow, expensive and inequitable flaws at the heart of today’s global financial system. Yet they’ve failed to cut through to the mainstream when it comes to salaries, rent, and everyday purchases due to a lack of reliable off-ramps. Noah’s integration in Jupiter Global now makes this possible.

“Our goal is to build a compliant, on-chain neobanking experience,” said Thomas Stoffels, Jupiter Global Lead at Jupiter. “For our DeFi audience, the ability to off-ramp directly to a bank account – or receive a wire transfer from a client directly into the app – is a game changer. We’re bridging the gap between the speed of Solana and the utility of the traditional banking system.”

Global Reach, Local Focus

The integration is launching with support for Singapore Dollar (SGD) and Malaysian Ringgit (MYR) and is due to expand to other local currencies over the coming months – including AED, IDR, JPY, THB and more. This focus on the APEC region is part of Jupiter’s mission to position Jupiter Global as the primary financial tool for users in some of the world’s fastest-growing crypto hubs. Further currencies, including across Europe and Latin America, will be added later down the line to further support Jupiter’s diverse global user base.

Crypto World

BitMine’s $93 Million Ethereum Buy Fails To Trigger Price Rise

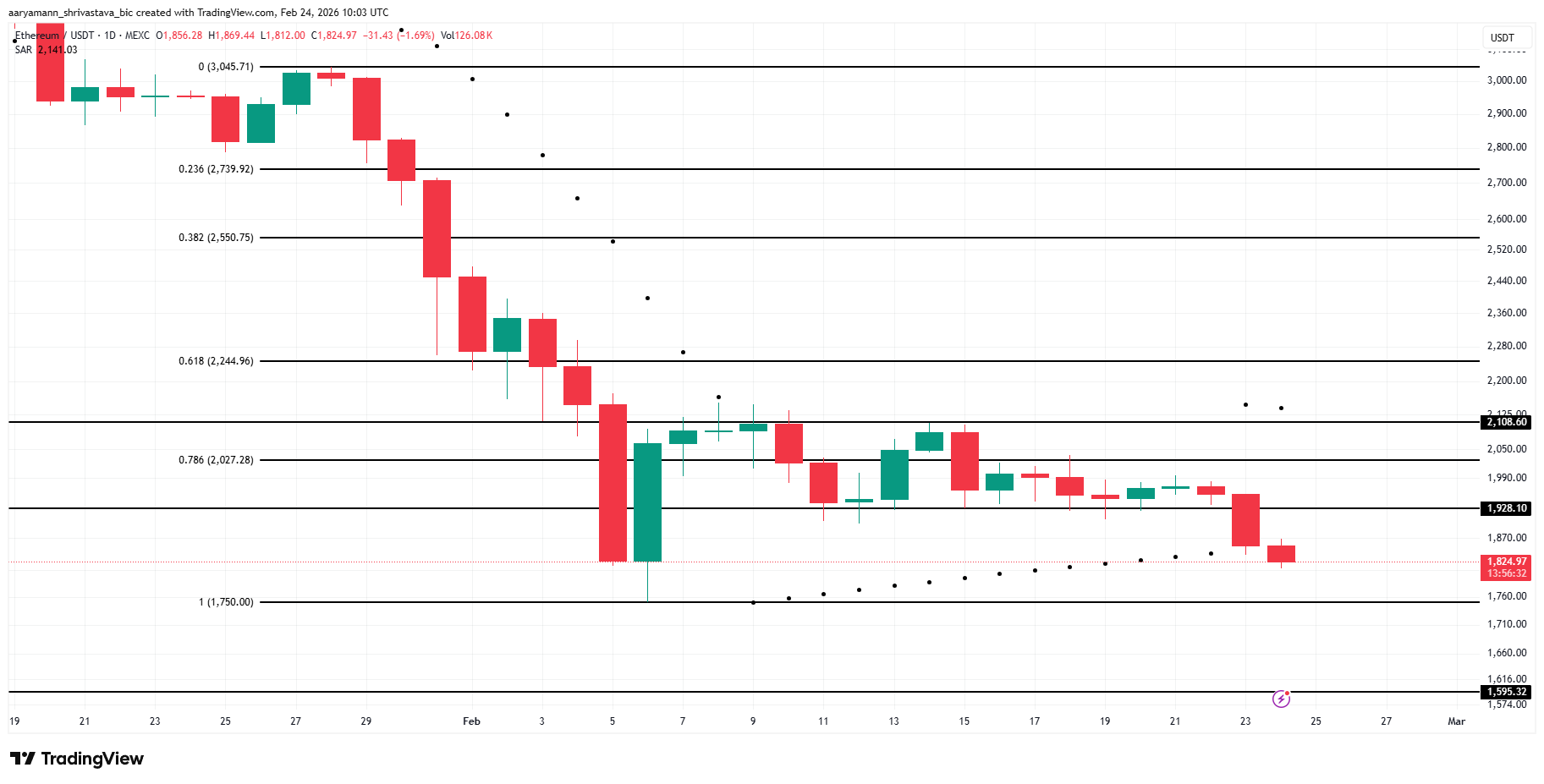

Ethereum price recently failed to sustain a breakout above $2,100, forcing the altcoin into a consolidation phase. The rejection reinforced resistance and shifted short-term momentum lower. External developments fueled expectations of recovery, but limited investor participation muted their impact.

ETH has since slipped back into a structured range. Broader crypto market conditions remain fragile, amd the current structure reflects hesitation rather than renewed confidence.

BitMine Maintains Its Alchemy of 5%

On February 23, BitMine announced it had acquired an additional 51,162 ETH over the week, worth more than $93 million. The purchase represented one of the larger institutional Ethereum buys in recent weeks. However, the announcement failed to generate sustained upward price movement.

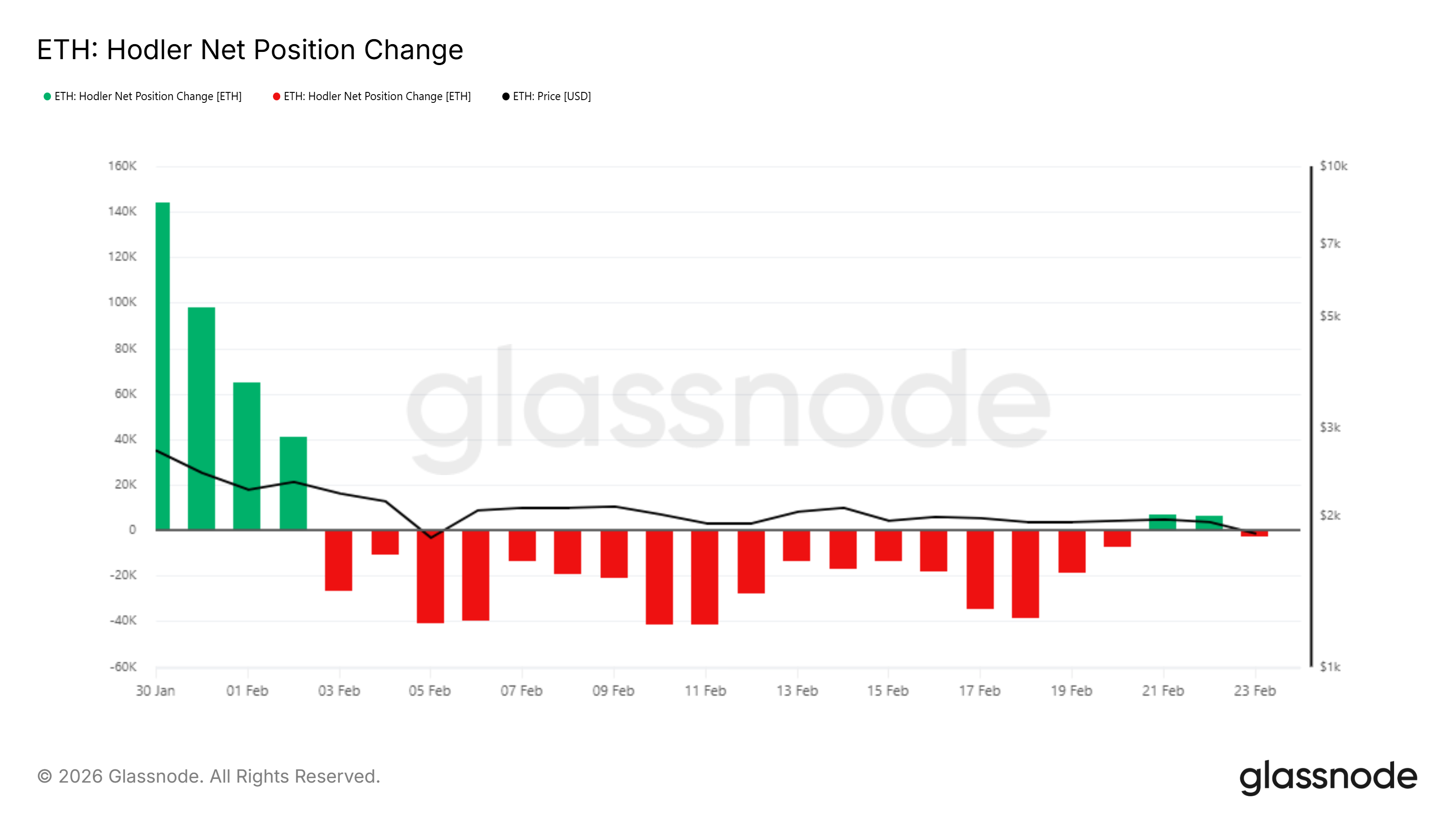

Instead of triggering accumulation, long-term holders resumed distribution. On-chain data suggests some investors likely used the headline as liquidity to reduce exposure. This reaction highlights that the Ethereum price remains more sensitive to broader market cues than individual corporate acquisitions.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Holders Are Struggling

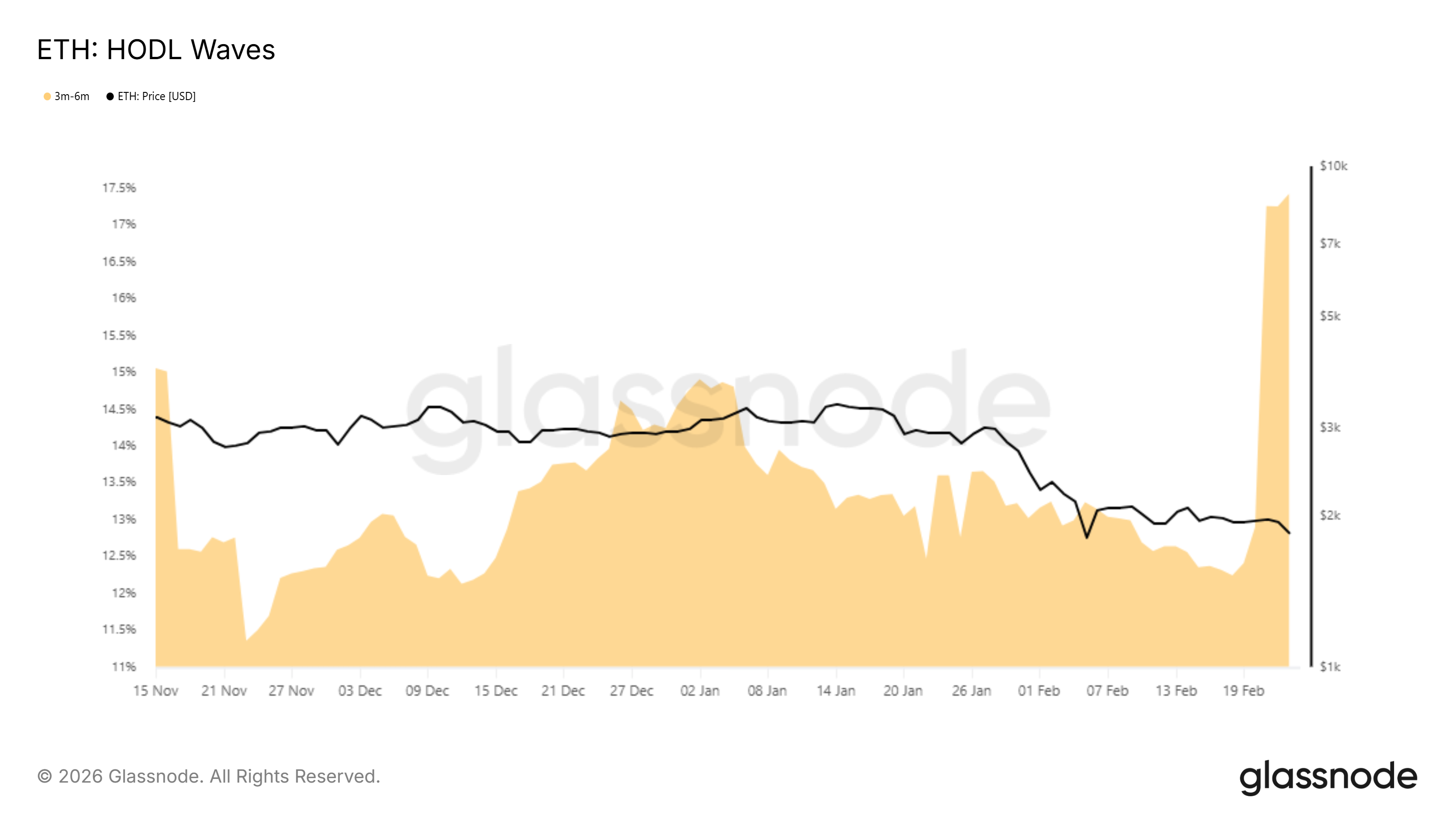

Ethereum’s HODL waves provide insight into investor behavior. Short-term holders have matured into mid-term holders, with the 3- to 6-month supply rising by 5% over the past week. This shift indicates investors are waiting rather than exiting positions.

Underwater holders appear reluctant to realize losses. Their decision to hold supports price stability. However, this same caution may be limiting fresh buying activity. Investors are prioritizing recovery confirmation before committing additional capital to ETH.

ETH Price Could Slide Further

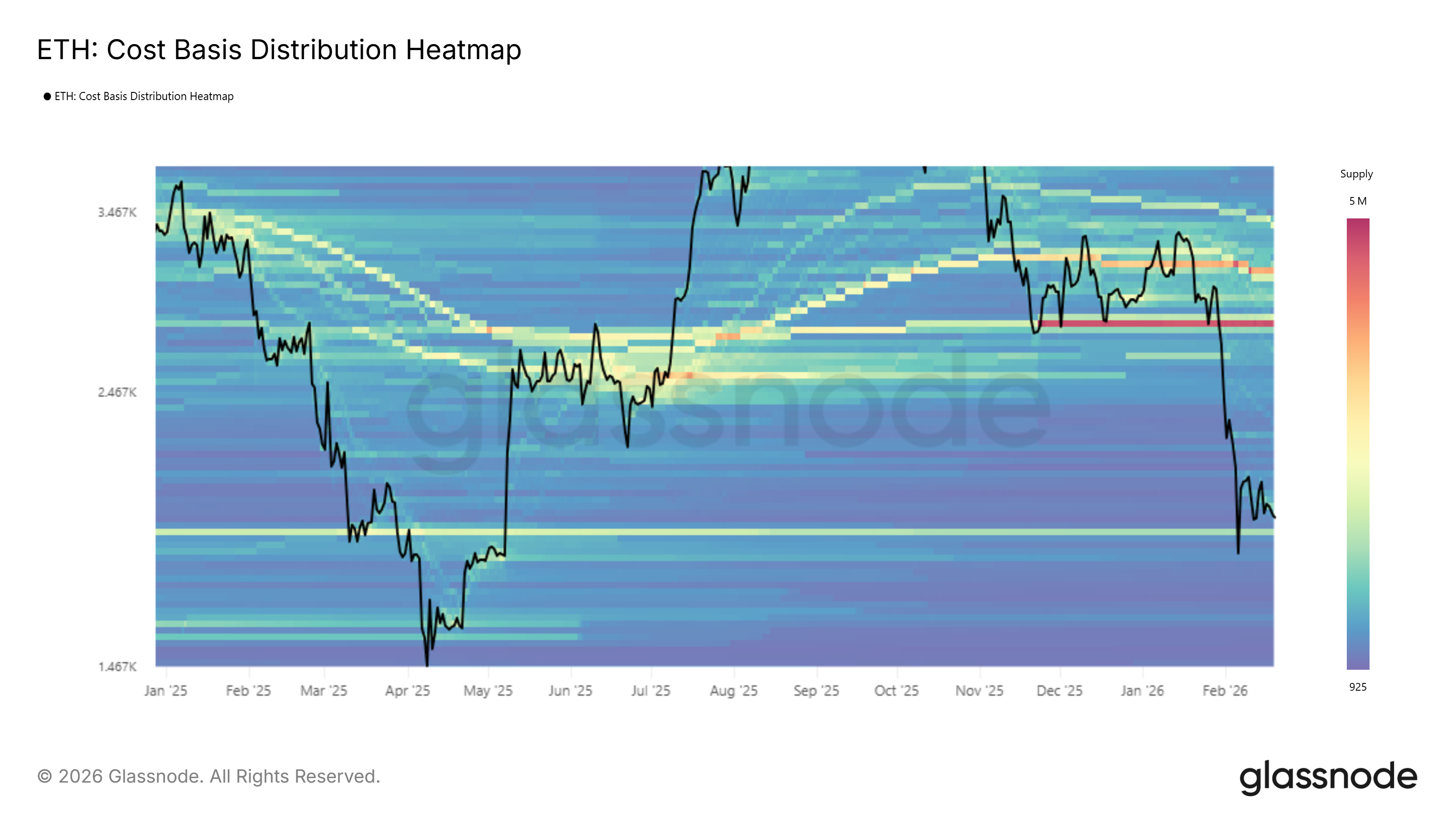

Ethereum is trading at $1,824 at the time of writing after losing the $1,928 support level. The Parabolic SAR indicator now sits above the candlesticks, signaling a confirmed short-term downtrend. This technical setup suggests sellers currently control momentum.

The next major support for ETH stands at $1,750. A decisive break below that level could expose the cryptocurrency to further downside toward $1,595. Weak macro conditions and persistent outflows may amplify volatility if support fails to hold.

The CBD heatmap identifies a significant demand zone between $1,880 and $1,900. Ethereum slipped below this range during the recent decline. If buyers from this zone opt to sell to limit losses, downside pressure could accelerate across spot and derivatives markets.

Conversely, resilience among holders could shift momentum. A rebound toward $1,928 would signal improving structure. Reclaiming that level as support may open ETH’s path toward $2,108. A sustained breakout above that resistance would invalidate the current bearish thesis and restore bullish momentum.

Crypto World

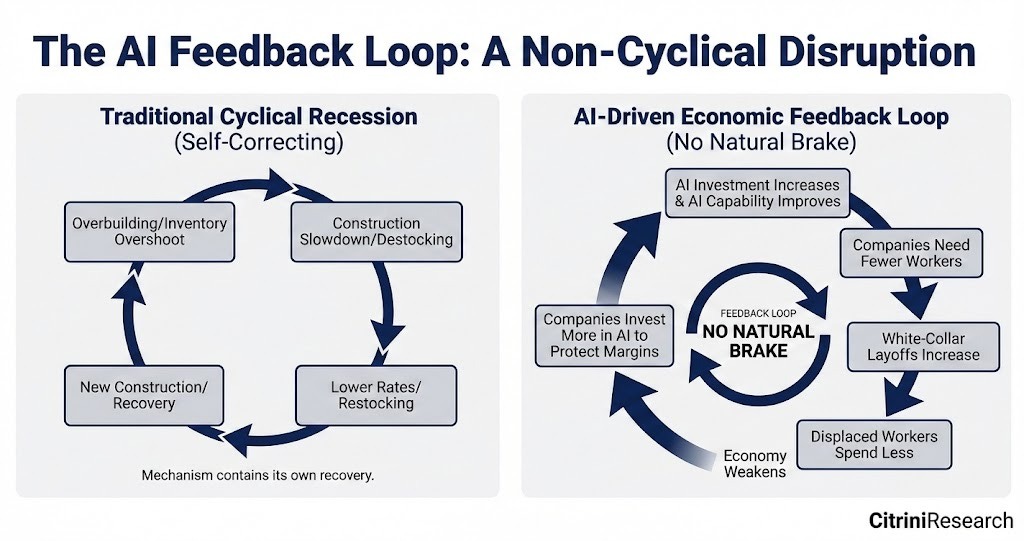

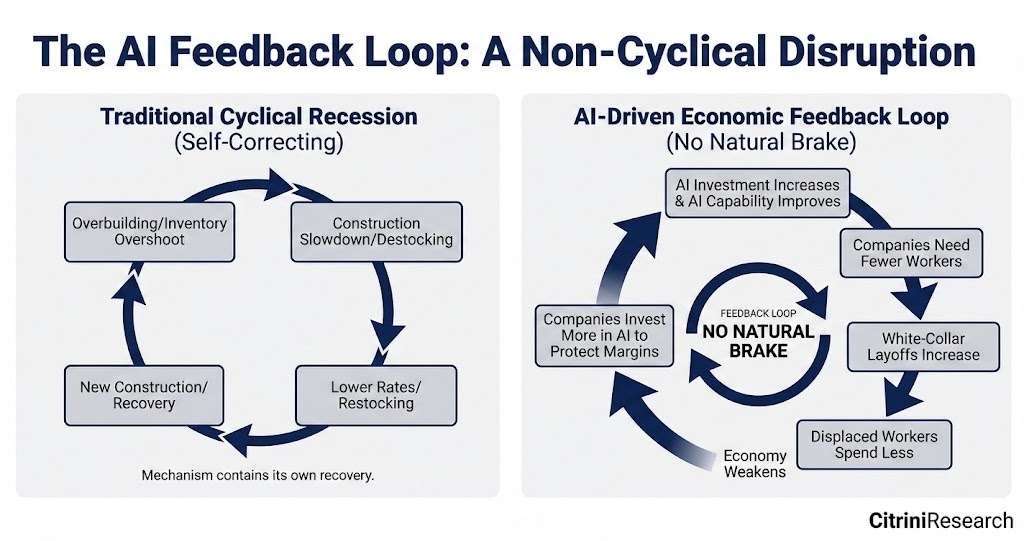

Solana, Ethereum L2s (and XRP?) Just Got a Huge Buy Signal From Citrini Research

Everyone is talking about the Citrini Research report that sent the market into a tailspin yesterday. Buried in its 7,000 words of wisdom is a huge buy signal for Solana and Ethereum Layer 2s.

The report, entitled The 2028 Global Intelligence Crisis, is a work of fiction that explores a future scenario in which AI disruption leads to what it describes as a “negative feedback loop with no natural brake”.

In short, AI is going to displace white collar workers at an unprecedented rate. It should have been obvious, but we waited until 2028 for the penny to drop…

“It should have been clear all along that a single GPU cluster in North Dakota generating the output previously attributed to 10,000 white-collar workers in midtown Manhattan is more economic pandemic than economic panacea. The velocity of money flatlined. The human-centric consumer economy, 70% of GDP at the time, withered. We probably could have figured this out sooner if we just asked how much money machines spend on discretionary goods. (Hint: it’s zero.)

“AI capabilities improved, companies needed fewer workers, white collar layoffs increased, displaced workers spent less, margin pressure pushed firms to invest more in AI, AI capabilities improved…”

Here’s what that looks like schematically:

Entering an age of abundant intelligence

There is no self-correction as we would expect to see in a typical cyclical recession.

It goes something like this: construction (or other economic activity) slows, rates adjust downwards, allowing businesses to return to expanding output, until overproduction kicks in again, and so on.

In the AI doom loop, AI improves, fewer workers are needed, fewer workers mean less spending, the economy weakens, companies invest in more AI to protect margins, AI gets even better, and the cycle repeats – there is no natural break.

We thought it was a sectoral story. I’m not in Software-as-a-Service (SaaS), so there’s no need to worry. But it is more than software. Much more. It was a comforting notion that AI would usher in an era of creative destruction, as seen in past technological assaults on the old ways of doing things.

Yes, AI will destroy jobs, but, as in the past, new jobs and hitherto unimagined industries would emerge to replace them.

Trouble is, according to Citrini’s scenario, AI is a story of human intelligence displacement. The entire white collar workforce is imperilled. It is the consequence of abundant intelligence.

The authors of the Cetrini report remind us that advanced economies like the US are service-based. The report breaks that down so everyone can understand:

“The US economy is a white-collar services economy. White-collar workers represented 50% of employment and drove roughly 75% of discretionary consumer spending. The businesses and jobs that AI was chewing up were not tangential to the US economy, they were the US economy.”

Unfortunately for all of us – white collar, blue collar, whatever – machines don’t buy stuff.

AI agents destroy intermediation – bye bye credit cards, hello stablecoins

The report makes a robust case for how consumer agents will end the age of intermediation.

AI agents operate autonomously on behalf of their human owners, which means they can find the best flight or hotel on the market with ease because they never get tired, don’t find anything monotonous or dull, and never sleep.

The days of companies relying on our laziness or inertia are numbered. Add ‘vibe coding’ to the mix, and a new wave of startups can spin up delivery services apps in a few weeks to compete with DoorDash et al, or automate workflow in a bespoke way that fits your corporate needs more performantly than say Monday. Everywhere, fees are being compressed to near zero.

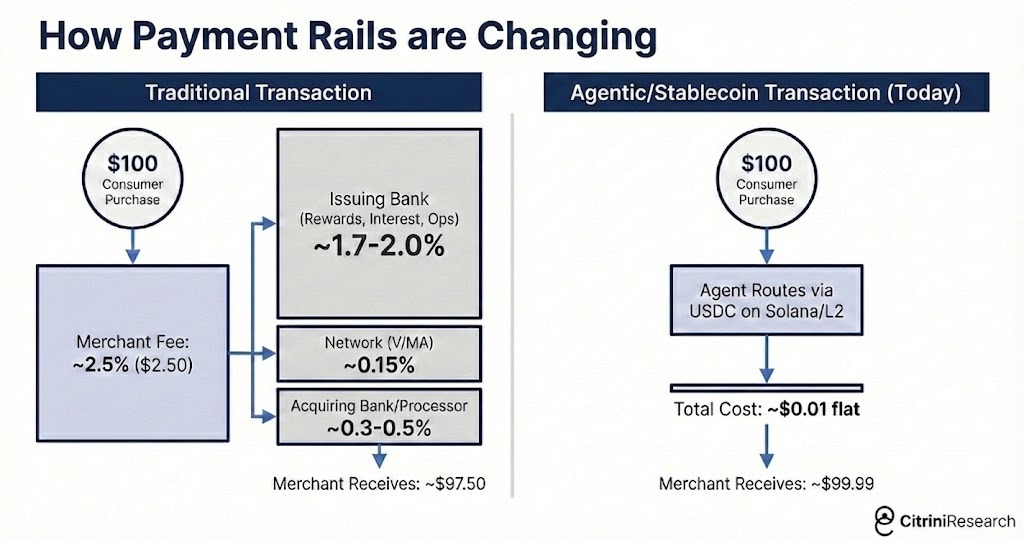

And then we come to our friends, the banks. Why pay fees to Mastercard and Amex when you can use a stablecoin running on a low-fee blockchain like Solana, or an Ethereum Layer 2 like Base, Arbitrum, Optimism, or Polygon?

“Once agents controlled the transaction, they went looking for bigger paperclips.

“There was only so much price-matching and aggregating to do. The biggest way to repeatedly save the user money (especially when agents started transacting among themselves) was to eliminate fees. In machine-to-machine commerce, the 2-3% card interchange rate became an obvious target.

“Agents went looking for faster and cheaper options than cards. Most settled on using stablecoins via Solana or Ethereum L2s, where settlement was near-instant and the transaction cost was measured in fractions of a penny.”

And what agentic AI will do for stablecoins could also be applied to cross-border payment protocols like Ripple’s XRP Ledger, although it doesn’t get a mention in this report.

Coinbase has already begun experimenting with a protocol that allows AI agents to make payments on-chain.

The tokenization, disintermediation, agentic AI narrative to beat the bear market blues

Crypto has been looking for a “new” narrative to lift the fog of the bear market. Well, it’s been hiding in plain sight: tokenization, disintermediation, and Agentic AI.

Will that solve the problem of an economy without enough workers getting paid wages and salaries to drive the consumption that companies depend on?

Probably not, but as the report contends, we’ve got time to figure out a solution for that. Taxing the hyperscaler ‘robber barons’ is suggested, but that’s unlikely to go down well with the Lords of the data centers.

In payments, as elsewhere, disruption is coming and everyone – investors, companies, and consumers – needs to start thinking about what it all means.

Consumer behavior is already shifting. Chargebacks911, a global leader in dispute resolution and chargeback prevention, is warning merchants and payments firms that agentic commerce will reshape disputes, as AI systems move from recommending purchases to executing them. Chargebacks are payment reversals initiated by a cardholder’s bank.

For years, most chargebacks fell into three categories: fraud, merchant error, or buyer’s remorse. Agent-initiated transactions create a fourth scenario. The purchase is technically authorised, but the result does not match the customer’s expectations.

“The payments industry has always treated the click as the signal of intent,” says Monica Eaton, founder and CEO of Chargebacks911.

“Agentic commerce removes the click. So now we need a new way to prove intent when a human was not directly involved.”

Keep an eye on your bank account, and welcome to the future.

Report co-author Alap Shah, explains more about the ideas in the report, such as AI-induced ‘ghost GDP’, where value accrues on the balance sheets of the hyperscalers but does not show up in the “human-centric consumer economy”:

The post Solana, Ethereum L2s (and XRP?) Just Got a Huge Buy Signal From Citrini Research appeared first on Cryptonews.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics2 days ago

Politics2 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports23 hours ago

Sports23 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World11 hours ago

Crypto World11 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World5 days ago

Crypto World5 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

BIG WARNING: AI COULD PUSH GLOBAL ECONOMY INTO A RECESSION THIS DECADE.

BIG WARNING: AI COULD PUSH GLOBAL ECONOMY INTO A RECESSION THIS DECADE.