Crypto World

Monad (MON) price slips after profit-taking as traders eye $0.030 resistance

- Monad price moved within the $0.020 and $0.23 range on Tuesday.

- The layer 1 project eyes traction as $100 million in private credit becomes verifiable on-chain.

- MON price could retest resistance at $0.030.

Monad’s native token, MON, was trading near $0.021 after falling about 7% over the past 24 hours.

Data from CoinMarketCap showed the decline followed renewed profit-taking after prices revisited the $0.025 level.

Continued weakness in Bitcoin and other major altcoins could add further pressure on MON in the near term.

However, some analysts see potential for a rebound as Monad positions itself as a platform for institutional-grade decentralised finance.

Recent developments include a network milestone that enables $100 million in private credit to be fully verifiable on-chain, as well as leadership changes at the Monad Foundation, which have renewed interest in the project’s longer-term prospects.

Monad’s growth amid Valos $100 million private credit launch

Monad’s public mainnet went live in November 2025, with the team unveiling a token sale on Coinbase.

In the few months since, the L1 project has seen nearly $480 million in stablecoin market cap, and DeFiLlama shows total value locked (TVL) currently sits at over $250 million.

Growth along these metrics suggests the native MON token could benefit as adoption ramps up.

On Tuesday, Valos announced the launch of a $100 million private‑credit vault on Accountable’s Yield App.

Notably, the private credit is now fully verifiable on‑chain via Monad. On-chain private credit effectively bridges traditional finance and DeFi, adding to adoption potential.

In parallel, the Monad Foundation has strengthened its institutional‑facing leadership by appointing three senior executives.

Urvit Goel joins from the Optimism Foundation as VP of go-to market, Joanita Titan assumes the role of head of institutional growth from FalconX, and Sagar Sarbhai, formerly of BVNK, is the new head of institutions for Asia‑Pacific.

The hires target institutional investors of the L1, which in turn could support higher demand for MON within an expanding ecosystem.

Monad price forecast

At the time of writing, MON trades in the $0.020-$0.023 range, with daily trading volume down 30% to suggest seller dominance is waning.

From a short‑term perspective, protocol adoption and shifts in macro conditions could help bulls hold $0.020 as they target a breakout to $0.030.

This outlook has been helped by the bounce from all-time lows of $0.016 in early February.

If momentum flips bullish, the all-time high near $0.05 will be a fresh short-term target.

On the downside, negative sentiment around new layer 1 tokens could scuttle bulls’ ambitions.

That outlook has hindered ZetaChain, Berachain, and Aster in recent weeks. Monad’s token could thus revisit lows of $0.016-$0.010 as support levels.

Crypto World

Nakamoto Eyes $107M All-Stock Buy: BTC Inc, UTXO

Nakamoto, the Bitcoin (CRYPTO: BTC) treasury company formerly known as KindlyMD, has signed definitive agreements to acquire BTC Inc and UTXO Management GP, advancing its plan to build a Bitcoin-native operating company. The move consolidates media, events and capital allocation under a single public vehicle as the company pivots away from its prior healthcare focus. The arrangement underscores a broader push to formalize Bitcoin-centric businesses within a listed framework, linking media properties, advisory services and asset management under one umbrella.

Key takeaways

- The all-stock deal values the acquisition at roughly $107.3 million, calculated from a fixed $1.12 per share under Nakamoto’s call-option framework combined with Friday’s close around $0.2951.

- BTC Inc and UTXO Management GP shareholders will receive 363,589,816 shares of Nakamoto common stock on a fully diluted basis, diluting existing holders given the price disparity with the current trading level.

- The transaction leverages a Marketing Services Agreement that granted Nakamoto a right to acquire BTC Inc, which itself owned a call option to acquire UTXO, tying three entities together through a stock-based consideration.

- Nakamoto’s balance sheet currently includes 5,398 BTC, a figure that places it ahead of several other public Bitcoin treasury holders and aligns with its expanded treasury strategy long in the works.

- The deal follows a broader Bitcoin treasury pivot, built on the idea that media, advisory and asset-management services can be bundled under a public company dedicated to Bitcoin, even as the broader market faces volatility and downcycles.

Tickers mentioned: $BTC, $NAKA

Sentiment: Neutral

Price impact: Negative. The stock traded lower after the announcement as dilution concerns weighed on investors.

Market context: The deal arrives amid a testing phase for corporate treasury strategies in crypto markets. Bitcoin’s price has experienced a steep swing in recent quarters, with the asset retreating from previous peaks and testing investor appetite for Bitcoin-focused corporate moves. The broader market environment has underscored the tension between ambitious, asset-backed business plans and the need for actionable, near-term value delivery to shareholders.

Why it matters

The proposed acquisition acts as a strategic centripetal force for Nakamoto’s ambitions to create a Bitcoin-native operating ecosystem. By bringing BTC Inc, known for Bitcoin Magazine and The Bitcoin Conference, together with UTXO Management GP, which provides advisory services and connections to Bitcoin-focused capital, Nakamoto aims to streamline the decision-making and capital allocation process around Bitcoin. This consolidation could shorten the path from media coverage and thought leadership to real-world investment and capital deployment in the Bitcoin space.

From a portfolio perspective, Nakamoto’s 5,398 BTC on its balance sheet places the company among the more substantial publicly disclosed Bitcoin treasuries. The tally is frequently cited by market trackers such as BitcoinTreasuries.NET, which catalogs corporate bitcoin holdings and related disclosures. The combination of media influence, conference branding and asset-management capabilities under one roof positions Nakamoto to influence both public perception and practical investment flows around Bitcoin. The move follows a broader industry pattern where companies seek to align communications, investor relations and treasury management under a single corporate entity to maximize efficiency and visibility.

The background of the deal is also noteworthy: Nakamoto rebranded from KindlyMD after facing headwinds in its healthcare business, including a subpar share price performance that spurred a strategic repositioning toward Bitcoin. This pivot — from healthcare services to a Bitcoin-focused treasury and media strategy — illustrates how public markets reward clear alignment between asset exposure and governance, as well as a coherent long-term plan for capital allocation in an asset class that remains highly cyclical and sensitive to macro shifts.

In the context of the crypto downturn, where Bitcoin’s price has declined from peaks observed during the previous cycle, investors are closely watching how treasury-centric models can sustain growth and deliver cash flow in a public market setting. As Cointelegraph and other outlets have reported, treasury adoption and the formation of Bitcoin-focused public vehicles have faced pressure during periods of downturn, making the current deal a critical test case for the viability of a diversified, Bitcoin-centric public platform.

Related coverage has highlighted the interplay between Bitcoin media, events and investment vehicles as a potential accelerator for mainstream adoption, even as the sector contends with volatility and evolving regulatory scrutiny. The current transaction, with its all-stock consideration and fixed-price framework, emphasizes a willingness to prize strategic alignment and long-term value creation over near-term share-price parity.

What to watch next

- Regulatory approvals and closing conditions for the acquisition of BTC Inc and UTXO Management GP, including any required shareholder votes.

- Completion of the stock issuance: timing, share registrations and any subsequent adjustments to the fully diluted share count.

- Performance of BTC Inc and UTXO assets under Nakamoto’s ownership, especially how BTC Inc’s media assets (Bitcoin Magazine) and conference operations scale within the public vehicle.

- Monitoring Nakamoto’s treasury strategy as new corporate cash flows emerge from the consolidated platform and whether additional acquisitions or partnerships follow.

Sources & verification

- Nakamoto Holdings announces definitive agreements to acquire BTC Inc and UTXO Management GP, with details of the all-stock consideration and call-option framework.

- The Marketing Services Agreement (MSA) underlying the call option and acquisition structure, including the right to acquire BTC Inc and its implications for the deal’s valuation.

- Nakamoto’s disclosed Bitcoin holdings (5,398 BTC) and the company’s public market status on Nasdaq under NAKA, as reflected in industry trackers and the company’s filings.

- Bitcoin Inc’s role as the parent entity for Bitcoin Magazine and organizer of The Bitcoin Conference, and UTXO’s advisory relationship with 210k Capital.

- BitcoinTreasuries.NET and publicly accessible market data pages showing Nakamoto’s position relative to other public Bitcoin treasury holders and the company’s market capitalization trends.

Key figures and next steps

Nakamoto broadens Bitcoin treasury play with all-stock acquisitions

Nakamoto’s latest pivot marks a concerted effort to transform a niche treasury strategy into a scalable, publicly traded platform. By acquiring BTC Inc, which operates Bitcoin Magazine and The Bitcoin Conference, and UTXO Management GP, which provides Bitcoin-focused advisory services, the company is positioning itself as a one-stop shop for Bitcoin media, events, strategy and asset management. The stock-based consideration, fixed at $1.12 per share, is substantial relative to the current trading price, underscoring a willingness to accept significant dilution to accelerate the consolidation of these assets under a single corporate umbrella. The resulting combined entity would have a diversified revenue stream spanning media properties, event-driven revenue and Bitcoin advisory and asset services, all tethered to the performance of the Bitcoin ecosystem itself. The size of the consideration — 363,589,816 shares on a fully diluted basis — reflects both the ambition of the deal and the complexity inherent in cross-entity stock swaps tied to a volatile asset class.

From a governance perspective, the transaction hinges on a stock-for-assets approach that aligns incentives with Nakamoto’s long-term growth strategy. The fact that Nakamoto’s stock trades on Nasdaq under NAKA, with a market capitalization around a few hundred million dollars, adds pressure to deliver tangible upside for investors beyond mere consolidation. The market’s initial reaction appeared negative, as indicated by a post-announcement decline in Nakamoto’s share price, a typical response when large pools of new shares enter the float. Yet the strategic logic remains: a public vehicle that can coordinate Bitcoin media reach, capital-formation activities and wallet-level treasury strategies may unlock synergies that are not as easily realized through standalone entities.

Historically, Nakamoto’s Bitcoin holdings have been a cornerstone of its narrative. With 5,398 BTC on its balance sheet, the company sits ahead of several peers in the public-treasury space, positioning it as a reference point for others evaluating whether to scale similar approaches. The integration of BTC Inc’s media empire and UTXO’s advisory reach could deepen liquidity for Bitcoin-focused assets and accelerate capital allocation to Bitcoin-related ventures, potentially smoothing the path for new fundraising or strategic partnerships.

As this process unfolds, observers will watch how the combined entity manages governance, treasury allocation, and the delivery of near-term earnings or cash flows that can validate the business model. The deal’s all-stock structure implies a forecast of growth fueled by equity rather than immediate cash, a choice that emphasizes confidence in long-run value creation but also invites closer scrutiny of dilution effects and ongoing capital discipline.

In summary, the acquisition represents a deliberate bet on the breadth of the Bitcoin ecosystem — media influence, conference-driven engagement, and advisory and asset-management services — converging in a single public platform. If executed thoughtfully, the new entity could become a template for how Bitcoin-centric businesses scale within public markets while maintaining alignment with the asset’s core network and community dynamics. The coming quarters will reveal whether the expected synergies translate into sustained shareholder value as Bitcoin’s market cycles continue to shape corporate strategy in this evolving sector.

Crypto World

MYX Oversold for the First Time

MYX Finance has entered a critical phase after weeks of intense selling pressure. The token has suffered a steep decline amid broader bearish crypto market conditions.

Heavy profit-taking and forced exits accelerated the fall. MYX has now become a focal point of concern among traders

Sponsored

Sponsored

MYX Finance Token Forms History

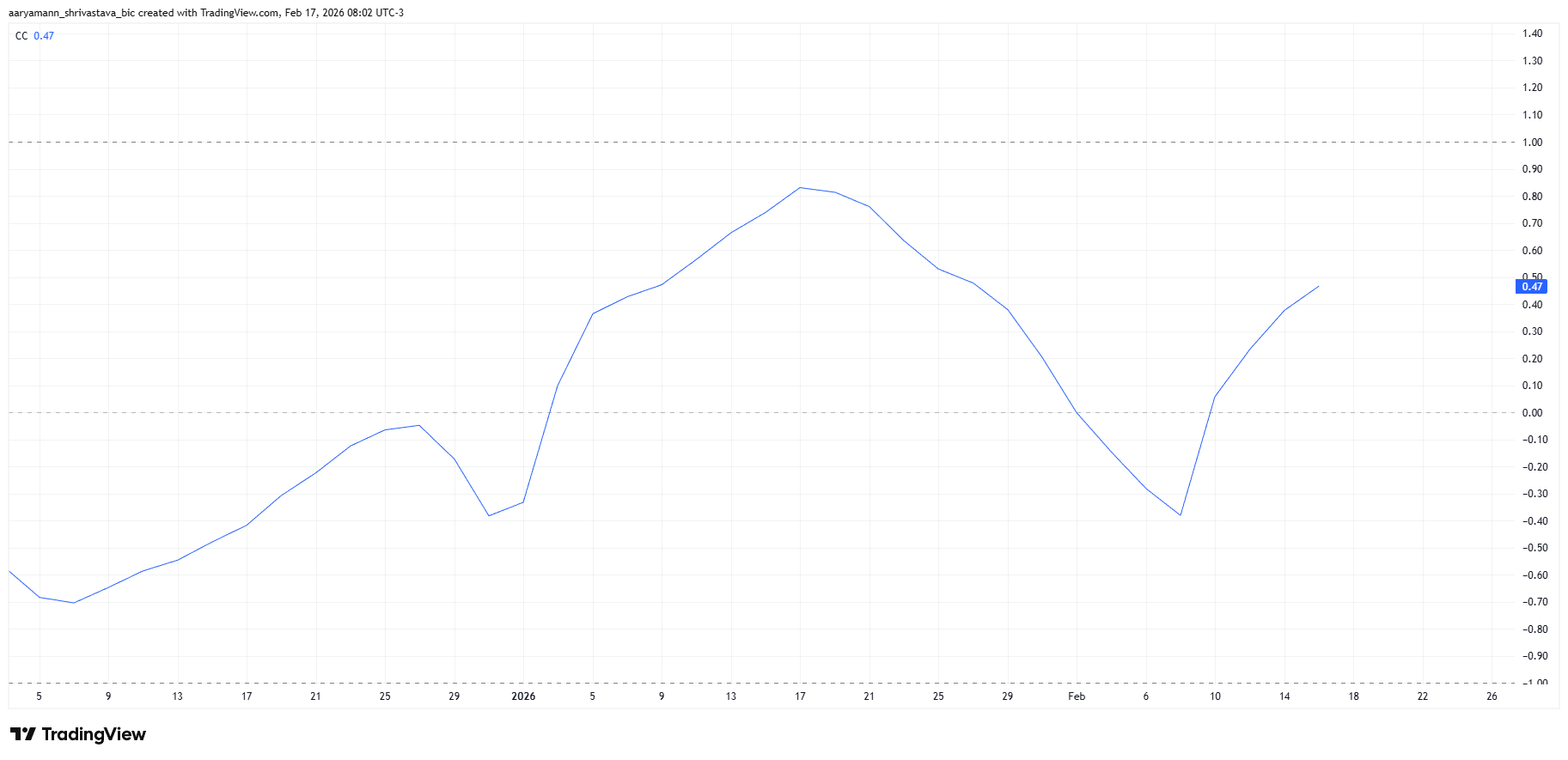

MYX’s correlation with Bitcoin has shifted sharply since February 8. The coefficient improved from negative 0.42 to positive 0.47. This change indicates that MYX is increasingly tracking Bitcoin’s price movements.

However, this alignment presents risk. Since February 8, Bitcoin has remained in consolidation without meaningful recovery. A stronger positive correlation suggests MYX may continue mirroring Bitcoin’s weakness. Without a BTC breakout, bearish conditions could persist for MYX.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Money Flow Index highlights the intensity of recent selling. The indicator shows severe capital outflows as investors rushed to exit positions. Panic selling, combined with leveraged liquidations, intensified downward pressure.

Sponsored

Sponsored

This wave of capitulation has pushed MYX into oversold territory for the first time in its trading history. Typically, oversold conditions suggest selling may slow as value-focused buyers step in. In many cases, such readings precede short-term relief rallies.

However, context matters. Oversold signals alone do not guarantee immediate recovery. Broader market weakness and fragile sentiment could delay accumulation. If Bitcoin fails to stabilize, MYX may struggle to attract fresh capital despite extreme technical readings.

MYX Price Bounce Back Unlikely

MYX price is down nearly 30% in the past 24 hours. The token trades at $1.50 at the time of writing. This sharp drop compounds a 70% decline recorded since February 8, reinforcing the scale of the correction.

Current technical and macro signals suggest further downside risk. Continued correlation with Bitcoin and persistent outflows could pressure MYX lower. A retest of the $1.22 level appears plausible before oversold conditions trigger meaningful stabilization.

Conversely, investor behavior could shift sooner than expected. If holders halt selling and begin accumulating at discounted levels, momentum may change. Reclaiming the $1.68 support level would mark an early recovery signal. A confirmed bounce could open MYX price’s path toward $2.01 and potentially higher, invalidating the prevailing bearish outlook.

Crypto World

Stripe-Owned Bridge Gets OCC Conditional Approval for Bank Charter

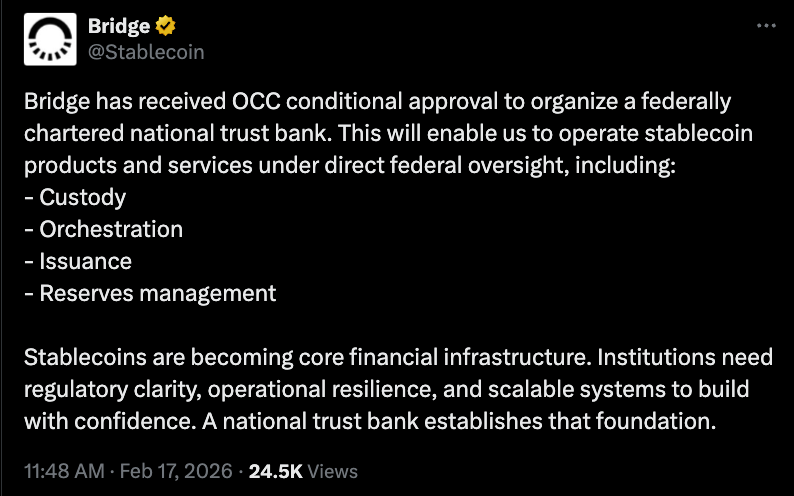

Stablecoin platform Bridge, owned by the payments processor Stripe, said it had received conditional approval to operate as a federally chartered national trust bank under the US Office of the Comptroller of the Currency (OCC).

In a Tuesday notice, Bridge said it had received conditional approval from the banking regulator, allowing the company to “operate stablecoin products and services under direct federal oversight” once fully approved. Bridge said the charter would allow it to offer custody of digital assets, issue stablecoins and manage stablecoin reserves.

“Our compliance framework already positions Bridge to be GENIUS ready,” said the company, referring to the stablecoin bill signed into law in July 2025. “Now achieving a national trust bank charter will provide our customers the regulatory backbone they need to build with stablecoins confidently and at scale.”

Bridge is one of several crypto-aligned companies seeking a national trust bank charter from the OCC following the passage of the GENIUS Act. In December, the agency conditionally approved applications from BitGo, Fidelity Digital Assets and Paxos to convert their respective state-level trust companies, and conditionally approved Circle and Ripple for national trust bank charters.

Related: Bankers push OCC to slow crypto trust charters until GENIUS rules clarified

According to OCC records, Bridge applied for a bank charter in October and was given approval on Feb. 12. Stripe acquired the platform in 2025 as part of a $1.1 billion deal for the company to support stablecoin payments.

In a Wednesday letter, the American Bankers Association (ABA) urged the OCC to slow its approval of crypto companies for national bank trust charters, saying rules under the GENIUS Act were still unclear. According to the banking group, companies could use national trust charters to essentially bypass oversight by US financial regulators.

“[…] ABA strongly encourages OCC to be patient, not measure its application decisioning progress against traditional timelines, and allow each charter applicant’s regulatory responsibilities to come fully into view before moving a charter application forward,” said the letter.

US policymakers still considering how to handle stablecoin rewards

As US lawmakers in the Senate advance bills to establish a comprehensive digital asset market structure framework, White House officials continue to meet with representatives from the crypto and banking industries to address stablecoin yield. Addressing stablecoins within the market structure bill, as well as issues related to tokenized equities and conflicts of interest, could be a sticking point for many lawmakers ahead of a potential vote in the Senate.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

Pred Raises $2.5M to Build the Fastest Trading Experience in Sports Prediction

[PRESS RELEASE – Panama City, Panama, February 17th, 2026]

Pred, a peer-to-peer sports prediction exchange, announced a $2.5 million funding round led by Accel, with participation from BEF by Coinbase Ventures and Reverie. The capital will support team expansion, liquidity development, and global user onboarding as Pred builds exchange-grade infrastructure for sports prediction markets. The platform is live in private beta, with traders being onboarded through an invite-only program ahead of broader public access.

Pred is building the fastest sports prediction exchange on Base, Coinbase’s layer-2 blockchain network. The platform lets traders buy and sell positions on sports outcomes with 200-millisecond execution and spreads under 2 percent. It is designed for traders who approach sports markets with the same analytical discipline used in financial markets, emphasising transparent order books, market-driven pricing, and on-chain settlement.

“Prediction markets have proven their value for episodic events, but sports represent an entirely different scale of opportunity, continuous, global, and deeply liquid. Pred is building purpose-built infrastructure for this market rather than retrofitting general-purpose tools. That’s the kind of focused execution we back.” – Prayank Swaroop, Partner at Accel.

While prediction markets have historically demonstrated strong forecasting accuracy, most applications have been limited to episodic events such as elections or macroeconomic outcomes. Sports present a fundamentally different environment, with continuous global demand, frequent events, and a natural fit for high-speed trading strategies. Despite the scale of the global sports betting economy, the majority of volume remains concentrated within house-controlled sportsbooks that set prices and manage risk internally.

Pred takes a different approach by applying an exchange model to sports predictions, allowing participants to trade directly with one another. Prices emerge through real supply and demand, reflecting collective market sentiment rather than fixed odds. By removing the house from the equation, Pred aims to create a more efficient, transparent, and trader-driven marketplace for sports outcomes.

“Sports prediction is a $500B global industry still running on infrastructure that punishes winners. We built Pred to change that, a decentralised exchange where speed, transparency, and skill are rewarded, not penalised.” – Amit Mahensaria, CEO and Co-Founder.

Pred will use the funding to build out its team with talent from financial and sports sectors, deepen market liquidity through institutional partnerships, and drive the trader growth needed to sustain a high-velocity exchange. The goal: become the premier global destination for sports prediction trading.

About Pred

Pred is building a sports prediction exchange that lets traders buy and sell positions on sports outcomes with 200ms execution and spreads under 2%. Unlike traditional sportsbooks that limit or ban winning users, Pred operates as a peer-to-peer exchange where skilled traders are welcome.

*Disclaimer: Pred does not operate in India, Singapore, the US, or OFAC-sanctioned countries.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Vitalik Buterin Draws a Clear Line

Users need not share his politics, product opinions, or cultural tastes to freely use the decentralized network, says Vitalik Buterin.

Ethereum co-founder Vitalik Buterin said that users do not need to agree with his views on applications, trust assumptions, politics, decentralized finance, decentralized social platforms, privacy-preserving payments, artificial intelligence, or even cultural preferences in order to use Ethereum.

He believes that disagreement with him on any one issue does not require agreement or disagreement on any other.

“Corposlop” Isn’t Censorship

In a lengthy post on X, Buterin stated that he does not claim to represent the entire Ethereum ecosystem. He described Ethereum as a decentralized protocol built around permissionlessness and censorship resistance, which allows anyone to use the network in whatever way they choose without regard for his opinions, the views of the Ethereum Foundation, or those of Ethereum client developers.

He said that labeling applications he dislikes as “corposlop” is not censorship. According to Buterin, free speech means individuals cannot prevent others from operating, but remain free to criticize, just as they may be criticized in return.

Buterin said such criticism is necessary and rejected the concept of “pretend neutrality,” in which individuals present themselves as equally open to all perspectives while avoiding clearly stated positions. He wrote that neutrality should apply to protocols, such as HTTP, Bitcoin, and Ethereum, and within limited scope to certain institutions, but not to individuals, who should instead clearly state their principles, including by identifying and criticizing things they believe are incompatible with those principles, and working with others who share aligned goals to build a metaverse where those principles are treated as a baseline.

He asserted that principles cannot be confined solely to protocol design, while arguing that any principle naturally leads to conclusions not only about how a protocol should be built but also about what should be built on top of it, and that such principles inevitably extend beyond technology into broader social questions, which he said should not be avoided.

Hollow Uses of “Freedom” in Tech

Buterin added that valuing concepts such as freedom while treating them as relevant only to technical choices and disconnected from other aspects of life is not pragmatic but is hollow. He further stated that a decentralized protocol must not be viewed as belonging to only one metaverse and that the boundaries of a metaverse are inherently fuzzy, which makes it common for people to align on some axes while disagreeing on others.

You may also like:

The latest comments from the Ethereum co-founder came a month after he backed the view held by Bitcoin maximalists that concerns around digital sovereignty were well-founded. Buterin had then argued that today’s internet has pivoted toward corporate-controlled systems that erode user power and described sovereignty as protecting privacy, attention, and autonomy from profit-driven platforms, not just resisting governments.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Shiba Inu price stabilizes at monthly support as oversold conditions ease

Shiba Inu price has reclaimed a key monthly support level after an impulsive sell-off, signaling that oversold conditions may be giving way to a relief rally as buyers begin to step back in.

Summary

- Monthly support reclaim signals seller exhaustion and short-term stabilization

- Oversold conditions are easing, supporting upside rotation

- Holding above value area low favors a move toward range highs

Shiba Inu (SHIB) price action has entered a critical phase after a sharp bearish expansion pushed the token into deeply oversold territory. Following this impulsive decline, SHIB briefly traded below a major high-timeframe support level before quickly reclaiming it, a technical development that often signals seller exhaustion rather than sustained breakdown.

This reclaim has shifted the short-term narrative from risk of continuation to potential stabilization. While broader market conditions remain mixed, SHIB’s ability to recover lost support and hold above it suggests that demand is beginning to absorb supply at lower levels.

The coming sessions will be key in determining whether this move develops into a larger recovery or remains a short-lived reaction.

Shiba Inu price key technical points

- Monthly support has been reclaimed, invalidating the recent breakdown

- Oversold conditions are easing, supporting a relief bounce scenario

- Holding above value area low increases upside probability, toward range highs

The recent sell-off in Shiba Inu was aggressive, producing a sequence of lower lows and strong bearish momentum. However, this downside move ultimately pushed the price below a key monthly support level, a zone that has historically attracted demand.

Rather than accepting below this level, the price quickly rebounded and reclaimed support, forming a bullish retest. This type of behavior is often associated with capitulation-style moves, where sellers exhaust themselves and buyers step in aggressively once liquidity is taken.

From a market structure perspective, reclaiming lost support after a brief breakdown weakens the bearish case and increases the likelihood that the move lower was corrective rather than trend-defining.

Consolidation at value area low

Following the reclaim, SHIB has entered a consolidation phase around the value-area low of the prior trading range. This region represents the lower boundary of fair value and is often where markets pause to rebalance after impulsive moves.

Holding above the value area low is critical. Acceptance above this level would indicate that buyers are defending price and absorbing remaining supply. Conversely, a failure to hold this region would reopen downside risk and call into question the recent reclaim.

At present, price action suggests balance rather than renewed selling pressure, reinforcing the stabilization narrative.

Oversold conditions support a relief rally

Momentum indicators had reached extreme oversold levels during the recent decline, reflecting panic-driven selling rather than orderly distribution. As price stabilizes, these oversold conditions are beginning to ease, a common prerequisite for relief rallies.

When oversold momentum coincides with a reclaim of high-timeframe support, the probability of a rotational move higher increases. This does not necessarily imply a full trend reversal, but it does open the door for a corrective rally toward higher resistance levels.

Volume behavior will be key in confirming this thesis. Sustained bullish volume during consolidation and early expansion phases would strengthen the case for continued upside.

Upside targets come into focus

If SHIB can hold above the value area low on a closing basis, the next logical upside objective is near the value area high of the previous range. This level represents the upper boundary of fair value and often acts as the first major resistance during recovery phases.

A move toward this area would complete a clean rotational structure, shifting sentiment from defensive to constructive in the short term. However, failure to reclaim and hold above value would keep the market vulnerable to renewed volatility.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Shiba Inu is showing early signs of stabilization after an oversold sell-off. The reclaim of monthly support and consolidation above the value area low suggest that downside momentum is weakening.

In the near term, traders should watch for continued acceptance above current support levels and an increase in bullish volume. If these conditions persist, a rotational move toward higher resistance becomes increasingly likely.

That said, SHIB remains within a broader corrective environment, and patience is required. As long as price holds above reclaimed support, the path of least resistance favors further upside exploration rather than immediate continuation lower.

Crypto World

Crypto custodian BitGo a potential acquisition target for Wall Street, analysts say

Wall Street analysts are betting that BitGo’s push into full-service institutional crypto finance will not only fuel long-term growth but also position the company as a prime acquisition target for traditional finance firms.

Compass Point analyst Ed Engel, who has a buy rating on the stock, wrote that the firm’s services could be attractive to traditional firms looking to offer crypto products to their clients.

“We … view BTGO as an ideal M&A target for Wall Street companies expanding into crypto. BitGo offers a full suite of services that could be integrated into traditional prime brokers and new entrants could acquire BitGo to provide these solutions to clients,” the analyst wrote.

BitGo was one of the first digital asset firms to go public this year, providing custody and security services for digital assets, primarily catering to institutional clients. The IPO marked one of the first times public equity investors could gain direct exposure to crypto infrastructure, making BitGo the bridge between traditional finance and digital assets as more financial firms push deeper into the digital asset space.

The infrastructure play is one of the points Engel said could offer more upside, noting that investors are overly focused on its core custody business rather than BitGo’s “opportunity to cross-sell prime services.” The analyst went as far as comparing it to Galaxy (GLXY) and Coinbase’s (COIN) prime brokerage services and noting that Galaxy’s average revenue per trading counterparty is “~6x BitGo’s, implying significant upside,” for BitGo, if the firm is able to ramp up its services.

‘Attractive’ take over target

The company’s competitive advantage and acquisition potential were echoed by at least one other Wall Street investment bank’s analyst.

“We believe BitGo’s competitive moat is solid, but more importantly we believe the company could make an attractive time-to-market asset for major Tradfi players looking to enter this market in an expedited manner,” said Canaccord Genuity in a note. The analyst has a $15 price target and a buy rating on the stock.

BitGo’s acquisition potential isn’t without precedent.

In May 2021, Galaxy Digital said it agreed to buy the firm for $1.2 billion, but later abandoned the deal after Galaxy said BitGo had failed to provide financial statements by a deadline at the end of July. With the stock being public, those concerns may no longer be an issue.

BitGo’s stock has dropped more than 40% since the company set its January IPO at $18 per share, now trading near $10.26. Meanwhile, bitcoin has declined about 24% year-to-date, Galaxy fell about 9% and Coinbase tumbled nearly 30% amid a broader crypto market selloff.

The IPO valued the firm at $2 billion, but after the recent selloff, the stock’s market cap is currently about $1.24 billion, bringing it closer to the valuation near the failed Galaxy deal.

However, Canaccord sees BitGo’s underperformance as an overreaction by the market. “BTGO shares… have reacted much more severely than any shorter term P&L trajectory weakness might warrant,” the investment bank’s analyst said, defending the stock.

BitGo currently has 10 analysts covering the stock, with nine buy ratings and one hold rating, according to FactSet data. Analyst price targets range from $12 to $18 per share, implying the stock could still rise by 17% to 75% from current prices.

Read more: Crypto M&A Heats Up as Big Banks and Fintechs Race to Scale

Crypto World

BitMine stock rebound? Tom Lee expects ETH V-shaped recovery

BitMine stock price could be on the verge of a strong bullish breakout in the coming weeks or months if Tom Lee’s Ethereum prediction works out.

Summary

- BitMine stock price formed a falling wedge pattern on the daily chart.

- Tom Lee predicts that the Ethereum price will have a V-shaped recovery.

- Ethereum has some of the best fundamentals in the crypto industry.

BMNR stock was trading at the crucial support level at $20, inside a range it has been stuck at in the past few days. It remains well below the all-time high of $160.

Tom Lee, the company’s Chairman, believes that the stock will rebound once the ongoing Ethereum (ETH) price bearish market ends. In a statement, Lee argued that Ethereum has had eight major drawdowns since 2018. All these drawdowns ended with a V-shaped recovery, and this one will do the same.

At the same time, Lee noted that ETH has some potential demand drivers, including its status as the largest smart contract blockchain, with top companies such as JPMorgan leveraging its technology.

More data show that Ethereum’s demand remains strong as exchange supply continues to fall. It has dropped to the lowest level in years, while the staking queue has reached a record high. Ethereum is also the biggest network for stablecoin processing, handling trillions in transactions a quarter.

These factors explain why BitMine has continued to accumulate Ethereum this year. The company now holds over 4.3 million tokens worth over $8.4 billion. It has bought over 157k coins in the last 30 days and is generating yield by staking the coins. It is also generating yield by investing its cash balances.

The company is also aiming to invest in more startups, a move that may generate substantial returns in the future. For example, it invested $200 million in Beast Industries, a company owned by Mr. Beast.

BitMine stock price technical analysis

The daily timeframe chart shows that the BMNR stock price has formed a giant falling wedge pattern. This pattern consists of two descending, converging trendlines, with a bullish breakout occurring when the two lines near their convergence.

The Relative Strength Index has moved from the oversold level of 25 to 37 and is pointing upward.

Therefore, the most likely scenario is that the BitMine stock price rebounds to the key resistance level at $34, its highest level in January, about 72% above the current level.

Crypto World

Pepe price reclaims structure as bullish engulfing candles signal reversal

Pepe price has reclaimed key high-timeframe support after a deviation lower, with a strong bullish engulfing candle breaking bearish structure and signaling a potential bottoming process.

Summary

- Deviation below support was invalidated, suggesting a liquidity sweep

- Bullish engulfing candle broke the lower-high structure, shifting momentum

- Reclaiming the value area low opens upside rotation toward the resistance

Pepe (PEPE) price action is showing early signs of structural recovery after a sharp deviation below a major high-timeframe support level. What initially appeared to be a breakdown has now been invalidated, as price quickly reclaimed the lost level with a decisive bullish engulfing candle.

This type of price behavior often signals exhaustion in selling pressure rather than the start of a sustained bearish continuation. Deviation-and-reclaim patterns are important inflection points in technical analysis, particularly when they occur at high-timeframe support.

In Pepe’s case, the reclaim has also disrupted the prevailing bearish market structure, raising the probability that a local or even macro bottom could be forming.

Pepe price key technical points

- Deviation below high-timeframe support has been reclaimed, invalidating the breakdown

- Bullish engulfing candle broke the sequence of lower highs, signaling a structure shift

- Value area low reclaim is required, to open upside continuation toward resistance

PEPE’s recent move below high-timeframe support can be classified as a deviation, where price briefly trades below a key level to trigger stop-losses and capture liquidity before reversing sharply higher. This behavior is commonly seen near market bottoms, as weak hands are flushed out before stronger participants step in.

Rather than finding acceptance below support, PEPE quickly reclaimed the level, indicating that sellers were unable to sustain control. The speed of the reclaim is significant, as prolonged trading below support would have suggested genuine bearish continuation.

From a market structure perspective, deviations followed by strong reclaims tend to weaken the bearish thesis and increase the probability of a rotational move higher.

Bullish engulfing breaks bearish structure

The reclaim of support was confirmed by a strong bullish engulfing candle, which engulfed multiple prior bearish candles. This type of candlestick formation often reflects aggressive buying interest and marks a shift in short-term momentum.

More importantly, this bullish engulfing candle broke the sequence of lower highs, which had defined PEPE’s bearish structure. Once lower highs are invalidated, the market transitions from a bearish trend into either balance or early bullish structure.

This structural shift does not guarantee immediate upside continuation, but it does suggest that the dominant bearish control has weakened substantially.

Holding above the high-timeframe support is critical

While the initial reclaim is constructive, confirmation will depend on PEPE’s ability to remain above high-timeframe support in the sessions ahead. Sustained acceptance above this level would indicate that demand is strong enough to absorb the remaining supply.

If price slips back below this support and fails to reclaim it, the deviation would lose its significance and downside risk would re-emerge. For now, however, the ability to hold above support keeps the bullish scenario intact.

Value area low reclaim opens upside path

The next key technical milestone for PEPE is the value area low (VAL). This level represents the lower boundary of fair value within the broader trading range. A reclaim and hold above the VAL on a closing basis would confirm acceptance back into value and increase the probability of continuation higher.

Once value is reclaimed, price often rotates toward the point of control (POC), which acts as the next major resistance and balance point within the range. This would represent a natural upside target if bullish momentum continues to build.

Range rotation scenario builds

With bearish structure broken and support reclaimed, PEPE is transitioning from a trend phase into a potential range-rotation environment. This means price may move higher in stages, rather than trending impulsively.

Such rotations are common after deviations and often lead to sustained recovery moves if volume and follow-through remain supportive.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, PEPE is showing early signs of a bullish shift. The deviation below support, followed by a strong bullish engulfing candle, significantly reduces near-term downside continuation risk.

In the coming sessions, traders should monitor whether the price can reclaim and hold above the value area low. Acceptance above this level would open the door for a rotational move toward the point of control and higher resistance within the range.

While volatility may remain elevated, the evidence currently favors stabilization and further upside exploration, rather than renewed breakdown, as long as PEPE holds above reclaimed support.

Crypto World

Stripe’s stablecoin firm Bridge wins initial approval to form national bank trust charter

Bridge, a stablecoin infrastructure firm owned by Stripe, said Tuesday it has received conditional approval from the U.S. Office of the Comptroller of the Currency (OCC) to form a national trust bank.

The charter would let Bridge National Trust Bank issue stablecoins, custody digital assets and manage reserves under direct federal oversight. It’s the latest step in Stripe’s broader push into blockchain-based payments since it acquired Bridge for $1.1 billion in 2024.

“This approval positions Bridge to help enterprises, fintechs, crypto businesses and financial institutions build with digital dollars inside a clear federal framework,” the company said in the press release.

Bridge says its systems already meet the compliance standards outlined in the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, the law passed last year that’s aimed at regulating stablecoin issuers. Federal banking regulators, including the OCC, Federal Reserve and Federal Deposit Insurance Corp., haven’t yet instituted the specific regulations mandated by the GENIUS Act, but they’re moving through that process now.

Bridge is part of a growing group of firms seeking to build stablecoin products inside a federal framework. In December, Circle, Ripple, Paxos, Fidelity Digital Assets and BitGo all received similar conditional approvals from the OCC, and Erebor Bank was granted a conditional national bank charter in October. Bridge applied for its charter in October, and the OCC’s records show it signed off last week.

The company currently powers stablecoin issuance for products like Phantom’s CASH and MetaMask’s mUSD via Stripe’s Open Issuance platform.

The OCC has not announced a timeline for final approval.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech18 hours ago

Tech18 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video13 hours ago

Video13 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World12 hours ago

Crypto World12 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports19 hours ago

Sports19 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery