Crypto World

Mubadala Investment Company and Al Warda boosted IBIT stakes in Q4

Two of Abu Dhabi’s major investment firms increased their exposure to bitcoin in the fourth quarter of 2025, buying into BlackRock’s spot bitcoin ETF as the market fell, according to recent regulatory filings.

Mubadala Investment Company, a sovereign wealth fund backed by the Abu Dhabi government, added nearly four million shares of BlackRock’s iShares Bitcoin Trust (IBIT) between October and December, bringing its total holdings to 12.7 million shares. The move came as bitcoin fell roughly 23% during the quarter.

Mubadala made its first purchases in IBIT in late 2024 and has been adding since.

Al Warda Investments, another Abu Dhabi-based investment management firm that oversees diversified global assets on behalf of government-related entities, held 8.2 million shares at the end of the fourth quarter, up slightly from 7.96 million shares three months earlier.

Together, the two funds held more than $1 billion worth of bitcoin via IBIT at the end of 2025. However, with bitcoin down another 23% year-to-date in 2026, the current value of their combined holdings has dropped to just over $800 million as of Tuesday (assuming they haven’t continued adding in 2026).

The disclosure, made through 13F filings with the U.S. Securities and Exchange Commission, reflects growing institutional interest in spot bitcoin ETFs, even during periods of market stress. BlackRock’s IBIT, which launched in early 2024, has quickly become the dominant vehicle for regulated exposure to bitcoin in the U.S.

While the crypto market has faced ongoing headwinds in early 2026 — including low volatility, reduced retail participation, and macroeconomic uncertainty — some long-term investors appear to be using the downturn to build positions in regulated, liquid products tied to digital assets.

BlackRock head of digital assets, Robert Mitchnick, said on a recent panel that there is a mistaken belief that hedge funds using ETFs are driving volatility and heavy selling, but that does not match what the firm is observing. Instead, he said, IBIT holders are in it for the long term.

Crypto World

“New” Bitcoin Whale Losses Deepen as Binance Inflows Rise

Bitcoin’s (BTC) price continued to consolidate near $68,000 on Tuesday, but sustained weakness below this level may generate additional sell pressure from the newest cohort of large holders.

While the long-term whales remain in profit, short-term whales are sitting on sizeable unrealized losses. One analyst highlighted how this pressure may impact BTC’s price, as other indicators point to a continued downtrend.

Key takeaways:

-

The short-term Bitcoin whales are sitting on net unrealized losses of 22% at current prices.

-

The Binance whale inflow ratio climbed to 0.62 from 0.4 in two weeks, signaling a rise in the large-holder deposits.

-

Long-term whales control 71% of the large-wallet supply and remain in profit above their realized price of $41,626.

New BTC whales face mounting unrealized losses

Market analyst Carmelo Alemán noted that the wallets holding 1,000–10,000 BTC control 4.483 million BTC at the moment. A total of 1.287 million BTC (28.7%) belongs to the short-term holder (STH) whales, while 3.196 million BTC (71.3%) sits with the long-term holder (LTH) whales.

The cost basis gap is significant. STH whales have a realized price of $88,494, carrying an unrealized loss of 22%. LTH whales hold a realized price of $41,626, maintaining a 65% in profit.

Alemán explained that this asymmetry shows the recent whale holders are under pressure while older capital retains a large cushion.

However, realized losses among STH whales have remained limited since Bitcoin’s all-time high of $126,000 in October 2025, reflecting resilience from the holders.

The key structural level remains near $41,626, which is the LTH realized price. As long as BTC holds above it, the data reflects redistribution rather than structural capitulation, the analyst said.

Related: Ray Dalio’s world order warning revives case for Bitcoin as neutral money

BTC whale deposits increase as pressure on long-term holders builds

The Binance whale inflow ratio, measuring the share of the 10 largest BTC deposits relative to total inflows, rose to 0.62 from 0.4 from Feb. 2 to Feb. 15. A higher ratio suggests increasing whale-driven sell-side activity.

Crypto analyst Darkfost said that a part of the flow is linked to the “Hyperunit whale,” who moved close to 10,000 BTC onto Binance.

LTH’s spent output profit ratio (SOPR) also dropped to 0.88. SOPR measures whether the coins are being sold at a profit or loss, with a reading below 1 meaning losses are being realized. The monthly average SOPR remains at 1.09, and the annual average stands at 1.87, indicating that long-term profitability is still intact.

Additionally, Alphractal founder Joao Wedson said that the long-term holder net-unrealized profit/loss (NUPL) stands at 0.36, meaning unrealized profits remain positive.

The analyst said that the past cycle bottoms formed only after the metric turned negative, implying Bitcoin may still need another dip to confirm capitulation among the LTH cohorts.

Related: Bitcoin weekly RSI echoes mid-2022 bear market as BTC plays liquidity games

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

BTC falls alongside key software ETF (IGV)

Cryptocurrencies started the shortened U.S. week on the back foot, with bitcoin sliding below $67,000 on Tuesday, falling below its tight weekend range of $68,000-$70,000.

The weakness coincided with a softer open for U.S. equities, especially for the battered software sector. The iShares Expanded Tech-Software Sector ETF (IGV) was 3% lower, and now 30% below the October high. Software stocks have been under pressure, with improving AI tools seen as a threat to their business models. Markets make opinions, and the current shibboleth says bitcoin is just software, so if AI is a threat to that sector, it’s a threat to bitcoin as well.

Read more: Bitcoin’s correlation with troubled software stock sector is growing

The broader Nasdaq fell 0.8%, and the S&P 500 fell 0.6%.

Meanwhile, the once-parabolic rally in precious metals continued to cool. Gold dropped 3% to around $4,860 per ounce, while silver tumbled another 6%, leaving it roughly 40% below its late-January peak.

Crypto-related equities also retreated, giving back part of Friday’s sharp bounce. Strategy (MSTR), the largest corporate bitcoin holder, fell around 5% with a simlar decline for USDC stablecoin issuer Circle (CRCL). Bitcoin miners and data center names Riot Platforms (RIOT), MARA, CleanSpark (CLSK), Cipher Mining (CIFR) and TeraWulf (WULF) all fell roughly 4%-5%.

Crypto in search of a narrative

Paul Howard, senior director at trading firm Wincent, said that crypto remains firmly tethered to macro sentiment.

“Macro news has been closely correlated with crypto’s risk profile the last 12 months and expectations are that macro numbers remain soft, implying a risk-off trade mentality,” Howard said.

He pointed to the U.S. Supreme Court’s ruling on tariffs expected later this week as a potentially bigger near-term catalyst than routine economic data.

For now, he expects more consolidation as bitcoin and the broader digital asset market search for a new narrative strong enough to pull capital back from AI stocks and commodities.

“Crypto has some work to do recreating itself as an appealing asset class and the relatively low prices are not attractive enough,” Howard said.

Crypto World

Zora Launches Attention Markets on Solana, Not Base

Decentralized SocialFi platform Zora has launched its new attention markets platform on Solana, allowing traders to speculate on which buzzwords, hashtags, trends and topics will go viral online.

“Trade what’s trending. Take positions on any topic, idea, meme, or moment before it breaks,” Zora’s newly launched platform states.

One of Zora’s founders, Jacob Horne, said on Tuesday that it costs 1 Solana (SOL), currently $85, to deploy a “Trend,” aimed at disincentivizing spam. Trends have no creator rewards.

Zora is also enabling “Pairs” to be created under a Trend, which does offer creator rewards.

In a promotional video, Zora referenced the $redlight and $coldplunge pairs under the $longevity trend, as an example.

BREAKING: Zora launches attention markets on Solana

You can now start markets and take positions on any trending topic, idea, meme, or momentpic.twitter.com/55c8tM5QnB

— Solana (@solana) February 17, 2026

Traders are already testing the app, with “attentionmarkets,” “longevity,” “cats,” “dogs,” “bitcoin” and “aigirlfriend” among the most-traded tickers so far.

The attention markets platform enables users to trade Trends and Pairs like ordinary tokens, with a dashboard to track user profits and losses in real-time.

The ZORA token responded positively to the announcement, rising 6.2% to $0.022 over the last 24 hours, while the broader crypto market retraced 1.2% over the same timeframe.

The launch of Zora’s attention markets coincides with the rapid rise of prediction markets, which are now consistently surpassing $10 billion in monthly trading volume and increasingly being marketed into the mainstream.

Meanwhile, Zora posted a job listing on Monday for an “Attention Economist,” looking for someone who lives on the internet and sees “what’s next before it has a name” by tracking cultural movements across the likes of TikTok, Instagram Reels, YouTube Shorts and X.

Base community criticizes Zora’s Solana integration

The Solana integration disappointed some members of the Base community, because Zora moved much of its activity from its native platform to Base last year and launched its first token on the network in April.

Zora also assisted with the launch of Creator Coins linked to Base profiles in July, which even helped Base overtake Solana in daily token creation activity later that month.

Related: Base App sunsets Creator Rewards to double down on trading

Jacek Trociński, the developer of Base memecoin Degen, said it was “really disappointing” to see Zora “pivot” to launch the attention markets platform on Solana.

“After getting support from the entire @base team for the better part of a year, they capitulated the second the trade changed. Low conviction, questionable morals, rinse users and repeat”.

“We had to put up with your… stuff for 9 months, extracted every penny from Base with a broken model and now a final pivot to a pump clone on Solana,” Veil Cash builder Apex777.eth said.

Base creator Jesse Pollak however, noted that Zora creator tools remain “fully operational” on Base and that he was happy to see Zora “continue to experiment to grow the onchain pie.”

Zora listed the Zora (ZORA) token on Solana in January, and Zora’s X profile location now shows up as “Solana.” It also hasn’t made a post about Base in several months.

However, it has not provided any public statement to suggest it is moving on from Base. Cointelegraph reached out to Zora for comment, but did not receive an immediate response.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

China’s DeepSeek AI Predicts the Price of XRP, PEPE and Shiba Inu By the End of 2026

When asked a carefully structured prompt, DeepSeek hints at the possibility of high upside this year for current HODLers of XRP, Pepe, and Shiba Inu, a timeline that may catch unprepared investors off guard.

Below is a breakdown of how current technical signals and broader ecosystem developments may support DeepSeek’s bullishness.

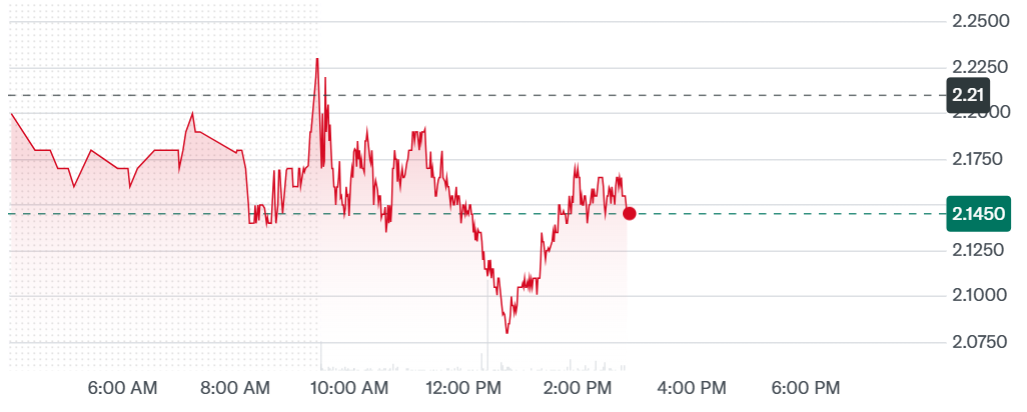

XRP ($XRP): DeepSeek Believes Ripple’s Roadmap Could Lift XRP Toward $8

In a recent company blog post, Ripple reiterated that XRP ($XRP) remains central to its ambition of turning the XRP Ledger into a globally adopted, enterprise-level payments infrastructure.

Thanks to near-instant settlement times and minimal transaction costs, the XRP Ledger is likely to benefit from growth in two rapidly expanding segments: stablecoins (including RLUSD) and real-world asset tokenization.

Presently, XRP trades close to $1.44. DeepSeek’s forecast points to a potential advance toward $8 by late 2026, implying gains of over 450% from current prices.

From a technical standpoint, XRP’s Relative Strength Index (RSI) is hovering around 42 and rising after briefly being oversold. That it has now converged with its 30-day moving average again suggests growing strength.

Possible upcoming catalysts include fresh institutional demand following approval of U.S. spot XRP ETFs with more ETFs to come, Ripple’s growing list of strategic partnerships, and the likelihood of U.S. legislators progressing the CLARITY bill later this year.

Pepe ($PEPE): DeepSeek Says Crypto’s Biggest Frog May Grow More than 5x in 2026… Feels Good, Man

Pepe ($PEPE), launched in April 2023, has emerged as the largest meme coin outside the Dogecoin niche, currently sporting a market capitalization near $2 billion.

Inspired by Matt Furie’s Boy’s Club comics, PEPE’s instantly recognizable visuals and meme-driven appeal have kept it highly visible across social media platforms.

Despite fierce competition within the meme coin arena, PEPE’s committed community, along with the many imitators it has spawned, has helped it maintain high visibility and dominance within the space.

Adding to the intrigue, occasional cryptic posts from Elon Musk on X have fueled speculation that PEPE may be sitting beside DOGE and BTC among his personal holdings.

PEPE is currently priced around $0.000004444, roughly 84% below its December 2024 peak of $0.00002803.

Although under DeepSeek’s most bullish assumptions, PEPE may not set a new ATH this year. Still, it could surge by approximately 440%, climbing to around $0.000024.

Shiba Inu (SHIB): DeepSeek Sees an Explosive Rally of Nearly 2,000%

Shiba Inu ($SHIB), introduced in 2020 as a tongue-in-cheek rival to Dogecoin, has since grown into a broad crypto ecosystem with a market capitalization of about $3.8 billion.

Currently trading near $0.000006505, DeepSeek suggests that a decisive breakout above resistance in the $0.000025 to $0.00003 range could trigger a strong breakout, potentially driving SHIB to $0.000115 by year-end.

Such a rally would represent roughly 1,668% upside from current levels and would place SHIB just above its October 2021 ATH of $0.00008616.

On the fundamentals front, Shiba Inu now offers more than meme appeal. Its Layer-2 network, Shibarium, delivers faster transactions, lower fees, enhanced privacy, and improved developer tools, helping SHIB stand apart from most meme coins, which lack utility.

Maxi Doge: A New Meme Coin Enters the Conversation

Thanks to their multibillion market caps, Shiba Inu and Pepe are effectively blue chip cryptos now.

So, investors chasing the next SHIB or PEPE are better off in the presale market, which offers bounteous opportunities to snap up the next big thing at very little cost.

Maxi Doge ($MAXI), a new meme coin that has already attracted over $4.6 million from investors anticipating a fresh meme-coin supercycle this year.

The project centers on Maxi Doge, a gym-obsessed, degen-themed rival to Dogecoin, leaning heavily into the competitive, irreverent humor that originally catapulted meme coins into the mainstream.

Presale buyers can currently stake MAXI for yields of up to 68% APY, with rewards decreasing as more tokens enter the staking pool.

MAXI sells at $0.0002804 in the current presale round, with scheduled price increases at each funding milestone. Tokens can be purchased using wallets such as MetaMask and Best Wallet, or via bank card.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post China’s DeepSeek AI Predicts the Price of XRP, PEPE and Shiba Inu By the End of 2026 appeared first on Cryptonews.

Crypto World

XRP Ledger nears BNB Chain in tokenized RWA rankings

The XRP Ledger has climbed to sixth place among blockchain networks by tokenized real-world asset value, surpassing Solana and approaching BNB Chain, according to the latest RWA league table data.

Summary

- The XRP ledger added $354 million in tokenized assets over the past 30 days.

- It currently ranks behind BNB Chain in total tokenized assets.

- If the current rate of RWA issuance continues, the ledger could challenge BNB Chain’s position among leading tokenization networks.

The ledger added $354 million in tokenized assets over the past 30 days, according to ETHNews. The growth occurred despite downward pressure on XRP’s market price during the period.

The network’s total RWA value, excluding stablecoins and combining distributed and represented assets, now exceeds that of Solana, which holds a slightly lower total in tokenized RWAs, according to the data.

The XRP Ledger currently ranks behind BNB Chain in total tokenized assets. The network would need to add additional tokenized value to overtake BNB Chain and secure fifth position globally, according to the rankings.

The increase in tokenized asset value on the XRP Ledger occurred while the token’s price declined during the broader market downturn. The divergence between price performance and on-chain asset growth indicates infrastructure development on the network, the report stated.

If the current rate of RWA issuance continues, the ledger could challenge BNB Chain’s position among leading tokenization networks, according to the analysis.

Crypto World

CFTC’s Selig opens legal dispute against states getting in way of prediction markets

The legal challenges from state governments against certain aspects of prediction markets such as Polymarket and Kalshi received a sharp rebuke from U.S. Commodity Futures Trading Commission Chairman Mike Selig, who is arguing that his federal agency has jurisdiction — not the states.

“To those who seek to challenge our authority in this space, let me be clear, we will see you in court,” Selig said in a video statement posted Tuesday on social media site X. He said his agency filed a legal brief in court to back up the federal role as the leading regulator over this corner of the derivatives markets.

“The CFTC has regulated these markets for over two decades,” he said. “They provide useful functions for society by allowing everyday Americans to hedge commercial risks like increases in temperature and energy price spikes, they also serve as an important check on our news media and our information streams.”

Selig did not mention sports bets in his list of examples, though that’s where many of the legal disputes are focused. States have gone after event-contract platforms with accusations they’ve breached sports-betting laws at the state level, such as in Nevada, Massachusetts and New York. A federal judge in Nevada concluded in November that the state authorities were correct and that the contracts aren’t properly the business of the CFTC, though that ruling is under appeal.

Coinbase, the top U.S. crypto exchange, has also sought to enter the prediction markets sector, and it’s currently suing Connecticut, Illinois and Michigan over those states’ attempts to regulate sports betting as gaming.

That’s the setting that Selig is weighing into as he declares “exclusive jurisdiction over these derivative markets.” But until the return to Washington of President Donald Trump, the agency had fought against these companies and some of their contracts, claiming that the sites’ political bets were unlawful and “contrary to the public interest.” But courts had gone against the CFTC in its legal fight with Kalshi, and when Trump’s administration overhauled the agency’s leadership, the fight was abandoned.

In early 2025, the president’s son, Don Trump Jr., joined Kalshi as a strategic adviser. In August, he then joined Polymarket’s advisory board.

In October, Trump Media & Technology Group (DJT), which owns President Donald Trump’s social platform Truth Social, said it was getting into the prediction markets business.

Within weeks of his confirmation by the Senate, Trump nominee Selig said that his agency was resetting its prediction markets approach and would pursue new policies on that front. He said the CFTC “will advance a new rulemaking grounded in a rational and coherent interpretation of the Commodity Exchange Act that promotes responsible innovation in our derivatives markets in line with Congressional intent.”

In the hours after Selig’s Tuesday statement, Utah Governor Spencer Cox responded with his own challenge.

“Mike, I appreciate you attempting this with a straight face, but I don’t remember the CFTC having authority over the ‘derivative market’ of LeBron James rebounds,” he wrote in a response on X. “These prediction markets you are breathlessly defending are gambling — pure and simple. They are destroying the lives of families and countless Americans, especially young men. They have no place in Utah.”

While Utah hasn’t been among states leading legal challenges against the prediction markets, there is a legislative effort there that seeks to target certain sports contracts. Cox advised Selig he’d use every power to “beat you in court.”

And U.S. Senator Elizabeth Warren, the ranking Democrat on the Senate Banking Committee, argued that Selig is undermining state powers.

“President Trump’s CFTC Chair is trying to strip states of their authority to regulate gambling within their borders and hamstring their ability to protect Americans from getting ripped off,” she said in a statement. “The CFTC should focus on ensuring our derivatives markets don’t blow up the economy again, not helping corrupt political insiders cash in.”

UPDATE (February 17, 2026, 17:59 UTC): Adds response from Utah governor.

UPDATE (February 17, 2026, 21:30 UTC): Adds statement from Senator Warren.

Crypto World

David Bailey-led company acquiring related firms

Nakamoto (NAKA) has signed definitive agreements to acquire media and events firm BTC Inc and asset management firm UTXO Management.

The all-stock deal is — NAKA will issue 363. million shares for the purchase — is valued at approximately $107.3 million and expected to close in the first quarter of 2026, according to a Tuesday press release.

BTC Inc runs several high-profile bitcoin media properties, including Bitcoin Magazine, The Bitcoin Conference, and the enterprise-focused Bitcoin for Corporations program. UTXO, meanwhile, advises 210k Capital, a hedge fund allocating capital into bitcoin-related public and private markets.

“We intend to operate a portfolio of companies across media, asset management, and advisory services that can scale with Bitcoin’s long-term growth,” said David Bailey, CEO of Nakamoto. “This transaction signifies the first step of the company we intend to build, and we’re just getting started.”

The transaction has raised eyebrows among some market watchers due to the steep discount between the original pricing and the current execution. One user on X pointed out that Nakamoto was originally set to pay over $400 million based on the agreed $1.12 share price, but with the stock now trading below 30 cents, the acquisition is closing at roughly $107 million.

Bailey, who also leads BTC Inc, is central to all three companies involved, making this a related-party transaction. A special committee of independent directors approved the deal with input from outside legal and financial advisers.

NAKA shares are flat on Tuesday, trading at just $0.30 versus the roughly $2.00 level prior to converting to a bitcoin treasury strategy (when the company was named Kindly MD).

Crypto World

Bitcoin’s Derivatives Crash: The Hidden Force Stalling Price Recovery

TLDR:

- Bitcoin open interest peaked at 381,000 BTC across all exchanges during the October 2025 cycle top.

- Binance recorded a 20.8% open interest drop between October 6 and 11, with Bybit and Gate.io falling 37%.

- Post-peak declines have persisted monthly, with Binance down an additional 39.3% since the market top.

- Shrinking derivatives exposure signals active risk reduction, making a sustained Bitcoin rally difficult.

Bitcoin’s price recovery has stalled, and the derivatives market may hold the answer. Open interest data across major exchanges shows a sustained and deepening contraction since the latest cycle peak.

Speculative activity that once fueled Bitcoin’s climb has now reversed course entirely. The data suggests that the collapse in derivatives positioning is playing a central role in keeping Bitcoin’s price under pressure.

A Record Build-Up Followed by a Sharp Collapse

Bitcoin’s derivatives market expanded aggressively throughout this cycle. On Binance, Bitcoin-denominated open interest peaked at 120,000 BTC in October 2025, compared to 94,300 BTC after the November 2021 high. That growth reflected an enormous build-up in speculative exposure heading into the cycle top.

Across all exchanges combined, open interest reached 381,000 BTC at the peak, up from 221,000 BTC in April 2024.

Analyst Darkfost noted on X that “speculation during this cycle reached unprecedented levels, and both novice and professional investors have paid the price.”

The unwind began swiftly after the October sell-off. Between October 6 and October 11 alone, Binance recorded a 20.8% drop in open interest. Bybit and Gate.io saw even steeper declines of 37% each during that same five-day window.

That rapid contraction removed a large volume of leveraged positioning from the market. Without that speculative support, Bitcoin lost a key structural driver that had been pushing prices higher throughout the cycle.

Why the Derivatives Slump Keeps Price Recovery Out of Reach

The contraction has not stopped at that initial sell-off. Since then, declines have continued in nearly every subsequent month across major platforms. Binance has fallen an additional 39.3%, while Bybit is down 33% and BitMEX has dropped 24%.

Darkfost pointed out that the derivatives market “was definitely a primary driver during this cycle, but it has also become a key force behind the decline.” As open interest shrinks, so does the fuel needed to sustain upward price momentum.

Traders are either voluntarily reducing exposure or being forced out through liquidations. Either way, the result is the same; fewer active positions mean less buying pressure and thinner market participation overall.

Under these conditions, any price rally lacks the depth to hold. Without a meaningful recovery in open interest, Bitcoin remains vulnerable to further selling pressure.

Derivatives data continues to serve as one of the clearest indicators of where market sentiment truly stands.

Crypto World

The crypto tax reckoning is here

Doing crypto taxes this year is going to suck.

For the past decade, the IRS has treated cryptocurrency as property rather than currency, treating every sale and exchange as a taxable event. However, despite blockchains being public ledgers, tax compliance rates have always been low. The gap between what the IRS expects and what crypto users actually pay in taxes has been growing for years.

That gap is about to close significantly.

We are entering the crypto tax ‘enforcement era’

The shift didn’t happen overnight. In 2021, the IRS launched Operation Hidden Treasure to target deliberate concealment of crypto income. By 2022, it had hired agents with specialized blockchain expertise and secured court orders for data from major exchanges, including Coinbase. The message was clear: the era of lax enforcement was ending.

Now, in 2026, we’re seeing authorities take this a significant step further. This marks what I’d call the beginning of the end for crypto tax avoidance, not just in the US, but worldwide.

Forty-eight countries, including the U.S., U.K., EU members and Brazil, have agreed to implement the OECD’s Crypto-Asset Reporting Framework (CARF). All crypto-asset service providers must now report user transaction data to authorities. In the U.K., HMRC recently issued 650,000 nudge letters to crypto investors who owed tax, a 134% increase compared to last year.

In the U.S., the shift is even more concrete. For the first time, cryptocurrency exchanges will issue Form 1099-DA, a new document that declares your cost basis and proceeds directly to the IRS. It’s similar to the 1099-B used for stocks, and brokers had to issue them by February 17, 2026, covering all sales and exchanges from 2025. From the 2026 tax year onward, brokers will also report cost basis, giving the IRS an unprecedented view of investor gains and losses.

This represents a fundamental shift from self-disclosure to automatic reporting. The IRS can now easily compare what brokers report with what taxpayers file, making errors, omissions and under-reporting easier to detect.

I keep seeing crypto investors on X and Reddit saying the government will eventually remove taxes on crypto. They won’t. Users need to stop waiting for that to happen.

The Problem: rules are written by people who don’t use crypto

The Form 1099-DA was clearly drafted by legislators who know nothing about crypto, which is unfortunate.

These regulations treat cryptocurrency like stocks, but crypto behaves nothing like stocks. Real crypto users don’t just buy and hold on Coinbase. They move assets between multiple wallets, bridge across chains, interact with DeFi protocols, provide liquidity, stake tokens and use complex trading strategies across dozens of platforms. Many of these activities involve transactions outside centralized exchanges. This is where the new reporting framework falls short.

The new rules are going to be a real burden for anyone who uses crypto the way it was designed to be used. That’s a problem that goes beyond mere annoyance for individuals and will have significant repercussions for the industry as a whole.

If interacting with DeFi creates a huge tax compliance problem, fewer people will use it. If moving assets to self-custody means drowning in paperwork, people will leave their funds on exchanges. Though these regulations were inevitable and well-intentioned, they risk pushing users back to centralized systems that crypto was meant to replace.

The real headaches are just beginning

I spend a lot of time engaging with the crypto community online, and I’ve seen countless users try to file their taxes manually, hit a wall and then give up.

If you haven’t filed crypto taxes in the past, now is the time. We have users constantly messaging us, needing to file multiple past years. I’ve even seen investors trying to report on four or more tax years at once. They’ve probably never filed before, and now they’re scrambling because they know enforcement is ramping up.

The trick is to pull your records constantly, not just during tax season. Many trading platforms delete historical data after a certain period, but the IRS sees large flows when you offramp and wants to know where that money originated. Without those trading records, you can’t prove your cost basis or show losses.

What’s next for crypto tax reporting?

It’s clear we’re entering a new phase of crypto tax reporting. It’s shifting from being a vague, regulatory gray area to transparency and much tighter enforcement.

The crypto industry needs to adapt to this reality now, rather than fight or ignore it. The message for investors is clear –get compliant now. Gather documentation for all purchases, sales and transfers across wallets and exchanges. The longer you wait, the harder it’s going to be.

The challenge for the crypto industry is different: we need to continue developing tools that are agile and can adapt to the fast pace at which enforcement is introducing these rules. Ultimately, we need to make tax reporting as easy as possible for investors, so the industry can continue to thrive.

Crypto World

HIVE Revenue Jumps 219% as AI Expansion Offsets Bitcoin Price Weakness

HIVE Digital Technologies delivered a record fiscal third quarter despite weaker Bitcoin prices, suggesting that its expansion into artificial intelligence and high-performance computing is offsetting broader crypto-market headwinds.

For the quarter ended Dec. 31, 2025, HIVE reported $93.1 million in revenue, a 219% increase from a year earlier. Gross operating margin expanded more than sixfold year over year to $32.1 million, representing about 35% of revenue.

The strong performance came even as Bitcoin (BTC) prices declined about 10% during the quarter and network difficulty rose about 15%, conditions that have pressured mining margins across the industry following the 2024 halving.

HIVE generated 885 Bitcoin during the period, a 23% quarter-on-quarter increase, while scaling its installed hashrate to 25 exahashes per second (EH/s).

Beyond mining, the company continues to build out its AI and high-performance computing (HPC) business. In February, HIVE signed a two-year, $30 million contract to deploy 504 Nvidia B200 GPUs for enterprise AI cloud services.

The deal is expected to add about $15 million in annual recurring revenue and lift HIVE’s HPC annualized revenue run rate by about 75%.

The company is targeting $140 million in annual recurring AI cloud revenue by the fourth quarter of 2026, as part of a broader plan to scale total HPC revenue to $225 million as it expands GPU cloud and colocation capacity.

Related: Bitcoin mining’s 2026 reckoning: AI pivots, margin pressure and a fight to survive

HIVE’s expansion beyond Bitcoin mining gains traction

HIVE was among the early publicly listed Bitcoin miners, but it began pivoting toward HPC infrastructure several years ago as management anticipated increasing competition and margin compression in the mining sector.

That diversification has become increasingly relevant. Mining profitability deteriorated sharply after the 2024 halving reduced block rewards, while rising network difficulty and volatile Bitcoin prices added further pressure. The environment intensified after Bitcoin retraced from its October 2025 highs, forcing many miners to reassess capital allocation and infrastructure strategy.

HIVE’s “dual-engine” model, using Bitcoin mining as a cash-flow generator while building recurring AI and HPC revenue, reflects a broader shift among publicly traded miners seeking stability beyond Bitcoin’s price cycles.

Several other Bitcoin miners, including IREN and TeraWulf, have shifted toward AI workloads, reflecting a growing view among analysts that the next infrastructure “supercycle” will be powered by artificial intelligence rather than crypto.

Related: Paradigm reframes Bitcoin mining as grid asset, not energy drain

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech22 hours ago

Tech22 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video17 hours ago

Video17 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World16 hours ago

Crypto World16 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports22 hours ago

Sports22 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery