Crypto World

MYX Price Skyrocketed 90% In Less Than 12 Hours, Here’s Why

MYX Finance delivered one of the most aggressive intraday rallies in the crypto market this week. After nearly two weeks of persistent decline, the altcoin surged 90% in less than 12 hours. The sharp reversal caught short sellers off guard and reignited speculative interest.

The rally followed news of MYX Finance’s strategic funding round led by Consensys, with participation from Consensys Mesh and Systemic Ventures. The announcement came ahead of the MYX V2 launch. Investors interpreted the backing as a validation of long-term viability, triggering immediate demand.

MYX Finance’s Recovery Was Foretold

BeInCrypto’s analysis highlighted how a rebound was already likely. The Money Flow Index, which measures buying and selling pressure using price and volume, fell below the 20.0 threshold. This marked the first time MYX entered extreme oversold territory since launch.

Oversold readings often indicate selling exhaustion. When MFI drops under 20.0, downside momentum typically weakens. The data suggested that panic-driven distribution had reached saturation. As selling pressure faded, fresh accumulation began, creating the conditions for a sharp recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

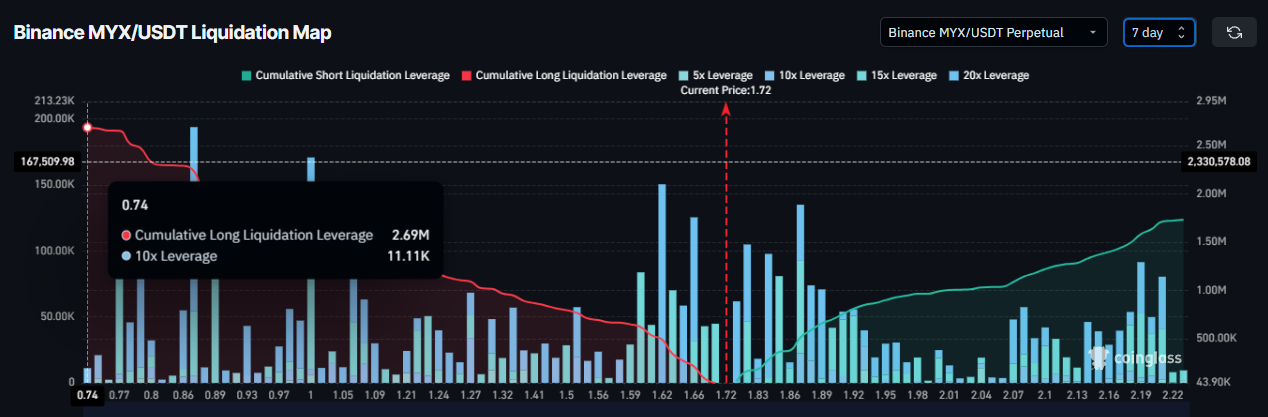

Derivatives positioning reinforces the bullish shift. The liquidation map shows MYX contracts currently skewed toward long exposure. Approximately $2.46 million in long positions are active, reflecting growing optimism among traders.

Funding rates have also turned positive. Positive funding indicates that long traders are paying to maintain positions. This dynamic signals confidence in continued upside. However, elevated leverage can increase volatility if momentum stalls.

MYX Price Needs To Breach a Few Barriers

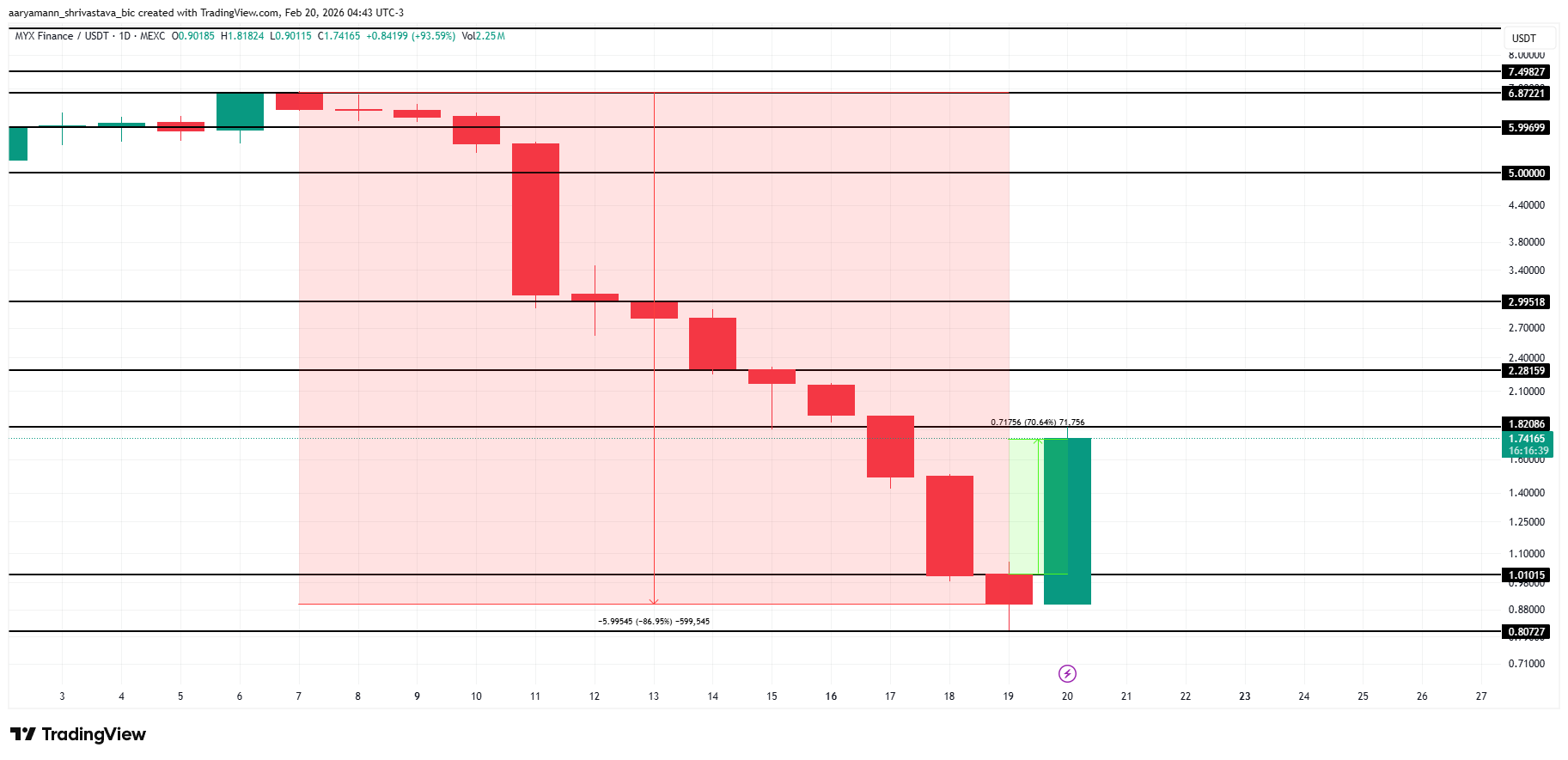

MYX price surged 90% on Friday, pushing the 24-hour gain to 70.6%. At the time of writing, the token trades at $1.74. The move partially offsets the 87% correction recorded over the previous 12 days.

The next resistance stands at $1.82. A decisive break above this level could open the path toward $2.28. Sustained volume and capital inflows will be necessary to validate the breakout. Without confirmation, upside may remain fragile.

If the rally was fueled primarily by speculation surrounding the funding round, selling pressure could return quickly. A failure to sustain gains may send MYX back toward $1.01. Such a decline would invalidate the bullish thesis and erase much of the recent recovery.

Crypto World

Silver Supply Shock? Binance Hits $70B as CME Goes 24/7

While silver inventories on COMEX continue to decline, Binance’s newly launched gold and silver perpetual futures have already surpassed $70 billion in trading volume within weeks.

The sharp convergence across metals and crypto derivatives markets signals surging demand for 24/7 synthetic exposure to precious metals.

Binance recorded over $70 billion in trading volume across its XAU/USDT and XAG/USDT perpetual contracts.

It points to a strong appetite for always-on, on-chain access to gold and silver price movements. The milestone highlights how traders are increasingly turning to crypto-native platforms to gain exposure to metals without traditional market-hour constraints.

At the same time, physical silver dynamics are tightening. Silver backing futures keep falling, with the March-to-May contract roll reaching 30 million ounces per day. This pace could clear the current open interest.

“At that pace, COMEX is out of silver by February 27,” wrote investment specialist Karel Mercx, adding that from April onward, the market risks a physical shortage unless meaningful inflows arrive in the coming weeks.

The structure of the futures curve adds to the urgency. When adjusting for financing costs such as SOFR (Secured Overnight Financing Rate) and storage, the March–May spread is approaching backwardation. This condition effectively signals immediate demand for physical metal over future delivery.

In carry-adjusted terms, backwardation signals that physical silver is more valuable now than later.

Rising futures prices can intensify this dynamic, as higher forward pricing encourages speculative buying. It also prompts producers and holders to retain physical supply in anticipation of further appreciation, pulling additional metal out of the market.

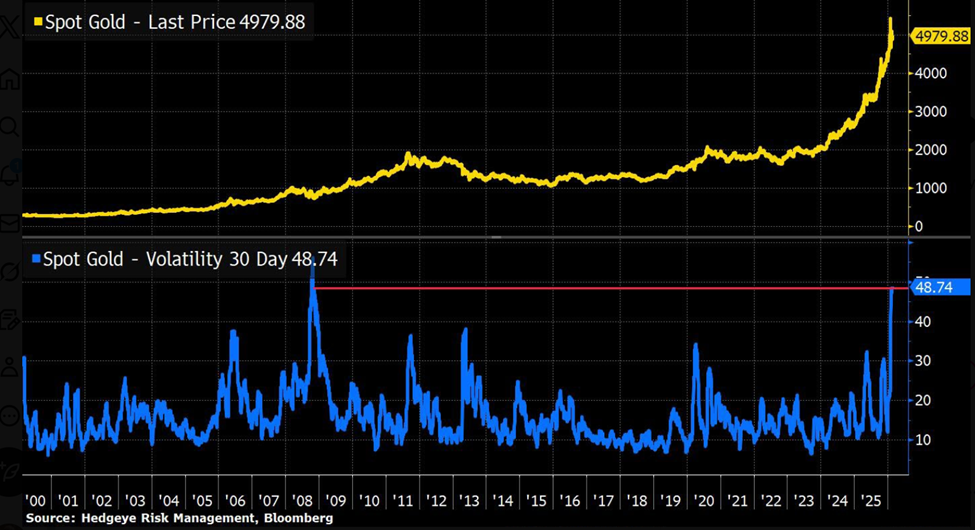

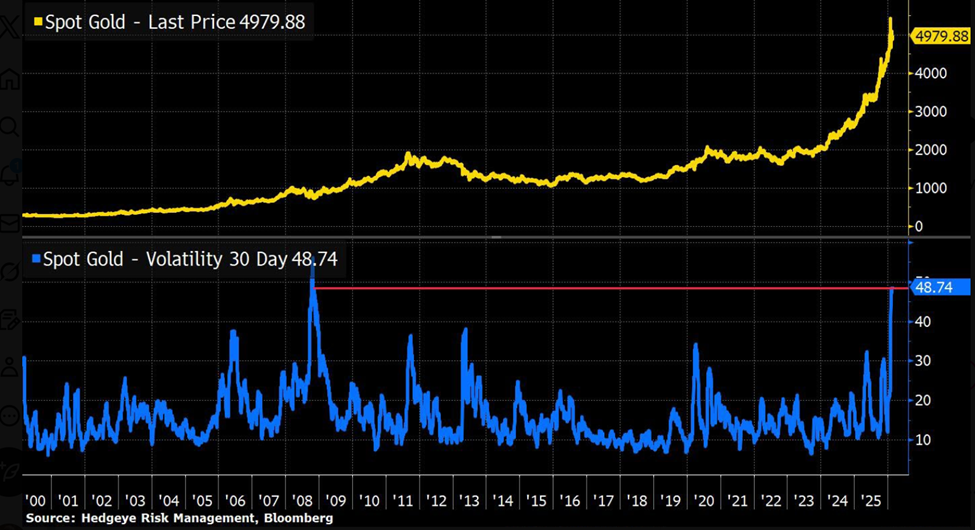

Meanwhile, gold volatility has surged, with its 30-day volatility at its highest level since 2008. The surge reflects heightened macro uncertainty and rapid shifts in positioning across derivatives markets.

The structural shift toward round-the-clock trading is not limited to crypto exchanges. CME Group announced that beginning May 29, crypto futures and options will trade 24 hours a day, seven days a week on CME Globex, pending regulatory review.

CME reported a record $3 trillion in notional volume across crypto futures and options in 2025, citing record-high demand for digital asset risk management.

Year-to-date 2026 data show average daily volume up 46% year-over-year and futures ADV up 47%, reinforcing sustained institutional participation.

The development may also reduce the risk of weekend price gaps. This would allow markets to respond instantly to geopolitical or macro shocks. Notably, the feature is already native to crypto exchanges like Binance.

Taken together, the surge in derivatives activity, accelerating silver inventory drawdowns, elevated gold volatility, and the normalization of 24/7 trading suggest markets are entering a structurally different phase.

As physical supply tightens and financial access expands, traders are positioning for potential scarcity in both metals vaults and digital order books.

Crypto World

Silver Price Breaks February Resistance Line

As seen on the XAG/USD chart, silver has today breached the upper boundary of the descending channel formed by February’s lower highs and lows.

Bullish sentiment is supported by heightened geopolitical tensions and rising demand for safe-haven assets. According to media reports:

→ On Thursday, US President Donald Trump warned Iran that it must reach an agreement on its nuclear programme, or “really bad things” would happen, setting a 10–15 day deadline.

→ In response, Tehran threatened retaliatory strikes on US bases in the region if attacked.

On 11 February, analysing the XAG/USD chart, we noted that silver was consolidating between two key levels:

→ resistance around $87.5–95

→ support near $70

Today’s bullish breakout of the channel’s upper boundary – which acted as resistance in February – can be interpreted as a move towards the $87.5–95 zone.

Confidence for bulls is further reinforced by an inverted head and shoulders (SHS) pattern. If buyers are determined, this should be confirmed by XAG/USD holding above:

→ the channel breakout level near $79

→ the psychological $80 mark.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Blockchain technology upgraded political campaign financing

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

In U.S. politics, campaign finance reporting is one of the most crucially vital parts of any election. While still important, the reporting standards and practices are dated. Currently, candidates must fill out and send reports to the Federal Election Commission every three months. Which then means voters, donors, or any other campaign stakeholders have to wait months before they see vital information on campaign financing and funding. Although today, using blockchain technology, a lot of this information can reliably be delivered in real time.

Summary

- Campaign finance is stuck in batch mode: Quarterly filings delay transparency, while blockchain can deliver real-time visibility into funding flows.

- Public wallets enable live verification: Voters, journalists, and donors can independently track contributions and spending without waiting for intermediaries.

- Transparency shifts incentives: Continuous on-chain disclosure makes questionable activity easier to flag early — turning reporting into active accountability.

Real-time verification through a public wallet

During our campaign, we chose to use a public crypto wallet so donors and voters could verify activity directly. Instead of waiting for a filing window, anyone could view the wallet, check balances, and see transactions as they occurred. The ledger created a live record of campaign funds, allowing people to follow the flow of money without intermediaries interpreting or summarizing it later.

In practical terms, on-chain records show the transaction amount, the sending address, and the timestamp. Journalists, analysts, and voters can review activity themselves rather than relying on delayed reports or second-hand explanations. Expenditures can be tracked the same way, creating a permanent record of spending that remains visible over time. Anyone with basic tools can confirm activity independently, without relying on summaries released weeks later.

Public ledgers already operate at scale

There is a global rise in demand for blockchain technology as regulations and policies are opening the gates for the industry. With the CLARITY Act set to pass this year, there is a lot of momentum now within the legislative branch.

Currently, nearly 1 in 10 people own cryptocurrencies. At the same time, government and corporate interest in crypto is increasing as stablecoin regulation is advancing across more than 70 percent of major jurisdictions, and roughly 80 percent of jurisdictions have new digital asset initiatives from financial institutions.

The idea of real-time public reporting aligns with other sectors that have embraced digital auditability. Finance departments in corporations are increasingly exploring crypto workflows. A mid-2025 survey found that nearly 24 percent of North American chief financial officers expect to use digital currency in their finance operations within two years.

A practical use case for political finance

With the financial systems and the modern infrastructure already set in place, blockchain can easily be implemented in the political environment. Apart from transparency, on-chain features could prevent errors and fraud as it automatically links and timestamp transactions.

Apart from the transparency, implementing blockchain features in the campaign can prevent errors and fraud. Traditional batch reporting can lead to mistakes because it relies on manual reconciliation and delayed submission.

Meanwhile, distributed ledgers automatically link and timestamp transactions. Academic research highlights how on-chain systems can enhance traceability and trust across sectors by eliminating opaque intermediaries and enabling third parties to validate records independently.

Oversight and practical accountability

Transparency around who is funding a campaign is not only expected, it is imperative for accountability. Blockchain infrastructure modernizes how that transparency happens. Rather than relying on delayed filings and databases, on-chain systems can provide real-time visibility to funding whilst still using blockchain standards to ensure accuracy, integrity, and compliance. This is about making disclosures clearer, faster, and harder to manipulate.

Public wallets can transform campaign finance from retrospective reporting into active verification. Instead of waiting weeks or months to learn how money moved, voters can see live transactions and trust the campaign’s contributions are from legitimate sources. This can change incentives, questionable activity is flagged earlier, and accountability happens continuously, making empty promises harder to sustain. By aligning transparency with the pace of modern decision-making, blockchain restores confidence in the system and gives voters a clearer basis for choosing leaders who operate in the open.

Crypto World

Tennessee judge sides with Kalshi in ongoing sports markets battle

A federal judge in Tennessee has granted a preliminary injunction preventing state officials from enforcing gambling laws against prediction market platform Kalshi, marking a significant win for the federally regulated exchange in its escalating legal battles with state regulators.

Summary

- A Tennessee federal court granted a preliminary injunction blocking the Tennessee Sports Wagering Council from enforcing state gambling laws against Kalshi while litigation continues.

- U.S. District Judge Aleta A. Trauger signaled Kalshi is likely to succeed in arguing its sports event contracts fall under federal derivatives law regulated by the Commodity Futures Trading Commission, not state betting statutes.

- The ruling adds to a growing nationwide legal patchwork, including enforcement efforts by the Nevada Gaming Control Board, highlighting an escalating federal-versus-state regulatory clash over prediction markets.

Tennessee court halts state crackdown on Kalshi

U.S. District Judge Aleta A. Trauger ruled that Kalshi is likely to succeed in its argument that its sports-related event contracts fall under federal derivatives law, rather than state gambling statutes. The decision temporarily blocks enforcement actions by the Tennessee Sports Wagering Council while the broader lawsuit proceeds.

Kalshi operates as a designated contract market regulated by the CFTC offering event-based contracts that allow users to trade on the outcome of real-world events, including sports.

The company argues that these contracts qualify as “swaps” under the Commodity Exchange Act, placing them squarely within federal jurisdiction and preempting state-level gambling laws.

Tennessee regulators had issued cease-and-desist letters alleging that Kalshi’s sports markets constituted unlicensed sports betting. In granting the injunction, the court indicated that subjecting Kalshi to both federal derivatives oversight and state gaming regulation could undermine the uniform regulatory framework established by Congress.

The ruling adds to a growing patchwork of legal decisions nationwide. In Nevada, the Nevada Gaming Control Board has filed a civil enforcement action accusing Kalshi of offering unlawful wagering, while other states have taken mixed approaches in court.

Though temporary, the injunction underscores a broader jurisdictional clash between federal derivatives regulators and state gaming authorities. The outcome could have sweeping implications for prediction markets across the United States, potentially reshaping how sports-related event contracts are classified and regulated nationwide.

Crypto World

The 100-Day Crypto Bloodbath That’s Crushing Altcoins

According to CoinGlass, momentum gauges sit in neutral territory, reinforcing views that neither bulls nor bears dominate yet across majors.

The crypto market has lost about $730 billion in value in the past 100 days, according to data shared by on-chain analyst GugaOnChain on February 20.

The scale and speed of the drawdown point to heavy capital outflows, with smaller altcoins falling faster than large assets and traders watching for signs of stabilization.

Deepening Bearish Sentiment

According to GugaOnChain, Bitcoin’s market cap fell from $1.69 trillion on November 22, 2025, to $1.34 trillion currently, a decline of 21.62%. The top 20 cryptocurrencies, excluding Bitcoin and stablecoins, also suffered a major blow, dropping 15.17% from $1.07 trillion to $810.65 billion.

Just as vulnerable were mid- and small-cap altcoins, which plunged 20.06% from $390.38 billion to $267.63 billion over their respective 100-day windows.

Meanwhile, the selling pressure shows no sign of abating. Separate figures posted by Arab Chain show whale inflows to Binance reached a 30-day average near $8.3 billion, the highest level since 2024.

Large transfers to exchanges can signal preparation to sell or rebalance holdings, though such flows can also reflect derivatives positioning or liquidity management. The spike followed months of stable activity, which analysts often treat as a sign of changing sentiment among major holders.

Price action seems to be matching that cagey tone. At the time of writing, BTC was trading just below the $68,000 level after falling by more than 24% in the last month and roughly 30% over the past year.

You may also like:

Market-wide metrics also paint a similar picture, with total crypto capitalization standing near $2.4 trillion, up just 0.5% in 24 hours. According to CoinGlass, the average RSI sits near 45, indicating neutral momentum, and the Altcoin Season Index reads 45, also neutral.

Additionally, Bitcoin dominance holds near 57%, which signals that capital has not rotated aggressively into altcoins.

On-Chain Activity Slows

Recent data from market intelligence provider Santiment shows that network activity has also collapsed alongside prices. According to the firm, Bitcoin’s active supply stopped growing, with fewer coins moving across the network.

Per the data, there are 42% fewer unique Bitcoin addresses making transactions compared to 2021 levels, and 47% fewer new addresses are being created. Analysts describe this phenomenon as “social demotivation,” which is emotional fatigue and reduced engagement that often precedes narrative shifts.

Elsewhere, Glassnode reported that Bitcoin has broken below the “True Market Mean” and slipped into a defensive range toward the realized price of approximately $54,900. Historically, deeper bear market phases have tended to find their lower structural boundary around this level, which represents the average acquisition cost of all circulating coins.

Furthermore, the Accumulation Trend Score sits near 0.43, well short of the 1.0 level that would signal serious large-entity buying. At the same time, Spot Cumulative Volume Delta has turned negative across major exchanges, meaning sellers are still in control.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

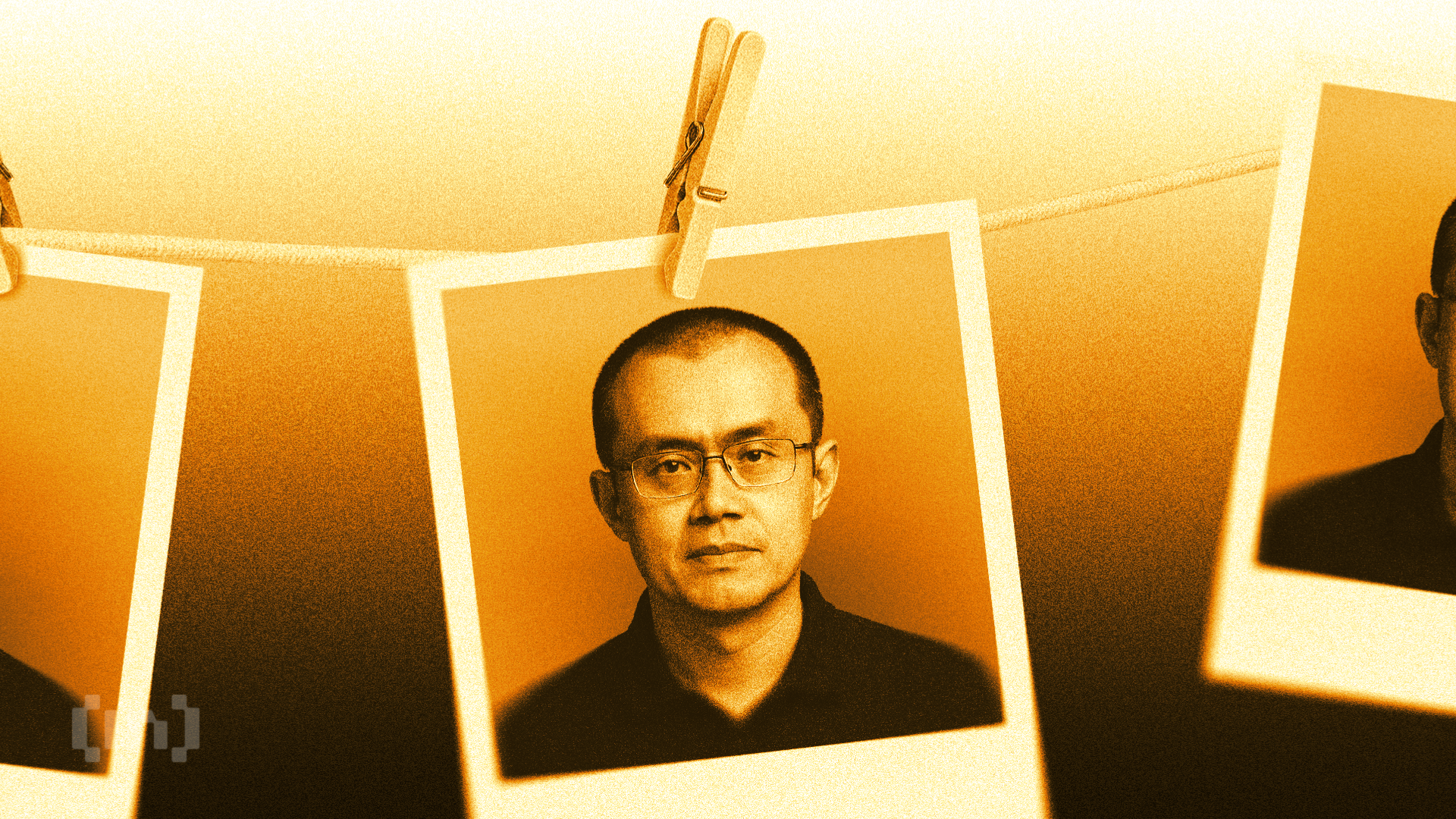

CZ, Mar-a-Lago, & Binance’s Ties To Trump’s USD1 Stablecoin

Changpeng Zhao (CZ), the recently pardoned founder of Binance, returned to the US this week, for the first time since leaving federal prison in 2024. He attended the crypto summit hosted by the Trump family–backed World Liberty Financial (WLFI) at Mar-a-Lago.

The appearance marked a dramatic turnaround for CZ, who pleaded guilty in 2023 to anti-money laundering violations and served a four-month sentence before being granted a full presidential pardon in October 2025.

CZ Returns to US After Presidential Pardon

Reports describe the gathering as both low-key and symbolically loaded. During the event, CZ:

- Mingled with Eric Trump and Donald Trump Jr.,

- Attended panels, including one with newly appointed CFTC Chairman Michael Selig, and

- Shared space with prominent figures such as Goldman Sachs CEO David Solomon, NYSE President Lynn Martin, Coinbase founder Brian Armstrong, Senator Bernie Moreno, Kevin O’Leary, and even Nicki Minaj.

“Learned a lot,” CZ shared, emphasizing policy insights rather than political optics.

The optics of CZ’s return are striking. From federal prison and a $50 million personal fine to casually networking at the president’s club, the event signals that the legal chapter is closed.

Trump’s pardoning of CZ effectively removed long-term barriers to US travel and business activity. It allows him to rebuild influence within elite financial and regulatory circles.

Networks at Mar-a-Lago as Binance Controls 87% of Trump-Linked USD1 Stablecoin

The timing also coincides with Binance’s growing role in WLFI’s USD1 stablecoin. The exchange reportedly controls roughly 85–87% of the $5.4 billion circulating supply, strengthening a Trump-backed venture that critics have questioned for potential conflicts of interest.

While some lawmakers and commentators have raised concerns about a perceived quid pro quo between the pardon and Binance’s dominance in the stablecoin, CZ has repeatedly called such reports “not news.”

Nevertheless, Binance is reinforcing its dominance in the USD1 ecosystem with a fresh incentive push. From February 20 to March 20, the exchange will distribute 235 million WLFI tokens to USD1 holders, rewarding early adopters for providing liquidity.

Mar-a-Lago Summit Highlights Crypto-Political Convergence and USD1 Ambitions

The Mar-a-Lago summit highlighted the convergence of crypto, finance, and political influence. World Liberty’s leadership outlined ambitious plans for USD1, framing it as a “new digital Bretton Woods system” to integrate real estate, banking, and decentralized finance.

“…the work is just beginning… We are building the future, and we are doing it together,” WLFI wrote.

Attendees were urged to explore its use, while WLFI also announced upcoming tokenized investment products tied to Trump resorts.

Despite Binance remaining barred from US operations due to the 2023 settlement, CZ’s presence at a high-profile US event highlights a shift.

Engagements with policy leaders like CFTC Chairman Rostin Behnam and lobbying veterans such as Brian Armstrong suggest that figures like CZ are regaining a foothold in discussions shaping the future of digital assets.

Whether CZ’s return to the US will translate into renewed operational influence for Binance or remain a high-level networking exercise is uncertain.

What is clear, however, is the symbolism: a once-convicted crypto executive now freely attends elite US circles, at an event that blends business ambition with political connections. Meanwhile, his firm exerts unprecedented influence over a politically linked stablecoin.

Crypto World

ETH, XRP, ADA, BNB, HYPE flash mixed signals this week

ETH, XRP, ADA, BNB, HYPE sit near key levels after a choppy week of failed breakouts and fragile supports.

Summary

- TON embeds its wallet in Telegram, enabling payments, gifts, and asset transfers without traditional crypto UX, targeting over 1B users.

- CEO Max Crown says TON is “built to serve everyday users,” focusing on distribution, onboarding, and UX rather than just technical specs.

- Telegram gifts and NFT stickers have driven nine‑figure NFT volume, over 500k wallets, and rapid Toncoin (TON) account growth, signaling rising institutional and retail interest.

Ethereum (ETH) traded relatively flat over the period, with buyers maintaining key support levels as selling momentum decreased, according to technical analysts. The cryptocurrency faces resistance at higher price points, and analysts noted that recent weekly losses could precede a relief rally testing those resistance levels. Technical indicators suggest Ethereum may be completing a second downward movement in an ABC correction pattern.

Ripple closed the week with slight gains, though the advance proved insufficient to reverse bearish chart patterns. An attempt to break through resistance was rejected by sellers, a signal that the downtrend may persist, according to market observers. Analysts indicated that continued selling momentum could drive prices to lower support levels, with price reactions at nearby support expected to provide direction signals.

Cardano remained near key support levels but showed signs of weakness that could result in a breach of that level, according to technical analysis. The cryptocurrency’s price action reflected patterns similar to Ripple, with bearish momentum persisting as buyers and sellers contest support levels. Cardano has underperformed during the current year, with analysts noting that sustained gains would require reclaiming materially higher price levels.

Binance Coin (BNB) held near support levels over the past week, with selling pressure appearing to ease, though analysts cautioned the selloff may not be complete. Higher resistance levels remained untested, indicating buyer hesitation despite substantially decreased selling volume. Technical analysts stated that maintaining current support could encourage buyers to challenge resistance levels, while renewed selling pressure could push prices to lower support zones.

Hype (HYPE) closed the week lower following rejection at resistance levels. Buyers remained defensive, with analysts projecting potential further declines to key support. A loss of that support level would constitute an extremely bearish signal and could result in new yearly lows, according to market observers. Conversely, holding that level could be interpreted as a higher low formation, potentially encouraging buyer re-entry. Analysts characterized the cryptocurrency as being in a pullback phase that may extend for an indeterminate period.

Crypto World

BitMine Is Confident in Ethereum’s Recovery: Here’s Why

Ethereum (ETH) is holding below $2,000, leaving many investors underwater as the downtrend extends into February 2026.

Despite the sustained weakness, BitMine has maintained a bullish stance on Ethereum. This raises a key question: Is their confidence driven by narrative or sentiment, or is there another factor behind their conviction?

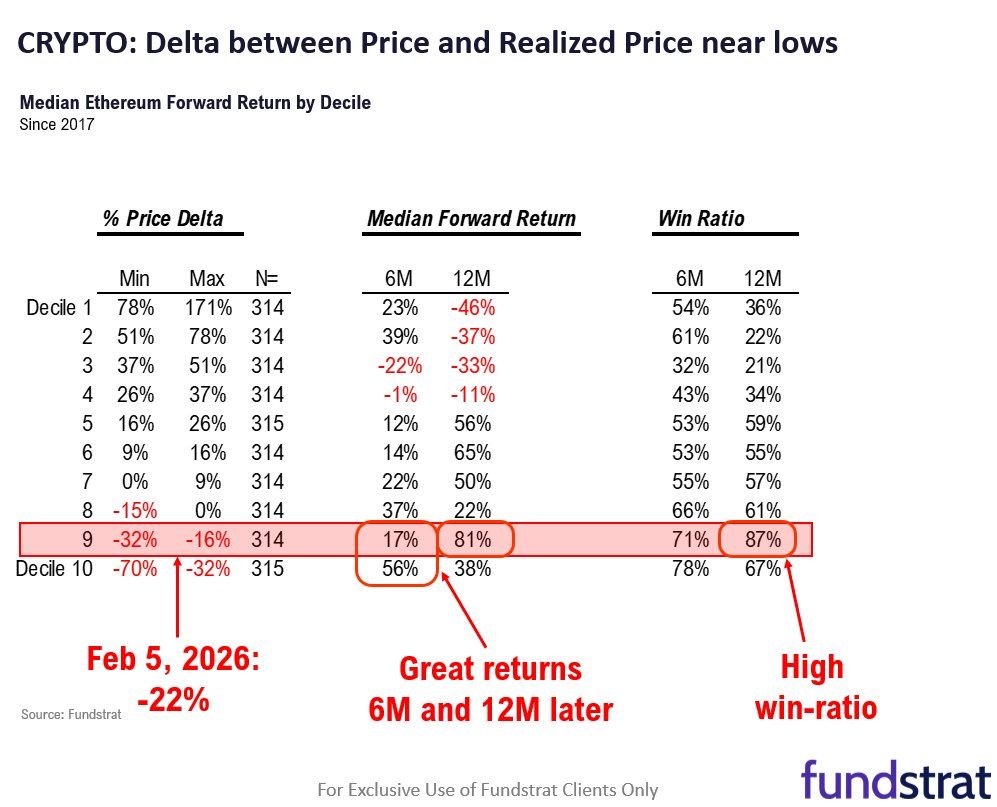

Ethereum’s Pain Reaches 9th Decile: What Does That Mean For The Price?

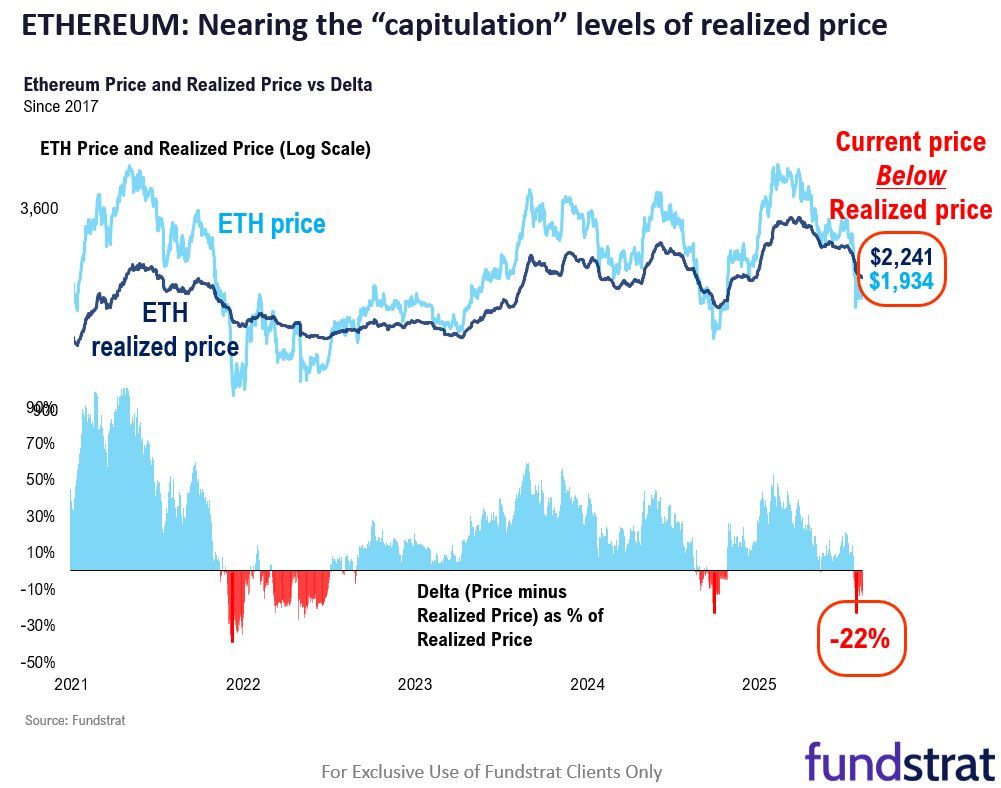

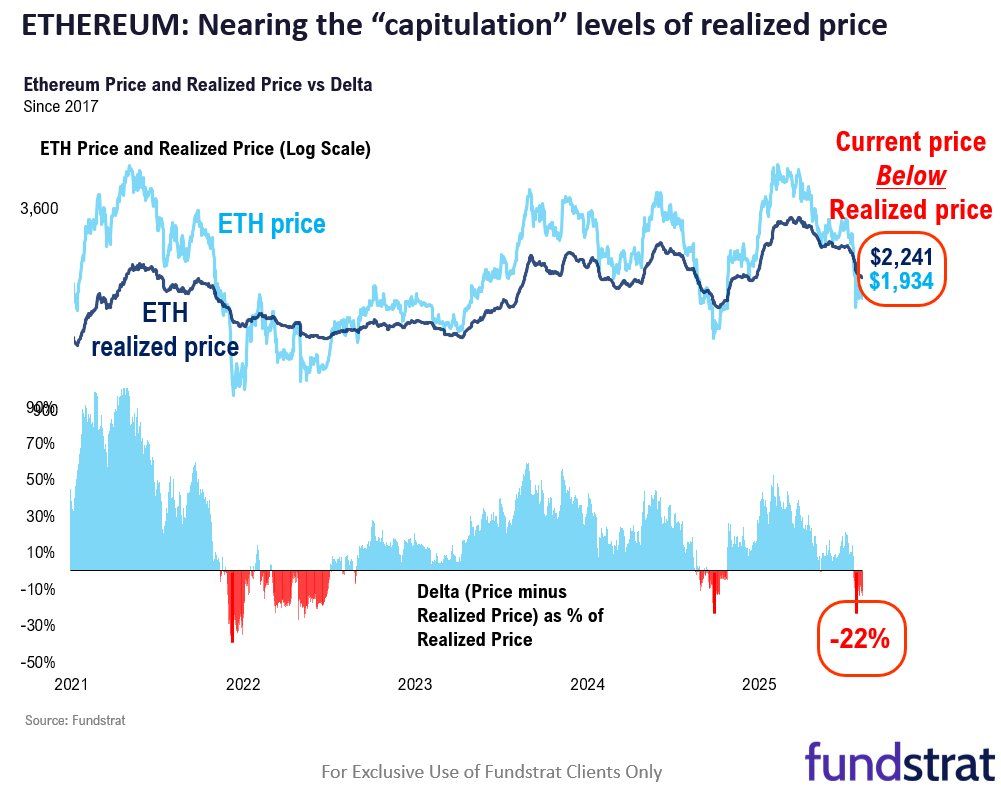

In a detailed post on X (formerly Twitter), BitMine highlighted the research by Sean Farrell, Fundstrat’s Head of Digital Asset Strategy, focusing on Ethereum’s realized price. This is an on-chain valuation metric that reflects the average acquisition cost of all coins currently in circulation.

According to the data, Ethereum’s realized price stands at $2,241. At the time of the analysis, the asset was trading near $1,934.

This leaves the average holder in the red. According to Fundstrat’s model, the “loss for realized price was 22%.”

The analysis compared the current drawdown to prior cycle lows. During the 2022 bear market, Ethereum traded as much as 39% below its realized price. In 2025, the discount reached approximately 21%.

“If we apply this ‘loss’ to the current realized ETH price of $2,241, we get implied ‘lows’ for ETH. Using 2022, this implies $1,367. Using 2025, this implies $1,770,” the analysis noted.

Using a decile analysis, the post revealed that the current drawdown falls into the 9th decile (extremely high). For context, a decile analysis is a quantitative method used in statistics, finance, and marketing to segment a dataset into 10 equal-sized groups (deciles) based on the distribution of a specific variable.

The data suggests that the median 12-month forward return in this decile was approximately 81%, with a 12-month win ratio of 87%. In other words, in most historical instances when ETH reached similar drawdown levels, it was trading higher one year later.

“Is this the bottom? Seems like we are closing in on that low. Looking beyond the near-term, the risk/reward for ETH is positive,” the post read.

BitMine Chairman Tom Lee previously emphasized that sharp drawdowns are a recurring feature of Ethereum’s price history. Since 2018, ETH has experienced eight separate declines of 50% or more from local highs, suggesting that corrections of this magnitude have occurred roughly once per year.

In 2025, Ethereum fell 64% between January and March. Despite that steep drop, the asset later rebounded significantly.

“ETH sees V-shaped recoveries from major lows. This happened in each of the 8 prior declines of 50% or more. A similar recovery is expected in 2026. The best investment opportunities in crypto have presented themselves after declines. Think back to 2025, the single best entry points in crypto occurred after markets fell sharply due to tariff concerns,” Lee said.

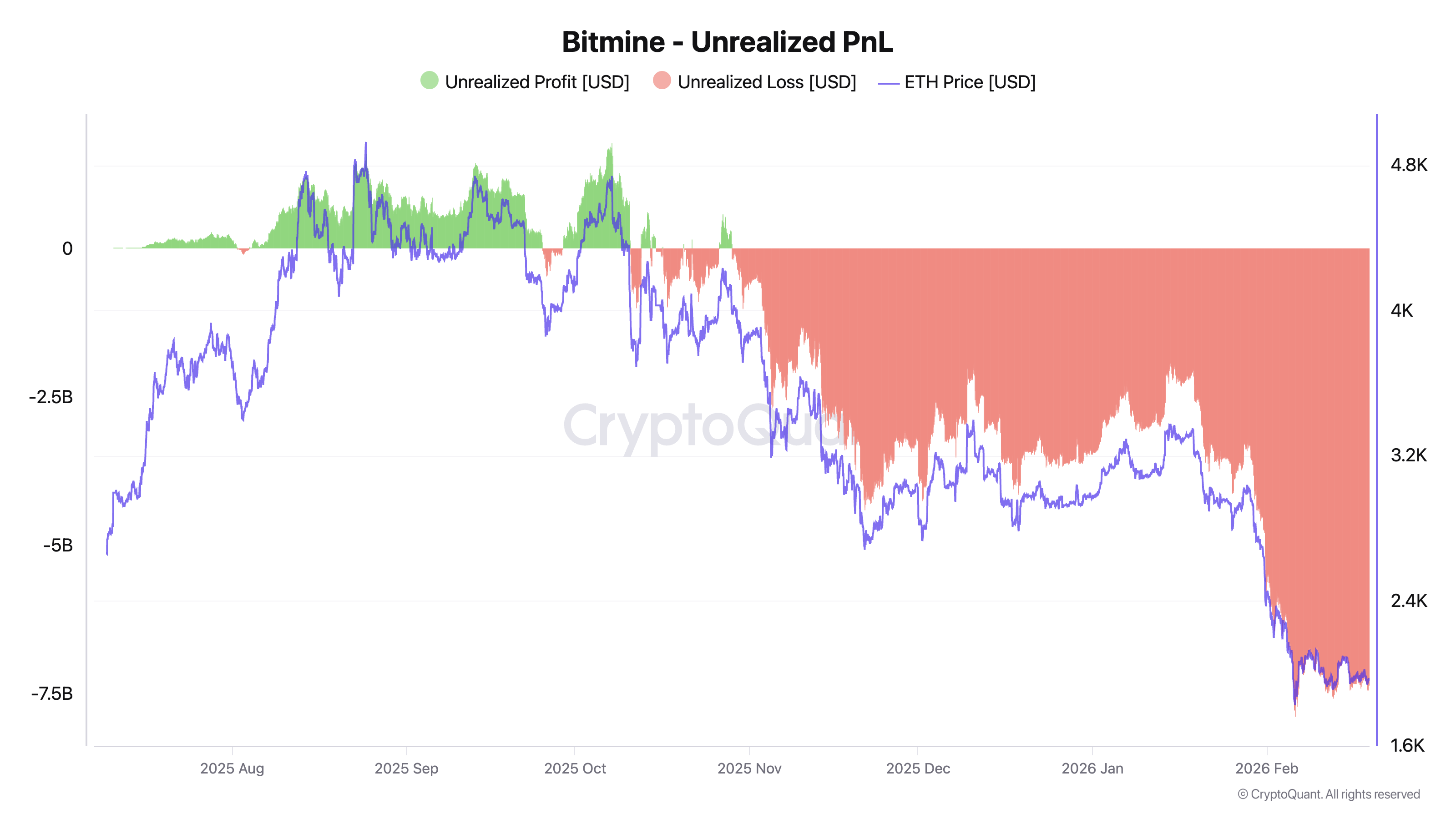

Ethereum Recovery Could Be Critical for BitMine’s $7 Billion Underwater Position

If Ethereum delivers a sustained recovery with strong upside returns, it could represent a meaningful inflection point for investors, particularly BitMine. The company’s unrealized losses have expanded to approximately $7 billion, according to CryptoQuant data.

At the same time, BitMine appears to be reinforcing its bullish stance through continued accumulation. Lookonchain reported that the firm purchased 10,000 ETH from Kraken today.

This transaction followed a much larger single-day acquisition of 35,000 ETH. BitMine acquired 20,000 ETH from BitGo and 15,000 ETH from FalconX.

Taken together, the purchases suggest that despite mounting unrealized losses, BitMine is positioning for a potential upside scenario rather than reducing exposure.

Crypto World

Crypto Miner Bitdeer Slumps 17% After $300M Debt Offering

Bitdeer Technologies Group (NASDAQ: BTDR), a Singapore-based operator of data centers and Bitcoin (CRYPTO: BTC) mining infrastructure, unveiled a private placement of US$300 million in convertible senior notes, with an option for purchasers to subscribe to an additional US$45 million. The offering marks Bitdeer’s second convertible debt sale since a US$150 million issue in April 2024, a move that coincided with a notable decline in the stock price at the time. The notes are scheduled to mature in 2032, carry semiannual interest payments, and can be converted into cash, shares, or a combination of both. Proceeds are earmarked for data-center expansion, AI cloud growth, the development of mining rigs, and general corporate purposes. Bitdeer operates globally, with data centers in the United States, Norway, and Bhutan, while maintaining its headquarters in Singapore.

Key takeaways

- The company is offering US$300 million in convertible senior notes, with a potential additional US$45 million via private placement.

- These notes mature in 2032, are senior unsecured, and pay semiannual interest; holders may convert to cash, stock, or a mix.

- The funds will support data-center expansion, AI cloud initiatives, mining-rig development, and general corporate purposes.

- This is Bitdeer’s second convertible-note sale, following a US$150 million offering in April 2024 that coincided with a roughly 18% drop in the stock at the time.

- To offset potential dilution, the deal includes capped-call transactions and a concurrent registered direct share offering aimed at repurchasing notes due in 2029.

- Traders punished Bitdeer shares on the news, with the stock down about 17% on the session before closing near the year’s lows.

Tickers mentioned: $BTDR, $BTC

Sentiment: Bearish

Price impact: Negative. Bitdeer’s stock fell roughly 17% on the news, underscoring dilution concerns and investor sensitivity to capital-structure changes.

Trading idea (Not Financial Advice): Hold. The combination of convertible issuance and dilution-offset mechanisms warrants caution, even as the proceeds underpin ambitious expansion plans.

Market context: The transaction reflects a broader pattern among crypto miners financing growth with convertible debt, a structure that can dilute equity if notes convert and that often arrives with offsetting strategies to manage equity dilution.

Why it matters

The planned private placement of convertible notes signals Bitdeer’s continued appetite for aggressive expansion in a capital-intensive sector. By targeting data-center capacity and AI cloud services alongside mining-rig development, the company is positioning itself to scale its infrastructure footprint in multiple jurisdictions. The convertible structure offers investors upside if the stock appreciates, while providing downside protection through bond characteristics. However, the potential for future dilution remains a live concern for existing shareholders, especially if the notes are converted as Bitdeer’s equity price strengthens.

From a corporate-finance perspective, the use of convertible debt aligns with investor demand for instruments that balance debt-like safety with equity-like upside. The inclusion of capped-call transactions is designed to mitigate dilution, but it does not eliminate the fundamental trade-off between raising capital and preserving share value. The concurrent share offering intended to repurchase notes due in 2029 adds another layer of capital-management activity, signaling a deliberate attempt to optimize the capital stack while pursuing growth objectives.

For market participants, the development underscores how mining-focused operators are navigating a landscape where capital-structure decisions can materially impact stock performance. As miners race to expand capacity and enter adjacent growth areas like AI cloud services, financing decisions—particularly those involving convertibles—will continue to draw scrutiny from investors who weigh dilution risk against potential long-term value creation. The broader environment for crypto equities remains sensitive to macro signals, sector volatility, and regulatory developments, making the next steps for Bitdeer—such as the final terms of the private placement and the effectiveness of dilution-offset strategies—worth watching closely.

What to watch next

- Closing terms and timing of the US$300 million convertible note offering, including whether the additional US$45 million private placement is exercised.

- Results and milestones tied to data-center expansion and AI cloud initiatives, including capacity additions and any operational KPIs.

- Details of the capped-call transactions and how they are structured to offset dilution, along with the timing and terms of the concurrent registered direct share offering to repurchase 2029 notes.

- Any further commentary from Bitdeer on its use of proceeds and how debt financing affects its capital-structure strategy amid ongoing market volatility for crypto equities.

Sources & verification

- Bitdeer announces proposed private placement of US$300 million convertible notes. https://ir.bitdeer.com/news-releases/news-release-details/bitdeer-announces-proposed-private-placement-us3000-million-0

- Strategy to equitize convertible debt over next 3-6 years: Saylor. https://cointelegraph.com/magazine/strategy-plans-equitize-convertible-debt-over-next-3-6-years-saylor

- What are convertible senior notes? How MicroStrategy uses them to buy Bitcoin. https://cointelegraph.com/explained/what-are-convertible-senior-notes-how-microstrategy-uses-them-to-buy-bitcoin

- Bitdeer Ohio mining facility fire stock coverage. https://cointelegraph.com/news/bitdeer-ohio-mining-facility-fire-stock

- Bitdeer 150m notes offering expansion stock drop. https://cointelegraph.com/news/bitdeer-150m-notes-offering-expansion-stock-drop

Debt financing and expansion goals drive Bitdeer’s latest convertible note offering

Bitdeer Technologies Group (NASDAQ: BTDR), a Singapore-based operator of data centers and Bitcoin (CRYPTO: BTC) mining infrastructure, has unveiled a private placement of US$300 million in convertible senior notes, with a potential extension of up to US$45 million via a private placement. The move marks Bitdeer’s second foray into convertible debt after a US$150 million offering in April 2024, an issue that coincided with a sharp retreat in the company’s share price. The newly proposed notes carry a maturity date in 2032, and they are described as senior unsecured obligations with semiannual interest payments. In a convertible arrangement, investors can choose to convert their holds into cash, shares, or a combination of both, depending on the terms at issue and market conditions at the time of conversion.

The use of convertible notes taps into a common financing channel for crypto miners seeking to fund rapid capacity expansion without immediately diluting equity. Bitdeer’s stated use of proceeds—data-center expansion, AI cloud growth, mining-rig development, and general corporate purposes—highlights a strategy focused on bolstering both scale and diversification beyond strictly mining revenues. The company’s operations span multiple geographies, with data centers in the United States, Norway, and Bhutan, underscoring the geographic footprint often required to manage energy costs, regulatory considerations, and resilience in a capital-intensive industry.

The market’s reaction to the announcement was swift. Bitdeer’s stock moved lower on the news, underscoring investor anxiety around potential dilution and the timing of a sizable capital raise. The announcement also references the company’s earlier convertible-note activity; the April 2024 US$150 million offering previously produced an 18% slide in the share price, illustrating how these structures can be priced into equity performance even when the underlying business objectives are growth-oriented. To partially counteract dilution, Bitdeer plans to employ capped call transactions as part of the convertible-note framework, a technique often used to mitigate the dilution impact when notes convert to equity. In parallel, the company is pursuing a registered direct share offering tied to a program to repurchase a portion of its existing convertible notes due in 2029, highlighting an ongoing effort to manage the capital stack in a way that blends financing flexibility with equity preservation.

In the broader context, this approach mirrors a recurring theme among mining and crypto infrastructure players who rely on convertible debt to finance expansion while attempting to shield existing shareholders from excessive dilution. Market observers will be watching not only the terms of the 2032 notes but also the practical effectiveness of the capped-call strategy and the impact of the 2029-note repurchase plan on Bitdeer’s future earnings and share count. The situation also sits within a larger narrative about how crypto-focused companies balance growth ambitions with the need for disciplined capital management amid fluctuating crypto prices and evolving regulatory signals.

Crypto World

If War With Iran Is Almost Certain, How Might Bitcoin Price React?

Bitcoin price is on the edge again.

Price swings are getting crazy, and it’s sitting around $67,400 like it’s not sure which way to jump. Traders are nervous. Really nervous.

On Polymarket, bettors now put the odds of a U.S. strike on Iran this month at 61%. Crypto felt it fast. Liquidations rolled in. Risk-off mode kicked on. And suddenly, everyone’s playing defense.

Key Takeaways

The Signal: Polymarket bettors price in a 61% chance of imminent US military action.

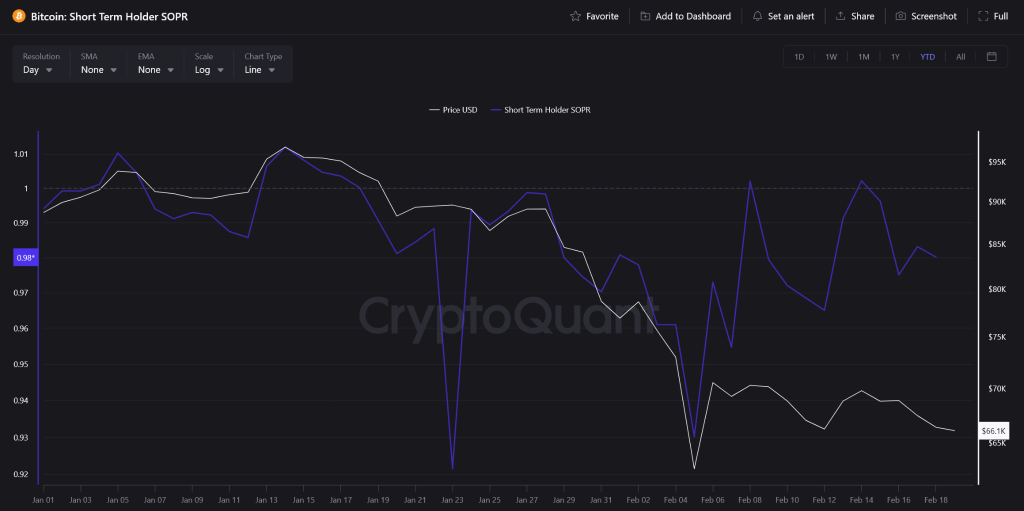

The Risk: Short-Term Holder SOPR has dipped below 1.0, indicating panic selling at a loss.

The Impact: Bitcoin risks breaking critical $65,000 support if conflict escalates this weekend.

Why Is This Happening Now?

Tensions between Washington and Tehran feels almost certain now.

Reports say the Pentagon has strike options ready after nuclear talks stalled. That kind of headline pushes investors straight into gold and cash. Risk assets get dumped first.

On chain data backs it up. The Short Term Holder SOPR is below 1. That means recent buyers are selling at a loss just to get out.

Add in uncertainty around possible Fed policy tweaks and you get a messy mix. Geopolitics plus macro pressure. While the US Iran story dominates, Bitcoin is trading like a classic risk asset, with sharp intraday drops and fragile sentiment.

What Does This Mean for Bitcoin Price?

Bitcoin is leaning hard on the $66,000 to $65,729 support zone. Lose that on a daily close and $60,000 comes into focus fast.

The short term Sharpe ratio has flipped negative, showing ugly risk adjusted returns during the panic. Nearly $80M in longs have already been wiped out since the drop from $70,000.

While retail is dumping, some political insiders are floating massive long term targets. That hints whales may see this dip as opportunity. Arthur Hayes also pointed to Treasury liquidity dynamics that could support crypto once the dust settles.

Volatility into the weekend looks guaranteed. But talks in Oman on Friday could change the tone. If tensions cool, a sharp relief rally could trap late shorts.

Discover: Here are the crypto likely to explode!

The post If War With Iran Is Almost Certain, How Might Bitcoin Price React? appeared first on Cryptonews.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video9 hours ago

Video9 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World13 hours ago

Crypto World13 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market