Crypto World

No Systemic Failures, Rising On-Chain Assets

Chainlink’s Nazarov said real-world assets could surpass cryptocurrencies in total value.

Bitcoin and the rest of the cryptocurrencies can’t shake off the doldrums. Despite the ongoing weakness, this cycle has at least avoided major institutional failures that were seen in past bear markets.

And as investors weather the drawdowns, real-world assets (RWAs) are quietly expanding on-chain regardless of crypto prices.

RWAs Keep Moving On-Chain

In a recent post on X, Chainlink co-founder Sergey Nazarov highlighted that, unlike the previous cycle, which saw the collapse of FTX and multiple lenders during large price drops, this cycle has not produced large systemic risks. He said that crypto systems have managed price and liquidity drawdowns more effectively, thereby creating a more “reliable” environment for both retail and institutional capital.

Nazarov also said that the migration of real-world assets onto blockchains is accelerating independently of cryptocurrency prices. He pointed to ongoing RWA issuance and the growth of on-chain perpetual markets for traditional commodities such as silver, which are rivaling traditional markets, particularly during periods when permissioned trading becomes more restrictive or risky.

According to Nazarov, the growth of RWAs is driven by the value of 24/7/365 markets, on-chain collateral management, and access to reliable market data, rather than fluctuations in Bitcoin or other crypto assets.

He identified three trends expected to shape the next stage of crypto adoption. First, on-chain perpetual markets and tokenized real-world assets provide long-term, durable value. Second, institutional adoption is being driven by fundamental technological advantages, including permissionless, always-on DeFi markets. Third, infrastructure supporting RWAs is in increasing demand, as more complex assets require reliable systems for tokenization, data management, and market operation.

Nazarov added that if current trends continue, RWAs on-chain could surpass cryptocurrencies in total value, and potentially redefine the industry while continuing to support cryptocurrency growth by bringing more capital on-chain.

You may also like:

Developer Activity Across RWA Projects

Data shared by Santiment shows strong developer activity across RWA projects over the past 30 days. Hedera (HBAR) ranked first, followed by Chainlink (LINK) and Avalanche (AVAX). Stellar (XLM) and IOTA (IOTA) placed fourth and fifth. Chia Network (XCH), VeChain (VET), Lumerin (LMR), Creditcoin (CTC), and Injective (INJ) completed the top ten.

The rankings also revealed that RWA-focused blockchain projects continue to see steady development activity despite market turbulence.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BTC manages quick gain as oil drops $3 per barrel

After retreating back to the $69,000 area during early U.S. morning hours Wednesday, bitcoin has quickly spiked to nearly $71,000.

Other crypto assets, including ether (ETH), solana (SOL) and XRP, saw the same sharp moves higher.

The gains appeared to come as crude oil quickly reversed most of its session’s large gains, dropping $3 per barrel in a matter of minutes. At press time, WTI crude futures for April were at $85, up 2% for the day.

Crude’s drop also benefited stocks, with the Nasdaq moving from a small decline to a gain of 0.5% in early U.S. trade.

Crypto-related shares were mixed, with Strategy (MSTR), Galaxy Digital (GLXY) and Bullish (BLSH) posting modest advances, while Coinbase (COIN) and eToro (ETOR) were slightly lower.

With the ongoing war against Iran, risk markets this week have been mostly ruled by oil’s price action. Stocks and crypto plunged on Sunday evening as oil surged to $120, but then gained as oil quickly retreated.

Fresh inflation data

Wednesday’s February CPI report was in line with economist forecasts, up 0.3% on a month-to-month basis, putting the 12-month inflation rate at 2.4%. Next month, however, could show a much different picture due to the outbreak of the U.S.-Iran war, posing the question of whether the Federal Reserve will respond to the temporary shock or take a more hawkish stance after being caught off guard during the last inflation cycle.

Stephen Coltman, head of macro at 21shares says the Fed’s choice will be critical, noting that investors will be watching next week’s Fed meeting closely for signs on how officials plan to react.

As for bitcoin, the rise in next month’s data is likely “already baked in the cake,” he said.

Crypto World

Arthur Hayes Deploys Net Liquidity Strategy: Not Buying BTC Now Even If He Has Only $1

Arthur Hayes has officially stopped buying Bitcoin ($BTC). The BitMEX co-founder says he will not deploy fresh capital until the Federal Reserve explicitly expands the money supply.

With Bitcoin struggling to break resistance, Hayes is tracking a specific “Net Liquidity” metric that suggests the current rally lacks fundamental fuel.

He is waiting for the centralized banking cartel to restart the money printer before chasing the market any higher.

Discover: The best pre-launch crypto sales

Why Arthur Hayes Is Slamming the Brakes on Bitcoin

Hayes’s hesitation stems from his Net Liquidity framework, a formula that subtracts the Treasury General Account (TGA) and Reverse Repo (RRP) balances from the Fed’s total balance sheet.

While nominal prices are high, real dollar liquidity has not expanded enough to support a sustained breakout above $90,000. Hayes views the current market as a trap for traders expecting a straight line up.

“If I had $1 to invest right now, would I be putting it into Bitcoin? No. I would wait,” Hayes said on a podcast. He argues that while geopolitical tensions usually drive safe-haven assets, the only thing that truly matters for Macro Crypto cycles is fiat debasement.

This thesis is reinforced by market data showing Bitcoin decoupling from traditional bond yields, a divergence that historically signals impending volatility.

Hayes warns that without an immediate pivot back to Quantitative Easing, the “American war machine” alone cannot sustain asset prices. He believes the market is pricing in liquidity that hasn’t arrived yet. If the Fed refuses to loosen its monetary policy, Hayes predicts the current chop could move downwards.

He is positioning for a scenario where the TGA drains slowly, leaving risk assets starved for capital in the short term. Only when the printing press whirs to life will the Net Liquidity conditions turn green for aggressive accumulation.

The Levels to Watch for Bitcoin

Bitcoin Price Analysis currently shows a market caught between institutional accumulation and macro exhaustion. Bitcoin is trading under the $90,000 psychological ceiling, a level that has rejected bulls multiple times. Hayes suggests that a failure here could trigger a slide toward $60,000, flushing out late longs.

$60,000 is the level that matters most. If price action breaks below this support, Hayes anticipates a “massive sell-off” driven by cascading liquidations. Concurrently, Wall Street is buying Bitcoin strategically but is not yet invested enough to chase breakouts unconditionally.

Conversely, the bull case requires a definitive reclaim of $90,000 on high volume. If spot buyers can push through this resistance, the path to $100,000 opens up quickly, invalidating the bearish liquidity thesis.

Traders looking for confirmation might look at simple math that nailed the last BTC bottom to identify safe entry points if Hayes’ predicted dip materializes.

If Net Liquidity remains flat, Bitcoin likely ranges sideways or bleeds slowly. But if the Fed is forced to cut rates due to external shocks, the $90,000 cap will likely shatter overnight.

Discover: The best new cryptocurrencies

The post Arthur Hayes Deploys Net Liquidity Strategy: Not Buying BTC Now Even If He Has Only $1 appeared first on Cryptonews.

Crypto World

Oracle error adds to turmoil at DeFi giant Aave

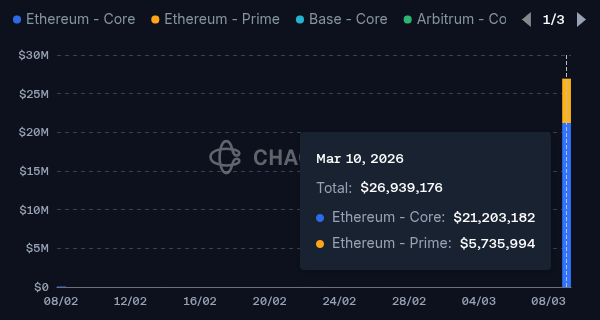

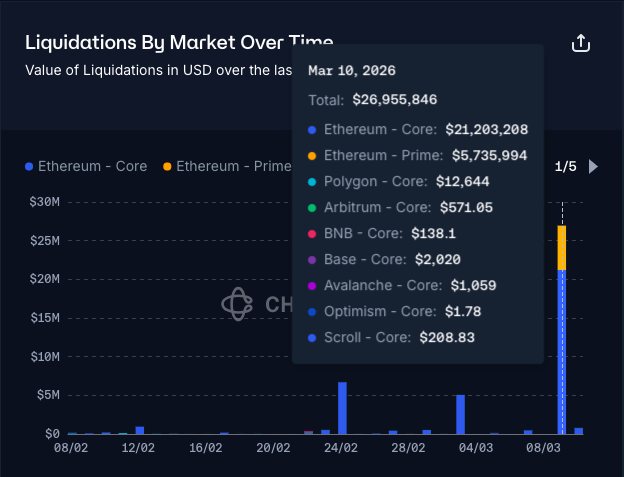

Almost $27 million worth of liquidations were triggered on DeFi lending giant Aave yesterday, thanks to a faulty price cap oracle update.

The Correlated Asset Price Oracle (CAPO), run by risk manager Chaos Labs, sets caps for the price ratio between correlated assets, in order to protect against price manipulation attacks on the protocol.

In a post to the Aave governance forum, Chaos Labs explained that, due to a timestamp mismatch, the price ratio between wstETH and stETH was capped below the current market rate, causing a price drop of 2.85%.

This was enough to liquidate those positions close enough to the liquidation threshold.

The company’s dashboard (filtered for wstETH) shows $21.2 million of liquidations on Aave’s Ethereum Core instance, and a further $5.7 million on its Prime instance.

Read more: Aave developer BDG Labs to ‘cease contribution’ after DAO drama

Chaos Labs’ founder, Omer Goldberg, promised that “all affected users will be fully reimbursed.” He says that, since launching over a year ago, its oracles “have streamed over 1,200 payloads for ~3k+ parameters, with zero incidents.”

While the protocol didn’t suffer bad debt, liquidators profited approximately 500 ether (ETH) worth $875,000. Around 30% of this (154 ETH) was recovered, and will be used to reimburse users, with the remainder coming from the Aave treasury.

A similar pricing error resulted in $1.8 million of bad debt DeFi protocol Moonwell last month.

In an AI-coauthored update, the ratio between ETH and cbETH was used to price cbETH in dollars, liquidating borrowers whose collateral was suddenly worth $1.12 instead of around $2,200.

The damage for Aave may not have been too severe this time, but one blockchain security professional questioned why the changes aren’t run through a transaction simulation before going live, a simple sanity check which could prevent more serious losses, and even bad debt, in future.

Aave in crisis

The malfunction comes during a period of tumult for decentralized finance’s number one protocol.

Since December last year, the DAO and Aave Labs have been in dispute over who really controls Aave. The spat has seen DAO service providers accuse founder Stani Kulechov’s Aave Labs of playing dirty and pushing through plans for an upcoming v4 of the protocol.

Indeed, two key service providers have recently thrown in the towel.

Developer BGD Labs left last month over Labs’ snubbing of the wildly successful v3, in favor of the Labs-developed v4.

Shortly after, Marc Zeller’s ACI reached “breaking point” following the recent Aave Will Win vote, which swung narrowly in Labs’ favor.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Aave Oracle Glitch Causes $27M Liquidations: CAPO Misconfiguration Confirmed

A misconfigured Oracle system in Aave triggered $27 million in forced liquidations on March 10, undervaluing wrapped staked Ether by 2.85% against its actual market rate.

According to the post-mortem by Chaos Labs, the CAPO oracle error caused Aave V3 Ethereum Core and Prime instances to apply an exchange rate of roughly 1.1939 wstETH-per-ETH when the live onchain rate was approximately 1.228, enough of a gap to push 34 high-leverage E-Mode positions below their liquidation thresholds automatically.

It resulted in the liquidation of 10,938 wstETH. The protocol says it incurred no bad debt and is moving to compensate all affected users.

The Damage: 34 Users, $27M in Liquidations, and 499 ETH in Bot Profits

The oracle glitch liquidated 34 users, with the total volume reaching $27 million in wstETH positions.

Liquidation bots moved quickly, capturing 499 ETH in bonuses, approximately $1.2 million, by executing against positions that should not have been eligible for liquidation at that moment.

Aave founder and CEO Stani Kulechov confirmed in a Wednesday post that the protocol generated no bad debt from the incident.

Of the 499 ETH that went to liquidators, Aave recaptured 141 ETH ($285,000) through BuilderNet refunds and an additional 13 ETH in liquidation fees.

Those recovered funds will flow directly to affected users as compensation, with DAO treasury funds covering any remaining shortfall up to the full 345 ETH identified as the excess liquidation windfall.

Lido contributors confirmed the event had no connection to wstETH or the Lido staking protocol itself; the issue originated entirely within Aave’s oracle configuration layer.

With Ethereum price defending the $2,000 support zone around the time of the incident, the liquidation values were amplified by the broader market context for ETH-denominated collateral.

Discover: The best pre-launch crypto sales

Chaos Labs Confirms Aave CAPO Oracle Misconfiguration: Here Is What They Found

Chaos Labs, Aave’s external risk management partner, confirmed the incident stemmed from what it described as an onchain configuration misalignment under differing onchain update constraints, not a design flaw in the CAPO system or in the core oracle infrastructure of Aave.

The team emphasized that Chaos Risk Oracles had processed over 1,200 payloads and more than 3,000 parameters across Aave markets without incident prior to March 10.

Chaos Labs quickly contained the situation: borrow caps on wstETH were reduced immediately, and snapshot parameters were manually realigned to restore oracle accuracy. Kulechov noted in his public statement that the configuration issue had already been remediated by the time the post-mortem was published, and praised the team’s response speed in limiting broader DeFi risk contagion.

The Aave governance post-mortem marks this as the first operational failure in CAPO’s deployment history on Aave V3, despite more than a year of live operation across multiple markets.

What Traders and Aave Users Are Watching Next

The immediate focus is on the full reimbursement timeline. Aave DAO service providers are finalizing compensation for all 34 affected users following the initial 141 ETH refund via BuilderNet, with a formal governance announcement expected shortly.

Beyond compensation, governance teams are conducting a broader review of CAPO parameters across all Aave markets, updating stale snapshots and building out enhanced monitoring to flag rate divergences before they reach liquidation-threshold proximity.

Whether that review produces binding parameter update standards or remains advisory is the governance question to watch.

If the DAO formalizes automated CAPO sync requirements and publishes updated risk oracle documentation, the incident may ultimately strengthen Aave’s operational credibility. If the review stalls at the discussion stage, the reputational cost will compound the financial one.

Discover: The best new cryptocurrencies

The post Aave Oracle Glitch Causes $27M Liquidations: CAPO Misconfiguration Confirmed appeared first on Cryptonews.

Crypto World

CBI Arrests Darwin Labs CTO in GainBitcoin Cryptocurrency Case

India’s Central Bureau of Investigation (CBI) has arrested Ayush Varshney, co-founder and chief technology officer of Darwin Labs Private Limited, in connection with the long-running GainBitcoin cryptocurrency fraud investigation.

According to a Wednesday press release shared via the CBIs official X account, Varshney was detained at Mumbai airport on Monday while attempting to leave India after a Look Out Circular had been issued against him. He was formally arrested and handed over to the CBI on Tuesday.

The CBI said Darwin Labs played a central role in building the technological infrastructure used by the alleged scheme, including the GainBitcoin investor platform and associated tools used to manage payments and wallets.

The arrest is the latest development in India’s investigation into the multi-million-dollar GainBitcoin scheme, one of the country’s largest alleged cryptocurrency investment frauds.

Investigators link developer to infrastructure behind alleged scheme

According to the CBI, the GainBitcoin scheme was promoted through Variabletech Pte. Ltd. and allegedly promised investors monthly returns of about 10% in Bitcoin (BTC) for up to 18 months. “The funds collected from investors were subsequently misappropriated,” the CBI said.

Related: India’s central bank proposes linking BRICS digital currencies for trade: Reuters

The agency said Darwin Labs and its co-founders, including Varshney, Sahil Baghla and Nikunj Jain, were involved in designing and deploying a cryptocurrency token known as MCAP along with its associated ERC-20 smart contract.

CBI added that the company also helped develop key components of the platform’s technical infrastructure, including the GBMiners.com mining pool, a Bitcoin payment gateway, the Coin Bank Bitcoin wallet, and the GainBitcoin investor website used to interact with participants.

Decade-old case involved 8,000 investors and $790 million

GainBitcoin emerged in the mid-2010s as a cloud-mining investment platform that encouraged users to purchase Bitcoin and deposit it with the service in exchange for promised fixed returns.

The CBI alleged that the scheme eventually relied on a multi-level marketing structure in which payouts were tied to recruiting new investors. As new deposits slowed, the platform reportedly shifted payouts from Bitcoin to its in-house MCAP token, which had a significantly lower value.

The operation was allegedly masterminded by Amit Bhardwaj, a prominent early Bitcoin promoter in India who died in 2022 while out on bail.

On Feb. 26, 2025, Indian authorities conducted searches at more than 60 locations as part of the investigation into the GainBitcoin scheme.

Investigators have previously said the case involves 8,000 investors, with estimated losses reported by authorities ranging from about 6,606 crore Indian rupees (roughly $790 million).

Magazine: DAT panic dumps 73,000 ETH, India’s crypto tax stays: Asia Express

Crypto World

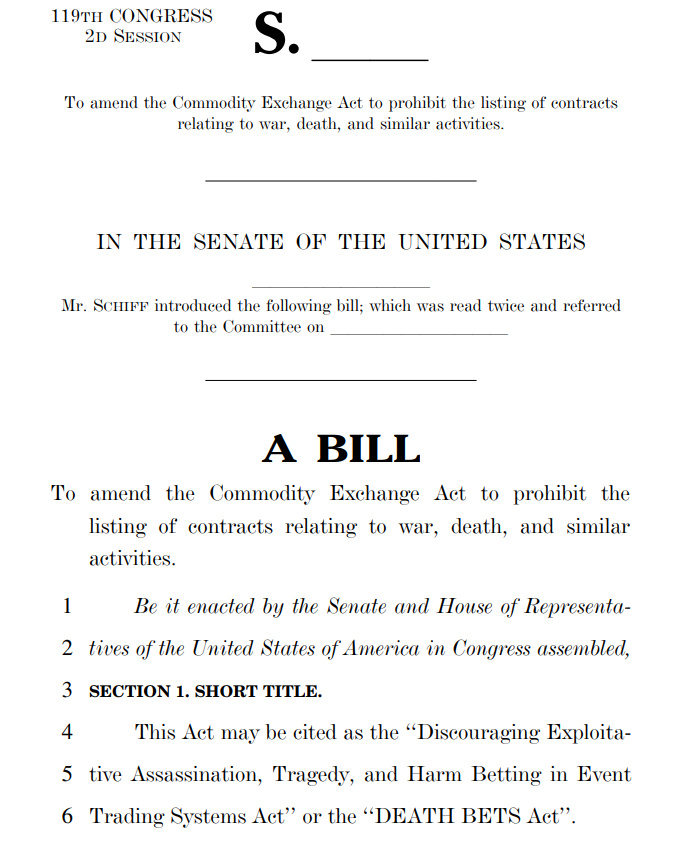

Senator Introduces ‘DEATH BETS’ Act Against War-Linked Prediction Markets

US Democratic Party Senator Adam Schiff introduced legislation Tuesday that would explicitly bar federally regulated prediction-market platforms from listing contracts tied to war, terrorism, assassination and individual deaths.

The bill, called the DEATH BETS Act, would amend the Commodity Exchange Act to make those contracts prohibited for entities overseen by the US Commodity Futures Trading Commission (CFTC).

In a statement announcing the bill, Schiff said markets that let traders profit from violent events create incentives for the misuse of classified information, threaten national security and encourage violence. He said prediction markets had become a “Wild West” and called for Congress and the CFTC to make clear that such “death bets” are not allowed.

The bill seeks to ban prediction market contracts that involve references to “terrorism, assassination, war, or any similar activity,” or that are related to an “individual’s death.” The bill was referred to the Senate Committee on Agriculture, Nutrition, and Forestry for consideration, where Schiff is a member.

US-Israel war with Iran ignites military insider concerns

The legislation comes after renewed scrutiny of event-contract platforms during the recent US and Israeli military confrontation with Iran, when war-related markets drew heavy trading and fresh allegations of insider activity.

Six Polymarket traders netted $1 million by accurately betting on the US strike against Iran.

Related: Suspected insider wallets rack up $1.2M betting on ZachXBT’s Axiom exposé

The six wallets were all created in February and placed all their bets on the contracts predicting the timing of a potential US attack, with several shares purchased only hours before the first reported explosions in Iran’s capital, Tehran.

On Tuesday, a new wallet spent $32,900 to bet on US forces entering Iran by Saturday, despite the odds continuing to decline, according to blockchain data platform Lookonchain.

Related: Kalshi, Polymarket face trading halt in Nevada after court rulings

In February, Israeli authorities arrested and indicted two people suspected of using secret information about Israel striking Iran for insider trading on Polymarket.

Insider concerns grew in January after a Polymarket account profited $400,000 after it placed a bet on a contract predicting that Venezuelan President Nicholas Maduro would be captured, wagering the funds just hours before US forces captured him.

Magazine: Inside a 30,000 phone bot farm stealing crypto airdrops from real users

Crypto World

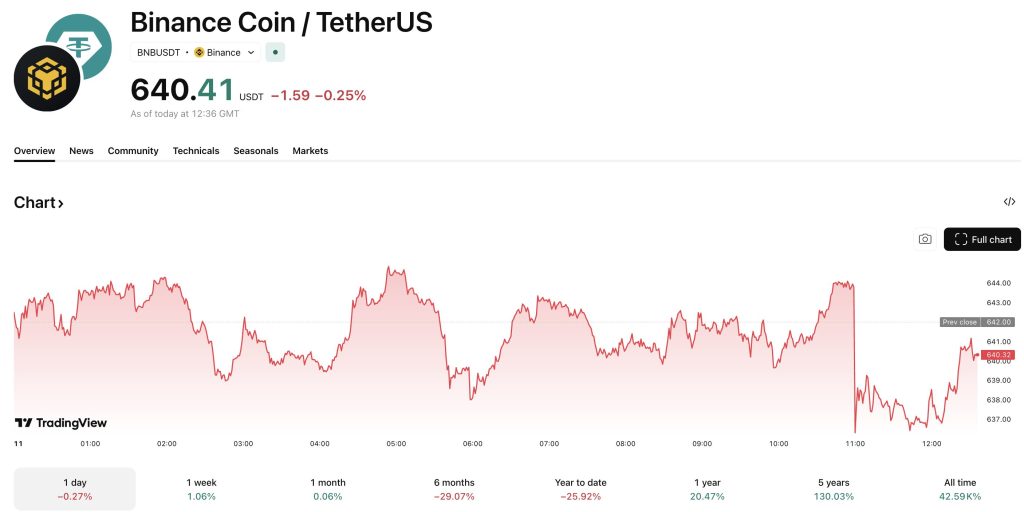

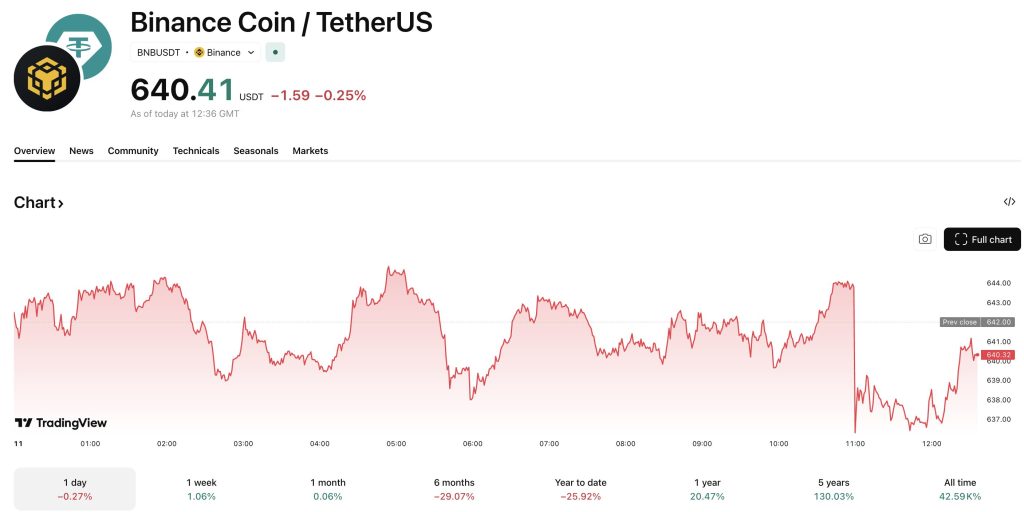

Binance WSJ Lawsuit: The Crypto Exchange Sues Wall Street Journal Over ‘Defamatory’ Iran Sanctions Report

The Binance crypto exchange has officially filed a defamation lawsuit against the Wall Street Journal, or known as WSJ, in the Southern District of New York. The complaint, filed today (March 11), alleges the newspaper published false claims regarding the exchange’s compliance controls and handling of Iran sanctions data.

At the center of the dispute is a February report claiming Binance knowingly processed over $1Bn for sanctioned entities.

This news has led to the BNB price dropping 1% in the past hours, to $640, as investors are seemingly spooked at yet another potential legal dispute involving Binance.

CEO Richard Teng has condemned the reporting as inaccurate, stating the outlet ignored documented evidence provided before publication.

What’s the WSJ Report Actually Alleged And Why Binance Says It’s Wrong

The Wall Street Journal article, titled “Binance Fired Staff Who Flagged $1 Billion Moving to Sanctioned Iran Entities,” depicted a chaotic internal struggle at the world’s largest crypto exchange.

It is alleged that compliance staff were fired not for policy breaches, but for doing their jobs identifying illicit flows.

Specifically, the report claimed Binance processed $1.7Bn in transactions linked to Iranian entities, including a Hong Kong-based fiat-to-crypto converter called “Blessed Trust.”

According to the Journal, this activity continued despite internal red flags. The report immediately triggered a regulatory inquiry.

US Senator Richard Blumenthal cited the article as grounds for demanding a formal investigation into the exchange’s operations, which Binance CEO Richard Teng responded to on March 6, denying all claims.

The allegations arrived during a sensitive period for crypto regulation, mirroring the pressure seen as Democrats introduce bills to ban platforms like Polymarket over compliance concerns.

DISCOVER: Next Crypto to Explode in 2026

Binance Fires Back: 19 Ignored Responses and a 96.8% Compliance Claim

Binance’s defense hinges on what it calls willful disregard for the facts. The exchange claims it sent the WSJ 19 detailed responses and answered 27 specific questions before the publication deadline, none of which appeared in the final story.

Richard Teng publicly rejected the narrative, emphasizing that the employees in question were dismissed for data policy violations, not for flagging sanctions evasion.

The exchange cited hard numbers to counter the defamation claims. Binance states it has achieved a -96.8% reduction in sanctions exposure risks through upgraded protocols. Currently, more than 1,500 employees, nearly a quarter of the workforce within Binance, work in compliance.

Regarding the specific “Blessed Trust” account, Binance clarified that the entity was offboarded and reported to law enforcement in 2025, long before the WSJ report suggested the activity was ongoing.

What This Means for Binance and the Broader Crypto-Media Relationship

This lawsuit seeks compensatory and punitive damages, arguing the report caused harm that no simple correction can fix. The legal action follows a significant win for Binance on March 7, when a federal judge dismissed a separate lawsuit alleging the exchange facilitated terrorist financing.

That court found no material support was provided, strengthening Binance’s position that it is not liable for the actions of bad actors who might attempt to access the platform.

Traders are watching this case closely as a test of the “actual malice” standard in crypto reporting. While the exchange settled with the DOJ in 2023 for $4.3Bn over historical failures, this aggressive legal stance signals a refusal to accept what it deems false narratives about its current operations.

The focus now shifts to the WSJ’s response and whether the regulatory inquiry sparked by the article will sustain momentum without the supporting media narrative.

We will continue to update this story as more details emerge over the coming days and weeks.

EXPLORE: Best Crypto Presales to Buy in 2026

The post Binance WSJ Lawsuit: The Crypto Exchange Sues Wall Street Journal Over ‘Defamatory’ Iran Sanctions Report appeared first on Cryptonews.

Crypto World

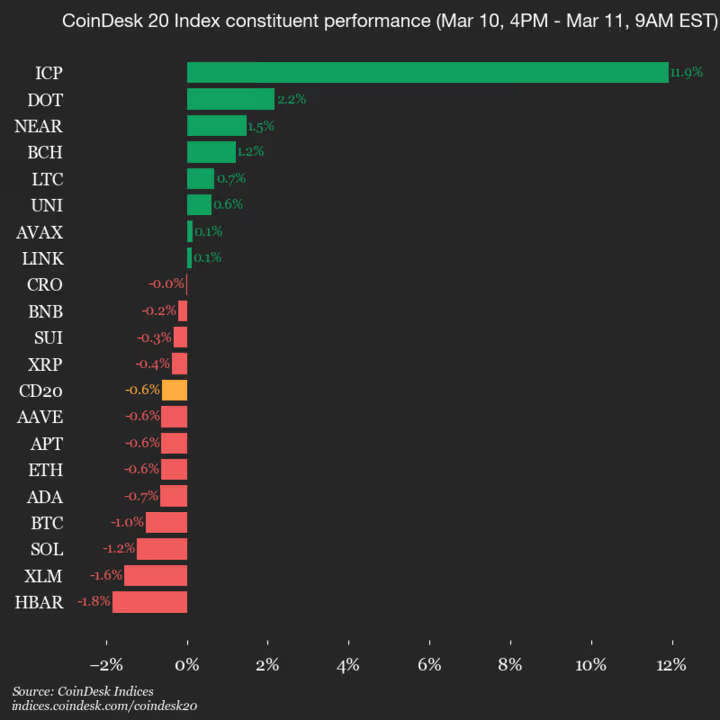

Hedera (HBAR) drops 1.8%, leading index lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1980.55, down 0.6% (-12.31) since 4 p.m. ET on Tuesday.

Eight of 20 assets are trading higher.

Leaders: ICP (+11.9%) and DOT (+2.2%).

Laggards: HBAR (-1.8%) and XLM (-1.6%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

February Inflation Data Stable, But Iran Conflict Threatens New Price Surge

TLDR

- February’s Consumer Price Index increased 2.4% year-over-year, aligned with analyst predictions

- Core inflation (stripping out food and energy costs) registered at 2.5% annually, meeting forecasts

- Report captures timeframe prior to U.S.-Israel coordinated strikes against Iran

- Crude oil has jumped approximately 18% since late February, while pump prices climbed 20%

- Federal Reserve anticipated to maintain current interest rate range of 3.5%–3.75% at upcoming meeting

While February’s inflation report appeared reassuring at first glance, the underlying narrative reveals a more complex situation unfolding.

The Consumer Price Index advanced 0.3% month-over-month in February and climbed 2.4% on an annual basis. These metrics aligned precisely with economist projections. Meanwhile, core CPI—which excludes volatile food and energy categories—increased 0.2% monthly and 2.5% yearly, similarly matching consensus estimates.

The Bureau of Labor Statistics published these figures on Wednesday, March 11.

Both energy and food categories showed increases during February, though these changes were relatively contained compared to subsequent developments following the data collection period.

Crucially, this report reflects conditions that existed before coordinated U.S. and Israeli military operations against Iran commenced in late February. Those hostilities have subsequently created significant disruptions throughout global energy markets.

Iran Crisis Delivers Major Shock to Energy Sector

The Strait of Hormuz—a critical chokepoint handling approximately 20% of worldwide oil shipments—has experienced a dramatic reduction in tanker movement. Intelligence reports suggest Iran has deployed naval mines throughout the waterway, prompting President Trump to warn of potential additional military responses.

Brent crude futures stood near $92 per barrel at press time, following an earlier spike to almost $120 this week. Motorists across America have seen gasoline costs surge 20% as a direct consequence.

Bank of America’s economist Stephen Juneau noted that petroleum prices have climbed roughly 18% since February concluded. He indicated that sustained conflict would probably generate upward pressure on both headline and underlying inflation measures in coming months.

The International Energy Agency has put forward its most substantial strategic reserve release proposal to date aimed at market stabilization, the Wall Street Journal reported. IEA member countries were scheduled to vote on this initiative Wednesday. The prior record stood at 182 million barrels, authorized following Russia’s 2022 Ukraine invasion.

Implications for Federal Reserve Policy

The Fed’s favored inflation metric—the Personal Consumption Expenditures index—registered 2.9% annually in December. This remains substantially above the central bank’s 2% objective. January’s PCE figures are scheduled for Friday release, with forecasters anticipating a 3.1% annual rate.

Market indicators suggest the Federal Reserve will almost certainly maintain its current rate posture during next week’s policy meeting, preserving the 3.5%–3.75% band, per CME FedWatch tracking data.

Employment trends add another dimension of complexity to the Fed’s calculus. The U.S. economy surprisingly shed 92,000 positions last month, elevating the unemployment rate to 4.4%.

President Trump indicated earlier this week the military operations might conclude “very soon,” though U.S. and Israeli forces have maintained strikes across multiple Iranian targets throughout the Middle East region.

Crypto World

Ghana opens crypto trading sandbox with 11 firms under new VASP law

Ghana’s Securities and Exchange Commission (SEC) said 11 companies have been granted access to a regulatory sandbox to test cryptocurrency and digital asset services under the country’s Virtual Asset Service Providers Act, 2025.

The program allows companies to run their products in a controlled environment while regulators monitor risks and compliance.

The sandbox will run for 12 months and sits at the center of Ghana’s early efforts to bring oversight to the crypto sector, according to a press release.

Companies in the first cohort include asset tokenization firms like Africoin, Blu Penguin, Vaulta, XChain and Goldbod as well as cryptocurrency exchanges like Hyro Exchange, HanyPay and WhiteBit.

The commission said firms whose products are market-ready and meet regulatory requirements could transition to a full license after six months. Others may remain in the sandbox for the remaining period to refine their services.

The SEC said the exercise will also help it shape detailed licensing guidelines for different types of crypto businesses. Data gathered during the pilot will inform rules covering areas such as investor protection, market integrity and anti-money laundering controls.

Once the sandbox closes, the regulator plans to publish the final guidelines and open the licensing process to a broader set of virtual asset service providers.

-

Business5 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

News Videos2 days ago

News Videos2 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Ann Taylor

-

Crypto World2 days ago

Crypto World2 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech7 hours ago

Tech7 hours agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Sports6 days ago

Sports6 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics5 days ago

Politics5 days agoTop Mamdani aide takes progressive project to the UK

-

Sports4 days ago

Sports4 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business22 hours ago

Business22 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

NewsBeat6 days ago

NewsBeat6 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment4 days ago

Entertainment4 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business3 days ago

Business3 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business7 hours ago

Business7 hours agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat2 days ago

NewsBeat2 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech2 days ago

Tech2 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Entertainment7 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Crypto World7 days ago

Crypto World7 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech6 days ago

Tech6 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

BREAKING:

BREAKING: