CryptoCurrency

Nvidia’s Rubin Looks Bullish for Bittensor and AI Crypto Economy

Nvidia’s Rubin chips are turning AI into cheap infrastructure. That is why open intelligence markets like Bittensor are starting to matter.

Nvidia used CES 2026 to signal a major shift in how artificial intelligence will run. The company did not lead with consumer GPUs. Instead, it introduced Rubin, a rack-scale AI computing platform built to make large-scale inference faster, cheaper, and more efficient.

Sponsored

Sponsored

Rubin Turns AI into Industrial Infrastructure

Nvidia’s CES reveal was clear that it no longer sells individual chips. It sells AI factories.

Rubin is Nvidia’s next-generation data-center platform that follows Blackwell. It combines new GPUs, high-bandwidth HBM4 memory, custom CPUs, and ultra-fast interconnects into one tightly integrated system.

Unlike earlier generations, Rubin treats the entire rack as a single computing unit. This design reduces data movement, improves memory access, and cuts the cost of running large models.

As a result, it allows cloud providers and enterprises to run long-context and reasoning-heavy AI at much lower cost per token.

That matters because modern AI workloads no longer look like a single chatbot. They increasingly rely on many smaller models, agents, and specialized services calling each other in real time.

Lower Costs Change How AI Gets Built

By making inference cheaper and more scalable, Rubin enables a new type of AI economy. Developers can deploy thousands of fine-tuned models instead of one large monolith.

Sponsored

Sponsored

Enterprises can run agent-based systems that use multiple models for different tasks.

However, this creates a new problem. Once AI becomes modular and abundant, someone has to decide which model handles each request. Someone has to measure performance, manage trust, and route payments.

Cloud platforms can host the models, but they do not provide neutral marketplaces for them.

That Gap is Where Bittensor Fits

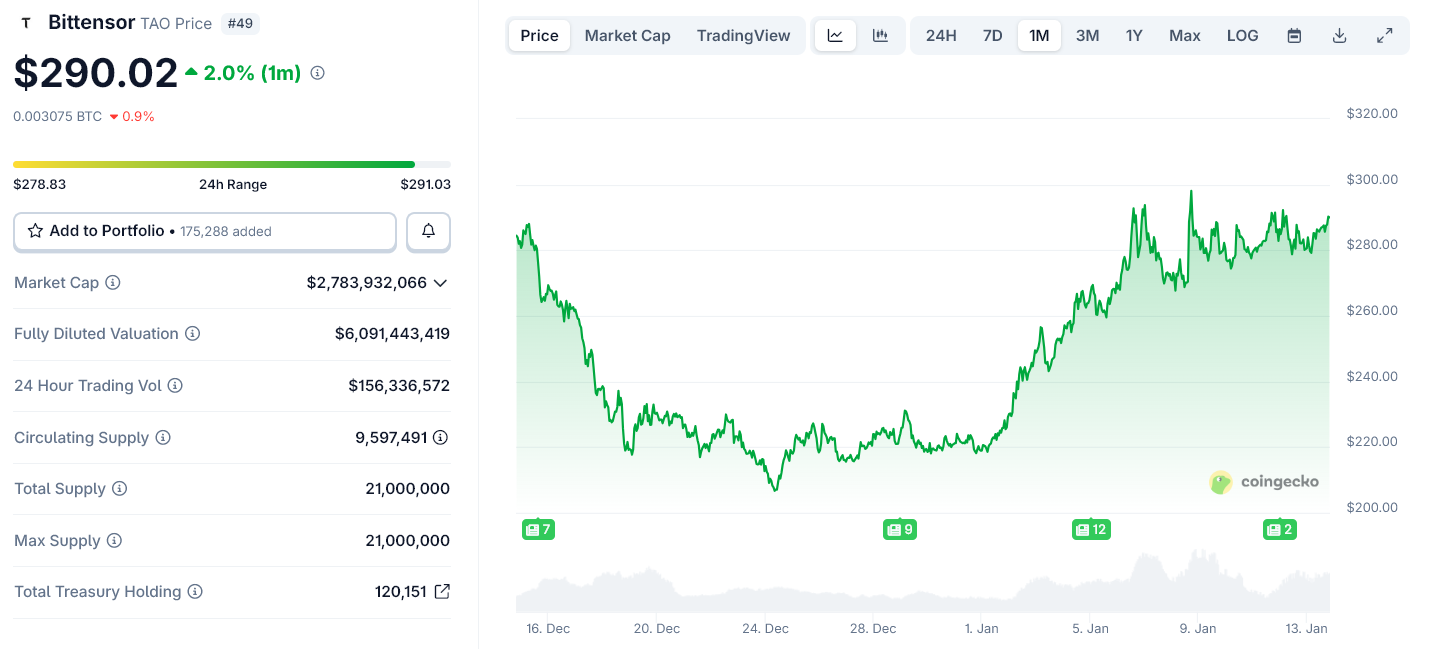

Bittensor does not sell compute. It runs a decentralized network where AI models compete to provide useful outputs. The network ranks those models using on-chain performance data and pays them in its native token, TAO.

Each Bittensor subnet acts like a market for a specific type of intelligence, such as text generation, image processing, or data analysis. Models that perform well earn more. Models that perform poorly lose influence.

Sponsored

Sponsored

This structure becomes more valuable as the number of models grows.

Why Nvidia’s Rubin Makes Bittensor’s Model Viable

Rubin does not compete with Bittensor. It makes Bittensor’s economic model work at scale.

As Nvidia lowers the cost of running AI, more developers and companies can deploy specialized models. That increases the need for a neutral system to rank, select, and pay those models across clouds and organizations.

Bittensor provides that coordination layer. It turns a flood of AI services into an open, competitive market.

Nvidia controls the physical layer of AI: chips, memory, and networks. Rubin strengthens that control by making AI cheaper and faster to run.

Sponsored

Sponsored

Bittensor operates one layer above that. It handles the economics of intelligence by deciding which models get used and rewarded.

As AI moves toward agent swarms and modular systems, that economic layer becomes harder to centralize.

What This Means Going Forward

Rubin’s rollout later in 2026 will expand AI capacity across data centers and clouds. That will drive growth in the number of models and agents competing for real workloads.

Open networks like Bittensor stand to benefit from that shift. They do not replace Nvidia’s infrastructure. They give it a market.

In that sense, Rubin does not weaken decentralized AI. It gives it something to organize.