CryptoCurrency

OJK-Ready White Label Crypto Exchange Software For Indonesia Launch

Robinhood, a leading trading platform, has announced plans to acquire Indonesian brokerage PT Buana Capital Sekuritas and licensed crypto exchange software PT Pedagang Aset Kripto. With this acquisition, the country entered the compelling market with 19 million crypto investors.

“Indonesia represents a fast-growing market for trading, making it an exciting place to further Robinhood’s mission to democratize finance for all. We look forward to bringing Indonesians the same innovative services that have earned the trust of Robinhood customers globally.”

Patrick Chan, Head of Asia at Robinhood.

Indonesia has quietly become one of the most serious crypto markets in the world. Not because it is hype-driven or speculative-only, but because it has real users, volumes, and favorable regulations. And that’s exactly why cryptocurrency exchange software founders are circling it.

This guide answers the questions every entrepreneur asks before committing to an OJK-compliant white label cryptocurrency exchange or custom development:

- Is the Indonesian crypto market big enough?

- Which crypto exchange software model actually works in Indonesia?

- What does “regulated digital asset exchange” really mean in Indonesia?

- How fast can exchanges go live?

- How much does it cost to launch a cryptocurrency exchange in Indonesia in 2025?

Let’s get into it.

Why Launch Cryptocurrency Exchange Software in Indonesia in 2026?

- Growing User Base and Surging Transaction Volumes

By the end of 2026, Indonesia crossed 19 million registered crypto investors, up from 4 million registered investors in 2020. Despite extreme market volatility and prolonged crypto winters, the country has experienced attractive growth in the number of users over the past five years.

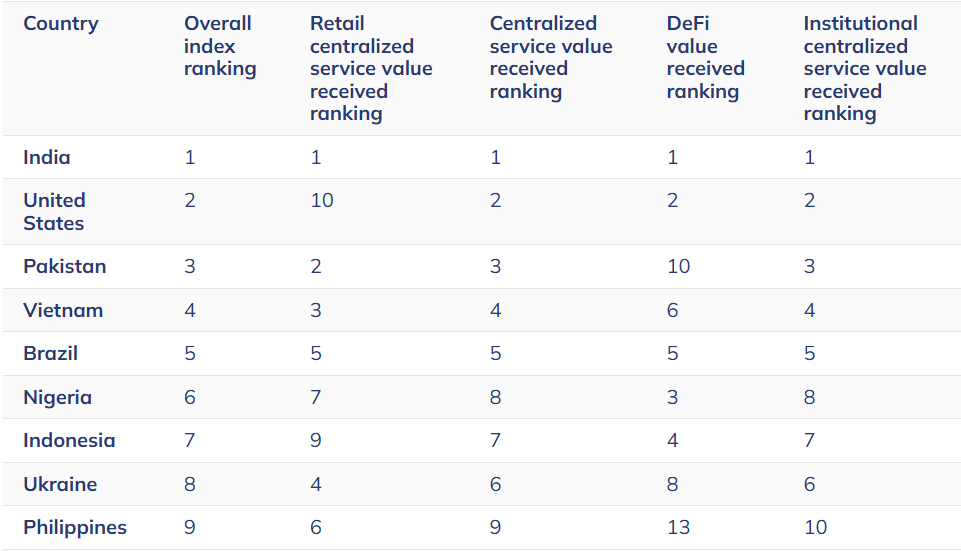

Chainalysis ranks Indonesia 7th globally in crypto adoption

Moreover, it’s not just the signups that define a fast-growing crypto market, but real trading activity demonstrated by transaction volumes. Transaction volumes jumped from Rp64.9 trillion (US$3.9B) in 2020 to Rp859 trillion (US$52.1B). After various adverse conditions resulting in a massive drop, the transaction volumes regained, reaching Rp446.77 trillion (US$26.8 billion) in September 2025.

With the most adaptive and progressive crypto regulatory framework aligned with the Commodity Futures Trading Regulatory Agency, Bappebti, Indonesia becomes the first country with a formal crypto ecosystem comprising:

-

- A licensed national crypto bourse

- A dedicated crypto clearing house

- Licensed crypto asset exchanges

- A Government-approved list of tradeable digital assets

Regulations have evolved significantly after the gradual transition to the Financial Services Authority (Otoritas Jasa Keuangan / OJK). It now publishes routine updates for customers and prepares broader financial oversight. Clear rules, transparent infrastructure, and formal supervision offer a clear foundation to businesses seeking crypto exchange development.

- Inclination Towards Novel Financial Tools

With a population of 280 million people and a median age of 30 years, the country is known to have a young, digitally literate, and mobile-fintech-friendly audience accustomed to e-wallets, digital banking, and other digital financial services. Therefore, crypto isn’t something strange there, and cryptocurrency exchange software solutions can build upon the existing habits of Indonesians by creating intuitive UI/UXs for youngsters.

The 7% of the population in Indonesia already owns crypto.

Indonesians are not experimenting with crypto but investing for the long term (as mentioned by the ABI report) and making it an essential part of their portfolio. Moreover, crypto owners are experimenting beyond trading by actively engaging in staking, derivatives trading, yield-based products, RWAs, etc.

Apart from these, a report also reveals that 43% of exchange volume between July 2023 and July 2024 came from high-value transfers ranging from $10K to $1M.

This demonstrates that the market is just retail-based, but it has serious traders, long-term holders, and professionals, perfect for institutional-grade crypto exchange development.

Indonesia vs Southeast Asia Crypto Market Snapshot

| Metric | Indonesia | Thailand | Vietnam |

|---|---|---|---|

| Global Adoption Rank | 7th | 17th | 4th |

| Users (2025) | 19M+ | ~17M | ~20M |

| On-chain Growth YoY | 103% | 120% (smaller base) | 55% |

| Regulatory Clarity | High | Medium | Low |

| Exchange Scalability | Strong | Moderate | Fragmented |

Comparison Takeaway:

Vietnam wins on remittances.

Indonesia wins on scale, regulation, and exchange viability. If you’re building an exchange, not just a wallet, Indonesia is the safer bet.

Which Crypto Exchange Model Works in Indonesia?

1. Centralized Crypto Exchange Software

Centralized Exchanges (CEXs) dominate Indonesia’s crypto trading volumes as the regulatory framework mandates trading on centralized infrastructures. Also, they are primary providers of local fiat on/off ramps. Here’s what CEXs in Indonesia are preferred for:

- Trust in regulated platforms

- Deep liquidity

- Local fiat on/off ramps

- Targeting High-value traders

2. Decentralized Exchange Software (DEX)

While CEXs are the mandatory entry point, Indonesia actually ranks 4th globally in DeFi value received, indicating a more “hybrid” user behavior than a purely CEX-dependent one.

Most users onboard crypto, trade, and manage liquidity through CEXs, then deploy assets into DeFi protocols for yield, savings, or long-term positioning. This creates a market where CEXs dominate execution, while DeFi serves as a secondary value layer, making hybrid exchange development a winner.

Hybrid trading infrastructures that combine centralized exchanges and decentralized wallets hit the spot as they combine:

- CEX-grade liquidity

- OJK-compliant KYC/AML

- Self-custody

- DeFi features for advanced users

This works perfectly for Indonesia’s market, where 58% of users are long-term holders who want safety and flexibility.

How to Launch a Crypto Exchange Software in Indonesia in 7 Days

Custom-building crypto exchange software from scratch won’t get a business anywhere in a week, but with a OJK-alligned white label crypto exchange software, it looks realistic.

Day 1-2: Exchange Model & Infrastructure

A business planning to launch a crypto exchange software in Indonesia must start with the following:

- Every great product starts with in-depth market research. Since you’re launching in Indonesia, you must learn that its crypto economy is driven by:

- Savings and long-term holding

- Remittances

- Gaming and Web3 participation

- Growing DeFi interest

So, you must build a crypto exchange superapp that doesn’t just facilitate buying and selling but also integrates self-custody with DeFi yield options, stablecoin-powered cross-border transactions, mini-games, and community-building DeSoc engines.

- Finalize the exchange model (CEX-first or hybrid, depending on custody strategy).

- Deploy the core execution layer:

- Matching engine

- Local fiat Rails

- Order book logic

- Wallet and custody architecture

- Define compliance scope aligned with OJK expectations (KYC, AML, reporting, custody separation).

With Antier’s OJK-ready white label crypto exchange development, businesses can go live in just 7 days, as it consolidates all the necessary layers, and its KYC/AML architecture prepares exchanges for licensing.

Day 3-4: White Label Crypto Exchange Deployment

After sharing the basic requirements for cryptocurrency exchange software launch in Indonesia, businesses join forces with their tech provider to:

- Deploy a well-tested white label crypto trading platform.

- Configure:

- Trading pairs and fee structure

- UI/UX branding

- Admin dashboards and risk controls

- Integrate custodial wallets and optional non-custodial wallets for hybrid access

This enables cryptocurrency exchanges to support CEX-grade trading while maintaining DeFi access as a secondary layer, making it best-suited for the Indonesian market.

Day 5: Liquidity & Trading Pairs

Since the basic infrastructure is set, it is time for businesses to set up liquidity, which is unnegotiable for exchanges. The white label crypto exchange development company then helps with the following:

- Integrating liquidity providers or market-making services.

- Configuring depth and spread management.

- Preparing proof-of-funds and custody documentation.

- Activating core spot markets

As the majority of users enter and exit through centralized exchanges with fiat rails, integrating deep order books with liquidity integrations and partnerships becomes essential.

Day 6: Compliance Systems

- At last, white label cryptocurrency exchange development companies activate KYC/AML workflows as per OJK regulatory requirements.

- They also need to configure the following as per business and jurisdictional requirements:

- Audit logs and reporting structures

- tiered account limits and transaction monitoring

- Withdrawal controls and risk thresholds

This ensures the platform is operationally compliant, even while licensing processes continue.

Day 7: Go-Live Readiness

At the final stage, the white label crypto exchange software provider executes and enables the following:

- Final QA and stress testing

- Sandbox or controlled public access

- Prepare asset listing documentation for regulator review

- Align internal processes for ongoing compliance and audits

The final result after 7 days is technically live, liquid, and compliance-aligned crypto exchange software ready for OJK’s review.

Legal & Regulatory Requirements Checklist For Crypto Exchange Software Launch in Indonesia

While the white label cryptocurrency exchange software is getting configured, licensing runs parallel.

1. Entity & Licensing

- Registration as a local Indonesian entity

- Application for crypto exchange licensing with Bappebti / OJK

- Preparation for licensing documentation under Regulation No. 13/2022

2. Capital & Financial Readiness

- Allocation of Rp 100B paid-up capital

- Maintaining Rp 50B as minimum equity

- Preparation of proof-of-funds and audited financial statements

3. Operational Structure and KYC Setup

- Appointment of IT, compliance, risk, and customer support services provider

- Defining and documenting internal governance, escalation procedures, and operational workflows for regulators.

- Enabling enhanced checks for transactions > USD 1,000

4. Tax & Reporting

- 0.1% income tax and 0.11% VAT applies on crypto transactions

- Set up periodic regulatory and tax reporting

How Much Does it Cost to Launch a Crypto Exchange Software in Indonesia?

| Model | Cost Range | Impact |

|---|---|---|

| White Label Crypto Exchange | $50 and above | Fast, compliant, 60–80% cost savings |

| Custom Build | $1M and onwards | Full control, long timelines |

Founders overspend when they:

- Overbuild before licensing clarity

- Underestimate compliance overhead

Final Takeaway

Before going live, confirm this list is clean

- OJK-aligned compliance systems

- KYC/AML workflows tested

- Liquidity and proof-of-funds ready

- Local fiat integration is working

- Infrastructure scalable for 19M+ users

When you build a crypto exchange superapp with top-notch security and compliance baked within the ecosystem, you are all ready to win the Indonesian crypto market.

Antier helps founders launch regulation-ready crypto exchange software using proven white label infrastructure tailored for Indonesia’s market realities and OJK requirements. We offer compliance-aware turnkey exchange solutions so businesses don’t burn months or millions learning lessons that others learnt the hard way.

If the goal is to launch fast, stay compliant, and scale confidently, shortcuts aren’t the risk, but wrong shortcuts are.

Even if you have a standout cryptocurrency exchange development idea in mind, our team of experts can help you build it from the ground up. So, share your requirements right away and let’s start building your crypto trading empire.

Frequently Asked Questions

01. What is Robinhood’s recent acquisition in Indonesia?

Robinhood plans to acquire Indonesian brokerage PT Buana Capital Sekuritas and licensed crypto exchange software PT Pedagang Aset Kripto to expand its presence in the growing Indonesian market.

02. How many registered crypto investors are there in Indonesia?

By the end of 2026, Indonesia is expected to have 19 million registered crypto investors, a significant increase from 4 million in 2020.

03. What factors contribute to Indonesia’s status as a serious crypto market?

Indonesia’s crypto market is characterized by a growing user base, increasing transaction volumes, and a favorable regulatory framework, making it a compelling environment for cryptocurrency trading.