Crypto World

Playnance unveils Web2-to-Web3 gaming ecosystem after years in stealth mode

- Playnance unveils Web2-to-Web3 gaming infrastructure after years operating privately at scale.

- The platform processes 1.5 million daily on-chain transactions with over 10,000 active users.

- Playnance focuses on simplifying blockchain access through Web2-style onboarding systems.

Playnance has made its first public announcement, revealing itself as a Web3 infrastructure and consumer platform company that has been operating a live ecosystem aimed at onboarding mainstream Web2 users into blockchain-based environments.

The announcement was made on February 5, 2026, from Tel Aviv, marking the company’s first formal introduction after several years of developing and running its technology and platforms privately.

Founded in 2020, Playnance has positioned itself as a Web2-to-Web3 gaming infrastructure layer.

The company integrates with more than 30 game studios and enables the conversion of thousands of games into fully on-chain experiences, where all gameplay actions are executed and recorded directly on blockchain networks.

Infrastructure built to simplify blockchain adoption

Playnance’s core offering focuses on removing technical barriers commonly associated with blockchain usage.

The company’s products are designed to allow users to interact with on-chain systems without needing direct knowledge of blockchain mechanics.

Instead, users access platforms through familiar Web2-style interfaces, including standard account creation and login processes, while blockchain functionality operates in the background.

The company stated that its live platforms currently process approximately 1.5 million on-chain transactions daily and support more than 10,000 daily active users.

According to Playnance, a significant portion of its user base originates from traditional Web2 environments.

These users are reportedly able to onboard and interact with blockchain-based systems without using external wallets or managing private keys, suggesting continued on-chain engagement from audiences outside the traditional crypto sector.

The company’s ecosystem also includes the G Coin initiative, which is currently operating in pre-sale mode and is accessible through the Playnance official website.

Consumer platforms showcase operational ecosystem

Playnance operates several consumer-facing platforms designed to demonstrate its infrastructure capabilities.

Among these are PlayW3, Up vs Down, and other products that run on shared on-chain infrastructure and wallet systems.

The integrated structure allows users to move between platforms without repeating onboarding procedures.

All user interactions across these platforms are executed and recorded on-chain while remaining non-custodial, aligning with the company’s focus on user control and blockchain transparency.

The shared wallet and infrastructure framework also supports cross-platform engagement within the broader Playnance ecosystem.

“Our focus was on building systems that people could use without needing to understand blockchain mechanics,” said Pini Peter, CEO of Playnance. “We prioritized live operation and user behavior over public announcements, and this is the first time we are formally introducing the company after reaching scale.”

Expansion strategy centred on user behaviour

Playnance stated that its infrastructure is designed to support high-volume consumer activity and continuous on-chain execution.

The company’s approach reflects a broader industry shift toward practical blockchain applications targeting mainstream audiences.

Looking ahead, Playnance indicated that its ecosystem expansion will be guided by observed user behaviour and platform performance.

The company emphasised that its development roadmap will focus on real usage data rather than speculative adoption models.

Playnance describes itself as a company focused on reducing friction between user behaviour and blockchain execution by operating consumer platforms at scale.

Crypto World

Ripple-linked token zooms 6% as bitcoin (BTC) nears $67,000

XRP rallied 6% as bitcoin neared the $67,000 mark in U.S. morning hours Wednesday, with data from one exchange showing spot buyers outpaced sellers by more than 200%.

News Background

- Long-time XRP supporter and exchange Bitrue told CoinDesk that it observed a sharp surge in XRP spot activity between Feb. 23–24, with retail purchase volumes rising 212% and outpacing sell orders by more than two-to-one.

- The spike coincides with what some traders describe as a quiet accumulation phase following recent volatility.

- Institutional positioning also appears constructive. Since launching in mid-November, XRP exchange-traded funds have attracted roughly $1.1 billion in net assets, posting positive weekly inflows with only limited outflow days.

- That stands in contrast to bitcoin ETFs, which are down on a year-to-date basis, suggesting potential capital rotation within crypto allocations rather than broad-based exit.

- Spot traders also realized nearly $1.93 billion in losses during mid-February’s drawdown, Bitrue said, a shakeout that historically has preceded stronger recoveries once speculative leverage clears.

Price Action Summary

- XRP climbed from $1.34 to $1.42, gaining roughly 6%

- Break above $1.37 triggered a volume surge to 259M, more than double the daily average

- Price consolidated near $1.42 after testing $1.43

Technical Analysis

- The decisive move came with the sustained break above $1.37 resistance. Volume expansion confirmed participation beyond thin liquidity conditions, with price forming higher lows throughout the session.

- Near-term structure remains constructive while XRP holds above $1.40. However, overhead supply near $1.45 remains a key test.

- Failure to maintain current levels would shift focus back to the $1.37 breakout zone as first support.

What traders say is next?

- Traders are watching whether the $1.40–$1.42 zone can hold as a new base. A push above $1.45 would open room toward $1.50 and potentially $1.57.

- If momentum fades and XRP slips back below $1.37, the breakout risks turning into a false move, reopening the prior consolidation range.

- For now, elevated volume combined with spot-heavy buying suggests positioning is improving — but confirmation depends on follow-through above resistance.

Crypto World

XRP Price Sets 20% Bear Trap? Shorts and Whale Buying Collide

XRP price is up about 2% in the past 24 hours. This small move is part of a broader rebound of nearly 6% after XRP briefly broke below a critical support level. Yes, a breakdown.

That breakdown initially confirmed a bearish head-and-shoulders pattern, which projected a steep 20% decline. But the story did not end there. Instead of accelerating lower, XRP rebounded quickly. New data now shows this breakdown may have served as bearish bait, drawing in short sellers before reversing.

XRP’s 20% Bearish Breakdown Created the Perfect Trap Setup

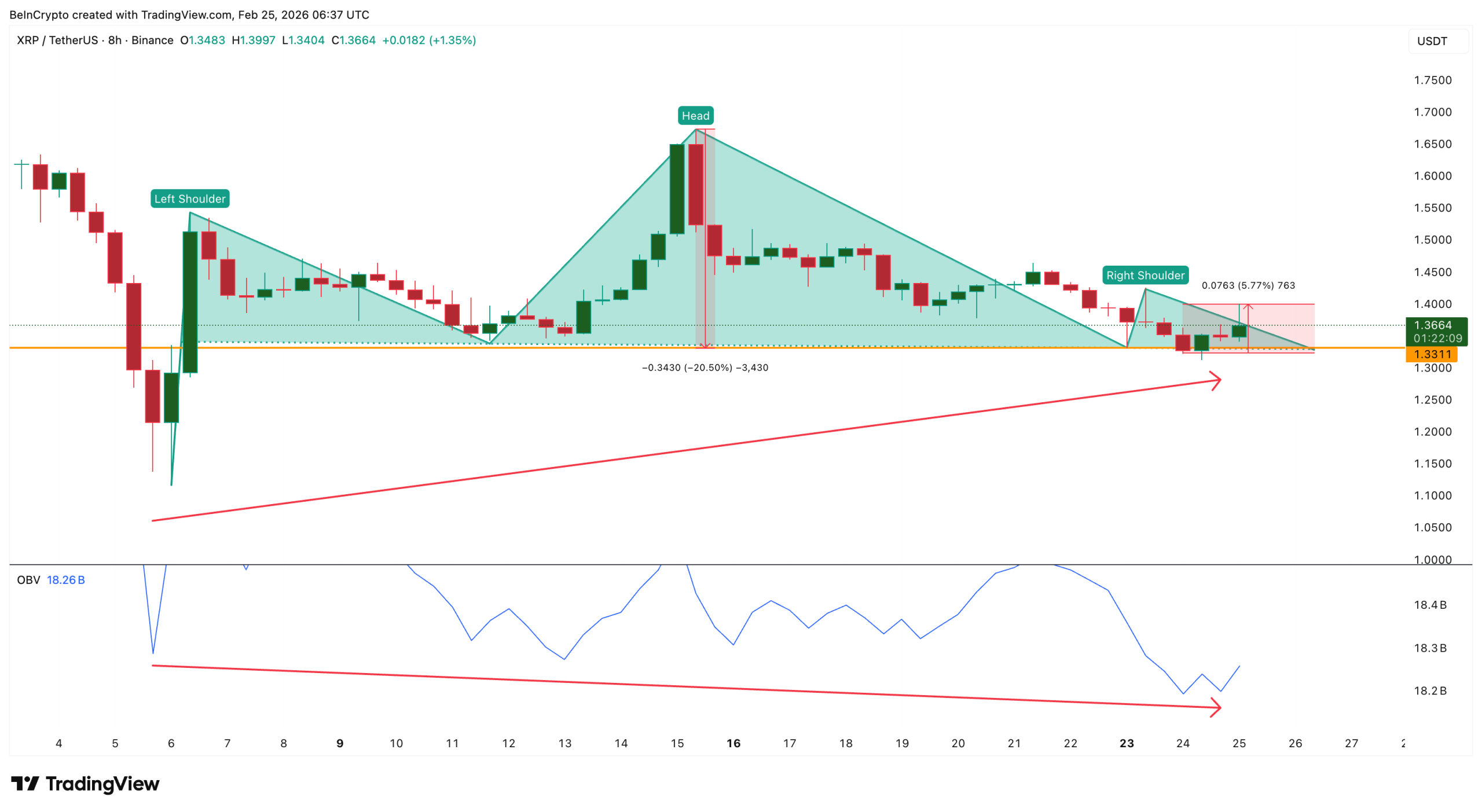

The bearish pattern began forming on the 8-hour chart on February 6. XRP created a head-and-shoulders pattern. It is one of the most widely watched bearish reversal patterns. The key level in this pattern is the neckline. For XRP, this support sat near $1.33.

When the XRP Ledger token broke below this level on February 24, it confirmed the bearish structure. Based on the height of the pattern, the projected downside target was about 20%. At the same time, another warning appeared, confirming the breakdown.

On-Balance Volume (OBV) was declining even as the XRP price was rising between February 5 and February 24. OBV measures buying and selling pressure using volume. When OBV falls while price rises, it shows weakening buyer strength. This made the breakdown look even more convincing.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

But instead of continuing toward the 20% target, XRP quickly reversed and rebounded nearly 6%. This was the first sign that the breakdown had turned into a trap.

$770 Million Open Interest Surge Shows Traders Took the Bait

Open interest data confirms that traders reacted aggressively to the breakdown. Open interest, which measures the total value of active futures positions, surged from around $750 million on February 22 to nearly $770 million on February 23, just hours before the breakdown.

At the same time, funding rates dropped sharply from around –0.0025% to nearly –0.014%, a 460% surge in the short positioning intensity. This change is important.

Funding rates becoming more negative means short sellers are increasing rapidly and are willing to pay a premium to hold those bearish bets. In simple terms, traders were aggressively betting on XRP to crash further.

This created a crowded short trade. But when XRP rebounded instead of collapsing, many of those short positions were likely forced to close or reduce exposure.

Open interest later dropped from $770 million to around $756 million as the price rebounded. This decline suggests leveraged positions were closed during the reversal. Open interest alone does not confirm whether longs or shorts exited.

However, because funding rates were heavily negative before the rebound, it indicates bearish positions were dominant, and some of those traders likely reduced exposure or got liquidated as the breakdown failed.

150 Million XRP Whale Buying Happened During the Trap — Not Before It

Whale behavior during this period adds another critical piece. Wallets holding between 1 million and 10 million XRP increased their holdings from 3.77 billion XRP to 3.81 billion XRP. At the same time, the largest whale group, holding between 100 million and 1 billion XRP, increased holdings from 8.35 billion XRP to 8.46 billion XRP.

Combined, these groups added approximately 150 million XRP over two days, from February 23 to February 25. At an average price of $1.35, this equals about $200 million in buying. Importantly, this accumulation happened during and immediately after the breakdown.

This means whales were not panic-selling. They were absorbing supply as traders exited positions.

This behavior often reflects positioning during periods of elevated market fear. It also increases the chances that breakdown continuation may remain limited unless whales begin selling.

XRP Price Now Approaches Another Breakdown Zone — But Trap Risk Remains High

XRP is now approaching another critical risk zone (the neckline), this time near $1.31 as another right shoulder forms. This level remains the most important support. If XRP breaks below $1.31 and holds below it, the bearish pattern, with another 20%+ breakdown path, could again get activated.

In that case, the next downside targets sit near $1.26 and $1.17, highlighted later. These levels align with key technical support zones.

However, recent trap behavior suggests another scenario is possible. If XRP briefly breaks below $1.31 but quickly recovers, it could trigger another short squeeze.

On the upside, reclaiming $1.40 would weaken the bearish setup. The trap may be forming, as open interest has risen again to $754 million, and funding rates have moved back into negative territory.

A move above $1.67 would fully invalidate the head-and-shoulders structure. Until either level breaks decisively, XRP may continue moving inside a trap-prone range. For now, the data shows a clear pattern.

A 20% breakdown projection attracted aggressive short positions. Open interest surged. Funding turned deeply negative. But whales accumulated 150 million XRP during the panic. This combination suggests XRP’s bearish breakdown may have acted more as bait than confirmation.

The next move will decide whether the pattern finally delivers its projected decline or becomes another trap in an increasingly volatile derivatives-driven market.

Crypto World

Kraken Launches Fixed-Rate Crypto Loans for Pro Members

Kraken has expanded its lending toolkit with Flexline, a crypto-backed loan offering designed for Kraken Pro users seeking liquidity without selling their digital assets. The fixed-rate facility supports terms ranging from two days to two years, with loan proceeds issued in either cryptocurrency or stablecoins depending on eligibility. Collateral sits in segregated wallets and is included in Kraken’s Proof of Reserves attestations, which the exchange says verify client assets on a 1:1 basis. Annual percentage rates run from 10% to 25%, and borrowers can repay early, though an early repayment fee applies. Availability is restricted to certain regions, with the product not offered in Australia, Brazil, Canada, India, New Zealand, Switzerland, the United Arab Emirates, the United Kingdom, or the United States. The rollout follows Kraken’s recent foray into tokenized equity perpetual futures on its regulated derivatives platform, expanding leveraged exposure to major indices and select equities for eligible non-US clients. (CRYPTO: XRP) and other well-known assets feature in the broader landscape Kraken outlined, signaling a broader push toward collateralized liquidity across the ecosystem.

Key takeaways

- Flexline provides fixed-rate crypto-backed loans with terms from two days to two years, and borrowers can receive funds in crypto or stablecoins depending on eligibility; loan-to-value ratios are not disclosed.

- Collateral is held in segregated wallets and reflected in Proofs of Reserves attestations, offering 1:1 backing in the eyes of the lender.

- APR ranges between 10% and 25%; early repayment is allowed but carries a fee; the product is not available in several major markets, including the US and UK, among others.

- The launch sits within a broader trend of crypto-backed lending across centralized exchanges, DeFi, and traditional finance, highlighted by parallel moves such as Coinbase expanding its collateralized loan product and institutional participation in lending infrastructures.

- Kraken’s expansion comes as DeFi lending remains sizable, with on-chain data indicating substantial liquidity and borrowing activity across leading protocols and an ongoing consolidation of traditional finance actors into crypto lending ecosystems.

Tickers mentioned: $XRP, $DOGE, $ADA, $LTC, $USDC, MORPHO, $APO, $AAPL, $NVDA, $TSLA

Market context: The Flexline announcement arrives amid renewed momentum in crypto-backed lending, spanning exchanges, DeFi, and traditional finance. On-chain data show DefiLlama reporting roughly $51.9 billion in total value locked (TVL) across DeFi lending, with about $30.8 billion actively borrowed, led by the Aave ecosystem and a growing suite of collateralized products. This backdrop underpins Kraken’s push into flexible liquidity, aligning with a broader industry trend toward asset-backed credit facilities as market participants seek alternative funding rails amid liquidity cycles and evolving regulatory expectations.

Why it matters

For users, Flexline represents a structured path to liquidity without realizing tax-inefficient or market-timing-driven asset sales. By accepting collateral that remains on the books of the exchange, borrowers can access funds quickly, with the option to keep exposure to their upside while maintaining asset ownership. The 1:1 Proof of Reserves attestations Kraken cites aim to bolster confidence in the solvency and transparency of the arrangement, an important consideration as lenders navigate ongoing scrutiny and evolving custody standards. The inclusion of a wide array of collateral types—ranging from DeFi mainstays to stablecoins—highlights the industry’s ongoing effort to diversify liquidity channels and reduce dependence on any single asset class.

From a broader market perspective, Flexline fits a momentum arc where institutional and high-net-worth participants are increasingly experimenting with crypto-backed credit as a tool for liquidity management and yield optimization. The Coinbase expansion of its collateralized loan product to support a larger basket of assets, including XRP and other major tokens, underscores a competitive dynamic among CeFi players to offer more flexible borrowing terms without forcing asset liquidation. At the same time, rate environments and regional restrictions continue to shape how and where such products are deployed, with regulators in several jurisdictions paying closer attention to risk controls around collateral valuation and liquidation triggers. These dynamics are complemented by DeFi activity and institutional partnerships that point to a maturing ecosystem where multiple rails—CeFi, DeFi, and traditional finance—coexist and interact more frequently.

Looking ahead, market participants will watch how liquidity facilities such as Flexline influence user behavior during drawdowns, the appetite of counterparties to post diverse collateral (including tokens with volatile price trajectories), and the pace at which regulators delineate acceptable risk parameters for crypto-backed lending. The presence of established players like Apollo Global Management, which has engaged with Morpho in blockchain-enabled lending infrastructure, signals continued institutional curiosity, even if the path to broad adoption remains contingent on regulatory clarity and risk management frameworks. The evolving landscape suggests lenders will increasingly balance rapid funding with robust collateral-risk controls, aiming to deliver utility for traders and investors without compromising balance-sheet integrity.

As the ecosystem continues to evolve, Flexline could become a reference point for how crypto-backed credit products are designed, tested, and scaled across jurisdictions. The integration of transparent custody, reserve attestations, and a diverse set of collateral types could help normalize these facilities as a pragmatic tool for liquidity management on both retail and professional scales.

What to watch next

- Regional accessibility updates: whether Kraken expands Flexline availability to additional jurisdictions currently restricted.

- Asset coverage: whether more collateral types, including new tokens, are added to the supported list.

- Regulatory milestones: any changes in rules affecting crypto-backed lending, custody, and reserve reporting in major markets.

- Product integration: how Flexline interacts with Kraken’s other offerings, such as tokenized equity futures and other derivative products, and any cross-collateral or risk-management enhancements.

Sources & verification

- Kraken Flexline official page: https://www.kraken.com/en-gb/pro/flexline

- Kraken Learn comparison page: https://www.kraken.com/learn/kraken-vs-kraken-pro#:~:text=geared%20toward%20beginners%20and%20individual%20investors%2C%20while%20Kraken%20Pro%20is%20for%20advanced%20and%20institutional%20traders.

- Business Wire press release on Flexline launch: https://www.businesswire.com/news/home/20260225892767/en/Kraken-Launches-Flexline-a-Crypto-Secured-Loan-Offering-Flexible-Access-to-Liquidity

- DefiLlama lending data: https://defillama.com/protocols/lending

- Cointelegraph coverage of Apollo-Morpho partnership: https://cointelegraph.com/news/apollo-deepens-blockchain-play-enters-crypto-lending-via-morpho-partnership

What the article means for readers

Beyond the specifics of Flexline, Kraken’s move signals a continuing shift toward more accessible, asset-backed liquidity options in crypto markets. For builders, it reinforces the importance of secure custody architectures and transparent reserve reporting as core capabilities that enable scalable lending. For investors, the initiative highlights the evolving risk-reward calculus of crypto credit, where yield considerations must be weighed against the stability of collateral, platform risk, and the regulatory backdrop that governs use of crypto-backed lines of credit.

Rewritten Article Body: Kraken’s Flexline and the trajectory of crypto-backed lending

Kraken’s Flexline marks a deliberate pivot toward liquidity-first thinking in the crypto space. By enabling borrowers to post collateral and receive funds without parting with their holdings, the exchange is expanding the practical toolkit available to traders who face sudden cash needs or strategic opportunities. The mechanism rests on fixed-rate terms that stretch from a few days to several years, delivering predictability for budgeting while avoiding the volatility risk that can come with floating-rate loans in unsettled markets. The policy framework explicitly restricts some regions, a reminder that the regulatory landscape remains uneven across jurisdictions and that product design must respond to those realities. The stated APR band of 10% to 25% aligns with other crypto-backed facilities, though the precise Loan-to-Value ratios are not disclosed publicly, a common feature among lenders who balance risk with the flexibility to tailor terms to collateral type and borrower profile.

Collateral is held in segregated wallets, and the company asserts that it participates in 1:1 Proof of Reserves attestations. In effect, this positions Flexline as a transparent, auditable line of credit backed by clients’ on-chain assets. The prospect of liquidation remains a core risk management lever; Kraken notes that collateral can be liquidated if a borrower breaches maintenance requirements or fails to repay at maturity. Early repayment is allowed, but it comes with a fee, a design choice that aligns incentives toward timely settlement and preserves the lender’s ability to manage liquidity risk. The regional exclusions—Australia, Brazil, Canada, India, New Zealand, Switzerland, the United Arab Emirates, the United Kingdom and the United States—underscore the reality that jurisdictional risk remains a central concern for crypto lenders and borrowers alike, shaping product availability rather than merely reflecting policy preference.

From a product strategy standpoint, Flexline is not a stand-alone initiative. Kraken frames it within a broader expansion of liquidity options across its ecosystem. The same week, it launched tokenized equity perpetual futures on a regulated derivatives platform, providing eligible non-US traders with around-the-clock leveraged exposure to broad US stock indices, as well as individual equities such as Apple (CRYPTO: AAPL) and Nvidia (CRYPTO: NVDA), alongside other marquee names. This pairing of crypto-backed loans and tokenized equity instruments illustrates an integrated approach to liquidity and exposure that leverages both crypto and traditional markets. The inclusion of stablecoins as viable loan proceeds further broadens accessibility, enabling borrowers to receive funds in a form that can be immediately deployed within Kraken’s trading and settlement rails or withdrawn where geographic rules permit.

Across the broader market, Flexline exists within a resurgent appetite for crypto-backed lending that spans centralized exchanges, DeFi platforms, and traditional finance players. Coinbase’s recent expansion of its collateralized loan product—allowing US users to borrow up to $100,000 in USDC against a diverse asset set including XRP and other tokens—signals a competitive impulse among CeFi lenders to broaden asset coverage and reduce friction for borrowers. On the DeFi side, the liquidity story remains robust, with DefiLlama data indicating that the sector’s TVL hovered near $51.9 billion, with roughly $30.8 billion actively borrowed. Aave remains a dominant force, accounting for a substantial share of the TVL, while Morpho and other protocols continue to capture flows as lenders and borrowers explore alternatives to traditional custodial models.

Institutional involvement in crypto lending has also intensified. Apollo Global Management recently deepened its blockchain play through a Morpho partnership, signaling that traditional asset managers see potential in blockchain-based lending infrastructure and related token economics. The MORPHO token, along with related governance and staking dynamics, sits at the intersection of DeFi incentives and institutional risk management, illustrating how the line between traditional finance and crypto-native markets continues to blur. The broader ecosystem is also watching the dynamics around asset-backed liquidity in relation to regulatory expectations and risk controls, including how custody solves and reserve transparency practices evolve to meet stricter scrutiny.

For market participants, Flexline offers a practical option to unlock liquidity while maintaining exposure to digital assets. The decision to allow proceeds in both crypto and stablecoins provides flexibility, particularly for traders who want to execute spread trades or rebalance positions without triggering tax events or incurring high slippage from an asset sale. Yet with a fixed-rate structure and a potential liquidation path, borrowers must weigh the benefits of immediate liquidity against ongoing collateral risk and the potential cost of early repayment. In a landscape where DeFi lending has demonstrated resilience but remains sensitive to macro shifts and regulatory signals, Kraken’s Flexline contributes to a more nuanced, multi-rail approach to crypto credit—one that could push other players to refine their own terms, risk disclosures, and reserve practices to stay competitive while safeguarding investor confidence.

Looking forward, the evolution of crypto-backed lending will hinge on regulatory clarity, custody innovations, and the continued integration of crypto-native and traditional financial products. As lenders experiment with more asset classes and as traders increasingly treat crypto credit lines as a normal part of their toolkit, the industry will need to maintain rigorous risk management, transparent reporting, and robust liquidity provisions. Flexline’s early steps suggest a trend toward streamlined liquidity with stronger reserve guarantees, a combination that could help drive wider adoption while ensuring that credit facilities remain resilient in the face of price volatility and shifting regulatory winds.

What to verify

- Official Kraken Flexline terms and eligibility details on the Flexline page and the Learn portal.

- The Business Wire press release for the official rollout narrative and regional restrictions.

- DefiLlama’s current lending TVL and the distribution among leading DeFi lenders, including Aave and Morpho.

- Coinbase collateralized loan product expansion disclosures and any related regulatory filings or statements.

Crypto World

Wall Street Is Going On-Chain, And Investors Still Don’t Get It, Says Bitwise CIO

Wall Street firms are launching tokenized funds, stablecoins, and on-chain products, yet Bitwise’s CIO says that investors remain stuck in outdated crypto narratives.

Bitwise’s Chief Investment Officer Matt Hougan believes there is a fundamental disconnect between perception and reality in the crypto market. He argued that investors often misinterpret what is truly happening because behavioral biases, particularly anchoring bias, distort their view.

Anchoring bias, the tendency to fixate on the first piece of information encountered, shapes how people evaluate opportunities. This leads them to overweight initial impressions even when new evidence emerges. Hougan stated that this factor played a key role in his own entry into crypto in 2018.

Tokenization Is Exploding

In his latest memo, Hougan stressed that Wall Street is moving on-chain and pointed to several concrete developments. Paul Atkins launched “Project Crypto,” a commission-wide initiative aimed at modernizing securities regulation so that US markets can operate on-chain. Larry Fink said the industry is entering the early stages of tokenizing all assets. BlackRock followed that view by launching its $2 billion BUIDL tokenized Treasury fund on Uniswap. Apollo tokenized its $700 billion Diversified Credit Fund across six blockchains and announced plans to acquire a stake in Morpho.

Additionally, major banks, such as JPMorgan, Bank of America, Citigroup, and Wells Fargo, are discussing a joint stablecoin. JPMorgan has already launched a deposit token on Base. Fidelity is hiring a DeFi vaults manager.

Despite these initiatives, the Bitwise exec said that traditional investors fail to register these changes. Even crypto investors themselves, he added, exhibit fatigue from repeated claims of institutional adoption. Data, however, tells a different story.

Where Does the Value Go?

Tokenized real-world assets have grown sharply from 2020 to 2025. Hougan warned that while the opportunity is clear, the exact path to capture it is uncertain. Questions remain about whether value from tokenization will accrue to public Layer 1 networks like Ethereum and Solana, to quasi-private blockchains such as Canton Network and Tempo, to DeFi tokens, or to companies building in the ecosystem, including incumbents like BlackRock and JPMorgan, versus crypto-native firms.

“The biggest alpha opportunities come when the consensus narrative is stale and reality has moved on, but investors are still anchored on the old story. That’s exactly where we are with crypto today. “

Meanwhile, crypto analytics platform Presto Research expects tokenization to be a central driver of crypto’s next institutional phase. In its 2026 outlook, the firm projected that the combined value of tokenized real-world assets and stablecoins will approach $490 billion by the end of 2026.

You may also like:

The report also observed that growth will be fueled by demand for tokenized US Treasury bills and credit instruments.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Management wins board approval to sell BTC

GD Culture Group (GDC) has received board approval to sell part of its 7,500 bitcoin reserve to help fund a previously announced stock repurchase program, the company said.

The board authorization allows management to decide when and how to carry out the bitcoin sales. GD Culture emphasized it’s not obligated to sell any set amount and can alter or halt the plan at any time.

Facing a sharp decline in the stock price as the price of bitcoin has tumbled in recent months, the board approved a $100 million repurchase program earlier this month.

The company’s bitcoin holdings are currently worth about $497 million, according to data from CoinGecko. That value has dropped over time, with GD Culture carrying an unrealized loss of $344 million, down nearly 41% from its total acquisition cost of $841.5 million.

The company got its large bitcoin stash through the acquisition of Pallas Capital Holding. The move was, at the time, financed through the issuance of 39.18 million shares.

Other companies have also started divesting their bitcoin holdings. Earlier this week, Bitdeer sold all of its BTC to fund a move into AI data centers, while Riot Platforms reduced its BTC balance late last year.

GDC shares are higher by 7% on Wednesday alongside a modest bounce in the price of bitcoin to above $67,000. They remain down by nearly 70% from their September 2025 peak.

Crypto World

Bitcoin is facing a major hurdle around $70,000 that will decide if this rally is built to last

Bitcoin snapped back near $69,000 on Wednesday, rallying more than 10% from Tuesday’s low as crypto markets staged a broad relief rally after a prolonged stretch of pessimism.

Ethereum’s ether (ETH), , native tokens of Solana (SOL) and all posted double-digit gains, extending a move that caught many traders leaning the wrong way.

Digital asset stocks, battered lower in the past months amid falling crypto prices, also enjoyed a relief rally. Stablecoin issuer Circle (CRCL) surged 34% after its earnings report, while crypto exchange Coinbase (COIN) jumped 14%. Strategy (MSTR), the largest corporate holder of bitcoin, climbed 9%, and the ether treasury firm BitMine advanced 12%.

The broad-based rally offered a welcome reprieve after weeks of persistent selling pressure and dread of a next leg lower.

Still, analysts cautioned that despite the sharp bounce across tokens and equities, crypto markets are not out of the woods yet, with key resistance levels and macro risks still looming.

While there was no immediate catalyst behind the Wednesday move, extreme fear and bearish positioning across crypto markets were prime conditions for a violent countertrend advance, according to Joel Kruger, market strategist at LMAX Group.

“Crypto assets have been heavily pressured in recent months and overdue for a technical bounce,” he wrote. “The market had built up a meaningful tactical short bias, leaving it vulnerable to sharp squeezes on limited headlines.”

Still, Kruger cautioned against calling the rebound the start of a durable uptrend yet.

“Given the abrupt nature of the rally and the absence of a clear trigger — particularly against the backdrop of thinner liquidity conditions — the advance should be treated with caution,” he said.

Chasing the rally

Joshua Lim, global co-head of markets at FalconX, said his desk is seeing heavy demand for bullish bets on ether in the options market. Specifically, traders are buying call options and call spreads in the $2,000–$2,200 range over the next two to three weeks, seeking to profit from further near-term upside.

Lim added that some funds are also “chasing this rally” by rotating into higher-volatility altcoins and using options to amplify potential gains — a sign that risk appetite has picked up quickly after the recent rebound.

Adding some complexity, roughly 115,000 BTC options worth $7.49 billion will expire Friday at month-end. The so-called “max pain” — the price level where the largest number of options expire worthless — currently is at around $75,000, Wintermute OTC trader Jasper De Maere noted. The “max pain” point can sometimes act as a magnetic level into expiry, though dealer positioning appears weak, he said.

“Fundamental indicators still remain unconvincing that this strength will see much follow through,” De Maere added.

Levels to watch

Technically, bitcoin faces stiff resistance in the $70,000 and $72,000 zone, where recent rallies have stalled as sellers stepped in. Overcoming those levels would be the first challenge in turning the bounce into a durable move higher.

Bitfinex analysts also pointed to $78,000, where the “True Market Mean,” an onchain valuation metric to estimate bitcoin’s fair value based on actual capital flows into the network, currently sits.

That level must be reclaimed on a sustained weekly basis before the structural picture improves, Bitfinex analysts said.

Crypto World

GDC Board Gives Company Greenlight to Sell BTC for Share Buyback

The board of directors for GD Culture Group (GDC), a publicly listed holding company focused on digital marketing and AI, on Wednesday authorized the company to sell Bitcoin (BTC) from its corporate treasury to pay for a share buyback program.

The move appears to be a reversal of a May 2025 decision to build a cryptocurrency reserve of Bitcoin and Official Trump Coin (TRUMP).

Wednesday’s authorization allows the company to sell the BTC from its treasury in “one or more transactions,” and the company is not under an obligation to sell any amount of BTC, according to GDC’s announcement

In February, the company announced a stock buyback program of up to $100 million of its shares for a period of six months.

Shares of GDC traded up more than 24% by Wednesday’s close at $4.13 apiece, according to Yahoo Finance.

The announcement came amid a broad crypto market downturn, which dragged the price of BTC down as low as $60,000, more than 50% from its all-time high above $126,000; the market rout has negatively impacted Bitcoin treasury companies.

Related: FG Nexus sells another $14M in Ether as losses mount on treasury bet

GDC climbs the treasury ranks in a matter of months, but entered near the market top

GDC purchased 7,500 BTC through an $875 million acquisition of Pallas Capital Holding in September 2025, when BTC was trading between $109,000 and $117,000. Shares of the company plunged about 28% in response to the deal.

GDC is the 15th largest BTC treasury company by Bitcoin holdings, according to data from BitcoinTreasuries, but is down about 41% on its BTC investment.

The company has a multiple on net asset value (mNAV) of 0.42; mNAV is a critical metric for Bitcoin treasury companies, calculated by dividing the market capitalization of the company by the dollar value of its BTC holdings.

Despite the market drawdown, the company’s 7,500 BTC treasury is valued at about $517.5 million using the market price at the time of publication; this is more than double GDC’s market cap of about $236.7 million, following today’s stock surge.

Magazine: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’

Crypto World

rises 3% after earnings beat, lifting AI miners CIFR, IREN, WULF,

Nvidia(NVDA), the world’s largest public company by market value and bellwether for the AI sector, once again topped Wall Street expectations for the fourth quarter, reporting results after the close of U.S. markets on Wednesday.

The chipmaker beat estimates, reporting revenue of $68.1 billion, a 73% increase from a year earlier, as continued AI-related capital spending fueled strong demand for its chips. It also reported adjusted earnings per share of $1.62, beating estimates. Wall Street analysts expected Nvidia to report approximately $66.1 billion in revenue and $1.54 in adjusted EPS, according to FactSet data.

Shares rose nearly 3% in post-market trading on Wednesday following the earnings release.

Investors are now focused on guidance. Nvidia expects first-quarter revenue of around $78 billion, up from analyst expectations of $72.9 billion, setting the tone for the next phase of AI-driven growth.

The chip-making giant also said that its Data Center revenue for the fourth quarter was a record $62.3 billion, up 75% from a year ago and up 22% from the prior quarter, driven by the “major platform shifts – accelerated computing and AI.”

“Today’s report is a strong pushback against the narrative that hyperscaler AI growth could start fading into 2027,” said Thomas Monteiro, senior analyst at Investing.com. “The roughly 75% surge in data center revenue further reinforces that hyperscaler AI infrastructure deployment remains firmly in expansion mode.”

Following the results and outlook, bitcoin remained at session highs around $69,500 after a 10% rally from Tuesday’s lows. AI-focused crypto tokens such as Bittensor (TAO) and Internet Computer (ICP) added to their gains.

Crypto miners, increasingly linked to AI and high-performance computing infrastructure, also saw modest gains following Nvidia’s report. IREN (IREN), Cipher Digital (CIFR), and TeraWulf (WULF were 1%-2% higher in after-hours trading.

The company will host a conference call at 5 p.m. ET, where investors will be listening closely for further signals on the next phase of the AI infrastructure buildout.

UPDATE (Feb. 25, 22:10 UTC): Adds analyst comment.

Crypto World

Chicago Crypto Lender Loses $75 Million, CEO Steps Down

Crypto liquidity firm BlockFills suspended withdrawals after $75 million losses and CEO Nicholas Hammer stepped down.

Blockfills is a Chicago-based crypto liquidity provider and lender that primarily serves institutional clients such as hedge funds, asset managers, and high-net-worth trading firms.

Why It Matters

- Institutional crypto lender losses can restrict liquidity for hedge funds, traders, and asset managers.

- Withdrawal freezes raise solvency concerns and counterparty risk across crypto markets.

- Leadership exits and sale efforts signal financial distress at a major institutional trading firm.

The Details

- BlockFills co-founder and CEO Nicholas Hammer stepped down in February 2026.

- The company appointed Joseph Perry as interim CEO.

- BlockFills suspended client deposits and withdrawals on Feb. 11, 2026.

- The firm reported approximately $75 million in losses tied to its crypto lending operations.

- Losses occurred after crypto collateral backing loans fell in value during market declines.

- Some clients received warnings to withdraw assets before the freeze.

- Customer deposits and withdrawals remain halted as of late February 2026.

- BlockFills is actively seeking a buyer or strategic investor.

- The firm operates from Chicago and serves institutional crypto trading clients globally.

The Big Picture

- BlockFills provides liquidity, lending, and trading infrastructure to institutional crypto clients.

- Crypto lenders face losses when falling asset prices reduce collateral coverage on loans.

- Similar lending failures previously triggered collapses at Celsius, Voyager, and Genesis.

- Institutional crypto markets remain exposed to liquidity stress during volatile price cycles.

- Firms increasingly pursue acquisitions or restructuring after lending losses reduce available capital.

Crypto World

XRP Price Prediction: Whales Are Dumping Millions, Is XRP About to Crash Below $1?

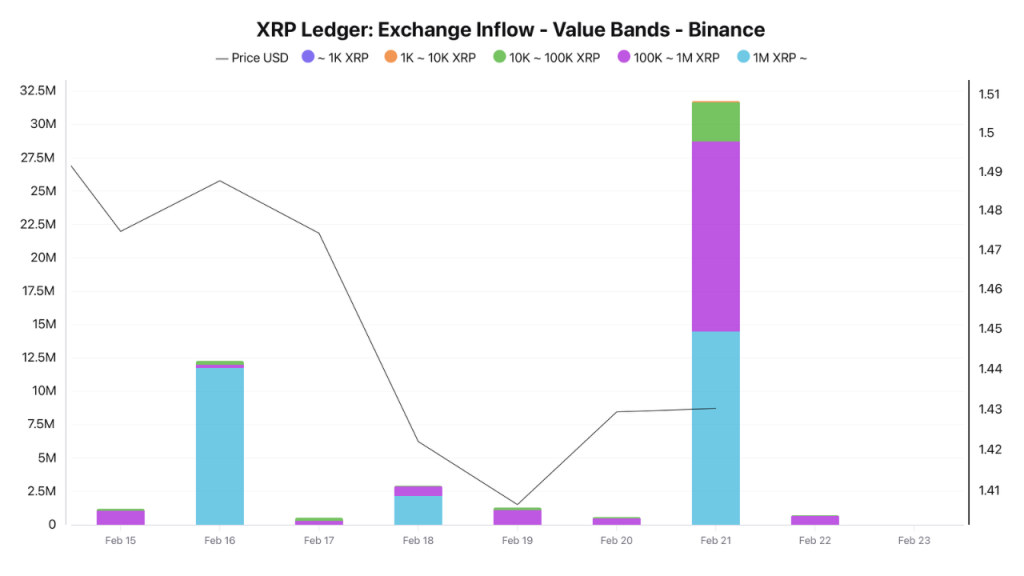

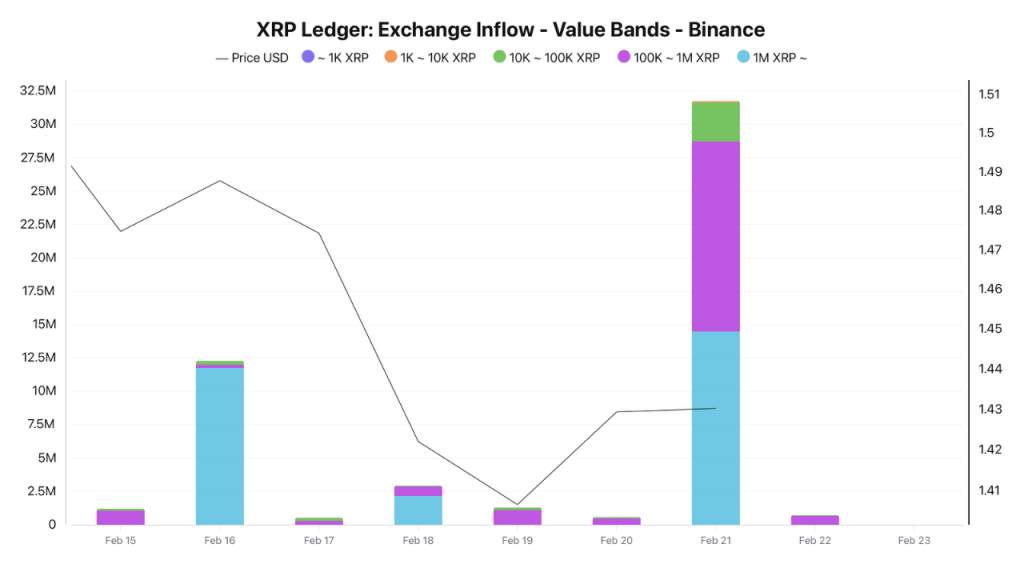

Whales just moved size onto Binance, maybe to sell? Under these conditions, even small moves affect XRP price prediction.

More than 31M XRP, worth about $45M, were transferred to the exchange in a single day, with large holder wallets driving most of the flow. That is not retail noise. It is a meaningful supply potentially preparing to sell.

Big exchange inflows often signal distribution. When coins leave cold storage and hit order books, sell-side pressure increases immediately.

This comes while XRP is hovering in the mid $1.30 range, trying to stabilize after recent volatility. At the same time, longer-term headlines remain constructive, creating a clear divergence between narrative and on-chain behavior.

If buyers absorb this supply, the structure holds. If similar inflows continue, downside risk grows fast.

XRP Price Prediction: Is XRP About to Crash Below $1?

XRP just bounced again from the $1.30 support, and it is still trading above the old descending channel. That matters.

The channel capped price for weeks, so staying above it keeps the breakout valid instead of turning it into a fake move.

As long as XRP prints higher lows above $1.30 and holds outside the channel, the short-term bias stays constructive.

The first upside test sits near $1.61. Clear that with strength and $1.90 comes back into play, with $2.10 and $2.50 as broader swing targets if momentum expands.

But $1.30 is carrying the structure right now. Another weak bounce would show fatigue, and a clean breakdown could open the path toward $1.10.

For now, holding $1.30 and the reclaimed channel keep the bullish setup alive. Lose both, and the breakout story starts to fade.

SUBBD (SUBBD) Gives Creators the Chance to Monetize AI-Generated Content

SUBBD ($SUBBD) is reshaping how creators make, share, and monetize their work by merging AI tools with blockchain technology in one seamless platform.

Instead of jumping between a bunch of apps to create, edit, and post content, SUBBD keeps everything in one place. One ecosystem, fewer headaches.

At the center of it all is the $SUBBD token. It powers the whole experience for both creators and users. It makes paying for subscriptions and exclusive content simple, and it gives holders perks like governance rights, staking rewards, and access to premium tools.

With over 2,000 influencers already on board and a combined audience of 250 million, the upside potential for $SUBBD is starting to look hard to ignore.

You can buy $SUBBD at its discounted presale price of $0.057520 by visiting the official SUBBD website.

Link up your wallet (e.g., Best Wallet) and either swap USDT or ETH for this token or use a bank card to invest.

Visit the Official SUBBD Website Here

The post XRP Price Prediction: Whales Are Dumping Millions, Is XRP About to Crash Below $1? appeared first on Cryptonews.

-

Video6 days ago

Video6 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics4 days ago

Politics4 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports7 days ago

Sports7 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World2 days ago

Crypto World2 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Tech1 day ago

Tech1 day agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat3 days ago

NewsBeat3 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat1 day ago

NewsBeat1 day agoPolice latest as search for missing woman enters day nine

-

Business1 day ago

Business1 day agoTrue Citrus debuts functional drink mix collection

-

Crypto World1 day ago

Crypto World1 day agoEntering new markets without increasing payment costs

-

Sports2 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Business1 day ago

Business1 day agoWBD says Paramount makes higher bid, board will weigh offer against Netflix deal