Crypto World

Polymarket Parent Blockratize Inc. Seeks Trademark for ‘POLY’ Token

TLDR

- Blockratize Inc., the parent company of Polymarket, has filed trademark applications for the terms “POLY” and “$POLY.”

- The trademark filings cover various services, including digital token and cryptocurrency trading, as well as platform-as-a-service offerings.

- Both trademark applications were filed on February 4 and are currently listed as “live” and “pending” by the U.S. Patent and Trademark Office.

- The filings were submitted on an “intent to use” basis, meaning the marks are not yet in active commercial use.

- Polymarket executives have previously confirmed plans to launch a native POLY token alongside an airdrop, but no official launch timeline has been provided.

Blockratize Inc., the parent company of the crypto-powered prediction platform Polymarket, has filed trademark applications in the U.S. for “POLY”. These filings, made on February 4, signal the company’s ongoing plans to launch a native token. The applications are currently listed as “live” and “pending,” suggesting the project is moving forward.

The trademark filings span multiple classes, covering digital token services, cryptocurrency trading, and platform-as-a-service offerings. This move aligns with previous statements from Polymarket executives about the potential launch of a native token, adding a formal legal step to their plans. While the filings don’t specify a timeline, they confirm ongoing preparations for the launch of the POLY token.

Trademark Filings Confirm Polymarket’s Token Plans

Polymarket’s trademark applications cover a range of services, including downloadable software for cryptocurrency trading and financial services. These filings have been submitted on an “intent to use” basis, meaning they are not yet in active commercial use. The company has also applied for digital token and cryptocurrency services as part of its broader market strategy.

While the trademark filings do not mention specific dates or mechanics, they do reinforce earlier statements from Polymarket executives. In October, Polymarket’s Chief Marketing Officer, Matthew Modabber, confirmed the company’s plans for the POLY token launch. Founder Shayne Coplan also teased the token’s release, with both executives noting that the U.S. app’s relaunch would take precedence over the token rollout.

Polymarket’s Expansion and Token Speculation

Polymarket has become one of the largest global venues for prediction markets, with $7.7 billion in trading volume last month. This growth has spurred anticipation for the POLY token, particularly as speculation around the launch continues to build. With the increasing popularity of prediction markets in politics, sports, and macro events, the token launch has captured the attention of the broader cryptocurrency community.

The company has secured significant investments, including a $2 billion deal with the Intercontinental Exchange, parent of the New York Stock Exchange. Polymarket has also formed strategic partnerships with major names like Google Finance, Yahoo Finance, DraftKings, and the National Hockey League.

Crypto World

Avalanche (AVAX) Gains 2% as Index Trades Flat

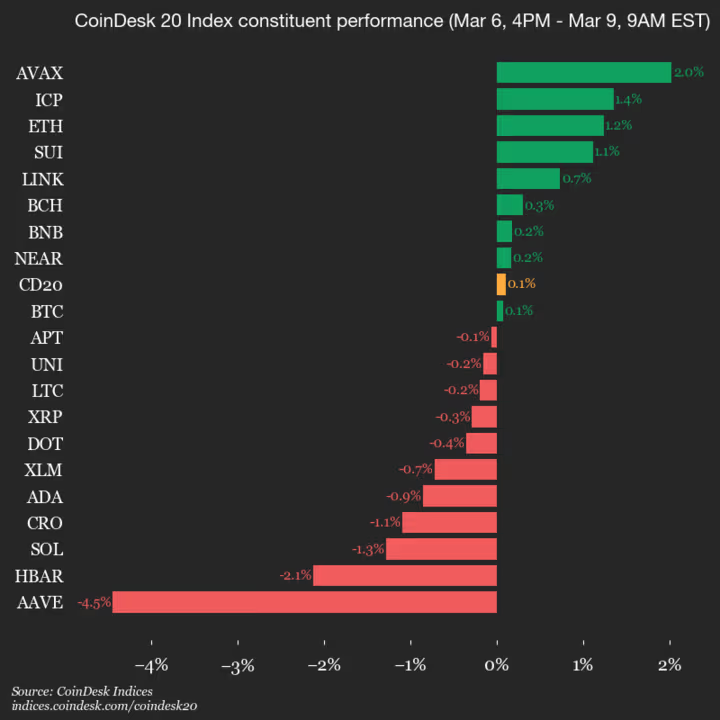

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1948.46, up 0.1% (+2.05) since 4 p.m. ET on Friday.

Nine of the 20 assets are trading higher.

Leaders: AVAX (+2.0%) and ICP (+1.4%).

Laggards: AAVE (-4.5%) and HBAR (-2.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Here’s why Pi Network price may keep soaring this week

Pi Network price rose by 2.2% on Monday, making it one of the top gainers in the crypto market. It has now soared by ~70% from its lowest level this year, and several key catalysts may drive it higher this week.

Summary

- Pi Network price has rebounded by ~70% from its lowest level this year.

- The network will continue rising ahead of the upcoming Pi Day.

- Technical analysis suggests that the token will continue rising this year.

Pi Coin (PI) token was trading at $0.2165 on Monday, paring back some of the losses made on Sunday. This rebound has made it one of the best-performing coins in the crypto industry this year.

Pi Network token will likely continue the recent bull run because of the upcoming Pi Day event, which will take place on Saturday this week. The developers have a long history of making major announcements on this day. As such, the price may continue rising as traders anticipate the event.

Pi Network is going through a series of core upgrades, with the current one expected to conclude on March 12. These upgrades will make it a better network, especially as the developers plans to launch decentralized exchange and automated market maker tools.

Pi Network price will also benefit from the ongoing investments in the artificial intelligence industry. It invested in OpenMind last year, and on Friday, the developers shared key details of this partnership.

In addition to the monetary impact, Pi Network hopes that the partnership will help its miners make extra money by providing their resources to the company. It also hopes to replicate this model to other companies in the AI industry.

Pi Coin price will also benefit from the upcoming validator rewards distribution, which is expected to happen later this month.

Most importantly, there are signs that demand is rising. Data shows that the daily volume jumped to $38 million, much higher than where it was a few months ago when it dropped below $10 million.

Pi Network price technical analysis

The daily chart reveals that the Pi Coin price has staged a strong comeback after bottoming at its all-time low of $0.1312 on February 12.

Pi has already crossed above the 100-day Exponential Moving Average, confirming the bullish outlook. In most cases, moving above that level is a sign that bulls are in control for now.

The coin has moved above the Supertrend indicator. Also, the Percentage Price Oscillator and the Relative Strength Index have continued rising.

Therefore, the coin will likely continue rising as bulls target the important resistance level at $0.2935, its highest point in October last year. This price is about 35% above the current level.

Crypto World

Microsoft (MSFT) Stock Integrates Anthropic’s Claude into New Copilot Cowork Feature

Key Highlights

- Microsoft unveiled Copilot Cowork, leveraging Anthropic’s Claude Cowork platform, designed for Microsoft 365 business customers

- The AI agent automates workflows including presentation creation, Excel data manipulation, and calendar coordination with minimal user intervention

- MSFT shares have declined 15% year-to-date, with an additional 9% drop in February after Anthropic’s Claude Cowork announcement

- The tech giant is integrating Claude Sonnet models into M365 Copilot, diversifying away from exclusive OpenAI GPT dependency

- Microsoft 365 Copilot subscription seats surged 160% year-over-year during the latest reporting period

On Monday, Microsoft revealed Copilot Cowork, an innovative AI agent solution developed through a partnership with Anthropic. This release integrates Claude Cowork’s self-sufficient features straight into the Microsoft 365 platform.

The intelligent assistant can generate slide decks, fill spreadsheet cells, and coordinate with team members for scheduling — requiring only basic direction from users. The feature remains in beta testing, with broader availability planned for select enterprise customers within weeks.

Microsoft emphasized its security infrastructure as a differentiator. While Claude Cowork functions locally on individual machines, Copilot Cowork runs exclusively through cloud infrastructure.

“We work only in a cloud environment and we work only on behalf of the user. So you know exactly what information it has access to,” said Jared Spataro, who leads Microsoft’s AI-at-Work efforts.

The release comes at a strategic moment. Anthropic’s initial Claude Cowork announcement on January 30 triggered widespread concern across technology equities. Companies like Salesforce (CRM), ServiceNow (NOW), Intuit (INTU), and Thomson Reuters (TRI) experienced significant declines.

Microsoft wasn’t spared either. The company’s shares tumbled almost 9% during February in response to the Cowork announcement. Year-to-date, MSFT has retreated 15% from its 2026 opening levels.

Expanding Model Portfolio Beyond OpenAI

Monday’s reveal also signals an important strategic pivot in Microsoft’s artificial intelligence approach. The company confirmed it will offer Anthropic’s Claude Sonnet models within M365 Copilot — a platform that had previously operated solely on OpenAI’s GPT infrastructure.

OpenAI represents approximately 45% of Microsoft’s cloud services contract pipeline, a level of dependency that has concerned some market analysts. Incorporating Anthropic’s technology provides greater strategic diversification.

Copilot Cowork pricing details remain undisclosed. Microsoft indicated that certain functionality will be bundled within its current $30-per-user monthly M365 Copilot subscription, while additional capacity will require separate purchases.

Corporate Customer Growth Metrics

Microsoft’s business AI adoption figures demonstrate strong momentum. Paid M365 Copilot licenses expanded 160% compared to the previous year in the latest quarter, while daily engagement surged tenfold.

Organizations implementing Copilot across more than 35,000 licenses tripled year-over-year. Notable recent deployments span Mercedes-Benz, NASA, Fiserv, ING, and the US Department of the Interior.

Microsoft simultaneously introduced additional autonomous AI capabilities across Word, Excel, PowerPoint, and Outlook. The Microsoft Agent 365 management platform has reached general availability at $15 monthly per user.

The corporation packaged its complete offering — encompassing Entra, Copilot 365, and Agent 365 — into a comprehensive Microsoft 365 E7 bundle priced at $99 per user monthly.

Microsoft shares closed Friday at $408.96, declining 0.42%, with pre-market indicators Monday morning pointing to an additional 1.1% decrease to $404.41.

Crypto World

Solana ETFs Build ‘Serious Investor Base,’ Outpacing Bitcoin in Key Metrics

Solana (SOL) ETFs have defied brutal market mechanics since going live in July 2025. While the token’s price collapsed by a little over 57% over the same period, the funds themselves have attracted $1.45 billion in net inflows.

This extreme divergence signals that a “serious investor base” is accumulating heavily even as retail capitulates.

Normally, assets that fall this sharply struggle to attract new liquidity. But Solana ETFs are doing the opposite, absorbing capital at a rate that effectively decouples institutional demand from spot price action. Adjusted for market capitalization, the buying pressure is nearly unprecedented.

To put the numbers in perspective, Solana’s inflow data is arguably stronger than Bitcoin’s when scaled for size.

Bloomberg Intelligence analyst Eric Balchunas notes that if adjusted for the market cap difference, Solana’s $1.45 billion haul is the equivalent of $54 billion in net new flows for Bitcoin, roughly double what Bitcoin ETFs managed at the same stage.

While Bitcoin holds above $68,000 amid strong ETF inflows, Solana’s accumulation during a 50%+ crash highlights a different kind of conviction.

“About as unlucky timing as you’ll ever see,” Balchunas wrote on X regarding the launch timing relative to the price crash. Yet, the funds have not only accumulated capital but retained it.

“They managed to not only accumulate $1.5 billion in flows but also not really give any of it up. Both are really good signs for the future.”

Discover: The best meme coins on Solana

Will SOL Price Catch Up with ETF Volume?

The resilience of these flows suggests the buyer profile is drastically different from the typical retail trader.

According to 13F filings, the majority of Solana ETF holders are institutions, hedge funds, pension funds, and asset managers, who typically operate with multi-year time horizons. They are buying the thesis, not the weekly candle.

As $1.5 billion floods Solana ETFs despite the crash, the data indicates smart money views the $85 range as a deep value zone. If these investors refused to sell during the steep slide from $300, they effectively set a high-conviction floor.

This behavior creates a “diamond hand” dynamic where a significant portion of the floating supply is moving into cold storage custody vehicles.

Balchunas framed the situation clearly: “If we adjust for the size of Solana versus Bitcoin market cap, it’s the equivalent of $54 billion in net new flows.”

For active traders, this metric is a leading indicator. Volume often precedes price, and in this case, custodial volume is screaming bullish divergence even while the chart looks bearish.

Could Institutional Accumulation via Solana ETFs Trigger a Supply Shock?

The broader implication here is a potential supply squeeze. When price drops but custody holdings rise, the asset becomes more illiquid on the sell side.

We are seeing a similar dynamic elsewhere in the market, where Bitcoin is vanishing from exchanges at rates that suggest a looming supply shock.

For Solana, the setup is even more aggressive given the market cap disparity. Investors viewing current prices as a buying opportunity rather than a warning sign have absorbed the selling pressure from the FTX-era unwinds and broader market corrections.

If market sentiment flips neutral or bullish, the lack of liquid supply could force a violent repricing to the upside.

The level to watch is $100. If ETF inflows sustain their current pace, a reclaim of this psychological level could trigger a squeeze against late shorts who are betting on a continued downtrend.

Discover: The best crypto to diversify your portfolio with

The post Solana ETFs Build ‘Serious Investor Base,’ Outpacing Bitcoin in Key Metrics appeared first on Cryptonews.

Crypto World

Bybit ramps up Middle East operations amid regional tensions

Bybit has reaffirmed its commitment to the Middle East amid escalating regional tensions, unveiling a leadership change designed to accelerate growth across the Middle East and North Africa (MENA). The exchange said it appointed Derek Dai as the new MENA country manager, a move that places a sharper focus on market expansion, regulatory collaboration, institutional partnerships, and localized product development in the UAE and surrounding markets. The announcement comes as exchanges seek to balance regional risk with a strategy of deeper, more regulated presence in one of crypto’s fastest-growing hubs.

Key takeaways

- Bybit appointed Derek Dai as the MENA country manager, with responsibilities spanning market expansion, regulatory engagement, institutional partnerships, and localized product development.

- The firm stated it has no plans to scale back Middle East operations despite regional tensions, signaling a strategic pivot toward deeper regional investment.

- Dubai’s ecosystem remains a focal point, with Bybit aiming to broaden access to the UAE dirham and strengthen ties with local financial centers and banks.

- Market context underscores the Middle East as a pivotal crypto region: UAE-based crypto firms number in the thousands, and licensing activity in Abu Dhabi’s ADGM grew notably in early 2025.

- Safety measures for UAE-based staff were highlighted as the company navigates a volatile security environment while pursuing long-term regional growth.

Sentiment: Neutral

Market context: The Bybit development aligns with broader regional crypto activity and regulatory evolution in Dubai and across the UAE. Data points from the region highlight its growing role in the crypto economy, including the presence of thousands of crypto firms and notable licensing trends in Abu Dhabi Global Market (ADGM). The broader story of crypto adoption in the Gulf continues to unfold amid geopolitical risk and ongoing regulatory scrutiny.

Why it matters

The Middle East has emerged as a strategic corridor for crypto activity, drawing exchanges, custodians, and fintech firms that seek regulated access to capital, talent, and a growing consumer base. Bybit’s move to formalize a dedicated MENA leadership role signals a commitment to long-term presence in a region that regulators view as a test case for integrating digital assets into mainstream finance. The UAE’s ambition to become a leading digital asset hub remains a central narrative, even as external shocks test business continuity and risk management practices.

Industry dynamics in the region are shaped by a concerted effort to bridge digital assets with traditional finance. Bybit’s emphasis on expanding UAE dirham liquidity and forging partnerships with banks and payment providers points to a broader strategy: to provide seamless on/off-ramps and to integrate crypto services into existing financial infrastructures. In this context, collaborations with major financial centers like the Dubai International Financial Centre (DIFC) and the Dubai Multi Commodities Centre (DMCC) are pivot points for establishing compliant, scalable operations that can weather regional instability.

The regional narrative is reinforced by data suggesting a real, if uneven, growth trajectory. In neighboring Iran, for instance, crypto activity has shown spikes in withdrawal flows following regional events, underscoring a demand for accessible digital asset channels during periods of stress. Authorities and industry participants alike watch how the Gulf states balance innovation with risk controls as they ramp up licensing regimes and supervision architectures. In the crypto policy space, these dynamics are part of a broader pattern of increased institutional interest and regulated infrastructure building in the area.

Bybit’s leadership statements emphasize a deliberate, locally rooted approach. The company’s leadership argues that the UAE’s vision to become the world’s leading digital asset hub is not undermined by crisis; rather, the country’s demonstrated resilience reinforces the strategic rationale for building in the region. In practical terms, the company has outlined concrete steps to support its people on the ground, including daily check-ins, real-time safety confirmations, and relocation or travel assistance as needed to navigate the evolving risk environment.

The expansion plan also reflects a longer horizon for digital asset infrastructure in the region. Bybit’s focus on deepening ties with major financial centers and expanding tokenized real-world assets can help bridge traditional finance with the digital asset ecosystem. The move sits within a broader ecosystem of UAE-based activity, where approximately 1,800 crypto companies operate and employ more than 8,600 people, and where licensing activity in Abu Dhabi’s ADGM has shown meaningful upticks at the start of 2025 compared with the previous year.

As the market digests these developments, Bybit’s approach will be watched for signals about the region’s openness to institutionalized crypto services and the reliability of regional fintech partnerships during times of geopolitical tension. The company’s emphasis on compliance, talent development, and community engagement aligns with a cautious but forward-looking view of Dubai and the UAE as critical nodes in the global digital asset economy.

What to watch next

- Regulatory progress in the UAE, particularly around licensing frameworks and approvals tied to DIFC and DMCC initiatives.

- New partnerships with banks and payment providers to enable UAE dirham settlements and broaden on/off-ramp capabilities.

- Progress on tokenized real-world assets and other product integrations that connect digital assets with everyday financial services.

- Updates on Bybit’s regional hiring, local compliance programs, and regional risk-management practices.

Sources & verification

- Bybit press release announcing Derek Dai as MENA country manager and outlining expanded regional responsibilities.

- Bybit statements reaffirming continued Middle East commitment and plans for deeper regional investment.

- Analyses and data on UAE crypto ecosystem indicators, including the scale of firms and licensing trends in ADGM for early 2025.

- Reports on crypto activity in Iran and related outflows following regional strikes, with coverage tied to industry data sources.

Bybit broadens MENA footprint as regional tensions test crypto expansion

Bybit is recalibrating its regional strategy with a formal MENA leadership appointment that signals longer-term intent to build in a market viewed as a strategic gateway for regulated crypto services in the Middle East. Derek Dai’s appointment as MENA country manager places demand-side growth, regulatory collaboration, and partnerships at the forefront of the company’s regional playbook, while anchored by a local product development agenda tailored to the UAE and nearby markets. The emphasis on regulatory cooperation is a notable signal in a landscape where compliance and risk management increasingly determine what gets built and who can operate in the region.

In remarks accompanying the announcement, Bybit’s leadership stressed resilience and continuity. Helen Liu, co-CEO of Bybit, highlighted that the company has no intention of scaling back its Middle East footprint despite the current crisis, framing the region as a strategic priority rather than a temporary exposure. A subsequent blockquote captured the stance: “Some companies are reassessing their Gulf exposure right now. We are doing the opposite. We are deepening our presence, our investment, and our commitment to this region.”

The discourse around Bybit’s regional strategy also includes a strong emphasis on people and governance. The exchange noted ongoing measures to safeguard UAE-based staff, including daily safety check-ins and relocation or travel support where needed. This attention to workforce welfare sits alongside a broader push to enroll local talent in regulatory compliance, community initiatives, and long-term capacity-building—an approach seen as essential to maintaining operations in a high-stakes environment.

On the commercial front, Bybit’s strategy centers on expanding access to local currencies, expanding partnerships with banks and payment providers, and strengthening the financial infrastructure that ties digital assets to everyday finance. The leadership stressed a desire to deepen collaboration with Dubai’s flagship financial ecosystems, notably the DIFC and DMCC, as part of a broader effort to anchor digital asset services within established economic channels. The aim is to create a more integrated ecosystem where digital assets can interface smoothly with traditional finance, while also supporting the growth of tokenized real-world assets that bridge the two worlds.

Beyond the immediate operational implications, the story in the UAE and wider MENA reflects the region’s growing prominence in the crypto space. The market’s trajectory is shaped by a combination of regulatory clarity, a robust capital cycle, and a corporate push to scale responsibly in a market characterized by both opportunity and risk. While the geopolitical backdrop remains unsettled, the region’s regulators and financial centers have continued to emphasize the importance of a regulated, compliant, and innovation-friendly environment for digital asset services.

Crypto World

Avalanche price forecast as bears keep AVAX below key level

- Avalanche climbed above $9 as bulls mirrored broader gains.

- However, the altcoin remains in bearish momentum as the price hovers below a key level.

- Derivatives data and technical indicators offer a mixed outlook for the AVAX price.

Avalanche price continues to face headwinds as the token trades just above $9.00.

Despite slight gains after four consecutive days of downward action, AVAX price remains below the $10 mark as on-chain metrics and technical indicators show a mixed outlook.

The overall bearish price action and underlying crypto market sentiment favour sellers, particularly amid the unfolding geopolitical scenario.

Avalanche derivatives outlook

The derivatives market for Avalanche presents a conflicting picture that traders must navigate carefully.

On one hand, Avalanche futures Open Interest (OI) has fallen to $387 million, having declined steadily since mid-January.

Coinglass data shows OI is nearing the February low of $361 million, which could highlight a drop in investor confidence amid a broader bearish outlook.

Such a decline in open interest typically suggests that traders are closing positions rather than opening new ones, reflecting a cautious or bearish sentiment across the broader market.

However, a closer look at the funding rates tells a different story. The funding rate for AVAX turned positive on Monday after hitting -0.0153% on March 6.

While it is not steady amid recent price declines, it currently hovers around 0.0070%.

A positive funding rate indicates that long positions are paying shorts.

Often, this suggests that despite the falling price, a segment of the market remains bullish and is willing to pay a premium to hold long positions.

This divergence of a falling open interest and positive funding suggests that while overall participation is down, the remaining leveraged traders are optimistic of a notable rebound.

Avalanche price forecast

The technical picture for Avalanche indicates that the region around the $8.63 and $8.10 levels provides a crucial support zone.

AVAX has bounced off this area multiple times in the past two months, with bulls setting the lower boundary of the range as a key level on Feb 6 and on Feb 26.

However, the bulls have failed to go higher amid supply wall rejection below $10.

Avalanche’s price has declined by more than 26% year-to-date.

The Relative Strength Index (RSI) currently reads 46, which is below the neutral 50 level.

However, it’s upturned to indicate that bulls could reclaim traction.

Also notably, the Moving Average Convergence Divergence (MACD) indicator features a bullish crossover whose upside bias has not yet been invalidated.

As of Monday morning, AVAX traded at $9.08, hovering just above the critical support zone.

Should the market sentiment shift and buyers step in, a recovery to above $11 could bring the next level of $14 into play.

If the bearish momentum outlook picks up fresh momentum, the token’s value could test the February 6 low of $7.53.

Crypto World

Nasdaq Teams Up With Kraken to Deliver Tokenized Stocks

Kraken will be working with Nasdaq to deliver tokenized stocks.

Payward, the infrastructure platform behind the popular US-based crypto exchange Kraken, has announced that it will be teaming up with Nasdaq. The initiative aims to develop tokenized equities and further bridge traditional capital markets with blockchain-based financial systems.

The move highlights a growing effort within the traditional financial industry to modernize its infrastructure. As CryptoPotato reported earlier last week, it was indeed the crypto industry that led global markets following the US strike on Iran.

xStockz, Kraken’s tokenized equity product, will power a permissionless infrastructure layer designed to support Nasdaq’s issuer-sponsored equity tokens.

Tokenized stocks, as well as commodities such as Gold, Silver, and most recently, crude oil, have been the talk of the town lately, as crypto-powered exchanges allow for 24/7 trading unlike many of the traditional venues.

According to the official release, the initiative will build on the growing adoption of xStocks, which has already surpassed $25 billion in total transaction volume, per reports. In essence, Kraken will be acting as a distribution partner. Commenting on the matter was Arjun Sethi, co-CEO of Payward and Kraken, who said:

Tokenization upgrades market infrastructure at the asset layer by allowing equities to exist as programmable financial instruments that can operate across both regulated capital markets and open blockchain networks. Today most equities sit inside brokerage systems where their utility is laregly limited to directional exposure and, in some cases, broker-specific margin arrangements.

The move signals the increasing institutionalization of the industry, as well as a notable shift towards traditional equities and commodities. Moreover, Kraken seems to be pedal-to-the-metal on the latest shift, becoming the very first company to receive a Fed Master account last week.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Synthetic Liquidity Mining: The Next Evolution of DeFi Incentives

For years, liquidity mining has been one of the core engines powering growth in decentralized finance. Protocols reward users with tokens in exchange for providing liquidity to pools, helping bootstrap markets and maintain healthy trading conditions. While effective, the model also has drawbacks: capital inefficiency, impermanent loss, and the need to lock funds directly into liquidity pools.

A new concept is emerging that could reshape this system — Synthetic Liquidity Mining.

Instead of requiring users to deposit assets into liquidity pools, this model allows them to earn incentives through derivatives exposure that mirrors liquidity provision. In other words, users can simulate the economic behavior of liquidity providers without actually supplying liquidity.

The Problem With Traditional Liquidity Mining

Traditional liquidity mining helped spark the DeFi boom around the time of the DeFi Summer. However, over time, several structural weaknesses became clear:

1. Capital Inefficiency

Liquidity providers must lock assets into pools, which means their capital cannot easily be used elsewhere. Large amounts of idle liquidity sit inside protocols simply to qualify for rewards.

2. Impermanent Loss

Providing liquidity to automated market makers like Uniswap exposes users to price divergence between pooled assets, which can reduce returns even when incentives are offered.

3. Mercenary Capital

Many liquidity miners are purely incentive-driven. They enter when rewards are high and leave when emissions drop, creating unstable liquidity for protocols.

These limitations are pushing DeFi designers to rethink how incentives should work.

What Is Synthetic Liquidity Mining?

Synthetic Liquidity Mining allows users to earn protocol incentives by taking derivative positions that replicate the payoff structure of providing liquidity.

Instead of depositing tokens into a pool, users may:

-

Open synthetic LP positions

-

Hold derivative tokens representing liquidity exposure

-

Trade perpetual or options-style contracts tied to pool performance

These instruments mirror the profit-and-loss dynamics of liquidity providers, including trading fees or pool performance, without requiring users to supply the actual assets.

Think of it as “LP exposure without LP capital.”

How It Works

A synthetic liquidity mining system typically includes three components:

1. Synthetic Liquidity Tokens

Protocols mint derivative tokens representing exposure to a liquidity pool’s performance.

For example:

Users buy or stake these tokens to gain exposure.

2. Derivative-Based Incentives

Rather than rewarding liquidity deposits, protocols distribute incentives to users who hold or trade these synthetic instruments.

Rewards may depend on:

-

Time held

-

Position size

-

Pool volatility

-

Market demand

3. Hedged Liquidity Providers

Behind the scenes, the protocol or specialized market makers may provide the actual liquidity and hedge the exposure created by synthetic traders.

This creates a separation between:

Advantages of Synthetic Liquidity Mining

Greater Capital Efficiency

Users can gain liquidity exposure with significantly less capital compared to providing assets directly to pools.

Reduced Impermanent Loss Risk

Because positions are derivative-based, users may hedge or manage risk more dynamically.

Programmable Incentives

Protocols can design incentives around market conditions instead of relying solely on emissions.

New DeFi Trading Strategies

Synthetic LP exposure can become a tradable financial instrument, opening strategies such as:

-

LP exposure arbitrage

-

volatility trading

-

liquidity speculation

Potential Use Cases

Liquidity Exposure Markets

Synthetic LP tokens could become tradable assets themselves, creating markets where traders speculate on pool performance.

Cross-Protocol Incentives

A protocol could incentivize liquidity for another platform by issuing synthetic exposure rather than moving capital.

Risk Hedging

Traditional liquidity providers might hedge their positions using synthetic contracts that offset impermanent loss.

Challenges and Risks

Despite its promise, Synthetic Liquidity Mining introduces new complexities.

Pricing Complexity

Accurately tracking LP performance requires robust pricing models and Oracle infrastructure.

Derivative Risk

Synthetic systems can introduce leverage, liquidation risks, and cascading market effects.

Smart Contract Complexity

Derivative protocols are often significantly more complex than basic AMMs, increasing potential attack surfaces.

The Bigger Picture

DeFi is gradually evolving from simple token incentives into full-fledged financial engineering. Synthetic Liquidity Mining represents a shift toward separating capital from exposure, allowing markets to allocate risk more efficiently.

In the long run, liquidity itself may become a tradable asset class, where participants choose between providing liquidity, speculating on it, or hedging it through derivatives.

If that future materializes, Synthetic Liquidity Mining could become one of the key mechanisms shaping the next generation of decentralized financial markets.

REQUEST AN ARTICLE

Crypto World

Nigel Farage Invests in Stack BTC as UK Debates Crypto Donations

Reform UK party leader Nigel Farage has invested 215,000 pounds (around $286,000) in Stack BTC, a London-listed Bitcoin treasury company chaired by former UK Chancellor Kwasi Kwarteng, as the Reform UK leader deepens his ties to the crypto sector.

The investment gives Farage a 6.31% stake in the company through his media vehicle Thorn In The Side, according to a Monday release.

Stack said it raised $346,000 by issuing 5.2 million new shares at $0.65 each in a strategic funding round that included Farage and Blockchain.com. The company said Blockchain.com also entered a partnership to help deliver institutional-grade services for Stack’s planned Bitcoin (BTC) treasury.

“I have long been one of the UK’s few political advocates for Bitcoin, recognising the role digital currencies will play in the future of business and finance,” Farage said. “London and the UK has historically been the centre of the world’s financial markets, and I believe that we can and should be a major global hub for the crypto industry.”

He said he is “excited about Stack’s plans to acquire and grow British businesses, representing permanent, supportive and long-term capital.”

Stack raised $2.9 million in February

Stack, which trades on London’s Aquis exchange, said it raised about $2.9 million in February and holds 21 Bitcoin worth around $1.4 million at current prices, according to its website. The company purchased the BTC in one tranche on March 5. Kwarteng and his wife control about a 5.88% stake.

Farage has increasingly cast himself as one of the UK’s most outspoken political supporters of digital assets. In May 2025 at the Bitcoin conference in Las Vegas, Farage said Reform UK would accept crypto donations and introduce a “Cryptoassets and Digital Finance Bill” if the party wins control of government in the next general election, expected before August 2029.

Related: UK widens crypto reporting rules to cover domestic transactions

That push has coincided with growing controversy around crypto’s role in UK politics. Cointelegraph reported Thursday that Reform UK received another $4 million from Thailand-based crypto investor Christopher Harborne in late 2025, after an earlier $12 million donation that helped make him one of the party’s most significant financial backers.

The investment comes as the UK debates whether political parties should be allowed to accept crypto donations. On Dec. 2, officials were reported to be considering a ban, and on Feb. 26, security committee chair Matt Western called for a temporary moratorium until the Electoral Commission issues formal guidance.

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

Crypto World

Strategy (MSTR) added 17,994 bitcoin last week, bringing total holdings to 738,731 coins

Led by Executive Chairman Michael Saylor, Strategy (MSTR) made a massive bitcoin purchase last week.

The leading bitcoin treasury company added 17,994 bitcoin to its holdings for a total cost of $1.28 billion, or $70,946 per coin. The company stack now stands at 738,731 BTC acquired for $56.04 billion, or $75,862 per coin.

Bitcoin is currently trading just below $68,000.

Last week’s buys were mostly funded via $900 million in sales of common stock. The company also sold $377 million of its STRC preferred series of stock, according to a Monday morning filing.

MSTR shares are higher by 0.2% in pre-market trading.

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

News Videos2 hours ago

News Videos2 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports1 day ago

Sports1 day agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Tech7 days ago

Tech7 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business20 hours ago

Business20 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment2 days ago

Entertainment2 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat7 days ago

NewsBeat7 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech4 days ago

Tech4 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview