CryptoCurrency

Privacy-First Stablecoin Development With Decentralized Identity

Stablecoins are no longer experimental tools. In 2026, they will become a regulated financial infrastructure used for payments, settlements, and cross-border value movement. As adoption grows, privacy has moved from a secondary concern to a core system requirement shaping modern stablecoin development. Regulators expect compliance and traceability. Users expect data protection and control. Platforms must scale without turning identity management into a long-term risk. Traditional KYC models were not built for this reality, and their limitations are now clear.

Decentralized identity offers a practical alternative. It allows stablecoin development systems to verify eligibility without storing excessive personal data, enforce rules without surveillance, and scale compliance without friction. This blog explains why stablecoin development in 2026 depends on decentralized identity, how privacy-first architecture reshapes compliance, and what teams must get right today to avoid costly rebuilds tomorrow.

What Is Decentralized Identity and Why Does It Matter for Stablecoins?

Decentralized Identity (DID) is a method that enables users to prove their identity without disclosing their personal data each time. Instead of storing identity details (name, passport, address) in a central database, DID lets users own their identity and share only what’s required, such as “I’m verified” or “I’m allowed to transact, using cryptographic proofs.

In simple terms

Traditional identity = Upload your documents, trust the platform

Decentralized identity = Prove eligibility while keeping your data private.

Why does this matter for stablecoins?

Stablecoins sit at the intersection of money, regulation, and privacy. That creates a hard problem:

- Regulators want KYC, AML, and traceability.

- Users want privacy and data protection.

- Platforms need scalable compliance without friction.

- Decentralized identity solves this by separating verification from data exposure.

The key benefits of stablecoin systems

- Privacy by design – Users don’t expose full identity data on-chain

- Compliance-ready – Proof-based KYC works with regulatory requirements

- Lower risk – No massive identity databases to hack or leak

- Cross-platform reuse – One verified identity can work across wallets, apps, and networks

As stablecoins move from trading tools to payment rails and settlement infrastructure, identity can no longer be optional or centralized. Decentralized identity allows stablecoin platforms to:

- Enforce rules without surveillance.

- Scale globally without redoing KYC everywhere

- Balance user trust with regulatory oversight

In short, DID turns identity from a liability into infrastructure, making modern stablecoin development both compliant and user-friendly.

Validate your stablecoin compliance and identity framework before scaling

Why Is Privacy Becoming a Critical Requirement in Stablecoin Development?

Privacy has shifted from a compliance checkbox to a core system expectation. In 2026, stablecoin platforms will be judged not only on stability and speed, but also on how responsibly they handle identity, data, and transaction visibility at scale.

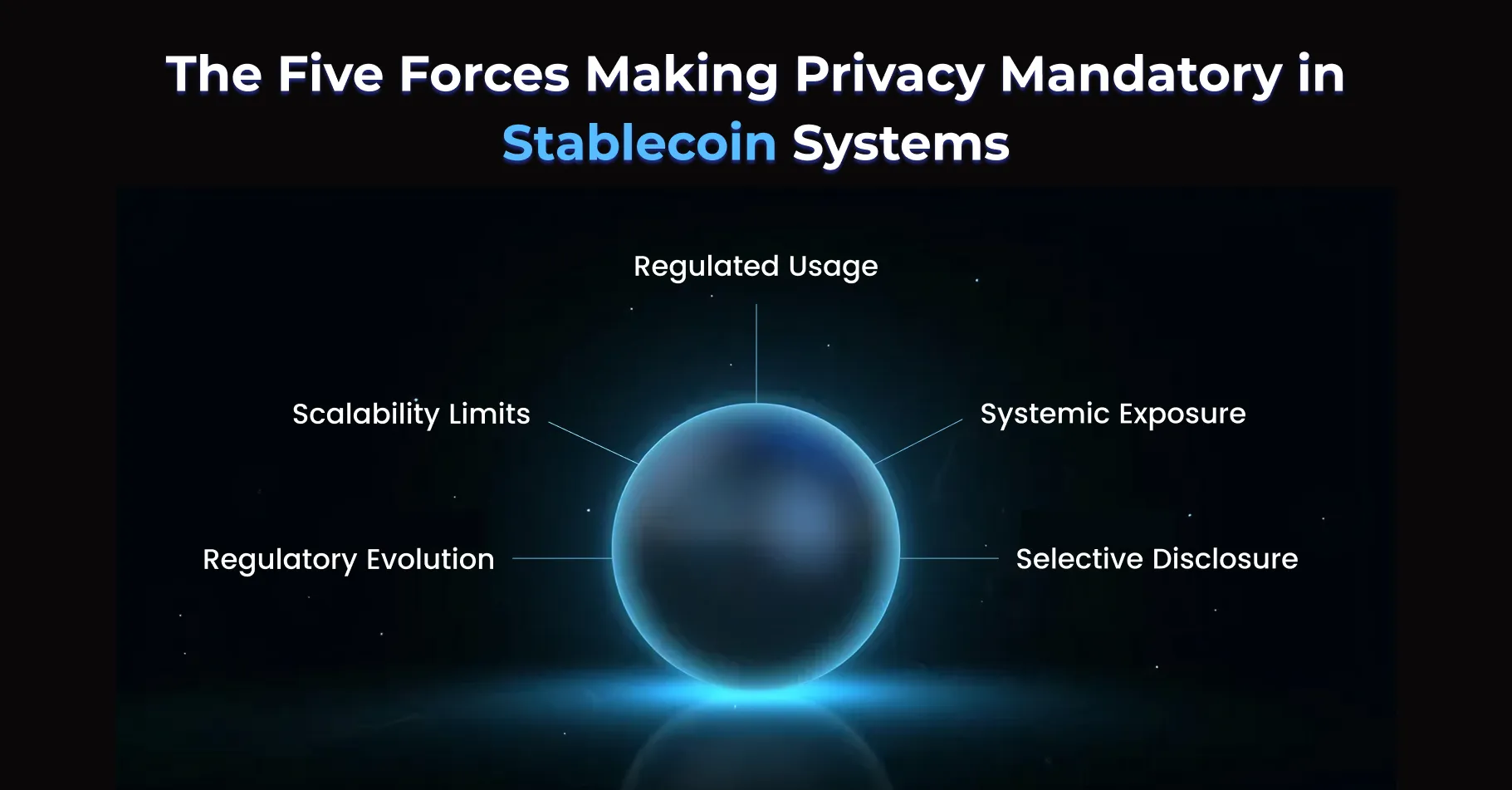

Below are the key reasons privacy is now non-negotiable, explained from an execution and risk perspective.

- Regulated Usage: Stablecoins now function within treasury operations, cross-border settlements, payroll systems, and merchant payment flows. This shift places them under regulatory expectations similar to traditional finance. Modern Stablecoin Development must therefore embed privacy controls that meet compliance requirements without exposing sensitive user data.

- Systemic Exposure: Centralized identity storage increases long-term risk as platforms scale. Data breaches, internal misuse, and regulatory penalties become more likely over time. For organizations assessing stablecoin development services, privacy failures directly translate into operational disruptions and sustained legal exposure.

- Selective Disclosure: Enterprises and users now expect to prove compliance attributes without revealing full identity profiles. This demand is becoming standard across regulated digital finance. Scalable stablecoin development solutions rely on privacy-preserving verification models rather than blanket data collection.

- Regulatory Evolution: Regulators in 2026 increasingly prioritize auditability over data custody. The ability to verify transactions without retaining excessive personal information is becoming a defining requirement. This evolution directly influences how a stablecoin development company designs compliance and monitoring layers.

- Scalability Limits: Weak privacy architecture restricts expansion into new jurisdictions and enterprise partnerships. Each market adds friction when identity systems are rigid or centralized. Privacy-first stablecoin development reduces onboarding friction and supports sustainable, multi-market growth.

Privacy is no longer about concealment. It is about control, accountability, and long-term system resilience. Stablecoin platforms that treat privacy as foundational infrastructure will scale with confidence in 2026 and beyond.

How Does DID Enable Privacy Without Breaking Compliance?

DID allows stablecoin platforms to meet regulatory requirements without collecting or storing excessive personal data. It replaces data-heavy compliance models with verification methods that are precise, auditable, and privacy-preserving.

Here is how this works in practical stablecoin development.

- Proof-Based Verification: Users prove required conditions such as jurisdiction or eligibility without sharing full identity records. Platforms validate cryptographic proofs instead of storing sensitive data, reducing exposure while maintaining compliance.

- User-Controlled Credentials: Credentials are issued by trusted authorities but held by users. Stablecoin platforms verify claims only when needed and avoid long-term data custody, lowering breach risk and governance burden.

- Reusable Compliance: Verified credentials can be reused across transactions and systems. This removes repetitive onboarding and keeps compliance efficient as transaction volumes grow, a key advantage for scalable stablecoin development solutions.

- Auditable, Not Invasive: Transactions remain fully traceable and reviewable by regulators when required, without forcing platforms to retain sensitive identity data at all times. This approach allows development to meet compliance obligations while minimizing privacy risk across jurisdictions.

DID modernizes compliance by shifting verification from data storage to proof validation. This approach strengthens stablecoin development by enabling privacy protection while remaining fully compliant in 2026.

Get a strategic review of your stablecoin infrastructure

Stablecoin Architecture With vs Without DID

The difference between privacy-first and risk-heavy stablecoin systems is architectural, not cosmetic. Identity design influences compliance cost, data exposure, and the ability to scale across jurisdictions. The comparison below highlights how stablecoin architectures behave in practice when DID is absent versus when it is embedded as a core layer.

| Area | Without DID | With DID |

|---|---|---|

| Identity Handling | Platform-owned KYC data | User-controlled verifiable credentials |

| Privacy Approach | Full identity disclosure | Selective attribute disclosure |

| Compliance Model | Repetitive manual verification | Proof-based, policy-driven checks |

| Data Risk | High long-term storage exposure | Minimal data custody |

| Regulatory Oversight | Continuous data retention | Audit-ready proofs and records |

| Scalability | Compliance cost grows with usage | Compliance scales efficiently |

| Expansion Readiness | Rebuild per jurisdiction | Reusable credentials across regions |

| Cost Profile | Lower upfront, higher long-term risk | Higher design maturity, lower lifetime cost |

Architectures without DID rely on data accumulation to enforce compliance, which increases risk as the scale grows. Identity-first systems shift stablecoin development toward proof-based compliance, enabling privacy, regulatory alignment, and scalability in 2026.

Conclusion for Decision Makers

Stablecoins have moved from experimentation to financial infrastructure. At this stage, architecture choices directly determine regulatory durability, institutional trust, and long-term scalability. Identity, privacy, and compliance are no longer separate considerations. They are core to how stablecoin systems are designed and evaluated. DID provides a practical way to meet regulatory requirements while protecting user privacy. It replaces repeated data collection with proof-based verification, reducing compliance friction and operational risk. For decision makers, this is a foundational choice that impacts expansion, adoption, and cost control over time.

Teams that postpone identity design will face higher compliance burdens and forced rebuilds. Teams that plan correctly now are better positioned for payments, settlements, and enterprise use cases in 2026 and beyond. This is why many organizations rely on Antier, a leading stablecoin development company known for building stablecoin solutions that are compliant, scalable, and privacy-focused from the ground up. Review your stablecoin architecture today and move forward with a foundation built for regulation, trust, and scale.

Frequently Asked Questions

01. What is decentralized identity and how does it relate to stablecoins?

Decentralized identity (DID) allows users to prove their identity without disclosing personal data each time, enabling stablecoin systems to verify eligibility while maintaining user privacy.

02. Why is privacy a core requirement in stablecoin development?

As stablecoins evolve into regulated financial infrastructure, users demand data protection and control, while regulators require compliance and traceability, making privacy essential for modern stablecoin systems.

03. What are the benefits of using decentralized identity in stablecoin systems?

Decentralized identity offers privacy by design, compliance-ready proof-based KYC, lower risk of data breaches, and cross-platform identity reuse, making it a practical solution for stablecoin development.