CryptoCurrency

PUMP Price Falls to 5-Month Low, Is Bitcoin To Be Blamed?

Pump.fun has suffered a sharp price decline, pushing PUMP to a five-month low. The drop reflects sustained capital outflows from holders who see limited near-term value in the token.

Broader market weakness has worsened the situation, with Bitcoin’s instability adding pressure to already fragile sentiment.

Pump.fun Holders Move To Sell

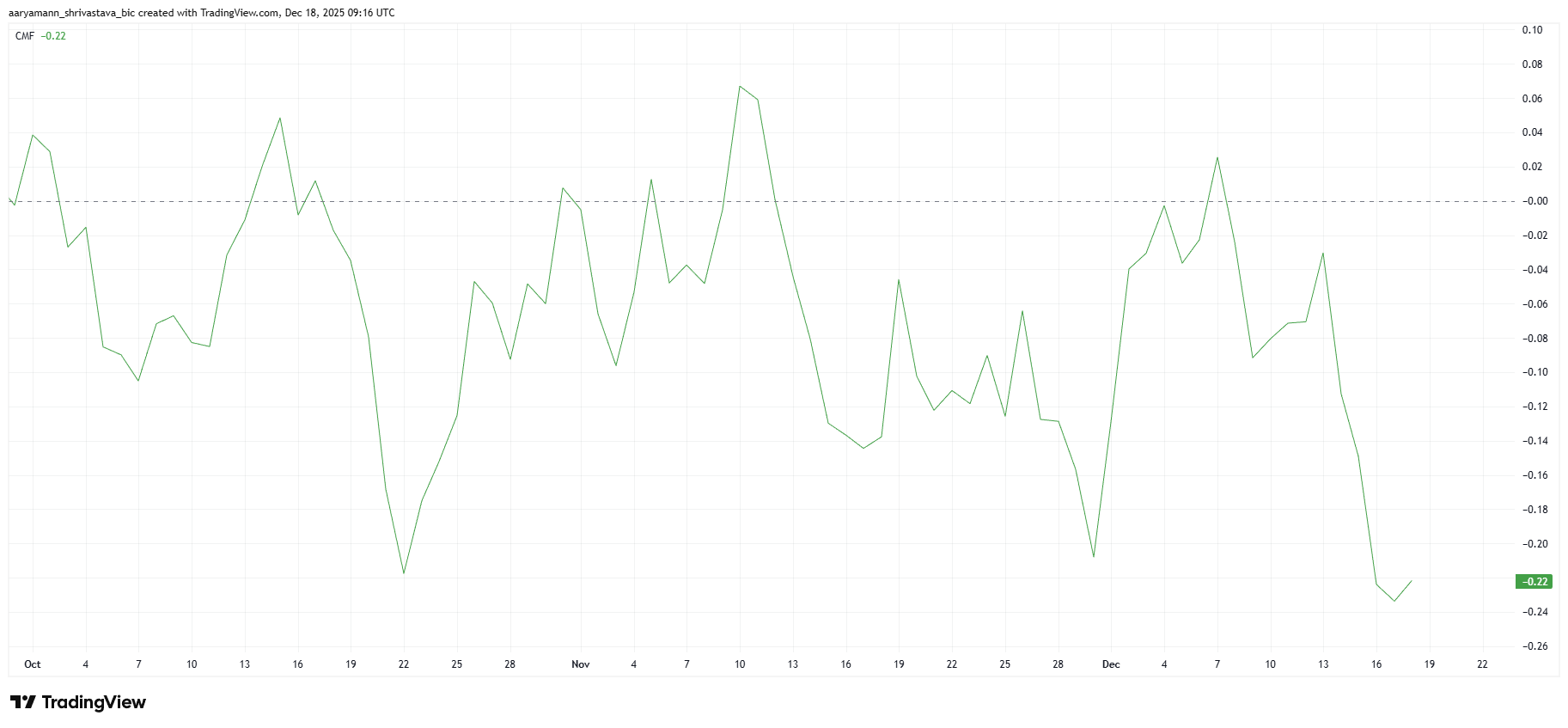

On-chain indicators point to a decisive loss of confidence among PUMP holders. The Chaikin Money Flow sits deep below the zero line, confirming aggressive capital withdrawals. Furthermore, this reading shows investors are exiting positions rather than positioning for a recovery.

Sponsored

Sponsored

The CMF has now reached an all-time low, marking the largest outflows in PUMP’s trading history. Such extreme readings typically reflect bearish conviction. Additionally, persistent selling reduces liquidity support, making short-term stabilization difficult and keeping downside risks elevated.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

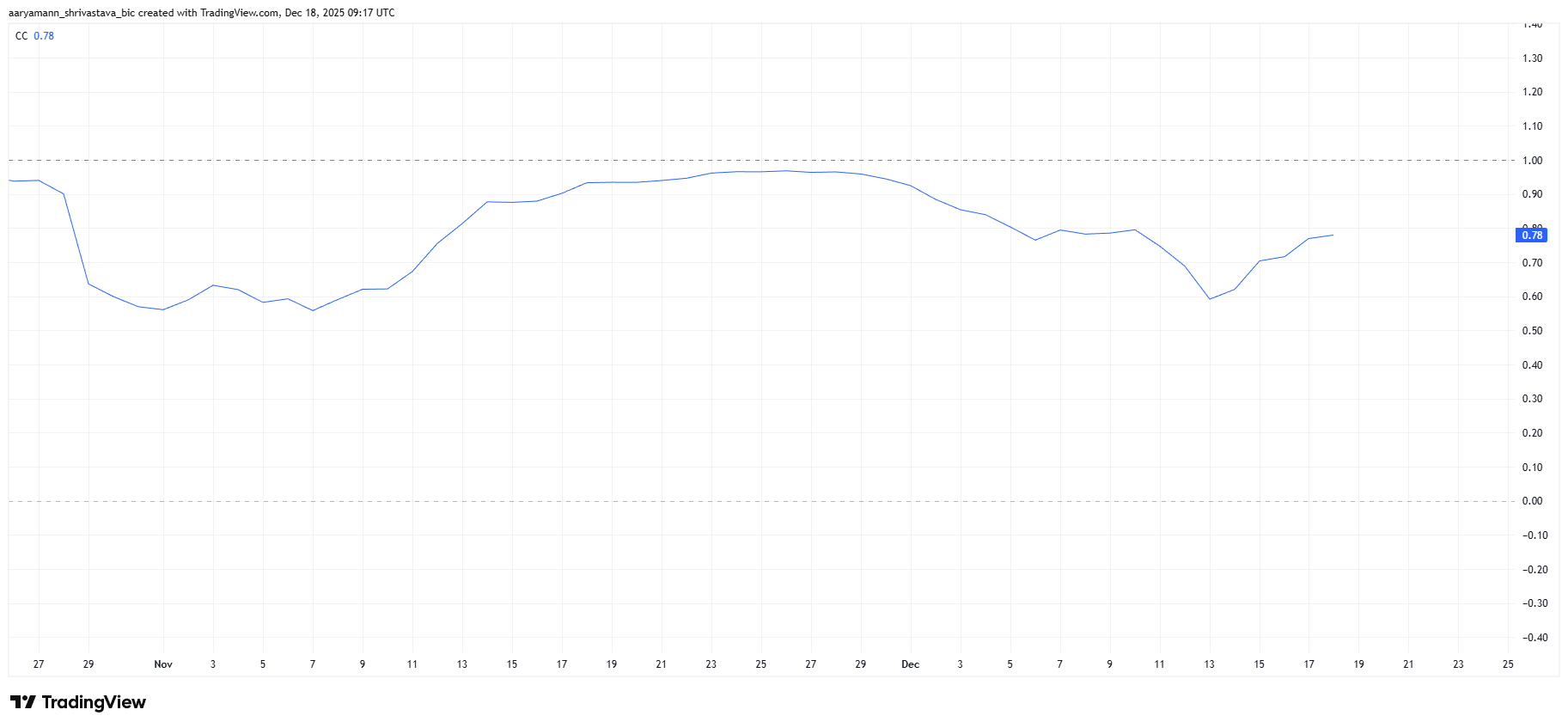

PUMP’s macro outlook remains closely tied to Bitcoin’s performance. Its correlation with Bitcoin recently rebounded to 0.78 after a brief decline. This indicates PUMP is once again closely tracking Bitcoin’s price movements.

This relationship is problematic given Bitcoin’s uncertainty near the $86,000 level. Besides, weakness in the broader market often amplifies losses in smaller tokens. Thus, if Bitcoin declines further, PUMP is likely to follow, extending losses for remaining holders.

PUMP Price May See Further Correction

PUMP is trading near $0.002031 at the time of writing, its lowest level in five months. As it stands, the token has fallen by more than 33.8% in just one week. Accelerating losses reflect worsening sentiment and the absence of consistent buying interest.

Continued holder exits could push PUMP toward the $0.001917 support. This level is critical for near-term stability. Additionally, the breakdown below it may open the door to $0.001711, reinforcing the bearish trend and intensifying downside volatility.

A recovery scenario depends on improved market conditions and renewed inflows of capital. Reclaiming $0.002123 as support would be an early signal of stabilization. Furthermore, if buying interest returns, PUMP could advance toward $0.002428, invalidating the bearish thesis and restoring short-term confidence.