CryptoCurrency

Record Retail Options and Geopolitical Shocks Threaten Markets This Week

Crypto markets are bracing for an unusually turbulent week, with record retail options activity colliding with escalating geopolitical risks.

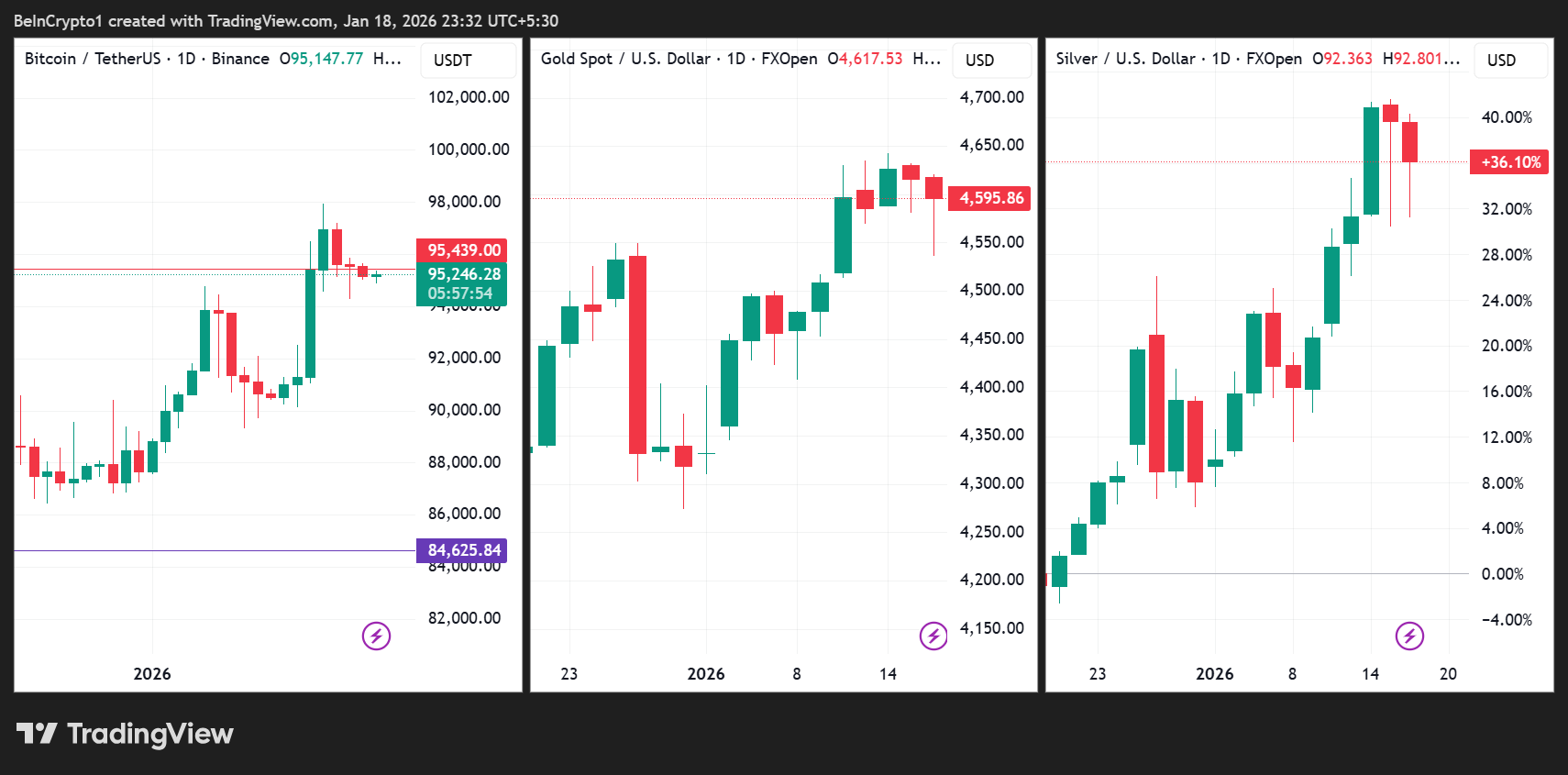

While the Bitcoin price steadied near $95,100 on Sunday, suggesting a market devoid of volatility as the pioneer crypto consolidates at thin levels, eyes remain peeled to the US-EU trade tensions, a looming Supreme Court ruling, and surging retail speculation converge.

Sponsored

Sponsored

Retail traders are exerting unprecedented influence over market forces, with reports showing that retail participation in options markets now accounts for 21.7% of total volume, up from 10.7% in 2022.

Daily retail call volume has surged to 8.2 million contracts, with puts hitting 5.4 million, the second-highest on record.

Bitcoin pioneer Max Keiser describes this frenzy as a market “casino gulag,” referencing a market dominated by speculation, leverage, and short-term bets, with participants trapped in a high-risk gambling environment.

Individual investors are increasingly shaping pricing trends and amplifying leverage across BTC, SPY, and other liquid assets.

“Retail investors have never speculated this much,” noted a global markets observer. “Call volume alone is exceeding 8 million contracts per day, while puts are up to 5 million. Overall retail options volume has more than doubled since last year. Risk appetite remains extremely high.”

Sponsored

Sponsored

Adding to market pressure, US-EU trade tensions are intensifying. Over the weekend, President Donald Trump announced 10% tariffs on eight European countries, a move designed to pressure support for the US purchase of Greenland.

These tariffs could escalate to 25% by June if no deal is reached, threatening $1.5 trillion in trade flows. French President Emmanuel Macron responded by calling for the EU to deploy its “anti-coercion instrument,” a measure that could block US banks from EU procurement and target American tech giants.

This unprecedented countermeasure could reshape global trade leverage.

Sponsored

Sponsored

Geopolitical Tensions, Legal Uncertainty, and Retail Speculation Threaten Market Stability

The geopolitical stakes extend beyond tariffs. Analysts warn that EU-Mercosur trade deals and US leverage over Mercosur countries, including Argentina and Brazil, could further destabilize global risk sentiment.

Analyst Endgame Macro described the situation as a test of leverage, noting that Washington could quietly pressure the South American trade bloc through financial and trade channels, creating asymmetric risk even without overt conflict.

Meanwhile, markets await a Supreme Court ruling on the legality of Trump’s tariffs, introducing additional uncertainty.

If the Court rules against the administration, it could erode confidence in trade policy and spark a sudden market sell-off.

Sponsored

Sponsored

Conversely, a ruling in favor of the tariffs would force investors to price in prolonged trade disruption and slower growth fully. Such an outcome would exert pressure on both equities and crypto.

Precious metals are already showing signs of stress. Market participants are tracking physical silver and other metals, which are subject to compounded volatility from tariff shocks and scarcity issues at exchanges such as the LBMA (London Bullion Market Association).

Historically, similar tariff shocks have prompted sharp flows from London into Comex (Commodity Exchange in New York), steepening backwardation, and creating short-term dislocations.

In this environment, Bitcoin’s near-$95,000 level is increasingly fragile. Retail speculation, legal uncertainty, and geopolitical friction are converging, creating a high-risk scenario for traders and institutions alike.

The combination of record retail activity and macro shocks could set the stage for one of the most volatile weeks in recent market history.