Crypto World

Ripple CEO Confirms White House Meeting With Crypto and Banking Reps

Washington’s ongoing push to align crypto policy with traditional finance took another step as White House officials hosted a second meeting with industry representatives and banking executives to refine a proposed market-structure bill in the U.S. Senate. The talks, aimed at narrowing gaps on stablecoin yields and other guardrails, arrive amid broader efforts to reconcile consumer protections with U.S. competitiveness in crypto innovation. In a Thursday Fox News appearance, Ripple (the company) CEO Brad Garlinghouse said his company’s chief legal officer, Stuart Alderoty, joined White House officials at the discussions earlier in the day. The remarks followed unconfirmed reports that the administration would push ahead with the CLARITY Act, a framework designed to establish a market structure for digital assets, though no deal was announced at the time of reporting. The evolving dialogue underscores the delicate balance lawmakers seek between enabling financial innovation and safeguarding taxpayers and markets.

Key takeaways

- White House discussions with crypto and banking representatives continue as lawmakers weigh stablecoin yield provisions and market-structure safeguards.

- Ripple’s leadership participated in the talks, signaling high-level interest from the sector in shaping policy deliberations.

- The CLARITY Act remains a focal point in Congress, having passed the House earlier in the year but facing delays in the Senate and ongoing committee scrutiny.

- Coinbase (EXCHANGE: COIN) CEO Brian Armstrong has publicly challenged certain provisions, arguing they could curb the regulatory role of the CFTC in favor of the SEC and raise concerns about tokenized equities.

- Crypto policy advocates described the White House meeting as constructive and aimed at a framework that preserves American competitiveness while protecting consumers.

Tickers mentioned: $COIN

Sentiment: Neutral

Market context: The discussions sit within a broader regulatory backdrop as lawmakers and agencies navigate the overlap between traditional securities rules and crypto tokens, with market participants watching for signals on how a potential framework may affect liquidity and risk appetite.

Why it matters

The conversations in Washington reflect a policy environment where the United States is attempting to define a national standard for digital assets without stifling innovation. While lawmakers have advanced parts of their market-structure agenda in some committees, others have pressed pause or demanded clarifications. A central tension is how to treat stablecoins and yield mechanisms—areas that could influence capital flows and the attractiveness of the U.S. as a hub for crypto and blockchain experimentation. The involvement of high-profile industry voices, including Ripple’s Alderoty and Coinbase’s Armstrong, signals that the stakeholder community is intent on shaping the legislative design rather than merely reacting to it.

The CLARITY Act has been a cornerstone in this debate. Passed by the House but hampered by delays in the Senate and internal concerns about conflicts of interest and the scope of regulation, the bill’s path forward hinges on finding consensus around DeFi rules, tokenized equities, and stablecoin governance. The ongoing discourse also highlights the role of regulators—specifically the CFTC and the SEC—in delineating authority over different asset classes. As policy debates intensify, market participants are weighing how any forthcoming framework could alter trading venues, custody standards, and the treatment of tokenized assets within investor portfolios.

From a market perspective, the immediate impact of policy discussions tends to be less about dramatic price shifts and more about positioning and expectations. Traders monitor committee schedules, public statements by key figures, and any formal markup dates that could signal a near-term stance or a shift in trajectory. The meetings also underscore a broader operational reality: policy clarity is often valued more than policy speed, as clearer rules can reduce regulatory risk and encourage longer-horizon project development in the crypto economy.

What to watch next

- Rescheduling and outcome of the Senate Banking Committee markup on digital asset market structure legislation.

- Public commentary from White House crypto advisers and other senior policymakers on the CLARITY Act and related regulations.

- Further statements from the private sector, including the participation of major exchanges and industry groups, on provisions affecting stablecoins and tokenized equities.

- Any new revelations from meetings hosted at high-profile venues (e.g., discussions linked to industry events or forums) about governance and enforcement expectations.

- New official documents or filings that detail how the proposed rules might interact with existing CFTC and SEC authorities.

Sources & verification

- Congress.gov — Text of the CLARITY Act and details on its legislative timeline.

- YouTube — Brad Garlinghouse Fox News interview referencing Alderoty’s attendance at the White House meeting.

- Crypto Council for Innovation — Public statements describing the discussions and their constructive tone.

- Cointelegraph coverage — Reporting on the Mar-a-Lago forum and related policy discussions, including sentiment from lawmakers.

Market reaction and key details

The White House’s latest round of talks with cryptocurrency and banking representatives illustrates a persistent drive to harmonize digital-asset policy with traditional financial oversight. The aim is to craft a framework that resists regulatory fragmentation while ensuring robust protections for consumers and market integrity. In a Thursday appearance on Fox News, Ripple (the company) CEO Brad Garlinghouse reiterated that Alderoty attended the White House discussions earlier in the day, signaling the depth of the policy engagement from the industry side. The remarks followed media speculation about how the administration would approach the CLARITY Act—the House-approved package designed to regulate digital assets and present a coherent market structure—now navigating Senate committees and potential amendments.

The CLARITY Act’s journey through Congress has been irregular. After passing the House in July, the bill faced a series of delays in the Senate, with lawmakers weighing provisions that would influence conflicts of interest and extend governance for decentralized finance, tokenized equities, and stablecoins. The evolving legislative signal is that the administration seeks to balance innovation with safeguards rather than rushing to a verdict. In this context, the meeting with White House officials, as described by Crypto Council for Innovation chief Ji Hun Kim, was noted as constructive and aimed at building a framework that preserves American consumer welfare while maintaining competitive edge in global crypto markets.

Meanwhile, the broader legislative calendar remains complex. The Senate Agriculture Committee earlier advanced its own version of a digital-asset market-structure bill in January, a development that underscores the multi-committee path such legislation often travels before markup and potential floor votes. Yet opposition from some industry players has complicated the process. Coinbase (EXCHANGE: COIN) CEO Brian Armstrong publicly challenged certain provisions that would cap rewards on stablecoin holdings and warned that the bill risks weakening the CFTC’s role in favor of the SEC. These concerns illustrate a familiar tension in U.S. policy debates: how to allocate regulatory authority without constraining innovation or market functionality.

As policymakers navigate these issues, the policy discourse has also touched on high-profile gatherings. A private forum at Mar-a-Lago, attended by policymakers and industry representatives, added another layer to the conversation around the CLARITY Act’s prospects. Senator Bernie Moreno, present at the event, suggested that the act could reach a point where it could be signed into law by spring, though the legislative reality remains uncertain given the ongoing committee reviews and potential revisions. The episodic nature of such appearances reflects the evolving, often negotiation-heavy, path that digital-asset policy typically follows in Washington.

Overall, the latest round of meetings and public statements suggests a cautious but forward-looking stance from both policymakers and industry participants. The objective appears to be a framework that discourages harmful practices, clarifies regulatory jurisdiction, and supports responsible innovation in crypto markets—without stifling the capital flows that underpin a growing ecosystem. For investors and builders, the near-term takeaway is to monitor committee calendars, regulatory updates, and official statements from the White House and key agencies for hints about the direction of risk management, disclosure requirements, and the scope of oversight that a forthcoming bill could impose.

Interim guidance and verbatim quotes from executive statements will likely continue to influence sentiment, particularly as the Senate Banking Committee and other panels recalibrate their approach to market structure, stablecoins, and tokenized assets. In the interim, the market context remains one of guarded optimism, with careful attention paid to regulatory clarity as much as to any immediate policy actions. The interplay between public policy, industry feedback, and the practical realities of operating in a highly dynamic crypto landscape will continue to shape liquidity conditions and risk sentiment in the months ahead.

Notes from the coverage and the primary sources referenced above should be verified for any updates to committee schedules, official statements, or new voting outcomes as the legislative process evolves.

Crypto World

BTC steadies at $67,000 as traders pay for crash protection

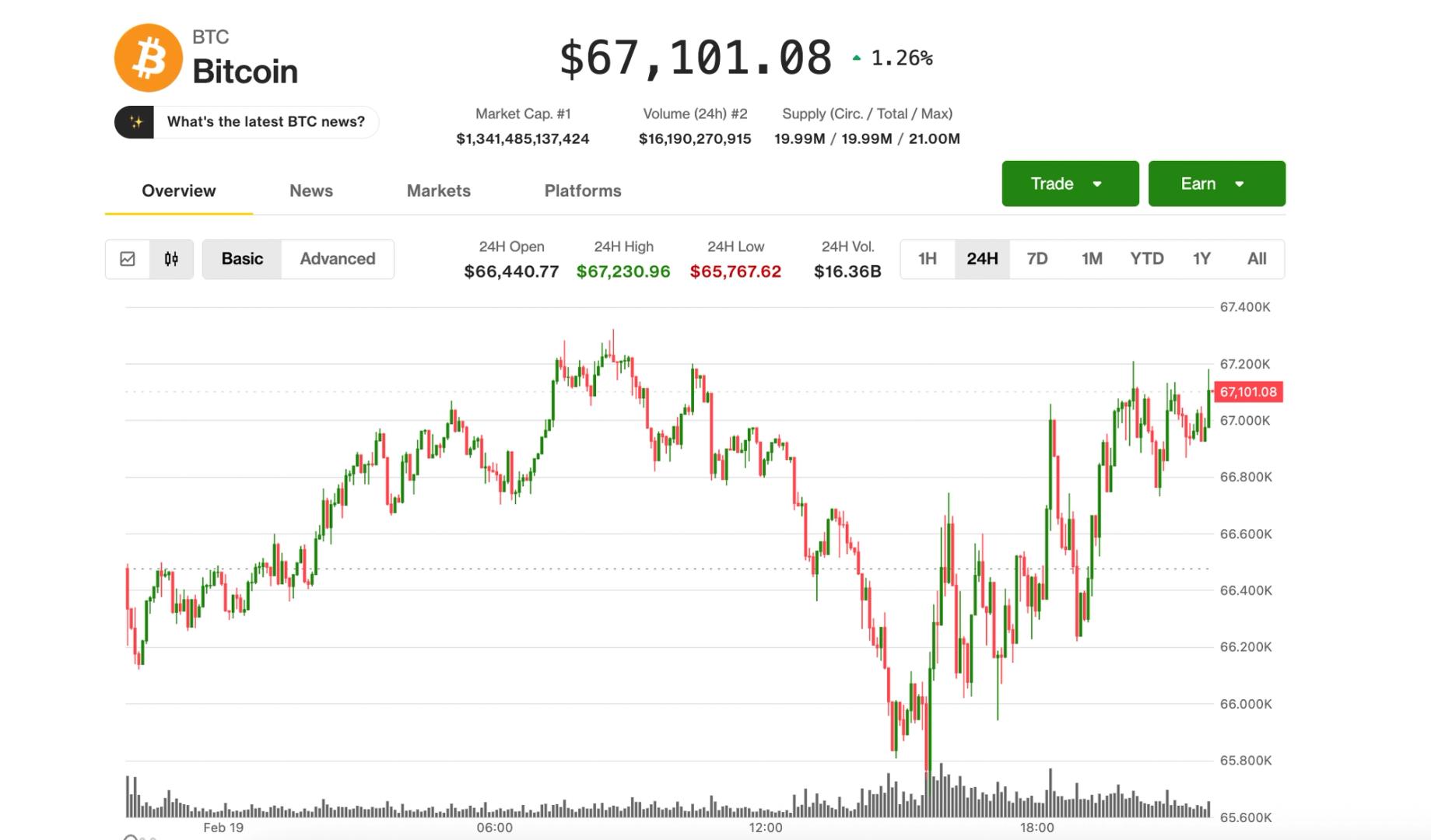

Bitcoin found its footing on Thursday, stabilizing above a key technical level after briefly slipping below $66,000 in early U.S. trading. The largest cryptocurrency recently changed hands at around $67,000, up roughly 1% over the past 24 hours.

The CoinDesk 20 Index lagged, with ether (ETH), XRP, BNB, and solana (SOL) flat to slightly lower during the same period, perhaps a signal of continued caution in altcoins amid shaky crypto markets.

Crypto-related stocks climbed modestly higher across the board, with bitcoin miners CleanSpark (CLSK) and MARA (MARA) standing out with 6% gains. Meanwhile, the S&P 500 and the tech-heavy Nasdaq 100 were 0.3% and 0.6% lower, respectively.

On the policy front, there were tentative signs of progress on the digital asset market structure bill. As CoinDesk’s Jesse Hamilton reported, White House-hosted talks between crypto industry representatives and bankers yielded incremental movement, though no compromise has yet emerged.

At the same time, cracks from the recent crypto downturn are still surfacing. Chicago-based crypto lender Blockfills, as CoinDesk reported, is exploring a sale after enduring a $75 million lending loss during the recent price crash and having temporarily suspended client deposits and withdrawals last week. With crypto prices tumbling sharply in recent months, investors have been bracing for potential blowups like those of Celsius and FTX in 2022. So far, however, the fallout appears contained — on the one hand, tempering worst-case fears, but on the other, avoiding the kind of complete washout that set the stage for the bottom of that brutal bear market and the beginning of the 2023-25 bull run.

Still, risks outside the crypto sphere continue to loom that leave investors hesitant to take risks.

Worries about mounting stress in credit markets flared up after private-equity company Blue Owl (OWL) permanently curbed redemptions in its $1.7 billion retail-focused private credit fund. OWL fell 6% on Thursday, while the shares of other major private credit managers, including Apollo Global (APO), Ares Capital (ARES) and Blackstone (BX) slid more than 5%.

Geopolitical tensions remain another overhang, with the prospect of U.S. military action against Iran still in play amid an ongoing regional buildup. Crude oil rallied another 2.8% over $66 per barrel, hitting its highest price since August.

Traders play defense

That caution is reflected in crypto derivatives markets, Jake Ostrovskis, head of OTC at trading firm Wintermute, pointed out. Many traders are buying downside protection while limiting upside participation, he noted, which means they are effectively paying for insurance against another drop while capping potential gains in a breakout to the upside.

The average U.S. bitcoin ETF cost basis now sits near $84,000, leaving a large share of ETF investors underwater — nursing a 20% paper loss on average — and potentially vulnerable to “capitulation selling” if prices slide further.

Still, total ETF holdings remain within about 5% of their peak in bitcoin terms, suggesting institutions are trimming exposure rather than rushing for the exits.

Crypto World

Intesa Sanpaolo Reveals $96M Bitcoin ETF Bet and Strategy Hedge

Italy’s largest lender, Intesa Sanpaolo (BIT: ISP), has significantly expanded its exposure to digital assets through exchange-traded funds, crypto-linked equities, and derivatives strategies tied to the sector’s most influential players. Regulatory filings covering positions as of Dec. 31, 2025 reveal nearly $100 million allocated to spot Bitcoin ETFs, alongside targeted bets designed to hedge valuation imbalances in publicly traded crypto companies. The disclosures come as institutional participation in cryptocurrency markets continues evolving through regulated investment vehicles, reflecting how traditional banks are cautiously integrating digital assets into broader portfolio strategies.

Key takeaways

- Intesa Sanpaolo disclosed more than $96 million in spot Bitcoin ETF holdings across multiple issuers in a U.S. regulatory filing.

- The bank combined long Bitcoin exposure with a sizable put option tied to Strategy shares, signaling a potential valuation hedge.

- A $4.3 million allocation to a Solana staking ETF highlights growing institutional interest beyond Bitcoin.

- Additional equity stakes include Circle, Robinhood, Coinbase, BitMine Immersion Technologies, and ETHZilla.

- The investments were filed under a shared-decision structure involving affiliated asset managers.

Tickers mentioned: $BTC, $SOL, $MSTR, $IBIT, $ARKB, $HOOD, $COIN

Sentiment: Neutral

Price impact: Neutral. The filing reflects portfolio positioning rather than a new market catalyst or capital inflow announcement.

Market context: Institutional investors increasingly prefer regulated crypto exposure through ETFs and structured derivatives as liquidity conditions and regulatory clarity evolve across global markets.

Why it matters

Large European banks moving deeper into crypto-related investments signal a gradual normalization of digital assets within traditional finance. Rather than direct token custody, institutions are increasingly using ETFs and derivatives to manage exposure while limiting operational risk.

The combination of long Bitcoin exposure and downside protection tied to crypto-equity valuations illustrates a more sophisticated approach to digital asset investing. This suggests institutions are no longer treating crypto purely as a speculative allocation but as part of broader relative-value strategies.

For builders and market participants, the development underscores how institutional adoption may increasingly flow through regulated capital markets rather than direct blockchain participation, shaping liquidity patterns and product innovation.

What to watch next

- Future quarterly regulatory filings showing whether Bitcoin ETF exposure expands or contracts.

- Potential updates or disclosures regarding the performance or adjustments of the Strategy derivatives position.

- Institutional adoption trends in staking-focused ETFs tied to alternative cryptocurrencies.

- Any public commentary from Intesa Sanpaolo regarding its proprietary crypto trading desk strategy.

Sources & verification

- SEC Form 13F filings covering positions held as of Dec. 31, 2025.

- Public disclosures from ETF issuers referenced in the filing.

- Corporate filings and treasury disclosures regarding Strategy’s Bitcoin holdings.

- Official statements and reporting regarding Intesa Sanpaolo’s crypto trading desk operations.

European banking giant expands crypto strategy through ETFs and derivatives

Intesa Sanpaolo has revealed a diversified set of cryptocurrency-related investments, combining exchange-traded funds, equity exposure, and options strategies as part of a broader institutional approach to digital assets. The positions were disclosed in a U.S. regulatory filing covering holdings at the end of December 2025, offering a detailed snapshot of how a major European bank is navigating crypto markets through regulated financial instruments.

The filing shows that the lender allocated slightly more than $96 million to spot Bitcoin exchange-traded funds tracking Bitcoin (CRYPTO: BTC). The largest allocation, valued at approximately $72.6 million, was invested in the ARK 21Shares Bitcoin ETF (BATS: ARKB). A further $23.4 million was directed toward the iShares Bitcoin Trust (NASDAQ: IBIT), reflecting a preference for large, liquid ETF products designed to mirror the cryptocurrency’s price performance.

These holdings place the bank among a growing group of traditional financial institutions using ETFs to gain exposure without directly holding digital assets. Spot Bitcoin ETFs allow investors to participate in price movements through familiar market infrastructure, simplifying compliance and custody considerations compared with direct token ownership.

The filing also included a smaller but notable position tied to alternative cryptocurrencies. Intesa Sanpaolo reported a $4.3 million investment in a staking-focused exchange-traded fund tracking Solana (CRYPTO: SOL). Unlike standard price-tracking funds, staking ETFs aim to capture blockchain rewards generated through network validation activities, potentially offering yield alongside market exposure.

The addition suggests institutional curiosity is gradually expanding beyond Bitcoin toward networks associated with decentralized applications and staking economics, though allocations remain comparatively modest.

Alongside directional crypto exposure, the bank disclosed a derivatives position tied to Strategy (NASDAQ: MSTR), widely recognized as the largest corporate holder of Bitcoin. The lender holds a sizable put option referencing shares whose underlying securities were valued at roughly $184.6 million at the time of filing.

A put option grants the holder the right, but not the obligation, to sell shares at a predetermined price before expiration. Such a position can generate gains if the stock declines, making it a common hedging tool.

When viewed alongside the bank’s long exposure to Bitcoin ETFs, the derivatives strategy may represent a relative-value trade. Strategy’s share price has historically traded at a premium compared with the value of the Bitcoin held on its balance sheet, often measured using a multiple of net asset value, or mNAV.

According to publicly available company metrics, Strategy shares previously traded near 2.9 times the value of their underlying Bitcoin holdings before narrowing to roughly 1.21 mNAV. A continued compression of that premium could benefit investors positioned for downside movement in the stock while maintaining broader bullish exposure to Bitcoin itself.

Beyond ETFs and derivatives, Intesa Sanpaolo also reported equity stakes in several companies closely tied to the digital asset ecosystem. The largest disclosed position was a roughly $4.4 million holding in Circle Internet Group, a company associated with stablecoin infrastructure.

Additional allocations included approximately $3.6 million invested in Robinhood Markets (NASDAQ: HOOD), $347,400 in Coinbase Global (NASDAQ: COIN), and smaller positions in BitMine Immersion Technologies and ETHZilla Corp. These investments collectively represent exposure to trading platforms, infrastructure providers, and emerging crypto-related ventures.

Compared with the ETF allocations, these equity stakes remain relatively small, suggesting they function as supplementary exposure rather than core portfolio drivers.

The filing categorized the investments under a “DFND,” or shared-defined, structure. This designation typically indicates that investment decisions were made collaboratively between the parent institution and affiliated asset managers. Such arrangements are common when a central strategy is overseen at the group level while execution occurs across subsidiaries or client mandates.

Whether the positions were driven primarily by proprietary trading activity or institutional client portfolios has not been clarified publicly. Requests for comment regarding the strategy were not answered at the time of disclosure.

A separate filing submitted by the bank’s U.S.-based wealth management division reported no direct digital asset exposure, highlighting how crypto positioning may remain concentrated within specific operational units rather than broadly distributed across the organization.

The disclosures align with a gradual expansion of the lender’s crypto capabilities over recent years. In 2023, Intesa Sanpaolo established a proprietary trading desk within its corporate and investment banking division focused on digital assets. The following year, the bank executed its first direct Bitcoin purchase, acquiring roughly €1 million worth of the cryptocurrency.

At the end of December, when the filing snapshot was taken, Bitcoin traded near $88,000. Market conditions have since shifted significantly, with prices declining toward the $68,000 range during early 2026 trading sessions in London. That volatility underscores why institutions increasingly rely on diversified instruments such as ETFs and derivatives rather than maintaining concentrated spot exposure.

More broadly, the strategy illustrates how traditional banks are approaching digital assets through familiar financial frameworks. By combining regulated investment vehicles, hedging mechanisms, and selective equity stakes, institutions can participate in the sector while maintaining risk controls consistent with existing portfolio management practices.

As crypto markets mature, filings such as this provide insight into how legacy financial players are adapting. Instead of treating digital assets as isolated speculative bets, major institutions appear increasingly focused on relative pricing opportunities, diversified exposure, and capital efficiency within a rapidly evolving asset class.

Crypto World

85% Rally Possible Despite Criticism

The ASTER price has fallen nearly 70% from its post-launch highs, reflecting fading hype and rising criticism. User activity and trading volume seem to have collapsed even faster, raising doubts about its recovery.

Yet beneath this weakness, technical patterns and whale accumulation show a different picture. These signals suggest Aster may still attempt a major breakout despite the sharp decline in participation.

Aster User Activity and Trading Volume Collapse After Post-Launch Frenzy

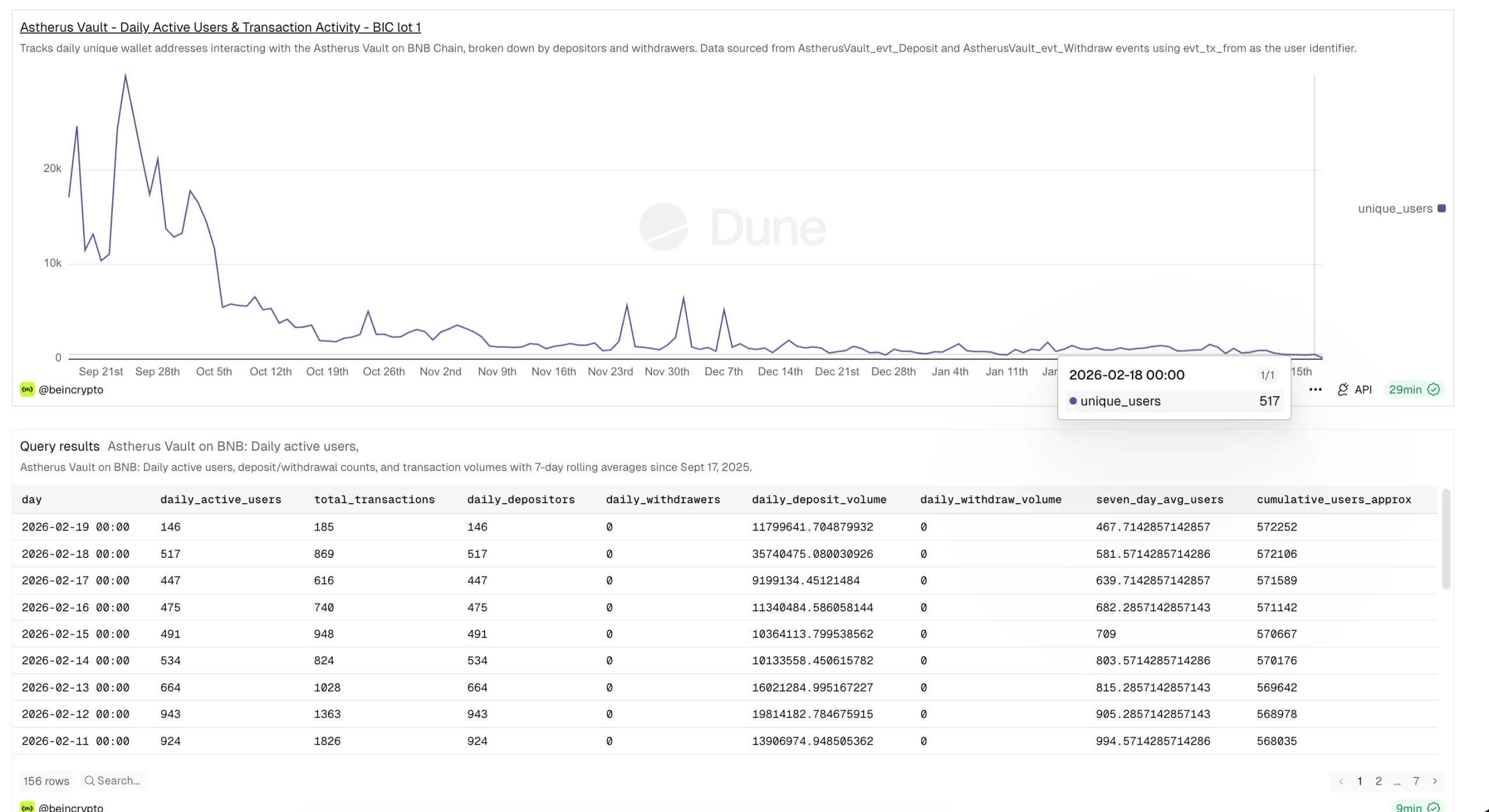

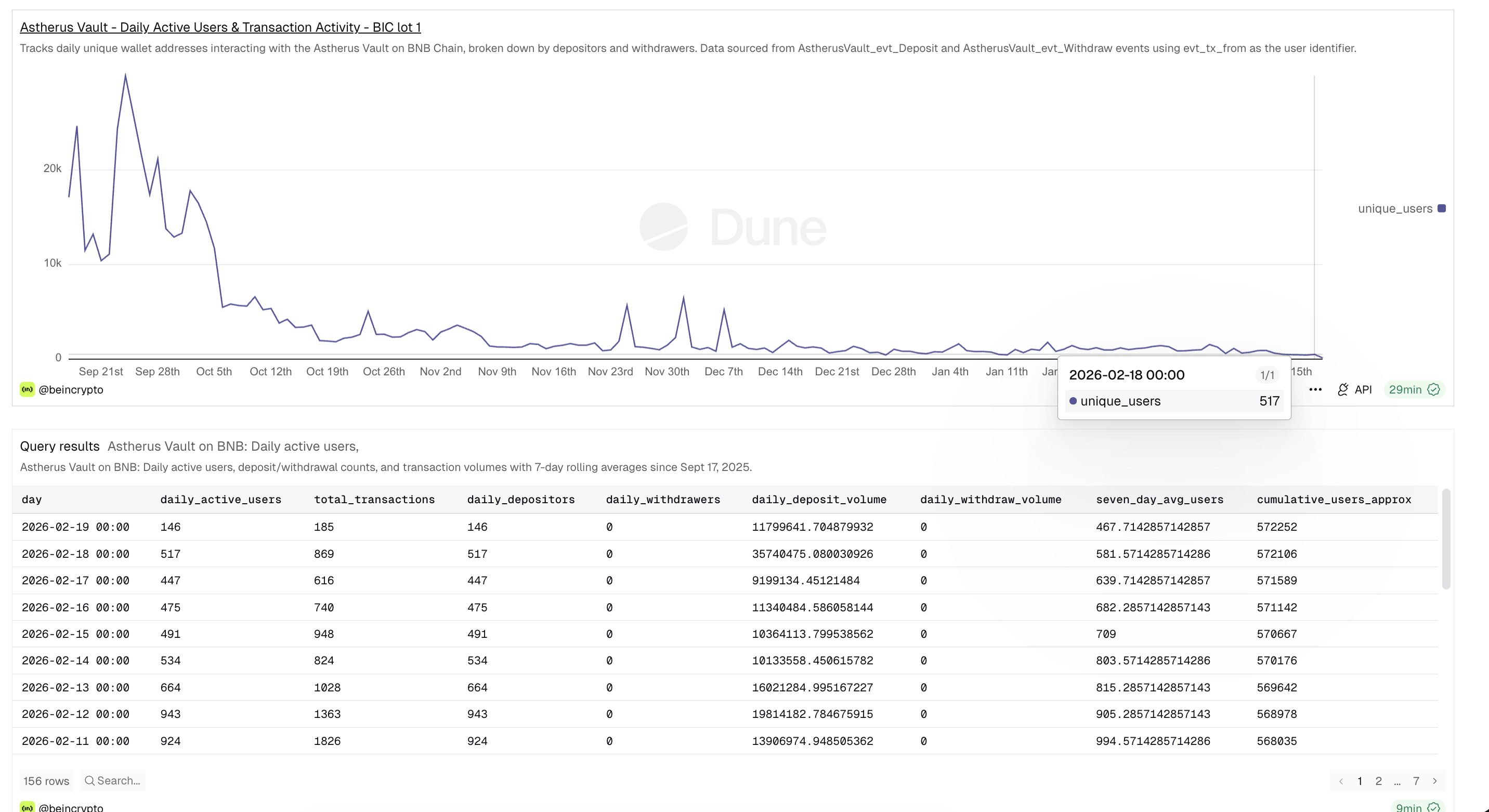

ASTER (formerly Astherus) has seen a dramatic collapse in user participation since its September 2025 token launch.

Daily active addresses interacting with the Astherus Vault on BNB Chain peaked at 29,062 on September 24. As of February 19, that number has fallen to just 146. This represents a 99.5% drop in daily active users.

Disclaimer: These figures reflect Astherus Vault deposit and withdrawal activity on BNB Chain specifically. Aster operates across BNB Chain, Ethereum, Solana, and Arbitrum, and total platform-wide trader activity — including perpetual and spot trading — is likely significantly higher than vault-only metrics suggest.

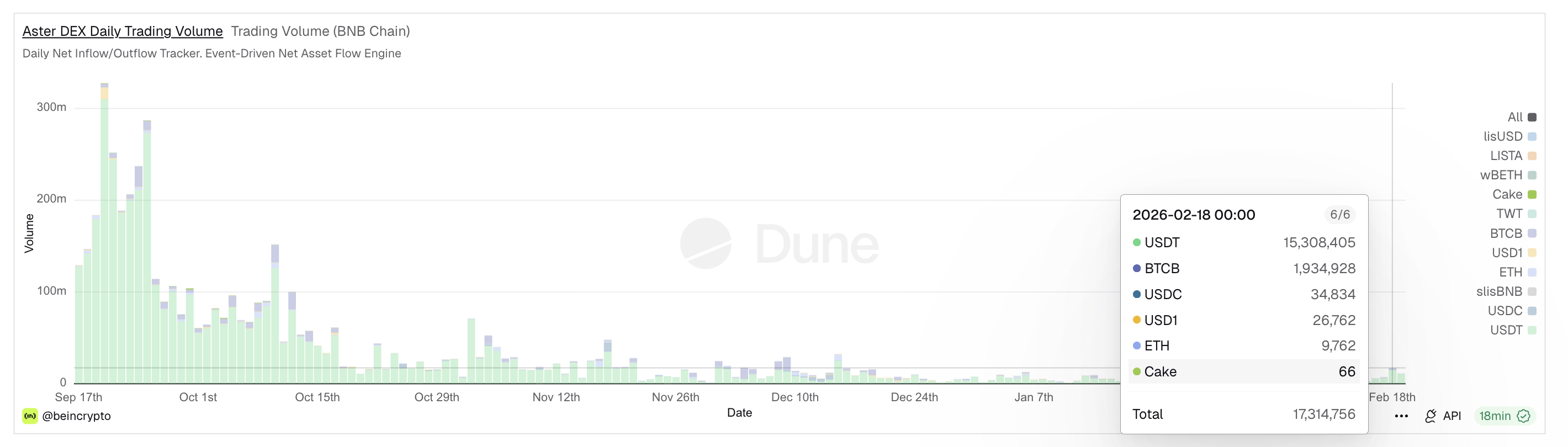

Trading activity has followed the same trend. Daily decentralized exchange volume on BNB Chain, per data pulled via Dune, has declined from a peak of $327.75 million to just $17.31 million.

This marks a 94.7% drop in trading volume. On-chain trading volume reflects real buying and selling happening on the blockchain. When it falls sharply, it shows reduced participation and weaker demand.

This collapse aligns with Aster’s price decline. The token is down about 70% from its $2.41 high reached shortly after launch. The drop reflects the end of a possible hype-driven phase.

However, the full picture is more complex. Cumulative unique addresses interacting with the protocol have continued rising, reaching 572,252. This shows new users are still entering the ecosystem, even as daily activity declines.

More importantly, the remaining users are committing large capital. On February 19, total deposits reached $11.8 million from just 146 wallets. This equals an average of about $80,000 per wallet. This shows that while retail participation has dropped, high-value investors remain active.

Additionally, daily withdrawals from the vault have remained at zero consistently since the TGE, indicating that while fewer users are depositing new capital, existing capital is not exiting the system.

Bullish Divergence and EMA Setup Show Early Reversal Signs

Despite the fundamental weakness, technical indicators show early signs of recovery. On the 12-hour chart, ASTER has formed a bullish divergence between December 7 and February 14. During this period, the price made a lower low. But the Relative Strength Index, or RSI, made a higher low.

RSI measures buying and selling strength on a scale from 0 to 100. When the price falls while the RSI rises, it indicates that selling pressure is weakening. This pattern often appears before a price recovery begins. Aster has not yet fully responded to this signal. This suggests the bullish pressure may still be building.

At the same time, the 20-period exponential moving average, or EMA, is approaching a bullish crossover above the 100-period EMA. EMA tracks the average price over time, giving more weight to recent prices. When shorter EMAs cross above longer ones, it signals strengthening momentum and a possible trend reversal.

The price is also forming an inverse head-and-shoulders pattern.

This is a bullish reversal structure showing buyers slowly gaining control. The neckline of this pattern sits near $0.79. A breakout above this level would confirm the recovery.

Whale Accumulation and Sentiment Collapse Create Opposing Forces

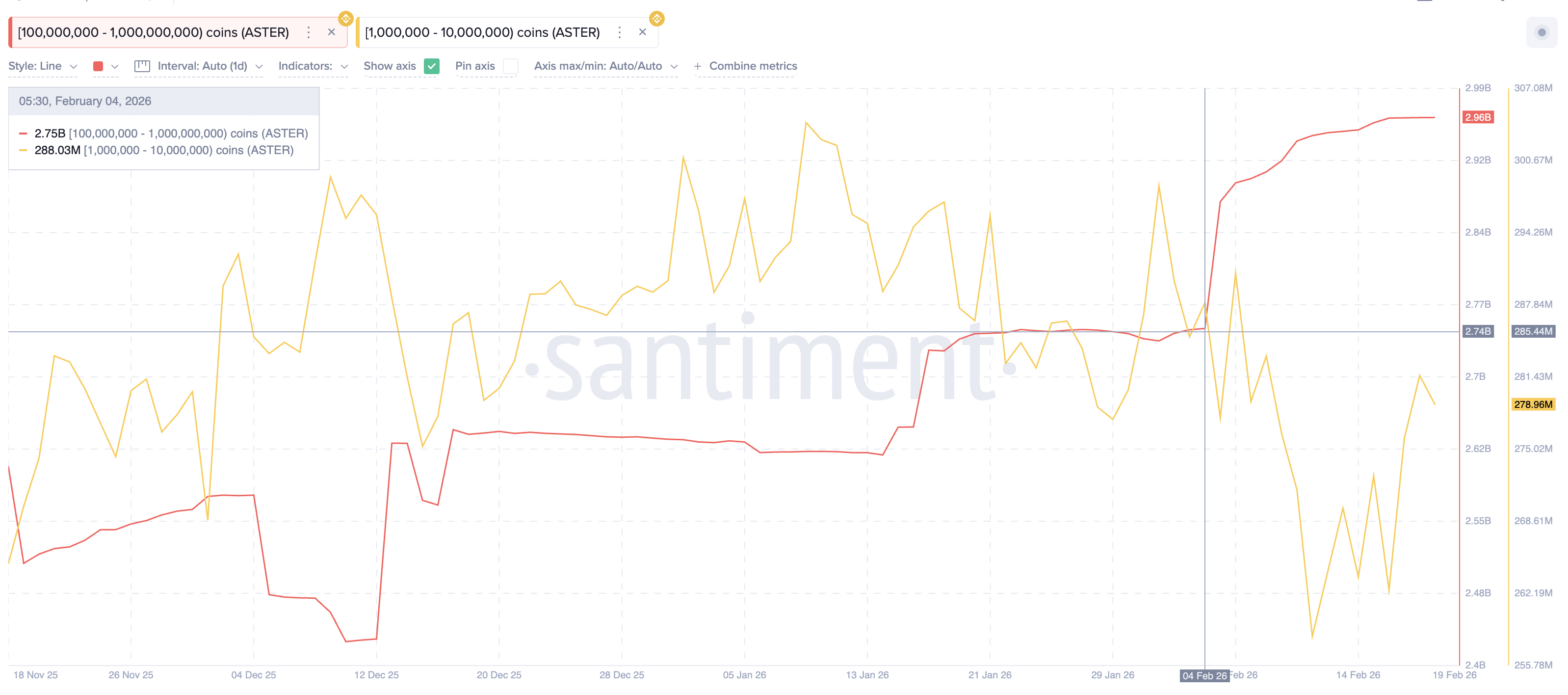

Large investors continue accumulating ASTER despite weak public sentiment. Wallets holding between 100 million and 1 billion ASTER have increased their holdings from 2.75 billion to 2.96 billion ASTER since early February. This steady increase shows strong confidence from the largest holders.

Mid-sized whales holding between 1 million and 10 million ASTER have also increased their holdings from 262.48 million to 278.96 million ASTER.

However, some of these smaller whales have recently started reducing positions slightly. This decline appears to be linked to the recent collapse in positive sentiment.

Market sentiment has dropped sharply. Positive sentiment scores fell from 10.39 on February 12 to near zero recently.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This reflects rising criticism and negative perception around Aster’s declining activity, which, based on available data, appears somewhat exaggerated but not entirely unfounded.

This creates a conflict in the market. Large whales continue accumulating, showing long-term confidence. But smaller investors are becoming more cautious as sentiment weakens. This divergence between whale behavior and public sentiment often appears near major turning points.

ASTER Price Levels That Could Trigger an 85% Breakout

The ASTER price now sits near a critical technical level. The neckline of the inverse head-and-shoulders pattern is located at $0.79. A breakout above this level would confirm the bullish reversal. If this breakout happens, the next resistance levels appear at $0.92, $1.06, and $1.29. The full breakout target sits near $1.46. This would represent an 85% rally from current levels.

However, downside risks still exist. If Aster falls below $0.68, the bullish setup would weaken. A deeper drop below $0.39 would invalidate the pattern completely and confirm continued bearish pressure.

For now, Aster remains at a turning point. User activity and sentiment have collapsed sharply. But whale accumulation, bullish divergence, and reversal patterns suggest recovery remains possible. The next move above $0.79 or below $0.39 will likely decide Aster’s long-term direction.

Crypto World

Anchorage Digital Builds Federal Rails for Stablecoin Payments

TLDR:

- Anchorage Digital Stablecoin Solutions enables international banks to settle USD transfers using regulated stablecoin infrastructure.

- Federal oversight through the OCC places stablecoin custody and issuance under a single national banking framework.

- The platform replaces correspondent banking with programmable balances that reduce settlement time and trapped liquidity.

- Support for multiple USD stablecoins creates a unified rail for minting, custody, and cross-border dollar movement.

Anchorage Digital has launched a new banking platform designed to move U.S. dollars across borders using stablecoin infrastructure. The product targets licensed international banks seeking regulated access to blockchain-based settlement.

The rollout aligns with recent U.S. legislative efforts to formalize stablecoin oversight. The initiative positions stablecoins as an institutional payment rail rather than a retail crypto product.

Anchorage Digital Stablecoin Solutions targets regulated global settlement

The new service allows foreign banks to onboard directly with Anchorage Digital and access both fiat and stablecoin wallets. Institutions can conduct outbound and inbound U.S. dollar transfers using supported blockchain networks.

According to statements shared at ETHDenver and on social media, the platform consolidates minting, redemption, custody, and treasury management into a single system.

This replaces correspondent banking flows that often rely on pre-funded nostro and vostro accounts.

By shifting settlement to programmable stablecoin balances, banks can reduce idle capital and shorten transfer timelines. Settlement windows compress from several days to minutes while maintaining regulated custody standards.

Company co-founder Kevin Wysocki described the product as consistent with federal goals under the GENIUS Act. His comments framed stablecoins as an extension of dollar dominance through compliant digital infrastructure.

Federal oversight anchors stablecoin issuance and custody model

Anchorage Digital operates as a federally chartered trust bank supervised by the Office of the Comptroller of the Currency. This structure removes the need for state-by-state licensing and places client assets under a single regulatory framework.

Funds remain segregated and bankruptcy remote, according to product documentation released with the launch. Digital assets are stored in vaults using institutional policy controls designed for compliance and risk management.

The platform supports multiple dollar-backed stablecoins across major chains. These include USA₮ from Tether, USDtb from Ethena Labs, USDGO from OSL, and future issuances such as Western Union’s USDPT.

Anchorage Digital stated that it will provide primary mint and redeem access for federally issued stablecoins once the GENIUS Act reaches final implementation. The system remains stablecoin-agnostic, allowing banks to custody and transfer other approved tokens through the same interface.

Nathan McCauley, the company’s chief executive, said the service aims to modernize settlement while preserving compliance controls. He emphasized that blockchain rails can operate behind the scenes without altering bank-facing workflows.

The launch follows growing onchain settlement volumes tied to dollar-pegged tokens. Industry data shows stablecoins now process trillions of dollars annually, driven by demand for faster and cheaper cross-border transfers.

By combining regulated issuance, qualified custody, and blockchain-native settlement, the product connects banks into a shared network of compliant counterparties. This approach positions stablecoins as financial infrastructure rather than speculative assets.

Crypto World

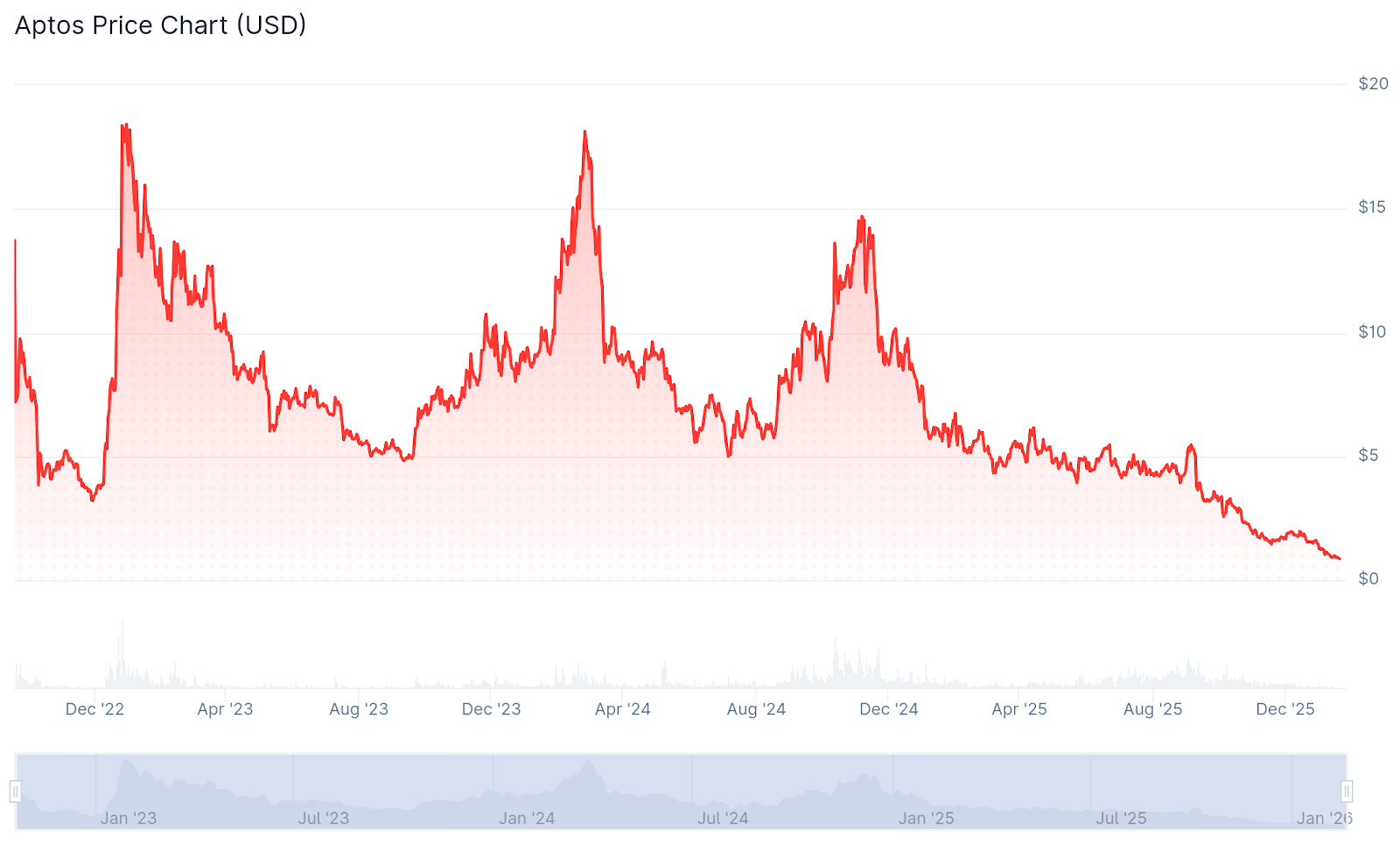

Aptos Pivots Tokenomics Towards Performance-Driven Deflation

The Layer 1 network proposes token buybacks, raising gas fees by 10x, and reducing the staking rewards rate.

Layer 1 blockchain Aptos is proposing a major shift in its tokenomics, intended to reward long-term stakers and use transaction fees to fund token buybacks, as the APT token continues to hit new lows.

The team posted the update on X today, stating that “The Aptos network is transitioning to performance-driven tokenomics designed to align supply mechanics with network utilization.”

Through this update, Aptos aims to transition from its high-inflation, subsidy-based model to a deflationary, revenue-driven supply. The update proposes a hard cap of 2.1 billion APT, and the Aptos Foundation will permanently lock 210 million APT, worth $180 million, and use staking rewards to support network operations rather than token sales.

The update also calls for a tenfold increase in gas fees, claiming that even after this increase, network fees would “still be the lowest in the world at around $0.00014.” The increased fees are expected to boost the amount of APT purchased and burned through the programmatic buyback program.

Aptos also proposes to drop the staking reward rate by 50% from 5.19% to 2.6%. This decrease is expected to be paired with a future governance proposal that would offer higher reward rates to users who commit to longer staking terms, whereas short-term stakers would be subject to the 2.6% rate.

APT has had a rough year, falling 87% from 6.31 to $0.86 since February 2025, and 95% from its all-time high of $19.92 in 2023.

Despite the token’s poor performance, Aptos is DeFi’s tenth-largest blockchain by stablecoin market capitalization, with $1.4 billion in total value, and is ranked eleventh by stablecoin transaction volume, with $587 billion, according to Artemis Terminal.

Crypto World

Anchorage Digital offers non-U.S. banks a stablecoin stand-in for correspondent banking

Anchorage Digital, the first crypto firm to get a U.S. banking charter, wants international banks to swap out correspondent banking relationships with a new service that offers U.S.-regulated stablecoin rails for non-U.S. institutions.

The bank is launching what it calls “Stablecoin Solutions” to permit easy, cross-border movement of dollar-tied assets, combining “minting and redemption, custody, fiat treasury management, and settlement” into one service, it said in a Thursday statement.

“Stablecoins are becoming core financial infrastructure,” said Nathan McCauley, co-founder and CEO of Anchorage Digital, in a statement. “Stablecoin Solutions gives banks a federally regulated way to move dollars globally using blockchain rails, without compromising custody, compliance, or operational control.”

Now that the U.S. has a new law governing stablecoin issuers under last year’s Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, Anchorage Digital — already regulated under a federal charter by the Office of the Comptroller of the Currency — is moving to offer the stablecoin services. While it’s ready to handle any brand of stablecoin, a field currently dominated by Tether’s $USDT and Circle $USDC, the company said institutions can natively mint and redeem tokens “issued by Anchorage Digital Bank, including Tether’s USA₮, Ethena Labs’ USDtb, OSL’s USDGO and upcoming issuances such as Western Union’s USDPT.”

Correspondent banking allows foreign banks to tap another institution to handle their cross-border activities, such as wire transfers, currency exchange, taking foreign deposits and otherwise acting as a third-party proxy. But it can be expensive and time-consuming. Anchorage Digital is suggesting it can use stablecoin rails to cut settlement delays and simplify the complexity of the existing system.

The GENIUS Act that will govern this business isn’t yet implemented by the federal agencies involved in regulation and oversight, such as the OCC and other banking watchdogs. Those agencies have begun proposing some of the future regulations.

Some provisions on stablecoin yield are now being reopened in the ongoing Senate negotiation over the Digital Asset Market Clarity Act.

Read More: Tether invests $100 million in U.S. crypto bank Anchorage, valued at $4.2 billion

Crypto World

Latest White House talks on stablecoin yield make ‘progress’ with banks, no deal yet

More progress was made but no compromise deal has yet emerged after a meeting hosted by the White House on Thursday to bring crypto insiders and bankers to the table again on U.S. digital assets legislation, according to crypto insiders who attended.

“Today’s constructive meeting at the White House reflects the importance of focused working engagement,” said Ji Kim, the CEO of the Crypto Council for Innovation, who has been a regular participant in the talks. “The conversation built upon previous meetings to establish a framework that serves American consumers while reinforcing U.S. competitiveness,” he said, adding that there will be “more to come” to continue the progress.

“The dialogue was constructive and the tone cooperative,” Paul Grewal, the chief legal officer at Coinbase, wrote in a post on social media site X, saying the sides made “more progress.”

This was the third in a series of meetings meant to pierce the impasse that’s locked up the crypto market structure bill on a point that has nothing to do with market structure. The U.S. banking industry put its foot down about the way the previous legislative effort that’s now law — the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act — allowed crypto firms to offer rewards on stablecoins. Bankers argue that such rewards threaten the deposits business at the core of their industry, and they’ve demanded the Digital Asset Market Clarity Act rehash that point in the GENIUS Act.

After the most recent meeting in which the bankers arrived with a principles document that shut out talk of compromise, Thursday’s gathering extended well beyond the two-hour schedule, said people briefed on the talks. White House officials applied pressure on the participants to stay until they’d found common ground, including collecting their phones, the people said.

The question of whether stablecoins should be able to offer yield, such as in the products offered to customers on platforms like Coinbase, is among the major remaining sticking points of the legislation that would govern the U.S. crypto markets. An earlier compromise effort sought to give up rewards on static stablecoin holdings and only retain them on certain activities and transactions made with the assets. But banks had held the line on a demand that all rewards be banned.

If the industries come to terms on this point, it still doesn’t lock in a congressional victory. The Senate Banking Committee needs to hold a hearing to consider advancing the legislation, just as the Senate Agriculture Committee did when it voted along partisan lines to approve its own version. But to get a bill that can pass the Senate, the process will need many Democrats on board, and that hasn’t yet happened.

Democratic negotiators have insisted on a few major points, such as prohibiting senior government officials from significant business interests in crypto — a concern directed squarely at President Donald Trump. They’ve also called for the White House to fill the commissions at the Commodity Futures Trading Commission and the Securities and Exchange Commission, including nominating to fill the Democratic vacancies. Also, the members have demanded tighter controls on illicit finance risks, especially in decentralized finance (DeFi).

None of their requests have yet been met with offers from the Republicans and White House that have so far satisfied Democrats.

The Clarity Act is the top policy priority for the crypto industry. Once U.S. regulations are permanently set, the sector expects to see a surge in activity and investment as it becomes an indelible part of the U.S. financial system.

Read More: Banking trade groups responsible for impasse on market structure bill, Brian Armstrong says

UPDATE (February 19, 2026, 19:17 UTC): Adds comment from CCI’s Ji Kim.

Crypto World

Hack VC-Backed Nillion to Shut Down Its Chain on Cosmos, Shift Focus to Ethereum

The migration comes just months after Cosmos announced it’s stepping back from efforts to turn the Cosmos Hub into a smart contract platform as TVL declines.

NilChain, a privacy-focused blockchain built with the Cosmos SDK by Nillion, is winding down operations on Cosmos as part of broader shifts across the interoperability-focused ecosystem.

In an X announcement on Feb. 17, the team said the network will halt operations on March 23, urging holders of the NIL token to migrate their assets to Ethereum before the shutdown.

NilChain was designed as a network for secure computation. But the chain has seemingly not been able to reach broad usage inside the Cosmos ecosystem.

Leaving Cosmos, however, doesn’t mark an end to Nillion itself, as the company plans to continue operating on Ethereum. Amid the news, nilChain’s native token NIL briefly jumped over 10% on the day to $0.06 and is currently trading around $0.053, per data from CoinGecko.

It remains unclear why the team decided to migrate away from Cosmos. The Nillion team declined The Defiant’s request to comment on the move for this story.

NilChain may not be widely known compared with larger Layer 1 or Layer 2 networks, but Nillion has raised sizable funding. In December 2022, the company closed a roughly $20 million seed round led by Distributed Global, with participation from GSR Markets and HashKey.

It raised another $25 million in October 2024 in a round led by Hack VC, with backing from the Arbitrum Foundation, Worldcoin, Sei, HashKey Capital, and Animoca Brands.

Exodus from Cosmos

The move comes as Cosmos itself reassesses its direction. In July 2025, the Cosmos Hub scrapped plans to add native smart contract support, citing high costs and weak developer demand. Teams that had planned to deploy applications on the Hub were encouraged to build on other Cosmos-based chains instead.

That shift forced a reset for many teams and coincided with a wave of departures. Since mid-2025, several projects have announced exits or wind-downs across the Cosmos ecosystem.

The stablecoin-focused project Noble said earlier in January of this year it would leave Cosmos to launch its own EVM-compatible L1, saying the team wants to “meet users and developers where they already are.” Others have taken different paths with chains like Pryzm and Quasar announcing shutdowns or significant changes.

Some have publicly said they are leaving Cosmos after years of struggling with liquidity, user distribution, and developer traction following the collapse of Terra in 2022. Others, including infrastructure providers, argue the ecosystem still makes sense for teams focused on interoperability rather than consumer DeFi.

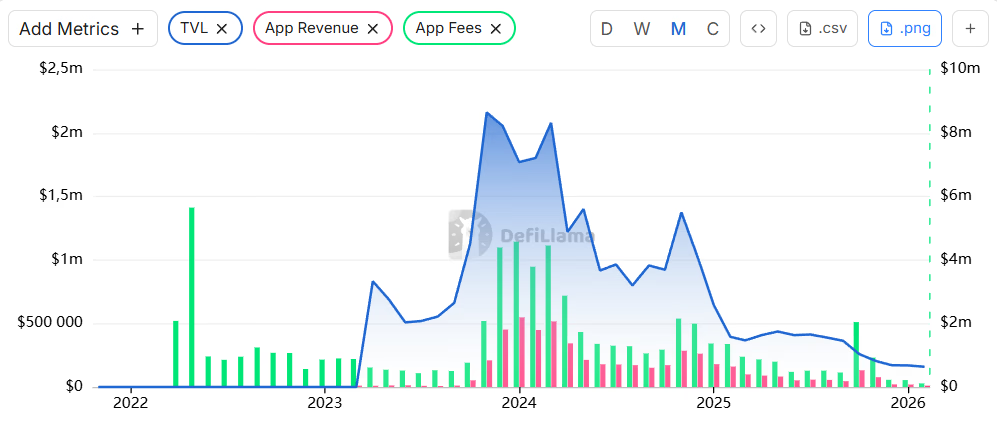

The Cosmos Hub itself has also seen declining activity. Data from DefiLlama shows total value locked on the network falling from about $2.65 million to roughly $131,000 earlier this month, the lowest level on record.

Network fees have also dropped sharply. By January, fees reached an all-time low of around $218,000, with only four of the 11 protocols deployed on the Cosmos Hub generating any revenue.

ATOM, the native token of Cosmos Hub, is down about 4% over the past 24 hours, though it rallied over 18% in the past week, per CoinGecko.

Crypto World

Brian Armstrong Slams Wall Street’s Misunderstanding of Coinbase’s Value

Brian Armstrong, CEO of Coinbase, has voiced concerns about the traditional financial industry’s perception of his company. In a recent Q&A session, Armstrong argued that Coinbase is undervalued and misunderstood by Wall Street. He attributes this to an ongoing resistance against cryptocurrency disruption, suggesting that the broader financial world has yet to fully recognize the true potential of Coinbase. The CEO highlights this misunderstanding as part of a larger trend where innovations are initially dismissed but later accepted as they prove their value.

“Why is Coinbase always misunderstood or under-appreciated by Wall Street?” – I got asked this today in our AMA with analysts, and it’s an interesting question. Sharing my answer here.

I do think Coinbase is a bit of a misunderstood company. It’s a classic innovator’s dilemma.…

— Brian Armstrong (@brian_armstrong) February 17, 2026

Armstrong Highlights the Innovator’s Dilemma in Finance

Armstrong attributes Wall Street’s reluctance to embrace Coinbase to what he calls the innovator’s dilemma. He compares the current skepticism toward cryptocurrency to the resistance faced by e-hailing services like Uber when they disrupted the traditional taxi industry.

Armstrong believes that, like the taxi companies of the past, Wall Street views cryptocurrency as a threat rather than a valuable innovation. According to him, traditional financial institutions fail to see that the future of finance is rapidly changing.

Despite these challenges, Armstrong remains confident about Coinbase’s future. He argues that while the financial industry resists the shift toward crypto, progressive institutions are starting to collaborate with Coinbase. Armstrong pointed out that five of the Global Systemically Important Banks (GSIB) have already engaged with Coinbase and begun exploring collaborations. He believes this is a crucial step in the mainstream acceptance of cryptocurrency as a legitimate financial tool.

Coinbase’s Growth Metrics Challenge Traditional Valuation

Armstrong underscores Coinbase’s impressive growth in an attempt to shift Wall Street’s perception. He highlights significant increases in key metrics, such as a 156% year-on-year rise in trading volume. Additionally, Coinbase’s market share has doubled, and its asset growth has tripled over the past three years. Armstrong stresses that these metrics should challenge Wall Street’s view of Coinbase as an undervalued asset.

The CEO also noted that Coinbase is no longer just a trading platform but a comprehensive financial infrastructure company. With 12 products currently generating over $100 million annually, Armstrong believes this diversification underscores Coinbase’s potential for long-term growth. He urges investors and financial institutions to recognize these achievements rather than relying on outdated perceptions of the company as merely a crypto exchange.

A Shift in Global Financial Systems with Crypto at the Core

According to Armstrong, the future of global finance is increasingly centered around cryptocurrency. He insists that Coinbase is not simply a digital asset exchange but an integral player in the evolving financial infrastructure.

Armstrong believes that banks and financial institutions must adapt to this new reality to stay competitive. He argues that those who embrace cryptocurrency infrastructure will benefit greatly, while those who resist will struggle to remain relevant in the future financial landscape.

Coinbase’s role in this transformation is becoming clearer with its partnerships with leading global financial institutions. As blockchain technology continues to disrupt traditional financial systems, Armstrong predicts that the companies most willing to embrace crypto will be the ones that thrive in the future. He encourages Wall Street to move beyond its initial skepticism and adopt a more forward-thinking approach, recognizing Coinbase as a key player in reshaping the financial world.

Crypto World

Important Coinbase Announcement Concerning XRP, ADA, and Other Altcoin Investors

“Borrowing up to $100K in USDC against your tokens, instantly, without selling,” the announcement reads.

The US-based exchange Coinbase expanded its crypto-backed loan offerings to include additional tokens, such as Ripple’s XRP and Cardano’s ADA.

For the moment, the new service is available across the USA, except for residents of New York State.

Further Support for These Assets

The company rolled out its lending product, called Coinbase Borrow, in 2021. Two years later, it discontinued the service, only to bring it back at the start of 2025.

Coinbase Borrow lets users take a loan using their cryptocurrency possessions as collateral instead of selling them. Until recently, clients were able to borrow up to $5 million in USDC against their Bitcoin (BTC) holdings and as much as $1 million in the stablecoin against Ethereum (ETH). The exchange, though, decided to expand the service by adding Ripple (XRP), Cardano (ADA), Dogecoin (DOGE), and Litecoin (LTC).

“Now you can unlock the value of your portfolio without giving up your position. Borrowing up to $100K in USDC against your tokens, instantly, without selling. Available now in the US (ex. NY),” the official announcement reads.

Backing from a major exchange like Coinbase can positively influence the prices of the involved cryptocurrencies by boosting their reputation and accessibility. In this case, however, XRP, ADA, DOGE, and LTC continued trading lower, reflecting the broader market’s bearish conditions.

It is important to note that the strongest price pumps typically occur right after Coinbase lists a token or reveals its intentions to do so. Last summer, for instance, the company added SPX6900 (SPX), AWE Network (AWE), Dolomite (DOLO), Flock (FLOCK), and Solayer (LAYER) to its roadmap. Some of the involved assets headed north by double digits following the disclosure.

It’s a completely different story when Coinbase terminates services with certain coins. Towards the end of last year, Muse Dao (MUSE), League of Kingdoms Arena (LOKA), and Wrapped Centrifuge (WCFG) tumbled substantially after they were removed from the trading venue.

You may also like:

What Else is New on Coinbase?

The exchange has been quite active lately, enabling additional trading options for its clients. Earlier this month, it announced that users can buy, sell, convert, send, receive, or store RaveDAO (RAVE), Walrus (WAL), AZTEC (AZTEC), and Espresso (ESP). All assets are live on Coinbase’s official website and application.

WAL, AZTEC, and ESP experienced an initial price upswing after the news but then headed south. RAVE, on the other hand, has kept pumping and currently trades around $0.44 (per CoinGecko), representing a 25% weekly increase.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports17 hours ago

Sports17 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment23 hours ago

Entertainment23 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

-

Crypto World6 days ago

Crypto World6 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery