CryptoCurrency

ROI of Hiring a Full-Stack Cryptocoin Development Company in 2026

If you’re planning to build a serious Web3 product in 2026, you already know one thing. The crypto market has grown. Hype isn’t enough, and poorly built projects don’t survive. Investors expect clarity, institutions demand compliance, and users won’t tolerate broken tokenomics or slow execution.

This is exactly why more founders are choosing a full stack cryptocoin development company to build their products instead of relying on scattered teams and risky shortcuts. In a market shaped by tighter regulations, stronger infrastructure, and rising competition, ROI now comes from faster launches, secure architecture, and a development partner who can scale with you. If your goal is to build something investors trust and users actually adopt, here’s why full stack crypto development is the smartest advantage you can leverage in 2026.

Why 2026 Has Changed the ROI Equation for Crypto Development

2026 is not 2021. The market has matured, regulations have tightened, and founders are being pushed toward sustainable, compliant, and utility driven crypto products. The shift is backed by real, verifiable data from 2025–2026:

- The global crypto market cap sits around $3.1–3.35 trillion as of late 2025, signaling strong sector recovery and renewed capital interest.

- Institutional adoption remains early, with institutions representing less than 5% of spot Bitcoin ETF assets but making up roughly 40 percent of futures trading volume, highlighting growing participation but not yet mass inflows.

- Regulatory frameworks expanded across multiple countries, including Vietnam, South Korea, Hong Kong, Singapore, the UAE, Australia, Brazil, and several EU nations. While the exact count varies, 2025 saw one of the most active years for crypto regulation updates.

- Layer 2 ecosystems surged with over 150% TVL growth, strengthening the demand for cross chain interoperability, even though exact protocol percentages vary.

- AI integrated crypto projects continue to trend upward, with notable growth from ecosystems like Bittensor, Fetch.ai, and Internet Computer, but without a confirmed universal percentage.

These trends make one thing clear. The ROI equation for crypto development in 2026 is no longer driven by hype or speculation. It is driven by:

- Compliance by design

- Security first development

- Interoperability across chains

- AI aligned token utilities

- Real world value creation

That’s why a full stack cryptocurrency development partner has become indispensable. You’re not just hiring them for engineering support. You’re hiring them to reduce compliance risk, increase product reliability, streamline architecture, and ensure your tokenomics can survive in a more regulated and data driven market.

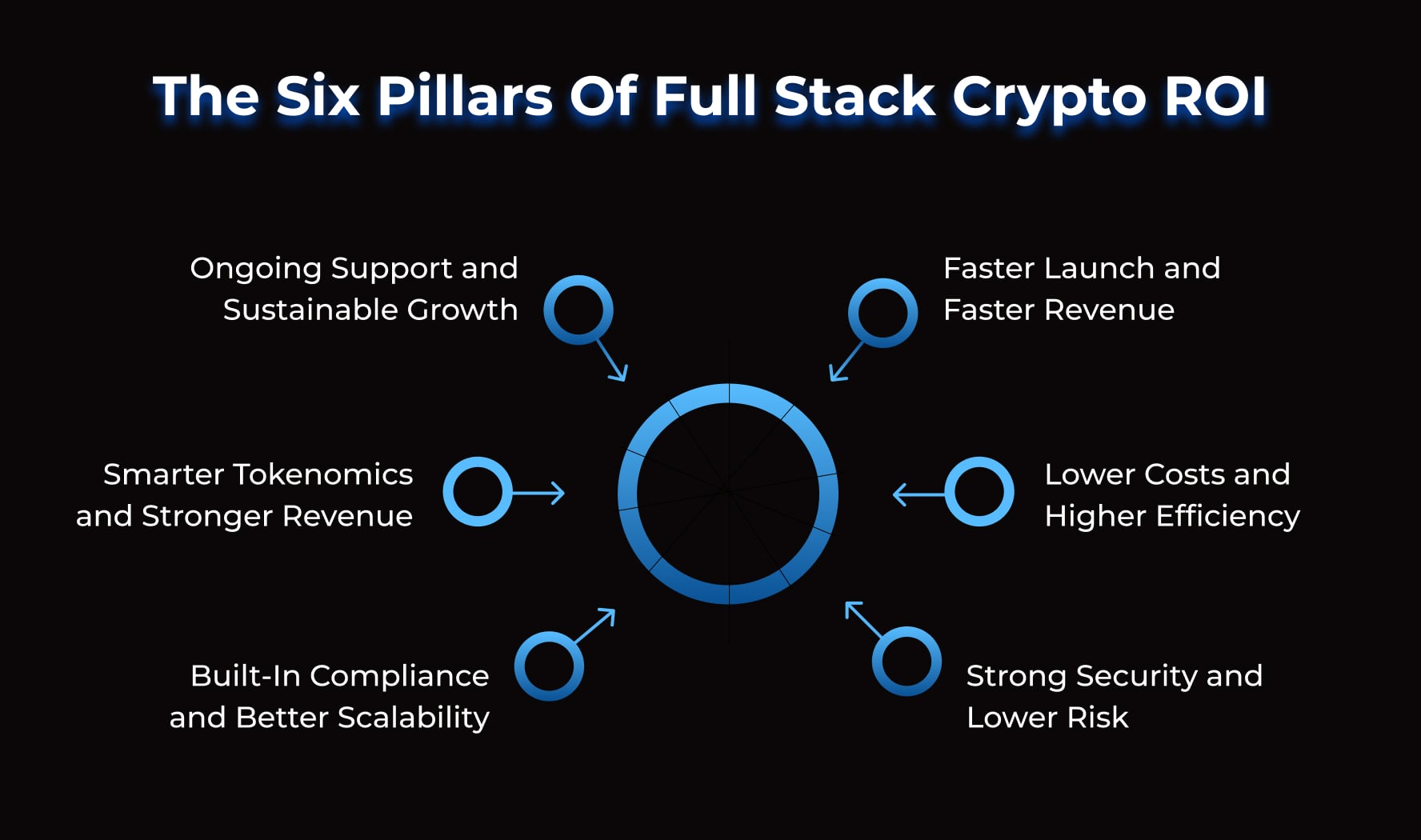

What You Gain by Working With a Full Stack Crypto Token Development Company

- Faster Launch and Faster Revenue

Building with fragmented teams slows everything down. Integrating their work slows it down even more. A full-stack partner cuts development cycles by up to 40% because:

- All teams work under the same architecture.

- No reworking of code due to misaligned tech stacks

- Tokenomics, compliance, and smart contracts are coordinated.

- Testing and audits happen in a single pipeline.

Speed isn’t just convenience. It saves months of burn and accelerates monetization.

This is also where choosing the right cryptocoin development company becomes a major advantage because you’re reducing friction across every stage of the build.

- Lower Costs and Higher Efficiency

Hiring blockchain engineers in 2026 is expensive. Assembling a full team internally requires hiring:

- Smart contract developers

- Blockchain architects

- DevOps engineers

- UX designers

- Security auditors

- Product strategists

And that doesn’t include the cost of training and retaining them. A full-stack crypto token development company eliminates this overhead. You get access to a complete technical ecosystem without building one from scratch. This also creates long-term financial predictability, which is essential when you are scaling something with recurring token utilities and network effects.

- Strong Security and Lower Risk

In 2026, the number one reason crypto projects fail is not a lack of demand. It’s a lack of security. A partner improves ROI because they prevent disasters that drain revenue:

- Smart contract exploits

- Liquidity manipulations

- Oracle vulnerabilities

- Non-compliant token logic

- Incorrect treasury structuring

- Mismanaged multisig and governance setups

You’re not just paying for development. You’re paying to eliminate risks that would cost millions to repair. Security is also one of the biggest reasons enterprises now depend on structured crypto token development services that prioritize audits, risk scoring, and continuous monitoring.

- Built In Compliance and Better Scalability

Regulators are not leaving any room for ambiguity anymore. A project that is non-compliant at launch does not scale. Period. Full-stack firms embed compliance frameworks across:

- Token issuance

- KYC and AML workflows

- Onchain reporting

- Cross-border regulatory alignment

- Stablecoin and security token rules

- Risk scoring and transaction monitoring

This gives founders a significant ROI advantage. You’re building something ready for banks, enterprises, and institutional partners.

- Smarter Tokenomics and Stronger Revenue

2026 tokenomics is very different from the old playbook. A full-stack firm helps craft revenue-centric tokenomics through:

- Circulation modeling

- End-user incentive frameworks

- Treasury optimization

- Burn and supply balance models.

- Staking yield that remains sustainable

- AI-powered token utility flows

This turns your token into a long-term value driver, not a short-term liquidity event.

A founder who gets tokenomics right attracts investors faster, retains users longer, and builds ecosystems that compound in value.

- Ongoing Support and Sustainable Growth

Launching the token or platform is just the first milestone. Full-stack companies offer retention value through:

- Continuous updates

- Patch management

- Security monitoring

- Chain upgrades

- Scaling support

- Node and infrastructure maintenance

This prevents your product from becoming obsolete or vulnerable, which directly contributes to your ROI long after the launch.

See How We Build High-ROI Crypto Products

Why Founders Prefer a Single Cryptocoin Development Company Over Multiple Vendors

Why Founders Prefer a Single Full Stack Partner Over Multiple Vendors. Let’s keep it simple.

Multiple vendors mean:

- Fragmented communication

- Unclear accountability

- Inconsistent workflows

- Higher integration costs

- Duplicated work

- Slower development

One full stack partner means:

- Unified strategy

- One technology roadmap

- One accountable entity

- Seamless architecture

- Ongoing scaling support

- Reduced cost and risk

This simplifies your business and strengthens your execution. And this is where a future focused cryptocoin development company becomes a long term growth partner instead of a short term contractor.

The 2026 Founder’s ROI Checklist

If you want to know whether your development partner is truly delivering ROI, measure them against this checklist. A seasoned cryptocoin development company will consistently meet these expectations across every phase of your product lifecycle.

- Are they decreasing your time to market?

- Are they reducing your total cost of ownership?

- Are they protecting you from compliance risks?

- Are they building tokenomics that sustain revenue?

- Are they providing enterprise-grade audits and security?

- Are they enabling long-term ecosystem scalability?

- Are they simplifying your operational complexity?

- Are they improving user trust and investor confidence?

If the answer is no to any of these, your ROI is compromised.

Final Thoughts

2026 is shaping up to be the year of structured, compliant, and revenue-driven digital asset systems. Founders who partner with a seasoned cryptocoin development company are the ones gaining real traction.

They launch faster.

They scale better.

They avoid costly mistakes.

They attract stronger capital.

They build products that users trust.

If long term value is your goal, a full stack development partner isn’t optional. It’s your smartest move. And this is exactly where Antier continues to lead with proven frameworks and enterprise ready execution. If you’re planning to develop a token ecosystem, scale a Web3 platform, or launch a compliant crypto product in 2026, we can guide your build from strategy to deployment. With Antier’s crypto token development services, you get a complete stack designed for speed, security, and scalability. If you’re ready to transform your idea into a market-ready, investor-ready, and future-ready solution, connect now and start your project with Antier’s full-stack expertise. Your ROI starts with the right partner.

Frequently Asked Questions

01. Why is full stack cryptocurrency development important for 2026?

Full stack cryptocurrency development is crucial for 2026 because it ensures compliance, security, interoperability, and real-world value creation, which are essential in a matured market with tighter regulations and rising competition.

02. How has the crypto market changed from 2021 to 2026?

The crypto market has matured significantly, with a global market cap of around $3.1–3.35 trillion, increased regulatory frameworks, and a shift towards sustainable, utility-driven products, moving away from hype and speculation.

03. What are the key factors driving ROI in crypto development for 2026?

The key factors driving ROI in crypto development for 2026 include compliance by design, security-first development, interoperability across chains, AI-aligned token utilities, and the creation of real-world value.