Crypto World

Roubini Predicts a ‘Crypto Apocalypse’ Amidst Bitcoin’s Plunge Under Trump-Era Policies

Roubini said that Bitcoin behaves like a leveraged bet, rising and falling alongside high-risk equities rather than hedging uncertainty.

Economist Nouriel Roubini, who is known for his anti-crypto rhetoric, predicted a looming “crypto apocalypse.” He explained that the future of money and payments will evolve gradually rather than undergo the revolutionary transformation promised by cryptocurrency advocates.

In a recent post, Roubini said Bitcoin and other cryptocurrencies’ latest price plunge demonstrates the extreme volatility of what he calls a “pseudo-asset class,” and expressed hope that policymakers recognize the risks before further damage occurs.

He recalled that one year earlier, Donald Trump had returned to the US presidency after courting retail crypto investors and receiving significant backing from crypto industry figures. This led several evangelists to predict that Bitcoin would reach at least $200,000 by the end of 2025 and become “digital gold.”

Roubini: Bitcoin Isn’t a Hedge

According to Roubini, Trump followed through by dismantling most crypto regulations, signing the Guiding and Establishing National Innovation for US Stable Coins (GENIUS) Act, pushing the Digital Asset Market Clarity (CLARITY) Act, profiting from domestic and foreign crypto deals, promoting a meme coin bearing his name, pardoning crypto criminals allegedly linked to terrorist organizations, and hosting private White House dinners for crypto insiders.

Roubini noted that crypto was also expected to benefit from macroeconomic and geopolitical risks, including rising public debt, fiat currency debasement, trade wars, and increased tensions involving the US, Iran, and China, factors that coincided with gold rising more than 60% in 2025.

Bitcoin, however, fell 6% that year and, as of the time of writing, was down 42% from its October peak and below its level at Trump’s election, while the TRUMP and MELANIA meme coins had dropped 95%. Roubini said Bitcoin repeatedly declined during periods when gold rallied, and argued that it behaves as a leveraged risk asset correlated with speculative stocks rather than a hedge.

He reiterated his long-standing view that crypto does not function as a currency, as it is neither a unit of account, a scalable payment system, nor a stable store of value, while citing El Salvador’s experience, where Bitcoin accounts for less than 5% of transactions. He further argued that crypto is not a true asset because it lacks income streams or real-world utility.

You may also like:

On Stablecoins and Regulations

Roubini said the only widely adopted crypto application after 17 years is the stablecoin, which he described as a digital form of fiat money already replicated by traditional finance, and maintained that most blockchain-based systems are centralized, permissioned, and privately controlled. He asserted that fully decentralized finance will never scale because governments will not permit anonymous transactions, and that AML and KYC requirements undermine claims of lower costs.

While speaking about regulation, Roubini warned the GENIUS Act risks recreating the instability of 19th-century free banking, as stablecoins lack narrow bank regulation, lender-of-last-resort access, or deposit insurance, making them vulnerable to runs. He also criticized proposals allowing stablecoins to pay interest, and claimed that this could destabilize fractional reserve banking unless payments and credit creation are structurally separated.

Roubini’s comments come as Bitcoin continues its downward trajectory, falling a fresh 6% on Thursday and trading below $71,600 at the time of writing. The latest decline has added to broader market unease, and analysts are warning that continued weakness in BTC could have wider implications. Market experts have increasingly raised concerns that firms holding large BTC reserves may face massive balance-sheet stress and systemic risk if prices continue to slide.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

From Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

TLDR:

- ETHZilla rebrands as Forum Markets and begins trading under the Nasdaq ticker FRMM starting March 2, 2026.

- Shares collapsed roughly 96% from their August 2025 peak despite a 13.3% single-day gain on the rebrand news.

- Peter Thiel’s Founders Fund exited its 7.5% stake in Q4 2025 as ETHZilla’s Ethereum treasury strategy unraveled.

- Forum Markets shifts focus to regulated, tokenized real-world assets, moving away from single-asset crypto exposure.

ETHZilla is pulling back from its crypto-heavy balance sheet strategy after a dramatic share price collapse. The company announced a full rebrand to Forum Markets, with trading set to begin under the Nasdaq ticker “FRMM” on March 2.

The retreat follows months of investor exits, asset sales, and a sustained decline from last year’s highs. In place of Ethereum treasury holdings, the company is now directing its focus toward tokenized real-world assets built on regulated infrastructure.

ETHZilla Scales Back Crypto Holdings After Sharp Investor Exodus

ETHZilla built its identity around holding Ethereum directly on its balance sheet as a public company. The strategy was designed to give traditional investors exposure to Ethereum without directly purchasing the asset.

Shares soared to $107 on August 13, 2025, shortly after the company revealed plans for a $425 million Ethereum treasury. That announcement followed a pivot away from its earlier biotech business model.

The rally, however, proved short-lived as market conditions deteriorated and enthusiasm faded. The company began selling crypto assets to reduce its exposure as the stock continued sliding.

Investor confidence took a further blow when Peter Thiel’s Founders Fund exited its 7.5% stake during Q4 2025. Accounting for a 1-for-10 stock split executed in October, shares had fallen roughly 98% from their effective peak of $174.60.

The retreat from crypto exposure was gradual but deliberate. ETHZilla reduced its Ethereum holdings while exploring alternative business lines to shore up its equity performance.

One move included entering jet engine leasing through a new subsidiary called ETHZilla Aerospace. That unit tokenized equity in leased engines via the Eurus Aero Token I, deployed on the Arbitrum layer-2 network.

Shares climbed 13.3% to $3.91 on the day the rebrand was announced. Despite that recovery, the stock remains down approximately 96% from its August 2025 peak.

The single-day gain reflects cautious optimism around the company’s new direction. Whether that momentum continues under the Forum Markets name remains to be seen.

RWA Strategy Positions Forum Markets for a More Stable Model

The shift toward tokenized real-world assets marks a fundamental change in how the company plans to generate and sustain value.

Forum Markets intends to develop tokenized products backed by tangible assets using regulated infrastructure. That approach moves away from the volatility associated with holding large crypto positions on a public balance sheet. The aviation leasing venture offered an early preview of where the company is headed.

Vincent Liu, chief investment officer at Kronos Research, addressed the structural risks that drove the retreat. “Single-asset treasury strategies are highly dependent on strong market conditions and sustained equity premiums,” Liu told Decrypt.

He added that treasury-focused firms ultimately need revenue-generating businesses and broader asset exposure to remain relevant long term.

His comments reflect a broader concern within the industry about the sustainability of crypto-only balance sheet models.

Liu also pointed to specific weaknesses tied to Ethereum-focused strategies. He described the model as fragile, noting that its value is “tightly linked to network activity,” thereby creating “a correlation trap where purchasing power weakens during ecosystem downturns.”

Fragmentation across Ethereum’s base layer and its layer-2 networks further dilutes the overall narrative and premium.

He added that the model is “further undermined by the absence of a hard supply cap, leaving its long-term scarcity proposition open to question.”

Forum Markets is set to begin trading under the FRMM ticker on March 2, replacing the former ETHZ symbol on the Nasdaq Capital Market.

The rebrand draws a clear line between the company’s failed crypto treasury experiment and its new asset-backed direction.

The transition reflects a growing recognition that public companies cannot sustain themselves on crypto price appreciation alone. Building regulated, revenue-linked products appears to be the model Forum Markets is now betting on.

Crypto World

Uniswap Fee Switch Vote Gains Momentum, Pushing UNI Higher by 15% in a Single Day

TLDR:

- UNI surged roughly 15% in 24 hours, outpacing Bitcoin’s 4.7% and Ether’s 8.5% gains during the same period.

- The governance proposal targets eight additional chains and would automate fee collection across all new v3 liquidity pools.

- Estimated new annualized revenue of $27 million would stack on top of $34 million already generated through UNI burns.

- Uniswap recorded $3.12 million in gross profit in Q1 2026, compared with effectively zero in all prior reporting periods.

A Uniswap governance vote to broaden its fee switch mechanism has pushed UNI higher by roughly 15% in 24 hours.

The proposal seeks to expand protocol fee capture across eight additional layer-2 chains. It would also automate fee collection across all v3 liquidity pools by default.

Estimates point to approximately $27 million in additional annualized revenue, building on the $34 million already generated through UNI burns since the fee switch launched late last year.

Uniswap Vote to Broaden Fee Switch Targets Multi-Chain Revenue

The governance vote to broaden the fee switch comes structured as two separate onchain proposals. Transaction limits required splitting the changes across two votes for technical reasons. Both votes target protocol fee activation across multiple blockchains beyond Ethereum.

Central to the proposal is a new tool called the v3OpenFeeAdapter. It applies protocol fees across all liquidity pools uniformly, based on each pool’s fee tier. This replaces the older model, which required governance to activate pools on a case-by-case basis.

The new system makes fee collection automatic for all newly created v3 pools going forward. This removes the need for repeated manual governance decisions for each pool. Over time, even long-tail trading pairs could begin contributing meaningfully to protocol revenue.

Since the fee switch first rolled out in late 2025, Uniswap has already burned over $5.5 million worth of UNI. That figure implies an annualized burn rate of around $34 million at current trading levels. The proposed expansion could layer an estimated $27 million more on top of that annual total.

UNI Climbs as Fee Switch Vote Draws Investor Attention

UNI’s 15% gain came as broader crypto markets also moved higher during the same period. Bitcoin rose around 4.7%, while Ether gained approximately 8.5% over 24 hours.

UNI’s move clearly outpaced both major assets, reflecting targeted investor interest in the governance vote.

The fee switch works by redirecting a share of trading fees away from liquidity providers toward the protocol treasury.

Those redirected funds support UNI token buybacks, burns, and treasury growth. This mechanism ties UNI’s market value more directly to Uniswap’s aggregate trading volume.

In Q1 2026, Uniswap posted roughly $3.12 million in gross profit, according to DeFi Llama data. That figure compares with effectively zero profit in periods before the fee switch activated.

The data reflects early but measurable progress in Uniswap’s shift toward a revenue-generating protocol.

Still, the broader vote to broaden the fee switch raises questions about liquidity competitiveness on layer-2 networks.

Fee-sensitive traders and market makers could shift activity to rival platforms offering better terms. How Uniswap manages that balance will likely shape both its revenue trajectory and UNI’s performance ahead.

Crypto World

U.S. regulator’s GENIUS pitch puts dark cloud over crypto sector’s stablecoin model

The crypto industry’s stablecoin operations, such as the arrangement between issuer Circle and leading exchange Coinbase, could be under serious pressure in the U.S. Office of the Comptroller of the Currency’s newly proposed set of stablecoin rules.

Even as OCC chief Jonathan Gould testified in the U.S. Senate on issues that included crypto oversight on Thursday, people in the industry said they’ve been trying to understand his agency’s 376-page proposal to regulate domestic issuers under the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act that became law last year. The allowance of stablecoin yield and reward has not only been central to the GENIUS Act, but it’s also been a chief negotiation point in the more important follow-up legislation known as the Digital Asset Market Clarity Act.

Close financial ties between issuers and crypto platforms that handle their tokens “would make it highly likely that the issuer’s payments of yield or interest would be made to the holder through an intermediary or an attempt the evade the GENIUS Act’s prohibition on interest and yield payments,” the OCC proposal suggested.

The firms can rebut that presumption, the OCC said, “given the issuer provides sufficient evidence to the contrary.”

On the controversial point of rewards, the industry has worked under an assumption that the GENIUS Act’s ban on yield or rewards offered by stablecoin issuers doesn’t extend to third parties that can offer their own rewards programs on those issuers’ tokens, such as at Coinbase. But the OCC’s proposed language assumes that the law’s prohibition would be improperly evaded under certain third-party relationships, though the details are still being studied by crypto lobbyists and lawyers.

Industry insiders who requested anonymity acknowledged this opening effort looks bad, and they’ll line up to try to get it changed, but some suggest the agency’s wording may leave enough room that continued rewards could be manageable.

Todd Phillips, a former lawyer at the Federal Deposit Insurance Corp. and business professor in Georgia who tracks digital assets policy, agreed the proposed language doesn’t seem like a hard no.

“I think there’s some play in the joints of what the OCC has proposed,” Phillips told CoinDesk on Thursday. He said the opening language seems uncertain on whether it means to “shut down all permutations of stablecoin rewards.”

“The OCC has clearly gone beyond what the statute requires,” Phillips said, adding that the extent of the restriction “is open to debate.”

The agency didn’t immediately respond to questions from CoinDesk.

The crypto industry’s primary policy aim in Washington is to advance the Clarity Act’s regulations for the overall U.S. digital asset markets. In that legislative negotiation, this issue of stablecoin yield has become one of the leading points of contention, with U.S. bankers arguing that such yield threatens their foundational dependence on customer deposits. During those talks, the crypto side has repeatedly argued that the GENIUS Act, as it stands, allows third party crypto firms to offer rewards on stablecoin holdings and activities.

One of the insiders in the negotiation told CoinDesk on Thursday that the OCC’s action should undermine the banks’ lobbying, because what’s the point of hashing out stablecoin yield in further legislation when the banking regulator has already taken it up as a proposed rule? Despite that, they also said the OCC overreached, and the industry will likely fight the proposed rulemaking even as the Clarity Act continues its way through Congress.

Meanwhile, the proposals advanced by Gould — a former chief legal officer at Bitfury who has otherwise been strongly supportive of the crypto industry — casts some doubt on industry confidence that GENIUS will protect stablecoin rewards programs, which represents a significant business at Coinbase. The U.S. crypto exchange hasn’t yet made any public statements, and a company spokesperson declined to comment.

The proposed rulemaking from the OCC, which charters and oversees national banks and trusts in the U.S., is preliminary, opening the ideas to a public comment period that would later have to be followed up with a final rulemaking process. With controversial rules, this process usually requires months of discussion and review.

If the OCC does cut off the ability of crypto platforms to extend stablecoin yield to customers, it may eliminate one of the Clarity Act sticking points, though other matters are also still standing in the way of the bill. Democratic lawmakers have insisted — for instance — that the legislation address potential conflicts of interest posed by senior government officials, such as President Donald Trump, personally profiting from the crypto industry.

At a Thursday hearing before the Senate Banking Committee, stablecoin rewards came up often as a business that scares the banking industry. Regulators suggested they haven’t yet seen a flight of deposits from banks.

“We have to take these concerns, the concerns of community banks, especially seriously,” said Senator Angela Alsobrooks, a Democrat who sought to negotiate a compromise in the Clarity Act to ban the crypto industry from rewards on stablecoin holdings in a way that resembles a deposit account. So far, negotiations among the political parties, the banks, the crypto industry and the White House haven’t yet advanced to a compromise that can get to a vote in the Senate.

Read More: OCC pitches stablecoin rules as U.S. Senate holds banking hearing in which crypto stars

Crypto World

BSC Fees Hit Multi-Month Lows as History Signals Bitcoin Rebound Ahead

The slowdown in on-chain activity echoes a similar lull last summer that came right before a huge rebound in Bitcoin.

The total fees paid on the Binance Smart Chain (BSC) recently fell to approximately $593,000, marking the network’s lowest usage cost since at least August 2025.

This collapse in transaction activity on one of crypto’s busiest highways is reviving memories of a similar demand drought last summer that immediately preceded a 95% rally in Bitcoin (BTC).

A Silent Market Flashes a Historic Signal

Blockchain fees are the clearest measure of user demand, representing what people pay to move tokens or use decentralized applications. When fees drop sharply, it signals reduced network congestion and waning speculative interest.

According to data from analyst Amr Taha, on February 23, BSC fees sank to $593,000, which is well below the $1.07 million trough recorded on August 7, 2025. At that time, Bitcoin was trading near $55,000, and, per Taha, the fee drop later helped form a major bottom before the asset embarked on a rally that saw its price shoot up by more than 95%.

The on-chain observer also flagged a steep drop in Bitcoin’s short-term holder realized market cap, which fell to about $386 billion on February 24, well below an earlier low of $440 billion recorded on April 8, 2025.

Historically, similar contractions have coincided with heavy capitulation phases that preceded rebounds, including the move that took BTC from around $78,000 to above $108,000 following the April 2025 low.

Derivatives and the Path to Recovery

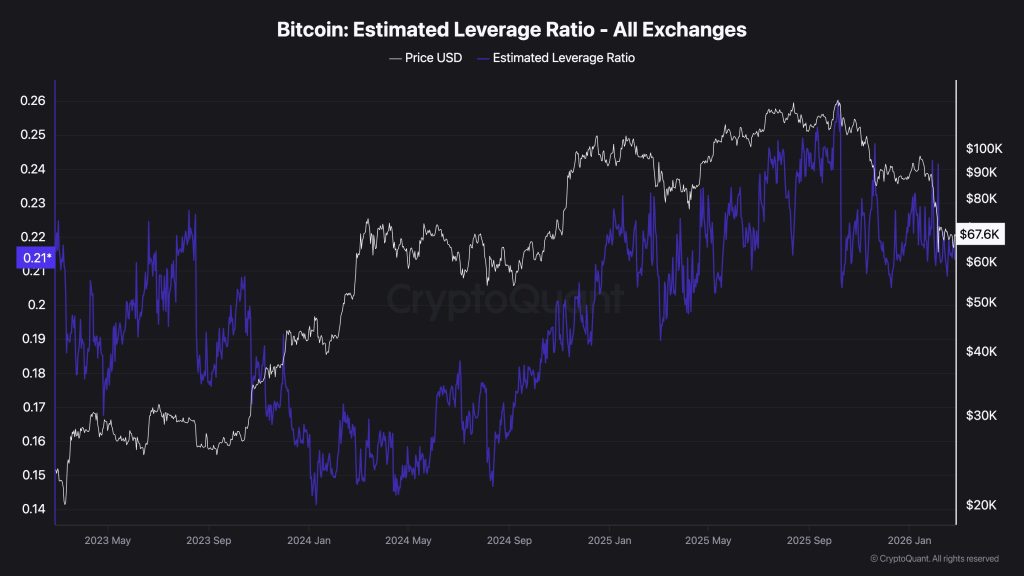

While the decline in spot activity signals caution, the derivatives market is undergoing a structural reset that could pave the way for the next move. According to XWIN Research Japan, open interest in Bitcoin futures has fallen sharply, reflecting a broad deleveraging phase. Analysts at the institution noted that the recent drop in price was accompanied by falling open interest, indicating that liquidations and derivatives-driven unwinds, rather than aggressive spot selling, drove the decline. This type of reset can stabilize the market, even if it does not immediately signal renewed demand.

You may also like:

Further complicating the outlook is the options market structure. Coinbase Institutional’s analysis shows a pronounced negative gamma band concentrated between $60,000 and $70,000. When dealers hold negative gamma, their hedging activity can amplify price moves, meaning a break below $60,000 could accelerate selling.

Despite the cautious tone, some on-chain indicators offer a glimmer of stability, with the Binance Fund Flow Ratio remaining low around 0.012, implying limited immediate sell-side pressure. During the recent drop toward the mid-$60,000 region, the ratio did not spike, meaning panic-driven spot inflows were absent.

However, as XWIN Research noted, weak inflows do not equal strong accumulation, and the medium-term trend of demand metrics has not yet turned decisively upward.

For a durable bottom to form, stronger spot volume support will be essential. As it stands, Bitcoin is trading just above $68,000 at the time of writing, down roughly 23% over the past month and more than 46% below its all-time high above $126,000.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Circle paid $461 million in distribution costs from $733 million reserve income in Q4

Circle sent 63% of Q4 USDC reserve income to distributors, compressing margins.

Summary

- Circle generated $733.4m in Q4 reserve income and paid $460.6m in distribution and transaction costs, leaving $272.8m net reserve income before operating expenses.

- USDC circulation hit $75.3b, up 72% YoY, with average USDC outstanding doubling to $76.2b and a 3.8% reserve return, down 68 bps YoY.

- “USDC on Platform” reached $12.5b, up 459% YoY, with a 17.8% daily weighted share of total supply, concentrating economics around a few key distributors.

Circle Internet Financial reported fourth quarter earnings showing the stablecoin issuer paid $460.6 million in distribution and transaction costs against $733.4 million in reserve income, representing approximately 63% of gross yield generated from customer deposits.

The company’s USDC stablecoin circulation reached $75.3 billion at year-end, up 72% year-over-year, according to the earnings report. Reserve income increased 69% while adjusted EBITDA grew fivefold compared to the prior year period.

Total revenue and reserve income reached $770.2 million for the quarter, with distribution costs accounting for nearly 60% of earnings, according to the financial statements. Circle retained $272.8 million in net reserve income after distribution payments.

The company publishes “Revenue Less Distribution Costs” as a core performance metric each quarter. Circle’s net reserve margin settled at 37% in the fourth quarter, meaning the issuer retained approximately $0.37 for every dollar of gross reserve yield.

Stablecoin issuers generate income by holding user deposits in reserve portfolios consisting primarily of short-term Treasury securities and similar instruments. Circle reported a 3.8% reserve return rate in the fourth quarter, down 68 basis points year-over-year. Average USDC in circulation doubled from $38.1 billion to $76.2 billion during the period.

Distribution costs rose 52% year-over-year, according to the earnings report. Circle attributed the increase to “increased distribution payments” to exchanges, wallets, and fintech platforms that provide user access. The prior-year period included a $60 million one-time fee to a distribution partner, previously disclosed.

Circle’s five-quarter trend data shows distributors consistently claimed approximately 63% of reserve income each quarter. Distribution payments are tied to placement agreements and transaction flows rather than fixed technology costs.

The company’s risk disclosures state it may be “unable to maintain existing relationships with financial institutions and similar firms or enter into new relationships.” Circle flags potential pressure to accept “less favorable financial terms” with distribution partners and highlights “dependence on a few key distributors” as a structural constraint.

Circle tracks a metric called “USDC on Platform,” measuring the share of total USDC held across partner platforms. That figure reached $12.5 billion at year-end, up 459% year-over-year, with a daily weighted average of 17.8% of total circulation, according to company data.

Treasury bill yields remained in the mid-3% range as of late February 2026. Market expectations contemplate potential Federal Reserve rate cuts in coming quarters, according to financial market data. A declining rate environment would compress reserve income while distribution costs may prove less flexible, potentially pressuring issuer margins.

Circle’s guidance reflects margin compression relative to the fourth quarter’s 40% RLDC margin, according to the company’s forward-looking statements. The guidance indicates distribution costs may not decline proportionally to reserve income in a lower-rate environment.

In most stablecoin implementations, users do not directly receive yield on their holdings. Issuers earn reserve income and negotiate distribution agreements with platforms that control user access. Distributors do not bear balance sheet risk associated with reserves.

The GENIUS Act, referenced in Circle’s regulatory disclosures, establishes a U.S. framework for payment stablecoins. The legislation formalizes regulatory requirements for stablecoin issuers.

Circle’s operational risk disclosures focus on distributor relationships rather than traditional liquidity concerns. The company states that major partners could change incentive structures, promote competing stablecoins, or develop proprietary infrastructure. Such shifts could reallocate transaction flows and distribution economics.

Circle’s reserves are liquid, audited, and managed conservatively, according to company disclosures. The balance sheet is structured to withstand redemption surges.

The company’s “USDC on Platform” metric monitors concentration of balances across distribution partners. Higher concentration on specific platforms affects negotiating leverage in distribution agreements.

Market dynamics in the stablecoin sector increasingly focus on securing and maintaining distribution relationships with platforms that control user access. Issuers compete for placement on exchanges, wallets, and payment rails that determine transaction flows.

Circle’s fourth quarter results showed the company generated $733.4 million in reserve income and allocated $460.6 million to distribution and transaction costs, leaving $272.8 million in net reserve income before operating expenses.

Circle Internet Financial reported fourth quarter earnings showing the stablecoin issuer paid $460.6 million in distribution and transaction costs against $733.4 million in reserve income, representing approximately 63% of gross yield generated from customer deposits.

The company’s USDC stablecoin circulation reached $75.3 billion at year-end, up 72% year-over-year, according to the earnings report. Reserve income increased 69% while adjusted EBITDA grew fivefold compared to the prior year period.

Total revenue and reserve income reached $770.2 million for the quarter, with distribution costs accounting for nearly 60% of earnings, according to the financial statements. Circle retained $272.8 million in net reserve income after distribution payments.

The company publishes “Revenue Less Distribution Costs” as a core performance metric each quarter. Circle’s net reserve margin settled at 37% in the fourth quarter, meaning the issuer retained approximately $0.37 for every dollar of gross reserve yield.

Stablecoin issuers generate income by holding user deposits in reserve portfolios consisting primarily of short-term Treasury securities and similar instruments. Circle reported a 3.8% reserve return rate in the fourth quarter, down 68 basis points year-over-year. Average USDC in circulation doubled from $38.1 billion to $76.2 billion during the period.

Distribution costs rose 52% year-over-year, according to the earnings report. Circle attributed the increase to “increased distribution payments” to exchanges, wallets, and fintech platforms that provide user access. The prior-year period included a $60 million one-time fee to a distribution partner, previously disclosed.

Circle’s five-quarter trend data shows distributors consistently claimed approximately 63% of reserve income each quarter. Distribution payments are tied to placement agreements and transaction flows rather than fixed technology costs.

The company’s risk disclosures state it may be “unable to maintain existing relationships with financial institutions and similar firms or enter into new relationships.” Circle flags potential pressure to accept “less favorable financial terms” with distribution partners and highlights “dependence on a few key distributors” as a structural constraint.

Circle tracks a metric called “USDC on Platform,” measuring the share of total USDC held across partner platforms. That figure reached $12.5 billion at year-end, up 459% year-over-year, with a daily weighted average of 17.8% of total circulation, according to company data.

Treasury bill yields remained in the mid-3% range as of late February 2026. Market expectations contemplate potential Federal Reserve rate cuts in coming quarters, according to financial market data. A declining rate environment would compress reserve income while distribution costs may prove less flexible, potentially pressuring issuer margins.

Circle’s guidance reflects margin compression relative to the fourth quarter’s 40% RLDC margin, according to the company’s forward-looking statements. The guidance indicates distribution costs may not decline proportionally to reserve income in a lower-rate environment.

In most stablecoin implementations, users do not directly receive yield on their holdings. Issuers earn reserve income and negotiate distribution agreements with platforms that control user access. Distributors do not bear balance sheet risk associated with reserves.

The GENIUS Act, referenced in Circle’s regulatory disclosures, establishes a U.S. framework for payment stablecoins. The legislation formalizes regulatory requirements for stablecoin issuers.

Circle’s operational risk disclosures focus on distributor relationships rather than traditional liquidity concerns. The company states that major partners could change incentive structures, promote competing stablecoins, or develop proprietary infrastructure. Such shifts could reallocate transaction flows and distribution economics.

Circle’s reserves are liquid, audited, and managed conservatively, according to company disclosures. The balance sheet is structured to withstand redemption surges.

The company’s “USDC on Platform” metric monitors concentration of balances across distribution partners. Higher concentration on specific platforms affects negotiating leverage in distribution agreements.

Market dynamics in the stablecoin sector increasingly focus on securing and maintaining distribution relationships with platforms that control user access. Issuers compete for placement on exchanges, wallets, and payment rails that determine transaction flows.

Circle’s fourth quarter results showed the company generated $733.4 million in reserve income and allocated $460.6 million to distribution and transaction costs, leaving $272.8 million in net reserve income before operating expenses.

Crypto World

Bitcoin ETF Inflows Rise While Derivatives Markets Reflect Caution

Key takeaways:

-

Bitcoin derivatives show persistent fear despite the current rally toward $70,000, as seen by futures premiums being pinned well below neutral levels.

-

The markets’ cautious stance stems from broad risk-aversion and lingering concerns over institutional BTC liquidations and Bitcoin network security.

Bitcoin (BTC) retested the $70,000 level on Wednesday, recovering from Tuesday’s low of $62,500. While inflows into Bitcoin exchange-traded funds (ETFs) helped stabilize market sentiment, the momentum failed to restore confidence within the BTC derivatives markets. Traders remain concerned that underlying factors are preventing a sustained rally toward $75,000.

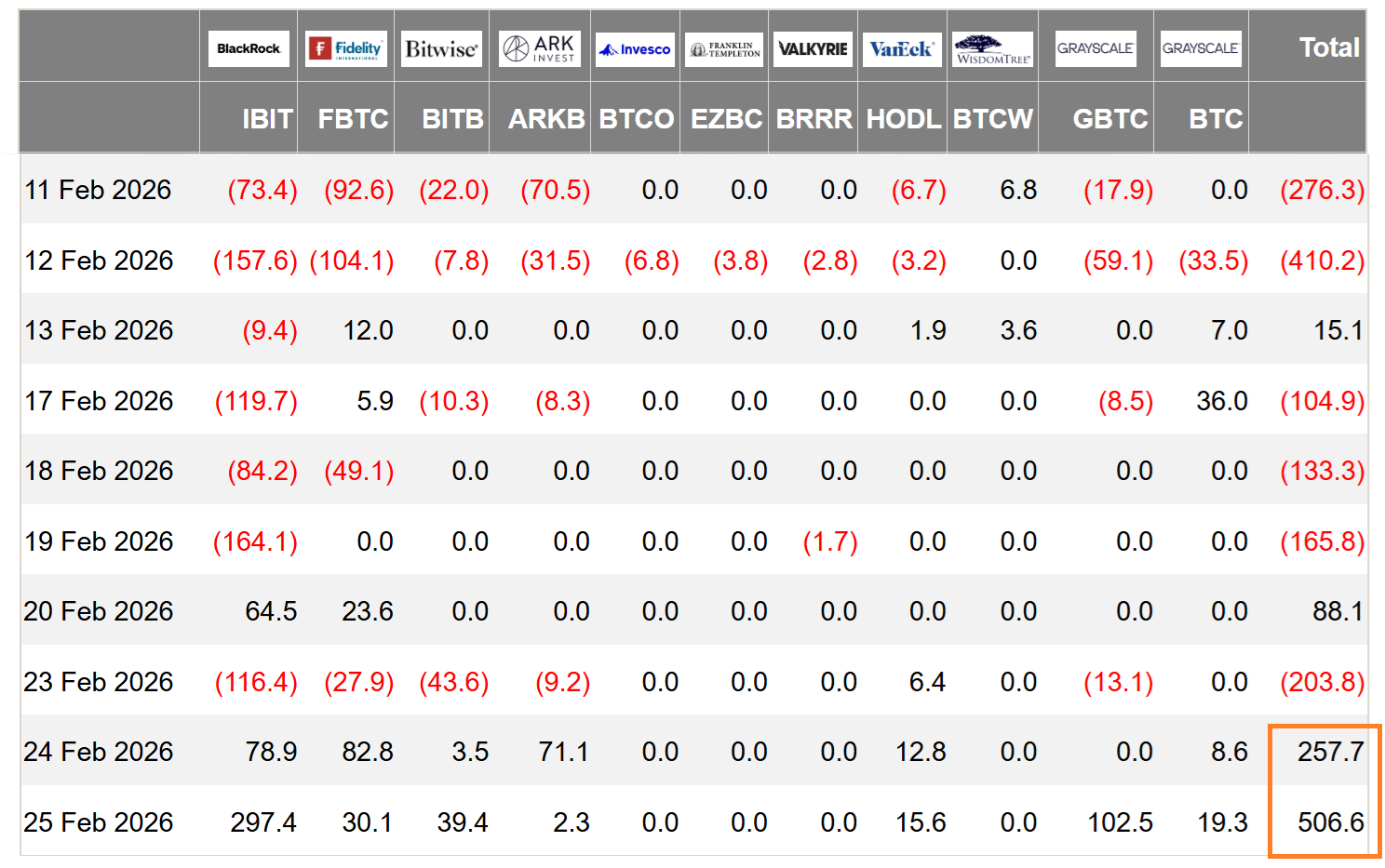

US-listed Bitcoin ETFs recorded $764 million in net inflows over two days, partially offsetting the $1.2 billion in outflows seen during the previous eight trading days. These large movements are typically attributed to institutional activity, suggesting strong demand when prices dip below $65,000.

Despite this demand, the appetite for leveraged bullish positions in BTC futures has dropped sharply.

The annualized premium for Bitcoin futures relative to spot markets sat at 2% on Thursday, remaining well below the 5% neutral threshold. Bullish momentum has been largely absent since Jan. 31, the date Bitcoin surrendered the $85,000 support level after holding it for over nine months. Data from the options market further indicates that professional traders are prioritizing the avoidance of downside exposure.

Bitcoin put (sell) options traded at a 14% premium compared to equivalent call (buy) instruments on Thursday. In a neutral market environment, this indicator typically fluctuates between -6% and +6%, signaling that fear remains a dominant force. Although this skew metric has improved from the 28% “panic” levels recorded on Tuesday, the recovery to $70,000 has done little to shift the cautious outlook of derivatives traders.

Is a single entity behind Bitcoin’s price weakness?

Recently, a number of unproven theories have been proposed to explain Bitcoin’s 32% decline over seven weeks. This downward trend began following the Oct. 10, 2025, market crash, which eliminated $19 billion in leveraged positions across the cryptocurrency sector. This volatility coincided with US President Donald Trump announcing a 100% increase in import tariffs on Chinese goods.

Following that event, Binance reportedly provided $283 million in compensation to users affected by liquidations attributed to internal oracle pricing errors, system latency, and asset transfer degradation. Binance co-founder and former CEO Changpeng “CZ” Zhao has since refuted allegations that the exchange intentionally triggered the October 2025 crash.

Other market participants have linked the recent bearishness to concerns over quantum computing. These fears intensified after Jefferies strategist Christopher Wood removed Bitcoin from his “Greed & Fear” model portfolio in January, citing potential risks to long-term security. In response, developers drafted a proposal, BIP-360, which focuses on advancing post-quantum cryptography onchain.

Related: Coin Bureau CEO on Bitcoin in 2026–Cycles, Liquidity and a Divided Market

The most recent explanation for Bitcoin’s lackluster performance involves the quantitative trading firm Jane Street. These claims gained momentum after Terraform Labs’ court-appointed administrator sued the company, alleging insider trading related to transactions that accelerated the collapse of the Terra Luna ecosystem in May 2022.

Jane Street’s recent 13-F filing disclosed significant holdings in BlackRock’s iShares Bitcoin Trust ETF and various Bitcoin mining companies. However, Julio Moreno, head of research at CryptoQuant, noted that such activity is typical for delta-neutral strategies.

Ultimately, the 5% decline in Nvidia (NVDA US) shares on Thursday following strong earnings suggests a growing risk-averse sentiment among investors, which may partially explain why Bitcoin struggles to reclaim the $75,000 level.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Pi Network price flashes rare bullish pattern amid upgrades and whale buying

Pi Network price has done well this month, moving from a low of $0.1295 on February 6 to the current $0.1700. It has formed a highly bullish pattern, pointing to more gains as key upgrades and whale buying continues.

Summary

- Pi Network price has formed a bullish flag pattern on the 12-hour chart.

- The network is undergoing a series of upgrades.

- Data shows that whales are continuing to accumulate the token.

Pi Coin (PI) price could be on the verge of a strong bullish breakout in the coming days. First, the network is carrying out a major upgrade as it seeks to move to the latest version of the Stellar Consensus Protocol. This upgrade, when fully implemented, will make Pi a faster network with more functionality.

In a statement on Thursday, the developers noted that the next main upgrade deadline will be on March 1. After moving to 19.9, there will be four main stages, with the final one expected to happen in April this year. It is common for cryptocurrencies to rebound ahead of a major upgrade.

Pi Network price will also benefit from the ongoing whale buying. Data shows that the number of whales jumped rose to 20, with the biggest one holding over 383 million coins. The whale has bought over 17 million Pi coins this month, a sign that he expects it to rebound over time.

Meanwhile, the team noted that they are working on more features. A major one is the plan to launch a KYC-as-a-Service feature, a move that will see it compete with popular platforms like Humanity Protocol and Worldcoin. This product will be based on the success of the ongoing KYC process that has verified over 16 million users.

The biggest catalyst for the Pi Network Coin price will be the potential Kraken listing. Kraken, a top American exchange, has signaled that it will list it this year. Such a listing will make it available in the United States, and likely put more pressure to other exchanges to list it.

Pi Network price has formed a bullish flag pattern

The 12-hour chart shows that the Pi Coin price has flashed key bullish patterns that may lead to more gains. It has formed a bullish flag pattern, which is made up of a vertical line and a descending channel. It has now exited the upper side of this channel, which may lead to more gains.

Pi Coin price has also remained above the Supertrend indicator, a sign that bulls are still in control. It also moved slightly above the 50-period moving average, while the Relative Strength Index is pointing upwards.

Therefore, the most likely Pi Network forecast is bullish, with the next key target being at $0.2065. This target is about 20% above the current level.

Crypto World

STRK price outlook as Starknet prepares to launch strkBTC, a shielded Bitcoin for private transactions

- strkBTC will enable private Bitcoin transactions on Starknet’s DeFi network.

- STRK is down nearly 70% in 90 days, closely tracking Bitcoin’s movements.

- The key STRK price levels to watch are the support at $0.04 and the resistance at $0.045.

Starknet is gearing up for a major move in the decentralised finance (DeFi) space with the upcoming launch of strkBTC, a Bitcoin-based asset designed to bring privacy and confidentiality to transactions on its Layer-2 network.

According to a press release by Starknet, the new asset will allow users to transact Bitcoin within DeFi without exposing balances or counterparties.

It is built with shielded transfers in mind, giving users the flexibility to maintain privacy while interacting with the DeFi ecosystem.

strkBTC will be issued deterministically from verifiable Bitcoin deposits, meaning that the minting process does not rely on discretionary control.

This ensures that the token’s supply mirrors actual Bitcoin deposits on the network, creating a transparent and verifiable foundation for its use.

Users can choose between public and shielded modes, enabling confidential transactions while still preserving regulatory compliance.

This is achieved through selective disclosure mechanisms, which allow necessary audits without exposing the broader network activity.

The launch of strkBTC is part of Starknet’s strategy to increase Bitcoin adoption in DeFi while addressing concerns that have historically held back institutional participation.

By combining privacy, composability, and auditability, Starknet aims to attract both retail and institutional users to its ecosystem.

Starknet (STRK) market reaction

Starknet’s native token, STRK, has been under significant pressure in recent months.

The token has dropped roughly 70% over the past 90 days, reflecting a broader trend in cryptocurrency markets.

Its current price sits near $0.042, with a 24-hour decline of over 8%.

However, market activity remains moderate, with a 24-hour trading volume of around $52 million and a total value locked (TVL) on the network of roughly $446 million.

The upcoming strkBTC launch may provide a catalyst for renewed interest.

The introduction of a privacy-focused Bitcoin asset could enhance the utility of the Starknet network and increase demand for STRK as a governance and utility token.

In addition, STRK’s performance is closely tied to Bitcoin’s price movements, and the stabilisation of BTC above $66,000 could help STRK consolidate in the range of $0.04 to $0.045.

On the other hand, a sustained move below $0.04 may see the STRK token test the $0.035 support zone.

Investors should also keep an eye on broader market sentiment indicators, such as the Fear & Greed Index.

Historically, movements out of extreme fear have preceded market rebounds, suggesting that even in a downtrend, relief rallies are possible.

STRK price forecast

Starknet (STRK) remains in a cautious position, with short-term consolidation possible, although long-term direction is dependent on broader crypto market recovery and the success of strkBTC’s adoption within Starknet’s DeFi ecosystem.

The launch of strkBTC adds an important layer of fundamental support for STRK, as the token’s utility within the network is set to increase.

For short-term traders, the key levels to watch include the immediate support at $0.04 and the resistance at $0.045.

A break above $0.045 could signal the start of a more sustained recovery, especially if Bitcoin shows strength simultaneously.

Conversely, a drop below $0.04 would likely signal further downside toward $0.035, continuing the current bearish trend.

Crypto World

Why Retail Is Moving From Crypto To Stock: Will They Comeback?

Retail activity in crypto fell off a cliff, and it seems they are moving elsewhere.

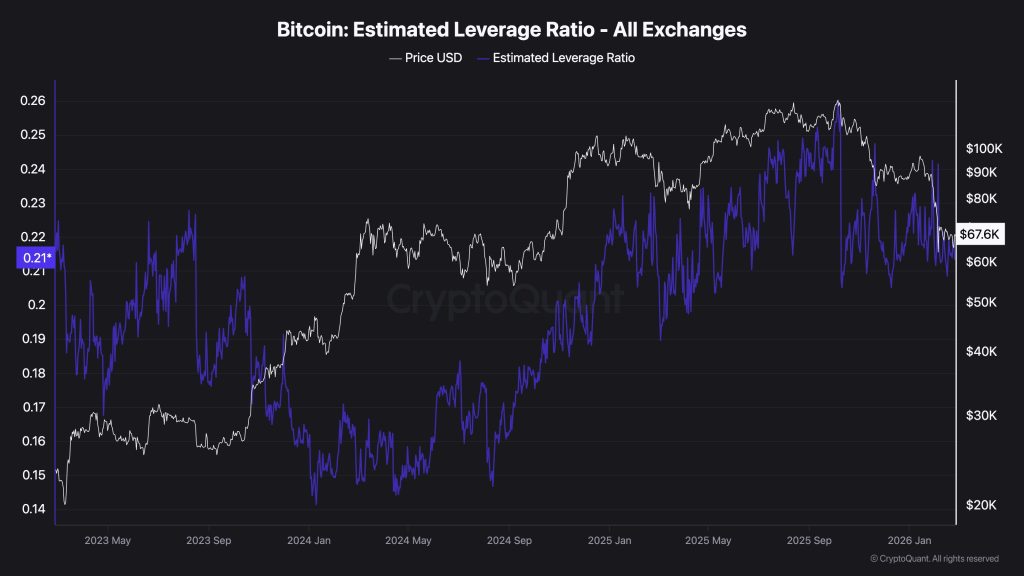

Spot volumes are down 25% to 30%, and Estimated Leverage Ratios have dropped 28%. This looks like capitulation, coming four months after Bitcoin topped at $126,000 and slid 46%.

Capital is rotating hard into equities. The old “buy the dip” reflex that defined the 2024–2025 run is fading. Liquidity on major exchanges is thinning, and instead of moving with tech stocks, crypto is starting to lose capital to them as traders choose stability over volatility.

Key Takeaways

- The Signal: Leverage Flushed: Estimated Leverage Ratios (ELR) plummeted from 0.1980 to 0.1414, wiping out speculative froth.

- The Data: Equities Rotation: Retail traders hit all-time high net inflows of $650 million into stocks and options in January 2026.

- The Outlook: Sideways Summer: Analysts predict range-bound action through mid-2026 as retail capital remains sidelined.

The Data Behind the Retail Crypto Liquidity Drain

The data is clear. The speculative engine has stalled. Estimated Leverage Ratios dropped 28%, sliding from 0.1980 to 0.1414.

Binance activity fell by about $4.71 billion, down 16.4%, with daily volume now near $24 billion. Without heavy retail participation, rebounds are weak and short-lived. Price is leaning on passive institutional flows rather than aggressive speculation.

The “digital gold” hype has cooled among short-term traders. After the fall from $126,000, fewer participants are willing to catch dips. The leverage reset suggests the high-risk crowd that drove the 2025 rally has either been liquidated or stepped aside.

People Are Moving From Crypto To Stocks

Retail is not moving to cash. It is moving to stocks.

In January 2026 alone, retail traders funneled $350 million into cash equities and more than $300 million into options. That is record flow. The shift is clear.

The BTC-to-Nasdaq volatility ratio has dropped below 2x. Stocks now offer comparable volatility with far smaller drawdowns. After a 46% Bitcoin correction, that trade-off looks rational to burned traders.

Institutions are still active in crypto through ETFs, but they provide floors, not frenzy. They accumulate quietly. They do not create viral rallies.

Meanwhile, the speculative energy has rotated to AI-driven equity names. Traders are using language models to dissect earnings and hunt for an edge in stocks. Compared to that, crypto currently looks opaque and momentum-starved.

Until retail risk appetite swings back, crypto is missing the explosive buy-side pressure that once fueled vertical moves.

Discover: Here are the crypto likely to explode!

The post Why Retail Is Moving From Crypto To Stock: Will They Comeback? appeared first on Cryptonews.

Crypto World

ZachXBT accuses Axiom employees of insider trading

A new investigation claims that employees at crypto trading platform Axiom abused internal tools to access private user data and profit from insider trading.

Summary

- ZachXBT released a report accusing Axiom Exchange employees of misusing internal tools to track private wallets.

- The investigation linked leaked dashboards, recorded calls, and on-chain data to alleged insider trading and coordinated memecoin activity.

- Unusual betting on Polymarket before the reveal raised further questions about information leaks and market manipulation.

On Feb. 26, blockchain investigator ZachXBT published a detailed report on X accusing staff at Axiom Exchange of misusing internal dashboards to track private wallets and trade ahead of users.

According to the report, one of the main figures involved was Broox Bauer, known online as @WheresBroox, a senior business development employee based in New York. ZachXBT said Bauer had access to internal systems that allowed him to search users by referral code, wallet address, or user ID.

Internal tools allegedly used to track private wallets

Recordings and leaked screenshots reviewed by the investigator show Bauer discussing how he researched 10 to 20 wallets at first and expanded gradually to avoid detection. In one clip, he claimed he could “find out anything” about an Axiom user.

In another, he outlined rules for requesting lookups and offered to share full wallet lists.

Screenshots from April and August 2025 allegedly showed internal dashboards displaying private wallet connections for traders identified as “Jerry” and “Monix.” Bauer also discussed tracking users who traded the memecoin AURA.

ZachXBT said the group compiled this information into Google Sheets, mapping wallet addresses linked to prominent traders and influencers. Several of those named reportedly confirmed that the data matched their private wallets.

One targeted trader, Marcell, was known for accumulating large token supplies before promoting projects to followers. Investigators said such traders were attractive targets because their private wallets were rarely public, making internal data especially valuable.

On-chain analysis linked Bauer’s main wallet and related addresses to heavy memecoin trading. Funds were traced to multiple centralized exchange deposit wallets, although ZachXBT noted that confirming exact insider trades would require Axiom’s internal logs.

The report also mentioned other employees and associates, including Ryan (Ryucio), Gowno (Seb), and a moderator known as Mystery, as being involved in or aware of lookup activity.

Axiom was founded in 2024 and later joined Y Combinator’s Winter 2025 batch. ZachXBT said the company had generated more than $390 million in revenue to date.

Polymarket bettors realize huge profits

The investigation also triggered unusual activity on Polymarket, where users had previously bet on which company would be exposed. In the days before the report, the market saw more than $23 million in volume.

Two wallets reportedly placed nearly $60,000 in bets on Axiom just hours before the reveal and earned about $109,000, according to data shared by Lookonchain. “Insiders making money on a bet about insider trading — interesting,” Lookonchain remarked.

Another trader, “predictorxyz,” wagered $65,800 when odds were below 14% and later made more than $411,000. Some analysts suggested these trades may have relied on non-public information.

Following the report, Axiom released a statement saying it was “shocked and disappointed” by the alleged misuse of internal tools. The company said it had removed access to the systems involved and launched an internal investigation.

ZachXBT criticized Axiom for weak access controls, noting that business development staff could view full wallet histories, nicknames, and linked accounts. He added that the case may fall under the jurisdiction of the Southern District of New York because Bauer is based in New York.

Whether criminal charges follow remains unclear. However, the report has renewed concerns about employee oversight, data security, and insider risk within fast-growing crypto platforms.

-

Video7 days ago

Video7 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics5 days ago

Politics5 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports3 days ago

Sports3 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics3 days ago

Politics3 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business2 days ago

Business2 days agoTrue Citrus debuts functional drink mix collection

-

Crypto World3 days ago

Crypto World3 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business4 days ago

Business4 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business4 days ago

Business4 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Tech2 days ago

Tech2 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat22 hours ago

NewsBeat22 hours agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat1 day ago

NewsBeat1 day agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat4 days ago

NewsBeat4 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech4 days ago

Tech4 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat4 days ago

NewsBeat4 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics4 days ago

Politics4 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat2 days ago

NewsBeat2 days agoPolice latest as search for missing woman enters day nine

-

Business19 hours ago

Business19 hours agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Crypto World2 days ago

Crypto World2 days agoEntering new markets without increasing payment costs

-

Sports3 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week