Crypto World

SafeMoon Scandal Ends With 8-Year Sentence for Ex-CEO

Former SafeMoon CEO Braden Karony sentenced to 8 years for fraud tied to $9 million in misused liquidity funds.

Braden John Karony, SafeMoon’s former CEO, has been sentenced to 8 years in prison for his role in a multi-million dollar crypto fraud scheme.

U.S. District Judge Eric Komite handed out the judgment in a Brooklyn federal court after a jury convicted him in May 2025 following a three-week trial.

Details of The Sentencing

Court documents show that Karony was found guilty of conspiracy to commit securities fraud, wire fraud, and money laundering. As part of the ruling, he has been ordered to forfeit approximately $7.5 million, while the amount of restitution to victims will be determined at a later date. The jury also issued a verdict instructing the forfeiture of two residential properties.

Meanwhile, one of his co-conspirators, Thomas Smith, pleaded guilty in February 2025 and is awaiting sentencing, while Kyle Nagy remains at large.

“Karony lied to investors from all walks of life—including military veterans and hard-working Americans—and defrauded thousands of victims in order to buy mansions, sports cars, and custom trucks,” said United States Attorney Joseph Nocella, Jr.

FBI Assistant Director in Charge James C. Barnacle said the former executive abused his position and betrayed investors’ trust by stealing more than $9 million in cryptocurrency to finance a lavish lifestyle. The proceeds were used to purchase luxury vehicles and real estate, including a $2.2 million home in Utah, additional homes in Kansas, a $277,000 Audi R8 sports car, a Tesla, a custom Ford F-550, and Jeep Gladiator pickup trucks.

IRS-CI New York Special Agent in Charge Harry T. Chavis added that Karony carried out the scheme by exploiting his access to SafeMoon’s liquidity pool while attempting to conceal the transactions, which law enforcement eventually traced, exposing the scheme.

Liquidity Pool Misrepresentations

SafeMoon tokens were launched in March 2021 by the firm on a public blockchain, with each transaction automatically subject to a 10% tax that was split into two 5% tranches. One was meant to be reflected to holders in proportion to their holdings, increasing their token balances, while the remaining 5% was designated for its pools to boost market liquidity.

You may also like:

In the months following its debut, SafeMoon attracted millions of customers and reached a market capitalization exceeding $8 billion.

Prosecutors claim that Karony and his partners lied about important details of the company, including false statements that its reserves were locked and could not be used for personal reasons, that tokens would only be used for specific business purposes, that digital asset pairs would be added to the liquidity pool manually when trades occurred on certain exchanges, and that the developers were not using or trading SafeMoon for their own gain.

In reality, they retained access to the liquidity pools and diverted millions of dollars’ worth of crypto for personal enrichment.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRP Faces Potential Downside Targets as Exchange Liquidity Levels Remain Unswept

TLDR:

- Three major exchanges show unswept XRP lows: KuCoin at $1.08, Bitfinex at $1.00, and Binance perp at $0.77.

- Historical mean-reversion data suggests 45% average pullback could target the $0.75 to $0.65 support zone.

- Seven exchange lows already swept including Poloniex, Gemini, Coinbase, Bitstamp, and Binance spot pairs.

- Two scenario paths emerge: rapid liquidity sweep with violent reversal or slow bleed to targets before bounce.

XRP price action has captured attention from technical analysts who point to specific exchange liquidity levels yet to be tested.

Crypto analyst EGRAG CRYPTO highlighted several key price points across major trading platforms that could serve as downside targets.

The analysis combines historical mean-reversion patterns with unfilled liquidity zones on exchange charts. Market participants now watch whether these levels will be reached before any reversal occurs.

Untapped Exchange Lows and Mean-Reversion Data

Three major exchange price levels remain unswept according to EGRAG CRYPTO’s recent analysis. KuCoin’s XRP/USDT pair shows a low of $1.08 that has not been taken yet.

Bitfinex recorded an XRP/USD low at $1.00 that also remains untouched. Binance perpetual futures for XRP/USD marked a wick down to $0.77 without a subsequent test.

The analyst contrasted these with already-swept levels across multiple platforms. Poloniex, Gemini, Coinbase, Bitstamp, TradingView, and Binance spot all saw their respective lows tested in recent price action.

Poloniex XRP/USDT touched $2.26 while the USD pair hit $2.17 during previous drawdowns. Gemini reached $2.10, Coinbase dropped to $1.77, and Bitstamp found support at $1.58 before bouncing.

Historical mean-reversion patterns from the Super Guppy indicator add context to potential downside projections. Cycle 1 showed approximately 50% retracement from local highs during previous corrections.

Cycle 2 demonstrated around 40% pullback before finding support and reversing. The average of these two cycles suggests roughly 45% mean reversion could occur.

Based on this historical data, the analyst projects a potential final sweep into the $0.75 to $0.65 range. This zone aligns with macro green uptrend support visible on longer-term charts.

The level also represents where remaining liquidity completion would occur across exchanges. An ascending triangle pattern on higher timeframes would remain structurally valid even with a move to this area.

Two Scenario Paths and Technical Structure

The analysis presents two distinct paths forward for XRP price development. The first scenario involves a rapid liquidity sweep followed by an immediate violent reclaim of higher levels.

This pattern typically generates the fastest reversals when market sentiment reaches maximum pain. Such moves often catch traders off guard after capitulation moments.

The alternative path involves a slower price bleed toward the $0.75 to $0.65 zone over an extended period. After tagging these levels and completing the liquidity sweep, a reversal would then commence.

Both scenarios ultimately lead to the same technical outcome despite different timeframes and volatility profiles.

EGRAG CRYPTO emphasized viewing this as structural price action rather than emotional market behavior. The analyst noted that Binance printed the most aggressive downward wick visible on current charts.

The commentary stressed that tolerance for potential moves to $0.75 to $0.65 separates long-term holders from short-term participants.

The analyst disclosed maintaining a long-term position untouched while actively trading the macro range. Dollar-cost averaging continues for core holdings alongside cash reserves held for optimal entry timing.

This approach separates strategic accumulation from tactical trading within the broader price structure.

Crypto World

In-App Trading coming to X in a ‘Couple’ of Weeks

The upcoming Smart Cashtags feature on the X social media platform will allow users to trade stocks and crypto directly within the application, according to Nikita Bier, X’s head of product.

“We are launching a number of features in a couple of weeks, including Smart Cashtags that will enable you to trade stocks and crypto directly from the timeline,” Bier said in an X post on Saturday.

Bier announced the upcoming rollout of Smart Cashtags in January, teasing the possibility of in-app trading in an image showing the feature in the announcement, but no official confirmation.

The X platform introduced a basic Cashtag system in 2022 that tracked the prices of major stocks and cryptocurrencies and provided visual financial data for supported assets, including Bitcoin (BTC) and Ether (ETH), but the feature was discontinued.

Cointelegraph reached out to X about the upcoming feature, but did not receive a response by the time of publication.

The X platform is a hub of crypto-related activity, and the integration of in-app trading brings it closer to owner Elon Musk’s stated goal of becoming an “everything app,” similar to WeChat, a messaging and social media app in China with integrated payment features.

Related: Musk’s xAI seeks crypto expert to train AI on market analysis

X inches into payments as it attempts to become an “everything app”

Elon Musk provided an update on Wednesday for the launch timeline of X Money, the platform’s payments feature that will allow users to send each other money, similar to Venmo or Cash App.

Speaking at his AI company xAI’s “All Hands” presentation, Musk said the X Money feature is still in a limited beta testing phase over the next two months, with a worldwide rollout after the testing phase concludes.

“This is intended to be the place where all money is. The central source of all monetary transactions,” he said.

The X platform has about 600 million average monthly users, according to Musk. “We want it to be such that if you wanted to, you could live your life on the X app,” he added.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Bitcoin Bulls Surge to $69K as Retail Traders Push Short Positions

Bitcoin rose to around $69,482 on Friday as fresh on-chain data showed continued accumulation from smaller holders in February. Analysts say the breakout could evolve into a broader bullish phase, though other signals point to a period of consolidation underlying any uptrend.

Key takeaways

- BTC breached the $69,000 resistance and broke out of its descending channel, triggering roughly $92 million in short liquidations within four hours.

- Small wallets ($0–$10,000) added about $613 million in cumulative volume delta (CVD) in February, while the whale cohort pulled back with outflows totaling around $4.5 billion for the month.

- The short-term holder SOPR (spent output profit ratio) hit its lowest level since November 2022, signaling near-term selling pressure among new buyers.

- Futures activity surged, with about $96 million in liquidations over the last four hours and $92 million coming from short positions, indicating a pronounced short squeeze dynamic.

- Platform concentration of liquidations pointed to Bybit (22.5%), Hyperliquid (22%), and Gate (15%), suggesting a notable share of leveraged exposure remains focused on a few venues.

Tickers mentioned: $BTC

Sentiment: Bullish

Price impact: Positive. The breakout above key resistance and a short-squeeze setup imply potential momentum amplification in the near term.

Market context: The move occurs amid fluctuating liquidity and cautious risk sentiment, with February data showing persistent retail demand alongside mixed behavior from larger holders. The broader market is navigating competing signals—on-chain accumulation in small wallets versus continued distribution among whales—suggesting a nuanced backdrop for the next leg higher.

Why it matters

From a macro perspective, the latest price action underscores the ongoing tension between continuation bias and consolidation risk in Bitcoin’s cycle. An upward break above the immediate price zone around $69,000 can be interpreted as the market testing a new structural floor after several weeks of choppy trading. If the price sustains above the $68,000 level, traders will watch for sustained momentum that could push BTC toward higher liquidity pockets near $71,500 and potentially $74,000. The compressed 50- and 100-period exponential moving averages on shorter timeframes lend credence to a temporary acceleration, as price and trend indicators converge and traders reevaluate risk premia as they observe market microstructure shifts in real time. The immediate turnover in the market—brief futures liquidations and a short squeeze—also hints at sentiment that remains fragile among freshly minted entrants, even as the price action signals renewed demand from smaller holders. The net effect is a market that is briefly more constructive than it was in the immediate prior weeks, but with a cadence of caution that could persist as observers parse macro signals and evolving liquidity conditions.

On-chain activity provides a nuanced lens on who is driving the move. February’s data shows a clear split in behavior between retail and institutional-like holders. Small wallets accumulating $613 million in CVD indicates that ordinary buyers were active and willing to step in during price dips, potentially underpinning a floor under the current rally. In contrast, larger holders have not yet shown a decisive pivot; whale wallets remained net negative earlier in February and have since paused in a clear accumulation pattern, but without a definitive breakout. That divergence is a reminder that the next phase of the rally could hinge on whether large holders re-embrace accumulation or liquidity remains anchored by retail demand alone. The dynamic raises the possibility that the market could consolidate or retest prior highs before a broader, sustained ascent takes hold.

The data on liquidations helps explain the near-term price behavior. A near-term surge in futures liquidations, concentrated among a handful of platforms, points to a short-squeeze dynamic that can propel prices beyond technical resistances when hedged bets unwind in tandem. Bybit, Hyperliquid, and Gate accounted for a substantial share of these liquidations, implying that the most active leveraged positions were concentrated on a few venues. This pattern, paired with the evolving SOPR trajectory, suggests that profit-taking among the most recent entrants could re-emerge if the price fails to sustain higher levels or if macro catalysts reassert caution. Yet, the same microstructure signals a broader appetite for risk among retail participants who were able to bid in February and now appear poised to participate again as price action builds confidence in new higher ranges.

For market observers, the question is whether the relief rally can evolve into a durable advance or if February’s accumulation remains a testing ground before a more persistent trend establishes itself. The short-term indicators—targets near $71,500 and then $74,000, along with ongoing EMA compression—favor a continuation scenario, provided the price can hold above critical zones and avoid a reversion into broad choppiness. If new data show sustained SOPR above 1 or a clear uptick in whale accumulation, the bullish narrative strengthens. Conversely, a failure to hold supports, or a renewed wave of selling pressure from larger holders, could trigger a deeper correction and a renewed phase of consolidation. The market’s path remains contingent on a blend of price action, on-chain signals, and liquidity dynamics that define Bitcoin’s near-term trajectory.

For observers who track the price action closely, the key is to balance the optimism of retail-driven demand with the caution demanded by the absence of a decisive, broad-based accumulation signal from the largest holders. The coming sessions will be telling as traders weigh the momentum indicators against macro signals and the shifting risk appetite that continues to shape liquidity in the crypto markets. The current setup is a reminder that while a breakout can ignite a new leg higher, the exact path is inherently data-driven, and the next move will depend on whether the market can convert short-term momentum into a more durable trend.

All told, Bitcoin’s latest move shows a market that is ready to test higher levels but remains susceptible to pullbacks if macro cues deteriorate or if the on-chain narrative shifts away from retail-led demand. The coming days will be pivotal for traders seeking clarity on whether this rally represents a sustainable breakout or a transient relief rally within a broader consolidation phase.

For further context on price action and on-chain indicators used in this assessment, see the ongoing chart surveillance available via the BTCUSDT data feed on TradingView.

Crypto World

SOL Holders Could Face New Risk

Solana price has moved sideways in recent sessions, showing consolidation rather than decisive recovery. Despite this bounce, investor behavior suggests confidence remains limited across the broader crypto market.

The past 10 days have reflected relative stability within a defined trading range. However, stability has not translated into renewed accumulation.

Sponsored

Sponsored

Solana Is Losing New Holders’ Confidence

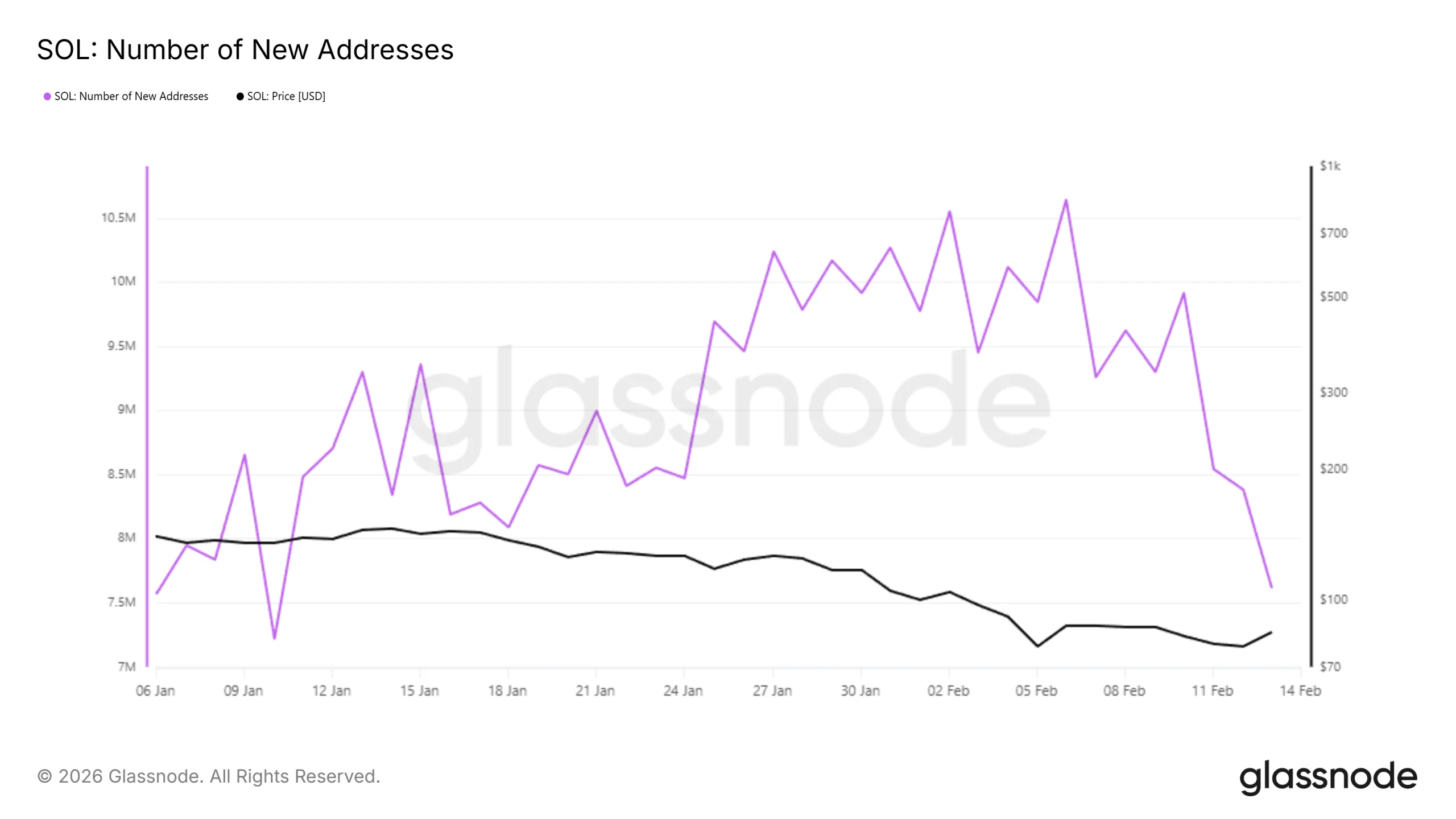

New Solana investors were the first to reduce activity. Addresses completing their first transaction on the network are classified as new addresses. Earlier this year, Solana recorded nearly 10 million new addresses at peak engagement.

Over the past four days, that number has declined by 23% to 7.62 million. The contraction signals a slowing of onboarding momentum. Reduced network expansion often reflects hesitation among prospective buyers waiting for clearer recovery signals.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This pullback indicates that holders expect stronger upside confirmation before returning aggressively. Many appear unwilling to chase short-term rallies. Until consistent price appreciation emerges, onboarding growth may remain subdued.

Solana Holders Are Also Pulling Back

Exchange net position change data highlights a shift from buying to selling pressure. Green bars represent inflows to exchanges, which typically signal intent to sell during bearish phases. Recent readings show increasing transfers of SOL to trading platforms.

Sponsored

Sponsored

Approximately 1.4 million SOL entered exchanges over the last 48 hours, worth around $117 million. Such inflows increase available supply on exchanges. Elevated balances can limit upside momentum if buyers fail to absorb distribution.

If SOL price continues rising, short-term holders may intensify profit-taking. That behavior often caps rallies in range-bound markets. Sustained inflows would reinforce consolidation rather than support a sustained breakout.

SOL Price Breakout Unlikely

Solana price remains range-bound between $89 resistance and $78 support. The current level at $86 places SOL near the midpoint of this channel. While the 10% daily gain improves sentiment, broader recovery remains uncertain.

Given slowing new address growth and rising exchange inflows, downside risk persists. A failure to hold $78 could send SOL toward $67. Such a move would confirm the continuation of the prevailing bearish structure.

If investors halt selling and inflows diminish, SOL could challenge $89 resistance. A breakout above that level may push the price toward $97. Sustained strength beyond $97 could target $105, invalidating the bearish thesis and signaling structural recovery.

Crypto World

Crypto Group Gives Major CLARITY Act Waring to US Congress

The Digital Chamber, a leading cryptocurrency advocacy group, has urged the US Congress to preserve yield-generating capabilities for payment stablecoins.

In its latest proposal, the group argued that current legislative drafts in the CLARITY Act threaten to outlaw the fundamental mechanics of DeFi.

Sponsored

Digital Chamber Urges Congress to Preserve Stablecoin Yields

The group specifically petitioned lawmakers to retain the exemptions in Section 404 of the proposed CLARITY Act.

These provisions distinguish between traditional “interest,” which banks pay on insured deposits, and other interest rates. They effectively separate this income from “rewards” derived from liquidity provision (LP) activities on decentralized exchanges.

The Chamber warned that removing these exemptions would not only stifle domestic innovation but also “undermine dollar dominance.”

The group posits that if US-regulated stablecoins are legally barred from participating in DeFi markets, global capital will inevitably flow to foreign-issued digital assets or unregulated offshore entities.

Sponsored

This shift, they argue, would effectively reduce demand for the US dollar in the digital economy.

Furthermore, the advocacy group stressed that a total ban on yields would force users into passive holding strategies.

According to them, this could, ironically, increase financial exposure to “impermanent loss.” This is a risk associated with asset volatility in liquidity pools.

Sponsored

Digital Chamber Offers Regulatory Concessions

Notably, the banking lobby contends that allowing stablecoins to offer yield without complying with banking capital requirements creates a dangerous arbitrage opportunity.

They argue that this regulatory gap threatens to destabilize the entire financial system. They also claimed that high-yield stablecoins would siphon liquidity away from community banks.

As a proposed compromise, the Chamber suggested mandating clear consumer disclosures to clarify that stablecoin yields are not comparable to bank interest rates and are not FDIC-insured.

Sponsored

Additionally, they recommended that regulators conduct a federal “Deposit Impact” study two years after the bill becomes law.

The group argues that this empirical data will prove that stablecoins complement, rather than disrupt, the traditional banking sector.

The recommendations arrive as negotiations on a comprehensive market-structure bill (CLARITY Act) reach a critical impasse.

A high-stakes meeting at the White House earlier this week between banking representatives and cryptocurrency executives reportedly ended in deadlock.

Wall Street lobbyists remain staunchly opposed to any measure that would allow non-bank stablecoin issuers to pass yields to customers, viewing such products as a direct threat to the traditional depository model.

Crypto World

What Happened to Compound’s Crypto Lending Empire?

Compound was an OG of DeFi lending, but missteps have knocked it off its perch.

Compound was once the default answer for crypto lending in decentralized finance. Launched in 2018 by Robert Leshner and Geoffrey Hayes, the protocol lets users earn interest or borrow assets directly on Ethereum, in a fully decentralized manner, without banks or brokers.

For early DeFi users, it felt obvious. The project raised millions in backing from Andreessen Horowitz, Bain Capital Crypto, Paradigm, and Coinbase Ventures.

Compound also helped popularize yield farming, especially after launching its governance token, COMP, in 2020, which turned passive users into active participants.

By 2021, Compound was the core infrastructure for crypto lending. Billions of dollars sat in its smart contracts. Other protocols like Yearn Finance and exchanges like Coinbase also integrated it, cementing the protocol’s dominance in the space.

That changed in October 2021, when the protocol’s liquidity began to thin quickly.

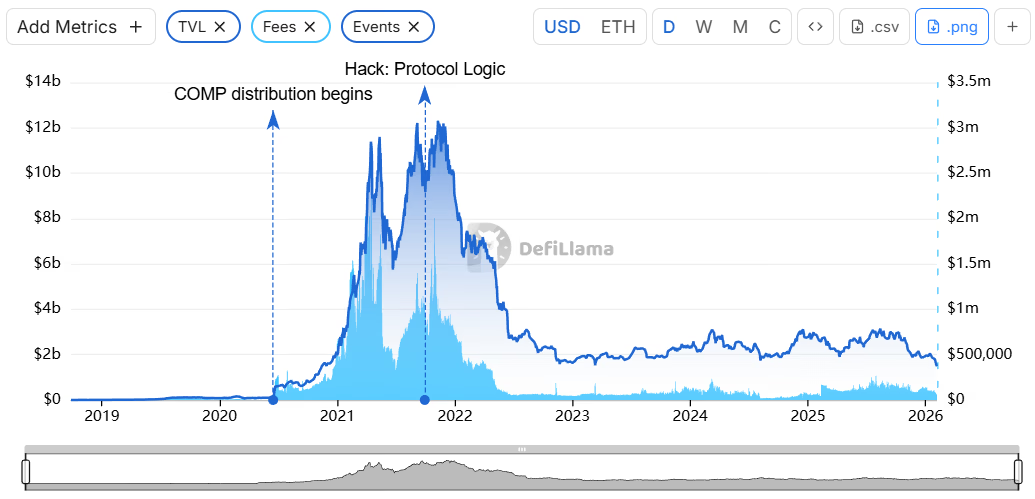

The decline is evident in Compound’s total value locked (TVL), which fell sharply from a November 2021 peak of $12 billion to just $2.2 billion by November 2022, per data from DefiLlama.

Value Leak

The problems began when a protocol update called “Proposal 62,” intended to adjust COMP rewards, went live with a bug. As a result, the protocol began overpaying rewards, leaking tens of millions of dollars’ worth of COMP to users.

Because of how Compound governance worked, the team couldn’t immediately stop it. The fix had to wait through a mandatory timelock. In the meantime, tokens kept flowing out, and confidence in the protocol’s stability went with them.

In an X post on Sept. 30, 2021 Leshner asked recipients who received excess COMP to return it and offered a 10% reward for whitehat returns.

He added that “otherwise, it’s being reported as income to the IRS, and most of you are doxxed.” The threat sparked swift backlash from the crypto community, and Leshner later called it a bone-headed post and walked it back.

But funds continued to leave, and tens of millions of dollars flowed out of the protocol in the weeks after the bug was discovered. Even though the issue was fixed, the incident was enough to shake confidence.

Bad Timing

It’s hard to say if the October 2021 bug alone ended Compound’s dominance, but it clearly left the protocol vulnerable at a bad time. By December 2021, Bitcoin had started falling from its $69,000 all-time high, signaling the start of a multi‑year crypto bear market.

As crypto prices fell, lending activity slowed across DeFi as borrowers began pulling funds. For Compound, which relied heavily on pooled liquidity markets, those outflows hit harder than rivals like Aave and Maker, which were built around isolated or more flexible risk models.

The contrast became clearer as the 2022 crypto winter came in. After Terra’s multi-billion dollar collapse, the implosion of FTX, and a string of centralized lender failures, the crypto community grew more sensitive to systemic risk.

Behind the scenes, leadership was changing too. Leshner stepped back from day-to-day involvement, and by June 2023, he left Compound and founded Superstate, a tokenization platform that allows companies to issue and trade their public shares on blockchain.

As a result, today Compound looks markedly different from its peak, when crypto lending was still taking off. Today, Compound’s once double-digit TVL sits at just below $1.4 billion. That makes it the 7th largest lending protocol in DeFi by TVL, where Aave dominates with a TVL of nearly $27 billion.

Monthly fees have dropped from a 2021 peak of nearly $47 million to about $3.5 million, while the protocol’s highest monthly revenue since the start of 2025 was $888,666, down from an all-time high of $5.14 million in April 2021.

Compound declined The Defiant’s request for comment for this story.

Crypto World

Bitcoin Shorts Hit Extreme, Last Time BTC Exploded 83%

Bitcoin price is attempting another breakout toward $70,000 after weeks of choppy consolidation. BTC trades at $69,815 at publication, sitting just below the $70,610 resistance level. The largest cryptocurrency is trying to recover recent losses, yet mixed on-chain and derivatives signals present an uncertain short-term outlook.

Market participants are closely watching this psychological threshold. A sustained move above $70,000 could shift sentiment decisively. However, persistent bearish positioning suggests that volatility may intensify before a clear trend emerges.

Sponsored

Bitcoin Shorts Resemble The Past

Aggregated funding rate data across major crypto exchanges shows an extreme surge in short positioning. Current negative funding levels are the deepest since August 2024. That period ultimately marked a significant Bitcoin bottom.

In August 2024, traders crowded into downside bets as funding rates plunged. Instead of continuing lower, Bitcoin reversed sharply. The reversal triggered widespread short liquidations and fueled an approximately 83% rally over the following four months.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Deeply negative funding rates signal heavy bearish positioning and widespread fear, uncertainty, and doubt (FUD). While this setup does not guarantee immediate upside, it creates a fragile structure. If price rises, forced short-covering could amplify volatility and accelerate upward momentum.

Sponsored

Bitcoin Towards Capitulation

The Net Unrealized Profit and Loss, or NUPL, indicator has returned to the Hope/Fear zone near 0.18. This reading shows that profit cushions among holders are thin. When NUPL enters this regime, market behavior tends to become reactive.

Historically, declines into this zone often preceded extended weakness. Panic selling typically intensifies before a durable bottom forms. Unless capitulation resets sentiment, Bitcoin may remain vulnerable to deeper pullbacks before stabilizing.

Sponsored

What Does The Short-Term Outlook Look Like?

Short-term technical cues suggest improving momentum. The Chaikin Money Flow, which measures capital inflows and outflows, is approaching the zero line. A confirmed move into positive territory would signal renewed demand for Bitcoin.

Simultaneously, the Moving Average Convergence Divergence indicator is nearing a bullish crossover. A confirmed crossover would indicate a shift from bearish to bullish momentum. However, early signals require validation through sustained price strength.

Even with improving indicators, broader sentiment remains cautious. Shorts are unlikely to close voluntarily under weak conditions. This dynamic increases the probability that a price-driven liquidation event becomes the catalyst for recovery.

Sponsored

BTC Price Needs a Strong Push

Bitcoin trades at $69,815 and remains capped below $70,610 resistance. The $70,000 level represents a critical psychological barrier. A decisive close above this threshold could trigger renewed bullish momentum and attract fresh capital inflows.

However, bearish pressure persists in derivatives markets. Continued dominance of short contracts could keep BTC below $70,000. A breakdown below $65,156 support may trigger long liquidations and intensify downside volatility.

If Bitcoin secures strong investor support and overcomes selling pressure above $70,000, upside targets emerge. A rally toward $73,499 could develop quickly.

Sustained strength may extend gains toward $76,685, invalidating the bearish thesis and confirming a broader recovery attempt.

Crypto World

All Social Benefits Can Be Distributed Onchain, Says Compliance Exec

Blockchain technology is increasingly being viewed as a practical backbone for distributing social benefits, though regulatory guardrails remain a central challenge for governments testing on-chain tools. In the Marshall Islands, guidance from Guidepost Solutions on regulatory compliance and sanctions framework accompanies the rollout of a tokenized debt instrument known as USDM1, issued by the state and backed 1:1 by short-term U.S. Treasuries. Separately, the country launched a Universal Basic Income (UBI) program in November 2025, delivering quarterly payments directly to citizens via a mobile wallet. As proponents point out, digital delivery can accelerate provisioning and provide auditable trails for expenditures, but the path to widescale adoption is entangled with anti-money laundering (AML) and know-your-customer (KYC) requirements that regulators say are non-negotiable.

Key takeaways

- Tokenized government debt is expanding, with asset-backed bonds that settle rapidly and offer fractional ownership gaining traction in pilots and policy discussions.

- The Marshall Islands’ UBI program, distributed through a digital wallet since November 2025, exemplifies how on-chain tools can reach citizens directly, pending robust AML/KYC controls.

- Regulators view AML and sanctions compliance as the largest risk in issuing on-chain bonds to the public, underscoring the need for rigorous oversight in tokenized finance.

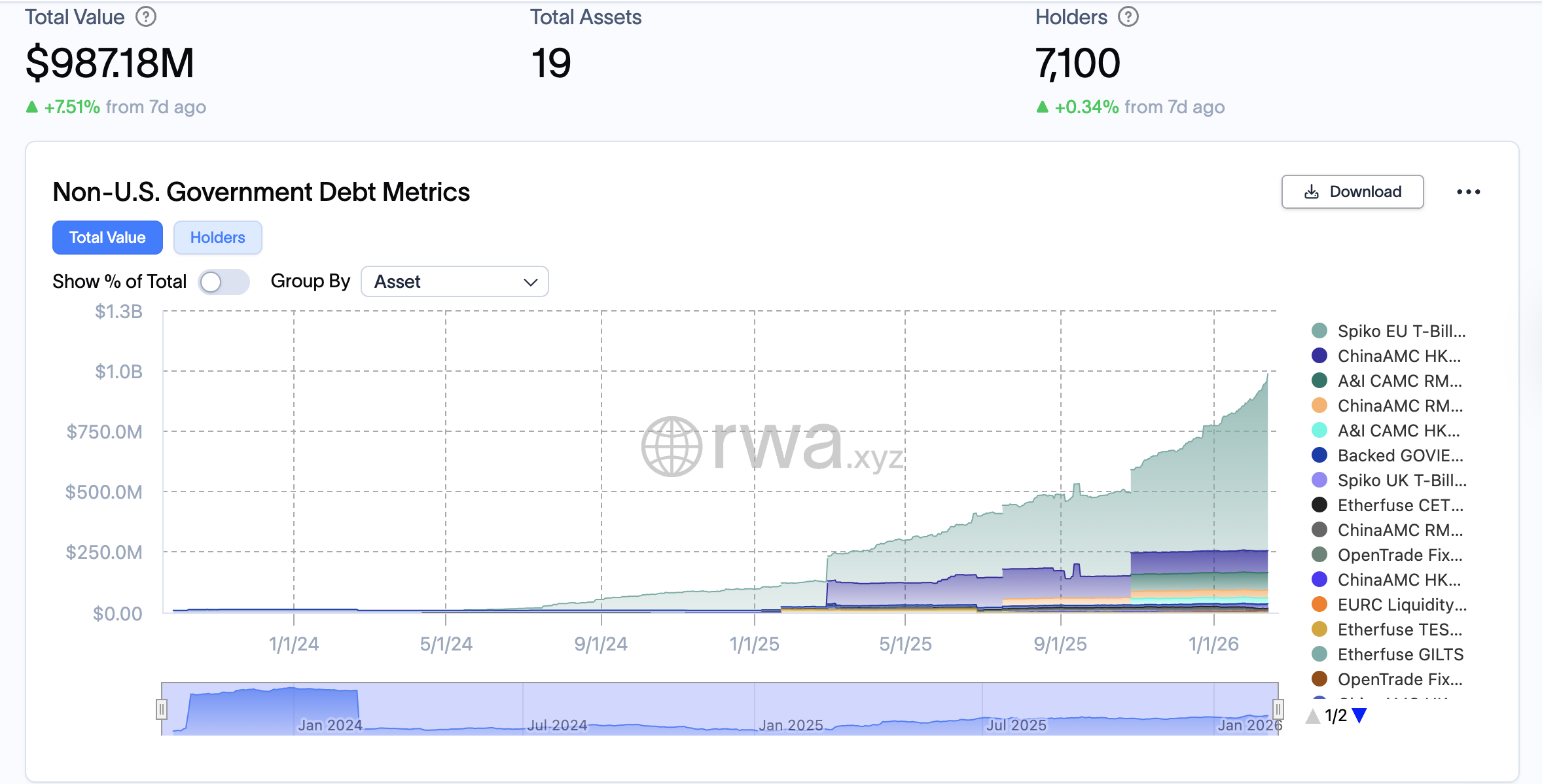

- Data show a sharp rise in tokenized U.S. Treasuries, illustrating growing demand for programmable settlement and auditable fund flows in public debt markets.

- Analysts forecast meaningful growth for the tokenized bond market, with projections pointing to hundreds of billions of dollars by decade’s end, contingent on regulatory clarity.

Market context: The push toward tokenized government debt and on-chain social benefits sits amid a broader push to modernize public finance and expand financial inclusion. Jurisdictions are piloting tokenized instruments to cut settlement times and reduce transaction costs, while also grappling with the necessary compliance architecture. The United Kingdom has taken a parallel step, with HSBC appointed for a tokenized gilt pilot, signaling cross-border interest in the model. Data from Token Terminal indicate the tokenized U.S. Treasury market has grown more than 50-fold since 2024, highlighting the rapid shift toward on-chain finance in a $X trillion debt ecosystem. Analysts, including Lamine Brahimi, co-founder of Taurus SA, project the tokenized bond market could surge to around $300 billion by 2030, a forecast that reflects both demand for digital liquidity tools and the continuing need for robust governance.

Why it matters

The Marshall Islands’ approach illustrates how tokenization can reshape public finance and social programs alike. By backing a debt instrument 1:1 with short-term U.S. Treasuries and tying it to a regulatory framework shaped by a risk-focused compliance firm, the government aims to attract legitimate investment while maintaining guardrails against misuse. The on-chain UBI experiment is a practical testbed for direct-to-citizen distributions, where quarterly payments flow through a digital wallet rather than traditional channels. The potential benefits—faster disbursement, traceable expenditure lines, and a more inclusive financial system—could extend beyond the Marshall Islands, offering a blueprint for other nations seeking to streamline welfare programs and debt issuance through programmable money.

However, the regulatory reality remains central. AML requirements and sanctions screening are highlighted by experts as the most significant obstacles to broad adoption. Governments issuing tokenized bonds must collect know-your-customer information to ensure funds reach the intended beneficiaries, while also ensuring that sanctions regimes are not breached through on-chain channels. The tension between innovation and compliance is not unique to the Marshall Islands; it is echoed in wider discussions about tokenization of public assets and the need for robust, interoperable standards that can scale across borders without compromising security or oversight.

From an investor and builder perspective, the narrative is equally nuanced. Tokenization promises near-instant settlement and fractional ownership, expanding access to assets that were previously illiquid or inaccessible to ordinary individuals. The growth in the tokenized debt market, as tracked by data platforms like Token Terminal, is often cited as evidence that digital-native debt instruments can coexist with traditional markets while offering new forms of liquidity and programmability. Yet the same data underline that progress hinges on a stable policy environment—one that defines privacy, censorship-resistance, anti-fraud controls, and cross-border enforcement mechanisms. The broader ecosystem’s trajectory will be shaped by how quickly regulators can translate principles into scalable, enforceable rules without stifling innovation.

In parallel, pilots such as the UK gilt initiative and other tokenization efforts illustrate that government-sponsored projects are moving from theory toward real-world applications. The combination of digital governance with financial instrumentation could unlock new funding channels and enable more responsive social programs, provided that the operational and legal frameworks keep pace with technological capability. This synthesis—technological potential matched with disciplined compliance—will determine whether tokenized debt and on-chain welfare tools become enduring components of public finance or remain transient experiments.

What to watch next

- Progress and results from the Marshall Islands’ UBI wallet rollout and any regulatory updates on AML/KYC standards for on-chain benefits.

- Monitoring the UK’s tokenized gilt pilot and any published findings on feasibility, costs, and investor interest.

- Updates to tokenized debt instrument frameworks and sanctions regimes as more governments explore issuance and distribution through blockchain rails.

- New data releases from Token Terminal and other analytics firms tracking growth in tokenized government debt and on-chain settlements.

- Prominent forecasts, such as Taurus SA’s projection of a $300 billion tokenized bond market by 2030, and any revisions based on policy or market developments.

Sources & verification

- Guidance from Guidepost Solutions to the Marshall Islands government on regulatory compliance and sanctions for USDM1 tokenized debt instruments (tokenized debt instrument reference).

- Marshall Islands’ Universal Basic Income program launch in November 2025 via a digital wallet (UBI program reference).

- Analysis and data on the tokenized U.S. Treasuries market growth since 2024 from Token Terminal (growth reference).

- Forecast by Lamine Brahimi, co-founder of Taurus SA, that tokenized bonds could reach $300 billion by 2030 (market forecast reference).

- On-chain debt instrument and tokenized government debt discussions and related policy pilots, including RWA.XYZ and UK gilt pilot context (verification references).

Tokenized debt, digital governance, and the path to inclusive finance

The effort to tokenize government debt and deliver social benefits on-chain sits at the intersection of efficiency, transparency, and risk management. The Marshall Islands’ USDM1 project showcases how a regulatory framework can be crafted to support tokenized debt while maintaining strong sanctions and AML controls. The accompanying UBI initiative demonstrates a pragmatic use case for digital wallets as a means of distributing welfare benefits with auditable spending trails, potentially reducing delays and leakage that can accompany traditional channels. In parallel, the broader market signals—rapid growth in tokenized U.S. Treasuries, governance pilots in the UK, and ambitious market projections—underscore growing institutional and public interest in tokenization as a means to reimagine public finance and social programs. Yet the narrative remains contingent on a reliable compliance scaffold: one that balances innovation with rigorous risk management to safeguard funds and protect citizens. As policymakers, technologists, and financial actors navigate this evolving terrain, the defining question will be whether these on-chain instruments can deliver measurable benefits at scale without compromising the integrity of the financial system.

Crypto World

Onchain Public Benefits are the Future but Challenges Remain, CEO Says

Blockchain technology is an effective medium for administering social benefit programs, but key compliance challenges remain, according to Julie Myers Wood, CEO of compliance and monitoring consulting firm Guidepost Solutions.

Guidepost Solutions advised the Republic of the Marshall Islands’ government on a regulatory compliance and sanctions framework for its USDM1 bond, a tokenized debt instrument issued by the government, backed 1:1 by short-term US Treasuries.

The Marshall Islands government launched a Universal Basic Income (UBI) program in November 2025 that distributes quarterly benefits to citizens directly through a mobile wallet. Wood told Cointelegraph:

“Any benefit that is currently being distributed through analog means should be explored for a digital delivery option for several reasons. Digital delivery speeds up the process and can provide an auditable trail for provisioning and expenditures.”

Several governments are exploring tokenized debt instruments and administering social benefit programs onchain to eliminate settlement delays and costly transaction fees inherent in traditional finance by disintermediating the issuing and clearing process.

Related: UK government appoints HSBC for tokenized bond pilot

Regulatory compliance and sanctions challenges remain as the tokenized bond market grows

The cost reduction and near-instant settlement times for tokenized bonds and other onchain instruments democratize access to the financial system for individuals who lack access to traditional banking infrastructure.

However, anti-money laundering (AML) requirements and sanctions compliance are two of the biggest regulatory risks for governments issuing onchain bonds to the public, Wood told Cointelegraph.

Governments issuing tokenized bonds must also collect know-your-customer (KYC) information to ensure that funds are directed to the proper recipients, she added.

The tokenized US Treasury market grew by over 50x since 2024, according to data from crypto analysis platform Token Terminal.

The tokenized bond market could surge to $300 billion, according to a forecast from Lamine Brahimi, co-founder of Taurus SA, an enterprise-focused digital asset services company.

Reduced settlement times, transaction costs and asset fractionalization, which allows individuals to purchase fractions of a financial asset, all expand investor access to the global financial system, Brahimi told Cointelegraph.

Magazine: Will Robinhood’s tokenized stocks REALLY take over the world? Pros and cons

Crypto World

ZKP Stage 2 Presale Auction Ends in 5 Days! Buyers Rush Ahead of Supply Drops, as Monero and Cardano Track Trends

The digital asset landscape is shifting, and finding the best crypto to buy right now requires looking beyond the household names. While established players like Monero continue to offer privacy-centric utility, and analysts weigh in on the long-term Cardano price prediction, a new contender is rewriting the rules of entry. Zero Knowledge Proof (ZKP) is currently capturing the market’s attention with its unique Initial Coin Auction (ICA), a system designed for pure transparency.

As the Monero price USD faces typical market volatility, ZKP is moving through its final days of Stage 2. With the transition to Stage 3 occurring in just 5 days, the window to participate in the current 190-million daily token distribution is closing. Investors are pivoting toward ZKP’s deflationary burn mechanics and fair-launch protocol, seeking the stability and growth potential that traditional presales often lack.

Tracking Volatility and Demand for Monero Price USD

Privacy remains a core focus within the blockchain sector, making the Monero price USD a key metric for those tracking anonymity-centric assets. Recent market data indicate that Monero has faced notable volatility, including a sharp decline of over 50% from its January high of nearly $800. This correction has seen the Monero price USD stabilize around the $340 to $370 range as of February 2026.

Regulatory pressure continues to influence its market standing, with the asset facing approximately 73 exchange delistings over the past year due to tightening global compliance standards. While technical indicators like the RSI currently show oversold conditions, consistent selling pressure from long-term holders has impacted liquidity. Monero remains a specialized utility for private transactions, though it operates under persistent structural headwinds and shifting regulatory frameworks.

Analyzing the Future Through Cardano Price Prediction

Cardano continues to maintain its position as a major cryptocurrency by market capitalization, currently valued at approximately $9.22 billion. When analysts evaluate a long-term Cardano price prediction, they frequently focus on the protocol’s peer-reviewed development phases, such as the Voltaire era for on-chain governance. Technical data from February 2026 shows the asset trading near $0.26, supported by over 1.3 million active staking wallets that contribute to network decentralization.

Recent milestones include the launch of regulated ADA futures on the CME Group marketplace, marking a step in institutional integration. While a conservative Cardano price prediction often accounts for its methodical scaling approach, the network has reached 17,000 smart contract deployments, reflecting the steady development of its underlying technical infrastructure over time.

ZKP’s Stage 2 Presale Auction Enters Final Countdown

While many market participants wait on external price swings, Zero Knowledge Proof (ZKP) is introducing the first Initial Coin Auction (ICA), a radical shift toward true decentralization. This is precisely why it is being highlighted as the best crypto to buy right now. Unlike traditional models where prices are set behind closed doors, the ZKP price is determined by real-time market demand through a transparent, 24-hour on-chain process.

The urgency has reached a fever pitch as ZKP’s presale auction enter final days of Stage 2. This represents the absolute last window to access the largest remaining daily distribution of 190 million tokens. In just 5 days, the protocol triggers a structural supply cliff, transitioning to Stage 3 where the daily allocation is slashed by 10 million tokens to a 180-million limit.

This aggressive reduction continues across every subsequent stage of the 450-day timeline, meaning the available daily supply is rapidly evaporating. Furthermore, any unallocated tokens are burned permanently at the end of each day, ensuring that every 24-hour cycle is a final opportunity to participate at the current stage’s specific supply level.

To maintain total integrity, ZKP utilizes an “Anti-Whale” protocol, capping daily contributions at $50,000 per wallet. This prevents large players from dominating the auction, ensuring that the best crypto to buy right now remains accessible on equal terms. With no gas wars, no insider advantages, and a daily supply that drops by 10 million tokens in less than a week, the window to secure a position before the Stage 3 reduction is closing fast.

In Summary

In a market defined by choice, the path forward depends on specific objectives. While monitoring the Monero price USD remains vital for privacy-focused utility, and tracking the long-term Cardano price prediction is essential for patient, research-oriented holders, the shift toward transparent infrastructure is undeniable. ZKP stands out as the best crypto to buy right now, offering a fair-launch model that established projects simply cannot replicate.

With Stage 2 and its 190-million daily ceiling ending in just 5 days, the opportunity to secure tokens at this level is vanishing. As the supply cliff approaches and unallocated tokens burn daily, the window for maximum allocation is rapidly closing. The transition to Stage 3 marks a permanent tightening of the ecosystem, positioning ZKP as a high-momentum choice for those observing the shrinking supply.

Explore Zero Knowledge Proof:

Website: https://zkp.com/

Presale: https://buy.zkp.com/

Telegram: https://t.me/ZKPofficial

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video1 day ago

Video1 day agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World19 hours ago

Crypto World19 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?