Crypto World

SEC makes quiet shift to brokers’ stablecoin holdings that may pack big results

Broker-dealers regulated by the U.S. Securities and Exchange Commission (SEC) can treat their stablecoin holdings as regulatory capital, according to a tweak this week to a frequently-asked-questions document maintained by the agency.

That’s a seismic shift offered in the form of a minor addition to the SEC’s “Broker Dealer Financial Responsibilities” FAQ. It’s on-brand for a regulator that has made a steady series of changes to its crypto approach through informal guidance, industry correspondence and staff statements ever since its Crypto Task Force began work during the administration of President Donald Trump.

In this case, a new question No. 5 was added about what kind of “haircut” a firm should take on its holdings of stablecoins — the dollar-tied tokens such as Circle’s USDC and Tether’s USDT. The answer was 2%, meaning that instead of the previous understanding that such assets were not considered measurable against a broker-dealer’s capital tally (100% haircut), the firms will be able to count 98% of those holdings.

“While this guidance does not create new rules, it helps reduce uncertainty for firms seeking to operate compliantly under current securities laws,” said Cody Carbone, CEO of the Digital Chamber.

This puts stablecoins on the same footing as other financial products.

“That means stablecoins are now treated like money market funds on a firm’s balance sheet,” Tonya Evans, a former professor who now runs a crypto education business and is on the board of directors at Digital Currency Group, wrote in a post on social media site X. “Until today, some broker-dealers were zeroing out stablecoin holdings in their capital calculations. Holding them was a financial penalty. That’s over.”

Before, the more stringent SEC limits meant those companies — firms registered with the SEC to handle customers’ securities transactions and also trade in securities on their own behalf — weren’t easily able to custody tokenized securities or act as a go-between for trading. Now the firms that follow this steer from the agency will be able to more easily provide liquidity, aid settlement and advance tokenized finance.

“Everywhere from Robinhood to Goldman Sachs run on these calculations,” Larry Florio, deputy general counsel at Ethena Labs, wrote in an explainer posted on LinkedIn. Stablecoins are now working capital, he said.

SEC Commissioner Hester Peirce runs the agency’s task force and issued a statement on the change, contending that using stablecoins “will make it feasible for broker-dealers to engage in a broader range of business activities relating to tokenized securities and other crypto assets.” And she said she wants to consider how the existing SEC rules “could be amended to account for payment stablecoins.”

That’s the drawback of informal staff policies — they’re as easy to reverse as they were to issue, and they don’t carry the weight (and legal protections) of a rule.

The SEC has been working on some crypto rules in recent months, but they haven’t yet been produced, and the process usually takes several months — sometimes years. Even a formal rule can still be reversed by a new leadership at the agency, which is why crypto advocates are pushing for more legislation from Congress that would set the government’s digital assets approach into law, such as last year’s Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

UPDATE (February 20, 2026, 22:23 UTC): Adds comment from Digital Chamber CEO.

Crypto World

Ledn Closes $188M Bitcoin-Backed ABS With First-Ever Investment Grade Rating From S&P

TLDR:

- S&P assigned a BBB- rating to Ledn’s ABS senior notes, the first for a digital asset lender.

- The $188M offering was 2x oversubscribed, with institutional demand exceeding the full deal size.

- Ledn’s bitcoin collateral stays ring-fenced in custody and cannot be lent out by any party.

- The ABS creates a rated benchmark for bitcoin-backed loans, a first in crypto credit markets.

Ledn has closed a $188 million asset-backed security offering backed by its portfolio of Bitcoin-collateralized retail loans.

Standard & Poor’s assigned the senior notes a BBB- rating, marking the first investment grade rating ever given to a digital asset lending portfolio.

The deal drew twice the demand it sought, with institutional interest surpassing the full offering size. No crypto-native lender has hit this benchmark before.

Ledn Becomes First Crypto Lender to Earn Investment Grade ABS Rating From S&P

The rating places Ledn in a category previously reserved for traditional asset classes.

Auto loans, mortgages, and similar instruments have long carried these benchmarks. Bitcoin-backed lending has not, until now. S&P’s decision signals a structural shift in how institutions view crypto credit.

Ledn shared details of the transaction via a blog post published alongside the announcement. The company stated that S&P evaluated its loan book using the same analytical frameworks applied to conventional lending assets.

Operational procedures, custody standards, and technology platforms were all reviewed. The outcome confirmed that Ledn’s systems met institutional requirements.

The offering closed oversubscribed by a factor of two.

Demand from institutional buyers exceeded the $188 million target. Ledn did not disclose the specific investors involved. The oversubscription reflects growing appetite for rated crypto credit products among traditional capital allocators.

Ledn noted the ABS structure does not change how client collateral is handled. Bitcoin posted as collateral remains in custody and stays ring-fenced.

Neither Ledn, its funding partners, nor any financing vehicle can lend out that collateral. The company emphasized this in its blog post to address client concerns about counterparty exposure.

Bitcoin-Backed Lending Gets Its First Institutional Benchmark With This ABS Closing

The company has operated since 2018 and has navigated multiple market cycles, including the 2022 credit crisis. Its loan book maintained a clean performance record through those periods.

S&P’s review covered that full history. The rating reflects durability across volatile conditions, not just recent performance.

Ledn described the ABS market access as a new liquidity frontier. The structure creates a direct channel between its bitcoin-backed loan portfolio and institutional credit markets.

This allows funding that operates independently of broader digital asset market conditions. The company framed this as a long-term stability mechanism.

Pension funds and insurance companies typically require investment grade ratings before allocating capital. This deal now meets that threshold for the first time in the digital asset space.

Ledn’s blog post described the milestone as validation of the standards it has worked to establish. The transaction sets a new pricing and risk benchmark for the sector.

Crypto World

XRP Price Prediction February 2026: Why Smart Money Is Rotating From Ripple Into Pepeto for 100X Gains

You know what’s frustrating? Watching a coin you believe in go nowhere for months while something you never heard of quietly crosses $7.2 million in funding. That’s the story playing out right now between XRP and Pepeto.. And once you look at the math, the rotation makes perfect sense.

XRP sits at $1.43 today. Even the most optimistic Ripple forecast puts it at $5 this cycle. That’s roughly 3.5x from here. Solid, sure. But Pepeto is priced at $0.000000185 with a confirmed Binance listing and working products already live. The difference in upside potential isn’t even close.

Senator Elizabeth Warren sent a letter to Fed Chair Jerome Powell and Treasury Secretary Scott Bessent this week demanding they promise no taxpayer money goes toward propping up the crypto market. According to American Banker, Warren called out the Treasury Secretary for dodging questions about government intervention during a February 6 hearing. Bitcoin has lost roughly 50% since its October peak of $126,000. The letter signals that no bailout is coming. Investors who want upside need to find it on their own.

XRP price prediction for February 2026

XRP dipped 4.4% on February 19 to $1.40 before recovering to $1.43. The RSI reads 37, which means bearish pressure is still in control. The MACD keeps falling. If XRP holds above $1.35, a push toward $1.64 is possible. But even if it reaches $2, that’s only 40% from current levels. For investors chasing life changing returns, that math doesn’t excite anyone.

Best crypto presale to buy: Why Pepeto is where the real 100X sits

Pepeto is cutting through this bear cycle without breaking a sweat. Priced at $0.000000185, this project has attracted over $7.2 million from investors who clearly see something special. And they’re not buying hype. They are buying into a working platform you can actually test after joining the presale at pepeto.io.

PepetoSwap handles instant meme token trades. The cross chain bridge moves assets between networks. The upcoming exchange only lists verified projects, cutting scams out completely. Four products. All in demo stage. That is not a roadmap promise. That is real infrastructure built during a downturn.

But here is the part most people miss. The staking at 214% APY is nice. Put in $7,000 and collect $14,980 a year. But don’t confuse the yield with the main play. The main play is the gap between the presale price and what happens after Binance listing. SHIB went from nothing to $40 billion without a single product. PEPE reached $7 billion on memes alone. Pepeto has actual utility at a micro cap valuation. According to The Motley Fool, Wall Street firms predict Bitcoin at $150K this year. When the tide turns, projects like Pepeto benefit first. Founded by a Pepe cofounder, dual audited by SolidProof and Coinsult, zero tax. 70% filled.

Final verdict

The XRP price prediction shows moderate potential, maybe $2 by month end if sentiment shifts. But Pepeto at $0.000000185 with confirmed listing, working products, and $7.2M raised offers something XRP can’t: ground floor access before the world notices.

Click To Visit Official Website To Buy Pepeto: https://pepeto.io

FAQs

How high will XRP go in February 2026?

Technical indicators show XRP could reach $2 if it holds $1.35 support and Bitcoin recovers. But at $1.43, that’s roughly 40% upside. Pepeto at $0.000000184 offers asymmetric returns that XRP’s market cap simply can’t match.

Is Pepeto a better buy than XRP right now?

XRP is established but needs massive capital inflow for modest gains. Pepeto has a confirmed Binance listing, working demo, dual audits, and zero tax at a fraction of XRP’s market cap. For 100X potential, the math favors Pepeto.

Can Pepeto really reach 100X after listing?

SHIB hit $40 billion with no products. Pepeto has swap, bridge, exchange demo, audits, and a Pepe cofounder at a micro cap entry. 100X is conservative when you compare it to what pure hype tokens achieved.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Consensys-Backed Sharplink Now Holds 867,798 ETH in Treasury Strategy

Sharplink, the Nasdaq-listed firm backed by Consensys, has taken its Ethereum treasury to 867,798 ETH as of February 15, cementing its status as a massive corporate holder.

This stockpile, valued at roughly $1.69 billion, highlights a growing trend for institutions to be long on ETH.

Key Takeaways

- The Stash: Sharplink now holds 867,798 ETH, staking nearly 100% of the assets to generate continuous yield.

- The Support: Institutional ownership has surged to 46% as of Dec. 31, driven by confidence in CEO Joseph Chalom’s strategy.

- The Yield: The firm utilized liquid staking protocols to generate over 13,000 ETH in rewards to date.

Why Is StarLink Bullish on ETH?

Institutional appetite is shifting from passive holding to active yield generation.

Sharplink isn’t just sitting on assets; they are actively deploying them. According to recent filing data, institutional ownership in the firm hit 46% by the end of 2025.

This institutional bullishness on crypto, even through the current downturn, mirrors a broader trend seen globally.

For instance, sovereign funds are reportedly eyeing crypto assets. Abu Dhabi’s government recently disclosed $1 billion in spot Bitcoin ETF holdings.

Sharplink added about 60 new institutional investors in Q4 2025 alone, signaling that smart money not only wants exposure to crypto’s long-term price action, but specifically to its yield generation capabilities.

Discover: The best crypto to buy now

Breaking Down the Numbers

The strategy is technical and aggressive. According to an SEC filing, Sharplink’s total figure includes substantial allocations to liquid staking protocols: 225,429 ETH via Liquid Collective’s LsETH and 55,137 ETH through ether.fi’s WeETH.

Joseph Chalom, the CEO who joined from BlackRock, stated: “Sharplink stakes nearly 100% of its ETH holdings and has staked our holdings since the beginning.”

This approach has generated 13,615 ETH in staking rewards, benefiting shareholders even as spot prices fluctuate.

This level of accumulation is being paralleled across decentralized finance, creating scarcity for DeFi coins. Just this week, for instance, Pioneer QLabs bought over 18 million QONE tokens.

Additionally, yield farming is pulling institutions into crypto in diverse ways. Just look at Ledn, which engages institutional capital via Bitcoin-backed bonds.

Sharplink, though, is a pure Ethereum yield vehicle. Chalom noted that sophisticated investors want “disciplined execution” regarding risk management, which is likely a USP he pitched to court the new influx of new institutional capital.

What Does This Mean for Investors?

Efficiency is the game now. Sharplink’s pivot from gaming to a “digital asset treasury” model positions it as a liquid proxy for Ethereum’s network growth.

By staking heavily, they dampen the blow of market volatility and capture rewards that passive ETFs miss.

Ultimately, Starlink’s level of accumulation tightens supply while its heavyweight investors validate the corporate treasury thesis. This is no bad thing for all crypto believers.

Discover: The best meme coins on Solana

The post Consensys-Backed Sharplink Now Holds 867,798 ETH in Treasury Strategy appeared first on Cryptonews.

Crypto World

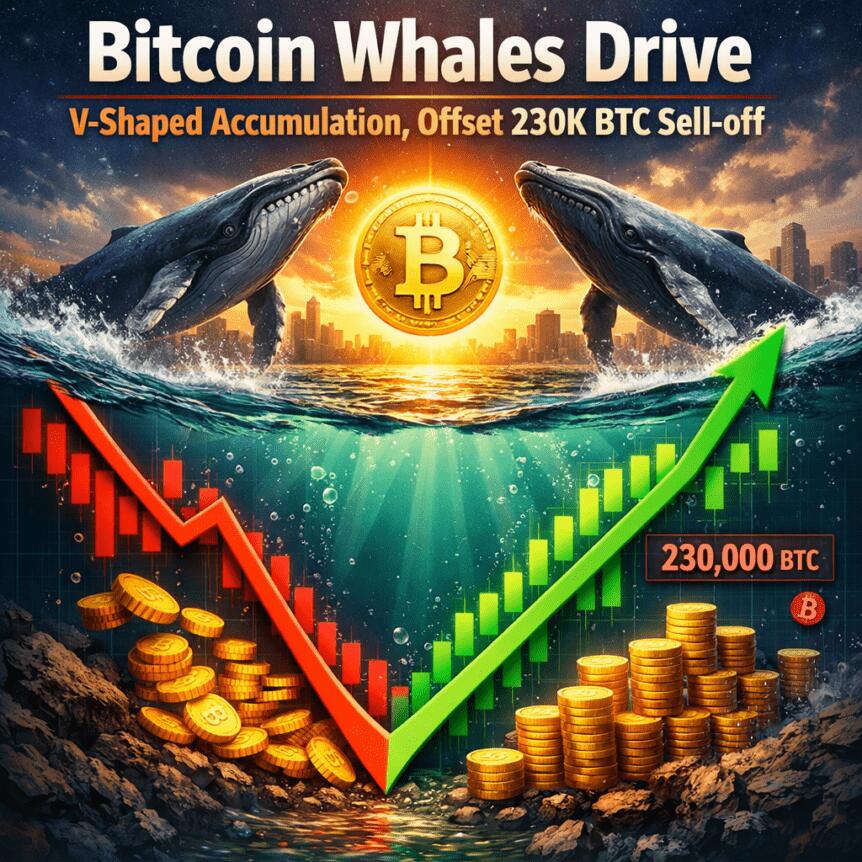

Bitcoin Whales Drive V-Shaped Accumulation, Offset 230K BTC Sell-off

Bitcoin (CRYPTO: BTC) whale activity has begun signaling a shift back toward the stability seen before the late-2025 market wobble. In recent months, wallets holding between 1,000 and 10,000 BTC have rebuilt their collective balance, pushing the total amount held by this cohort to 3.09 million BTC from 2.86 million BTC on Dec. 10, 2025. That 230,000-BTC increase essentially restores position levels observed prior to the October 2025 market dip. Meanwhile, exchange data show whale-related outflows averaging about 3.5% of the total BTC held on exchanges over a 30-day window—the strongest such rate since late 2024—suggesting a continued shift of coins away from spot venues.

Across on-chain data, the broader pattern points to an ongoing reallocation among major holders. CryptoQuant analysis shows that the large wallet segment has reaccumulated aggressively after a period of net selling, with roughly 98,000 BTC added to whale reserves over the past 30 days. The market narrative since August 2025 has been defined by a distribution phase, triggered after BTC touched new highs around the $124,000 level, with many observers noting that a sustained rally remained challenging in the face of shifting risk sentiment. This backdrop helps explain why the current accumulation cycle by whales is notable, even as price action remains sensitive to macro cues and shifting liquidity conditions.

CryptoQuant spot market data underscores a resilience in large-order activity. Through 2026, the average BTC order size has oscillated between roughly 950 BTC and 1,100 BTC, marking the most sustained period of sizable retail and institutional orders since September 2024. This pattern aligns with the return of liquidity into the market and a reopening of appetite among buyers willing to place larger blocks, even as price levels teeter between regions of resistance and support. A broader look at the February–March 2025 correction showed a similar appetite for larger orders, though the cadence of big-ticket purchases varied with retail participation and the timing of institutional inflows.

Total BTC balance of large holders (1k-10k). Source: CryptoQuant

BTC whale reserves return to pre-October peak

Analysts at CryptoQuant point to a notable reversal in the drawdown of whale reserves, with the 30-day window marking a substantial uptick in accumulation. The net shift is most visible in the 98,000 BTC added to the whale category over the most recent month, reversing earlier declines and signaling renewed appetite among larger holders. This reaccumulation comes as part of a broader dynamic in which a growing portion of BTC activity originates from wallets with medium-to-large holdings, while smaller retail activity continues to surface in bursts. The sequential build-up in whale balances is consistent with a risk-off tilt in some segments of the market, even as other indicators suggest a more mixed mood among traders and institutions alike.

On the exchange side, inflows and outflows tell a nuanced story. CryptoQuant tracks roughly $8.24 billion in whale BTC flows moving to Binance over the past 30 days, a reading that marks a 14-month high and underscores how large players continue to reposition assets within major venues. At the same time, retail flows have climbed to about $11.91 billion in the same window, with the retail-to-whale ratio reported at 1.45—indicating that smaller participants remain active, albeit with the larger-ticket trades increasingly concentrated among the whale segment. This juxtaposition helps explain why net balances on exchanges have remained relatively stable despite higher gross inflows, as outbound transfers offset incoming liquidity.

Glassnode data reinforce the idea that the on-chain ecosystem is undergoing a rebalancing rather than a straightforward surge in exchange activity. The latest figures show gross exchange whale withdrawals averaging 3.5% of total exchange-held BTC supply over a 30-day period—an aggressive pace not seen since November 2024. If the withdrawal flow persists, it could imply a continued willingness among whales to migrate BTC off exchanges, potentially reducing the available supply for immediate selling pressure. Based on current exchange balances, this translates to a rough net withdrawal range of 60,000–100,000 BTC in the past month, offering a broader sense of the scale involved in the ongoing shift between custody models and trading venues.

Related: “Resilient” Bitcoin holders defend BTC, but bear floor sits 20% lower: Glassnode

In parallel, the market continues to parse larger macro and crypto-specific signals. The on-chain narrative remains complex: while whale accumulation signals confidence among major holders, the overall price tempo depends on a confluence of liquidity availability, risk appetite, and regulatory developments. The balance between inflows to exchanges and outflows from them appears to be moderating, with indicators suggesting that the market could continue to experience periods of consolidation as participants assess whether the current supply dynamics translate into sustained price support or whether macro headwinds reassert themselves. The dynamic is a reminder that liquidity conditions in crypto markets remain a key driver of price discovery, even as on-chain behavior points to a more resilient posture among large holders.

Related: Quantum fears aren’t behind Bitcoin’s 46% drop, says developer

Key takeaways

- Whale holdings of 1,000–10,000 BTC climbed to 3.09 million BTC, up from 2.86 million BTC on Dec. 10, 2025, restoring levels seen before the October 2025 market wobble.

- The three-month accumulation included a net addition of about 230,000 BTC, signaling renewed demand from medium-to-large holders.

- Over the last 30 days, whale reserves reversed earlier declines with a gain of roughly 98,000 BTC, suggesting renewed on-chain interest.

- BTC spot market data shows large-average order sizes in 2026, ranging from 950 to 1,100 BTC, the strongest stretch of meaningful blocks since late-2024.

- Binance rail for whale flows reached about $8.24 billion in 30 days, a 14-month high, while retail flows were about $11.91 billion with a retail-to-whale ratio of 1.45.

- Glassnode reports a 3.5% average withdrawal rate of exchange-held BTC from whales over 30 days, indicating net exchange balances may remain relatively stable despite rising inflows.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The observed on-chain activity unfolds against ongoing liquidity shifts and evolving risk sentiment in crypto markets, with whales reaccumulating as retail participation remains active and exchange balances show a mix of inflows and offsetting withdrawals.

Why it matters

The reaccumulation by larger Bitcoin holders suggests an orientation toward longer-term custody and potential readiness to absorb buying pressure if market conditions improve. While price action remains contingent on macro signals and liquidity, the on-chain readouts point to a market that is gradually shifting from a phase of dispersion toward a more balanced posture where large entities are rebuilding positions while smaller players continue to transact in smaller blocks.

For traders, the pattern underscores the importance of watching cross-venue flows and the balance between inflows to exchanges and outbound movements. If whales keep moving BTC off exchanges or into more secure custody, the available supply for immediate selling could decline, potentially reducing near-term downside risk in the event of broader market stress. Conversely, sustained large-order activity on the buy side could provide a floor under price discovery, especially if macro catalysts align with a pickup in risk appetite among institutional players.

For developers and investors, the data emphasize the value of analyzing on-chain signals in conjunction with exchange flows and the behavior of different holder cohorts. The evolving distribution among whales, retail participants, and exchange inventories offers a nuanced view of the crypto liquidity landscape and the strategies that might shape price action in the coming months.

What to watch next

- Monitor whether the total balance of large holders (1k–10k BTC) continues to approach or exceed 3.1 million BTC in the coming weeks.

- Track net exchange balances to see if withdrawals persist or if inflows begin to outpace outflows again.

- Observe Binance inflows and outflows for whale BTC to gauge where large holders are moving portions of their stock and whether this signals shifting custody preferences.

- Watch the 30-day moving averages of large-order activity to confirm whether the 950–1,100 BTC order-size trend persists beyond 2026.

- Keep an eye on macro and regulatory developments that could influence risk appetite and liquidity across crypto markets.

Sources & verification

- CryptoQuant quicktake: Whales reaccumulate everything they sold since October (https://cryptoquant.com/insights/quicktake/69983917c876a02133a04bc2-Whales-reaccumulate-everything-they-sold-since-October)

- CryptoQuant quicktake: 82B in Whale BTC Flows to Binance (https://cryptoquant.com/insights/quicktake/69982730312550148f4ec237-82B-in-Whale-BTC-Flows-to-Binance-creating-a-14-Month-High)

- CryptoQuant: BTC spot average order size (https://cryptoquant.com/asset/btc/chart/market-indicator/spot-average-order)

- Glassnode data on exchange withdrawals (as cited in the article)

- Cointelegraph: Related piece on resilient bitcoin holders and market dynamics (https://cointelegraph.com/news/resilient-bitcoin-holders-defend-btc-but-bear-floor-sits-20-lower-glassnode)

What to watch next

- 3–5 forward-looking checks (dates, filings, unlocks, governance votes, product launches, regulatory steps) ONLY if consistent with the source.

Crypto World

BitGo and Figure Execute First Blockchain-Native Equity Trades on Figure’s Alternative Trading System

TLDR:

- BitGo Bank & Trust, N.A. serves as qualified custodian within Figure’s OPEN on-chain public equity network.

- Figure’s OPEN network launched in February 2026, enabling equity issuance and trading on Provenance Blockchain.

- The BitGo–Figure integration separates custody from execution, preserving counterparty risk protections for institutions.

- Real-time on-chain settlement reduces reconciliation layers, lowering operational costs for broker-dealers and asset managers.

Blockchain-native equity trading reached a new milestone as BitGo and Figure completed their first tokenized equity trades.

The trades were executed through Figure’s Alternative Trading System, operating on the Provenance Blockchain. BitGo Bank & Trust, N.A. served as the qualified custodian within Figure’s Onchain Public Equity Network.

The integration brings regulated custody and near real-time settlement to on-chain public equities, offering institutions a more efficient trading framework.

OPEN Network Brings Regulated On-Chain Equity Infrastructure to Market

Figure’s OPEN network launched in February 2026 as a regulated electronic trading venue. It enables companies to issue and trade equity directly on blockchain infrastructure.

Issuance, trading, and settlement are embedded into a single on-chain environment. This removes multiple intermediary layers that traditionally slow down public equity markets.

BitGo Bank & Trust, N.A. operates as a qualified custodian within the OPEN framework. The bank safeguards assets and provides regulated infrastructure for all participants.

Its custodian role ensures compliance with existing financial regulations for institutions. Consequently, regulated participants can access blockchain-native equity within a familiar oversight structure.

The completed trades demonstrate how tokenized equities can function in a continuous on-chain environment. Settlement activity occurs in real time within a regulated framework on Figure’s ATS.

Trade records are also published directly on-chain, adding a layer of market transparency. This approach removes several reconciliation steps found in traditional market infrastructure.

Mike Belshe, CEO of BitGo, spoke directly to the partnership’s broader purpose for market participants.

“At BitGo, our goal is to provide institutions the infrastructure and ability to trade, secure and build on anything on-chain. Our partnership with Figure moves the industry in that direction with BitGo operating as the independent trust layer to reduce risk, increase transparency and instill confidence in continuous markets.”

Custody Separation and Cost Efficiency Support Institutional Participation

BitGo and Figure maintain a clear separation between custody and trade execution throughout their integration. This preserves the counterparty risk protections that traditional market structure depends on.

Institutions can therefore engage with blockchain-native equity without compromising governance standards. The model mirrors core principles from conventional finance while running on blockchain rails.

By cutting reconciliation layers, the integration reduces operational overhead for market participants. Capital efficiency also improves compared to traditional batch-based settlement systems.

Broker-dealers and asset managers can use this as a repeatable integration model. As a result, on-chain equity products become more accessible to a broader range of regulated institutions.

Mike Cagney, Figure’s Executive Chairman, addressed how qualified custody makes institutional engagement more practical.

“Partnering with BitGo brings qualified custody and institutional-grade controls to the OPEN on-chain public equity network. With instant settlement on Provenance and the potential to meaningfully reduce market-structure friction and costs, this is a concrete step toward modernizing how public equities trade and settle.”

Together, BitGo and Figure have established a scalable framework for blockchain-native equity markets. The model combines blockchain efficiency with governance standards that institutions already recognize and trust.

Crypto World

Best Crypto Presale to Buy: Pepeto Outshines DeepSnitch AI and Bitcoin Hyper With 100X Tools at a Fraction of the Price

Three presales keep showing up in every crypto conversation this month. Pepeto, DeepSnitch AI, and Bitcoin Hyper. All three claim big returns. But most investors overlook the real question. It is not who raised the most. It is who built the most useful products at the cheapest entry point. And when you answer that honestly, one name pulls ahead by a wide margin.

Robinhood just launched its Ethereum Layer 2 blockchain and the public testnet handled 4 million transactions in seven days. According to Fortune, partners include Alchemy, LayerZero, and Chainlink. This tells you where crypto is heading in 2026. Infrastructure wins. Products win. Everything else is noise.

Best crypto presale: Pepeto builds what the meme economy actually needs

Think about what happens every time a new meme coin launches. Traders scramble to buy it. Then they realize they can’t swap it easily. They can’t bridge it across chains. They can’t verify if the project is legit. Pepeto (PEPETO) solves all three problems with tools that already work.

PepetoSwap lets you trade meme tokens instantly without waiting for centralized exchange listings. The cross chain bridge moves assets between blockchains so you are never stuck on the wrong network. And the upcoming exchange only accepts verified meme projects, filtering out rug pulls before they reach your wallet.

No other presale in 2026 offers this combination. Three tools working together as one ecosystem built specifically for the meme coin economy, which already sits at over $50 billion in total market cap. And the person behind it is a Pepe cofounder. Not an anonymous dev team. Someone who helped create one of the most successful meme coins in history and is now building the trading layer the entire sector needs.

Dual audits from SolidProof and Coinsult confirm clean contracts. Zero transaction tax means every dollar works for you. $7.2M raised during extreme market fear. And the entry price? $0.000000185. Thousands of times cheaper than either competitor. At that price, even a tiny fraction of SHIB’s $40 billion peak means returns that change everything. The 214% staking APY generates $10,700 a year on $5,000. But staking is just the bonus for holding. The real play is what this price becomes once the full ecosystem launches and volume flows in. 70% already filled.

DeepSnitch AI: Smart tools, but narrower scope

DeepSnitch AI raised $1.66M at $0.04064 with five AI agents that scan contracts and track sentiment. The utility is real. But think about the difference. DeepSnitch gives you information. Pepeto gives you the entire trading layer. Swap, bridge, and exchange under one roof. One helps you research. The other helps you research, trade, move assets, and avoid scams all in one place.

Then there is price. At $0.04064, DeepSnitch needs to reach $4.06 for a 100X. That requires a market cap north of $4 billion. Pepeto at $0.000000185 reaches 100X territory with a fraction of that valuation. According to The Motley Fool, billions in stablecoin capital sit on the sidelines. Entry price matters when that capital starts moving.

Bitcoin Hyper: Massive raise, limited upside left

Bitcoin Hyper raised over $31 million building a Bitcoin Layer 2 for faster transactions. The tech is solid. But $31 million already in means new buyers pay a premium. Analysts project 2X to 3X from here. Compare that to Pepeto’s three product ecosystem at $0.000000185 with a Pepe cofounder behind it. The risk reward gap speaks for itself.

The bottom line

Three presales. Only one has a three product ecosystem for the $50 billion meme market, a Pepe cofounder, dual audits, zero tax, and a price thousands of times cheaper. Pepeto is the best crypto presale to buy.

Click To Visit Official Website To Buy Pepeto: https://pepeto.io

FAQs

Why is Pepeto the best crypto presale over DeepSnitch AI and Bitcoin Hyper?

Pepeto offers three working tools (swap, bridge, exchange) for the meme economy, a Pepe cofounder, dual audits, zero tax, at $0.000000185. DeepSnitch focuses on analytics at a higher price. Bitcoin Hyper’s $31M raise limits new buyer upside. Pepeto’s utility, credibility, and entry price are unmatched.

Can I try Pepeto’s tools before buying?

After joining the presale at pepeto.io you can access the PepetoSwap demo and explore the ecosystem. The tools are functional, not concept renders.

How does Pepeto’s entry price compare to the others?

Pepeto: $0.000000185. DeepSnitch AI: $0.04064. Bitcoin Hyper: around $0.013. Pepeto’s price is thousands of times lower, meaning the same investment buys massively more upside potential when the ecosystem goes live.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

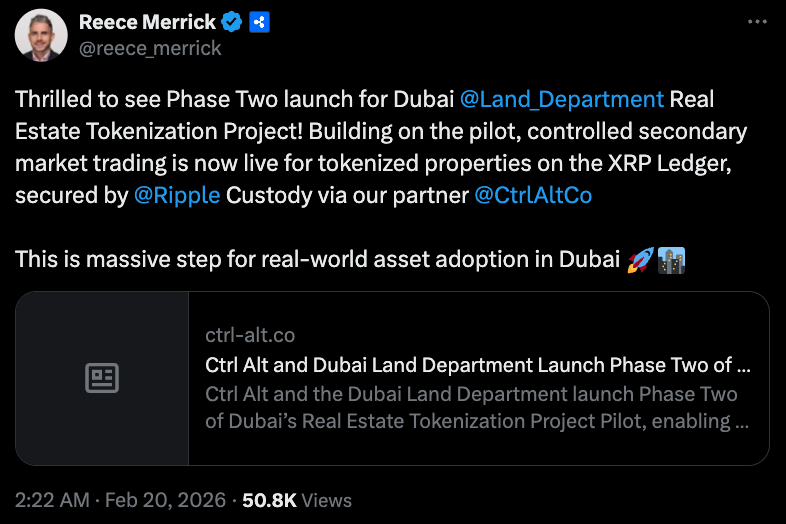

Tokenized Real Estate Projects Advance in Dubai and the Maldives

Entities in Dubai and the archipelagic nation of the Maldives are moving forward with tokenized real estate development projects worth millions of dollars, combined.

On Friday, the Dubai Land Department announced that it would launch the second phase of a real estate tokenization pilot program. The move followed about $5 million worth of real estate in Dubai being tokenized, allowing the resale of about 7.8 million tokens.

The tokenization infrastructure partner for the pilot, called Ctrl Alt, which is also licensed as a Virtual Asset Service Provider in Dubai, will issue “Asset-Referenced Virtual Asset management tokens” to facilitate the transfer of the tokens on secondary markets.

According to Ctrl Alt, all onchain transactions for the real estate tokens will be recorded on the XRP Ledger and secured by Ripple Custody.

Related: Ripple CEO confirms White House meeting between crypto, banking reps

The Dubai Land Department predicted in May 2025 that the tokenization project could contribute about $16 billion by 2033, equivalent to 7% of the jurisdiction’s total property transactions.

Some experts have said Dubai’s real estate market and crypto-friendly regulatory environment have made the emirate stand out among other jurisdictions globally.

Trump-tied hotel deal in the Maldives is also looking to tokenize

Ctrl Alt’s announcement came a few days after real estate development company DarGlobal and World Liberty Financial, a crypto company backed by US President Donald Trump and his sons, announced plans to tokenize the development phase of a Trump-branded resort in the Maldives.

The tokenization deal will happen in partnership with financial technology company Securitize.

“We definitely see this as taking over the way other projects are being funded,” DarGlobal CEO Ziad El Chaar told Cointelegraph, adding:

“[Tokenization] will open the door to many more investors, who would like to take part in investing in real estate but don’t have access today.”

World Liberty announced the deal at a crypto-aligned event at Trump’s Mar-a-Lago property on Wednesday.

Attendees included traditional finance players like Goldman Sachs CEO David Solomon, crypto industry representatives including Coinbase CEO Brian Armstrong, and Senators Ashley Moody and Bernie Moreno.

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi

Crypto World

Fed Research Finds Kalshi Markets Outperform Wall Street Surveys

A new study found that Kalshi’s markets respond more quickly to economic shifts than traditional surveys.

Despite endless debates over where gambling ends and predicting begins, a new Federal Reserve Board paper finds that prediction markets often pick up shifts in expectations faster — and sometimes even more accurately — than traditional tools.

The study, published by the Federal Reserve on Wednesday, Feb. 18, focused on prediction market Kalshi, comparing it with more traditional survey and market-implied forecasts and examining how expectations respond to macroeconomic and financial news.

When compared to standard benchmarks, the paper found that “Kalshi’s forecasts for the federal funds rate and CPI provide statistically significant improvements over fed funds futures and professional forecasters.” The authors also note that for inflation, Kalshi’s numbers often beat the consensus survey forecasts.

“The mode of the Kalshi distribution, for example, has perfectly matched the realized federal funds rate by the day of each meeting since 2022, a feat not achieved by either surveys or futures,” the paper says.

In tougher economic scenarios, Kalshi puts “far more weight on extreme inflation and weak growth than surveys,” the researchers add, suggesting that prediction markets are more sensitive to risks such as recession or runaway inflation.

The paper flags that Kalshi’s retail investor base “may alter its risk-premia properties,” but concludes that prediction markets are best seen as a supplement, not a replacement.

As The Defiant reported earlier, daily trading volume across Polymarket and Kalshi hit $400 million for the first time earlier in February, with sports and political markets drawing nearly all the liquidity.

According to data from Artemis, open interest across platforms, Polymarket, Kalshi, Limitless, Opinion, and others, jumped above $1.1 billion for the first time on Feb. 7, setting a new all-time high.

Crypto World

4-Hour Triangle Compression Signals Imminent Breakout

After the aggressive sell-off toward the $1.8K region, the market has transitioned into choppy consolidation, while lower timeframes are now approaching a decisive breakout point. The key question is whether this compression resolves to the upside or results in continuation within the dominant downtrend structure.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, ETH continues to trade inside a descending channel, with the midline acting as dynamic resistance and the $1.8K region serving as a firm structural base. Following the aggressive sell-off, the price action has turned increasingly choppy, printing overlapping candles and minor retracements rather than impulsive continuation. This behavior signals equilibrium and indecision.

The consolidation remains confined between the channel’s mid-boundary above and the $1.8K demand zone below. Each attempt to push higher has been capped before reclaiming a meaningful resistance cluster, while sellers have failed to generate a decisive breakdown beneath the base. Until one of these boundaries is violated, the dominant expectation is continued range-bound fluctuation.

A confirmed breakout above the midline would open the path toward the next resistance zone around the $2.3K–$2.5K region. Conversely, losing $1.8K would invalidate the equilibrium and likely trigger another bearish impulse.

ETH/USDT 4-Hour Chart

On the 4-hour timeframe, the price compression is more evident. ETH has formed a clear triangle pattern, defined by descending resistance and rising support. The structure reflects volatility contraction and is now approaching its apex, suggesting that a breakout is imminent.

The recent higher lows inside the pattern indicate improving short-term demand, increasing the probability of an upside resolution. However, as long as ETH remains capped below the 0.5 Fib at $2,396, the structure remains technically corrective within a broader downtrend.

A confirmed breakout above the triangle, followed by a reclaim of $2,396, would shift short-term momentum toward the 0.618 level at $2,549 and potentially the 0.702–0.786 retracement cluster near $2,658–$2,767, which also coincides with a marked supply zone on the chart.

On the downside, failure to break upward and a decisive loss of the triangle’s ascending support would expose the $1,800–$1,746 base once again. In that scenario, the recent consolidation would resolve as a continuation pattern rather than a reversal attempt.

At this stage, ETH is at a technical inflection point, with Fibonacci resistance levels clearly defining the upside targets and the $1.8K base anchoring the downside risk.

Sentiment Analysis

The Taker Buy/Sell Ratio across all exchanges provides additional context for the current equilibrium. The ratio has remained below the 1.0 threshold for a prolonged period, indicating that aggressive market sells have dominated overall order flow. This aligns with the broader bearish structure observed on higher timeframes.

However, the recent rebound in the ratio and the stabilization of its 30-day EMA suggest that selling pressure may be weakening. Although buyers have not yet taken full control, the gradual recovery toward the neutral level signals improving demand. If the ratio decisively moves above 1.0 and sustains that level, it would confirm aggressive market buying and increase the probability of an upside breakout from the triangle structure.

Overall, Ethereum is positioned at a technical and derivatives inflection point. The daily chart reflects equilibrium, the 4-hour chart shows imminent compression resolution, and order-flow metrics suggest that bearish dominance is softening. A decisive break from the current structure will likely define the next impulsive phase.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Custodia CEO Caitlin Long Says Trump Family Crypto Ties Are Blocking the CLARITY Act in the Senate

TLDR:

- Custodia CEO Caitlin Long called Trump family crypto ties the “big showstopper” blocking the CLARITY Act in the Senate.

- Long described the bill’s Senate passage as a “coin flip,” with seven Democratic votes still needed to reach cloture.

- Trump-linked projects like World Liberty Financial have made securing bipartisan Senate support significantly more difficult.

- Long warned that without legislation, crypto regulations remain vulnerable to reversal by any future incoming administration.

Custodia Bank CEO Caitlin Long has identified Trump family crypto ties as a central obstacle to the CLARITY Act’s Senate passage.

Speaking at ETH Denver on Wednesday, Long said meme coins and ventures linked to President Donald Trump have eroded bipartisan support for the bill.

She described its chances as a “coin flip.” The legislation passed the House in July 2025 but remains stalled in the Senate over ethics concerns and stablecoin disputes.

Long Points to Trump-Linked Crypto as the “Big Showstopper”

Long did not hold back when asked about the bill’s Senate difficulties. She called the Trump family’s involvement in crypto “the big showstopper in the CLARITY Act.”

Projects like World Liberty Financial and Trump-associated meme coins have drawn sharp Democratic opposition. That opposition has made the 60-vote cloture threshold increasingly difficult to reach.

Senator Elizabeth Warren has been among the most outspoken critics of Trump’s crypto activities. Long noted that even Senator Cynthia Lummis, a leading crypto advocate, admitted the controversy has complicated her efforts. “It created controversy,” Long told Decrypt.

“Lummis herself has said it made her job harder.” The ethics dimension has shifted the debate away from policy and toward politics.

Seven Democratic votes are needed to advance the bill past the Senate cloture threshold. So far, that number has proven hard to secure. Long acknowledged that an agreement satisfying both Congress and the White House remains possible.

“There is a possibility they reach an agreement on something the White House can live with, and Congress is comfortable with,” she said, “but they’ve got to be able to get the cloture vote.”

Meanwhile, negotiations are still active. White House officials, lenders, and the Crypto Council for Innovation met on Thursday to discuss stablecoin reward provisions.

That issue has emerged as another major sticking point alongside the ethics controversy. Both problems must be resolved for the bill to move forward.

Long Warns Against Relying on Rulemaking Over Legislation

Beyond the political obstacles, Long raised a broader concern about regulatory durability. She warned that rules established through agency rulemaking carry no permanent weight.

“When a new administration comes in, those rules can be reversed through new rule-making,” she said. A statutory framework, by contrast, requires a much harder process to undo.

Passing the CLARITY Act would lock in a regulatory structure that is far more resistant to political change. “If Congress puts it in statute, it doesn’t mean it can’t be changed,” Long said.

“It’s just a lot harder to change.” That durability is precisely why she believes congressional action matters more than regulatory guidance alone.

Long also addressed the current market downturn with measured perspective. She noted that a 50% drawdown is familiar to anyone who has been in crypto for years. “Those of us who’ve been around for a long time, a 50% drawdown is nothing,” she said.

Bear markets, she added, are an opportunity to build knowledge, with her consistent advice remaining the same: “Bear markets are the best time to get self-educated.”

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video23 hours ago

Video23 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion7 hours ago

Fashion7 hours agoWeekend Open Thread: Boden – Corporette.com

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market