Crypto World

Sell-Off Slams Treasuries, ETFs & Mining Infrastructure

Crypto’s latest sell-off isn’t just a price story. It’s shaping balance sheets, influencing how spot ETFs behave in stressed markets and altering the way mining infrastructure is used when volatility rises. This week, Ether’s slide has pushed ETH below the $2,200 mark, testing treasury-heavy corporate crypto strategies, while Bitcoin ETFs have handed a new cohort of investors their first sustained taste of downside volatility. At the same time, extreme weather has reminded miners that hash rate remains tethered to grid reliability, and a former crypto miner turned AI operator is illustrating how yesterday’s mining hardware is becoming today’s AI compute backbone.

Key takeaways

- BitMine Immersion Technologies, led by Tom Lee, is dealing with mounting paper losses on its Ether-heavy treasury as ETH dips and market liquidity tightens, with unrealized losses surpassing $7 billion on a roughly $9.1 billion Ether position that includes the purchase of 40,302 ETH.

- BlackRock’s iShares Bitcoin Trust (IBIT) has seen underwater performance for investors as Bitcoin’s retreat from peak levels deepens, underscoring how quickly ETF exposure can shift from upside to downside in a volatile market.

- A late-January US winter storm disrupted bitcoin production, highlighting the vulnerability of grid-dependent mining operations. CryptoQuant data show daily output for publicly listed miners fell sharply during the worst of the disruption, then began to rebound as conditions improved.

- CoreWeave’s transformation from a crypto mining backdrop into AI-focused infrastructure underscores a broader trend: yesterday’s mining hardware and facilities are increasingly repurposed to support AI data centers, a shift reinforced by major financing—Nvidia’s $2 billion equity investment.

- Taken together, the latest developments illustrate how crypto sell-offs ripple through treasuries, ETFs and the physical infrastructure that underpins the network, prompting a re-evaluation of risk management and asset allocation in the sector.

Tickers mentioned: $BTC, $ETH, $IBIT, $MARA, $HIVE, $HUT

Market context: The drawdown comes as institutional crypto exposure faces a confluence of price volatility, liquidity concerns and cyclical demand for compute capacity. ETF inflows and outflows tend to respond quickly to price moves, while miners’ production patterns reveal how power and weather can shape output in a grid-sensitive ecosystem.

Why it matters

The balance-sheet story around crypto treasuries is front and center again. BitMine’s exposure underscores the risk of anchoring large corporate reserves to volatile assets that can swing meaningfully within a single quarter. When assets sit in the treasury, unrealized losses are a function of mark-to-market moves; they become a real talking point when prices slip and capital-mix decisions come under scrutiny. The company’s $9.1 billion Ether position — including a recent 40,302 ETH purchase — highlights the scale of the risk, especially for a firm that seeks to model ETH performance as a core axis of its treasury strategy.

On the ETF side, investors in the IBIT fund have learned a hard lesson about downside risk in a bear market. The fund, one of BlackRock’s notable crypto vehicles, surged to become a flagship allocation for many buyers before the price retraced. As Bitcoin traded lower, the average investor’s position moved into negative territory, illustrating how quickly ETF performance can diverge from early expectations in an abrupt market reversal.

Weather and energy costs are still a significant constraint for miners. The winter storm that swept across parts of the United States in late January disrupted energy supply and grid stability, forcing miners to reduce or curtail production. CryptoQuant’s tracking of publicly listed miners showed daily Bitcoin output contracting from a typical 70–90 BTC range to roughly 30–40 BTC at the storm’s height, a striking example of how energy grid stress translates into on-chain results. As conditions improved, production resumed, but the episode underscored the vulnerability of hash-rate operations to external shocks beyond price cycles.

The AI compute cycle is reshaping the crypto infrastructure landscape. CoreWeave’s trajectory—from crypto-focused computing to AI data-center support—illustrates a broader redeployment of specialized hardware. As GPUs and other accelerators pivot away from proof-of-work demand, operators like CoreWeave have become a blueprint for repurposing mining-scale footprints to power AI workloads. Nvidia’s reported $2 billion equity investment in CoreWeave adds a regional confidence boost, reinforcing the view that the underlying compute fabric developed during the crypto era is now a critical layer for AI processing and data-intensive workloads.

Altogether, the latest data points outpace simple price narratives. They illuminate how markets, capital structures and infrastructure intersect in a bear environment, revealing both fragility and resilience across different segments of the crypto ecosystem. The convergence of treasuries exposed to ETH, ETF holders re-evaluating allocations, weather-driven production swings, and infrastructure migration toward AI all signal a period of recalibration for investors, builders and miners alike.

What to watch next

- BitMine’s forthcoming disclosures or earnings updates to gauge whether unrealized Ether losses translate into realized losses or further balance-sheet write-downs.

- Performance of IBIT as BTC prices stabilize or fall further, and whether new inflows offset earlier drawdowns for long-term holders.

- Mining sector resilience data, including weekly production numbers and energy-grid reliability metrics, to assess ongoing sensitivity to weather and energy costs.

- CoreWeave and similar AI-focused infrastructure players’ investment milestones and capacity expansions, particularly any additional financing or partnerships with AI developers.

Sources & verification

- BitMine Immersion Technologies’ Ether-related balance-sheet disclosures and references to unrealized losses as ETH trades below prior highs.

- Performance and investor commentary regarding BlackRock’s iShares Bitcoin Trust (IBIT) amid BTC price moves and ETF liquidity.

- CryptoQuant data detailing miner output fluctuations during the US winter storm and the subsequent recovery.

- Reporting on CoreWeave’s transition from crypto mining to AI infrastructure and Nvidia’s equity investment in the company.

Crypto market stress and the AI-backed data-center shift

Bitcoin (CRYPTO: BTC) and Ether (CRYPTO: ETH) remain the two largest macro anchors in the crypto market, and their price trajectories continue to drive a wide array of spillover effects. The current pullback has placed a spotlight on how corporate treasuries are risk-managed during drawdowns, as well as how ETFs react when underlying assets encounter extended price pressure. BitMine’s Ether-heavy treasury is a case in point: with ETH hovering around the low-$2,000s, unrealized losses have mounted, illustrating the trouble with balance sheets anchored to a single, volatile asset. The company’s substantial Ether position, including a notable addition of 40,302 ETH, points to strategic bets on long-term exposure that, in the near term, translate into large mark-to-market swings. In this environment, even if losses remain unrealized, they shape investor sentiment and the risk calculus behind future capital raises or debt covenants.

The ETF angle adds another dimension to risk transfer. IBIT, the flagship BlackRock product, has exposed investors to Bitcoin price action in a new cycle, and the downturn has drawn attention to the sensitivity of ETF performance to rapid price moves. The fact that the fund’s investors have found themselves underwater — a reminder of how quickly market timing can unravel in a bear phase — underscores the need for robust risk controls around ETF allocations in crypto portfolios. The ETF’s ability to scale rapidly to a substantial asset base is impressive, but downtrends reveal the volatility that sits just beneath the surface of even the most sophisticated products.

Meanwhile, miners faced a concrete operational test in late January as a winter storm swept across the United States. The weather disrupted power delivery and grid operations, forcing several public miners to dial back production. CryptoQuant’s daily output data for major operators tracked a sharp decline from the usual 70–90 BTC per day to roughly 30–40 BTC during the storm’s peak, illustrating how grid stress translates into lower on-chain activity. This temporary slowdown is a reminder that mining is not a purely financial activity; it remains deeply connected to physical infrastructure and regional energy dynamics. As grid conditions improved, production began to rebound, revealing the sector’s capacity to adapt under adverse circumstances.

Against this backdrop, CoreWeave’s pivot from crypto mining to AI infrastructure emphasizes how the compute ecosystem evolves across cycles. The company’s transformation, coupled with Nvidia’s $2 billion investment, reinforces the idea that the compute fabric built during the crypto era has broad relevance for AI workloads and high-performance computing. This shift is not merely tactical—it signals a longer-term trend where hardware and facilities originally designed to support crypto mining become foundational for AI data centers and other compute-intensive applications. For operators, the challenge is to manage this transition smoothly, align financing with new business models, and keep services competitive in an environment where demand for AI-ready infrastructure remains strong.

In sum, the latest market moves illuminate a market in transition: from price-driven narratives to structural ones where balance sheets, ETF dynamics, weather-sensitive operations and AI compute needs converge. The next few quarters will reveal whether this confluence accelerates consolidation, prompts more diversified treasury strategies, or fuels a new wave of infrastructure repurposing across the crypto space and beyond.

https://abs.twimg.com/widgets.js

Crypto World

Bitcoin price outlook weakens as oil jumps on Hormuz risks

Bitcoin price has slipped below $70,000 as oil prices surge more than 60% this year amid rising tensions around the Strait of Hormuz, adding macro pressure to risk assets.

Summary

- Bitcoin trades near $69,984 after falling 3.8% in the past 24 hours, though it remains up about 7.8% over the week.

- Oil prices have surged more than 60% this year as tensions around the Strait of Hormuz raise concerns about supply disruptions and inflation.

- Rising short-term volatility suggests the Bitcoin market is entering a repositioning phase that could lead to a larger move in either direction.

Bitcoin (BTC) was trading at $69,984 at press time, down 3.8% over the past 24 hours as risk sentiment across financial markets softened. The pullback comes after a volatile week.

Despite the recent drop, Bitcoin is still up roughly 7.8% for the week and has fluctuated between $63,176 and $73,669 over the last seven days. However, the cryptocurrency is still trading about 44% below its all-time high of $126,080 in October 2025.

The most recent price fluctuations have increased activity in the derivatives market. Open interest rose 1.24% to $44.39 billion, while trading volume increased 57.9% to $67.26 billion, according to CoinGlass data.

The rise indicates that as global market uncertainty increases, traders are actively re-positioning their portfolios.

Oil surge raises macro pressure

A report published on March 9 by CryptoQuant analysts points to rising geopolitical tensions around the Strait of Hormuz as a potential headwind for Bitcoin and other risk assets.

Due to growing worries about supply disruptions, oil prices have risen by more than 60% since the beginning of the year. The Strait of Hormuz is a vital part of the world’s energy markets, accounting for about 20% of daily oil exports and nearly 35% of oil transported by sea.

If this restricted shipping route is disrupted, energy costs could increase significantly. An increase in oil prices, according to analysts, could worsen inflation and put pressure on financial markets, which are already susceptible to supply disruptions.

This kind of macro-environment has historically been difficult for Bitcoin. Sharp increases in oil prices often coincide with later stages of market cycles, when risk appetite starts to decline. Exposure to speculative assets like cryptocurrencies may be discouraged by increased geopolitical tension.

Volatility signals market re-positioning

Bitcoin’s volatility structure has changed noticeably in recent months, according to a separate analysis using data from the Binance BTC Volatility & Range Engine. There have been significant short-term fluctuations.

After rising above 1.5 in February before declining once more, the 7-day volatility measure was recently close to 0.72. These kinds of abrupt spikes typically occur during times of market stress and are frequently connected to significant portfolio adjustments or derivatives liquidations.

Longer-term volatility, however, has stayed relatively stable. The 30-day volatility sits around 0.50, while the 90-day measure is close to 0.57. This suggests that although short-term price swings have increased, the overall market structure has not entered an extreme volatility phase.

The Average True Range indicator currently stands near 0.054, pointing to a moderate trading range compared with past periods of intense market activity.

Taken together, the data suggest Bitcoin is going through a repositioning phase after its earlier rally. Buyers and sellers are still competing for control in the short term, which explains the recent spikes in volatility.

At the same time, longer-term volatility remains contained, indicating that the market has not yet entered a full panic or euphoria phase.

Crypto World

Crypto doesn’t belong in an AI portfolio as it’s ‘a different animal,’ says a tech investor

Tech investor Imran Khan says cryptocurrency does not play a meaningful role in his AI investment strategy, arguing the asset class operates on a fundamentally different thesis than the AI-driven productivity boom.

Despite the growing narrative that AI and crypto will converge, Khan said he largely views them as separate investment themes.

“Crypto is a different animal,” he said in an interview. “When it comes to AI, you are investing for productivity and economic growth.” That difference means crypto rarely fits the framework his firm uses, which focuses on businesses that benefit from structural technology shifts.

Khan is the founder and chair of the investment committee at Proem Asset Management, a technology-focused investment firm, with $450 million in assets under management. Before launching Proem, he served as chief strategy officer at Snap (formerly Snapchat), helping lead the company to its public listing, and previously ran global internet investment banking at Credit Suisse, where he worked on major deals including Alibaba’s record-breaking IPO.

However, he isn’t anti-crypto.

While direct token exposure has not typically fit within the firm’s investment thesis, which focuses on fundamental private equity, Proem held positions in Coinbase (COIN), Robinhood (HOOD), as well as bitcoin miner Iren (IREN) and spot bitcoin through the iShares Bitcoin Trust (IBIT), according to its latest 13F filing. Those positions are not part of the firm’s AI strategy, but rather a part of its broader focus on the tech sector, Khan said.

Crypto and AI intersection

While Khan argues that the two industries are completely different, some investors argue that an intersection of AI and crypto makes sense because both rely on decentralized computing networks and data infrastructure.

The argument is that blockchains can provide payment rails and coordination systems for AI services that operate across the internet without a central owner. In fact, last month, Citrini Research’s report that laid out AI bubble fear and caused a brief market meltdown, mentioned that autonomous AI agents will disrupt traditional payment systems by bypassing credit card networks in favor of stablecoins.

Others say blockchain-based systems could also help track how AI models use data, verify outputs or manage digital identities for autonomous software agents.

While the idea of convergence of the two industries remains largely experimental, it has fueled a wave of startups trying to link AI development with crypto-based networks. Meanwhile, many bitcoin miners have already pivoted into the AI boom by repurposing their data centers and power infrastructure to support artificial intelligence computing

Even bitcoin could benefit from AI’s growth, NYDIG, a financial services and infrastructure firm, said. The firm’s analyst argued that if AI cuts jobs and wages, weakening consumer demand, it could force policymakers to cut rates to stabilize the economy, and adding a wave of liquidity could support the bitcoin price.

AI bubble fear

Khan’s comments come as the AI investment boom that surged after ChatGPT’s launch is beginning to show signs of strain.

Nvidia (NVDA) — the dominant supplier of chips used to train AI models — and networking and custom AI chip maker Broadcom (AVGO) are both down roughly 5% year-to-date, reflecting growing questions about the pace of returns from massive AI spending.

Meanwhile, the Citrini report that caused the AI scare outlined a hypothetical 2028 scenario in which rapid AI adoption leads to widespread white-collar job losses and a sharp drop in consumer spending.

While it is a concerning scenario, Khan is looking at the bigger picture, saying that similar fears have accompanied nearly every technological revolution.

“If you read Karl Marx, he said the same thing about machines 200 years ago,” Khan said. “Now we’re having an AI revolution that could be as big as the Industrial Revolution, and people are making the same arguments.”

He added that new technologies have historically reshaped labor markets rather than eliminating jobs entirely.

“When there is new technology, you create new kinds of jobs,” Khan said.

Crypto World

Bitmine (BMNR) buys 61,000 ether (ETH) as Tom Lee sees end in sight for bear market

BitMine Immersion Technologies (BMNR), the largest Ethereum-focused treasury firm, purchased 60,976 ether (ETH) through last week, increasing the pace of accumulation as the firm bets crypto prices are nearing the end of what it calls a “mini winter.”

The latest purchase, worth some $120 million at current prices, lifted BitMine’s ETH holdings to over 4.5 million tokens, worth more than $9 billion, according to a Monday update from the company. This was the company’s largest weekly purchase in token terms in 2026 so far.

The firm has steadily added to its treasury throughout the market downturn, even as unrealized losses on its position now is estimated at around $7.8 billion, according to data from DropsTab.

Chairman Thomas Lee said the company stepped up buying from the recent weekly average of roughly 45,000 to 50,000 ETH as market signals suggest a potential bottom may be forming.

“We continue to believe that crypto prices are in the late/final stages of the ‘mini-crypto winter,’” Lee said in a statement.

“As the adage goes, nobody rings the bell at the bottom.” he said. “Therefore BitMine’s strategy is to slightly increase its pace of ETH accumulation.”

The firm said it now earns $174 million annual revenue from staking more than 3 million of its ether token holdings, which could grow to $259 million once all tokens are locked to earn a yield.

Crypto World

Bitcoin’s 20 Millionth Coin Has Just Been Mined

The Bitcoin network has just reached 20 million mined coins, leaving just one million Bitcoin to be mined over the next century.

“The market is about to experience something new: A global asset with almost no new supply left,” Energy Co managing partner David Eng said in an X post on Sunday.

On average, about 450 new Bitcoins are mined each day at current rates. This rate halves roughly every four years as a result of the Bitcoin halving. With just 1 million Bitcoin supply left, the last Bitcoin is set to be mined around 2140.

Bitcoin’s finite supply offers “predictable rules”

Bitcoin mining company Elektron Energy CEO Raphael Zagury told Cointelegraph the level of clarity around Bitcoin’s supply is “unprecedented.”

“The issuance schedule is transparent decades into the future. Humans value predictable rules, especially when it comes to money,” Zagury said.

“The one million countdown reinforces everything that’s unique about Bitcoin,” added crypto exchange Swyftx portfolio manager Tommy Rogulj.

“It is a hard-capped, permissionless, and neutral bearer asset operating on a transparent supply curve that cannot be expanded like fiat currencies. This matters in a world that is increasingly succumbing to conflict and tech-driven uncertainty.”

In December, asset management firm Grayscale Investments said that a “digital money system with transparent, predictable, and ultimately scarce supply is a simple idea, but it has rising appeal in today’s economy due to fiat currency tail risks.”

“Non-event, no impact” on BTC’s price: Crypto exec

However, crypto analysts were not convinced the recent milestone would affect Bitcoin’s price.

“Already priced in, markets know the supply growth rate (inflation rate) of BTC with certainty, and it’s already lower than gold,” Capriole Investments founder Charles Edwards told Cointelegraph. “I think it’s a non-event, no impact.”

Zagury shares a similar view to Edwards. “I don’t think the milestone alone moves price in the short term,” Zagury said, adding that “liquidity and macro still dominate.”

Related: Bitcoin drops 2% as oil prices surge on energy shortage fears

“But long term, scarcity plus predictable policy is a powerful combination. Over time, markets tend to reward systems people can trust,” he said.

Bitcoin traded at $68,670 at the time of publication, down around 19% in the past year, according to CoinMarketCap.

What happens once Bitcoin supply stops?

One of the biggest questions among Bitcoiners is what happens once the last Bitcoin is mined in 2140, with some worried that the network’s security could suffer, as miners will no longer be incentivized by new coins.

It is understood that at that point, Bitcoin’s model will shift to transaction fees to incentivize miners to continue securing the network, though there are some concerns that it could lead to higher transaction fees.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

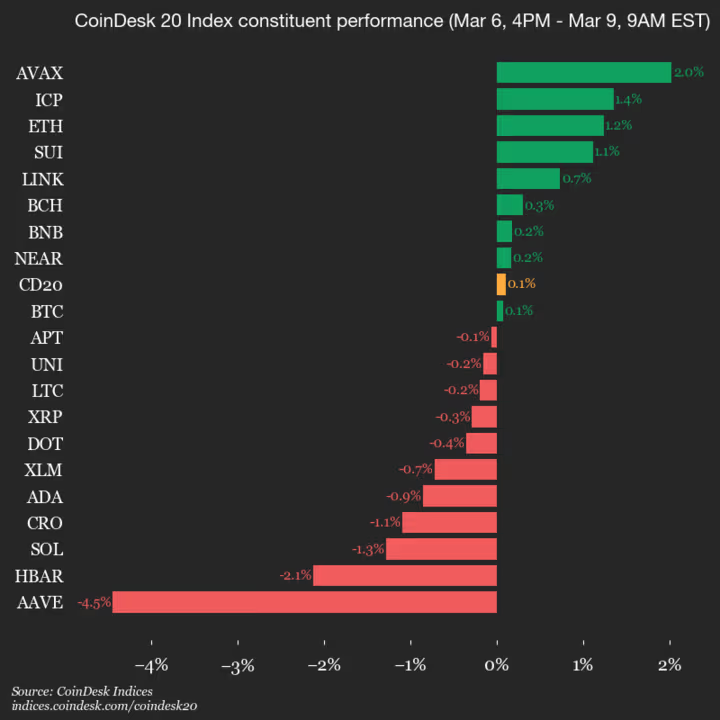

Avalanche (AVAX) Gains 2% as Index Trades Flat

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1948.46, up 0.1% (+2.05) since 4 p.m. ET on Friday.

Nine of the 20 assets are trading higher.

Leaders: AVAX (+2.0%) and ICP (+1.4%).

Laggards: AAVE (-4.5%) and HBAR (-2.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Here’s why Pi Network price may keep soaring this week

Pi Network price rose by 2.2% on Monday, making it one of the top gainers in the crypto market. It has now soared by ~70% from its lowest level this year, and several key catalysts may drive it higher this week.

Summary

- Pi Network price has rebounded by ~70% from its lowest level this year.

- The network will continue rising ahead of the upcoming Pi Day.

- Technical analysis suggests that the token will continue rising this year.

Pi Coin (PI) token was trading at $0.2165 on Monday, paring back some of the losses made on Sunday. This rebound has made it one of the best-performing coins in the crypto industry this year.

Pi Network token will likely continue the recent bull run because of the upcoming Pi Day event, which will take place on Saturday this week. The developers have a long history of making major announcements on this day. As such, the price may continue rising as traders anticipate the event.

Pi Network is going through a series of core upgrades, with the current one expected to conclude on March 12. These upgrades will make it a better network, especially as the developers plans to launch decentralized exchange and automated market maker tools.

Pi Network price will also benefit from the ongoing investments in the artificial intelligence industry. It invested in OpenMind last year, and on Friday, the developers shared key details of this partnership.

In addition to the monetary impact, Pi Network hopes that the partnership will help its miners make extra money by providing their resources to the company. It also hopes to replicate this model to other companies in the AI industry.

Pi Coin price will also benefit from the upcoming validator rewards distribution, which is expected to happen later this month.

Most importantly, there are signs that demand is rising. Data shows that the daily volume jumped to $38 million, much higher than where it was a few months ago when it dropped below $10 million.

Pi Network price technical analysis

The daily chart reveals that the Pi Coin price has staged a strong comeback after bottoming at its all-time low of $0.1312 on February 12.

Pi has already crossed above the 100-day Exponential Moving Average, confirming the bullish outlook. In most cases, moving above that level is a sign that bulls are in control for now.

The coin has moved above the Supertrend indicator. Also, the Percentage Price Oscillator and the Relative Strength Index have continued rising.

Therefore, the coin will likely continue rising as bulls target the important resistance level at $0.2935, its highest point in October last year. This price is about 35% above the current level.

Crypto World

Microsoft (MSFT) Stock Integrates Anthropic’s Claude into New Copilot Cowork Feature

Key Highlights

- Microsoft unveiled Copilot Cowork, leveraging Anthropic’s Claude Cowork platform, designed for Microsoft 365 business customers

- The AI agent automates workflows including presentation creation, Excel data manipulation, and calendar coordination with minimal user intervention

- MSFT shares have declined 15% year-to-date, with an additional 9% drop in February after Anthropic’s Claude Cowork announcement

- The tech giant is integrating Claude Sonnet models into M365 Copilot, diversifying away from exclusive OpenAI GPT dependency

- Microsoft 365 Copilot subscription seats surged 160% year-over-year during the latest reporting period

On Monday, Microsoft revealed Copilot Cowork, an innovative AI agent solution developed through a partnership with Anthropic. This release integrates Claude Cowork’s self-sufficient features straight into the Microsoft 365 platform.

The intelligent assistant can generate slide decks, fill spreadsheet cells, and coordinate with team members for scheduling — requiring only basic direction from users. The feature remains in beta testing, with broader availability planned for select enterprise customers within weeks.

Microsoft emphasized its security infrastructure as a differentiator. While Claude Cowork functions locally on individual machines, Copilot Cowork runs exclusively through cloud infrastructure.

“We work only in a cloud environment and we work only on behalf of the user. So you know exactly what information it has access to,” said Jared Spataro, who leads Microsoft’s AI-at-Work efforts.

The release comes at a strategic moment. Anthropic’s initial Claude Cowork announcement on January 30 triggered widespread concern across technology equities. Companies like Salesforce (CRM), ServiceNow (NOW), Intuit (INTU), and Thomson Reuters (TRI) experienced significant declines.

Microsoft wasn’t spared either. The company’s shares tumbled almost 9% during February in response to the Cowork announcement. Year-to-date, MSFT has retreated 15% from its 2026 opening levels.

Expanding Model Portfolio Beyond OpenAI

Monday’s reveal also signals an important strategic pivot in Microsoft’s artificial intelligence approach. The company confirmed it will offer Anthropic’s Claude Sonnet models within M365 Copilot — a platform that had previously operated solely on OpenAI’s GPT infrastructure.

OpenAI represents approximately 45% of Microsoft’s cloud services contract pipeline, a level of dependency that has concerned some market analysts. Incorporating Anthropic’s technology provides greater strategic diversification.

Copilot Cowork pricing details remain undisclosed. Microsoft indicated that certain functionality will be bundled within its current $30-per-user monthly M365 Copilot subscription, while additional capacity will require separate purchases.

Corporate Customer Growth Metrics

Microsoft’s business AI adoption figures demonstrate strong momentum. Paid M365 Copilot licenses expanded 160% compared to the previous year in the latest quarter, while daily engagement surged tenfold.

Organizations implementing Copilot across more than 35,000 licenses tripled year-over-year. Notable recent deployments span Mercedes-Benz, NASA, Fiserv, ING, and the US Department of the Interior.

Microsoft simultaneously introduced additional autonomous AI capabilities across Word, Excel, PowerPoint, and Outlook. The Microsoft Agent 365 management platform has reached general availability at $15 monthly per user.

The corporation packaged its complete offering — encompassing Entra, Copilot 365, and Agent 365 — into a comprehensive Microsoft 365 E7 bundle priced at $99 per user monthly.

Microsoft shares closed Friday at $408.96, declining 0.42%, with pre-market indicators Monday morning pointing to an additional 1.1% decrease to $404.41.

Crypto World

Solana ETFs Build ‘Serious Investor Base,’ Outpacing Bitcoin in Key Metrics

Solana (SOL) ETFs have defied brutal market mechanics since going live in July 2025. While the token’s price collapsed by a little over 57% over the same period, the funds themselves have attracted $1.45 billion in net inflows.

This extreme divergence signals that a “serious investor base” is accumulating heavily even as retail capitulates.

Normally, assets that fall this sharply struggle to attract new liquidity. But Solana ETFs are doing the opposite, absorbing capital at a rate that effectively decouples institutional demand from spot price action. Adjusted for market capitalization, the buying pressure is nearly unprecedented.

To put the numbers in perspective, Solana’s inflow data is arguably stronger than Bitcoin’s when scaled for size.

Bloomberg Intelligence analyst Eric Balchunas notes that if adjusted for the market cap difference, Solana’s $1.45 billion haul is the equivalent of $54 billion in net new flows for Bitcoin, roughly double what Bitcoin ETFs managed at the same stage.

While Bitcoin holds above $68,000 amid strong ETF inflows, Solana’s accumulation during a 50%+ crash highlights a different kind of conviction.

“About as unlucky timing as you’ll ever see,” Balchunas wrote on X regarding the launch timing relative to the price crash. Yet, the funds have not only accumulated capital but retained it.

“They managed to not only accumulate $1.5 billion in flows but also not really give any of it up. Both are really good signs for the future.”

Discover: The best meme coins on Solana

Will SOL Price Catch Up with ETF Volume?

The resilience of these flows suggests the buyer profile is drastically different from the typical retail trader.

According to 13F filings, the majority of Solana ETF holders are institutions, hedge funds, pension funds, and asset managers, who typically operate with multi-year time horizons. They are buying the thesis, not the weekly candle.

As $1.5 billion floods Solana ETFs despite the crash, the data indicates smart money views the $85 range as a deep value zone. If these investors refused to sell during the steep slide from $300, they effectively set a high-conviction floor.

This behavior creates a “diamond hand” dynamic where a significant portion of the floating supply is moving into cold storage custody vehicles.

Balchunas framed the situation clearly: “If we adjust for the size of Solana versus Bitcoin market cap, it’s the equivalent of $54 billion in net new flows.”

For active traders, this metric is a leading indicator. Volume often precedes price, and in this case, custodial volume is screaming bullish divergence even while the chart looks bearish.

Could Institutional Accumulation via Solana ETFs Trigger a Supply Shock?

The broader implication here is a potential supply squeeze. When price drops but custody holdings rise, the asset becomes more illiquid on the sell side.

We are seeing a similar dynamic elsewhere in the market, where Bitcoin is vanishing from exchanges at rates that suggest a looming supply shock.

For Solana, the setup is even more aggressive given the market cap disparity. Investors viewing current prices as a buying opportunity rather than a warning sign have absorbed the selling pressure from the FTX-era unwinds and broader market corrections.

If market sentiment flips neutral or bullish, the lack of liquid supply could force a violent repricing to the upside.

The level to watch is $100. If ETF inflows sustain their current pace, a reclaim of this psychological level could trigger a squeeze against late shorts who are betting on a continued downtrend.

Discover: The best crypto to diversify your portfolio with

The post Solana ETFs Build ‘Serious Investor Base,’ Outpacing Bitcoin in Key Metrics appeared first on Cryptonews.

Crypto World

Bybit ramps up Middle East operations amid regional tensions

Bybit has reaffirmed its commitment to the Middle East amid escalating regional tensions, unveiling a leadership change designed to accelerate growth across the Middle East and North Africa (MENA). The exchange said it appointed Derek Dai as the new MENA country manager, a move that places a sharper focus on market expansion, regulatory collaboration, institutional partnerships, and localized product development in the UAE and surrounding markets. The announcement comes as exchanges seek to balance regional risk with a strategy of deeper, more regulated presence in one of crypto’s fastest-growing hubs.

Key takeaways

- Bybit appointed Derek Dai as the MENA country manager, with responsibilities spanning market expansion, regulatory engagement, institutional partnerships, and localized product development.

- The firm stated it has no plans to scale back Middle East operations despite regional tensions, signaling a strategic pivot toward deeper regional investment.

- Dubai’s ecosystem remains a focal point, with Bybit aiming to broaden access to the UAE dirham and strengthen ties with local financial centers and banks.

- Market context underscores the Middle East as a pivotal crypto region: UAE-based crypto firms number in the thousands, and licensing activity in Abu Dhabi’s ADGM grew notably in early 2025.

- Safety measures for UAE-based staff were highlighted as the company navigates a volatile security environment while pursuing long-term regional growth.

Sentiment: Neutral

Market context: The Bybit development aligns with broader regional crypto activity and regulatory evolution in Dubai and across the UAE. Data points from the region highlight its growing role in the crypto economy, including the presence of thousands of crypto firms and notable licensing trends in Abu Dhabi Global Market (ADGM). The broader story of crypto adoption in the Gulf continues to unfold amid geopolitical risk and ongoing regulatory scrutiny.

Why it matters

The Middle East has emerged as a strategic corridor for crypto activity, drawing exchanges, custodians, and fintech firms that seek regulated access to capital, talent, and a growing consumer base. Bybit’s move to formalize a dedicated MENA leadership role signals a commitment to long-term presence in a region that regulators view as a test case for integrating digital assets into mainstream finance. The UAE’s ambition to become a leading digital asset hub remains a central narrative, even as external shocks test business continuity and risk management practices.

Industry dynamics in the region are shaped by a concerted effort to bridge digital assets with traditional finance. Bybit’s emphasis on expanding UAE dirham liquidity and forging partnerships with banks and payment providers points to a broader strategy: to provide seamless on/off-ramps and to integrate crypto services into existing financial infrastructures. In this context, collaborations with major financial centers like the Dubai International Financial Centre (DIFC) and the Dubai Multi Commodities Centre (DMCC) are pivot points for establishing compliant, scalable operations that can weather regional instability.

The regional narrative is reinforced by data suggesting a real, if uneven, growth trajectory. In neighboring Iran, for instance, crypto activity has shown spikes in withdrawal flows following regional events, underscoring a demand for accessible digital asset channels during periods of stress. Authorities and industry participants alike watch how the Gulf states balance innovation with risk controls as they ramp up licensing regimes and supervision architectures. In the crypto policy space, these dynamics are part of a broader pattern of increased institutional interest and regulated infrastructure building in the area.

Bybit’s leadership statements emphasize a deliberate, locally rooted approach. The company’s leadership argues that the UAE’s vision to become the world’s leading digital asset hub is not undermined by crisis; rather, the country’s demonstrated resilience reinforces the strategic rationale for building in the region. In practical terms, the company has outlined concrete steps to support its people on the ground, including daily check-ins, real-time safety confirmations, and relocation or travel assistance as needed to navigate the evolving risk environment.

The expansion plan also reflects a longer horizon for digital asset infrastructure in the region. Bybit’s focus on deepening ties with major financial centers and expanding tokenized real-world assets can help bridge traditional finance with the digital asset ecosystem. The move sits within a broader ecosystem of UAE-based activity, where approximately 1,800 crypto companies operate and employ more than 8,600 people, and where licensing activity in Abu Dhabi’s ADGM has shown meaningful upticks at the start of 2025 compared with the previous year.

As the market digests these developments, Bybit’s approach will be watched for signals about the region’s openness to institutionalized crypto services and the reliability of regional fintech partnerships during times of geopolitical tension. The company’s emphasis on compliance, talent development, and community engagement aligns with a cautious but forward-looking view of Dubai and the UAE as critical nodes in the global digital asset economy.

What to watch next

- Regulatory progress in the UAE, particularly around licensing frameworks and approvals tied to DIFC and DMCC initiatives.

- New partnerships with banks and payment providers to enable UAE dirham settlements and broaden on/off-ramp capabilities.

- Progress on tokenized real-world assets and other product integrations that connect digital assets with everyday financial services.

- Updates on Bybit’s regional hiring, local compliance programs, and regional risk-management practices.

Sources & verification

- Bybit press release announcing Derek Dai as MENA country manager and outlining expanded regional responsibilities.

- Bybit statements reaffirming continued Middle East commitment and plans for deeper regional investment.

- Analyses and data on UAE crypto ecosystem indicators, including the scale of firms and licensing trends in ADGM for early 2025.

- Reports on crypto activity in Iran and related outflows following regional strikes, with coverage tied to industry data sources.

Bybit broadens MENA footprint as regional tensions test crypto expansion

Bybit is recalibrating its regional strategy with a formal MENA leadership appointment that signals longer-term intent to build in a market viewed as a strategic gateway for regulated crypto services in the Middle East. Derek Dai’s appointment as MENA country manager places demand-side growth, regulatory collaboration, and partnerships at the forefront of the company’s regional playbook, while anchored by a local product development agenda tailored to the UAE and nearby markets. The emphasis on regulatory cooperation is a notable signal in a landscape where compliance and risk management increasingly determine what gets built and who can operate in the region.

In remarks accompanying the announcement, Bybit’s leadership stressed resilience and continuity. Helen Liu, co-CEO of Bybit, highlighted that the company has no intention of scaling back its Middle East footprint despite the current crisis, framing the region as a strategic priority rather than a temporary exposure. A subsequent blockquote captured the stance: “Some companies are reassessing their Gulf exposure right now. We are doing the opposite. We are deepening our presence, our investment, and our commitment to this region.”

The discourse around Bybit’s regional strategy also includes a strong emphasis on people and governance. The exchange noted ongoing measures to safeguard UAE-based staff, including daily safety check-ins and relocation or travel support where needed. This attention to workforce welfare sits alongside a broader push to enroll local talent in regulatory compliance, community initiatives, and long-term capacity-building—an approach seen as essential to maintaining operations in a high-stakes environment.

On the commercial front, Bybit’s strategy centers on expanding access to local currencies, expanding partnerships with banks and payment providers, and strengthening the financial infrastructure that ties digital assets to everyday finance. The leadership stressed a desire to deepen collaboration with Dubai’s flagship financial ecosystems, notably the DIFC and DMCC, as part of a broader effort to anchor digital asset services within established economic channels. The aim is to create a more integrated ecosystem where digital assets can interface smoothly with traditional finance, while also supporting the growth of tokenized real-world assets that bridge the two worlds.

Beyond the immediate operational implications, the story in the UAE and wider MENA reflects the region’s growing prominence in the crypto space. The market’s trajectory is shaped by a combination of regulatory clarity, a robust capital cycle, and a corporate push to scale responsibly in a market characterized by both opportunity and risk. While the geopolitical backdrop remains unsettled, the region’s regulators and financial centers have continued to emphasize the importance of a regulated, compliant, and innovation-friendly environment for digital asset services.

Crypto World

Avalanche price forecast as bears keep AVAX below key level

- Avalanche climbed above $9 as bulls mirrored broader gains.

- However, the altcoin remains in bearish momentum as the price hovers below a key level.

- Derivatives data and technical indicators offer a mixed outlook for the AVAX price.

Avalanche price continues to face headwinds as the token trades just above $9.00.

Despite slight gains after four consecutive days of downward action, AVAX price remains below the $10 mark as on-chain metrics and technical indicators show a mixed outlook.

The overall bearish price action and underlying crypto market sentiment favour sellers, particularly amid the unfolding geopolitical scenario.

Avalanche derivatives outlook

The derivatives market for Avalanche presents a conflicting picture that traders must navigate carefully.

On one hand, Avalanche futures Open Interest (OI) has fallen to $387 million, having declined steadily since mid-January.

Coinglass data shows OI is nearing the February low of $361 million, which could highlight a drop in investor confidence amid a broader bearish outlook.

Such a decline in open interest typically suggests that traders are closing positions rather than opening new ones, reflecting a cautious or bearish sentiment across the broader market.

However, a closer look at the funding rates tells a different story. The funding rate for AVAX turned positive on Monday after hitting -0.0153% on March 6.

While it is not steady amid recent price declines, it currently hovers around 0.0070%.

A positive funding rate indicates that long positions are paying shorts.

Often, this suggests that despite the falling price, a segment of the market remains bullish and is willing to pay a premium to hold long positions.

This divergence of a falling open interest and positive funding suggests that while overall participation is down, the remaining leveraged traders are optimistic of a notable rebound.

Avalanche price forecast

The technical picture for Avalanche indicates that the region around the $8.63 and $8.10 levels provides a crucial support zone.

AVAX has bounced off this area multiple times in the past two months, with bulls setting the lower boundary of the range as a key level on Feb 6 and on Feb 26.

However, the bulls have failed to go higher amid supply wall rejection below $10.

Avalanche’s price has declined by more than 26% year-to-date.

The Relative Strength Index (RSI) currently reads 46, which is below the neutral 50 level.

However, it’s upturned to indicate that bulls could reclaim traction.

Also notably, the Moving Average Convergence Divergence (MACD) indicator features a bullish crossover whose upside bias has not yet been invalidated.

As of Monday morning, AVAX traded at $9.08, hovering just above the critical support zone.

Should the market sentiment shift and buyers step in, a recovery to above $11 could bring the next level of $14 into play.

If the bearish momentum outlook picks up fresh momentum, the token’s value could test the February 6 low of $7.53.

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

News Videos2 hours ago

News Videos2 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports1 day ago

Sports1 day agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Tech7 days ago

Tech7 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business20 hours ago

Business20 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment2 days ago

Entertainment2 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat7 days ago

NewsBeat7 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech4 days ago

Tech4 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death