Crypto World

Singapore Gulf Bank announces regulated fiat-stablecoin interoperability service

Singapore Gulf Bank has announced a new service that lets institutions mint, trade and convert stablecoins to fiat within a single regulated platform.

Summary

- Singapore Gulf Bank has introduced a stablecoin interoperability service allowing institutions to mint, convert, and trade USDC and USDT across Solana, Ethereum, and Arbitrum.

- The bank expects to launch the service by Q1 2026.

According to a press release shared with crypto.news, the new service will allow SGB clients to mint, convert, hold, and trade stablecoins like USDC (USDC) and USDT (USDT) across major blockchain networks like Solana, Ethereum, and Arbitrum on SGB Net.

“Our ambition is to become the one bank for all of finance,” SGB’s Chief Executive Officer Shawn Chan said in an accompanying statement, adding that stablecoin management solutions remain “unnecessarily complex.”

SGB Net is a proprietary real-time, multi-currency clearing network that the bank launched earlier this year, specifically for digital asset firms. According to the bank, it currently processes over $2 billion in monthly fiat transaction volume.

The platform will come with built-in safeguards, including full compliance with Know Your Customer, Know Your Business, and anti-money laundering rules.

The bank has partnered with crypto infrastructure provider Fireblocks to handle custody of funds.

Singapore Gulf Bank and Fireblocks partnered in November. At the time, the bank said the partnership would help it automate treasury operations and mitigate operational risks.

SGB is currently working with its ecosystem partners and regulators to implement appropriate guardrails and expects to begin providing access to the service by Q1 2026.

Based on ongoing market trends, it is evident that there has been an increase in demand for regulated access to stablecoins, specifically dollar-backed stablecoins, which remain the dominant vehicle for digital liquidity and global settlements.

Last month, USDT issuer Tether launched USA₮, a federally regulated U.S. stablecoin that is compliant with the newly enacted GENIUS Act.

Elsewhere, in the UAE, Universal Digital Intl Limited has launched the country’s first central bank–approved stablecoin dubbed USDU, which is fully backed by U.S. dollars.

Crypto World

ETH Rebounds From $1.8K as Price Metrics Signal Prolonged Weakness

Ether has faced renewed selling pressure, with traders watching a price drift toward a critical support zone as bearish sentiment deepens. A roughly 14% slide over the past 10 days culminated in a notable surge in leveraged liquidations, underscoring the fragility of near-term demand for the network’s data-processing capabilities. The latest move comes as broader market dynamics remain tethered to Bitcoin, with cyclical risk-off trades and hedging activity intensifying as on-chain activity cools and institutional flows remain unsettled.

Key takeaways

- ETH futures liquidations reached $224 million after a 14% price drop over 10 days, coinciding with a broad pullback in on-chain activity and a precarious bias in the options market.

- Derivatives data show a sharp shift toward downside hedging, with the ETH put-to-call volume premium spiking to 2.2x and the 30-day delta skew at 18%, signaling elevated demand for protection against further declines.

- Ethereum’s network fundamentals deteriorated, with total value locked (TVL) dipping to $51 billion—the lowest level since May 2025—and 30-day network fees sliding to $13.7 million, indicating waning activity on the chain.

- Valuable anchor events added pressure, including a reported $7 million in ETH sales tied to donations associated with Ethereum co-founder Vitalik Buterin, contributing to a cautious mood around the asset.

- US-listed Ether ETFs recorded outsized outflows, totaling about $405 million since Feb. 11, driving assets under management down to roughly $12.4 billion and signaling continued institutional repositioning.

- The price path remains tightly correlated with Bitcoin, as Ether’s and BTC’s 20-day correlation held in the upper echelons, reinforcing the perception that macro flows dominate near-term moves.

The latest price action saw Ether fall toward the $1,800 level, erasing a substantial portion of gains from late last year and prompting traders to reassess risk exposure. The pullback has not only tested support but also exposed the fragility of the current floor, particularly as options markets show a renewed appetite for hedges rather than directional bets. The sentiment is not just about a single order book imbalance; it reflects a combination of thinner on-chain activity, lower disposable fees, and a sense that investors are waiting for clearer catalysts before re-engaging with sustained long exposure.

On the derivatives front, the market’s mood shifted abruptly on Tuesday. The put-to-call volume premium in ETH options rose to 2.2 times, a visible tilt toward downside protection as market participants positioned for increased volatility. The delta skew—an indicator of the relative pricing of puts versus calls—stood at about 18% on that day, underscoring that hedging costs were skewed toward protection rather than speculative bets on immediate rebounds. In practice, this configuration implies a market bracing for further price disruption, even as some traders may still tilt toward selling puts to attempt a bounce, a strategy that often backfires in persistent drawdowns.

The chain’s fundamental metrics corroborate a darker near-term outlook. Ethereum’s total value locked declined to around $51 billion, marking a multi-quarter low that suggests reduced appetite for DeFi protocols and the kinds of capital-intensive activity that historically sustain higher gas demand. Network fees have also cooled, averaging roughly $13.7 million over the past 30 days—well below late-2025 levels—and hint at a softer cadence of user activity and contract interaction. Against this backdrop, sentiment around encoding and data processing on the network remains subdued, with potential knock-on effects for validators and ecosystem development projects.

Beyond the on-chain and derivatives signals, a notable social and governance dynamic has fed into the mood music. A recent round of ETH sales linked to donations associated with Vitalik Buterin, Ethereum’s co-founder, drew additional attention. In January, Buterin earmarked a considerable tranche of ETH—16,384 ETH—for philanthropic purposes spanning privacy-focused technologies, open-source hardware, and secure, verifiable software systems. While charitable in nature, the sale added a layer of bearish optics during a week already defined by fragile confidence and risk-off trading. The optics reflect a broader theme: even constructive or altruistic actions can weigh on investor sentiment when market participants are looking for signals of durable demand recovery.

Further pressure has come from ETF-related trends. Outflows from Ether ETFs have been persistent, with US-listed Ether ETFs recording net withdrawals that have pushed total assets under management down to around $12.4 billion. The pace of withdrawals has accelerated since mid-February, contributing to a sense that institutional players are rebalancing away from Ether in favor of other assets or strategies. The development occurs alongside broader gold-market activity, where gold ETFs saw sizable inflows in the latest reporting period, highlighting a contrast in capital allocation across traditional and crypto-linked investment products.

From a price-movement standpoint, Ether remains tightly correlated with Bitcoin, a relationship that has historically amplified both upside and downside in periods of macro-driven risk appetite. The 20-day correlation between Ether and Bitcoin has hovered in the high 90s, illustrating how a single market narrative—risk-off sentiment—can pull both assets in the same direction for extended stretches. This correlation complicates a clean technical recovery play for Ether, as a broad risk-off backdrop can forestall sustained rallies even when Ether-specific catalysts emerge.

Amid this confluence of signals, traders face a difficult calibration: hedge protection while recognizing the potential for further declines, weigh the durability of on-chain usage against the immediate squeeze on liquidity, and monitor the evolving flow dynamics that continue to shape institutional positioning. The current environment is not merely about price—it is about the balance between hedging demand, network activity, and the liquidity hooks that can either slow or accelerate a potential drag on Ether’s value.

The broader backdrop remains essential. As risk sentiment in crypto persists in a cautious mode and macro flow regimes continue to influence asset dispersion, Ether’s path will depend as much on the resilience of hedging mechanisms and ETF liquidity as on any single protocol upgrade or on-chain development. The market is currently prioritizing protection over speculation, and until derivatives metrics stabilize and on-chain usage strengthens, the path of least resistance could tilt lower rather than higher.

Market context: The current dynamics place Ether in a broader risk-off framework where liquidity, hedging, and ETF flows weigh as heavily as on-chain activity in determining near-term momentum. In such an environment, macro catalysts and cross-asset capital allocation will continue to shape the trajectory of Ether alongside Bitcoin and other major crypto benchmarks.

Why it matters

For investors, the confluence of a price drop, rising hedging activity, and persistent ETF outflows signals a period of heightened caution. The absence of a clear catalyst for a fast revival raises the probability that Ether could test lower supports before any durable recovery materializes. Traders must weigh the cost of hedges against the risk of a deeper drawdown, particularly in a landscape where futures positions can unwind rapidly in response to new macro cues.

For builders and protocol participants, the softness in on-chain activity and the readiness of markets to hedge rather than deploy funds may influence decisions around network improvements, layer-2 integrations, and development roadmaps. A sustained reduction in network usage could impact fee-based incentives for validators and the long-term economic design of the platform, prompting a closer look at throughput solutions and utilization strategies.

For policymakers and institutional watchers, the flow dynamics around Ether ETFs and other crypto investment products offer insight into how mainstream capital is approaching crypto assets during stress. The rate of outflows and the resilience of liquidity in key products can inform discussions about product design, investor protection, and the evolving regulatory framework governing crypto markets.

What to watch next

- Monitor Ether’s price action around the $1,800 level for any decisive break or a potential bounce in the next 1–2 weeks.

- Track Ether ETF inflows/outflows and any new filings or product adjustments that could signal shifting institutional appetite.

- Watch Deribit and other venues for changes in put-call ratios and delta skew, which would indicate evolving hedging pressure.

- Observe on-chain metrics like TVL and network fees for any uptick in activity that could precede a tactical recovery.

- Keep an eye on the 20-day ETH/BTC correlation, as a sustained decoupling would be a meaningful sign of evolving market dynamics.

Sources & verification

- ETH price movement to around $1,800 and the $224 million leveraged liquidations over 48 hours.

- Deribit-based derivatives data showing a 2.2x put-to-call premium and an 18% delta skew for ETH options.

- Ethereum network metrics: TVL at $51 billion and 30-day network fees at $13.7 million.

- Vitalik Buterin’s ETH sale tied to donations for privacy-focused technologies and open-source hardware (ETH donations noted in January).

- US-listed Ether ETF net outflows totaling approximately $405 million since Feb. 11, with AUM around $12.4 billion.

- BTC–ETH 20-day correlation readings indicating tight co-movement over recent weeks.

Crypto World

Bitcoin eyes $60k as Kraken VP warns of deeper tariff-led slide

BTC fell about 5% in days as tariffs and geopolitics drove downside risk.

Summary

- BTC is in a sharp correction similar to equities, with renewed tariff uncertainty and geopolitical tensions cited as primary downside catalysts in the short term.

- Kraken VP Matt Howells-Barby flags ~$60k as critical support and warns a breakdown could open a path toward the mid-to-low $50k range.

- Historically, BTC has not bottomed until the 50-week MA drops below the 100-week MA in a death cross, implying potential further downside before a durable floor forms.

Matt Howells-Barby, Vice President of cryptocurrency exchange Kraken, identified critical price levels for Bitcoin as the digital asset undergoes a correction, according to statements from the executive.

Howells-Barby stated that Bitcoin is experiencing a sharp correction similar to movements in equity markets, with uncertainty surrounding tariffs cited as one of the primary factors driving the decline. The executive drew comparisons to macroeconomic pressure observed in April of the previous year, noting that geopolitical tensions could present additional downside risks in the short term.

The Kraken executive pointed to a critical support level as a technically significant threshold. According to Howells-Barby, a break below this support could push Bitcoin prices down to the lower-to-mid range.

Howells-Barby referenced historical data indicating that Bitcoin typically does not establish a clear bottom until the 50-week moving average falls below the 100-week moving average, a technical pattern known as a “death cross.” The absence of such a cross suggests the possibility of further declines extending below the lower range, according to the analysis.

Market analysts indicate that volatility may remain elevated in the current environment, with investors advised to focus on risk management strategies.

Crypto World

Here’s why the crypto market crash is gaining steam today (Feb. 24)

The crypto market crash gained steam today, February 24, with Bitcoin falling below the crucial support level at $65,000 and nearing its lowest level this month.

Summary

- The crypto market crash gained momentum on Tuesday.

- This retreat coincided with the ongoing risk-off sentiment.

- The retreat happened as the futures open interest continues falling.

Bitcoin (BTC) was trading at $63,000, while top altcoins like Ethereum (ETH), Ripple (XRP), and Solana (SOL) fell by over 4% in the last 24 hours. The market capitalization of all tokens tracked by CoinMarketCap dropped by 4.23% in the last 24 hours to over $2.18 trillion.

Crypto market crash accelerates as risk-off sentiment prevails

One major risk for the crypto market crash is that investors have largely embraced a risk-off sentiment this week. This view is supported by the view that the VIX Index jumped by over 15% on Monday as the US stock market dropped by over 1%. Gold price continued rising this week and is slowly nearing the all-time high.

Market participants have embraced a risk-off sentiment because of the potential war in Iran, which President Trump is considering. He has made the biggest military deployment in the region in decades and hinted that he will make a limited attack to force the Iranians to a deal.

A limited attack by the United States may lead to a prolonged war in the region. Such a war would lead to a surge in crude oil and natural gas prices, which would stimulate inflation in her region. Also, Bitcoin has proven that it is not a safe-haven asset.

The risk-off sentiment has also jumped because of the fear in the artificial intelligence industry. These fears have knocked many stocks, including companies like IBM, Microsoft, and Salesforce. In most cases, the crypto market tends to crash when stocks are not doing well.

The crypto market crash happened after the new Trump tariffs went into effect. Trump launched a 10% tariff on all goods coming to the US using Section 122. He is also eying more tariffs after launching several investigations.

Crypto prices sink amid weak technicals and falling open interest

The other reason why the crypto market is crashing is that the futures open interest continued falling. Data compiled by CoinGlass shows that open interest has dropped to $90 billion. Falling open interest is a sign of weak demand.

This retreat has coincided with the ongoing ETF outflows. Data shows that spot BTC outflows jumped to over $203 million on Monday, bringing the cumulative total in the last four months to over $7 billion. Ethereum ETF outflows have also continued accelerating.

Technicals have also contributed to the ongoing crypto market crash. The daily chart shows that the BTC price dropped after forming a bearish pennant pattern. It also remains below all moving averages and the Supertrend indicator. Therefore, the coin may continue falling to $50,000, which may lead to more downside.

Crypto World

Bitcoin Down 49.53% From ATH: How Far Can BTC Fall Before This Bear Market Finds a Bottom?

TLDR:

- Bitcoin has fallen 49.53% from its October 6, 2025 ATH, wiping out roughly $1.2 trillion in total market cap.

- The BPDA% metric sits deep below its one-year average, signaling extreme stress, capitulation, and widespread panic selling.

- Bitcoin’s Realized Price near $54,600 marks a historically significant accumulation zone during past bear market cycles.

- The $49,000 to $42,000 range holds the highest probability of bear exhaustion and may signal the start of the next cycle.

Bitcoin’s 49.53% decline from its all-time high has wiped out roughly $1.2 trillion in market value. The drop has renewed serious debate about how far this bear market can extend.

On October 6, 2025, Bitcoin’s market cap sat at $2.4891 trillion. Today, it has fallen to $1.2918 trillion. With extreme fear gripping the market and macro pressures mounting, analysts are now mapping the levels where Bitcoin could finally find its floor.

On-Chain Data Points to Where Bitcoin’s Decline May Stall

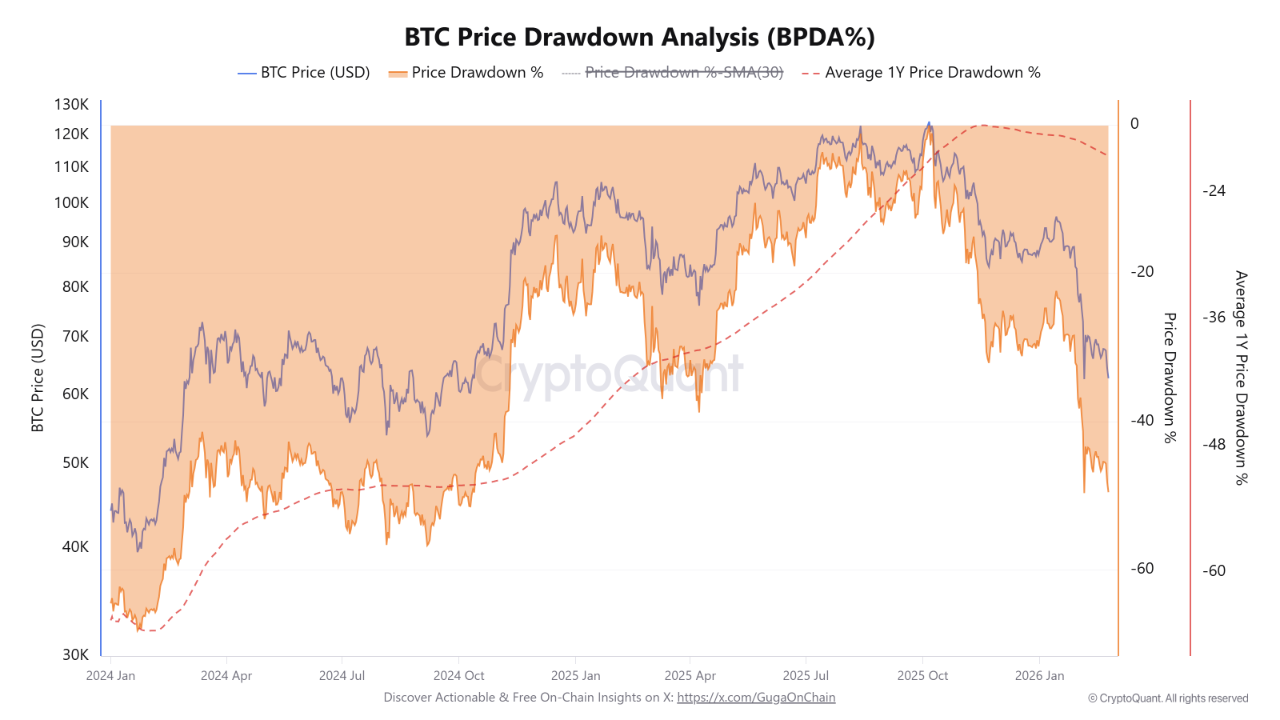

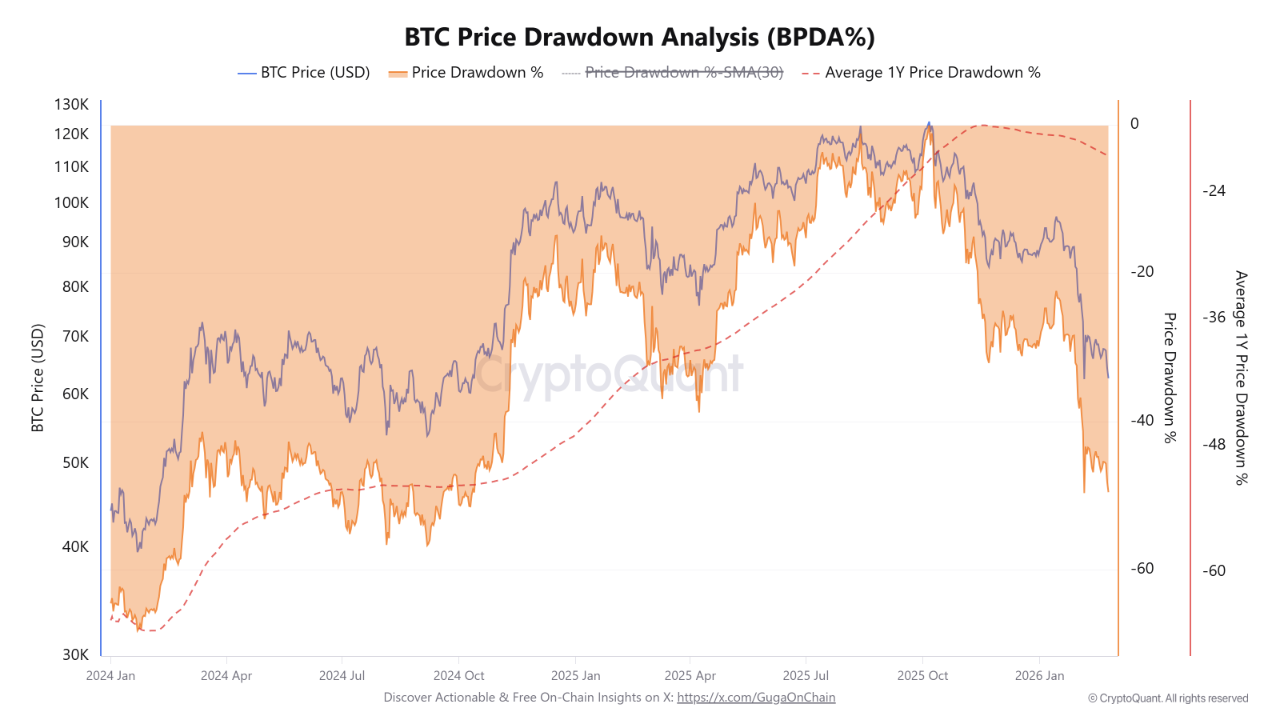

The BTC Price Drawdown Analysis (BPDA%) is one metric drawing close attention right now. When this reading falls far below its one-year average, it historically marks phases of stress, capitulation, and panic. That is exactly where it stands at this moment.

Crypto analyst GugaOnChain flagged this condition, noting that the current drawdown places Bitcoin in extreme stress territory.

Macro factors are adding pressure, particularly the 10% global tariffs announced by the Trump administration. These developments have kept fear elevated across broader risk markets.

Source: Cryptoquant

When BPDA% sits near its one-year average, the market is considered to be within a normal historical pattern. A reading well above that average typically signals recovery or relative stability. Neither condition applies today, which is why analysts continue watching lower levels carefully.

The data, therefore, suggests the correction may not be over. However, history also shows that readings this deep tend to precede meaningful accumulation phases. The question now is which price level triggers that shift.

Four Price Levels That Could Determine How Low Bitcoin Goes

GugaOnChain identified four support zones that may define Bitcoin’s downside from here. The $60,000 level is the nearest, though it is considered less likely to hold as a durable bottom given current momentum.

Below that, Bitcoin’s Realized Price near $54,600 becomes relevant. This metric reflects the average price at which all coins last moved on-chain. Historically, the Realized Price has acted as a magnet for accumulation activity during bear markets.

Further down, the $49,000 region carries the highest probability of bear exhaustion based on the analysis. This zone has previously drawn in long-term holders who view deep corrections as entry opportunities rather than reasons to exit.

The $42,000 level represents the most extreme scenario outlined in the data. While it would place a large portion of the market in unrealized loss, GugaOnChain describes it as an excellent area for initial long-term entries.

If on-chain metrics confirm seller exhaustion at any of these levels, the range between $49,000 and $42,000 could mark not just the bottom of this bear market, but the foundation for Bitcoin’s next major cycle.

Crypto World

Dow Jones forms an alarming pattern ahead of Salesforce, NVIDIA earnings

The Dow Jones Index retreated sharply this week as geopolitical risks rose ahead of key earnings by companies like NVIDIA and Salesforce.

Summary

- The Dow Jones Index has formed an alarming rising wedge on the daily chart.

- Market risks, including on Iran and tariffs, have continued rising.

- NVIDIA and Salesforce will publish their financial results on Wednesday.

The blue-chip Dow Jones was trading at $48,805, down by over 3.3% from its all-time high. Other top indices like the S&P 500 and Nasdaq 100 also dropped by over 1%.

Salesforce and NVIDIA to publish earnings this week

The Dow Jones retreated as market participants positioned to major risks. One key risk is the rising possibility that the US will strike Iran as soon as this week.

The risk of an attack rose after President Donald Trump warned that he may launch a limited attack on Iran, a move that would lead to an escalation. Such an escalation would then lead to higher oil prices and market volatility.

Market participants are also worried about Trump’s tariffs. New tariffs based on Section went into effect on Tuesday as the administration worked on more long-lasting ones.

The Dow Jones Index also retreated as Jamie Dimon warned of a 2008-like Global Financial Crisis. In a statement, he said:

“Unfortunately, we did see this in ’05, ’06 and ’07, almost the same thing — the rising tide was lifting all boats, everyone was making a lot of money. I see a couple of people doing some dumb things. They’re just doing dumb things to create NII.”

Looking ahead, the next key catalyst for the Dow Jones Index is the upcoming Salesforce and NVIDIA earnings, which will come out on Wednesday this week.

NVIDIA, the biggest constituent, is expected to report strong results and forward guidance as demand for GPUs jumped. The average estimate among analysts is that its revenue rose to over $66 billion in the fourth quarter.

Salesforce stock will be in the spotlight as it has tumbled by over 50% from its all-time high. It has dropped as investors remain concerned about the potential disruption by new AI tools by companies like Anthropic and OpenAI.

Dow Jones Index technical analysis

The daily chart shows that the Dow Jones Index reached a record high of $50,560 earlier this year. It has now pulled back to $48,805 as market risks escalate.

A closer look shows that the index has formed a rising wedge pattern, which is made up of two ascending and converging trendlines. It has already moved below the lower side, confirming the bearish outlook.

The index also formed a rising wedge pattern as the Relative Strength Index and the MACD indicators moved downwards as it rose.

Therefore, there is a risk that it may keep falling, potentially to the key target at $48,000.

Crypto World

Which platforms offer the most competitive mining returns?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Cloud mining platforms like Hashbitcoin are reshaping crypto mining in 2026, offering hardware-free access to Bitcoin, Litecoin, and Dogecoin with automated daily payouts.

Summary

- Hashbitcoin leads the rankings with flexible contracts, AI-driven mining optimization, daily settlements, and a $15 trial bonus for new users.

- Competing platforms such as IQMining, BitFuFu, NiceHash, StormGain, BeMine, and Binance provide alternative models ranging from industrial-scale mining to hash power marketplaces.

- Cloud mining emerges as a low-barrier, energy-efficient way to earn passive crypto income without purchasing ASIC hardware or managing technical infrastructure.

Today, mining Bitcoin, Litecoin, and Dogecoin has become easier than ever. Thanks to cloud mining platforms like Hashbitcoin, traditional mining rigs are gradually being replaced. There’s no need to purchase expensive ASIC miners or high-performance GPUs, nor worry about costly electricity bills or technical complexities. By choosing a top-tier cloud mining platform, users can effortlessly enjoy stable and lucrative daily passive cryptocurrency income.

This article provides an in-depth review of the most popular cloud mining platforms in 2026, helping investors easily start their journey of mining Bitcoin, Litecoin, and Dogecoin. Let’s explore the endless opportunities that cloud mining has to offer.

1.Hashbitcoin: The best cloud mining platform of 2026 for earning cryptocurrency

As one of the world’s leading cloud mining platforms, Hashbitcoin has established itself as the go-to platform for Bitcoin, Litecoin, and Dogecoin mining. Founded in 2017, Hashbitcoin has been providing premium mining services and is registered with the UK’s Financial Conduct Authority (FCA). The platform operates over 100 verified ASIC mining farms globally, offering users a daily return on investment (ROI) ranging from 3% to 9%.

New users can start risk-free with a $15 trial bonus provided by Hashbitcoin. The platform offers a variety of flexible contracts catering to both short-term and long-term investment needs, making it a perfect fit for all types of investors.

Hashbitcoin cloud mining contracts: Flexible plans for maximum profitability

| Mining Plan | Amount | Contract Term | Daily Rewards | Principal + Total Return |

| Newbie Mining Plan | $200 | 1 day | $7 | $207 |

| Avalon Mining Machine A15 Pro | $1200 | 2 days | $43.2 | $1286.4 |

| BitDeer SealMiner A2 | $3600 | 3 days | $136.8 | $4010.4 |

| Avalon Nano 3S Miner | $8000 | 2 days | $344 | $8688 |

| Antminer S23 Hyd | $16800 | 3 days | $924 | $19572 |

| Whatsminer M63S (390T) | $33000 | 2 days | $2145 | $37290 |

| Antminer E9 Pro | $58000 | 1 day | $5104 | $63104 |

Want to learn more about exciting investment opportunities? Visit Hashbitcoin’s contract page for full details.

What makes Hashbitcoin stand out?

- Free trial bonus: New users receive a $15 trial bonus upon registration, allowing them to experience real mining earnings without any upfront deposit.

- AI-driven mining optimization: The platform’s mining algorithm automatically selects the most profitable cryptocurrency to mine.

- High-yield referral program: Earn up to 3% commission by inviting friends to join Hashbitcoin, making it easy to generate extra income.

- Multi-cryptocurrency support: With one Hashbitcoin account, users can mine multiple cryptocurrencies, including BTC, ETH, LTC, and DOGE, enabling diversified investments.

- Daily payouts with full transparency: All earnings are settled daily and paid in full, with no hidden fees.

- Eco-friendly mining: Hashbitcoin is committed to using renewable energy sources like solar and wind power, creating an efficient and environmentally friendly mining process while reducing carbon emissions.

How to start cloud mining with Hashbitcoin

1. Register an account: Sign up with an email in just a few seconds and instantly receive a $15 free trial bonus.

2. Choose a mining contract: Users can start with the free trial plan or select one of the flexible mining contracts based on their budget.

3. Activate mining: Once payment is confirmed, the mining contract will be activated immediately, and mining will begin automatically.

4. Earn daily profits: Users can enjoy daily passive income with earnings calculated and paid every 24 hours.

5. Withdraw or reinvest: At the end of the contract, users can withdraw their principal and profits or reinvest in a new mining plan.

2. IQMining: A pioneer in cloud mining with stable long-term returns

IQMining is one of the longest-running companies in the cloud mining industry, known for its stable long-term returns. Its “smart mining” technology optimizes mining profitability, and the platform offers diversified investment plans to cater to various investor needs. For those seeking consistent long-term returns, IQMining is a reliable choice.

3. BitFuFu: Industrial-scale mining backed by institutional power

BitFuFu is a cloud mining platform that partners with global mining hardware giant Bitmain to provide industrial-scale mining services. Users can purchase their own ASIC miners through the platform and enjoy high-performance mining. Although the initial deposit requirements are high, the platform’s stable mining capacity makes it an ideal choice for large-scale mining users.

4. NiceHash: A leading global hash power marketplace

NiceHash is a major player in the cloud mining industry, known for its unique hash power trading model. The platform allows users to buy and sell idle hash power, offering great flexibility. However, compared to one-click solutions like Hashbitcoin, NiceHash requires users to have some technical knowledge to get started quickly.

5. StormGain: An integrated cloud mining and trading platform

StormGain is a mobile app that seamlessly integrates cryptocurrency trading and cloud mining. It offers attractive low-cost mining contracts. However, its mining profitability is relatively low unless combined with trading activities. For investors looking to combine mining with trading, StormGain is a good option.

6. BeMine: Unlock mining potential with shared ASIC ownership

BeMine is a cloud mining platform that allows users to share ownership of physical ASIC miners. By purchasing partial ownership of a miner, users can participate in cryptocurrency mining and gradually increase their long-term profitability. Its innovative shared model allows individual investors to benefit from industrial-level mining returns.

7. Binance: Seamless crypto mining with the power of a global exchange

Binance Cloud Mining is one of the top cloud mining platforms, focusing primarily on Bitcoin mining. It integrates seamlessly with Binance accounts, allowing users to dive into Bitcoin mining without additional setup. For users seeking top-tier cloud mining services combined with trading and staking features, Binance Cloud Mining is an ideal choice.

Conclusion

The cloud mining platforms listed above are all legally operating and highly reputable on a global scale. In addition to complying with legal standards, they offer transparent contracts, user-friendly interfaces, and lucrative daily earnings of up to $5,104. Among these excellent platforms, Hashbitcoin stands out as the top choice for investors seeking flexible and high-yield investment solutions, thanks to its fixed ROI, instant withdrawals, and reliability.

To learn more about Hashbitcoin, visit the official website. Contact email: [email protected]

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Terraform Labs Sues Jane Street for Alleged Insider Trading Prior to Terra-Luna Collapse: Report

The suit filed by Terraform Labs’ bankruptcy administrator seeks damages tied to alleged pre-collapse positioning.

Terraform Labs’ bankruptcy administrator has filed a lawsuit against Jane Street, alleging the company used insider information to profit from and accelerate the collapse of Terra-Luna.

The lawsuit claims that these trades came at the expense of investors and creditors who lost billions in the crash.

Jane Street Denies Accusations

A Wall Street Journal (WSJ) report reveals that Todd Snyder, the court-appointed plan administrator overseeing Terraform’s wind-down, is seeking damages from Jane Street, its co-founder Robert Granieri, and employees Bryce Pratt and Michael Huang.

In a complaint filed in a Manhattan federal court on Monday, Snyder alleges that the trading firm obtained material nonpublic information from insiders and used it to trade ahead of the market, speeding up the company’s downfall.

“Jane Street abused market relationships to rig the market in its favor during one of the most consequential events in crypto history,” wrote the administrator in a statement.

The company first signed on to trade directly with Terraform in late 2018, but its involvement in the project’s tokens did not intensify until February 2022.

The lawsuit claims that Pratt, a former intern at the crypto company who later joined the trading firm, reconnected with his previous colleagues and created a private group chat called “Bryce’s Secret” to collect insider information. He is also accused of coordinating email introductions between the company’s head of business development and the firm’s DeFi team. The complaint claims that these communications were then used to obtain confidential details and inform highly profitable trades.

Meanwhile, Jane Street has rejected the allegations, calling the lawsuit “a desperate attempt to extract money” and insisting that Terraform’s losses were the result of a multibillion-dollar fraud by its management. The firm added that it will defend itself “vigorously against these baseless, opportunistic claims.”

You may also like:

Insider Trades Linked to Terraform Collapse

The lawsuit highlights a May 7, 2022, incident in which the crypto platform moved 150 million TerraUSD out of the Curve3pool without notifying the market. Less than ten minutes later, a digital wallet reportedly connected to Jane Street withdrew 85 million TerraUSD from the same pool. However, Do Kwon, its founder, said the withdrawal was meant to move TerraUSD to a new liquidity pool for stablecoins.

Two days later, as the digital asset began losing its dollar peg, Pratt allegedly set up a group message with Kwon, Huang, and firm representatives to discuss potential bids on Luna as the company continued to reap more profits from trading the stablecoin.

Terraform collapsed later that month after TerraUSD lost its peg to the dollar, with the sister token Luna also plunging to near zero.

The crash erased roughly $40 billion in value and affected hundreds of thousands of investors worldwide, leading the company to file for bankruptcy in January 2024 and formally establish a wind-down trust later that year. Kwon is now serving a 15-year prison sentence following guilty pleas on two criminal counts in August.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

‘Biggest NFT trading platform on TRON,’ AINFT, has $6 in volume

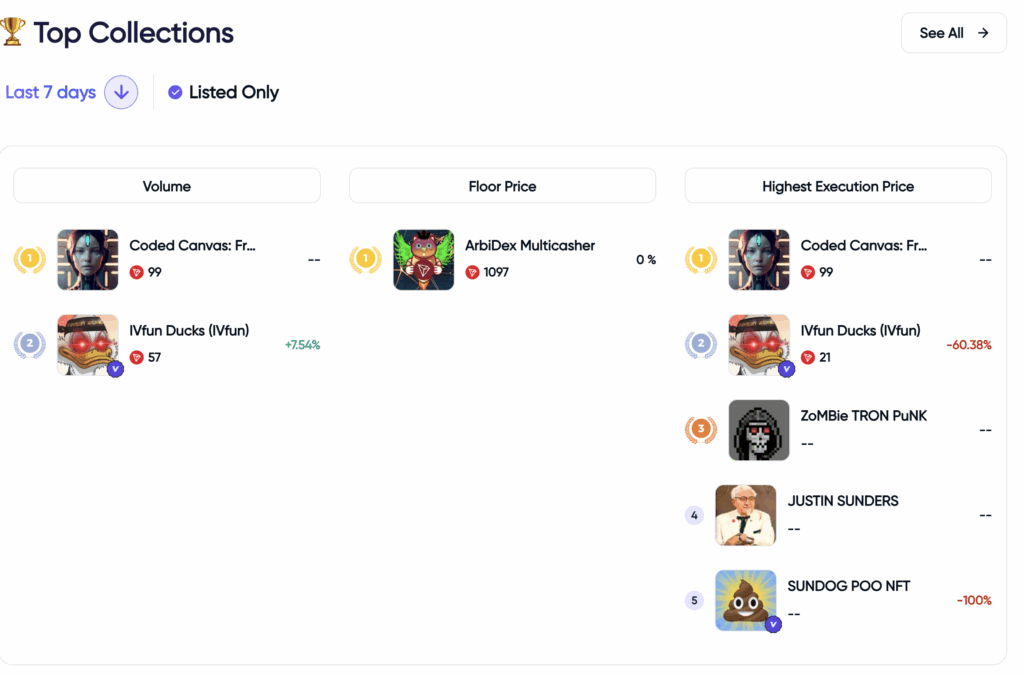

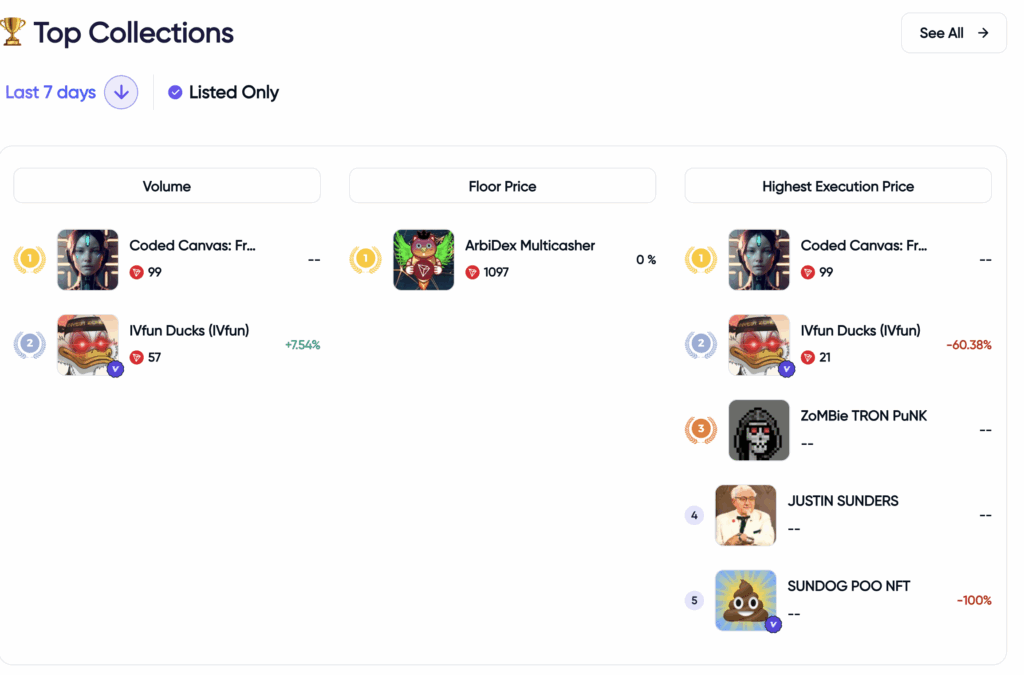

Justin Sun-founded AINFT (formerly APENFT) describes itself as “The Biggest NFT Trading Platform on TRON” on its website.

Sun has recently been aggressively promoting AINFT, posting about it on X on February 20, twice on the 11th, on the 10th, on the 6th, twice on the 5th, and six times on the 3rd.

Despite these frequent endorsements and its advertising, this platform has averaged approximately $6.24 per day in trading volume.

The AINFT marketplace lists a total of 156 TRX volume for its top project over the last seven days, split between only two collections.

At the current price of $0.28 for each individual TRX, that’s a total volume of $43.68 for this week.

If we divide that by the seven days, then we get a result of $6.24 per day in trading volume for the self-described “Biggest NFT Trading Platform on TRON.”

Read more: FTX estate says Justin Sun still owes it millions

AINFT has, in some sense, shifted away from NFTs, focusing on a variety of other artificial Intelligence (AI) features.

One of these features is what is advertised as the “BANK OF AI,” which is meant to make it convenient for AI agents to use TRON and BNB Chain.

Another feature, “AINFT Nova,” is described as “an AI agent launch platform where users can deploy AI agents and simultaneously issue their dedicated tokens.” This feature has yet to launch.

Read more: Justin Sun’s graveyard of abandoned crypto projects

Similarly, it’s yet to launch its “AINFT Agent Framework” for multi-agent systems, its “AINFT AgentTX,” which is “an AI-driven trading framework,” or its “AINFT Grid,” which claims to be “a platform dedicated to advancing decentralized AI model training and application.”

It has successfully embedded a chatbot interface that claims to provide access to a variety of models from OpenAI, Anthropic, and Google.

The value of the AINFT token has fallen by a quarter over the last year, according to data from CoinGecko.

AINFT is also connected to the legal dispute between David Geffen and Sun over the purchases of numerous pieces of art, with several of the transactions centering around what was then the APENFT Foundation.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Entering new markets without increasing payment costs

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

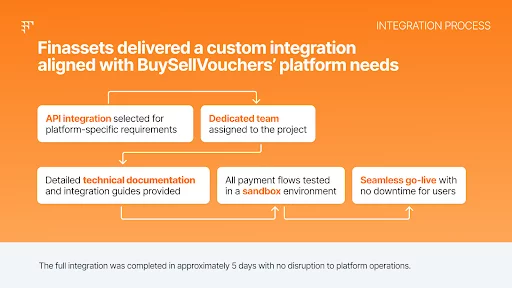

The partnership between BuySellVouchers and Finassets highlights how scalable crypto payment infrastructure can unlock cost-efficient international expansion.

Summary

- BuySellVouchers faced rising fees, limited network support, and operational bottlenecks that hindered global scaling under its previous payment provider.

- Switching to Finassets reduced processing costs by 50%, introduced fixed-fee predictability, optimized TRC-20 transactions, and enabled support for 70+ crypto networks.

- The upgraded payment architecture improved compliance alignment, automated mass payouts, enhanced transaction transparency, and created a stable foundation for sustainable international growth.

Bank payments on international marketplaces are losing efficiency, while crypto-based marketplace payments are becoming a fundamental payment infrastructure. Their success depends on the right payments partner and a scalable payment gateway for marketplace operations.

The BuySellVouchers case shows how the right payment solution supports expansion into new markets without increasing costs.

Marketplace payment processing must support business growth

BuySellVouchers.com is a global P2P marketplace for digital vouchers and gift cards, operating since 2015 with around $12 million in monthly turnover across Asia, Africa, Europe, and Russia.

Its business model is based on direct peer-to-peer trading, where marketplaces process payments between multiple parties, including cryptocurrency settlements.

As the company prepared for global expansion into new markets and planned to onboard sellers in different regions, it became clear that the existing payment gateway no longer met evolving business needs. Although crypto payments were already integrated, scaling exposed structural limits in the previous setup, turning the payment infrastructure into a bottleneck.

How to recognize when a payment provider no longer fits a business

Several warning signs indicated misalignment between the provider and the business model:

Sign

How it affects

Rising transaction fees as volumes increase

Makes financial planning difficult and reduces margin predictability as the business scales

Limited network support

Restricts flexibility across different payment methods and limits expansion into new markets

No dedicated technical support

Slows down resolution of transaction-related issues and increases operational risk

Lack of automation tools

Increases manual workload, operational pressure, and internal costs

At scale, these issues directly impact margins, predictability, and global expansion capability.

High volume payment processing requires strict technical and operational standards

For international growth, BuySellVouchers needed more than basic payment processing. It required marketplace payment solutions aligned with its business model.

The company defined clear criteria for a new payment gateway for marketplace operations:

Keeping costs stable as volume grows

The payment solution had to ensure that increasing transaction volume would not proportionally increase costs. This was critical to maintaining stable margins as the business expanded into different regions.

Clear pricing for financial planning

Transparent pricing without hidden monthly fees or setup fees, clear transaction statuses, and visibility across all marketplace payments were essential for financial forecasting and managing funds.

Regulatory coverage across regions

Processing had to comply with financial regulations, local regulations, and global regulations, ensuring compliance without limiting global expansion.

Easy onboarding and technical stability

- Scalable APIs capable of supporting growth

- Reliable high-volume payment processing

- Fast resolution of non-standard transaction scenarios typical for P2P marketplaces

Growth requires predictability, financially and operationally.

Finassets removed structural barriers for BuySellVouchers

After switching providers, BuySellVouchers partnered with Finassets.io low fee crypto payment gateway, which delivered a scalable marketplace payment platform designed for global payments and global payouts.

Low cost payment processing: financial effect of reducing processing costs by 50%

A fixed-fee model was implemented, allowing the company to forecast operational costs in advance and manage margins effectively.

Additionally, TRC-20 transaction optimization was introduced through the use of pre-purchased TRON Energy instead of burning TRX for every transaction.

As Vitalijs Feldmanis, CEO of Finassets, explains: “One of Finassets’ key advantages is that clients save significantly on transaction fees for the TRON network (TRC-20), because we cover network fees with purchased energy instead of burning TRX.”

Results:

- Processing fees reduced in half

- Predictable unit economics as turnover increased

- Direct positive impact on profitability

Broad network support

Support for more than 70 cryptocurrencies and networks, including ERC-20, BEP-20, Polygon, and others, allowed the platform to adapt to regional preferences and expand without structural payment limitations.

Compliance as a growth enabler

The processing structure aligned with BuySellVouchers’ offshore operating model and provided AML/KYC procedures adapted to the P2P risk profile, without excessive banking-style bureaucracy.

This enabled the company to:

- Standardize compliance processes

- Reduce internal operational workload

- Simplify interactions with a global user base

Compliance became a structured system rather than a scaling obstacle.

Operational stability as a competitive advantage

For a P2P marketplace, transaction speed and predictability directly influence user trust.

After implementing the Finassets infrastructure:

- Transaction statuses became fully transparent

- Delays and manual investigations were minimized

- High transaction volumes were processed reliably

Payments became predictable and manageable at scale.

Centralized visibility and financial control

The Finassets dashboard became a core operational tool for the BuySellVouchers team, particularly the Balance, Transactions, and B2B crypto Exchange tabs.

It enabled transparent balance tracking, full transaction visibility, real-time fiat equivalents, and simplified accounting exports. As a result, financial processes became more structured and operational workload was reduced.

Batch global payouts for high-volume operations

The mass payout feature accelerated recurring and large-volume transactions, a critical function for P2P and digital goods marketplaces.

This helped the business manage payouts more efficiently, save time internally, and maintain full control over payment operations.

Ongoing support and crypto expertise

Through the Finassets dashboard, the team gained:

- Full auditability

- Real-time fiat equivalents

- Simplified accounting

Sergej Balanel, CEO of BuySellVouchers.com, emphasized the importance of partner support: “We want to highlight the ongoing support from our partner, including their specialists being always available on Telegram. We got quick advice from the team, which helped us work smoothly together and speed up the integration process.”

With experienced technical specialists supporting operations, payments became a stable foundation for scalable growth.

Entering new markets without increasing payment costs

Traditionally, entering new markets leads to rising expenses due to fragmented payment methods, local options, bank transfers, and complex compliance requirements.

“As our volumes grew, processing costs and transaction predictability became critical. Finassets removed payments as a bottleneck, which directly improved realized turnover and simplified day-to-day operations. This is infrastructure we can confidently scale on.” — Sergei B., CEO, BuySellVouchers

Using a unified payment gateway for marketplace operations allowed the company to:

- Maintain a consistent fee structure across regions

- Eliminate chargebacks

- Avoid frozen funds

- Preserve predictable cash flow

Payments became a controllable, scalable infrastructure layer.

Scalability depends on payment architecture

The BuySellVouchers case shows that crypto payments alone do not guarantee lower costs or scalability.

What truly matters is the architecture of the payment gateway for marketplace operations and the strategic choice of a reliable processing partner.

A well-structured payment infrastructure allows businesses to enter new markets without increasing unit costs, improve margins as transaction volumes grow, and reduce operational and regulatory risks.

When payment operations become predictable and scalable, a marketplace gains a stable foundation for sustainable global growth.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

PayPal (PYPL) jumps 7% as Stripe reportedly weighs acquisition. Here is what it means for crypto

Stripe, which processed $1.9 trillion in transactions last year and was recently valued at $159 billion, is considering an acquisition of all or parts of PayPal (PYPL), according to a Bloomberg report.

Deliberations are in early stages, the report continued.

If completed, the deal would bring together two major payment firms that have both moved into stablecoins.

PayPal launched its dollar-backed stablecoin in 2022 through issuer Paxos. The token has since grown to a market value of about $4 billion. It allows users to move dollars across crypto networks at any time of day, often at a lower cost than bank wires.

Stripe has also pushed deeper into crypto. In 2024, it acquired Bridge for $1.1 billion, a company that builds tools for businesses and crypto projects to issue their own U.S. dollar-backed tokens. Stripe is also working with venture firm Paradigm to develop Tempo, a payments-focused blockchain now in testing.

PayPal has struggled mightily in recent years, its stock tumbling about 80% from record highs hit in 2021. Shares were already higher this week on buyout chatter, and they rose another 7% late Tuesday in the wake of the Stripe report.

Read more: Stripe’s Bridge sees stablecoin volume quadruple as utility insulates from ‘crypto winter’

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech7 days ago

Tech7 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World16 hours ago

Crypto World16 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech6 hours ago

Tech6 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting