CryptoCurrency

Slips 5% Despite Coinbase Deal, But Bottoming Signs Emerge

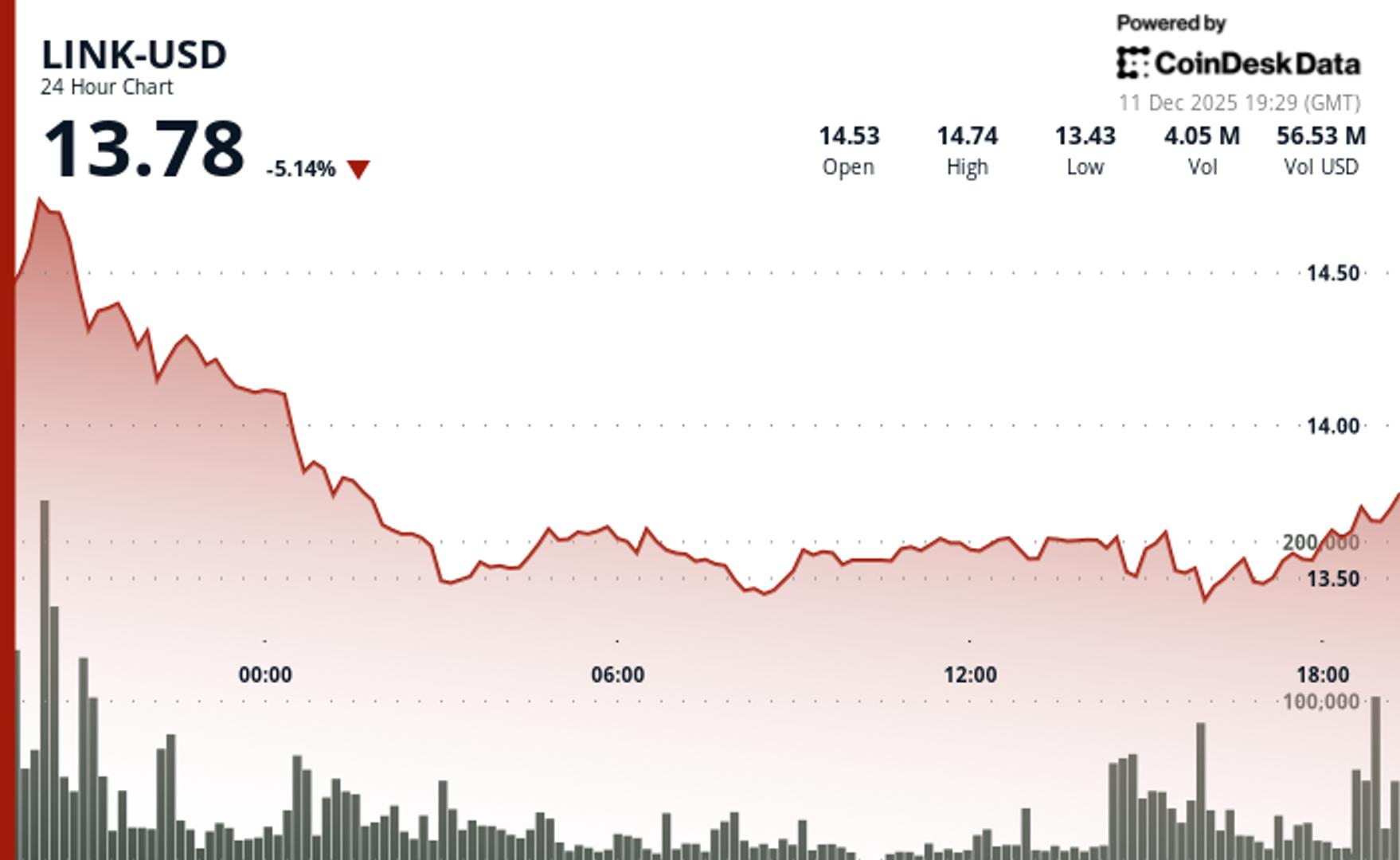

Chainlink’s LINK token fell nearly 5% over the past 24 hours to $13.74 on Thursday, reversing early gains despite a major announcement from Coinbase.

Earlier in the day, Coinbase revealed it had selected Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to power a new bridge connecting its $7 billion in wrapped assets, including cbETH, cbBTC and cbDOGE. The move marked a major institutional endorsement of Chainlink’s cross-chain infrastructure and positioning within the tokenization space.

In other news, Nasdaq-listed digital asset treasury firm Caliber (CWD) said it has started staking its LINK holdings for yield, starting with a 75,000 token deployment.

Despite the headlines, broader market conditions dampened sentiment. Weak altcoin momentum and renewed concerns around the Federal Reserve’s rate outlook contributed to LINK’s drop from Wednesday’s high of $14.46 to a Thursday low of $13.43.

Still, bottoming signals began to form late in the session. Trading volume surged 20.4% above the 7-day average, with a burst of over 340,000 LINK exchanged between 18:42 and 18:45 UTC, CoinDesk data showed.

Accumulation patterns emerged just above key support at $13.46, suggesting institutional positioning amid broader weakness, CoinDesk Research’s technical analysis tool noted.

Key Technical Levels Signal Stabilization

Support/Resistance:

- Primary support: $13.46 (session low)

- Resistance: $14.88 (recent rejection zone)

- Psychological resistance: $14.00

Volume Analysis:

- Late-session spike of 340K tokens (2,000%+ above session average) confirmed renewed buying interest

- Overall daily volume rose 20.4% above weekly average

Chart Patterns:

- Consolidation between $13.43–$13.67 after early selloff

- Final-hour breakout to $13.76 suggests possible short-term bottoming

Targets & Risk/Reward:

- Break above $14.00 could target $14.38 and $14.88

- Failure to hold $13.46 risks retrace toward $13.20

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.