Crypto World

Solana leans into tokenization and payments at Hong Kong’s Accelerate APAC event

Solana wants to position itself as the execution layer for “internet capital markets” in Asia, or venues where users can issue, trade, borrow, lend, and settle assets online, 24/7, without needing a traditional exchange, bank or clearing house.

At least, that was the position attendees and panelists at Solana’s Accelerate APAC event in Hong Kong on Wednesday. Speakers struck a noticeably institutional tone, with panels and keynotes focused less on hype cycles and more on payments, tokenization and the plumbing needed to onboard traditional finance at the conference, held alongside CoinDesk’s Consensus Hong Kong

The day’s agenda reflected that shift. Discussions ranged from SOL staking exchange-traded funds (ETFs) and digital asset trusts to stablecoin rails, tokenized securities and regulated exchange-traded products.

Asset managers including Mirae Asset and ChinaAMC shared the stage with infrastructure players such as CME Group, Fireblocks and Cumberland, showing how closely the ecosystem is courting traditional financial firms.

Payments also featured heavily. Multiple sessions centered on payment rails, compliant stablecoin infrastructure and cross-border use cases, with a clear emphasis on real-world adoption rather than speculative trading.

Infrastructure and AI were another pillar. Talks from Alibaba Cloud and several crypto-native builders highlighted the growing overlap between blockchain settlement layers and AI-driven applications, reinforcing Solana’s long-standing pitch around speed and scalability.

The overall mood in Hong Kong was simple and almost stubbornly consistent. Build.

Not the “buidl” that shows up in bull markets as a vibe check, but the kind that shows up when prices are down 70% over a year, attention is scant and nobody’s pretending the last few months have been fun. But that wasn’t the frame the event operated in.

Panels kept circling back to the same practical questions: How do stablecoins work at scale, how do you onboard institutions without breaking compliance and what metrics actually matter when you’re selling onchain rails to asset managers and banks. How do you make wallets feel less like science projects and how do you build tokenization infrastructure that survives a regulator’s first serious audit also took center stage

If anything, the downturn seemed to sharpen the messaging, with less talk about narratives and more about settlement, custody, payments, identity and the boring operational details that decide whether “real adoption” is real or just a meme.

A key vibe takeaway was not that Solana is immune to market cycles, but that the people building on it are trying to act like the cycle doesn’t get to decide what matters.

Crypto World

Binance Refutes Huge Outflows Allegations, Says Data is Misreported

Binance dismisses circulating concerns that the exchange is in trouble because of high outflows in the past days.

Binance, the world’s largest cryptocurrency exchange, is facing mounting rumors on social media that funds are flowing out of it at unprecedented rates.

“Get your funds off of Binance. -$17bn of withdrawals in the last 7 days. There is a risk they will become insolvent, and you won’t be able to get your money out. Withdraw now or cry later,” wrote a popular crypto analyst on X. Although the figures range from $10 billion to $17 billion, many others reiterated this opinion.

The exchange was quick to respond, saying that data from third-party sources shows discrepancies and that it is to be “restored.”

Thank you everyone for your concern about Binance. The data cited by Coinglass comes from third-party sources, and DefiLlama previously showed discrepancies. It will take another 24 to 48 hours for their data to be restored.”

Moreover, Binance said that they believe that “regularly conducting withdrawal tests on all trading platforms is a positive and healthy practice. When performing these tests, please double-check the address carefully. Confirm, then withdraw.”

They even went so far as to suggest an annual “withdrawal day” that should be established for all platforms to thoroughly verify the authenticity of their assets.

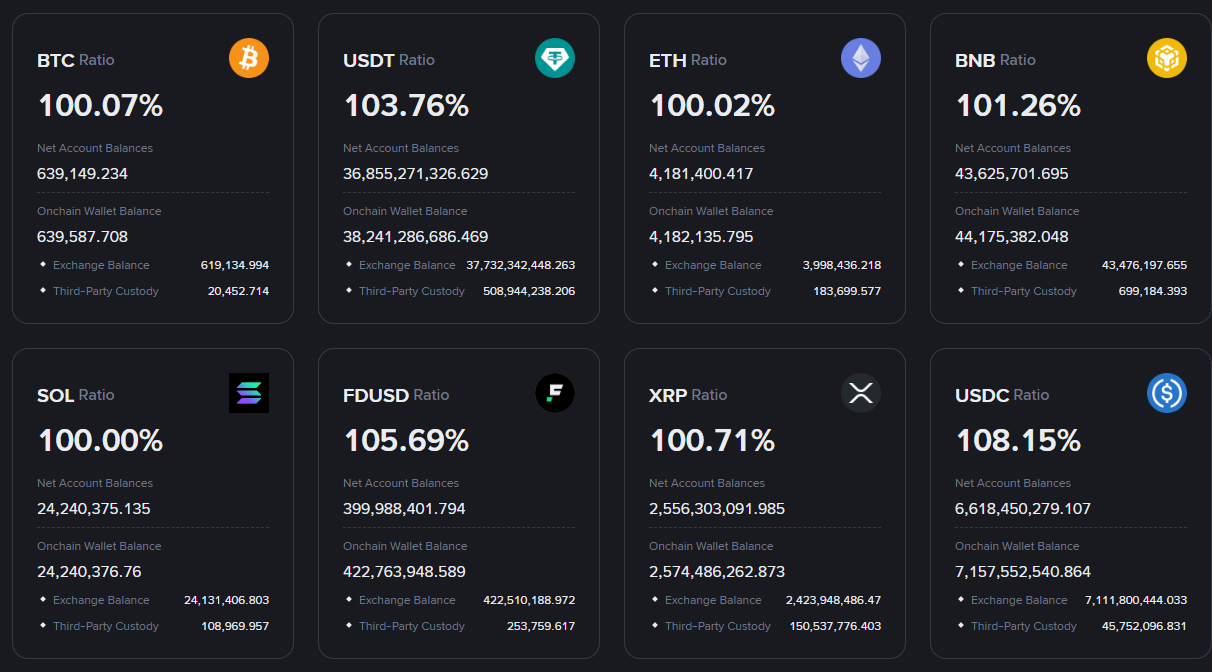

Meanwhile, the Proof-of-Reserves report on their official website reveals that all cryptocurrencies are, at the time of this writing, overcollateralized, meaning that there is more USD backing their reserves than crypto – a sign of health.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Euro And Sterling Rally Slows After Strong US Data

At the start of the week, the euro and sterling posted solid gains amid dollar weakness and expectations of a more accommodative Federal Reserve policy path, testing local highs. However, the release of the January US employment report shifted market sentiment.

Non-farm payrolls rose by 130K versus a forecast of 66K, the unemployment rate unexpectedly fell to 4.3% (forecast: 4.4%), and average hourly earnings increased by 0.4%, exceeding previous readings. The data confirmed the resilience of the US labour market and supported the dollar, prompting a pullback in EUR/USD and GBP/USD from their recent peaks.

EUR/USD

After testing the 1.1920–1.1900 range, EUR/USD entered a moderate correction, retracing part of the gains recorded in recent weeks. The move appears largely technical, driven by profit-taking.

While dollar strength following the upbeat data has reduced expectations of imminent Fed easing, it is still premature to speak of a reversal in the medium-term trend. Market participants continue to assess the sustainability of the latest macroeconomic figures and their implications for monetary policy.

Technical analysis suggests the formation of a sideways range between 1.1830 and 1.1920. A break above the upper boundary could pave the way for a move towards 1.2000, whereas a drop below 1.1830 may deepen the correction towards 1.1770.

Key events for EUR/USD:

- Today at 13:00 (GMT+2): Germany’s headline PCSI consumer sentiment index

- Today at 15:30 (GMT+2): US initial jobless claims

- Today at 21:30 (GMT+2): Speech by Bundesbank President Joachim Nagel

GBP/USD

Following the formation of a piercing pattern on the daily chart at the end of last week, GBP/USD strengthened towards the key 1.3700–1.3720 zone. However, after the release of strong US labour market data, the pair corrected to 1.3610.

If the pair consolidates below this level over the coming sessions, a return towards last week’s lows near 1.3500 is possible. A break above resistance at 1.3720 could open the way for a renewed test of this year’s highs.

Key events for GBP/USD:

- Today at 09:00 (GMT+2): UK GDP

- Today at 09:00 (GMT+2): UK services activity index

- Today at 13:00 (GMT+2): UK headline Thomson Reuters/Ipsos PCSI consumer sentiment index

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Robinhood Launches Ethereum Layer-2 Testnet, Expands Blockchain Vision

Robinhood has launched the public testnet for Robinhood Chain, marking a significant step in its blockchain ambitions. This Ethereum Layer-2 network aims to expand the company’s on-chain financial services. The move is part of Robinhood’s broader strategy to build its own blockchain infrastructure and bring tokenized assets and 24/7 trading to its platform.

The public testnet allows developers to test and evaluate applications on the network before its full launch. With the testnet in place, Robinhood aims to create a robust ecosystem for tokenized real-world and digital assets. In addition, the platform plans to integrate decentralized finance (DeFi) liquidity within the Ethereum ecosystem.

While this testnet launch marks an important milestone, Robinhood’s stock price has faced a downturn. Despite the promising developments, HOOD stock has dropped by 8.8%, trading at $78.09. The price drop follows a broader decline in stock value, particularly over the past few days.

Expanding Blockchain Infrastructure

Robinhood’s testnet launch signals its broader push into blockchain and decentralized finance. The Ethereum Layer-2 network is not only designed to improve scalability but also to rebuild Robinhood’s existing infrastructure. This focus on enhancing its systems is intended to integrate tokenized assets and DeFi features seamlessly into its platform.

In a statement, Johann Kerbrat, SVP and GM of Crypto and International at Robinhood, highlighted the company’s goal. He emphasized that the blockchain initiative is not just about scaling, but about transforming Robinhood’s core systems. The launch of Robinhood Chain is a crucial step in the company’s vision to establish its blockchain infrastructure.

The company expects that this infrastructure will create opportunities for developers to build innovative applications. With the Ethereum Layer-2 network, developers will be able to access the tools needed to bring their applications to life. The initiative aims to foster an ecosystem that will drive the future of tokenized financial services.

Revenue Declines and Market Reaction

Despite the excitement surrounding the testnet launch, Robinhood’s recent quarterly performance has raised concerns. The company reported Q4 revenue of $1.28 billion, falling short of expectations. This revenue miss came after the company had projected $1.35 billion in earnings for the quarter.

Additionally, Robinhood’s crypto transaction revenue also saw a decline, dropping to $221 million from $268 million in the previous quarter. This decrease in crypto-related revenue may have contributed to the negative market reaction. Despite these setbacks, the company remains committed to its blockchain plans and is pushing forward with its blockchain-based services.

The dip in stock price, combined with a decline in crypto transaction revenue, has raised questions about the company’s financial stability. However, Robinhood’s focus on its blockchain infrastructure could position it for long-term growth. The testnet launch is just the first step in a larger strategy to transform its platform and provide more advanced services to its users.

Integration with Key Blockchain Partners

Robinhood is partnering with several prominent blockchain infrastructure providers to integrate into the Robinhood Chain ecosystem. Companies like Alchemy, Allium, Chainlink, LayerZero, and TRM are among the first to join the initiative. These partnerships are expected to help strengthen the technical foundation of the network and expand its capabilities.

As Robinhood continues to develop its blockchain infrastructure, more partnerships will likely emerge. These collaborations will provide additional resources and tools to enhance the platform’s functionality. The involvement of established players in the blockchain space underscores the importance of Robinhood’s move into this new area.

The partnerships also signal Robinhood’s intention to build a robust ecosystem that can support a variety of applications. By integrating blockchain technology and decentralized finance liquidity, Robinhood aims to redefine financial services. The testnet launch marks the beginning of a larger effort to create a comprehensive blockchain platform that will serve the company’s growing user base.

Future Prospects of Robinhood Chain

The launch of the public testnet for Robinhood Chain is just the beginning of the company’s long-term blockchain strategy. The platform aims to bring tokenized real-world assets and DeFi services to its users. Over time, Robinhood plans to scale the network and introduce more advanced features that will transform its financial services.

With the support of key blockchain infrastructure providers, Robinhood is well-positioned to establish itself as a leader in the blockchain space. As the company continues to develop Robinhood Chain, it will likely attract more developers and businesses to the ecosystem. The future of Robinhood’s blockchain ambitions looks promising, as it seeks to disrupt traditional financial systems with its innovative approach.

While the road ahead may be challenging, Robinhood’s commitment to blockchain technology could lead to a transformative shift in the financial sector. The launch of Robinhood Chain represents a bold move to redefine how financial services are delivered and consumed. With a strong focus on tokenization and decentralized finance, Robinhood aims to lead the way in the next generation of financial technology.

Crypto World

OKX Ventures Invests in RWA Stablecoin with Securitize, Hamilton Lane

Securitize is piloting a novel real-world asset (RWA) stablecoin that is backed by tokenized private credit assets, marking a notable push to bring regulated, yield-generating assets onto blockchain rails. The initiative unfolds through a collaboration with STBL, Hamilton Lane, and OKX Ventures, aiming to issue the new stablecoin on OKX’s X Layer network. The structure ties the stable unit to tokenized exposure to Hamilton Lane’s Senior Credit Opportunities Fund via a feeder arrangement, while separating the yield generated by the underlying assets from the stablecoin itself. This approach is designed to address regulatory nerves around passive yields while enabling programmable settlement within a regulated, on-chain framework.

The collaboration brings together three pillars: Securitize’s tokenization platform, STBL’s stablecoin infrastructure, and Hamilton Lane’s private credit expertise, with financial backing and strategic input from OKX Ventures. The project envisions a broader ecosystem where institutional private markets can be accessed and managed on-chain, leveraging liquidity and settlement capabilities that are increasingly common in Layer-2 environments. In a Thursday X post, Securitize described the product as an ecosystem-specific stablecoin that will be issued on X Layer and collateralized by tokenized exposure to the Senior Credit Opportunities Fund, arranged through a feeder structure managed by Securitize.

The architecture is designed to keep the stable token distinct from the yields it represents. A dual-token model is central to the design: one token maintains price stability, while a separate mechanism accrues yield from the underlying assets. This separation is meant to respond to regulatory discussions in the United States that have focused on stablecoins that distribute passive returns to holders. By routing yield generation to the collateral layer, the framework aims to preserve the stability function of the token itself while still allowing on-chain access to private-credit yields. In a January 14 post, STBL emphasized that the approach aligns with evolving regulatory expectations of distinguishing stable payment instruments from investment products.

“This initiative brings deep liquidity, programmable settlement, and compliant yield management to the X Layer ecosystem, setting a new standard for how capital flows onchain.”

The project’s emphasis on real-world asset liquidity reflects a broader trend in which on-chain finance seeks greater institutional participation. STBL’s yield architecture is described as a deliberate attempt to sidestep certain regulatory concerns by ensuring the stablecoin is not classified as a yield-bearing instrument. The structure proposes that returns accrue at the collateral layer rather than being paid directly to stablecoin holders, a design choice that market participants hope will ease compliance frictions as digital asset markets mature. STBL’s statements highlight the intent to align with regulators’ expectations that separate the instrument used for payments from the investment or yield-generating activities beneath it.

In explaining the rationale, Securitize noted that tokenization of private credit, when combined with programmable settlement, can unlock a level of on-chain efficiency previously unavailable to traditional markets. The feeder arrangement linked to Hamilton Lane’s Senior Credit Opportunities Fund is intended to provide a robust, diversified exposure to private credit assets, while the on-chain wrapper enables programmable settlement and potentially broader liquidity across the X Layer ecosystem. The executives cited that the arrangement leverages the strength of tokenization and institutional governance structures to bring private markets into the on-chain world.

The collaboration is also positioned within a wider regulatory dialogue around stablecoins. By creating a dual-economy dynamic—one for the stable unit and another for the yield—the parties aim to provide a framework that can be more palatable to policymakers who are wary of passive yield mechanisms. The approach reflects a growing industry push to design financial primitives that preserve the reliability and predictability of stablecoins while still enabling on-chain access to sophisticated yield-generating strategies.

Cointelegraph reached out to OKX Ventures and STBL for comment on the token’s architecture and yield expectations. The public posts from Securitize and STBL on X provide the primary public vantage points for understanding how the feeder structure interacts with Hamilton Lane’s private-credit assets and how the on-chain settlement process is intended to function within the X Layer network. The broader context includes ongoing policy discussions around US market structure and the regulation of stablecoins, including concerns about passive yields on stablecoin holdings.

Related reporting has highlighted ongoing debates about tokenization, on-chain settlement, and regulated approaches to stablecoins, underscoring that the sector is still navigating a complex regulatory landscape. The new framework’s emphasis on separating stable value from yield is a direct response to these discussions, positioning the product as a test case for how regulated tokenization can coexist with the on-chain ecosystem.

The evolving design also aligns with broader efforts to tokenize RWAs and integrate them within regulated digital asset ecosystems. Securitize’s platform, which has logged immense growth in tokenized assets and long-standing relationships with major players in traditional finance, provides a credible basis for such an initiative. The project’s success will hinge on how effectively the feeder structure translates private-credit exposure into reliable on-chain liquidity, how well the dual-token model withstands regulatory scrutiny, and how the X Layer network accommodates scalable, compliant programmable settlement.

As the ecosystem evolves, observers will be watching for how governance and product metrics develop, including yield expectations, liquidity depth, and the ability to maintain stable unit value amid fluctuating demand for private-credit exposure. The collaboration signals a maturing phase in on-chain finance, where institutional players are increasingly willing to explore regulated mechanisms that can deliver both stability and yield through tokenized, on-chain structures.

Sources: OKX Ventures and STBL statements via X posts; Securitize’s official X post; Hamilton Lane’s exposure strategy via the same channels; regulatory discussions surrounding US market structure and stablecoins.

Video and related materials linked to the project are available through the channels referenced in the announcements, including a YouTube video linked in the original content. To review the latest details and context, readers can follow the primary posts on X from Securitize and STBL and the accompanying materials from Hamilton Lane and OKX Ventures.

Market context

Market context: The launch arrives as tokenization of real-world assets gains traction among institutional investors, even as regulators scrutinize stablecoins that distribute passive yields. By combining regulated tokenization, programmable settlement, and a dual-token design, the project seeks to balance on-chain efficiency with strict compliance expectations. The initiative also underscores growing interest in Layer-2 ecosystems like X Layer as venues for institutional-grade liquidity and on-chain settlement that can bridge traditional finance and digital asset markets.

Why it matters

The collaboration represents a notable step in the ongoing integration of real-world assets into on-chain finance. By linking a tokenized private-credit exposure to a stablecoin structure, the project tests whether RWAs can deliver stable value on-chain while preserving the ability to generate yield from traditional asset classes. If successful, this model could unlock new liquidity channels for private credit, potentially expanding the investor base for specialized funds and enabling more dynamic, on-chain risk management tools for institutions.

For builders and investors, the dual-token approach offers a blueprint for designing stablecoins that decouple payments from investment performance. Regulators have shown heightened scrutiny of yield-bearing stablecoins, and this architecture attempts to address those concerns by ensuring that the stable unit maintains price stability independently of the yield generated by the underlying assets. The project highlights how tokenization, governance, and settlement engineering can converge to create on-chain instruments that appeal to both institutional participants and compliant market participants.

From a market perspective, the initiative underscores the importance of liquidity and settlement infrastructure in enabling RWAs to function effectively on-chain. It also points to a broader appetite among market participants for regulated, transparent frameworks that can accommodate complex asset classes while offering the operational advantages of blockchain technology. The success of this approach will influence how other asset managers, custodians, and exchanges approach RWAs and their representation as on-chain instruments.

What to watch next

- Timeline and milestones for the stablecoin’s issuance on X Layer, including any feeder-structure milestones and governance changes.

- Regulatory updates or formal guidance that clarify how the dual-token model will be treated under US stablecoin and securities rules.

- Details on the yield mechanism at the collateral layer, including any performance benchmarks and risk controls for the underlying Senior Credit Opportunities Fund exposure.

- Confirmation of liquidity.Depth on X Layer and any listed or cross-chain integrations that expand access to the tokenized private-credit exposure.

- Additional announcements from Securitize, STBL, Hamilton Lane, and OKX Ventures detailing product roadmap and potential expansion into other asset classes or funds.

Sources & verification

- Official X posts from Securitize describing the ecosystem-specific stablecoin and its feeder structure.

- STBL official posts discussing the yield architecture and regulatory alignment for stablecoins.

- OKX Ventures statements and materials related to the investment and strategic collaboration.

- Hamilton Lane materials outlining the Senior Credit Opportunities Fund exposure used in the feeder arrangement.

- Discussion of the US market structure bill’s provisions affecting passive yield on stablecoins and related regulatory debates.

Crypto World

Crypto doesn’t need chaos to thrive

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

For years, the crypto industry has been dominated by a culture of short-term speculation: retail traders chasing outsized returns and institutions treating digital assets as a high-volatility side-bet. The narrative is outdated at best, and actively harmful at worst.

Summary

- Volatility doesn’t build markets — trust does: Durable adoption is tracking regulatory clarity, custody standards, and real-world utility, not hype cycles.

- Accountability is crypto’s next competitive edge: Transparent risk frameworks, proof of reserves, and operational discipline are replacing chaos as growth drivers.

- Reliability wins the next decade: Platforms that prioritise compliance, usability, and institutional-grade infrastructure will outlast those clinging to speculative noise.

As 2025 has shown, crypto doesn’t thrive on chaos; it thrives when the noise turns into focused conversation. Adoption grows when platforms deliver what users actually need: infrastructure users can rely on to pay, get paid, invest, and borrow with confidence. Today, the industry’s real unlock lies in something far more foundational: radical accountability with the next era defined by platforms that centre around reliability.

The myth that volatility drives sustainable adoption

The industry has long romanticised its boom-bust cycles as an inevitable, even healthy. This is a myth: one that benefits short-term traders but ultimately undermines long-term adoption. Volatility may attract headlines and generate short bursts of retail activity, but it doesn’t create sustainable markets.

What has changed is not just the presence regulation, but how markets are now responding to clarity. Data from recent market analyses show that institutional inflows and durable adoption are tracking clarity and stability, rather than volatility. Over the past year, institutional-scale transfers (>$1M) have accelerated in jurisdictions where regulatory frameworks are no longer theoretical, but operational: particularly following the launch of U.S. spot Bitcoin (BTC) exchange-traded funds and the full rollout of Europe’s harmonised licensing regimes.

In Europe, the Markets in Crypto-Assets Regulation’s implementation phase has marked a clear inflection point. As firms completed licensing, strengthened custody separation, and aligned products with regulatory expectations, capital that had previously remained cautious began to re-enter. The shift didn’t happen overnight, but once compliant infrastructure was live and proven, many institutional treasuries and asset managers began reframing crypto not as a speculative bet, but as a set of regulated financial tools capable of supporting treasury, liquidity, and capital-management functions.

This pattern is echoed globally. Adoption metrics show that real, durable usage is expanding in APAC and Latin America, driven less by speculation and more by utility: particularly stablecoin rails and everyday transaction flows. The lesson is clear: long-term usage emerges not as volatility fades, but as focus takes hold.

The critical accountability gap

The short-term chase created a pervasive accountability gap. Too many crypto businesses prioritised speed and hype over controls, governance, and operational discipline. The result was not innovation, but fragility and negligence often exposed at scale.

Real accountability is the new frontier of competition. Global financial oversight bodies note that a lack of clear accountability and transparency in crypto markets creates an ecosystem that seems vulnerable to fraud, scams, and investor harm, all collateral damage of the previous short-term, winner-takes-all culture. It means transparent risk frameworks, responsible asset listings, and compliance treated as a strategic capability rather than an afterthought. The lingering “reputation problem” is a direct tax imposed by a few bad actors on the entire ecosystem, or a narrative pushed by legacy incumbents.

Why the next wave of users will insist on higher standards

The next wave of institutional and retail users is arriving with a fundamentally different set of expectations. For retail users, the shift is already visible. The conversation is moving away from pure price speculation toward usability and trust, with fair markets, clearer disclosures, and fewer surprises. Growth is increasingly being driven by practical use cases such as payments, remittances, and on-chain savings, rather than social-media-fuelled price spikes. As crypto becomes part of everyday financial behaviour, reliability starts to play the role that excitement once did.

Institutions are following a similar logic at scale. Many have moved beyond watching from the sidelines and are now building longer-term strategies. That shift demands infrastructure they can rely on: legally enforceable custody separation, accountable counterparties with clear rulebooks, and predictable risk behaviour. Industry research consistently shows that regulatory clarity and operational maturity are the strongest drivers of sustained institutional participation. They’re seeking the core building blocks of modern finance, now applied to digital assets.

Together, these shifts point to the same conclusion: reliability has become the prerequisite for engagement, not a secondary consideration. As expectations converge between retail and institutional users, platforms that prioritise transparency, stability, and real-world usability will pull ahead, while those clinging to short-term chaos will increasingly find themselves out of step with the market.

Building a new standard

The new “standard of accountability” moves past flashy headlines. It’s regulated-first product design, clear disclosures users can actually understand, independent custody by default, and robust internal controls that are tested and verified.

It shouldn’t be looked at as slowing innovation, but redirecting it for the long-term survival of the industry. The greatest innovation today is a scalable, interoperable blockchain that meets the EU’s rigorous privacy standards, or a custody solution that provides real-time, cryptographic proof of reserves that even a skeptic can verify.

The long-term resilience this creates is what will finally mature crypto into the fundamental component of global finance. The players who adopt these higher standards early are actively shaping the market’s long-term structure and claiming its most valuable real estate: trust. The era ruled by short-term chaos is long gone, and the future belongs to those who build with the next decade, not the next cycle, in mind.

Crypto World

Daily Market Update: Stock Futures Rise With Bitcoin at $67,200 Ahead of Inflation Report

TLDR

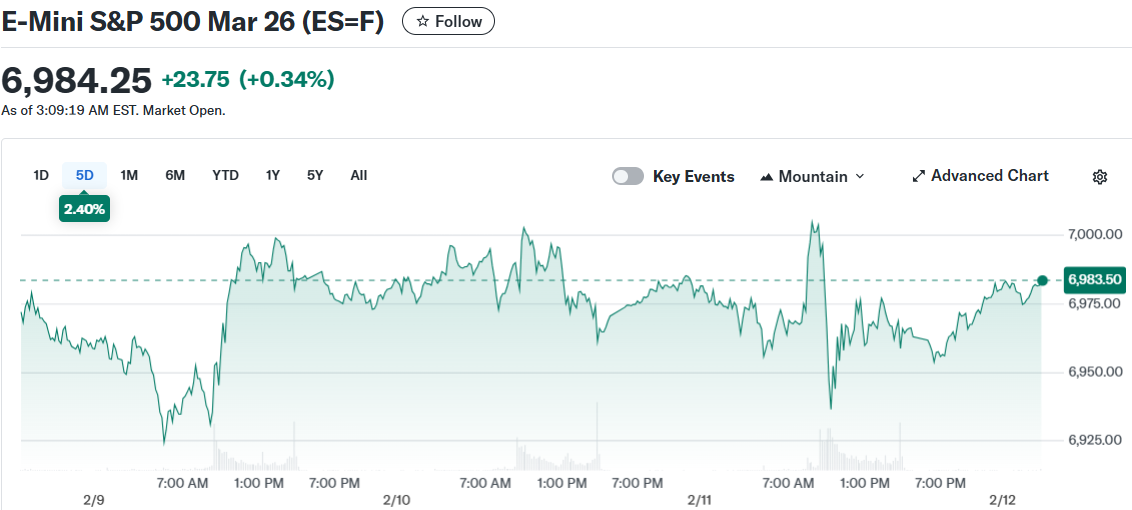

- U.S. stock futures advanced Thursday with Dow, S&P 500, and Nasdaq all posting gains after January jobs data showed 130,000 positions added

- Consumer Price Index report delayed by government shutdown now scheduled for Friday, expected to show 2.5% year-over-year inflation

- Federal Reserve rate cut probability stands at 5.4% for near-term action as strong employment complicates easing plans

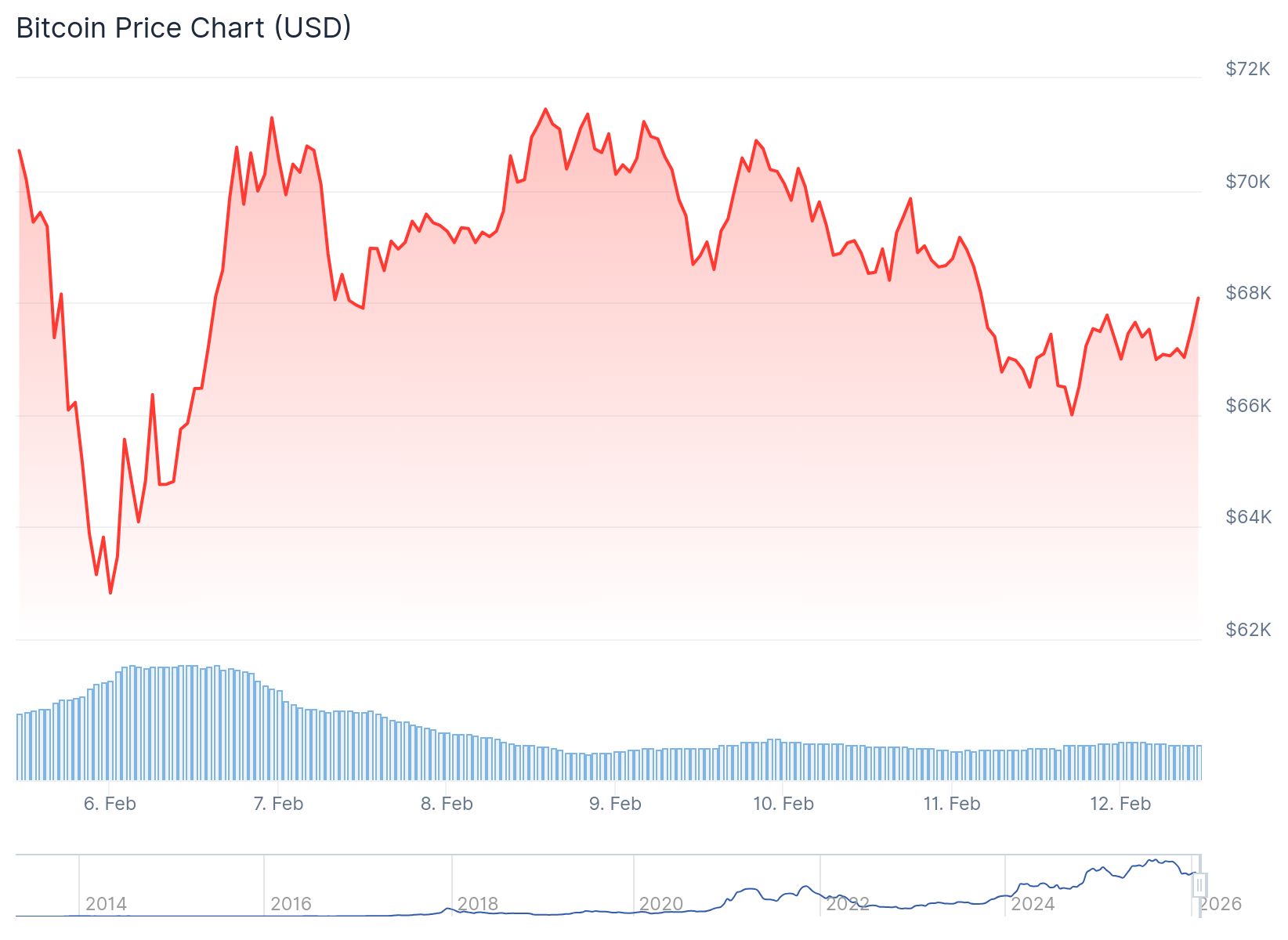

- Bitcoin consolidates at $67,200 while trading in $62,822 to $72,000 range following recent market selloff

- Cisco stock dropped 7% after-hours on missed earnings while McDonald’s dipped slightly despite beating estimates

U.S. stock futures moved higher Thursday morning as traders processed January’s employment report. The data showed 130,000 new jobs added last month, surpassing analyst expectations.

Dow Jones Industrial Average futures gained approximately 0.2% in early trading. S&P 500 futures rose by a similar margin while Nasdaq 100 futures advanced 0.1%.

The futures gains followed a mixed Wednesday session on Wall Street. Major indexes closed relatively flat after the jobs data complicated Federal Reserve policy expectations.

Employment Data Reshapes Market Outlook

Markets initially rallied following the January jobs report release. However, the stronger-than-expected hiring numbers created new questions about monetary policy timing.

Year-end 2025 employment figures were revised downward in the report. The revisions revealed slower job growth last year than initially calculated.

A resilient labor market paired with persistent inflation could reduce near-term rate cut likelihood. This scenario has become a key concern for equity investors who anticipated policy easing.

CME’s FedWatch tool currently indicates a 94.6% probability of unchanged rates. The Federal Reserve is expected to maintain the 3.50%-3.75% range at upcoming meetings.

Tim Sun from HashKey Group explained that positive economic news creates challenges for risk assets. Strong employment removes urgency for the Fed to implement early policy easing.

Inflation Report Takes Priority

Investors now turn attention to Friday’s Consumer Price Index data. The report was delayed due to a partial government shutdown but will provide crucial inflation insights.

January CPI is forecast to decline to 2.5% on a year-over-year basis. This would mark a 0.2% drop from December’s reading.

Derek Lim from Caladan stated that inflation data carries more weight than employment figures. A lower-than-expected reading would increase pressure on the Fed to cut rates sooner.

Lower policy rates typically ease financial conditions and reduce discount rates. This environment has historically supported both equities and cryptocurrencies during high liquidity periods.

Conversely, hotter inflation numbers could cement a higher-for-longer rate environment. Such an outcome would likely pressure risk assets across markets.

Crypto and After-Hours Movers

Bitcoin currently trades at $67,200, down 0.5% over 24 hours. Ethereum holds steady at $1,970 according to CoinGecko.

The leading cryptocurrency has traded between $62,822 and $72,000 this past week. Volatility remains relatively muted following late January and early February declines.

Sun noted that interest rate futures repriced quickly after jobs data. Rate cut expectations compressed and shifted toward the second half of 2026.

Cisco Systems fell roughly 7% in after-hours trading after missing profit forecasts. McDonald’s declined modestly despite surpassing earnings expectations.

Friday’s earnings calendar includes reports from Coinbase, Applied Materials, and Rivian. A softer inflation print would signal easing price pressures while growth continues.

Crypto World

Metaverse Development Company Building Virtual Real Estate Ecosystems

For a few years, metaverse digital real estate was treated like a gold rush. Headlines focused on million-dollar virtual land sales, celebrity plots, and speculative flipping. Many enterprises watched from the sidelines, unsure whether this was innovation or hype. Today, the conversation has matured.

Forward-thinking organizations are no longer asking “Should we buy virtual land?”

They’re asking “How can virtual real estate support our business model?”

That shift changes everything.

Metaverse digital real estate is evolving from a speculative asset into a strategic digital infrastructure layer, one that supports commerce, customer engagement, brand presence, and new revenue channels. Moreover, enterprises that understand this transition are beginning to build long-term advantages.

Analytics from DappRadar indicate that virtual land sales in leading metaverse platforms surpassed $1.6 billion in 2022, reflecting continued demand for digital real estate even amid market fluctuations. This gives a clear indication of the opportunity in the market in the time to come.

What Metaverse Digital Real Estate Really Means

Virtual real estate is not just a 3D parcel on a map. In a business context, it is:

- A persistent digital environment

- A programmable commercial space

- A branded engagement hub

- A community ecosystem

- A revenue-generating digital asset

Think of it less like buying land and more like owning prime digital territory where your audience interacts, shops, learns, and socializes. Just as websites and mobile apps became essential digital assets in the past decade, immersive environments are emerging as the next layer of digital presence.

The difference?

These spaces are experiential, interactive, and monetizable in ways traditional platforms are not.

Why Enterprises Are Taking Virtual Real Estate Seriously

1) Persistent Brand Presence

Unlike campaign-based digital marketing, metaverse spaces are persistent. Your environment exists 24/7 as a branded world users can revisit.

Enterprises use this for:

- Virtual showrooms

- Product demos

- Immersive brand storytelling

- Community hubs

This helps create long-term brand recall rather than one-time impressions.

2) Immersive Commerce Opportunities

Virtual real estate enables experiential commerce. Instead of browsing a catalog, users explore environments, interact with products, and engage socially.

A few of the prominent examples include:

- Virtual retail stores

- Digital product launches

- NFT-backed collectibles

- Token-gated experiences

This blurs the line between entertainment and commerce, a powerful driver of engagement & sales.

3) New Revenue Models

Well-designed metaverse environments can generate revenue through:

- Digital asset sales

- Event hosting

- Advertising placements

- Premium experiences

- Membership ecosystems

- Virtual leasing spaces

In other words, digital real estate can become an income-producing asset, not just a marketing experiment.

4) Community Ownership & Loyalty

Blockchain-enabled virtual real estate allows fractional ownership, governance tokens, and user participation. When users feel ownership, they stay longer. When they stay longer, ecosystems grow stronger. Here enterprises benefit from:

- Higher retention

- Community advocacy

- Organic growth loops

Looking for Metaverse Real Estate Development Services?

The Real Risk: Not Strategy, But Execution

Many early metaverse projects failed not because the concept was wrong but because execution was poor. Some of the most common pitfalls include:

- Empty virtual spaces with no utility

- Weak user experience design

- No monetization logic

- Scalability issues

- Lack of interoperability

- No long-term roadmap

Buying land without building value on it is like owning a mall with no stores. This is where strategy and development expertise matter.

From Buying Land to Building Platforms

Smart enterprises are moving away from simply purchasing parcels on third-party platforms. Instead, they are:

- Building their own environments

- Creating branded virtual ecosystems

- Designing commerce-ready spaces

- Integrating blockchain ownership layers

- Developing scalable metaverse infrastructure

This approach provides control, flexibility, and long-term ROI. However, enterprises need to keep in mind that choosing the right metaverse development company is the key to success.

What a Metaverse Development Company Actually Enables

Serious and strategic metaverse real estate development services do not represent a design project, it’s a technology, product, and business initiative.

A professional metaverse development company helps enterprises with:

1. Infrastructure Design

Building scalable, high-performance environments capable of supporting large user bases.

2. Blockchain Integration

Enabling asset ownership, NFTs, tokenization, and secure transactions.

3. Experience Design

Crafting environments users actually want to explore and return to.

4. Monetization Architecture

Designing revenue models that align with business goals.

5. Security & Compliance

Ensuring safe asset management and data integrity.

6. Long-Term Scalability

Planning for growth, updates, and evolving use cases.

Without these pillars, virtual real estate remains an experiment instead of becoming a business asset.

Who Should Invest in Metaverse Digital Real Estate?

This space is especially relevant for:

- Retail and eCommerce brands

- Real estate developers

- Gaming companies

- Education providers

- Event and entertainment firms

- Luxury and lifestyle brands

- Enterprises building digital communities

If your business depends on engagement, experience, or community, virtual real estate has strategic potential.

Why Early Builders Gain an Advantage

Just like early website adopters dominated search and early app adopters captured mobile markets, early metaverse builders gain:

- Category authority

- Prime digital positioning

- Community loyalty

- Ecosystem control

- Learning curve advantages

Waiting until the market is saturated increases costs and reduces differentiation. The key is not rushing blindly but building strategically.

Conclusion

It is ideal to approach virtual real estate as a business infrastructure project, not a speculative venture. Antier, as a leading metaverse development company helps enterprises:

- Design immersive branded environments

- Build blockchain-enabled ownership layers

- Develop commerce-ready virtual spaces

- Create scalable metaverse platforms

- Launch monetizable digital ecosystems

The focus is always on utility, scalability, and ROI. It is because in the long run, the value of virtual real estate comes from what you build on it, not what you pay for it.

Metaverse digital real estate is moving past speculation. It is becoming a strategic channel for digital presence, engagement, and revenue. Enterprises that treat it as infrastructure and just not hype will be the ones that capture real value. So, the ultimate question is no longer “Is virtual real estate real?” It’s “How will your business use it?”

Frequently Asked Questions

01. What is metaverse digital real estate?

Metaverse digital real estate refers to virtual spaces in a digital environment that serve as persistent, programmable commercial areas for brand engagement, community interaction, and revenue generation.

02. Why are enterprises investing in virtual real estate?

Enterprises are investing in virtual real estate to establish a persistent brand presence, create immersive commerce opportunities, and build long-term advantages in customer engagement and revenue channels.

03. How much did virtual land sales in leading metaverse platforms exceed in 2022?

Virtual land sales in leading metaverse platforms surpassed $1.6 billion in 2022, indicating strong demand for digital real estate despite market fluctuations.

Crypto World

SEC’s Atkins Grilled on Crypto Enforcement Pullback as Justin Sun Case Draws Congressional Scrutiny

TLDR:

- SEC paused Justin Sun’s wash trading case in 2023 while exploring resolution, raising conflict concerns over Trump ties

- Atkins offered lawmakers confidential briefing on Sun case but cited regulatory restrictions on public discussions

- SEC dropped major enforcement actions against Binance, Ripple, Coinbase, rejecting previous regulation-by-enforcement approach

- Atkins confirmed SEC and CFTC are developing joint crypto rules aligned with House-passed Clarity Act framework

SEC Chairman Paul Atkins faced intense scrutiny from House lawmakers regarding the agency’s shift in cryptocurrency enforcement policies.

During Wednesday’s oversight hearing before the House Financial Services Committee, Democrats questioned the regulatory pullback on major crypto cases, particularly involving Tron founder Justin Sun.

Atkins defended the agency’s new direction while promising clearer regulations for the digital asset industry through collaboration with the CFTC.

Sun Case Raises Questions About Enforcement Priorities

Representative Maxine Waters, the committee’s ranking Democrat, pressed Atkins on the agency’s handling of the Justin Sun investigation.

The SEC had accused Sun in 2023 of orchestrating wash trading schemes involving over 600,000 fraudulent transactions to inflate TRX token volumes. However, the agency paused the case last year while exploring potential resolution options.

Waters highlighted Sun’s connections to President Trump’s family through World Liberty Financial Inc. “Well, while you were exploring a potential resolution, Mr. Sun has been busy ingratiating himself within Trump’s orbit,” Waters said to Atkins during the hearing.

She questioned whether these ties influenced the SEC’s decision to halt enforcement actions. The California lawmaker also referenced recent allegations from Sun’s former girlfriend suggesting evidence of TRX manipulation.

Atkins responded that regulatory restrictions prevented him from discussing specific cases publicly. He offered lawmakers a confidential briefing on the matter, stating he was willing to have further conversations “to the extent the rules allow me to do that.”

Waters pressed further, asking whether the SEC’s focus on real fraud extended to crypto markets. “Whatever involves securities,” Atkins responded.

The agency dropped several high-profile enforcement actions last year against major crypto firms including Binance, Ripple, Coinbase, Kraken, and Robinhood.

SEC leadership criticized the previous administration’s regulation-by-enforcement approach. When asked about protecting investors versus Trump business interests, Atkins stated, “As far as what the Trump family does or not, I can’t speak to that.”

Regulatory Clarity Takes Center Stage

Republican committee members shifted focus toward Atkins’ plans for establishing comprehensive crypto regulations.

The chairman outlined ongoing coordination with the Commodity Futures Trading Commission to develop clear operational guidelines for digital asset companies.

These efforts align with the Clarity Act passed by the House, though the legislation’s Senate fate remains uncertain.

Atkins explained that both agencies are working on rules “consistent with what’s in the Clarity Act that you all passed here in the House, and hopefully what will come out of the joint work that you’re doing with the Senate.”

He added that this effort would help provide certainty regarding jurisdictional boundaries between the two agencies. The framework would establish which types of digital assets fall under SEC or CFTC oversight.

The CFTC recently updated its guidance on stablecoins, allowing national trust banks to issue payment stablecoins and expanding eligible tokenized collateral.

Meanwhile, the National Credit Union Administration proposed rules for credit unions seeking stablecoin issuer status.

These moves implement provisions from last year’s GENIUS Act, marking the crypto sector’s first major legislative achievement.

A policy race now develops between Atkins’ SEC and Senate lawmakers working on comprehensive crypto legislation.

Recent Senate delays may allow the SEC to lead in establishing digital asset regulations. The industry watches closely as regulatory frameworks take shape across multiple federal agencies.

Crypto World

Hundreds of developers competed in the Consensus Hong Kong 2026 hackathon

As the curtain falls on Consensus Hong Kong 2026, the focus has shifted from the corporate boardrooms to the show floor. While institutional talk dominated the main stages, nearly 1,000 developers spent the week in the trenches of the EasyA x Consensus Hackathon, signaling a definitive pivot in the industry: the “Year of the Application Layer.”

The competition, which has become a staple of Consensus by CoinDesk’s flagship events, saw over 30 projects pitch on demo day. The quality of builds, aided significantly by generative AI, clearly demonstrated that the barrier between a “proof of concept” and a “market-ready product” has effectively been removed.

A rising bar: From infrastructure to intent

The evolution of the developer talent at Consensus has grown gradually. In previous years, hackathon submissions were often deeply technical, building faster consensus mechanisms or niche scaling solutions that remained out of reach for the average user.

This year, however, the bar has been set to a new level. Developers have evolved into product builders, shifting their focus from the backend to the user.

“The big thing that we’ve seen right now is that developers are actually building things that real people can actually use,” said Phil Kwok, co-founder of EasyA. “We’ve seen a big increase in the application layer. This is the year of the horse in Asia, but it’s the year of the application layer in blockchain.”

This shift toward User Experience (UX) was evident in the sophisticated use of “passkeys”, technologies from iOS and Android that allow users to log into Web3 apps without the friction of 24-word seed phrases, Kwok said. By removing these traditional “clicks” and barriers, developers are finally making products that feel like the apps people use every day.

The Winners’ Circle

The judges awarded top honors to projects that prioritized automation, security, and risk management, three pillars essential for the next wave of retail adoption, Kwok explained.

First place: FoundrAI ($2,500)

Taking the top spot was FoundrAI, an autonomous AI agent designed to act as a “startup in a box.” The platform doesn’t just launch tokens; it manages the entire lifecycle of a project, including hiring human developers to build out the product. It represents a provocative look at the future of decentralized labor.

Second place: SentinelFi ($1,750)

Addressing the industry’s persistent “rug-pull” problem, SentinelFi provides real-time safety scores for crypto traders. By performing six-category on-chain analysis, the tool helps users sniff out scam tokens before they commit capital—a critical utility as token launch volumes explode.

Third Place: PumpStop ($1,000)

PumpStop rounded out the top three with a non-custodial trading layer focused on risk mitigation. Using state-channel instant execution, it allows traders to set stop-loss orders with on-chain proofs, bringing professional-grade trading tools to a decentralized environment without sacrificing custody.

The ‘show floor’ evolution

The growth of the hackathon reflects a broader shift in the Consensus ethos. Once a strictly corporate affair, the event has increasingly integrated the “builder” culture into its DNA. Dom Kwok, co-founder of EasyA, noted that the hackathon has moved from side rooms to the center of the show floor.

“Typically every hackathon that we host gets bigger and bigger,” Dom said. “It’s taking up more and more of the conference floor every year. We had someone flying in from San Diego just to see what was getting built.”

Despite the “depressing” macro environment often reflected in token prices, the sentiment on the ground in Hong Kong remained stubbornly bullish. Organizers pointed out that while interest rates and Fed policy drive the charts, the builders are focused on the 93% of the world that doesn’t yet own crypto. The path to that next billion users, it seems, is being paved by developers who finally realize that usability is the ultimate feature, Dom said.

Phil and Dom said they can’t wait for Consensus Miami 2026 to see how much more the bar is raised and how many more developers participate with surprisingly great new ideas.

Crypto World

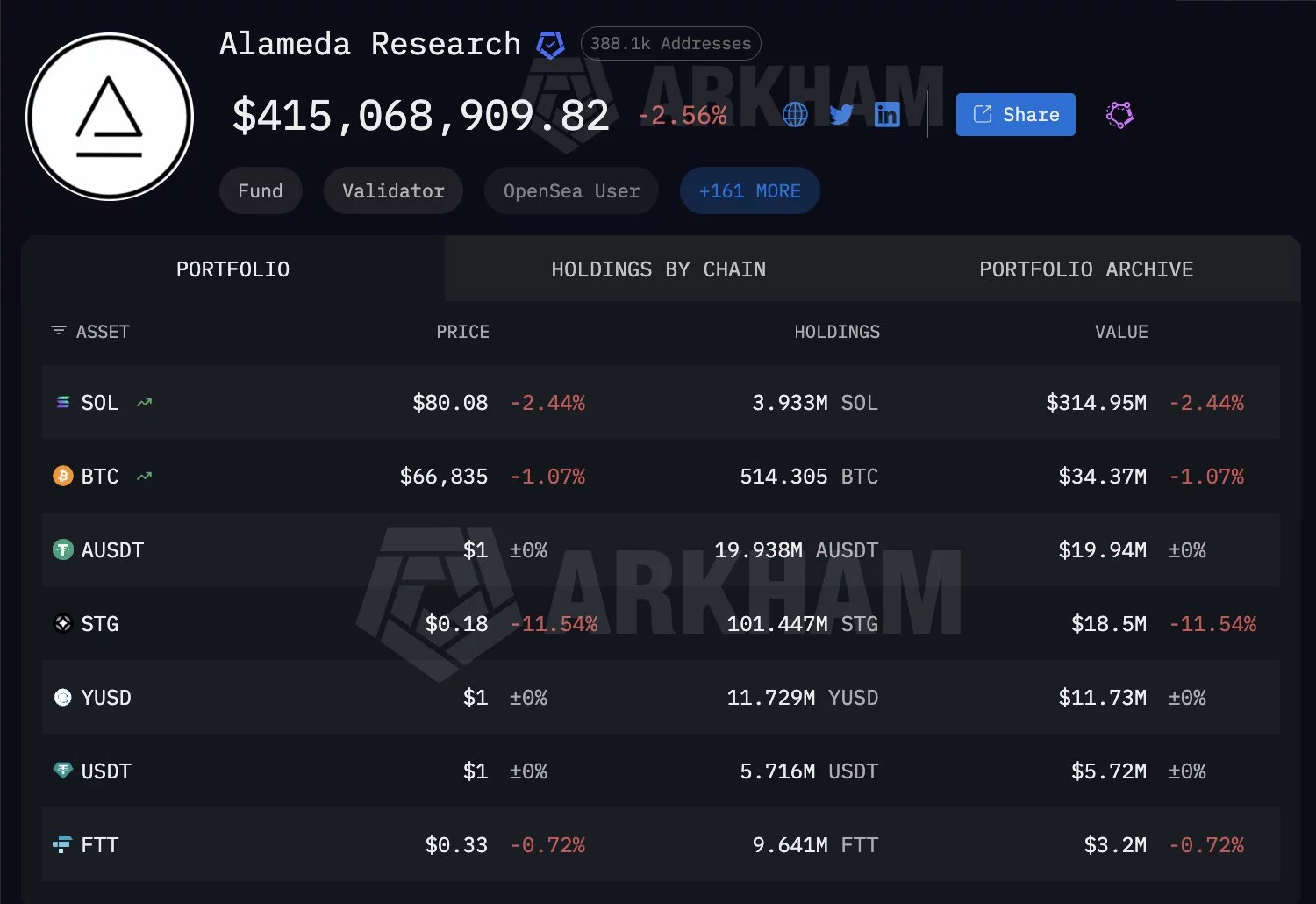

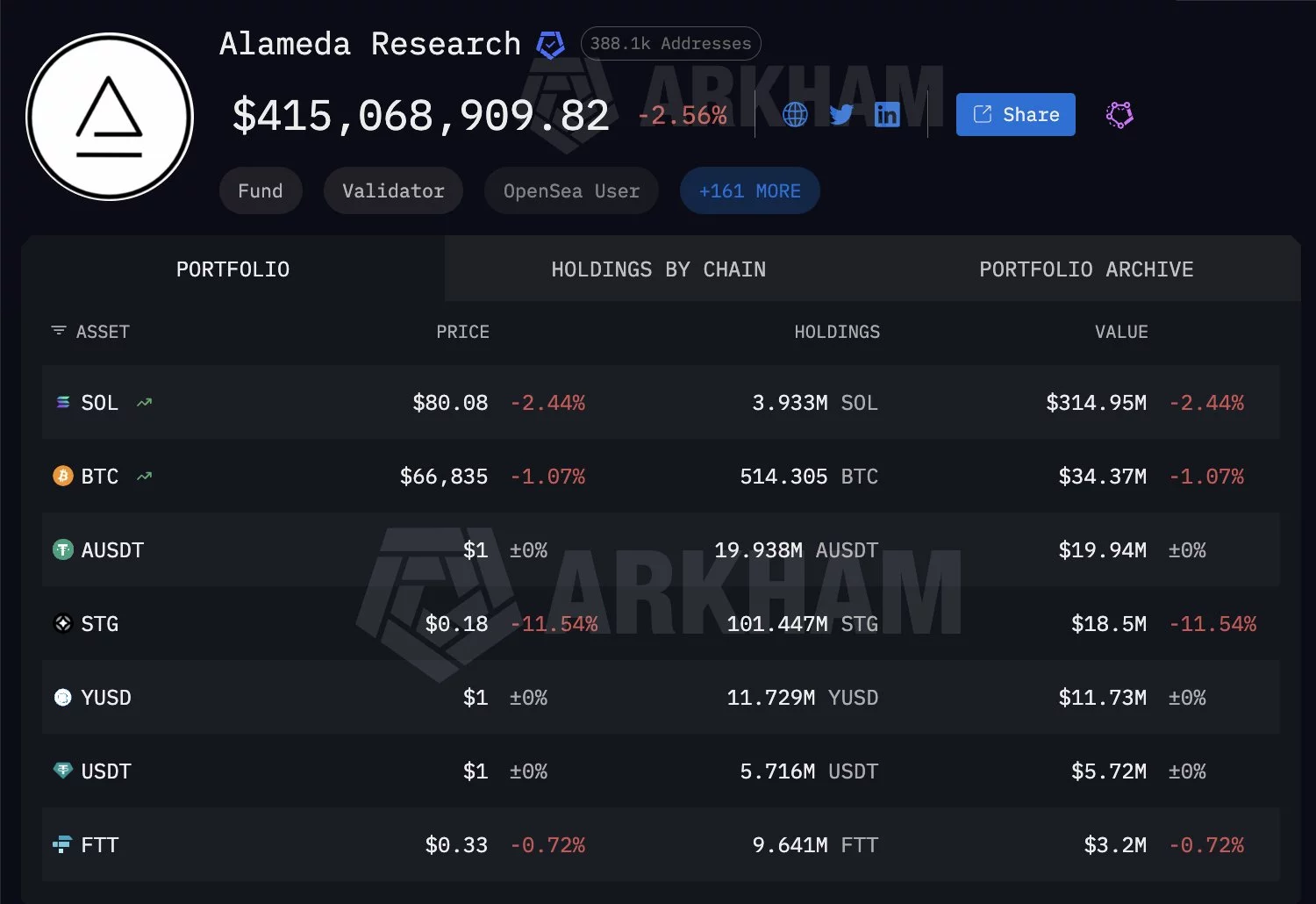

Alameda moves another $15M in Solana as traders watch for market impact

Alameda Research’s bankruptcy estate has distributed another $15 million worth of Solana to creditors, extending a repayment process that has now been running for nearly two years.

Summary

- Alameda Research’s bankruptcy estate distributed roughly $15.6 million in Solana to creditors in its latest monthly payout, extending a repayment process that has run for 21 months.

- Despite ongoing distributions, Alameda still holds nearly $315 million worth of SOL on-chain, keeping traders alert to potential supply overhang risks.

- Most of Alameda and FTX’s SOL was previously sold through OTC deals in 2024, with remaining distributions being handled gradually to limit market impact.

According to blockchain data highlighted by Arkham, the latest monthly tranche involved the transfer of roughly $15.60 million in Solana (SOL) to 25 separate addresses.

The movement forms part of a structured distribution program that has been ongoing for 21 months following the collapse of FTX and its trading arm, Alameda Research.

Despite the steady outflows, Alameda’s on-chain wallets still hold approximately $314.95 million worth of SOL, keeping the estate among the largest known holders of the token tied to the defunct exchange empire.

Market impact questions resurface

The renewed transfers have reignited debate over whether these distributions ultimately translate into sell pressure on the open market.

Arkham raised the question directly, asking whether the newly distributed SOL would be “SOLd straight into the market,” a concern that has repeatedly surfaced during prior repayment rounds.

While the latest tranche is relatively modest compared to Alameda’s historical holdings, traders remain sensitive to any supply overhang tied to creditor payouts, particularly during periods of broader market volatility.

Solana’s native token has been volatile in recent months, trading near the low-to-mid $80s to low $90s range after pulling back from higher levels seen in 2025.

Where Alameda’s SOL went

Additional context was provided by analyst Emmet Gallic, who traced the fate of the bulk of Alameda and FTX’s Solana holdings.

According to the analysis, roughly 43 million SOL was largely sold through over-the-counter deals across three major tranches in 2024, limiting direct market disruption.

Those sales included 26 million SOL at $64 to buyers such as Galaxy, Pantera, Jump, and Multicoin; 14 million SOL at $95 through a Pantera-led consortium; and a further 2 million SOL at $102 involving Figure Markets and Pantera.

Since those OTC sales, remaining SOL distributions have been handled gradually, suggesting a continued effort to balance creditor repayments with market stability. Still, with more than $300 million in SOL left on-chain, Alameda-linked movements are likely to remain a point of close scrutiny for Solana traders in the months ahead.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports11 hours ago

Sports11 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World13 hours ago

Crypto World13 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video8 hours ago

Video8 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process