CryptoCurrency

Solana Stablecoin Market Tripled to $15B ATH as Memecoin Frenzy Returns

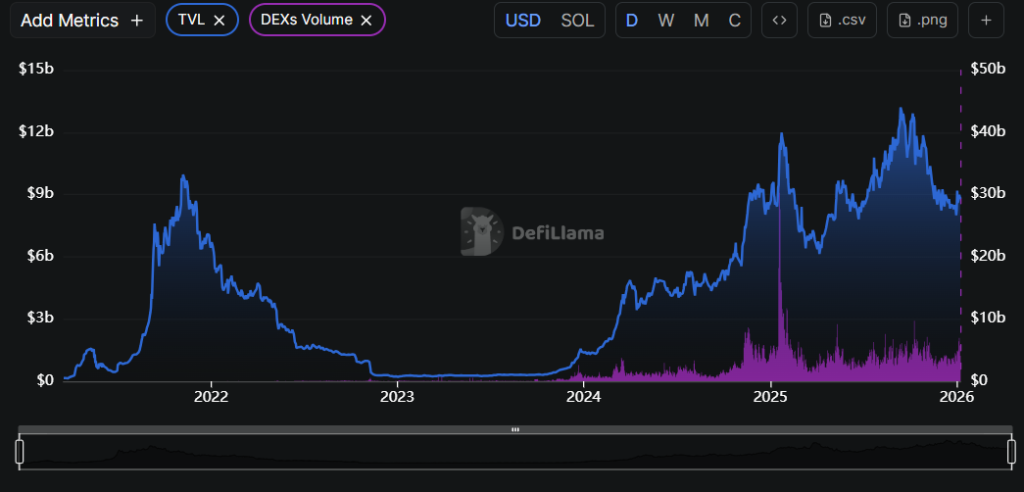

Solana’s stablecoin market capitalization has surged to an all-time high of $15 billion, up from approximately $7 billion in 2024, as memecoin trading activity makes a comeback across the blockchain.

The network issued nearly $10 billion in stablecoins over the past year alone, representing a 200% year-to-date increase that underscores accelerating capital inflows, with over $900 million in new stablecoins minted in the last 24 hours, according to Token Terminal data.

Circle’s USDC dominates the Solana stablecoin market, with an over 65% market share of $9.2 billion, followed by Tether’s USDT at $2.19 billion, PayPal USD at $952 million, Global Dollar at $888 million, and World Liberty Financial’s USD1, affiliated with President Trump, at $151.8 million.

The explosive growth comes as the broader Solana ecosystem regains momentum, with its market capitalization expanding 14.1% week-over-week to $ 75 billion, erasing a month of previous declines.

Solana Memecoin Revival Drives Trading Surge

The memecoin sector has roared back to life across Solana with remarkable intensity, propelling tokens to explosive double-digit gains that have reinvigorated trader interest and transaction volumes.

Bonk led the charge with a stunning 50% surge over seven days, while PENGU climbed more than 40% and popular assets like FARTCOIN, Dogwifhat, and Brett each pumped over 30% during the same period.

The memecoin launchpad Pump.Fun’s native token jumped 42.2%, reinforcing the sector’s recovery momentum and signaling renewed confidence in speculative trading.

The entire memecoin market now commands a $44 billion valuation, climbing 3.64% in 2026 with trading volume surging by over 20% as retail and institutional participants return to high-velocity trading.

The rally has been accompanied by strengthening on-chain fundamentals on Solana that demonstrate organic network growth.

Solana’s TVL jumped 12.5%, daily transactions rising 17.3%, and DEX trading volume climbing 13.1% week-over-week according to DeFiLlama metrics.

Revenue Generation Reaches New Heights

According to recent research from the Solana Foundation, applications built on Solana generated $2.39 billion in revenue in 2025, a 46% year-over-year increase and a new all-time high.

Seven applications successfully crossed the $100 million revenue threshold, led by Pump. Fun, Axiom Exchange, Meteora, Raydium, Jupiter, Photon, and BullX represent increasing monetization.

Beyond the top-tier performers, the long tail of smaller Solana applications collectively generated more than $500 million in revenue, demonstrating that success extends far beyond a handful of breakout projects.

Network revenue climbed to $1.4 billion, representing a forty-eight-fold increase over two years. The chain processed 33 billion non-vote transactions during the year and maintained an average of over 1,050 non-vote transactions per second.

Solana has cemented its position as the most popular blockchain for on-chain traders and recently overtook BNB Chain to become the second-most popular Layer 1 network for stablecoin transfers.

The network’s volume of tokenized equity products has reached $874.19 million, making it the largest network in this emerging category, ahead of both Ethereum and BNB Chain by market capitalization.

Western Union also recently announced plans to launch a dollar-backed stablecoin on Solana, opening a transformative new channel for its global customers to move money with significantly lower fees and faster settlement times.

The company, which built the first transcontinental telegraph line in 1861, is recasting its historic network for a digital era where transactions clear in seconds and operate around the clock.

Western Union’s US Dollar Payment Token will be issued by Anchorage Digital Bank and is scheduled to launch in the first half of 2026.

Just days ago, Morgan Stanley filed with the SEC to launch a Solana-linked ETF alongside a Bitcoin product, marking a watershed moment for institutional recognition.

Meanwhile, Solana-based decentralized exchange Jupiter introduced JupUSD, a reserve-backed USD stablecoin designed for deep integration across its product suite, further expanding the ecosystem’s financial infrastructure.

The post Solana Stablecoin Market Tripled to $15B ATH as Memecoin Frenzy Returns appeared first on Cryptonews.

(@tokenterminal)

(@tokenterminal)  JUST IN:

JUST IN: