CryptoCurrency

Sphere Stock Trade Identified With Relative Strength

November has been a tough month for stocks. While AI stocks took the brunt of the correction, relative strength lines were a great way to identify stocks that fought against the pullback to produce winning swing trades.

Rising Relative Strength Line

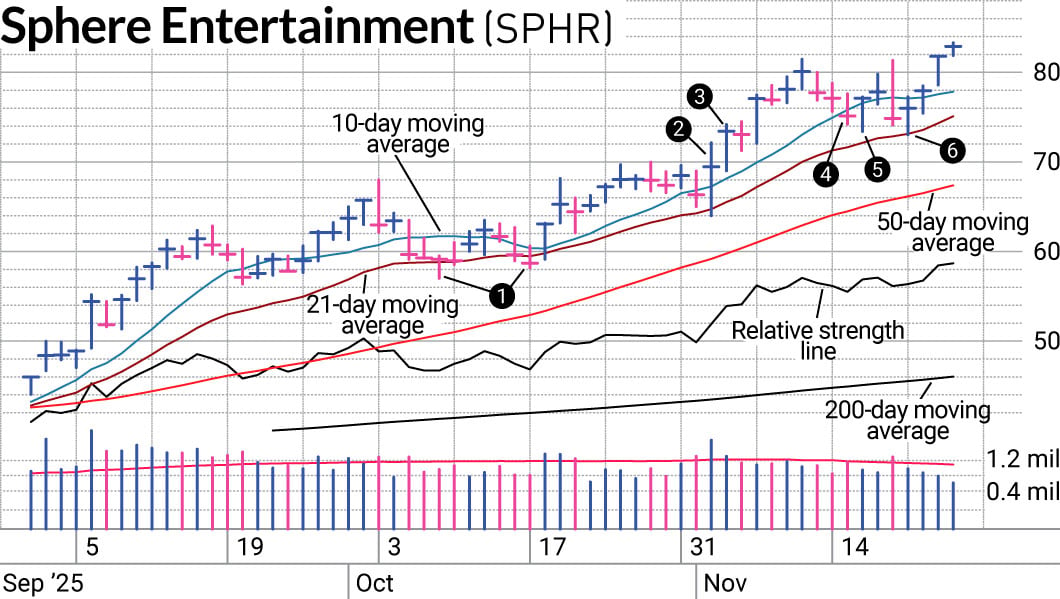

Sphere Entertainment (SPHR) wasn’t one of the leaders in the first part of the rally that began in April, but it wasn’t completely out of favor either. After breaking out from a cup base in September, it saw two touches with support at its 21-day moving average line in October (1). The relative strength line was holding up well during the October volatility.

On Nov. 4, while the Nasdaq composite was suffering its first of a few 2% drops, Sphere stock was having a favorable earnings reaction that saw initial weakness turn into an upside reversal (2). The divergence from the market plus the upside reversal setup earned Sphere a spot on the SwingTrader Current Trades list.

Even better: In a time where a lot of upside reversals weren’t seeing any follow-through action, Sphere immediately gave us cushion on our position (3).

Locking In Gains On Sphere Stock

The relative strength line continued higher as Sphere bucked the market pullback, but after three down days in a row, we got concerned the profits would evaporate (4). Sphere looked like it could get support at its 21-day line again while the Nasdaq composite and S&P 500 were falling to their 50-day lines. But what good does relative strength do if you are still losing money?

To protect the profit we locked in gains. One of the tough parts of the November market was how weakness would be followed by an upside reversal and then an undercut of the reversal. That happened with Sphere, too.

After we exited the position, Sphere fell further then saw an upside reversal (5). A few days later, the upside reversal was undercut by another upside reversal (6).

This time Sphere and the market seem to be gaining traction and that’s led to more aggressive buying on the SwingTrader product this week. At the same time, we’ve continued using relative strength to identify the best prospects and shift money to where it’s treated best.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on X, formerly known as Twitter, at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Learn How To Time The Market With IBD’s ETF Strategy

This Model Points To Inflows In Medical ETF

Looking For The Next Stock Market Winner? Start With These 3 Steps