Crypto World

Stablecoin A7A5 Grows Parallel System for Sanctioned Companies

As cryptocurrency is becoming increasingly intertwined with the traditional financial world, it’s also forming the foundation of a parallel, shadow financial system.

A January report from TRM Labs found a surge in illicit or illegal crypto use to an all-time high of $158 billion. This included a massive increase in crypto flows related to sanctions evasion.

This was led primarily by A7A5, a Russian ruble-based stablecoin launched by Russia-based company A7. Some $39 billion in sanctions-related crypto flows were attributed to the A7 wallet cluster.

Far from a small, underground system for illicit activity, A7A5 has facilitated billions of dollars’ worth of commercial activity, creating a “shadow” economy built on crypto.

Sanctions and the rise of A7A5

After Russia invaded Ukraine in February 2022, it faced a raft of sanctions excluding the country and companies based there from participating in the global financial system.

Mastercard and Visa suspended international operations for cards issued in Russia, while cards issued abroad stopped functioning in the country. Russian banks were also closed off from SWIFT, severely limiting the ability of companies based in the country to conduct commerce abroad.

While these major Western payment networks were shut off, alternatives grew. Mir, the Russian payment network founded in 2017, expanded its market share after Visa and Mastercard’s exit.

Russia also turned to crypto for international commerce. In December 2024, Russian Finance Minister Anton Siluanov noted that his government had passed legislation authorizing foreign trade in “digital financial assets” and Bitcoin (BTC) that was mined in Russia. While Siluanov did not recommend crypto as a form of investment, he claimed that it was “the future” in the context of global payments settlement.

Enter A7A5. The coin was first introduced in February 2025 by the eponymous A7 financial platform. According to legal and professional services firm Astraea Group, A7 is co-owned by Moldovan oligarch Ilan Shor, himself sanctioned and residing in Russia, and the state-owned Promsvyazbank (PSB), which has strong ties to Russia’s defense industry.

Shor and PSB developed a group of companies in strategically important sectors like oil, gas, metals, chemicals and defense technologies. These include A7-Agent, A7 Goldinvest and A71.

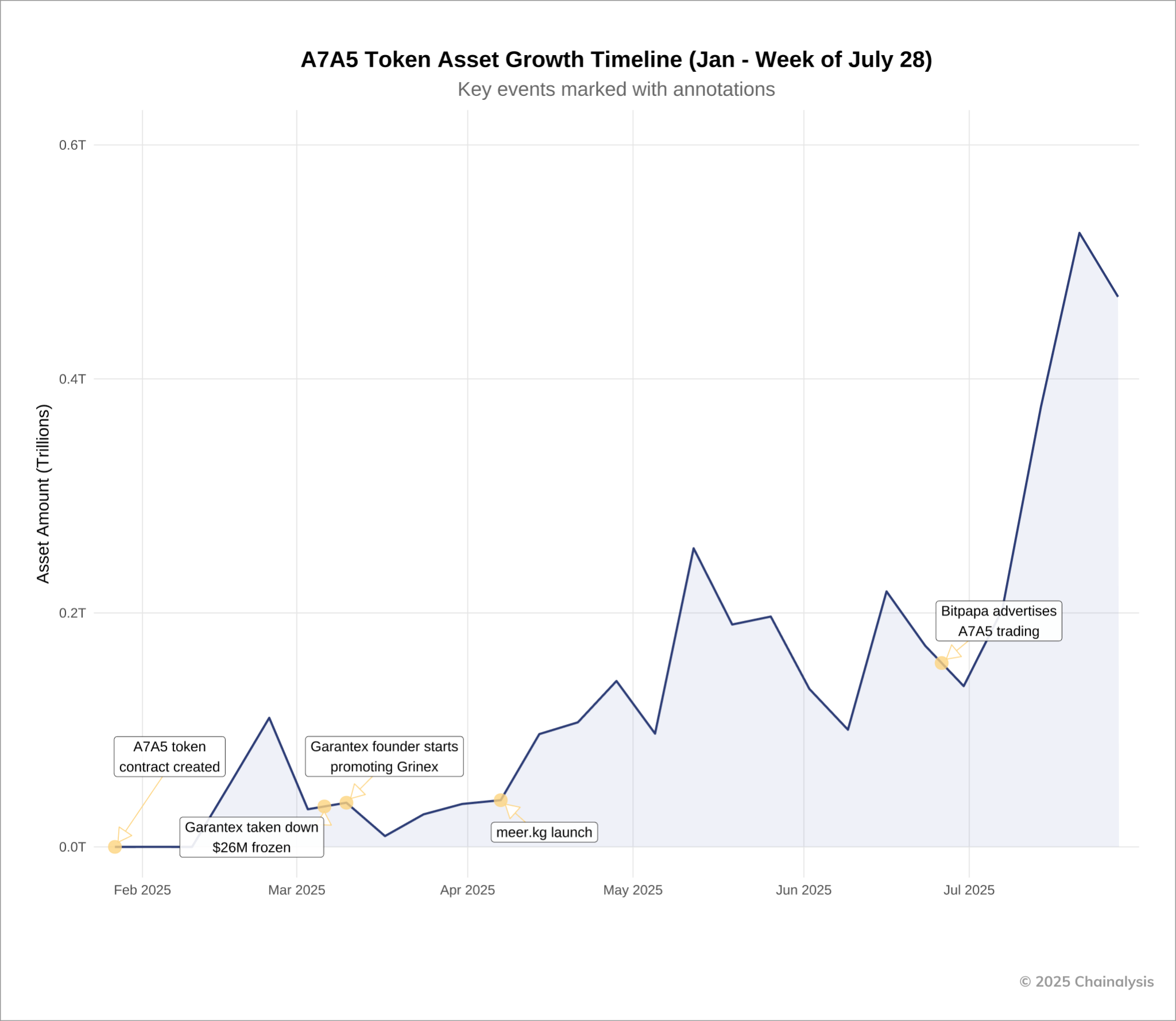

A7A5’s blockchain contract launched in February 2025 and soon began trading on Moscow-based exchange Garantex, which was subsequently sanctioned and shut down.

Trading has continued on Grinex. According to Chainalysis, this Kyrgyzstan-based exchange is the confirmed successor of its Russian counterpart and was accepting transfers from Garantex immediately after its sanction-induced closure.

The token was also launched on Kyrgyzstan-based platform Meer, as well as Bitpapa. Despite sanctions from the Office of Foreign Assets Control (OFAC) on all these platforms, token asset growth exploded in 2025.

Creating an alternative, sanctions-proof system

Analysts have noted that the illicit crypto economy has evolved beyond the darknet and ransomware but has become a separate, robust financial system for sanctioned actors.

Ari Redbord, global head of policy at TRM Labs, said, “State-aligned actors, professional criminals and sanctions evaders are no longer experimenting with crypto; they’re operating durable financial infrastructure onchain.”

He continued that, in 2025, Russia’s illicit crypto ecosystem “evolved into something far more deliberate … Wallets tied to the A7 network alone accounted for at least $39 billion, reflecting coordinated, state-aligned financial infrastructure built for sanctions evasion, not broad market use.”

State coordination with A7A5 and tie-ins with the broader Russian financial market are further evidenced by daily asset flows, according to Chainalysis. The vast majority of trades occur Monday through Friday, with the largest number of trades at the beginning of the week.

“These trading patterns suggest that A7A5 is primarily being used by businesses operating Monday through Friday, which would align with Russia’s legislative goals of facilitating cross-border transfers for Russian businesses via cryptocurrency,” wrote Chainalysis.

Andrew Firman, head of national security at Chainalysis, told Radio Free Europe in December 2025, “The A7A5 token development seems like Russia’s next logical step in Russia’s efforts to develop alternative payment systems to circumvent sanctions.”

In its report, TRM Labs stated that A7A5 volumes don’t represent sanctions evasion but sanctioned activity “more broadly, including state-aligned economic flows.”

“These dynamics illustrate how Russia-linked actors are increasingly leveraging crypto — particularly stablecoins and higher-risk services — as part of a long-term, nation-state-backed strategy.”

Oleg Ogienko, A7A5’s director for regulatory and overseas affairs, has told crypto news media that his company is not violating the laws of Kyrgyzstan, where doing business with Russian companies is not prohibited. He added that the company conducts Know Your Customer and Anti-Money Laundering procedures, as well as audits, and doesn’t violate Financial Action Task Force principles.

A company spokesperson previously told Cointelegraph that accusations of sanctions evasion “are politicized and lack factual evidence.”

“Companies and individuals globally use the A7A5 ruble stablecoin for export-import contracts, cross-border payments and blockchain projects. Its growth reflects a nondiscriminatory approach to value transfer on the blockchain,” they said.

Ambitions for further growth in the sector are apparent. In July, A7A5 announced that PSB cardholders will be able to purchase tokens with their cards. It plans to extend this service to other banks in the future.

In the space of a year, A7A5 has grown into an effective alternative payment rail for sanctioned parties. Time will tell how much appetite there is to grow this further.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

How Crypto and US Stocks Reacted to Trump Tariffs Ban

US financial markets and cryptocurrencies moved higher after the Supreme Court struck down former President Donald Trump’s sweeping global tariffs, removing a major source of economic uncertainty.

The court ruled that Trump exceeded his authority by using emergency powers to impose broad tariffs without approval from Congress. The decision limits the president’s ability to reshape trade policy unilaterally and restores Congress as the primary authority over tariffs.

Supreme Court Restores Congress’s Control Over Tariffs

The ruling immediately reshapes the balance of power in US economic policymaking.

The tariffs, imposed under emergency authority, had targeted imports from multiple countries and generated billions in revenue.

Businesses and trade groups challenged the measures, arguing they raised costs and disrupted supply chains. The Supreme Court’s decision now blocks similar tariffs unless Congress explicitly approves them.

Stocks and Crypto Rise as Trade Uncertainty Eases

Markets reacted quickly.

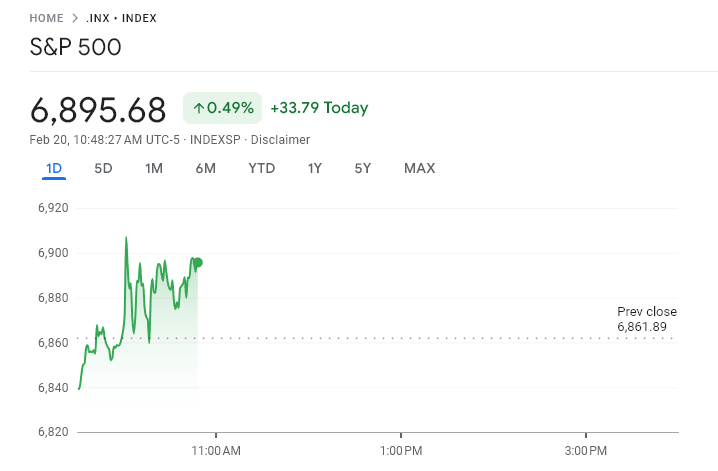

The S&P 500 rose about 0.40%, while the Nasdaq gained roughly 0.70%, signaling renewed investor confidence. Technology stocks led gains, reflecting improved expectations for economic growth and stability.

Meanwhile, the global crypto market cap climbed to about $2.38 trillion, with Bitcoin trading near $67,000 after recent volatility.

Gold briefly dipped following the decision before recovering, reflecting a shift in risk sentiment.

The market reaction reflects a key shift: reduced trade uncertainty. Tariffs often act like taxes on imports, raising prices and slowing economic activity.

Removing the threat of broad tariffs lowers inflation risks and improves liquidity expectations, both of which support risk assets.

This is particularly relevant for crypto.

Bitcoin and other digital assets are highly sensitive to global liquidity and investor confidence. When macroeconomic uncertainty declines, capital tends to flow back into riskier assets.

The recovery in crypto alongside stocks suggests investors are regaining confidence after weeks of geopolitical and economic stress.

However, the decision also highlights deeper political tensions. The ruling limits presidential authority and reinforces Congress’s constitutional control over tariffs. This could slow future trade actions but also reduce sudden policy shocks that destabilize markets.

For crypto markets, stability in global trade and economic policy is generally positive. While geopolitical risks remain, the Supreme Court’s decision removes one major macro threat.

In the near term, that shift appears to be supporting Bitcoin and the broader digital asset market.

Crypto World

Crypto Feels Macro Shock as US Economy Falters and Iran Conflict Risk Grows

TLDR:

- US Q4 GDP grew just 1.4%, well below expectations, signaling economic weakness for investors.

- PCE and Core PCE inflation readings exceeded forecasts, raising concerns over rising consumer costs.

- Slower growth and higher prices may pressure crypto trading liquidity and market volatility.

- Geopolitical risks with Iran add uncertainty to energy markets, indirectly affecting crypto sentiment.

The US economy recorded a sharp slowdown in Q4 GDP, hitting 1.4%, far below the expected 3% growth. Inflation measures, including the PCE Price Index and Core PCE, exceeded forecasts, signaling rising costs for consumers.

Investors are weighing the potential impact on markets, including crypto trading, amid economic uncertainty. The combination of slowing growth and rising prices presents challenges for monetary policy and market stability.

US Economic Data Raises Crypto Market Tensions

US GDP growth for the fourth quarter is among the weakest in two years, according to data reported by Crypto Rover. The slowdown coincides with inflation readings above expectations, signaling higher consumer prices across goods and services.

Rising costs may pressure disposable incomes, affecting investor liquidity available for speculative markets, including cryptocurrencies. Traders are monitoring these economic indicators closely to adjust exposure in volatile markets.

The PCE Price Index, a preferred measure of inflation, showed significant gains in January, exceeding projections. Core PCE, which strips out food and energy, also rose, pointing to persistent underlying inflation pressures.

These dynamics place pressure on the Federal Reserve to balance policy between easing and hawkish measures. Market participants are assessing potential scenarios for interest rates and liquidity conditions affecting crypto valuations.

Investor sentiment in crypto markets is increasingly tied to US economic data, as both liquidity and risk appetite respond to macroeconomic shifts. Slower growth may prompt caution, leading to reduced trading volumes and heightened price volatility.

Rising inflation could push the Fed to maintain tighter policies, which historically compresses speculative asset markets. Analysts note that cryptocurrency traders remain sensitive to macroeconomic policy moves, particularly in the US dollar context.

Trading platforms reported increased activity during the GDP announcement, reflecting rapid adjustments in portfolio allocations. Exchanges including Coinbase and Binance saw heightened volumes in BTC and ETH as investors reacted to the news.

Market participants are factoring in the dual pressure of slow growth and inflation for near-term trading strategies. Liquidity in smaller altcoins may experience higher volatility as attention focuses on macro-sensitive tokens.

Geopolitical Tensions Add Pressure to Crypto Markets

Tensions in the Middle East, particularly regarding US military planning toward Iran, are influencing global markets, including cryptocurrencies. Reports from Walter Bloomberg indicate potential US strikes targeting Iran’s leadership and nuclear facilities.

Any conflict could disrupt oil supply routes, indirectly affecting global liquidity and risk appetite in crypto markets. Investors are tracking developments closely for potential market-moving events.

The potential for limited US military action, including naval and air assets, raises uncertainty for energy markets. Tehran has warned of a decisive response if targeted, increasing the risk of regional escalation.

Crypto traders are considering these geopolitical factors alongside domestic economic data in portfolio strategies. Rising energy costs could feed into inflation expectations, further complicating monetary policy outlooks.

Regional instability coincides with macroeconomic pressures, potentially amplifying market volatility in digital assets. Traders are adjusting exposure in real time, particularly in stablecoins and BTC, seeking safe-haven positions.

Historical patterns show crypto markets react quickly to both economic and geopolitical shocks. Analysts suggest monitoring these developments closely to anticipate liquidity shifts and trading trends.

Crypto World

Polymarket ends trading loophole for bitcoin quants

After Polymarket quietly ended a substantial penalty on liquidity-removing ‘taker’ orders, quantitative traders (quants) lamented an end to their gravy train. For highly sophisticated market makers, that 500-millisecond quote-adjustment period granted them a superpower over slower traders.

Unfortunately for them, Polymarket has ended its time incentive.

Unsurprisingly, the money spigot used to flow from Polymarket and Kalshi advertising short-term binary options on the price of bitcoin (BTC) to everyday speculators.

Read more: Maduro Polymarket bet raises insider trading concerns

The exchanges feature 5 and 15 minute betting markets on the price of bitcoin (BTC). On their respective homepages, they place those markets in their top three spots on their homepage, and those markets have earned substantial media coverage.

These so-called prediction markets resolve on pricing data from Chainlink and carry high risk for anyone but the most sophisticated traders. One of those risks buried in technical documentation was the ability for market makers to make these adjustments to their quotes, helping ensure they received the most advantageous price.

Rewarding makers to lure money from Polymarket takers

According to several market observers, Polymarket has quietly eliminated its 500-millisecond (half-second) taker price delay.

Makers use limit orders that do not immediately execute, such as a bid price below the current ask price. Takers, in contrast, use market orders or immediately executable limit orders, such as a limit buy order with a price higher than the current ask.

In a traditional ‘level 2’ or Depth of Market (DOM) quote, makers are listed above and below the last price of an asset. Makers’ limit buy and sell orders, which cannot immediately execute against other orders, remain in pending status, ranked by price.

Takers, in contrast, whose orders always execute immediately using a standing order from a maker, create each market-clearing price.

Historically, exchanges have rewarded makers with various discounts to encourage their participation. Trading venues with consistently deep or ‘liquid’ DOM quotes across their trading pairs earn more business from traders who are concerned about the ability to easily enter and exit positions with minimal slippage.

Although penalties for takers and rewards for makers vary by exchange, Polymarket has a history of penalizing takers with a 500-millisecond price delay.

Quants never needed speed bumps

However, some traders detected its sudden, quiet removal this month. “Rumor has it the speed bump on crypto markets is GONE. No announcement, no changelog, nothing,” wrote one observer.

For quants and arbitrageurs, trades in Polymarket’s 5-minute games just got 500 ms faster. Those trades can also be hedged using Kalshi’s 15-minute binary options or hundreds of other BTC proxies.

For context, there were only 600 maximum taker transactions within five-minute increments. Now, the number of possible trading combinations seems to have exploded into the thousands or millions – bounded only by speeds of connectivity and computation.

“With the speed bump gone, latency is now the only moat,” someone noted.

Latency is, of course, a double-edged sword. The most advanced, colocated arbitrageurs with the quickest refresh rate on their quotes relative to the price of BTC on Chainlink oracles or even other exchanges can now enjoy amateur order flow from slower competitors.

Many other traders agreed with the implications.

“Was basically free money before,” observed one trader about the substantial, half-second incentive for makers to leisurely update their quotes with relative ease in computer time. “They did it to invite makers. Now makers are there, they take it away, but still give fee rebate.”

He forecasted another change in the future as a sunset of all incentive programs for Polymarket quant makers. “Next thing fee rebate is gone, and we pay for maker orders as well.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Brickken survey shows 53.8% of RWA issuers prioritize capital formation over liquidity

A new fourth quarter 2025 survey from tokenization platform Brickken suggests that the majority of real-world asset (RWA) issuers are using tokenization to raise capital rather than to unlock secondary market liquidity, according to a report shared with CoinDesk.

Among respondents, 53.8% said capital formation and fundraising efficiency is their main reason for tokenizing, while 15.4% said the need for liquidity was their main incentive. Another 38.4% said liquidity was not needed, while 46.2% said they expect secondary market liquidity within six to 12 months.

“What we’re seeing is a shift away from tokenization as a buzzword and toward tokenization as a financial infrastructure layer,” Jordi Esturi, CMO at Brickken, told CoinDesk. “Issuers are using it to solve real problems: capital access, investor reach, and operational complexity.”

Brickken’s report comes as major U.S. stock exchanges announce plans to expand trading models for tokenized assets, including 24/7 markets. CME Group said they will offer around-the-clock trading for its crypto derivatives by May 29, while the New York Stock Exchange (NYSE) and Nasdaq shared their plans to offer 24/7 tokenized stock trading.

Esturi said the exchanges’ plans have more to do with business model evolution than with an issuer demand disconnect. “It’s less about getting ahead of demand and more about exchanges evolving their business model,” he said. “Exchanges increase revenue by increasing trading volume, and extending trading hours is a natural lever.”

At the same time, many issuers are still in what he described as the phase of validation, during which they prove regulatory structures, test investor appetite and digitize issuance processes. “Liquidity is not yet their primary focus because they are building foundations,” he emphasized, adding that they view tokenization as “the upstream engine that feeds trading venues.”

The Brickken CMO also said that without compliant, structured, high-quality assets entering the market, secondary trading platforms have nothing meaningful to trade. “The true value creation happens at the issuance layer,” Esturi noted.

Optional liquidity versus mandatory

While 38.4% of surveyed issuers said liquidity was not required, Esturi pointed out the difference between “optional liquidity and mandatory liquidity,” noting that many private market issuers operate on long-term horizons. “Liquidity is inevitable, but it must scale in parallel with issuance volume and institutional adoption, not ahead of it.”

Ondo, which began with tokenized U.S. Treasuries and now has more than $2 billion in assets, is focused on stocks and ETFs specifically because of their “strong price discovery, deep liquidity and clear valuation,” Chief Strategy Officer Ian de Bode said in a recent interview with CoinDesk.

“You tokenize something either to make it easier to access or to use it as collateral,” de Bode said. “Stocks fit both, and they price like assets people actually understand, unlike a building in Manhattan. If TradFi moves to 24/7, that’s a godsend,” de Bode added. “It’s our biggest bottleneck.”

The survey shows that tokenization is already operational for many participants: 69.2% of respondents reported completing the tokenization process and being live, 23.1% are in progress, and 7.7% are still in the planning phase.

Regulations are still an issue

Regulation is a major concern among those surveyed: 53.8% of respondents said regulation slowed their operations, while 30.8% reported partial or contextual regulatory friction. In total, 84.6% experienced some level of regulatory drag. By comparison, 13% cited technology or development challenges as the hardest part of tokenization.

“Compliance isn’t something issuers are dealing with after launch; it’s something they’re taking into account and configuring from day one,” said Alvaro Garrido, founding partner at Legal Node. “We see an increasing demand for legal structures tailored to the specific project needs and underlying technology.”

The report also suggests tokenization is expanding beyond real estate. Real estate accounted for 10.7% of assets tokenized or planned for tokenization, compared with 28.6% for equity/shares and 17.9% for IP and entertainment-related assets. Respondents spanned sectors including technology platforms (31.6%), entertainment (15.8%), private credit (15.8%), renewable energy (5.3%), banking (5.3%), carbon assets (5.2%), aerospace (5.3%) and hospitality (5.2%).

“The real bridge between TradFi and DeFi is not ideological,” said Patrick Hennes, head of digital asset servicing at DZ PRIVATBANK. “It is issuance infrastructure that translates regulatory requirements, investor protection and asset servicing standards into programmable systems.”

Crypto World

Polymarket Traders Price in 82% Chance of Clarity Act Passage

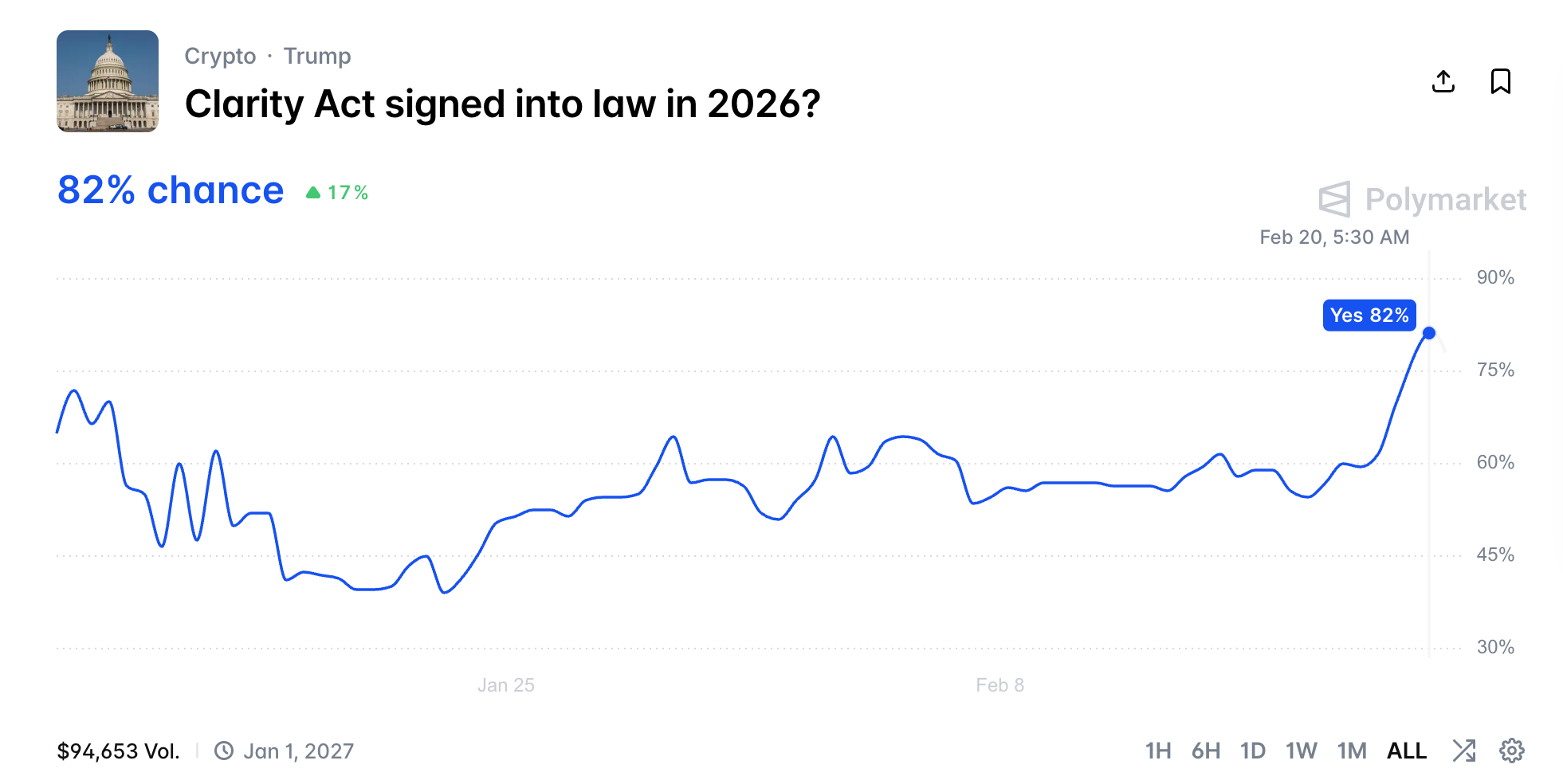

The probability of the Clarity Act being signed into law in 2026 surged to a record 82% on Polymarket earlier today.

The increase in odds comes ahead of a looming deadline to move the key crypto legislation forward.

Polymarket Signals Growing Confidence in Clarity Act as Negotiations Accelerate

Data from Polymarket shows that the probability of the Clarity Act becoming law rose sharply over the past 48 hours. Odds climbed from around 60% on February 18 to a peak of 82% earlier today.

At press time, the figure had eased to 78%, still reflecting a significant jump and signaling growing market confidence in the bill’s prospects.

The optimism is not limited to prediction market traders. Industry executives are also projecting strong momentum.

In an interview with Fox Business, Ripple CEO Brad Garlinghouse said there’s a 90% chance that the long-debated Clarity Act will pass by the end of April.

“The White House is pushing hard on this, and that is a big reason why it will get done. It needs to get done for US leadership,” he said.

The rise in retail optimism comes as the White House moves to push negotiations forward. According to Fox Business, a March 1 deadline has been set to advance the legislation ahead of the midterms.

White House Hosts Third Meeting as Clarity Act Deadline Nears

The Clarity Act is focused on establishing a regulatory framework for digital assets. At its core, the bill aims to clearly define regulatory oversight between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

The legislation passed the House last July. However, the Senate’s version remains stalled. The primary point of contention between banks and crypto firms centers on stablecoin yields. Last month, Coinbase withdrew its support for the bill after the Senate’s changes.

The administration has convened several discussions involving crypto firms and banking representatives, with a third meeting held on Thursday.

According to journalist Eleanor Terrett, a representative from the crypto industry argued that banks’ concerns may be rooted more in competitive dynamics than in measurable concerns over deposit flight.

A source representing banks told Terret that, for their part, they are pushing further analysis of how stablecoins could affect traditional deposit bases.

“Bank trade groups will brief their members on today’s discussions and gauge whether there’s room to compromise on allowing crypto firms to offer stablecoin rewards. One source said an end-of-month deadline doesn’t seem unrealistic, with talks set to continue in the coming days,” Terrett said.

As discussions move forward, March 1 stands out as a critical date in the legislative timeline. Despite ongoing disagreements, market analysts still view the bill as broadly positive for the industry.

If passed, it would mark a significant step toward reducing regulatory uncertainty and establishing clearer rules for the crypto sector overall.

Crypto World

Bitcoin Spikes as US Supreme Court Strikes Down Trump Tariffs

In a landmark 6–3 decision, the Supreme Court of the United States has ruled that President Donald Trump’s sweeping global tariffs were illegal, delivering a sharp blow to one of the White House’s core economic policies.

The decision immediately lifted risk appetite across financial markets — including crypto — though traders remain cautious about what comes next.

Crypto World

Bitcoin ETFs Near Five-Week Outflow Streak With $404M Outflows

Selling pressure in US-listed spot Bitcoin ETFs continued Thursday, with analysts noting the cryptocurrency is on track for one of its worst yearly starts.

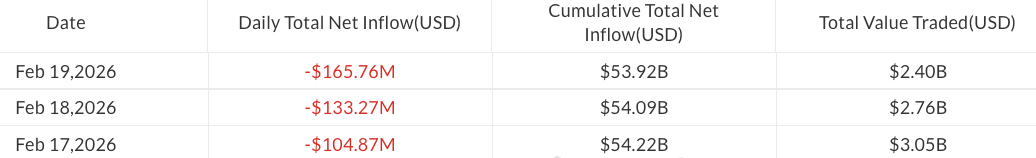

Spot Bitcoin (BTC) ETFs saw $165.8 million in outflows Thursday, bringing weekly losses to $403.9 million, according to SoSoValue data.

The redemptions moved the funds closer to a possible five-week outflow streak, with year-to-date (YTD) losses totaling $2.7 billion.

Trading activity continued to shrink, falling 21% over the week and reaching its lowest levels since late December, signaling weakening investor activity.

Despite $53.9 billion in cumulative net inflows, analysts, including DropsTab, noted that 2026 is shaping up to be “one of the worst yearly starts in Bitcoin’s history,” with BTC prices down about 22% year-to-date, according to TradingView data.

BlackRock’s IBIT leads losses with $368 million in outflows this week

BlackRock’s iShares Bitcoin Trust ETF (IBIT) accounted for the bulk of outflows this week, totaling $368 million, according to Farside data.

Other US-listed spot Bitcoin ETFs saw little or no activity this week, aside from about $50 million in outflows from the Fidelity Wise Origin Bitcoin Fund (FBTC) on Wednesday.

Some major financial institutions reported reducing IBIT exposure earlier this week, with Brevan Howard cutting its holding in the fund by as much as 85% in the fourth quarter of 2025.

Bitcoin set for one of its worst yearly starts

The ongoing outflows from Bitcoin ETFs coincide with weakening investor sentiment, as multiple sources point to unusually low BTC price levels compared to previous cycles.

Drops Analytics highlighted Bitcoin’s price in the context of halving — an event that reduces BTC’s block reward once every four years and is typically followed by price surges in the years that follow.

“Almost two years later, BTC trades around $66,000 — nearly the same level as during the April 2024 halving,” Drops Analytics said in a Telegram post on Thursday.

Related: Quantum fears aren’t behind Bitcoin’s 46% drop, says developer

“This has never happened before. In previous cycles, BTC was already three to 10 times above halving levels by now,” it added.

According to Checkonchain data, Bitcoin is off to its worst yearly start on record, 50 days into 2026, surpassing previous down years, including 2018.

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

Crypto World

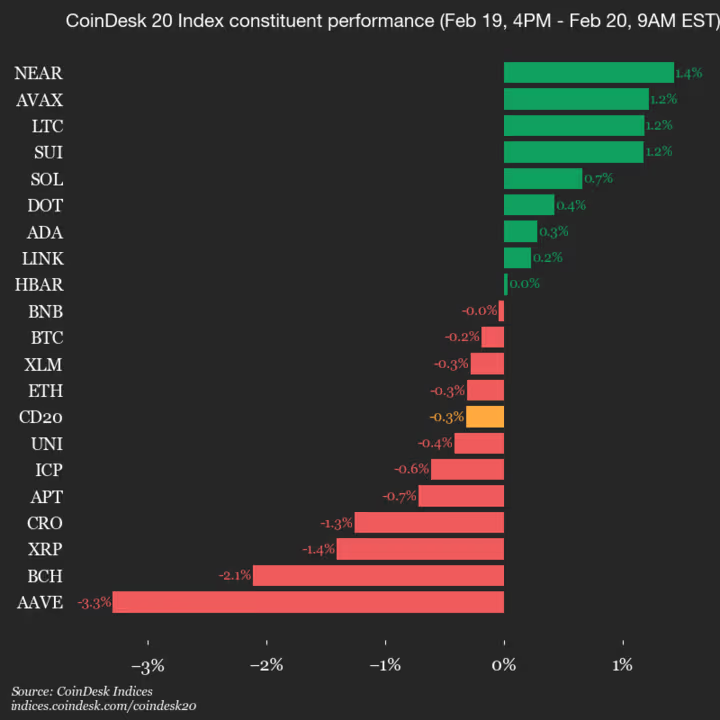

AAVE falls 3.3%, leading index lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1924.88, down 0.3% (-6.12) since yesterday’s close.

Nine of the 20 assets are trading higher.

Leaders: NEAR (+1.4%) and AVAX (+1.2%).

Laggards: AAVE (-3.3%) and BCH (-2.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

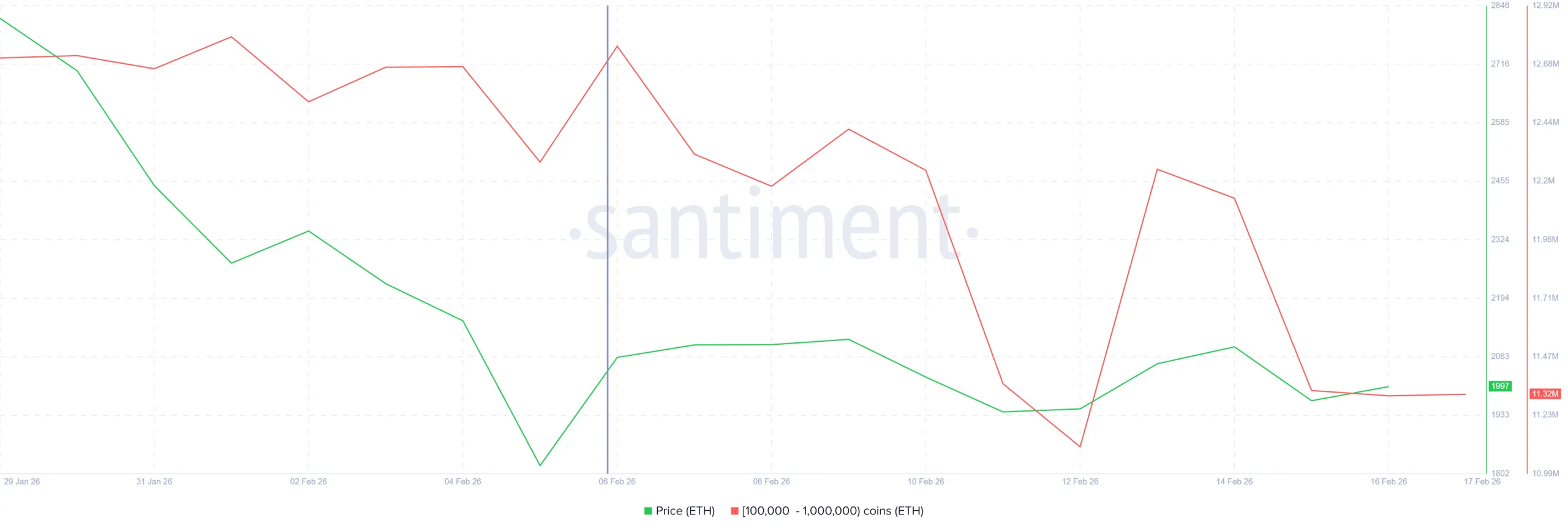

Is $2.7 Billion Whale Selling the Last Shakeout for Ethereum?

Ethereum continues to trade sideways as uncertainty weighs on the broader crypto market. The altcoin king has struggled to regain decisive bullish momentum.

While the current structure suggests potential bottom formation, large holders appear to be making aggressive moves.

Ethereum Whales Selling Has Not Stopped

Ethereum whales have demonstrated erratic behavior in recent sessions. Sharp accumulation phases have been followed by equally aggressive distribution. This volatility signals uncertainty among high-capital participants.

Over the past two weeks, addresses holding between 100,000 and 1 million ETH have sold approximately 1.43 million ETH. At current valuations, that equals roughly $2.7 billion. Such large-scale distribution significantly impacts liquidity conditions.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This level of selling often reflects late-cycle stress rather than early panic. Historically, heavy whale exits tend to occur near capitulation phases. Large holders sometimes reduce exposure before the broader acceptance of a market bottom. These episodes frequently precede structural reversals once selling pressure exhausts.

Ethereum Bottom Signals Strengthen

On-chain data provides additional context. The Net Unrealized Profit and Loss, or NUPL, indicator shows Ethereum in the capitulation zone. This reading indicates that average holders face substantial unrealized losses.

In prior cycles, similar NUPL conditions preceded meaningful reversals. However, Ethereum typically remains in this zone for extended periods. Capitulation does not imply immediate recovery.

Sustained time in the capitulation band often reduces speculative selling. As weaker hands exit positions, remaining holders tend to exhibit stronger conviction. Gradual stabilization in NUPL readings can signal diminishing downside momentum before recovery begins.

The Pi Cycle Top Indicator also supports a potential ETH bottoming narrative. This metric tracks the relationship between short-term and long-term moving averages. Historically, convergence signals overheating near cycle tops.

Conversely, extreme divergence between these averages often aligns with cyclical bottoms. Current readings show meaningful separation between the two curves. Similar divergence patterns previously marked recovery zones.

Historical instances demonstrate that widening gaps preceded upward reversals. Although timing remains uncertain, this structural setup aligns with late-stage correction behavior. Combined with capitulation metrics, the data suggests Ethereum may be approaching stabilization rather than early bear expansion.

ETH Price Holds Above Support

Ethereum trades at $1,960 at the time of writing. The asset has consistently held above the $1,928 support level despite whale distribution. This zone remains technically significant in maintaining short-term structure.

Although overall sentiment remains cautious, underlying demand has prevented a sharper breakdown. Buyers appear willing to accumulate near perceived value levels. Sustained support may enable Ethereum to challenge the $2,027 resistance. Clearing $2,108 would confirm a breakout from consolidation.

However, downside risks cannot be ignored. If bearish momentum intensifies, Ethereum could lose $1,928 support. A breakdown may expose $1,820 as the next potential floor. Continued weakness could extend toward $1,750, invalidating the near-term bullish thesis.

Crypto World

BTC quickly gives back gain as Trump tariffs struck down

The U.S. Supreme Court on Friday struck down President Trump’s tariff regime in a 6-3 decision.

“No President has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope,” the court ruling said.

“That lack of historical precedent, coupled with the breadth of authority that the President now claims, suggests that the tariffs extend beyond the President’s ‘legitimate reach.”

Bitcoin knee-jerked about 2% higher on the news, rising past the $68,000 level. As has been typical in crypto lately, though, the gain was reversed within minutes, returning to just below $67,000 at the current time.

Crypto’s fleeting gains stood in contrast to what’s appearing more sustainable in stocks, with the Nasdaq rising 0.6% to a session high.

Stagflationary data

Earlier Friday, a batch of U.S. economic data showed signs of stagflationary impulses. The U.S. economy grew only a modest 1.4% in the final three months of 2025, the Commerce Department reported. Alongside core personal consumer expenditure prices rose 3% year-over-year, faster than the hoped for 2.9% and up from 2.8% previously.

On a yearly basis, the economy grew 2.2%, which is the slowest growth since Covid year 2020.

“Today’s economic data delivered a messy message of both hotter than expected inflation, and slower than anticipated growth,” Art Hogan, chief market strategist at B. Riley Wealth, said. “The confusing message from today’s data confirms the current Fed bias to take their time with monetary policy.”

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video14 hours ago

Video14 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World19 hours ago

Crypto World19 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Crypto World7 days ago

Crypto World7 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery